Professional Documents

Culture Documents

Global Financial Crisis in India

Uploaded by

deyanimesh007Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global Financial Crisis in India

Uploaded by

deyanimesh007Copyright:

Available Formats

Kamla-Raj 2009

J Soc Sci, 21(1): 1-5 (2009)

Global Financial Crisis and Its Impact on India

A. Prasad and C. Panduranga Reddy Department of Humanities and Social Sciences, College of Engineering, Andhra Visakhapatnam 530 003, Andhra Pradesh, University, India

KEYWORDS Subprime. Real Estate. Collateralized Debt Obligations. Securitization. Speculation. Globalization ABSTRACT The global financial crisis originated in United States of America. During booming years when interest rates were low and there was great demand for houses, banks advanced housing loans to people with low credit worthiness on the assumption that housing prices would continue to rise. Later, the financial institutions repackaged these debts into financial instruments called Collateralized Debt Obligations and sold them to investors world-wide. In this way the risk was passed on multifold through derivatives trade. Surplus inventory of houses and the subsequent rise in interest rates led to the decline of housing prices in the year 2006-07 which resulted in unaffordable mortgage payments and many people defaulted or undertook foreclosure. The house prices crashed and the mortgage crisis affected many banks, mortgage companies and investment firms world-wide that had invested heavily in sub-prime mortgages. Different views on the reasons of the crisis include boom in the housing market, speculation, high-risk mortgage loans and lending practices, securitization practices, inaccurate credit ratings and poor regulation of the financial institutions. The financial crisis has not only affected United States of America, but also European Union, U.K and Asia. The Indian Economy too has felt the impact of the crisis to some extent. Though it is difficult to quantify the impact of the crisis on India, it is felt that certain sectors of the economy would be affected by the spillover effects of the financial crisis.

INTRODUCTIO N The current global financial crisis is rooted in the subprime crisis which surfaced over a year ago in the United States of America. During the boom years, mortgage brokers attracted by the big commissions, encouraged buyers with poor credit to accept housing mortgages with little or no down payment and without credit checks. A combination of low interest rates and large inflow of foreign funds during the booming years helped the banks to create easy credit conditions for many years. Banks lent money on the assumption that housing prices would continue to rise. Also the real estate bubble encouraged the demand for houses as financial assets. Banks and financial institutions later repackaged these debts with other high-risk debts and sold them to world- wide investors creating financial instruments called CDOs or Collateralized Debt Obligations (Sadhu 2008). In this way risk was passed on multifold through derivatives trade.

Address for Dr.A.Prasad M.B.A., Ph.D. correspondence: Associate Department Professor of Humanities and Social Sciences, College of Engineering, Andhra University, Visakhapatnam 530 003, Andhra Pradesh, India Mobile: 9440 197475 E-mail: ayathamprasad@yahoo.co.in

Surplus inventory of houses and increase in interest rates led to a decline in housing prices in 2006-2007 resulting in an increased defaults and foreclosure activity that collapsed the housing market ( Sengupta 2008 ). Consequently, a large number of properties were up for sale affecting mortgage companies, investment firms and government sponsored enterprises which had invested heavily in sub prime mortgages. Since the collateral debt instruments had been globally distributed, many banks and other financial institutions around the world were affected. Major Banks and other financial institutions around the world have reported losses of approximately US $ 435 billion as on 17th July, 2008 (Onaran 2008). Thus with the failure of a few leading institutions in United States, the entire financial system in the world has been affected. METHODOLOG Y The present study focuses on The origin and causes of global financial crisis and The impact of the crisis on the Indian economy. The data for the study has been collected from secondary sources.

2 RESULTS DISCUSSION Reasons for Financial Crisis AND

A. PRASAD AND C. PANDURANGA REDDY

3 High- Risk Mortgage Loans and Practices:A variety of factors caused lenders to . Lending offer higher-risk loans to higher-risk borrowers. The risk premium required by lenders to offer a The first hint of the trouble came from the subprime loan declined. In addition to considering collapse of two Bear Stearns hedge funds early high-risk borrowers, lenders have offered increas2007. Subsequently a number of other banks and ingly high-risk loan options and incentives. These financial institutions also began to show signs high-risk loans included No Income, No Job and of distress. Matters really came to the fore with No Assets loans. It is criticized that mortgage the bankruptcy of Lehman Brothers, a big underwriting practices including automated loan investment bank, in September 2008. approvals were not subjected to appropriate The reasons for the crisis are varied and complex. review and documentation. Some of them include boom in the housing market, 4. Securitization Practices:Securitization of speculation, high-risk mortgage loans and lending housing loans for people with poor credit- not practices, securitization practices, inaccurate credit the loans themselves-is also a reason behind the ratings and poor regulation. current global credit crisis. Securitization is a structured finance process in which assets, 1. Boom in the Housing Subprime receivables or financial instruments are acquired, borrowing was a major contributor to an increase pooled together as collateral for the third party Market: in house ownership rates and the demand for investments (Investment Banks). Due to housing. This demand helped fuel housing price securitization, investor appetite for mortgageincrease and consumer spending. Some house backed securities (MBS), and the tendency of owners used the increased property value rating agencies to assign investment-grade experienced in housing bubble to re-finance their ratings to MBS, loans with a high risk of default homes with lower interest rates and take second could be originated, packaged and the risk readily mortgages against the added value to use the transferred to others. funds for consumer spending. Increase in house 5. Inaccurate Credit Ratings: Credit rating purchases during the boom period eventually led process was faulty. High ratings given by credit to surplus inventory of houses, causing house rating agencies encouraged the flow of investor prices to decline, beginning in the summer of 2006. funds into mortgage-backed securities helping Easy credit, combined with the assumption that housing prices would continue to appreciate, had finance the housing boom. Risk rating agencies were unable to give proper ratings to complex encouraged many subprime borrowers to obtain instruments (Gregorio 2008). Several products adjustable-rate mortgages which they could not and financial institutions, including hedge funds, afford after the initial incentive period. Once and rating agencies are largely if not completely housing prices started depreciating moderately unregulated. in many parts of the U.S, re-financing became 6. Poor The problem has more difficult. Some house owners were unable occurred during an extremely accelerated process Regulation: to re-finance their loans reset to higher interest of financial innovation in market segments that rates and payment amounts. Excess supply of were poorly or ambiguously regulated mainly houses placed significant downward pressure on in the U.S. The fall of the financial institutions is prices. As prices declined, more house owners a reflection of the lax internal controls and the were at risk of default and foreclosure. 2. Speculation in real estate was ineffectiveness of regulatory oversight in the a contributing factor. During 2006, 22 per cent of context of a large volume of non-transparent Speculation: assets. It is indeed amazing that there were simply houses purchased (1.65 million units) were for no checks and balances in the financial system investment purposes with an additional 14 per to prevent such a crisis and not one of the socent (1.07 million units) purchased as vacation homes. In other words, nearly 40 per cent of house called pundits in the field has sounded a word of caution. There are doubts whether the purchases were not primary residences. Speculators left the market in 2006, which caused operations of derivatives markets have been as investment sales to fall much faster than the transparent as they should have been or if they have been manipulated. primary market.

GLOBAL FINANCIAL CRISIS AND ITS IMPACT ON INDIA

3 Foreign institutional investment (FII) is largely open to Indias equity, debt markets and market for mutual funds. The most immediate effect of the crisis has been an outflow of foreign institutional investment from the equity market. There is a serious concern about the likely impact on the economy because of the heavy foreign exchange outflows in the wake of sustained selling by Foreign Institutional Investors in the stock markets and withdrawal of funds by others. The crisis resulted in net outflow of $ 10.1billion from n the equity and debt markets in India till 22 d Oct, 2008 (Kundu 2008). There is even the prospect of emergence of deficit in the balance of payments in the near future. 4. The tumbling economy in the U.SInvestment:dampen the investment flow. It is is going to expected that the capital inflows into the country will dry up. Investments in mega projects, which are under implementation and in the pipeline, are bound to buy more time before injecting funds into infrastructure and other ventures. The buoyancy in the economy is absent in all the sectors. Investment in tourism, hospitality and healthcare has slowed down. Fresh investment flows into India is in doubt. 5. Real Estate: One of the casualties of the crisis is the real estate. The crisis will hit the Indian real estate sector hard (Sinha 2008). The realty sector is witnessing a sudden slump in demand because of the global economic slowdown. The recession has forced the real estate players to curtail their expansion plans. Many on-going real estate projects are suffering due to lack of capital, both from buyers and bankers. Some realtors have already defaulted on delivery dates and commitments. The steel producers have decided to resort to production cuts following a decline in demand for the commodity. 6. Stock Market: The financial turmoil affected the stock markets even in India. The combination of a rapid sell off by financial institutions and the prospect of economic slowdown have pulled down the stocks and commodities market. Foreign institutional investors pulled out close to $ 11 billion from India, dragging the capital market down with it (Lakshman 2008). Stock prices have fallen by 60 per cent. Indias stock market indexSensex touched above 21,000 mark in the month of January,2008 and has plunged below 10,000 during October 2008 ( Kundu 2008).The movement of Sensex shows a positive and significant relation

Impact on India Due to globalization, the Indian economy cannot be insulated from the present financial crisis in the developed economies. The development in the U.S financial sector has affected not only America but also European Union, U.K and Asia. The Indian economy too has felt the impact of the crisis though not to the same extent. It is premature to try to quantify the consequences of the crisis on the Indian economy. However the impact will be multi-fold. 1. Information With the global financial system getting trapped in the quicksand, Technology: there is uncertainty across the Indian Software industry. The U.S. banks have huge running relations with Indian Software Companies. A rough estimate suggests that at least a minimum of 30,000 Indian jobs could be impacted immediately in the wake of happenings in the U.S. financial system. Approximately 61 per cent of the Indian IT Sector revenues are from U.S financial corporations like Goldman Sachs, Washington Mutual, Citigroup, Bank of America, Morgan Stanley and Lehman Brothers. The top five Indian players account for 46 per cent of the IT industry revenues. The revenue contribution from U.S clients is approximately 58 per cent. About 30 per cent of the industry revenues are estimated to be from financial services (Atreya 2008). The software companies may face hard days ahead. 2. Exchange Exchange rate volatility in India has increased in the year 2008-09 Rate: compared to previous years. Massive selling by Foreign Institutional Investors and conversion of their holdings from rupees to dollars for repatriation has resulted in the rupee depreciating sharply against the dollar. Between January 1 and October 16, 2008, the Reserve Bank of India (RBI) reference rate for the rupee fell by nearly 25 per cent, from Rs.39.20 per dollar to Rs.48.86 (Chandrasekhar and Gosh 2008). This depreciation may be good for Indias exports that are adversely affected by the slowdown in global markets but it is not so good for those who have accumulated foreign exchange payment commitments. 3. Foreign Exchange After the macro-economic reforms in 1991, the Indian Outflow: economy has been increasingly integrated with the global economy. The financial institutions in India are exposed to the world financial market.

4 with Foreign Institutional Investment flows into the market. This also has an effect on the Primary Market. In 2007-08, the net Foreign Institutional Investment inflows into India amounted to $20.3 billion. As compared to this, they pulled out $11.1 billion during the first nine-and-a-half months of the calendar year 2008, of which $8.3 billion occurred over the first six-and-a-half months of the financial year 2008-09 (April 1 to October 16). 7. Exports: The crisis will sharply contract the demand for exports adversely affecting the countrys growth prospects. It will have an impact on merchandise exports and service exports. The decline in export growth may sharply affect some segments of the Indian Economy that are exportoriented. The slowdown in the world economy has affected the garment industry. The orders for factories which are dependent on exports, mainly to the U.S have come down following deferred buying by big apparel brands. Rising unemployment and reduced spending by the Americans have forced some of the leading brands in the U.S to close down their outlets, which in turn has affected the apparel industry here in India. The U.S accounts for 55 per cent of all global apparel imports (Bageshree and Srivatsa 2008). The global recession will undermine other major export sectors of the Indian economy like sea foods, gems and jewellery. 8. Increase inOne danger is of aUnemployment: dip in the employment market. The global financial crisis could increase unemployment. Layoffs and wage cuts are certain to take place in many companies where young employees are working in Business Process Outsourcing and Information Technology sectors (Ratnayake 2008). With job losses, the gap between the rich and the poor will be widened. It is estimated that there would be downsizing in many other fields as companies cut costs. The International Labor Organization predicted that millions of jobs will be lost by the end of 2009 due to the crisis - mostly in construction, real estate, financial services, and the auto sector. The Global Wage Report 2008-09 of International Labour Organization warns that tensions are likely to intensify over the issue of wages. There would also be a significant drop in new hiring (The Hindu 2008) All these will change the complexion of the job market. 9. :The ongoing crisis will have an adverse impact on some of the Indian banks. Some Banks of the Indian banks have invested in derivatives

A. PRASAD AND C. PANDURANGA REDDY

which might have exposure to investment bankers in U.S.A. However, Indian banks in general, have very little exposure to the asset markets of the developed world. Effectively speaking, the Indian banks and financial institutions have not experienced the kind of losses and write-downs that banks and financial institutions in the Western world have faced (Venkitaramanan 2008). Indian banks have very few branches abroad. Our Indian banks are slightly better protected from the financial meltdown, largely because of the greater role of the nationalized banks even today and other controls on domestic finance. Strict regulation and conservative policies adopted by the Reserve Bank of India have ensured that banks in India are relatively insulated from the travails of their western counterparts (Kundu 2008). CONCLUSIO N While the developed world, including the U.S, the Euro Zone and Japan, have plunged into recession, the Indian Economy is being affected by the spill-over effects of the global financial crisis (Chidambaram 2008). Great savings habit among people, strong fundamentals, strong conservative and regulatory regime have saved Indian economy from going out of gear, though significant parts of the economy have slowed down and there is a wide variance of opinion about how long it will continue. It is expected that growth will be moderate in India. The most important lesson that we must learn from the crisis is that we must be self-reliant. Though World Trade Organization (WTO) propagates free trade, we must adopt protectionist measures in certain sectors of the economy so that recession in any part of the globe does not affect our country. REFERENCE S

Atreya Manohar M 2008. The U.S Financial Crisis: Impact on the Indian IT Sector. From <http:// www.vcircle.com> (Retrieved December 29, 2008) Bageshree S, Srivatsa S Sharat 2008. Global slowdown hits Garment Industry. The Hindu , Daily , October 27, 2008. p.12 Chandrasekhar CP, Ghosh Jayanthi 2008. India and the Global Financial Crisis. From <http://www. macroscan.org> (Retrieved October 8, 2008) Chidambaram P 2008. Spill over effects of global crisis will be tackled. The Hindu , Daily, November 19, 2008, P. 15 Gregoria Jose De 2008. The International Financial Crisis

GLOBAL FINANCIAL CRISIS AND ITS IMPACT ON INDIA an impact on the Chilean Economy. From <http:// www.bis.org> (Retrieved October 30, 2008) I L O 2008. Economic meltdown to result in wage cuts. The Hindu , Daily, November 26, 2008, P. 14 Kundu Sridhar 2008. Can the India economy emerge unscathed from the global financial crisis? From< http://www.observerindia.com> (Retrieved December 3, 2008) Lakshman Nandini 2008.World Financial Crisis: Indias Hurting, Too. From <http://www.businessweek.com. (Retrieved October 29, 2008) Onaran Yalman 2008.Subprime Losses Top $ 379 Billion on Balance Sheet Marks: Table From< http:// www.Bloomberg.com> (Retrieved June 4, 2008) Ratnayake K 2008. International financial crisis exposes

5

vulnerability of Indian economy. From< http:// www.wsws.org> (Retrieved October 29, 2008) Sadhu Naveen 2008. Global financial crisis: The Story so far. From <http://indiaequity.wordpress.com> (Retrieved September 21, 2008) Sengupta Jayashree 2008. The financial crisis and its impact on India. From <http://www.observerindia. com> (Retrieved December 6, 2008) Sinha Prabhakar TNN 2008. U.S financial crisis set to impact Indias real estate sector. From <http://economictimes.indiatimes.com> (Retrieved November 14, 2008) Venkitaramanan S 2008. Global financial crisis: reflections on its impact on India. The Hindu , Daily, October10, 2008, P. 11.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

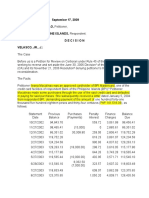

- Debt Reduction Calculator - Credit Repair Edition: Monthly Payment Initial Snowball StrategyDocument11 pagesDebt Reduction Calculator - Credit Repair Edition: Monthly Payment Initial Snowball StrategyLittlebeeNo ratings yet

- 1.FIM - Module I - Overview of Financial System and Interest RatesDocument19 pages1.FIM - Module I - Overview of Financial System and Interest RatesAmarendra PattnaikNo ratings yet

- Crisil RatingDocument20 pagesCrisil RatingChintan AcharyaNo ratings yet

- Commercialisation of Microfinancei N Sri LankaDocument7 pagesCommercialisation of Microfinancei N Sri LankaDamith ChandimalNo ratings yet

- Solution Manual For Principles of Managerial Finance Brief 8th Edition ZutterDocument36 pagesSolution Manual For Principles of Managerial Finance Brief 8th Edition Zutterkatevargasqrkbk100% (26)

- Cash Management in Banking: A StudyDocument80 pagesCash Management in Banking: A StudyVaishali Sharma100% (5)

- Project Report: Background: Mrs. Vidya Mankar, The Proprietor of "Dairy Farm" Is A Successful FarmerDocument6 pagesProject Report: Background: Mrs. Vidya Mankar, The Proprietor of "Dairy Farm" Is A Successful FarmervarshamankarNo ratings yet

- Study On The Effects of Technology..Document80 pagesStudy On The Effects of Technology..Christina Teng de CastroNo ratings yet

- (Reviewer) Credit Transactions (Atty. Lerma)Document40 pages(Reviewer) Credit Transactions (Atty. Lerma)Carl Joshua DayritNo ratings yet

- CHAP - 4 - Risks in Banking OperationsDocument5 pagesCHAP - 4 - Risks in Banking OperationsNgoc AnhNo ratings yet

- Zombies-To-Be and The Walking Dead of Debt (Steve Keen, 2016)Document23 pagesZombies-To-Be and The Walking Dead of Debt (Steve Keen, 2016)Vas RaNo ratings yet

- PAS 23 borrowing costsDocument7 pagesPAS 23 borrowing costsJustine Reine CornicoNo ratings yet

- Business Finance: Week 2 - Module 3Document15 pagesBusiness Finance: Week 2 - Module 3Minimi Lovely100% (1)

- Macalinao V BpiDocument9 pagesMacalinao V BpiChristiane Marie BajadaNo ratings yet

- Stages of Measuring Advertising EffectivenessDocument22 pagesStages of Measuring Advertising EffectivenessLakshmi MeganNo ratings yet

- LM-2 Nycdcc 2012-01-10Document49 pagesLM-2 Nycdcc 2012-01-10Latisha WalkerNo ratings yet

- Vietnam: Increasing Access To Credit Through Collateral (Secured Transactions) ReformDocument62 pagesVietnam: Increasing Access To Credit Through Collateral (Secured Transactions) ReformIFC Access to Finance and Financial MarketsNo ratings yet

- HNB Report-2Document37 pagesHNB Report-2Samith GurusingheNo ratings yet

- ING Bank Annual Report 2015: A step aheadDocument286 pagesING Bank Annual Report 2015: A step aheadJasper Laarmans Teixeira de MattosNo ratings yet

- Finance For Non-FinanceDocument35 pagesFinance For Non-FinanceDr Sarbesh Mishra100% (5)

- Traco Cable WCM ProjectDocument77 pagesTraco Cable WCM ProjectAjeesh K RajuNo ratings yet

- Ambank v KT Steel: Lease Agreement Valid Despite Non-RegistrationDocument30 pagesAmbank v KT Steel: Lease Agreement Valid Despite Non-RegistrationLe TigerNo ratings yet

- Simple Will Form and CommentaryDocument16 pagesSimple Will Form and CommentarypearlanderNo ratings yet

- NOC - TATA Capital PDFDocument1 pageNOC - TATA Capital PDFShuvabrata Ganai57% (7)

- Deposits Mobilizationand Financing ManagementDocument165 pagesDeposits Mobilizationand Financing ManagementHasan AbdulNo ratings yet

- Kisan Credit CardDocument4 pagesKisan Credit CardBabuNo ratings yet

- Final Format For Credit MidtermDocument8 pagesFinal Format For Credit MidtermCloieRjNo ratings yet

- SAMPLE Assignment Sub Prime Financial Crisis 2008Document4 pagesSAMPLE Assignment Sub Prime Financial Crisis 2008scholarsassistNo ratings yet

- 2006 Business CalculationsDocument13 pages2006 Business CalculationsthatasianpersonNo ratings yet

- Lozano v. Martinez, 146 SCRA 324Document14 pagesLozano v. Martinez, 146 SCRA 324ela kikayNo ratings yet