Professional Documents

Culture Documents

Old Tax Regime Vs New Tax Regime Comparision - Final

Uploaded by

RajOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Old Tax Regime Vs New Tax Regime Comparision - Final

Uploaded by

RajCopyright:

Available Formats

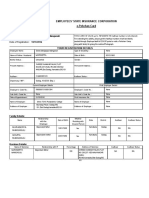

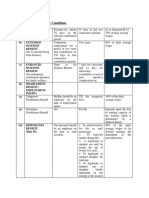

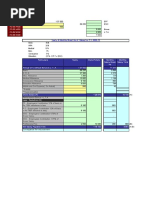

Comparison of Old Tax Regime & New Tax Regime:

Old Tax Regime New Tax Regime (Sec 115BAC)

This is the existing / Old Tax Regime where in This is the New Tax Regime where in an

an employee will be able to claim Section 10 employee will not be able to claim Section 10

Exemptions, Section 16 Deduction i.e., Exemptions, Section 16 Deduction i.e,

Standard Deduction & Profession Tax, Section Standard Deduction & Profession Tax, Section

24 Deduction (interest on Housing Loan) and 24 Deduction (interest on Housing Loan) and

avail deduction under Chapter VIA like avail deduction under Chapter VIA like

Insurance Premium, Provident Fund (PF), Insurance Premium, Provident Fund (PF),

Mediclaim Insurance etc. Mediclaim Insurance etc. Only deduction

Below is the applicable Income Tax Slabs allowed under Chapter VIA is NPS Employer

under this Regime Contribution u/s 80CCD(2) which is up to 10%

of Basic + DA

Below is the applicable Income Tax Slabs

Taxable Income Tax Rates under this Regime

0 - 2.5 Lakhs Exempt

Taxable Income Tax Rates

2.5 - 5 Lakhs 5%

0 - 2.5 Lakhs Exempt

5 - 10 Lakhs 20%

2.5 - 5 Lakhs 5%

Above 10 Lakhs 30%

5 – 7.5 Lakhs 10%

7.5 – 10 Lakhs 15%

10 – 12.5 Lakhs 20%

12.5 – 15 Lakhs 25%

Above 15 Lakhs 30%

Note: Employee choosing the Regime is only for Tax Calculation by Employer and at the time of

filing individual returns, employee has to Opt the Regime and File the Income Tax Returns

You might also like

- Old Vs New Tax Rates Regime (6 Cases)Document6 pagesOld Vs New Tax Rates Regime (6 Cases)Jigeesha BhargaviNo ratings yet

- Compliance Manual F.Y. 2020 21 A.Y.2021 22 PDFDocument52 pagesCompliance Manual F.Y. 2020 21 A.Y.2021 22 PDFTHERMAL TECH ENGINEERINGNo ratings yet

- Income Tax DepartmentDocument19 pagesIncome Tax DepartmentSharathNo ratings yet

- AgricultureDocument4 pagesAgriculturemohan rathoreNo ratings yet

- Yadnya-Income Tax Regime CalculatorDocument16 pagesYadnya-Income Tax Regime CalculatorRaghavendra DeshpandeNo ratings yet

- Contract Labour RegisterDocument34 pagesContract Labour Registerravinder.singh19853857No ratings yet

- Income Under The Head "Salaries": Shubhangi Gupta Roll No. 11 Financial Management Bhartiya Vidya BhavanDocument44 pagesIncome Under The Head "Salaries": Shubhangi Gupta Roll No. 11 Financial Management Bhartiya Vidya Bhavanhny0910No ratings yet

- Attendance Register FormatDocument1 pageAttendance Register Formatvishal_mtoNo ratings yet

- RegistrationDocument15 pagesRegistrationpratikdhond100% (3)

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument3 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationGoutam HotaNo ratings yet

- CCENT Notes Part-3Document63 pagesCCENT Notes Part-3Anil JunagalNo ratings yet

- The List of Components Which You Can Use For Salary BreakupDocument8 pagesThe List of Components Which You Can Use For Salary BreakupAnonymous VhqxrXNo ratings yet

- Kar Shops Commercial Forms FormatDocument16 pagesKar Shops Commercial Forms FormatbelvaisudheerNo ratings yet

- Major Spice State Wise Area Production Web 2015 PDFDocument3 pagesMajor Spice State Wise Area Production Web 2015 PDFbharatheeeyuduNo ratings yet

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument2 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationTontadarya PolytechnicNo ratings yet

- EPF CalenderDocument1 pageEPF CalenderAmitav TalukdarNo ratings yet

- PF Pension Settlement Form-TCSDocument4 pagesPF Pension Settlement Form-TCSSridhara Krishna BodavulaNo ratings yet

- Online Registration of Establishment With DSC: User ManualDocument39 pagesOnline Registration of Establishment With DSC: User ManualroseNo ratings yet

- Compliance PDFDocument20 pagesCompliance PDFSUBHANKAR PALNo ratings yet

- Benefits & Contributory Conditions: (I) (A) Sickness BenefitDocument4 pagesBenefits & Contributory Conditions: (I) (A) Sickness BenefitKunwar Sa Amit SinghNo ratings yet

- MCSE PracticalsDocument88 pagesMCSE PracticalsMayur UkandeNo ratings yet

- Karnataka Shops and Commercial Establishments Act, 1961Document44 pagesKarnataka Shops and Commercial Establishments Act, 1961Latest Laws TeamNo ratings yet

- Esic ChallanDocument7 pagesEsic Challanrgsr2008No ratings yet

- CCNA Cisco Routing Protocols and Concepts Final Exam-PracticeDocument22 pagesCCNA Cisco Routing Protocols and Concepts Final Exam-Practicesabriel69100% (1)

- What Is A Flexible Benefit Plan in A Salary Breakup? - QuoraDocument8 pagesWhat Is A Flexible Benefit Plan in A Salary Breakup? - QuoraSiNo ratings yet

- CCS LTC RULES PPT 20210617141434Document28 pagesCCS LTC RULES PPT 20210617141434Kumar KumarNo ratings yet

- Leave Record - INTERNALDocument50 pagesLeave Record - INTERNALDiyanaNo ratings yet

- Statutory ComplianceDocument2 pagesStatutory Compliancemax997No ratings yet

- Higher Pension As Per SC Decision With Calculation - Synopsis1Document13 pagesHigher Pension As Per SC Decision With Calculation - Synopsis1hariveerNo ratings yet

- USSP User Manual v1.0Document18 pagesUSSP User Manual v1.0Siva ChNo ratings yet

- Spice Growing States of IndiaDocument1 pageSpice Growing States of IndiahemachalNo ratings yet

- All Forms Under Factories Act 1948Document2 pagesAll Forms Under Factories Act 1948jagshishNo ratings yet

- Towngas ESG Report 2020Document59 pagesTowngas ESG Report 2020Jacky TamNo ratings yet

- Salary AdministrationDocument17 pagesSalary AdministrationMae Ann GonzalesNo ratings yet

- CTC Salary CalculatorDocument1 pageCTC Salary CalculatorsavideshwalNo ratings yet

- Code On Occupational Safety 2019Document95 pagesCode On Occupational Safety 2019kmalhotra9005No ratings yet

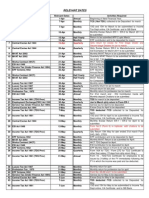

- Relevant Dates: 15-Apr QuarterlyDocument6 pagesRelevant Dates: 15-Apr Quarterlysanyu1208No ratings yet

- EPF Provident Fund CalculatorDocument6 pagesEPF Provident Fund CalculatorUtkal SolankiNo ratings yet

- Cheklist For Employers: Statutory Deposits & ReturnsDocument4 pagesCheklist For Employers: Statutory Deposits & ReturnsVas VasakulaNo ratings yet

- Form of Pension Proposals FormDocument14 pagesForm of Pension Proposals Formlakshmi naryanaNo ratings yet

- Salary Slip Format in PDF All PDFDocument3 pagesSalary Slip Format in PDF All PDFRajeev GunasekaranNo ratings yet

- Template - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKDocument9 pagesTemplate - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKajaykrsinghpintuNo ratings yet

- Overtime AllowanceDocument3 pagesOvertime AllowanceKumudha Devi100% (1)

- Presented By,: Shraddha Dhatrak (01) Priyanka Ghatrat Mayuri Koli Sneha MoreDocument30 pagesPresented By,: Shraddha Dhatrak (01) Priyanka Ghatrat Mayuri Koli Sneha MoreshraddhavanjariNo ratings yet

- Stationary Combustion Tool (Version4-1)Document18 pagesStationary Combustion Tool (Version4-1)hartiniNo ratings yet

- Appointment Salary BreakupDocument1 pageAppointment Salary BreakupPhani KumarNo ratings yet

- PF TransferDocument11 pagesPF TransfersinniNo ratings yet

- YTD Statement-1326013854886Document108 pagesYTD Statement-1326013854886deepson800No ratings yet

- HR ComplianceDocument4 pagesHR ComplianceAchuthan RamanNo ratings yet

- Atal Pension Yojana (APY)Document75 pagesAtal Pension Yojana (APY)prasenjit_gayen100% (2)

- CTS Marriage Loan PolicyDocument5 pagesCTS Marriage Loan PolicyshaannivasNo ratings yet

- Income-Tax Rates Under The New Tax Regime V/s The Old Tax RegimeDocument2 pagesIncome-Tax Rates Under The New Tax Regime V/s The Old Tax Regimeharish vNo ratings yet

- Old Vs New Tax RateDocument1 pageOld Vs New Tax RateFinance & Health ExpressNo ratings yet

- Detailed Comparison Between New Tax Regime Vs Old 2Document1 pageDetailed Comparison Between New Tax Regime Vs Old 2praveen917No ratings yet

- Note On Budget Proposals-2020Document4 pagesNote On Budget Proposals-2020Dhananjai SharmaNo ratings yet

- Unit 2 - Scope of Income and Residential Status, Rebate and ReliefDocument25 pagesUnit 2 - Scope of Income and Residential Status, Rebate and ReliefKhushi ThakurNo ratings yet

- Finshots Calculator For Tax RegimeDocument6 pagesFinshots Calculator For Tax RegimeSantosh mudaliarNo ratings yet

- 1 3+part+2Document28 pages1 3+part+2jaspreet kaurNo ratings yet

- Basic Concepts of TaxationDocument5 pagesBasic Concepts of TaxationMaya SharmaNo ratings yet

- Tax Deduction - DR Sajjad Wani JKASDocument26 pagesTax Deduction - DR Sajjad Wani JKASMohmad Yousuf100% (1)

- English Project: "Hafeez Contractor-The Man WHO Draws India"Document5 pagesEnglish Project: "Hafeez Contractor-The Man WHO Draws India"RajNo ratings yet

- History Chapter 3Document9 pagesHistory Chapter 3RajNo ratings yet

- Geography Chapter 4Document13 pagesGeography Chapter 4RajNo ratings yet

- ComputerDocument17 pagesComputerRajNo ratings yet

- Atharva Raj German HHWDocument17 pagesAtharva Raj German HHWRajNo ratings yet