Professional Documents

Culture Documents

Value of Supply: GST (Applicable For MAY'21/NOV'21)

Uploaded by

Tapan BarikOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Value of Supply: GST (Applicable For MAY'21/NOV'21)

Uploaded by

Tapan BarikCopyright:

Available Formats

GST(Applicable for MAY’21/NOV’21)

VALUE OF SUPPLY

VALUE OF TAXBALE SUPPLY [ section 15(1)]

(1) Value of taxable supply to be transaction value:

Price actually paid or payable for the said supply

Supplier and recipient are not related and

Price is the sole consideration for the supply

(2) Inclusions:

Taxes, duties, cesses, fees and charges except CGST,SGST, UTGST & GST

compensation cess. (if charged sperately). TCS under Income Tax not included.

Amount incurred by recipient on behalf of the supplier. (agar customer direct

payment bhi karega third party ko toh bhi include karenge). Payment made on

own account of recipient – not to be included.

Incidental expenses and amount charged for activities done before delivery

(commission, packing, inspection or certification charges, installation and testing

charges, outward freight, transit insurance)

Charges for delayed payment of consideration.

Subsidies (govt wali exclude karenge and private wali include)

(3) Exclusions:

Discounts:

Discount given on or before supply

Post supply discount:

Specially linked to relevant invoices and

Input tax credit as is attributable has to be reversed.

Non deductible discount (year end discount after reviewing dealer

performance)

CIRCULARS

֎ Free samples and gifts: not regarded as supply and ITC not admissible.

֎ Buy one get one free offer: value already included and ITC admissible.

֎ Staggered discount/volume discount – deductible.

֎ Secondary discount not deductible.

֎ Valuation of supply made by a component manufacturing using moulds and dies

owned by original equipment manufacturers (OEM) sent free of cost to him – value of

such moulds and dies not to be added to the value of supply made by component

manufacturer. If under obligation of component manufacturer such moulds and dies

supplied by OEM, then amortized value to be added in value of component.

If value cannot be determined on the above basis then shall b determined on basis of rules

ARHAM INSTITUTE, CA VARDHAMAN DAGA, 9039600091 Page 1

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- "Knowledge Is Superior To Marks",: PrefaceDocument12 pages"Knowledge Is Superior To Marks",: PrefaceTapan BarikNo ratings yet

- Strategic Analysis and Strategic Planning: Salient Features of The NotesDocument13 pagesStrategic Analysis and Strategic Planning: Salient Features of The NotesTapan BarikNo ratings yet

- 5 6233236502826976024Document85 pages5 6233236502826976024Tapan BarikNo ratings yet

- 5 6285256760169071780Document1 page5 6285256760169071780Tapan BarikNo ratings yet

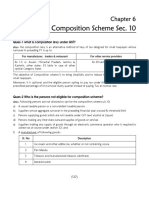

- Composition Scheme Sec. 10: Ques-1 What Is Composition Levy Under GST?Document12 pagesComposition Scheme Sec. 10: Ques-1 What Is Composition Levy Under GST?Tapan BarikNo ratings yet

- Ca & Cma Final Direct TaxDocument3 pagesCa & Cma Final Direct TaxTapan BarikNo ratings yet

- Cash Flow Statement New For YoutubeDocument48 pagesCash Flow Statement New For YoutubeTapan BarikNo ratings yet

- SM MCQDocument6 pagesSM MCQTapan BarikNo ratings yet

- December 2021 Term Examinations To Be Held From 8 - 15 December 2021Document2 pagesDecember 2021 Term Examinations To Be Held From 8 - 15 December 2021Tapan BarikNo ratings yet

- Cma Inter Audit MCQ BookDocument35 pagesCma Inter Audit MCQ BookTapan BarikNo ratings yet

- CMA Inter IDT MCQ BookletDocument35 pagesCMA Inter IDT MCQ BookletTapan BarikNo ratings yet

- Basics of GST - May 2021Document9 pagesBasics of GST - May 2021Tapan BarikNo ratings yet

- How To Decide The Moving AverageDocument1 pageHow To Decide The Moving AverageTapan BarikNo ratings yet

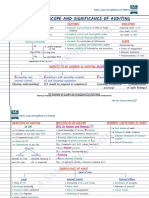

- Ca Samiksha Sethia: Nature, Scope and Significance of AuditingDocument4 pagesCa Samiksha Sethia: Nature, Scope and Significance of AuditingTapan BarikNo ratings yet