Professional Documents

Culture Documents

Member Statement Summary

Uploaded by

cathy clarkOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Member Statement Summary

Uploaded by

cathy clarkCopyright:

Available Formats

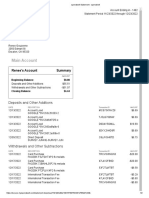

STATEMENT OF ACCOUNT

Member No. Statement Period Page

P.O. Box 80 (BLDG. 494) 0900046998 11/01/21 - 11/30/21 1

Fort Leonard Wood, MO 65473-0080

Phone (573) 329-3151

RANDY L STEPHENS

PO BOX 312

LAQUEY MO 65534

www.infuzecu.org

MEMBERSHIP SHARE (01)

Trans Effective Withdrawals Deposits

Date Date Transaction Description (Debits) (Credits) Balance

11/01/21 Beginning Balance 5.00

11/30/21 Ending Balance 5.00

Dividends Paid Year to Date $0.26

HIGH-RATE CHECKING (06)

Trans Effective Withdrawals Deposits

Date Date Transaction Description (Debits) (Credits) Balance

11/01/21 Beginning Balance 590.84

11/01/21 11/01/21 Withdrawal at ATM #379560 -400.00 190.84

ATM Infuze Credit Union 1300 Historic Rt66

Waynesville MO

11/02/21 11/02/21 Withdrawal at ATM #373240 -153.00 37.84

ATM 617831 300 ICHORD AVE WAYNESVILLE MO

11/02/21 11/02/21 Withdrawal Withdrawal Fee -1.00 36.84

ATM 617831 300 ICHORD AVE WAYNESVILLE MO

11/02/21 11/02/21 Withdrawal Debit Card MC Debit -22.69 14.15

11/02/21 SUBWAY 20350 312 ICHORD AVE. WAYNESVILLE

M

11/03/21 11/03/21 Withdrawal ACH CHECK N GO -165.42 -151.27

TYPE: 5132296623 ID: 8800012393

DATA: 20211102105001AFSACH CO: CHECK N GO

11/03/21 11/03/21 Withdrawal Courtesy Pay fee -20.00 -171.27

Entry Class Code: PPD

ACH Trace Number: 096016938430258

11/03/21 11/03/21 Withdrawal ACH GLOBAL GHLLC.COM -303.00 -474.27

TYPE: DepositTrn ID: 3200781415

DATA: 00001881155947 CO: GLOBAL GHLLC.COM

11/03/21 11/03/21 Withdrawal Courtesy Pay fee -20.00 -494.27

Entry Class Code: PPD

ACH Trace Number: 111000751488020

11/04/21 11/04/21 Withdrawal ACH AMERICAN FAMILY -171.94 -666.21

TYPE: AFT ID: PAFT075356

11/04/21 11/04/21 Withdrawal Courtesy Pay fee -20.00 -686.21

Entry Class Code: PPD

ACH Trace Number: 021000025523977

11/05/21 11/05/21 Deposit ACH WELLS FARGO IFI 0.09 -686.12

TYPE: TRIAL DEP ID: INTFIDTVOS

Entry Class Code: PPD

ACH Trace Number: 091000016552109

11/05/21 11/05/21 Deposit ACH WELLS FARGO IFI 0.29 -685.83

TYPE: TRIAL DEP ID: INTFIDTVOS

Entry Class Code: PPD

ACH Trace Number: 091000016552110

11/05/21 11/05/21 Withdrawal ACH WELLS FARGO IFI -0.38 -686.21

TYPE: TRIAL DEP ID: INTFIDTVOS

Continued on next page

PLEASE KEEP US I NFORM ED OF ADDRESS CHANGES

PLEASE CHECK YOUR NAME(S) AND ADDRESS ON THE FRONT OF THIS STATEMENT. IF NOT EXACTLY CORRECT, COMPLETE THIS FORM

AND RETURN IT TO THE CREDIT UNION OFFICE.

PLACE AN X IN FRONT OF THE ITEM(S) TO BE CHANGED.

Member's Name ___________________________________________________ Social Security No.__________________________

Joint Member's Name(s) _______________________________________________________________________________________

Address _____________________________________________________________________ Apt. No._______________________

City and State _______________________________________________________________ Zip Code _______________________

Change of Phone No.___________________________________________________________________

Signature _______________________________________________________________ Date _______________________________

PLEASE RETAIN THIS STATEMENT. IT'S A PERMANENT RECORD OF YOUR TRANSACTIONS.

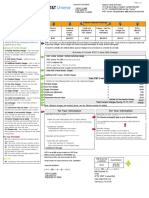

SHARE DRAFT RECONCILEMENT THIS FORM IS PROVIDED TO ASSIST YOU IN BALANCING YOUR DRAFT ACCOUNT

LIST DRAFTS OUTSTANDING PERIOD ENDING

DRAFT NUMBER AMOUNT

1. SUBTRACT FROM YOUR DRAFT REGISTER ANY CHARGES

LISTED ON THIS DRAFT STATEMENT W HICH YOU HAVE NOT

PREVIOUSLY DEDUCTED FROM YOUR BALANCE. ALSO, ADD

ANY DIVIDEND.

2. ENTER DRAFT BALANCE SHOW N

ON THIS STATEMENT HERE

$

+ $

3. ENTER DEPOSITS MADE LATER

THAN THE ENDING DATE ON THIS + $

STATEMENT

+ $

TOTAL (2 PLUS 3) $

4. IN YOUR DRAFT REGISTER, CHECK

OFF ALL DRAFTS PAID AND, IN AREA

PROVIDED AT LEFT, LIST NUMBERS AND

AMOUNTS OF ALL UNPAID DRAFTS.

5. SUBTRACT TOTAL

DRAFTS OUSTANDING - $

6. THIS AMOUNT SHOULD

EQUAL YOUR DRAFT $

TOTAL REGISTER BALANCE

IF YOU DO NOT BALANCE:

(1) VERIFY ADDITIONS AND SUBTRACTIONS - ABOVE AND IN YOUR DRAFT REGISTER.

(2) COMPARE THE DOLLAR AMOUNTS OF THE DRAFTS LISTED ON THIS STATEMENT W ITH THE DRAFT AMOUNTS LISTED IN YOUR DRAFT REGISTER.

(3) COMPARE THE DOLLAR AMOUNTS OF DEPOSITS LISTED ON THIS STATEMENT W ITH THE DEPOSIT AMOUNTS RECORDED IN YOUR DRAFT REGISTER.

YOUR BILLING RIGHTS - KEEP THIS NOTICE FOR FUTURE USE

This notice contains important information about your rights and our responsibilities under the Fair Credit Billing Act.

NOTIFY US IN CASE OF ERRORS OR QUESTIONS ABOUT YOUR STATEMENT. If you think your statement is wrong, or if you need more information about a transaction

on your statement, write us on a separate sheet at the address listed on your statement. Write to us as soon as possible. We must hear from you no later than 60 days after

we sent the first statement on which the error or problem appeared. You can telephone us, but doing so will not preserve your rights.

In your letter give us the following information:

* Your name and account number.

* The dollar amount of the suspected error.

* Describe the error and explain, if you can, why you believe there is an error. If you need more information, describe the item you are not sure about.

If you have authorized us to pay your OPEN-END Account automatically from your share account, share draft account, or through payroll deduction, you can stop the payment

on any amount you think is wrong. To stop payment your letter must reach us three business days before the automatic payment is scheduled to occur.

YOUR RIGHTS AND RESPONSIBILITIES AFTER WE RECEIVE YOUR WRITTEN NOTICE. We must acknowledge your letter within 30 days, unless we have corrected the

error by then. Within 90 days, we must either correct the error or explain why we believe the statement was correct.

After we receive your letter, we cannot try to collect any amount you question, or report you as delinquent. We can continue to send you statements for the amount you

question, including finance charges, and we can apply any unpaid amount against your credit limit. You do not have to pay any questioned amount while we are investigating,

but you are still obligated to pay the parts of your statement that are not in question. If we find that we made a mistake on your statement, you will not have to pay any finance

charges related to any questioned amount. If we didn't find a mistake, you may have to pay finance charges, and you will have to make up any missed payments on the

questioned amount. In either case, we will send you a statement of the amount that you owe and the date that it is due.

If you fail to pay the amount that we think you owe, we may report you as delinquent. However, if our explanation does not satisfy you and you write to us within ten days telling

us that you still refuse to pay, we must tell anyone we report to that you have a question about your statement. And, we must tell you the name of anyone we report you to. We

must tell anyone we report you to that the matter has been settled between us when it finally is settled.

If we don't follow these rules, we can't collect the first $50 of the questioned amount, even if your statement was correct.

SPECIAL RULE FOR CREDIT CARDS

If you have a problem with the quality of property or services that you purchased with a credit card, and you have tried in good faith to correct the problem with the merchant,

you may have the right not to pay the remaining amount due on the property or services. There are two limitations on this right: (a) You must have made the purchase in your

home state, within 100 miles of your current mailing address, and (b) the purchase price must have been more than $50.00. These limitations do not apply if we own or

operate the merchant, or if we mailed you the advertisement for the property or services.

IN CASE OF ERRORS OR QUESTIONS ABOUT YOUR ELECTRONIC TRANSFERS

Write us at the address shown on the front of this statement, or telephone us as soon as you can if you think your statement or receipt is wrong, or if you need more

information about a transfer on the statement or receipt. We must hear from you no later than 60 days after we sent you the FIRST statement on which the error or problem

appeared.

(1.) Tell us your name and account number.

(2.) Describe the error or the transfer you are unsure about, and explain as clearly as you can why you believe there is an error or why you need more information.

(3.) Tell us the dollar amount of the suspected error.

We will investigate your complaint and will correct any error promptly. If we take more than 10 business days to do this, we will recredit your account for the amount you think is

in error so that you will have use of the money during the time it takes us to complete our investigation. If you give notice of an error within 30 days after you make the first

deposit to your new account, we will have 20 business days instead of 10 business days to credit your account.

Infuze Credit Union Member Name Member No. Page

RANDY L STEPHENS 0900046998 2

HIGH-RATE CHECKING (06) - Continued

Trans Effective Withdrawals Deposits

Date Date Transaction Description (Debits) (Credits) Balance

11/05/21 11/05/21 Withdrawal Courtesy Pay fee -20.00 -706.21

Entry Class Code: WEB

ACH Trace Number: 091000016559184

11/10/21 11/10/21 Withdrawal NSF ACH Fee -29.00 -735.21

In the amount $0.59 VOYAGER

Entry Class Code: PPD

11/15/21 11/15/21 Withdrawal NSF ACH Fee -29.00 -764.21

In the amount $321.20 JEFFERSON BANK

Entry Class Code: PPD

11/18/21 11/18/21 Withdrawal NSF ACH Fee -29.00 -793.21

In the amount $200.00 WELLS FARGO IFI

Entry Class Code: WEB

11/30/21 11/30/21 Deposit ACH SSA TREAS 310 993.00 199.79

TYPE: XXSOC SEC ID: 9031736042

Entry Class Code: PPD

ACH Trace Number: 031736040529230

11/30/21 11/30/21 Withdrawal at ATM #812526 -80.00 119.79

ATM Infuze Credit Union 1300 Old Rt 66 Wes

Waynesville MO

11/30/21 11/30/21 Deposit ATM Fee Refunds 4.00 123.79

11/30/21 11/30/21 Deposit Dividend Split Rate 0.02 123.81

Annual Percentage Yield Earned 2.240% from 11/01/21 to

11/30/21

11/30/21 Ending Balance 123.81

Dividends Paid Year to Date $0.86

Total for This Period Total Year-to-Date

Total Returned Item Fees 87.00 116.00

Total Overdraft Fees 80.00 380.00

HOLIDAY EXPRESS LOAN (02)

Credit Credit Payment Past Due Total Next Payment Annual Daily

Limit Available Amount Amount Amount Due Due Date Percentage Rate Periodic Rate

93.10 93.10 12/04/21 17.990% .049287%

Trans Effective

Date Date Description Amount Interest Principal Fee Balance

11/01/21 Beginning Balance 1001.17

11/30/21 11/30/21 Loan Advance Insurance Debt Protection 1.17 1.17 1002.34

11/30/21 Ending Balance 1002.34

Interest Paid Year to Date $0.00

STATEMENT SUMMARY

Total Interest Paid Year to Date $3.62

Total Dividends Paid Year to Date $1.12

Total Dividends Paid in $0.00

You might also like

- Donna Dewberry Designs Distributorship Acct 10227 Dovehill LN CLERMONT FL 34711-6284Document5 pagesDonna Dewberry Designs Distributorship Acct 10227 Dovehill LN CLERMONT FL 34711-6284novelNo ratings yet

- Total Amount Due by 04/13/2022: Electric Usage History - Current Charges For ElectricityDocument1 pageTotal Amount Due by 04/13/2022: Electric Usage History - Current Charges For ElectricitynovelNo ratings yet

- Tinder Credit Union Bank StatementDocument3 pagesTinder Credit Union Bank Statementdudu adul100% (1)

- Financial Summary Account# Balance Financial Summary Account# BalanceDocument3 pagesFinancial Summary Account# Balance Financial Summary Account# BalanceShelvya ReeseNo ratings yet

- Review your credit union statementDocument3 pagesReview your credit union statementalysNo ratings yet

- Safari - Nov 2, 2017 at 4:13 PM PDFDocument1 pageSafari - Nov 2, 2017 at 4:13 PM PDFAmy HernandezNo ratings yet

- USA Citibank BankDocument1 pageUSA Citibank BankPolo OaracilNo ratings yet

- Statement of Account: Membership Summary Information For Member # 56228 As of 3/31/20Document4 pagesStatement of Account: Membership Summary Information For Member # 56228 As of 3/31/20Mark HolobaughNo ratings yet

- SpendAccount 8335 - 2022 12Document1 pageSpendAccount 8335 - 2022 12Dan BNo ratings yet

- ShowLV2Document PDFDocument2 pagesShowLV2Document PDFAnonymous tRY1QOeNo ratings yet

- EstatementDocument2 pagesEstatementIKEOKOLIE HOMEPCNo ratings yet

- February 01, 2020 Through February 29, 2020Document4 pagesFebruary 01, 2020 Through February 29, 2020Jimario SullivanNo ratings yet

- Electronic Account Statements - 2915075275 - 1-1-2023 - 3-31-2023 - Elena In-Home Catering LLC - 364992205 - 050 - 00667 - 4-1-2023Document3 pagesElectronic Account Statements - 2915075275 - 1-1-2023 - 3-31-2023 - Elena In-Home Catering LLC - 364992205 - 050 - 00667 - 4-1-2023Naiver Arias MartinezNo ratings yet

- 01 AB 0.428 000638740261156 P Y R&R Atms Rentals and Vending LLC UNIT 61054 2478 E Desert Inn RD LAS VEGAS NV 89160-8044Document4 pages01 AB 0.428 000638740261156 P Y R&R Atms Rentals and Vending LLC UNIT 61054 2478 E Desert Inn RD LAS VEGAS NV 89160-8044Madison BlackNo ratings yet

- Iesha Indi July Statement 2021Document1 pageIesha Indi July Statement 2021Sharon JonesNo ratings yet

- Darci Bentley FNBO STMNTDocument3 pagesDarci Bentley FNBO STMNTAlex NeziNo ratings yet

- Statement of Account: Credit Limit Rs Available Credit Limit RsDocument2 pagesStatement of Account: Credit Limit Rs Available Credit Limit RsGanesh KumarNo ratings yet

- DxwebDocument4 pagesDxwebjustinagtrfde100No ratings yet

- Free Small Business CHCKG: A Division of BOKF, NA P.O. Box 26148Document6 pagesFree Small Business CHCKG: A Division of BOKF, NA P.O. Box 26148Sara SnowNo ratings yet

- Raymond William Enyeart PO Box 1527 Calipatria CA 92233-1527Document1 pageRaymond William Enyeart PO Box 1527 Calipatria CA 92233-1527dolapo BalogunNo ratings yet

- Bank StatementDocument2 pagesBank StatementJohnson smithNo ratings yet

- B872DKMQTYVRAH95E6834142YUATFHDocument2 pagesB872DKMQTYVRAH95E6834142YUATFHLuke MurrayNo ratings yet

- Tdecu MarchDocument3 pagesTdecu MarchMuhammad MudassarNo ratings yet

- Wings Financial StatementDocument3 pagesWings Financial Statementmdeecash042No ratings yet

- Manual ManualDocument2 pagesManual ManualBobNo ratings yet

- Company Name and Logo: Address 1 Address 2 Address 3 Address 4 Address 5Document2 pagesCompany Name and Logo: Address 1 Address 2 Address 3 Address 4 Address 5Nadiia AvetisianNo ratings yet

- Monthly StatementDocument2 pagesMonthly StatementYuniioor UrbaezNo ratings yet

- Hippocrates Health Institute, Inc.Document2 pagesHippocrates Health Institute, Inc.bg giangNo ratings yet

- ReneeDocument2 pagesReneeAseadNo ratings yet

- FTDocumentDocument2 pagesFTDocumentGustavo UribeNo ratings yet

- Invoice INV-8100Document2 pagesInvoice INV-8100Mubashir AsifNo ratings yet

- Estmt - 2023 03 31Document6 pagesEstmt - 2023 03 31lzel8210No ratings yet

- Robinhood Account Statement for April 2021Document11 pagesRobinhood Account Statement for April 2021adam burdNo ratings yet

- ICBC Credit Card: HKD Payment Autopay Authorization FormDocument2 pagesICBC Credit Card: HKD Payment Autopay Authorization FormGladys TseNo ratings yet

- Account Details - Navy Federal Credit Union 10.16 To 11.10Document2 pagesAccount Details - Navy Federal Credit Union 10.16 To 11.10mondol miaNo ratings yet

- TfecuDocument2 pagesTfecuBeverly LewisNo ratings yet

- R PDFDocument2 pagesR PDFmariana tkachNo ratings yet

- Texas Bank April30Document4 pagesTexas Bank April3076xzv4kk5vNo ratings yet

- PNC Access Checking Account SummaryDocument2 pagesPNC Access Checking Account SummaryNiao PjNo ratings yet

- Account Summary: Consolidated StatementDocument5 pagesAccount Summary: Consolidated Statementhetimurni55No ratings yet

- All in A Health 05976Document2 pagesAll in A Health 05976mike jonesNo ratings yet

- Bank Statement: Rokeditswe R Masange 266 Sauce Town Bulawayo ZimbabweDocument2 pagesBank Statement: Rokeditswe R Masange 266 Sauce Town Bulawayo ZimbabweWierd SpecieNo ratings yet

- 01 SP 000638363874726 E Shequila Lanica Cole 615 Bellwood Ave Apt 2E BELLWOOD IL 60104-1825Document8 pages01 SP 000638363874726 E Shequila Lanica Cole 615 Bellwood Ave Apt 2E BELLWOOD IL 60104-1825Shequila ColeNo ratings yet

- June 2023 Financial StatementDocument14 pagesJune 2023 Financial StatementRohan DuncanNo ratings yet

- Checking Account StatementDocument2 pagesChecking Account Statementbrainroach15No ratings yet

- NCB CREDIT CARD STATEMENT DETAILSDocument2 pagesNCB CREDIT CARD STATEMENT DETAILSRomarioNo ratings yet

- Account Summary Contact Us: Search DocumentDocument7 pagesAccount Summary Contact Us: Search Documentmr w hrNo ratings yet

- Direct Deposit PaystubDocument1 pageDirect Deposit PaystubQiydar The KingNo ratings yet

- Account Summary and Transactions for Business CheckingDocument4 pagesAccount Summary and Transactions for Business CheckingJonathan Seagull LivingstonNo ratings yet

- Christopher Collins January Bank StatementDocument2 pagesChristopher Collins January Bank StatementJim Boaz100% (1)

- April Bank StatementDocument1 pageApril Bank StatementQuiskeya LLCNo ratings yet

- Monthly Statement: Name Address Account Number Statement PeriodDocument18 pagesMonthly Statement: Name Address Account Number Statement PeriodAlexander Weir-WitmerNo ratings yet

- Washington Gas MD - 2Document2 pagesWashington Gas MD - 2Djibzlae0% (1)

- Summary of Accounts: 102101645 Lori Fudens Hair Designing, Inc. 140 Island Fly CLEARFLTER BEACH FL 33767-2216Document3 pagesSummary of Accounts: 102101645 Lori Fudens Hair Designing, Inc. 140 Island Fly CLEARFLTER BEACH FL 33767-2216bobNo ratings yet

- Viaions of The EndDocument5 pagesViaions of The EndDon PayneNo ratings yet

- #3315 December 2022Document4 pages#3315 December 2022annie janeNo ratings yet

- Shaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service RequestedDocument3 pagesShaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service Requestedshaheed taylorNo ratings yet

- USAA Bank Statement 5 PageDocument8 pagesUSAA Bank Statement 5 Pagechmuh110No ratings yet

- Megan Jenkins Gemini StatementDocument2 pagesMegan Jenkins Gemini StatementJonathan Seagull LivingstonNo ratings yet

- Statement DownloadDocument4 pagesStatement Downloaddennisg945133% (3)

- D - FNBT VoidedDocument1 pageD - FNBT Voidedcathy clarkNo ratings yet

- Agreement to Assign Home Sale ContractDocument1 pageAgreement to Assign Home Sale Contractcathy clarkNo ratings yet

- Buyers Agreement FormDocument2 pagesBuyers Agreement Formcathy clarkNo ratings yet

- Build Your Savings With The Power Stash AccountDocument2 pagesBuild Your Savings With The Power Stash Accountcathy clarkNo ratings yet

- Eligibility Notice: You Can't Enroll at This Time: Household Member(s) Results Next StepsDocument12 pagesEligibility Notice: You Can't Enroll at This Time: Household Member(s) Results Next Stepscathy clarkNo ratings yet

- Deseret First Credit Union Statement.Document6 pagesDeseret First Credit Union Statement.cathy clarkNo ratings yet

- Utility Bill TemplateDocument3 pagesUtility Bill Templatecathy clark100% (2)

- Armed Forces StatementDocument4 pagesArmed Forces Statementcathy clarkNo ratings yet

- Dep - Direct - Deposit - Form - USAA Direct Deposit FormDocument2 pagesDep - Direct - Deposit - Form - USAA Direct Deposit Formcathy clarkNo ratings yet

- Account Summary and Current ChargesDocument1 pageAccount Summary and Current Chargescathy clarkNo ratings yet

- Questions? Call 1.888.662.4722 TTY 1.800.898.5999 or Write: HSBC P.O. Box 9 Buffalo, New York 14240Document2 pagesQuestions? Call 1.888.662.4722 TTY 1.800.898.5999 or Write: HSBC P.O. Box 9 Buffalo, New York 14240cathy clarkNo ratings yet