Professional Documents

Culture Documents

Dnyansagar Institute of Management & Research: 2015-16/MBA-II/ Sem-IV

Dnyansagar Institute of Management & Research: 2015-16/MBA-II/ Sem-IV

Uploaded by

Farnood RumiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dnyansagar Institute of Management & Research: 2015-16/MBA-II/ Sem-IV

Dnyansagar Institute of Management & Research: 2015-16/MBA-II/ Sem-IV

Uploaded by

Farnood RumiCopyright:

Available Formats

DNYANSAGAR INSTITUTE OF MANAGEMENT & RESEARCH

2015-16/MBA-II/ Sem-IV

ASSIGNMENT: INDIRECT TAXATION (409)

Q1. Sharma and Company manufactures 5 quilts a day and uses cotton

fiber (Rs.100 per kg) and cotton cloth (Rs.50 per meter) as input. In

making one quilt 2 kgs of cottonB fibre and 5 meters of cloth are used.

If excise duty on cotton fiber is 8% and on cloth it is 10% while on quilt

it is 12%, calculate the total duty paid to the government in one month

when the value added by the Company is Rs.109 per quilt, if the

transaction is (i) without Cenvat (ii) with Cenvat.

Q2. Mr. Kumar imports 50 kgs of chocolate @ Rs 250 per kg, 80 kgs of

biscuits @ Rs 400 per kg and 1 quintal of wafers @ Rs 200 per kg. 25%

of chocolate, 10% of biscuits and 15% of wafers were damaged in the

transport. Customs duty on all these items is 25% but on damaged

goods it is 5%. Calculate the total amount of duty he has to pay for this

transaction, if 2% education cess is to be charged on customs duty.

Q3. A washing machine dealer, purchases 5 washing machines (WM)

@Rs. 22,000 per unit and 2 WM @ 25,000 per unit from the company.

After earning profit of Rs. 6000 on each machine. The dealer sells 5 WM

at Rs. 28750 and 2 WM at Rs. 31750. How much percentage of VAT he

has paid and what is the total amount paid by him to the government

as VAT.

Q4. A wholesaler purchases 15 meters of cloth from the manufacturer

@Rs. 80 per meter and sells to the retailer after adding value of Rs. 20

per meter. The retailer sells the cloth and making a profit of Rs.50 per

meter. Calculate how much total tax was paid to the government in the

whole transaction, through (i) VAT and (ii) Sales tax method,

considering that both taxes were levied @8%.

DATE: 26/02/2016 LAST DATE OF SUBMISSION: 15/03/2016

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

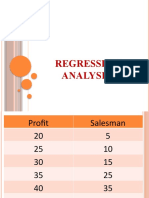

- Regression AnalsysisDocument9 pagesRegression AnalsysisFarnood RumiNo ratings yet

- Business Plan: Opening A Restaurant in Ulaanbaatar, MongoliaDocument53 pagesBusiness Plan: Opening A Restaurant in Ulaanbaatar, MongoliaFarnood RumiNo ratings yet

- Assignment 410Document1 pageAssignment 410Farnood RumiNo ratings yet

- Haroof e Tehejji UrduDocument271 pagesHaroof e Tehejji UrduFarnood RumiNo ratings yet