Professional Documents

Culture Documents

A. The Following Account Balances Were Presented On December 31, 2017

Uploaded by

Shiela Mae Pon AnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A. The Following Account Balances Were Presented On December 31, 2017

Uploaded by

Shiela Mae Pon AnCopyright:

Available Formats

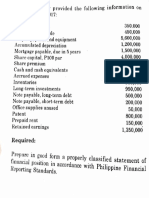

P1 (Statement of Financial Position) 300,000

A. The following account balances were presented Advances to officer-not currently collectible 100,000

on December 31, 2017:

Sinking Fund 400,000

Long-term refundable deposit 50,000

Share Capital 5,000,000

Cash surrender value 60,000

Share Premium-ordinary 500,000

lease rights 100,000

Retained Earnings -un appropriated 880,000

Serial bonds payable(P500,000 due every July 1 of

Accrued Interest on notes receivable 10,000

each year) 2,500,000

Land held for speculation 500,000

Employees income tax payable 20,000

Computer software 3,250,000

Notes Payable 100,000

Unearned rent income 40,000

Accrued Expenses 30,000

Premium on Bonds payable 1,000,000

Accrued Interest on notes payable 10,000

Share Premium-preference 500,000

Income Tax payable 60,000

SSS payable 10,000

Allowance for doubtful accounts 50,000

Dividend payable 120,000

Advances from customers 100,000

Preference share redemption fund 350,000

Accounts Receivable 500,000

Investment in Associates 1,300,000

Accumulated Depreciation-Bldg. 1,600,000

Mortgage Note payable in quarterly installments

of P100,000 2,000,000

Accumulated Depreciation-machinery 1,300,000

Estimated Liability for damages 140,000

Financial assets at amortized cost 1,500,000

Retained Earnings appropriated for plant

expansion 1,000,000

Land 1,500,000

Retained Earnings appropriated for contingencies 100,000

Machinery 2,000,000

Trademark 150,000

Factory supplies 50,000

Notes receivable 150,000

B. The following balances were presented at year-end

Building 4,000,000

Cash 420,000

Claim receivable 20,000 Trade accounts 930,000

Finished goods 400,000

Allowance for doubtful accounts (20,000)

Franchise 200,000

Goods in Process 600,000

Claims against shipper for goods lost in transit 30,000

Prepaid insurance 20,000 Selling price of unsold goods sent by Hazel on

consignment at 130% of cost and included in ending

Raw materials 200,000 inventory 260,000

Financial assets at fair value 250,000

Total Accounts receivable 1,200,000

Tools 40,000

What total amount should be presented as current assets?

Goodwill 100,000

Plant expansion fund 500,000

Accounts payable

C. The entity provided the following data on Dec. 7,500,000

31, 2017 Notes receivable, net of discounted note

P500,000 2,000,000

Cash, including sinking fund of 500,000 for bonds

payable due on June 30, 2018 2,000,000

Inventory 4,000,000

Notes receivable 1,200,000

18,000,000

Notes receivable discounted 700,000

Trade accounts receivable 5,000,000

Accounts receivable- unassigned 3,000,000

Allowance for doubtful accounts (500,000)

Accounts receivable- assigned 800,000 Selling price for A company’s unsold goods

sent to Other Company on Consignment at

Allowance for doubtful accounts 100,000

150% of cost and excluded from A

Company’s ending Inventory 3,000,000

Equity of assignee in accounts receivable assigned 500,000 7,500,000

Inventory, including P600, 000 costs of goods in

transit purchased FOB destination. The goods

1. What is the net realizable value of accounts

were received on January 3, 2018 2,800,000

receivable?

2. On December 31, 2017, what amount should be

What total amount of current assets should be reported on reported as total current assets?

Dec. 31, 2017?

D. The Entity reported the following current assets F. The entity disclosed the following liabilities

on Dec. 31, 2017

Accounts payable, after deducting debit

Cash 5,000,000 balances in supplier's accounts amounting to

100,000 4,000,000

Accounts Receivable 2,000,000

Inventory, Including goods received on Accrued expenses 1,500,000

consignment P200,000 800,000

Bond investment at Fair value through Credit balances of customer's accounts 500,000

other comprehensive income 1,000,000

Prepaid expenses, including a deposit of Share dividend payable 1,000,000

P50,000 made on inventory to be Claims for increase in wages and allowance by

delivered in 18 mos. 150,000 employees, covered in pending lawsuit 400,000

Total Current Assets 8,950,000 Estimated expenses in redeeming prize coupons 600,000

What total amount should be reported as current liabilities?

Cash in general checking account 3,500,000 G. The entity reported the following liability

Cash fund to be used to retire bond balances on Dec. 31, 2017

payable in 2019 1,000,000 10% notes payable issued on Oct. 1, 2016

maturing Oct. 1, 2018 2,000,000

Cash held to pay value added taxes 500,000 12% notes payable issued on march 1, 2016

maturing on march 1, 2018 4,000,000

5,000,000 The 2017 financial statements were issued on March 31,

2018. The entity has discretion to refinance the 10% note

payable for at least twelve months after December 31,

1. The correct amount of cash balance to be reported 2017.

as current assets? On December 31, 2017, the entire P4, 000, 000 balance of

the 12% note payable was refinance on a long-term basis.

2. What total amount of current assets should be

reported on December 31, 2017? What amount of the notes payable should be classified as

noncurrent on December 31, 2017?

E. A company reported the following current assets on H. The Entity provided the following trial balance

December 31, 2017: on June 30, 2017:

Cash Overdraft 100,000

Cash 4,500,000

Accounts receivable Accounts receivable 350,000

5,180,000

Inventory 580,000

All receivables on long-term contracts are considered to be

Prepaid expenses 120,000 collectible within 12mos.

During the year, estimated tax payments of P450,000 were

charged to prepaid taxes. The entity has not recorded

Land held for sale 1,000,000

income tax expense. The tax rate is 30%.

Property, plant and On Dec. 31, 2017, what amount should be reported as

equipment, net 950,000 1. Total retained earnings

2. Total current liabilities

Accounts payable 200,000 3. Total current assets

4. Total shareholder’s Equity

Accrued expenses 150,000

J. On Dec. 31, 2017, The entity showed the following:

Share premium 250,000

Share capital 1,500,000 Cash 3,200,000

Retained earnings 800,000 Accounts Receivable 2,500,000

3,000,000 3,000,000 Inventory 2,000,000

Deferred tax asset 700,000

Check amounting to P300, 000 were written to vendors and

recorded on June 29, 2017 resulting in a cash overdraft of Prepaid expenses 100,000

P100, 000. The check was mailed on July 9, 2017.

Land held for sale was sold for cash on July 15, 2017. 8,500,000

The entity issued the financial statements on July 31, 2017.

1. What total amount should be reported as current

assets? Cash on hand, including customer postdated

2. What total amount should be reported as current check P50,000 and employees IOU P50,000 500,000

liabilities? Cash in bank per bank statement,

3. What total amount should be reported as

outstanding check on December 31,2017

shareholder’s equity?

P200,000 2,700,000

3,200,000

I.The entity provided the following account balances on

December 31, 2017 which had been adjusted except for

income tax expense: Customer's debit balances, net of customers'

deposit P50,000 1,900,000

Cash 600,000

Allowance for doubtful accounts (150,000)

Sales price of goods invoiced to customers at

Accounts receivable, net 3,500,000

150% of cost on December 29, 2017 but

Cost in excess of billing on long-term

delivered on January 5, 2018 and 750,000

contracts 1,600,000

Billings in excess of cost on long-term

contracts 700,000 excluded from reported inventory 2,500,000

Prepaid taxes 450,000

1. What is the adjusted cash balance

Property, plant and equipment, net 1,510,000 2. What total amount should be reported as current

assets on Dec. 31, 2017?

Notes payable-noncurrent 1,620,000

Share capital 750,000

Share premium 2,030,000

Retained earnings un appropriated 900,000

Retained earnings restricted for notes

payable 160,000

Earnings from long-term contracts 6,680,000

Cost and expenses

You might also like

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Financial PositionDocument4 pagesFinancial PositionBeth Diaz Laurente100% (2)

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- Exemplar Company Financial Position StatementDocument2 pagesExemplar Company Financial Position Statementmitakumo uwuNo ratings yet

- Financial StatementsDocument1 pageFinancial StatementsjaphethadadNo ratings yet

- Problem Solving Updates in Philippine Accounting and Financial Reporting StandardsDocument5 pagesProblem Solving Updates in Philippine Accounting and Financial Reporting StandardsgnlynNo ratings yet

- Assignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedDocument10 pagesAssignment 1 Statement of Financial Position-Compressed - Compressed - Compressed-Min-CompressedJason MablesNo ratings yet

- (LAB) Activity - Preparation of Financial Statements Using SpreadsheetDocument3 pages(LAB) Activity - Preparation of Financial Statements Using SpreadsheetJUVEN LOGAGAY0% (1)

- INTACC 3 Dilemma Company (Financial Position)Document1 pageINTACC 3 Dilemma Company (Financial Position)Ian SantosNo ratings yet

- Practice Comptency Exam 124Document3 pagesPractice Comptency Exam 124Ivan Pacificar BioreNo ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionmoNo ratings yet

- 121 Class Project Financials and Accounts ProblemsDocument2 pages121 Class Project Financials and Accounts ProblemsJames Darwin TehNo ratings yet

- Sir Mac Book SolmanDocument10 pagesSir Mac Book SolmanJAY AUBREY PINEDANo ratings yet

- Balance SheetDocument2 pagesBalance SheetKeight NuevaNo ratings yet

- Far Quiz 2 Final W AnswersDocument6 pagesFar Quiz 2 Final W AnswersGia HipolitoNo ratings yet

- PDF Chapter 2 CompressDocument33 pagesPDF Chapter 2 CompressRonel GaviolaNo ratings yet

- ACC203 - AssignmentDocument2 pagesACC203 - AssignmentHailsey WinterNo ratings yet

- Fa3 PDF LongDocument1 pageFa3 PDF LongAmir LMNo ratings yet

- Hard Company financial statement analysisDocument4 pagesHard Company financial statement analysisMarriz Bustaliño Tan78% (9)

- Activity Part 1 Prepartion of Financial StatementsDocument4 pagesActivity Part 1 Prepartion of Financial Statementsjrmsu-3No ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- Group 1Document2 pagesGroup 1Niro MadlusNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersCarlos John Talania 1923No ratings yet

- Updates - Midterm Lspu ExamDocument6 pagesUpdates - Midterm Lspu ExamAngelo HilomaNo ratings yet

- Quiz 3 Acctg For Business Combination - EntriesDocument6 pagesQuiz 3 Acctg For Business Combination - EntriesNhicoleChoiNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Statement of Financial PositionDocument5 pagesStatement of Financial Positionbobo tangaNo ratings yet

- 03 - HO - Statement of Comprehensive IncomeDocument3 pages03 - HO - Statement of Comprehensive IncomeYoung MetroNo ratings yet

- Lspu Updates Final Exam PDFDocument4 pagesLspu Updates Final Exam PDFAngelo HilomaNo ratings yet

- 8-2 at 8-3Document6 pages8-2 at 8-3danmatthew265No ratings yet

- Evening CompanyDocument2 pagesEvening Companyfaye fayeNo ratings yet

- Balance Sheet IAS 1Document3 pagesBalance Sheet IAS 1briankuria21No ratings yet

- Financial Statement Elements and Accounting EquationDocument12 pagesFinancial Statement Elements and Accounting EquationKaith Mendoza100% (1)

- Financial ManagementDocument9 pagesFinancial Managementkendrapancho9No ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- Cashflow Statement Problems & SolutionsDocument2 pagesCashflow Statement Problems & SolutionsHaidee Flavier Sabido100% (1)

- Unit I VDocument15 pagesUnit I VLeslie Mae Vargas ZafeNo ratings yet

- Case 1.: Additional InformationDocument3 pagesCase 1.: Additional InformationPearl Jade YecyecNo ratings yet

- Redeemable Preferred Stock Long-Term Loans Liabilities Against Asset Subject To Financial Lease Deferred Tax Liabilities Warranty ObligationsDocument2 pagesRedeemable Preferred Stock Long-Term Loans Liabilities Against Asset Subject To Financial Lease Deferred Tax Liabilities Warranty Obligationsnida vardakNo ratings yet

- Manuel L Quezon University SOAB Arts Integrated Review Statement of Financial Position Income StatementDocument5 pagesManuel L Quezon University SOAB Arts Integrated Review Statement of Financial Position Income StatementP De GuzmanNo ratings yet

- Statement of CashflowDocument2 pagesStatement of CashflowAna Marie IllutNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- Practice Questions-IAS-1Document2 pagesPractice Questions-IAS-1Ayyan AzeemNo ratings yet

- 2, Questions and Answers 2, Questions and AnswersDocument35 pages2, Questions and Answers 2, Questions and AnswersHazel Pacheco100% (1)

- Statement of Comprehensive Income Problems...Document2 pagesStatement of Comprehensive Income Problems...Darlyn Dalida San PedroNo ratings yet

- PX Set H Solution PDFDocument14 pagesPX Set H Solution PDFChristine Altamarino89% (9)

- Output No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond PapersDocument2 pagesOutput No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond Papersnmdl123No ratings yet

- Corporate LiquidationDocument4 pagesCorporate LiquidationMae100% (1)

- Updates in Philippine Accounting and Financial Reporting StandardsDocument4 pagesUpdates in Philippine Accounting and Financial Reporting StandardsWindie SisodNo ratings yet

- Post-Combination Balance Sheet and Goodwill CalculationDocument2 pagesPost-Combination Balance Sheet and Goodwill CalculationEdward James SantiagoNo ratings yet

- Audit of Financial StatementsDocument8 pagesAudit of Financial Statementsd.pagkatoytoyNo ratings yet

- Chapter 2 - Review On Financial StatementsDocument6 pagesChapter 2 - Review On Financial StatementsLorraine Millama PurayNo ratings yet

- Chapter 9 - Presentation of Fs (Statement of Comprehensive Income)Document2 pagesChapter 9 - Presentation of Fs (Statement of Comprehensive Income)Mark IlanoNo ratings yet

- Chapter 2Document33 pagesChapter 2jake doinog93% (14)

- Chapter 2Document34 pagesChapter 2Marjorie PalmaNo ratings yet

- Output No. 3Document1 pageOutput No. 3chingNo ratings yet

- Review 105 - Day 13 P1: Notes ReceivableDocument21 pagesReview 105 - Day 13 P1: Notes ReceivableAldrin ZolinaNo ratings yet

- P1 (Statement of Change in Equity)Document1 pageP1 (Statement of Change in Equity)Shiela Mae Pon AnNo ratings yet

- Universidad de ManilaDocument2 pagesUniversidad de ManilaShiela Mae Pon AnNo ratings yet

- Quiz #1 (Q)Document6 pagesQuiz #1 (Q)Shiela Mae Pon AnNo ratings yet

- Quiz #2 - BSA 23 Absorp Variable CostingDocument6 pagesQuiz #2 - BSA 23 Absorp Variable CostingShiela Mae Pon AnNo ratings yet

- Assignment - Variable Ab (Q)Document2 pagesAssignment - Variable Ab (Q)Shiela Mae Pon AnNo ratings yet

- UNIVERSIDAD DE MANILA MIDTERM EXAMDocument6 pagesUNIVERSIDAD DE MANILA MIDTERM EXAMShiela Mae Pon AnNo ratings yet

- College of Business & Accountancy Manila City 1 Sem SY 2021-22Document2 pagesCollege of Business & Accountancy Manila City 1 Sem SY 2021-22Shiela Mae Pon AnNo ratings yet

- Time Value of Money: Marios MavridesDocument35 pagesTime Value of Money: Marios Mavridesandreas panayiotouNo ratings yet

- PAWNSHOPSDocument1 pagePAWNSHOPSBianca SiguenzaNo ratings yet

- ECO432 Explains Financial SystemsDocument7 pagesECO432 Explains Financial SystemsNuzhat TasnumNo ratings yet

- Investment Analysis & ManagementDocument29 pagesInvestment Analysis & ManagementSubhan ImranNo ratings yet

- TPA - Important SectionsDocument2 pagesTPA - Important SectionsRitesh AroraNo ratings yet

- FM 42: Investment and Portfolio ManagementDocument39 pagesFM 42: Investment and Portfolio ManagementSarah Jane OrillosaNo ratings yet

- ACC226 Lease AccountingDocument18 pagesACC226 Lease AccountingJaneth Barrete100% (2)

- GuaranteeDocument6 pagesGuaranteeDharna SinglaNo ratings yet

- Daisy Land Bank of The Philippines Vs COADocument3 pagesDaisy Land Bank of The Philippines Vs COAAllenNo ratings yet

- Financial Planning PDFDocument24 pagesFinancial Planning PDFLaila UbandoNo ratings yet

- 21 Problems For CB NewDocument5 pages21 Problems For CB NewLinh LinhNo ratings yet

- Ufrs ActivityDocument4 pagesUfrs ActivityErika TeradoNo ratings yet

- Interpretation of Insurance ContractsDocument2 pagesInterpretation of Insurance ContractsCiara De LeonNo ratings yet

- RTC Jurisdiction Over Consignation Case Involving Property Purchase DisputeDocument1 pageRTC Jurisdiction Over Consignation Case Involving Property Purchase DisputeDaphne EnriquezNo ratings yet

- Obligations and Contracts under Judge Ludmila LimDocument30 pagesObligations and Contracts under Judge Ludmila LimChelsea AlogNo ratings yet

- Rescheduling LetterDocument2 pagesRescheduling Letterمحمدريحان سعيد بتيلNo ratings yet

- Valuation Report of Property Depicted as Lots 1A, 1B & 1CDocument9 pagesValuation Report of Property Depicted as Lots 1A, 1B & 1CRadeeshaNo ratings yet

- The Black Woman Is GodDocument22 pagesThe Black Woman Is GodDario Best75% (4)

- Background: Chapter 11 Debtor/telecommunications Carrier and Its Debtor-Subsidiary Brought AdversaryDocument10 pagesBackground: Chapter 11 Debtor/telecommunications Carrier and Its Debtor-Subsidiary Brought AdversaryJun MaNo ratings yet

- Bonds PayableDocument52 pagesBonds PayableJohn Charles Andaya100% (2)

- Insurance Co Only Liable to Extent of Mortgage CreditDocument2 pagesInsurance Co Only Liable to Extent of Mortgage CreditRoi GatocNo ratings yet

- 09-Affin Skim Rumah Pertamaku-I Tawarruq ENG v07 2020Document10 pages09-Affin Skim Rumah Pertamaku-I Tawarruq ENG v07 2020afiq aqmalNo ratings yet

- Monte de Piedad v. Javier, 36 OG 2176Document5 pagesMonte de Piedad v. Javier, 36 OG 2176Cza PeñaNo ratings yet

- Asset v1 IMF+FMAx+2T2017+Type@Asset+Block@M1 Assessments ActivityDocument7 pagesAsset v1 IMF+FMAx+2T2017+Type@Asset+Block@M1 Assessments ActivitySmitaNo ratings yet

- Harsh Mini ProjectDocument178 pagesHarsh Mini ProjectHarsh Kumar100% (1)

- Venn DiagramDocument29 pagesVenn DiagramRJ DimaanoNo ratings yet

- Week 011-Module Key Concepts of Simple and Compound Interests, and Simple and General Annuities - Part 001Document7 pagesWeek 011-Module Key Concepts of Simple and Compound Interests, and Simple and General Annuities - Part 001Jieann BalicocoNo ratings yet

- IfciDocument6 pagesIfciIti TurgaliaNo ratings yet

- Zambia Institute of Advanced Legal Education - Suggested Model Answers - 2018Document25 pagesZambia Institute of Advanced Legal Education - Suggested Model Answers - 2018Leonard TemboNo ratings yet

- Fin 004 Module 2 2021Document36 pagesFin 004 Module 2 2021lianna marieNo ratings yet