Professional Documents

Culture Documents

Hope For Trust Usa: IRS Publication 78 Details

Hope For Trust Usa: IRS Publication 78 Details

Uploaded by

Daniy-ELCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- How To Form Nonprofit 501 C 3Document29 pagesHow To Form Nonprofit 501 C 3Margaret Sullivan100% (1)

- Corporation SoleDocument13 pagesCorporation Soledsr_prophet100% (1)

- Ohio Attorney General's Nonprofit HandbookDocument30 pagesOhio Attorney General's Nonprofit HandbookMike DeWine100% (2)

- 501C Bylaws SampleDocument8 pages501C Bylaws SampleLincoln Reserve Group Inc.No ratings yet

- Checklist NonprofitDocument5 pagesChecklist Nonprofitkatenunley100% (1)

- Joyce Grant Award Letter 041609Document6 pagesJoyce Grant Award Letter 041609Sweet WaterNo ratings yet

- Holy Spirit Sciences Ministries of AmaracapanaDocument1 pageHoly Spirit Sciences Ministries of AmaracapanaDhakiy M Aqiel ElNo ratings yet

- NFSA Handbook PDFDocument48 pagesNFSA Handbook PDFNeeraj Kumar100% (1)

- Nra 2018 990Document108 pagesNra 2018 990jpr9954No ratings yet

- Instructions For Form 990-T: Internal Revenue ServiceDocument15 pagesInstructions For Form 990-T: Internal Revenue ServiceIRSNo ratings yet

- 2013 - Form 990Document30 pages2013 - Form 990Fred MednickNo ratings yet

- SFI Regional Coordinator ManualDocument38 pagesSFI Regional Coordinator ManualMorgan JohnstoneNo ratings yet

- iSocialWatch Inc. Delaware Articles of IncorporationDocument3 pagesiSocialWatch Inc. Delaware Articles of IncorporationiSocialWatch.com50% (2)

- Savings Solidarity: Enjoy Special Discounts On Wireless Devices and SaveDocument38 pagesSavings Solidarity: Enjoy Special Discounts On Wireless Devices and SaveIATSENo ratings yet

- Financial Guidelines For Local SDA Churches 279Document11 pagesFinancial Guidelines For Local SDA Churches 279Faith Joel ShimbaNo ratings yet

- Tulsa Community Investment Grant Application RequirementsDocument6 pagesTulsa Community Investment Grant Application Requirementsapi-25993403No ratings yet

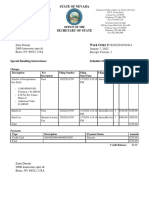

- Barbara K. Cegavske: Zane Durant 2000 Lonesome Spur DR Reno, NV 89521, USA January 7, 2022 Receipt Version: 1Document10 pagesBarbara K. Cegavske: Zane Durant 2000 Lonesome Spur DR Reno, NV 89521, USA January 7, 2022 Receipt Version: 1fiqiNo ratings yet

- Lansing (MI) City Council Meeting Info Packet For June 28 MeetingDocument213 pagesLansing (MI) City Council Meeting Info Packet For June 28 MeetingwesthorpNo ratings yet

- 501 CDocument20 pages501 CEn Mahaksapatalika0% (1)

- Montgomery County Bill 15-23, Landlord-Tenant Relations - Anti Rent Gouging ProtectionsDocument9 pagesMontgomery County Bill 15-23, Landlord-Tenant Relations - Anti Rent Gouging ProtectionsABC7NewsNo ratings yet

- Church of Scientology: 1993 Form 1023 Submission To The IRS. Application For 501 (C) 3 Tax ExemptionDocument69 pagesChurch of Scientology: 1993 Form 1023 Submission To The IRS. Application For 501 (C) 3 Tax ExemptionThe Department of Official InformationNo ratings yet

- Vera Institute 990 FormDocument59 pagesVera Institute 990 FormFox NewsNo ratings yet

- Pa Rev-72Document12 pagesPa Rev-72Nick Rosati0% (1)

- Constitution and By-Laws: Asme Manual Mm-1Document56 pagesConstitution and By-Laws: Asme Manual Mm-1vhin84No ratings yet

- Blood Business: American Red Cross Form 990 2012Document74 pagesBlood Business: American Red Cross Form 990 2012LansingStateJournalNo ratings yet

- Courtyard of Honor Inc Full Filing Nonprofit Explorer PropublicaDocument11 pagesCourtyard of Honor Inc Full Filing Nonprofit Explorer PropublicaPennLiveNo ratings yet

- Audit and Investigation of The City of Deerfield Beach FestivalsDocument944 pagesAudit and Investigation of The City of Deerfield Beach FestivalsKesslerInternationalNo ratings yet

- SPN National ReportDocument31 pagesSPN National ReportprogressnowNo ratings yet

- SCC Founding DocumentsDocument17 pagesSCC Founding DocumentsL. A. PatersonNo ratings yet

- Reapers Hockey Association V AHAI ComplaintDocument43 pagesReapers Hockey Association V AHAI ComplaintJonah MeadowsNo ratings yet

Hope For Trust Usa: IRS Publication 78 Details

Hope For Trust Usa: IRS Publication 78 Details

Uploaded by

Daniy-ELOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hope For Trust Usa: IRS Publication 78 Details

Hope For Trust Usa: IRS Publication 78 Details

Uploaded by

Daniy-ELCopyright:

Available Formats

Generated on December 11, 2021

HOPE FOR TRUST USA

Aka HOPE FOR TRUST USA

830 Glenwood Ave Ste 510-242 Foundation Status Code: PC*

Atlanta, GA 30316

Public charity described in section 509(a)(1) or (2)

NOTE: This is a subordinate organization covered under group exemption number 3317. IRS regulations specify that subordinate organizations within Group Exemptions

inherit the tax deductibility (i.e., Pub 78) status of the parent organization. For reference, the parent organization is FULL GOSPEL OF CHRIST FELLOWSHIP INC (54-1598036)

IRS Publication 78 Details

Organization name Location Most recent IRS Publication 78

FULL GOSPEL OF CHRIST FELLOWSHIP INC GAINESVILLE, VA November 2021

EIN Deductibility status description Verified with most recent Internal Revenue Bulletin

45-2986746 Generally, a central organization holding a group December 06, 2021

exemption letter, whose subordinate units covered by

the group exemption are also eligible to receive tax-

deductible contributions, even though they are not

separately listed (deductibility limitation dependent on

various factors).

IRS Business Master File Details

Organization name Most recent IRS BMF Reason for Non-Private Foundation Status

FULL GOSPEL OF CHRIST FELLOWSHIP INC November 08 2021 Section 509(a)(1) organization as referred to in Section

170(b)(1)(A)(i)

EIN IRS subsection Ruling date

45-2986746 This organization is a 501(c)(3) Public Charity 12/1991

This organization was not included in the Office of Foreign Assets Control Specially Designated Nationals (SDN) list.

On September 8, 2011, the IRS issued regulations which eliminated the advance ruling process for a section 501(c)(3) organization. Learn more

* The Foundation Status Code is the code that foundations are required to provide for each grantee annually on part XV of Form 990PF. Note that this code cannot be derived

in some cases (e.g., supporting organizations for which 'type' can't be determined).

IRS Revenue Procedure 2011-33 allows grantors to rely on third-party resources, such as GuideStar Charity Check, to obtain required Business Master File (BMF) data

concerning a potential grantee's public charity classification under section 509 (a) (1), (2) or (3).

GuideStar Charity Check Data Sources

-GuideStar acquires all IRS data directly from the Internal Revenue Service. -The IRS Automatic Revocation of Exemption List contains organizations that have had their federal tax-exempt

status automatically revoked for failing to file an annual return or notice with the IRS for three consecutive years.

-IRS Publication 78 (Cumulative List of Organizations) lists organizations that have been recognized by the Internal

Revenue Service as eligible to receive tax-deductible contributions. -The Foundation Status Code is a value derived by mapping the codes found on the 990PF filing instructions to the

corresponding codes in the IRS BMF. Note that not all codes are able to be mapped due to insufficient data.

-The IRS Internal Revenue Bulletin (IRB) lists changes in charitable status since the last Publication 78 release.

Between the release of IRS Publication 78 and the subsequent IRS Internal Revenue Bulletin, the IRB date will -The Office of Foreign Assets Control (OFAC) Specially Designated Nationals (SDN) list organizations that are owned

reflect the most recent release date of IRS Publication 78. or controlled by targeted individuals, groups, and entities, such as terrorists or narcotics traffickers.Their assets are

blocked and U.S. persons are generally prohibited from dealing with them.

-The IRS Business Master File lists approximately 1.7 million nonprofits registered with the IRS as tax-exempt

organizations.

© 2021 Candid. All rights reserved. Candid is a 501(c)(3) nonprofit organization, EIN 13-1837418. Donations are tax-deductible.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- How To Form Nonprofit 501 C 3Document29 pagesHow To Form Nonprofit 501 C 3Margaret Sullivan100% (1)

- Corporation SoleDocument13 pagesCorporation Soledsr_prophet100% (1)

- Ohio Attorney General's Nonprofit HandbookDocument30 pagesOhio Attorney General's Nonprofit HandbookMike DeWine100% (2)

- 501C Bylaws SampleDocument8 pages501C Bylaws SampleLincoln Reserve Group Inc.No ratings yet

- Checklist NonprofitDocument5 pagesChecklist Nonprofitkatenunley100% (1)

- Joyce Grant Award Letter 041609Document6 pagesJoyce Grant Award Letter 041609Sweet WaterNo ratings yet

- Holy Spirit Sciences Ministries of AmaracapanaDocument1 pageHoly Spirit Sciences Ministries of AmaracapanaDhakiy M Aqiel ElNo ratings yet

- NFSA Handbook PDFDocument48 pagesNFSA Handbook PDFNeeraj Kumar100% (1)

- Nra 2018 990Document108 pagesNra 2018 990jpr9954No ratings yet

- Instructions For Form 990-T: Internal Revenue ServiceDocument15 pagesInstructions For Form 990-T: Internal Revenue ServiceIRSNo ratings yet

- 2013 - Form 990Document30 pages2013 - Form 990Fred MednickNo ratings yet

- SFI Regional Coordinator ManualDocument38 pagesSFI Regional Coordinator ManualMorgan JohnstoneNo ratings yet

- iSocialWatch Inc. Delaware Articles of IncorporationDocument3 pagesiSocialWatch Inc. Delaware Articles of IncorporationiSocialWatch.com50% (2)

- Savings Solidarity: Enjoy Special Discounts On Wireless Devices and SaveDocument38 pagesSavings Solidarity: Enjoy Special Discounts On Wireless Devices and SaveIATSENo ratings yet

- Financial Guidelines For Local SDA Churches 279Document11 pagesFinancial Guidelines For Local SDA Churches 279Faith Joel ShimbaNo ratings yet

- Tulsa Community Investment Grant Application RequirementsDocument6 pagesTulsa Community Investment Grant Application Requirementsapi-25993403No ratings yet

- Barbara K. Cegavske: Zane Durant 2000 Lonesome Spur DR Reno, NV 89521, USA January 7, 2022 Receipt Version: 1Document10 pagesBarbara K. Cegavske: Zane Durant 2000 Lonesome Spur DR Reno, NV 89521, USA January 7, 2022 Receipt Version: 1fiqiNo ratings yet

- Lansing (MI) City Council Meeting Info Packet For June 28 MeetingDocument213 pagesLansing (MI) City Council Meeting Info Packet For June 28 MeetingwesthorpNo ratings yet

- 501 CDocument20 pages501 CEn Mahaksapatalika0% (1)

- Montgomery County Bill 15-23, Landlord-Tenant Relations - Anti Rent Gouging ProtectionsDocument9 pagesMontgomery County Bill 15-23, Landlord-Tenant Relations - Anti Rent Gouging ProtectionsABC7NewsNo ratings yet

- Church of Scientology: 1993 Form 1023 Submission To The IRS. Application For 501 (C) 3 Tax ExemptionDocument69 pagesChurch of Scientology: 1993 Form 1023 Submission To The IRS. Application For 501 (C) 3 Tax ExemptionThe Department of Official InformationNo ratings yet

- Vera Institute 990 FormDocument59 pagesVera Institute 990 FormFox NewsNo ratings yet

- Pa Rev-72Document12 pagesPa Rev-72Nick Rosati0% (1)

- Constitution and By-Laws: Asme Manual Mm-1Document56 pagesConstitution and By-Laws: Asme Manual Mm-1vhin84No ratings yet

- Blood Business: American Red Cross Form 990 2012Document74 pagesBlood Business: American Red Cross Form 990 2012LansingStateJournalNo ratings yet

- Courtyard of Honor Inc Full Filing Nonprofit Explorer PropublicaDocument11 pagesCourtyard of Honor Inc Full Filing Nonprofit Explorer PropublicaPennLiveNo ratings yet

- Audit and Investigation of The City of Deerfield Beach FestivalsDocument944 pagesAudit and Investigation of The City of Deerfield Beach FestivalsKesslerInternationalNo ratings yet

- SPN National ReportDocument31 pagesSPN National ReportprogressnowNo ratings yet

- SCC Founding DocumentsDocument17 pagesSCC Founding DocumentsL. A. PatersonNo ratings yet

- Reapers Hockey Association V AHAI ComplaintDocument43 pagesReapers Hockey Association V AHAI ComplaintJonah MeadowsNo ratings yet