Professional Documents

Culture Documents

Important Information About Expenses: Expense Examples

Uploaded by

Ljubisa Matic0 ratings0% found this document useful (0 votes)

5 views1 pageOriginal Title

LS Sar Page11

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageImportant Information About Expenses: Expense Examples

Uploaded by

Ljubisa MaticCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

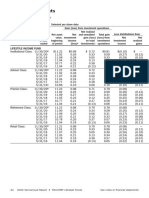

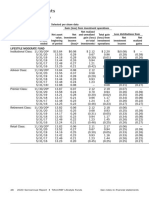

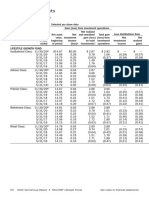

Important information about expenses

Expense examples

Six months ended November 30, 2020

Beginning Ending Effective

account account Expenses paid expenses paid

Lifestyle Funds value value during period* during period†

Premier Class (6/1/20) (11/30/20) (6/1/20–11/30/20) (6/1/20–11/30/20)

Income Fund actual return $ 1,000.00 $ 1,070.40 $ 1.30 $ 2.91

5% annual hypothetical return 1,000.00 1,023.82 1.27 2.84

Conservative Fund actual return 1,000.00 1,114.24 1.33 3.18

5% annual hypothetical return 1,000.00 1,023.82 1.27 3.04

Moderate Fund actual return 1,000.00 1,158.46 1.30 3.41

5% annual hypothetical return 1,000.00 1,023.87 1.22 3.19

Growth Fund actual return 1,000.00 1,195.02 1.32 3.63

5% annual hypothetical return 1,000.00 1,023.87 1.22 3.35

Aggressive Growth Fund

actual return 1,000.00 1,233.48 1.34 3.86

5% annual hypothetical return 1,000.00 1,023.87 1.22 3.50

* “Expenses paid during period” is based on each fund’s actual expense ratio for the most recent fiscal half-

year, multiplied by the average account value over the six-month period, multiplied by 183/365. There were

183 days in the six months ended November 30, 2020. The expense charges of one or more of the fund’s share

classes may at times reflect a waiver or reimbursement. Please see the prospectus for an explanation, including

the date on which this waiver or reimbursement is scheduled to end. Without such waiver or reimbursement, the

expenses of the affected share classes would be higher and their performance lower. The annualized expense

ratio for the six-month period was 0.25% for the Income Fund, 0.25% for the Conservative Fund, 0.24% for the

Moderate Fund, 0.24% for the Growth Fund and 0.24% for the Aggressive Growth Fund.

†

“Effective expenses paid during period” is based on each fund’s total expense ratio for the most recent fiscal

half-year, which includes the fund’s own expense ratio plus its pro rata share of its underlying funds’ expenses

(which the fund bears through its investment in the underlying funds). For the six-month period, the total

annualized weighted average expense ratio was 0.56% for the Income Fund, 0.60% for the Conservative Fund,

0.63% for the Moderate Fund, 0.66% for the Growth Fund and 0.69% for the Aggressive Growth Fund.

TIAA-CREF Lifestyle Funds 2020 Semiannual Report 11

You might also like

- Statements of Changes in Net Assets: TIAA-CREF Lifestyle Funds For The Period or Year EndedDocument1 pageStatements of Changes in Net Assets: TIAA-CREF Lifestyle Funds For The Period or Year EndedLjubisa MaticNo ratings yet

- Financial Highlights: TIAA-CREF Lifestyle FundsDocument1 pageFinancial Highlights: TIAA-CREF Lifestyle FundsLjubisa MaticNo ratings yet

- See Notes To Financial Statements TIAA-CREF Lifestyle Funds 2020 Semiannual Report 45Document1 pageSee Notes To Financial Statements TIAA-CREF Lifestyle Funds 2020 Semiannual Report 45Ljubisa MaticNo ratings yet

- LS Sar Page48Document1 pageLS Sar Page48Ljubisa MaticNo ratings yet

- LS Sar Page47Document1 pageLS Sar Page47Ljubisa MaticNo ratings yet

- LS Sar Page49Document1 pageLS Sar Page49Ljubisa MaticNo ratings yet

- LS Sar Page50Document1 pageLS Sar Page50Ljubisa MaticNo ratings yet

- LS Sar Page51Document1 pageLS Sar Page51Ljubisa MaticNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hamro Savings & CreditDocument9 pagesHamro Savings & Creditrk shahNo ratings yet

- Ru Advanced Accounting ExerciseDocument1 pageRu Advanced Accounting Exerciseprince matamboNo ratings yet

- Procurement Candidate Manual SS OnlineDocument427 pagesProcurement Candidate Manual SS OnlineBùi Duy TâyNo ratings yet

- StolPer Samuelson Theorem NoteDocument10 pagesStolPer Samuelson Theorem NoterthoangNo ratings yet

- Balance Sheet GodrejDocument2 pagesBalance Sheet GodrejDhruvi PatelNo ratings yet

- 413 Marketing of ServicesDocument94 pages413 Marketing of ServicesAishwarya ChauhanNo ratings yet

- India Construction Sector Report 2021-2022Document86 pagesIndia Construction Sector Report 2021-2022Lavanya Subramaniam100% (1)

- The Abington Journal 07-24-2013Document20 pagesThe Abington Journal 07-24-2013The Times LeaderNo ratings yet

- TRA Taxes at Glance - 2016-17Document22 pagesTRA Taxes at Glance - 2016-17Timothy Rogatus67% (3)

- IAS OUR DREAM NOTES COMPILATION PART 3 (17 - 23rd Nov.2013)Document45 pagesIAS OUR DREAM NOTES COMPILATION PART 3 (17 - 23rd Nov.2013)Swapnil Patil50% (2)

- An Introduction To Futures Markets-SDocument4 pagesAn Introduction To Futures Markets-SmikeNo ratings yet

- Barrera Vs Lorenzo GR 130994Document13 pagesBarrera Vs Lorenzo GR 130994Anonymous geq9k8oQyONo ratings yet

- Dipartimento: Economia E Management Cattedra: Economiaaziendale (Business Administration)Document56 pagesDipartimento: Economia E Management Cattedra: Economiaaziendale (Business Administration)Kanak MishraNo ratings yet

- Reading 31 Slides - Private Company ValuationDocument57 pagesReading 31 Slides - Private Company ValuationtamannaakterNo ratings yet

- Updates (Company Update)Document6 pagesUpdates (Company Update)Shyam SunderNo ratings yet

- MSCI May18 MicroPublicList PDFDocument8 pagesMSCI May18 MicroPublicList PDFadi sebaNo ratings yet

- Formalities For Setting Up Small BusinessDocument37 pagesFormalities For Setting Up Small BusinessNitya GuptaNo ratings yet

- F3 Mock Exam 1Document12 pagesF3 Mock Exam 1Smith TiwariNo ratings yet

- Why We Have Never Used The Black-Scholes-Merton Option Pricing FormulaDocument10 pagesWhy We Have Never Used The Black-Scholes-Merton Option Pricing Formulaapi-3729160100% (1)

- Yankee Candle Brand AuditDocument7 pagesYankee Candle Brand AuditLaurenHouseNo ratings yet

- Danske Bank - Credit Research Bane Nor Eiendom As PDFDocument21 pagesDanske Bank - Credit Research Bane Nor Eiendom As PDFDiego García VaqueroNo ratings yet

- From Help Desk To Service DeskDocument57 pagesFrom Help Desk To Service DeskteacherignouNo ratings yet

- DE1734859 Central Maharashtra Feb'18Document39 pagesDE1734859 Central Maharashtra Feb'18Adesh NaharNo ratings yet

- Departmental AccountingDocument10 pagesDepartmental AccountingRobert HensonNo ratings yet

- AECOM Handbook 2023 21 30Document10 pagesAECOM Handbook 2023 21 30vividsurveyorNo ratings yet

- Financial DerivatiesDocument22 pagesFinancial DerivatiesA.r. PirzadoNo ratings yet

- Excess Return Model of Firm Valuation: Presented by KUNAAL (19397038) G KIRITHIKA DEVI (19397036)Document19 pagesExcess Return Model of Firm Valuation: Presented by KUNAAL (19397038) G KIRITHIKA DEVI (19397036)KUNAL KISHOR SINGHNo ratings yet

- Option Chain LogicDocument20 pagesOption Chain LogicNitesh Singh0% (1)

- Business Simulation ReportDocument12 pagesBusiness Simulation ReportTanika Agarwal100% (1)

- Musharakah by Sheikh Muhammad Taqi UsmaniDocument9 pagesMusharakah by Sheikh Muhammad Taqi UsmaniMUSALMAN BHAINo ratings yet