Professional Documents

Culture Documents

TradeZilla 2.0 - Discover Your Trading Edge

TradeZilla 2.0 - Discover Your Trading Edge

Uploaded by

Vipul AgrawalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TradeZilla 2.0 - Discover Your Trading Edge

TradeZilla 2.0 - Discover Your Trading Edge

Uploaded by

Vipul AgrawalCopyright:

Available Formats

TradeZilla 2.

0 – Discover Your Trading Edge

Market Profile & Orderflow Mentorship Program (Jan 2019 Edition) (Premium Recorded Webinars)

(January 5, 2019 by Rajandran)

TradeZilla 2.0 is a complete 1month mentorship program for active traders (intraday/positional) to Explore Trading Edge and

Be an Independent Trader. This Mentorship program is an institutional grade trader skill development program designed in an

objective way to take advantage of traders behavior to trade any market conditions, to trade any trading instrument across the

world.

Unconventional tools like market profile, order-flow analysis are used to explain the market/traders behavior. Signature trades

using market profile are deeply explained to the users with intensive live market training.

The following things are covered under TradeZilla 2.0

Market Profile Basics

How to gain trading edge using Market Profile

How to read Market Profile

Introduction to auction Theory

Basics of Market Profile (Basic Terminologies, Profile Distribution Patterns, Open Types)

Learn the importance of Point of control, Poor Low, Poor High, Failed Auction and other short term nuances

Understand the traders behavior using market profile

Learn how dumb money plays using market profile

Learn to understand the market confidence avoid unwanted noise/sideways markets

Trading Price Vs Trading Value Area

Learn Excess and Balance Concepts

When to trade with the trend and when to trade against the trend using Market Profile

When to avoid trades using market profile

Market Profile Advanced

Market Profile Chart Settings for Various Instruments (Indices, Stocks, Commodities, Currencies)

How to estimate/forecast the stop loss of other traders using market profile

How to Prepare for a Trading Day (Top Down Analysis & Pre Market Analysis)

Signature Trades in Market Profile(G2/G3 Patterns), Poor Low/Poor High Patterns

How to draw short-term and intraday references and understand the significance of the reference lines

How and when to trade against crowd sentiment

Best Trading Practices and Market Profile Trading Principles

Learn how to invest for Short Term/Long Term using Market Profile

Gap Strategy and Spike Strategies in Market Profile

Orderflow Trading Strategies – Basics

Lesson 1 : Introduction to Auction Theory, Orderflow & Market Depth 101

Lesson 2 : How to Setup Orderflow Charts, Orderflow Settings, Datafeed Vendors

Lesson 3 : Orderflow using Minute Bars, Range Bars, UniRenko Bars which one to use?

Lesson 4 : Understanding Market Participants

Lesson 5 : Importance of Delta & Point of Control

Lesson 6 : Orderflow Support & Resistance levels

Lesson 7 : How one can identify Absorption from Orderflow

Lesson 8 : Identify Orderflow Momentum Patterns & Momentum

Exhaustion (Trend Reversal) Patterns

Lesson 9 : How to Combine Orderflow with Market Profile / Price Action Studies

Lesson 10: Best Orderflow Trading Practices

Lesson 11: Intraday Scalping Strategies using Orderflow

Lesson 12: Case Studies & Conclusion

This video access is currently available only for people who attended TradeZilla with valid membership

You might also like

- Order FlowDocument4 pagesOrder FlowrlprisNo ratings yet

- COT Indicators - COT Indicator Suite For MetaTrader - MT4 - MT5Document1 pageCOT Indicators - COT Indicator Suite For MetaTrader - MT4 - MT5Shahbaz SyedNo ratings yet

- Average True RangeDocument2 pagesAverage True Rangesanny2005100% (1)

- Acegazettepriceaction Supplyanddemand 140117194309 Phpapp01Document41 pagesAcegazettepriceaction Supplyanddemand 140117194309 Phpapp01Panneer Selvam Easwaran100% (1)

- Expectancy: What Is Expectancy in A Nutshell?Document3 pagesExpectancy: What Is Expectancy in A Nutshell?rafa manggala100% (1)

- Richard NeyDocument15 pagesRichard Neyharishgarud100% (4)

- 2018 June Provisional 20180202-1-1Document16 pages2018 June Provisional 20180202-1-1hhhhNo ratings yet

- DAY TRADING STRATEGY: Proven Techniques for Profitable Day Trading (2024 Guide for Beginners)From EverandDAY TRADING STRATEGY: Proven Techniques for Profitable Day Trading (2024 Guide for Beginners)No ratings yet

- The Complete Trading SystemDocument5 pagesThe Complete Trading SystemMariafra AntonioNo ratings yet

- MPDocument4 pagesMPJohn BestNo ratings yet

- BookMap NT User GuideDocument14 pagesBookMap NT User GuideRoseane SobralNo ratings yet

- Channel Breakouts: Part 1: EntriesDocument5 pagesChannel Breakouts: Part 1: EntriesdavyhuangNo ratings yet

- Distance Weighted Moving AveragesDocument6 pagesDistance Weighted Moving AveragessuperbuddyNo ratings yet

- Multi-MarketProfile (AAD Mods) (Options) (08!24!2012)Document11 pagesMulti-MarketProfile (AAD Mods) (Options) (08!24!2012)roh_nessNo ratings yet

- The First Battle,: Forex Art of WarDocument29 pagesThe First Battle,: Forex Art of WardevulskyNo ratings yet

- Initial Balance Perspective: The OpenDocument2 pagesInitial Balance Perspective: The OpenwilwilwelNo ratings yet

- Ultimate Swing Trader Manual: Read/DownloadDocument3 pagesUltimate Swing Trader Manual: Read/DownloadAalon SheikhNo ratings yet

- Advanced MP Manual RezaDocument33 pagesAdvanced MP Manual RezaAyman erNo ratings yet

- Market Profile Instructions PDFDocument1 pageMarket Profile Instructions PDFdhungtnNo ratings yet

- Forex Strategy - Dreamliner HFT MethodDocument14 pagesForex Strategy - Dreamliner HFT MethodfuraitoNo ratings yet

- Leon Wilson - Trading SuccessDocument20 pagesLeon Wilson - Trading Successmanastha100% (1)

- OANDA User ManualDocument81 pagesOANDA User ManualYann MoncuitNo ratings yet

- Safezone Stops: Free Download Subscribe Education Trading Diary Forum HelpDocument6 pagesSafezone Stops: Free Download Subscribe Education Trading Diary Forum HelpPapy RysNo ratings yet

- Swing Failure PatternDocument6 pagesSwing Failure PatternAmoniNo ratings yet

- Intra-Day Momentum: Imperial College LondonDocument53 pagesIntra-Day Momentum: Imperial College LondonNikhil AroraNo ratings yet

- The Trendline Ebook Guide: Lesson Recap - Cliff Notes Tradeciety - Your Online Forex AcademyDocument6 pagesThe Trendline Ebook Guide: Lesson Recap - Cliff Notes Tradeciety - Your Online Forex AcademyThato MotlhabaneNo ratings yet

- For Ex Box ProfitDocument29 pagesFor Ex Box Profitnhar15No ratings yet

- Supply and Demand Basic Forex Stocks Trading Nutshell by Alfonso Moreno PDFDocument73 pagesSupply and Demand Basic Forex Stocks Trading Nutshell by Alfonso Moreno PDFIrene CiurlaNo ratings yet

- Printer Friendly - Module 5 - Trade Management & PsychologyDocument78 pagesPrinter Friendly - Module 5 - Trade Management & PsychologyOguz ErdoganNo ratings yet

- Trader Nexus - Advanced Trailing Stop Metastock Stop Loss PluginDocument6 pagesTrader Nexus - Advanced Trailing Stop Metastock Stop Loss PluginlenovojiNo ratings yet

- OrderFlow Charts and Notes 12th Oct 17 - VtrenderDocument4 pagesOrderFlow Charts and Notes 12th Oct 17 - VtrenderSinghRaviNo ratings yet

- Philakone Course ListDocument1 pagePhilakone Course ListprajwalNo ratings yet

- Development and Analysis of A Trading Algorithm Using Candlestick PatternsDocument21 pagesDevelopment and Analysis of A Trading Algorithm Using Candlestick PatternsManziniLeeNo ratings yet

- The Logical Trader Applying A Method To The Madness PDFDocument137 pagesThe Logical Trader Applying A Method To The Madness PDFJose GuzmanNo ratings yet

- Tensor Charts ScalpingDocument10 pagesTensor Charts Scalpingpotfictio100% (1)

- Monitoring The Smart Money by Using On Balance VolumeDocument5 pagesMonitoring The Smart Money by Using On Balance VolumeNo NameNo ratings yet

- Chapter - IDocument50 pagesChapter - IshahimermaidNo ratings yet

- Trader Profile - THE SCALPER Scalping Tools and Techniques: Information Is A Key ToolDocument9 pagesTrader Profile - THE SCALPER Scalping Tools and Techniques: Information Is A Key ToolAhmad Zamroni100% (1)

- Trader Dale'S Profile Pack Quick GuideDocument14 pagesTrader Dale'S Profile Pack Quick GuideRui LopesNo ratings yet

- OrderFlow Charts and Notes 27th Sept 17 - VtrenderDocument12 pagesOrderFlow Charts and Notes 27th Sept 17 - VtrenderSinghRaviNo ratings yet

- Price Channel DrawingDocument6 pagesPrice Channel Drawingravi lathiyaNo ratings yet

- Short Term Trading1Document5 pagesShort Term Trading1LUCKYNo ratings yet

- Book The Trading CrowdDocument20 pagesBook The Trading CrowdGeorge Akrivos100% (1)

- Box Trading StrategyDocument15 pagesBox Trading StrategyYogesh chavanNo ratings yet

- Introduction To Trading Strategy Design, Position Sizing and Optimization - Frank Svarholt TradeNodeAB 2011 21sDocument21 pagesIntroduction To Trading Strategy Design, Position Sizing and Optimization - Frank Svarholt TradeNodeAB 2011 21slowtarhkNo ratings yet

- Heikin Ashi Newsletter 01122014Document32 pagesHeikin Ashi Newsletter 01122014anicket kabeerNo ratings yet

- Commodities TradingDocument2 pagesCommodities TradingAdityaKumarNo ratings yet

- The Magic Momentum Method of Trading The Forex MarketDocument16 pagesThe Magic Momentum Method of Trading The Forex MarketBhavya ShahNo ratings yet

- USD/JPY - Long Trade Called at 27/09/2011. HIGH RISK TRADE! James FournierDocument5 pagesUSD/JPY - Long Trade Called at 27/09/2011. HIGH RISK TRADE! James Fournierapi-100874888No ratings yet

- Firststrike 1 PDFDocument8 pagesFirststrike 1 PDFgrigoreceliluminatNo ratings yet

- Gom Order Flow Pro V1Document19 pagesGom Order Flow Pro V1julian Mejia100% (1)

- For Traders - How To Pass A Trading Challenge in 2024Document63 pagesFor Traders - How To Pass A Trading Challenge in 2024brunodpferreira18100% (1)

- Andy BushkDocument2 pagesAndy Bushklaxmicc67% (3)

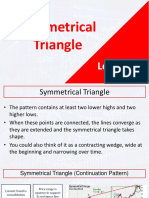

- PinoyInvestor Academy - Technical Analysis Part 3Document18 pagesPinoyInvestor Academy - Technical Analysis Part 3Art JamesNo ratings yet

- Pivot Points in Forex Trading - The 70-80% RuleDocument3 pagesPivot Points in Forex Trading - The 70-80% Ruleanand_studyNo ratings yet

- How To Develop A Profitable Trading SystemDocument3 pagesHow To Develop A Profitable Trading SystemJoe DNo ratings yet

- The Profitable Art and Science of Vibratrading: Non-Directional Vibrational Trading Methodologies for Consistent ProfitsFrom EverandThe Profitable Art and Science of Vibratrading: Non-Directional Vibrational Trading Methodologies for Consistent ProfitsNo ratings yet

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeFrom EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNo ratings yet

- Hydro Survey Guide All in OneDocument73 pagesHydro Survey Guide All in OneAyesha MariyaNo ratings yet

- MP Tut On How To Deal - With Exponential Emotional InformationDocument5 pagesMP Tut On How To Deal - With Exponential Emotional InformationAyesha MariyaNo ratings yet

- SonarDocument19 pagesSonarAyesha MariyaNo ratings yet

- Module11 Personal FinanceDocument426 pagesModule11 Personal FinanceAyesha MariyaNo ratings yet

- Manual Multibeam SonarDocument23 pagesManual Multibeam SonarAyesha MariyaNo ratings yet

- How To Become A Hydrographic Surveyor: Tools and Equipment Typically UsedDocument2 pagesHow To Become A Hydrographic Surveyor: Tools and Equipment Typically UsedAyesha MariyaNo ratings yet

- Lidar EsentialsDocument40 pagesLidar EsentialsAyesha MariyaNo ratings yet

- BestPracticesInHydrographicSurveying 09-2019 Final508 (WithAddedAppendices)Document222 pagesBestPracticesInHydrographicSurveying 09-2019 Final508 (WithAddedAppendices)Ayesha MariyaNo ratings yet

- Basic Applied Survey MathsDocument34 pagesBasic Applied Survey MathsAyesha MariyaNo ratings yet

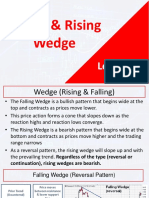

- Falling & Rising WedgeDocument4 pagesFalling & Rising WedgeAyesha MariyaNo ratings yet

- 6.1 Lecture 30 PDFDocument3 pages6.1 Lecture 30 PDFAyesha MariyaNo ratings yet

- Pivot CallsDocument1 pagePivot CallsAyesha MariyaNo ratings yet

- CPR Tricks IntradayDocument1 pageCPR Tricks IntradayAyesha MariyaNo ratings yet

- 2.1 Trading PlanDocument1 page2.1 Trading PlanAyesha MariyaNo ratings yet

- c02 ConsumersDocument8 pagesc02 ConsumersHuyen NguyenNo ratings yet

- Inequality Is A Necessary Evil'Document2 pagesInequality Is A Necessary Evil'Jennifer DelgadoNo ratings yet

- Economic Analysis of Soft DrinksDocument14 pagesEconomic Analysis of Soft DrinksParv PandeyNo ratings yet

- Decoding Global Financial Markets: Glance at Financial ProductsDocument8 pagesDecoding Global Financial Markets: Glance at Financial ProductsAKANKSHA SINGHNo ratings yet

- Retail Revenue ManagementDocument17 pagesRetail Revenue ManagementfkkfoxNo ratings yet

- Lesson 4 EntrepDocument2 pagesLesson 4 Entrepzelz 7u7No ratings yet

- Consumer's EquilibriumDocument7 pagesConsumer's EquilibriumAryan JainNo ratings yet

- Income Tax Department Rule 11UADocument3 pagesIncome Tax Department Rule 11UASourabh GargNo ratings yet

- Pricing To Capture ValueDocument30 pagesPricing To Capture ValueArshad RS100% (1)

- IMC Module 1Document61 pagesIMC Module 1Vidhi ShahNo ratings yet

- II. Understanding The MarketplaceDocument4 pagesII. Understanding The MarketplaceNevan NovaNo ratings yet

- The Definition of MarketingDocument3 pagesThe Definition of Marketingluckyg1122No ratings yet

- Cambridge O Level: Economics 2281/12Document12 pagesCambridge O Level: Economics 2281/12Zoya RashdiNo ratings yet

- S1-2 SEMM21-22-Intro To Course Sports MKTGDocument70 pagesS1-2 SEMM21-22-Intro To Course Sports MKTGAj StylesNo ratings yet

- Marketing Strategies and Advertisement of Digital BanksDocument2 pagesMarketing Strategies and Advertisement of Digital Banksstreetfighter283No ratings yet

- Demand Elasticity and Different Types of GoodsDocument19 pagesDemand Elasticity and Different Types of GoodsMh ParvezNo ratings yet

- Exer 1 - Chap 123Document3 pagesExer 1 - Chap 123ywmfry29mkNo ratings yet

- BA100 - Basic MarketingDocument22 pagesBA100 - Basic MarketingSam CorsigaNo ratings yet

- B2B Marketing - Sharad SarinDocument12 pagesB2B Marketing - Sharad SarinMegha SharmaNo ratings yet

- BigbazaarDocument10 pagesBigbazaarAmrit Mishra100% (1)

- Integrated Marketing CommunicationsDocument5 pagesIntegrated Marketing CommunicationsAkshay KalraNo ratings yet

- (Hons) Syllabus (SDSU)Document78 pages(Hons) Syllabus (SDSU)Aman YaduvanshiNo ratings yet

- 4P ModelDocument3 pages4P ModelRoni RoyNo ratings yet

- International Marketing Mix StrategyDocument4 pagesInternational Marketing Mix StrategyScorpio199900% (1)

- Managerial EconomicsDocument99 pagesManagerial Economicsthakara2875% (12)

- MRP Presentation FinalDocument8 pagesMRP Presentation FinalU DNo ratings yet

- Summer Traininig Project Tittle - 2022Document18 pagesSummer Traininig Project Tittle - 2022Chungalbaz Dimag 4kNo ratings yet

- Hull OFOD10e MultipleChoice Questions and Answers Ch05Document6 pagesHull OFOD10e MultipleChoice Questions and Answers Ch05Kevin Molly KamrathNo ratings yet