Professional Documents

Culture Documents

Assignment

Uploaded by

Ian Santos0 ratings0% found this document useful (0 votes)

3 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageAssignment

Uploaded by

Ian SantosCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

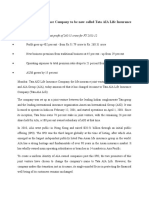

1. D.

There would be no intercompany accounts from a consolidated point of view because

there is a parent and a subsidiary relationship

2. A.

Unsecured liabilities without priority P 45 000

Stockholders’ equity 36 000

Unsecure liabilities with priority 10 000

Loss on realization of assets ( 45 000)

Total estimated amount available 91 000

Less: Estimated administrative costs 4 500

Unsecured liabilities with priority 10 000 (14 500)

Estimated amount available for unsecured,

non-priority creditors 76,500

(76,500/91,000) 85%

3. B.

Estimated deficiency to unsecured creditors:

Free assets:

Assets pledged to fully secured liabilities

(80 000 – 60 000) P 20 000

Free assets 272 000

Total free assets P 292 000

Less: Unsecured liabilities with priority 40 000

Net free assets P 252 000

Less: Unsecured liabilities without priority:

Partially secured liabilities (80 000 – 50 000) P30 000

Add: Unsecured liabilities without priority 330 000

360 000

Estimated deficiency to unsecured liabilities P180 000

Expected recovery % of Unsecured liabilities

(252 000/360 000) 70% or P.70

4. C.

Total liabilities (refer to Liabilities not liquidated) P 1 700 000

Add: Stockholders’ equity (1 500 – 500 000) 1 000 000

Total LSHE = Total Assets P 2 700 000

Less: Non-cash assets (refer to Assets not liquidated) 1 375 000

Cash balance, ending P 1 325 000

5. D.

You might also like

- Santos Assign AisDocument5 pagesSantos Assign AisIan SantosNo ratings yet

- FAR 3201 NotesDocument3 pagesFAR 3201 NotesIan SantosNo ratings yet

- Case Digest BPI Vs BPI EmployeesDocument2 pagesCase Digest BPI Vs BPI EmployeesIan SantosNo ratings yet

- Case Digest BPI Vs BPI EmployeesDocument3 pagesCase Digest BPI Vs BPI EmployeesIan SantosNo ratings yet

- FCL Reflection (Webinar)Document1 pageFCL Reflection (Webinar)Ian SantosNo ratings yet

- Exercise - Audit of Biological AssetsDocument2 pagesExercise - Audit of Biological AssetsIan SantosNo ratings yet

- FCL Reflection (Gawad Kalinga) - SantosDocument1 pageFCL Reflection (Gawad Kalinga) - SantosIan SantosNo ratings yet

- Assignment 2 - SantosDocument2 pagesAssignment 2 - SantosIan SantosNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Wealth Matrix - Shifting From Active To Passive Income 5 Day WeekendDocument7 pagesThe Wealth Matrix - Shifting From Active To Passive Income 5 Day Weekendkegezifapa0% (1)

- Math Series Course 1 Student Assignments Chapter 6Document14 pagesMath Series Course 1 Student Assignments Chapter 6api-261894355No ratings yet

- Contemporary World ReportDocument7 pagesContemporary World ReportCathlyn Galang80% (5)

- Economics Study Guide Unit 2: Market Economies at Work: Supply & Demand DemandDocument3 pagesEconomics Study Guide Unit 2: Market Economies at Work: Supply & Demand DemandKini Bubblezz HaynesNo ratings yet

- Monetary Policy During PTI GovernmentDocument2 pagesMonetary Policy During PTI GovernmentAMNA SHARIF BAJWANo ratings yet

- SHAREHOLDER?STAKEHOLDERDocument2 pagesSHAREHOLDER?STAKEHOLDERDushyant PandaNo ratings yet

- AFM Sample QuestionsDocument3 pagesAFM Sample QuestionsKaiwan PatrawalaNo ratings yet

- TRICYCLE Fare Matrix For One (1) To Two (2) PassengersDocument2 pagesTRICYCLE Fare Matrix For One (1) To Two (2) PassengersDaisy DimabuyuNo ratings yet

- 10 Terminologies in Engineering EconomyDocument4 pages10 Terminologies in Engineering EconomyKristianNo ratings yet

- Valuation of Colgate-PalmoliveDocument9 pagesValuation of Colgate-PalmoliveMichael JohnsonNo ratings yet

- Payslip Daily Rate: 373.00Document48 pagesPayslip Daily Rate: 373.00Nichole John ErnietaNo ratings yet

- No PlanDocument74 pagesNo PlanhenrykylawNo ratings yet

- Test Bank For Economic Development 12th Edition Todaro, SmithDocument15 pagesTest Bank For Economic Development 12th Edition Todaro, Smitha15906672360% (5)

- Financial Times Europe - 16-10-2019Document20 pagesFinancial Times Europe - 16-10-2019Ashutosh YadavNo ratings yet

- Tata AIG Life Insurance Company To Be Now Called Tata AIA Life Insurance CompanyDocument3 pagesTata AIG Life Insurance Company To Be Now Called Tata AIA Life Insurance CompanyShobanaNo ratings yet

- Screenshot 2023-05-01 at 8.00.41 AMDocument2 pagesScreenshot 2023-05-01 at 8.00.41 AMZia UddinNo ratings yet

- Certificate of Good StandingsDocument5 pagesCertificate of Good StandingsRrichard Prieto MmallariNo ratings yet

- ValuTeachers Path To GreatnessDocument12 pagesValuTeachers Path To GreatnessScott DauenhauerNo ratings yet

- Seabank Statement FEB PDFDocument1 pageSeabank Statement FEB PDFMhd Aref SiregarNo ratings yet

- Lesson Under Cover BossDocument4 pagesLesson Under Cover BossAbhishek PokhrelNo ratings yet

- A Critica To Shaik Transformation ProblemDocument15 pagesA Critica To Shaik Transformation ProblemYupi HelloNo ratings yet

- Chapter 18 Multinational Capital BudgetingDocument15 pagesChapter 18 Multinational Capital Budgetingyosua chrisma100% (1)

- Environment Clearance Status Query Form: SearchDocument6 pagesEnvironment Clearance Status Query Form: SearchPankaj RajbharNo ratings yet

- 2019 Sustainability Report - : Astra Agro Lestari TBKDocument140 pages2019 Sustainability Report - : Astra Agro Lestari TBKYanuar PaksiNo ratings yet

- New Authority To Travel (September 2019)Document4 pagesNew Authority To Travel (September 2019)Meach CallejoNo ratings yet

- TRANSACTIONDocument127 pagesTRANSACTIONNikhil DevdharNo ratings yet

- Sinda® Casing and Tubing With API 5L, API 5CT Certification and ISO Quality System CertificationDocument5 pagesSinda® Casing and Tubing With API 5L, API 5CT Certification and ISO Quality System CertificationAngirekula gopi krishnaNo ratings yet

- DEV 1150 LECTURE Classification of Developing CountriesDocument17 pagesDEV 1150 LECTURE Classification of Developing Countriesanipa mwaleNo ratings yet

- WT61P802Document1 pageWT61P802miteshNo ratings yet

- SAMRATDocument3 pagesSAMRATsamaNo ratings yet