Professional Documents

Culture Documents

0822

0822

Uploaded by

Sumit Sharma0 ratings0% found this document useful (0 votes)

10 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pages0822

0822

Uploaded by

Sumit SharmaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

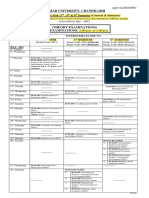

Exam,Code:0013

Sub, Code: 0822

2012

Bachelor of Commerce

Third Semester

BCM-306; Goods and Service Tax

Time allowed: 3 Hours Max. Marks: 80

NOTE: Attempt four short answer (ype questions from Section A. Atempt two questions each

from Section B and C respectively

1. Attempt any’ four of the following:-

8) Discuss the provisions relating to time of supply of goods that are taxable under

reverse charge’?

b) Why GST is not suitable in India.

©) Write a note on Credit and Debit note.

4) Explain valuation rules under GST.

©) What kind of penalties may be imposed as per GST Act?

£) Explain GST council structure (4x3)

Section - B

I. Who are liable for Registration under GST? Explain in detail Procedure of

registration. (13)

Hi. What kind of the powers are granted to officials as per GST Act? Explains rules of

appointment of officers at different levels. (as)

IV. How GST is better than previous tax system? Explain in detail the Jatest development

in GST. (1s)

V. Explain with example Invoice. Tax Invoice and Bill of Supply. (as)

ection

VI. Explain the norms of supplies in course of interstate and intra state trade, (15)

VII. Explain various exemptions from GST. How returns and payments are adjusted under

«i5)

PT.O

Sub, Code: 082,

(ea)

VII. How to calculate taxable value and tax liability? Fyplain with suitable example. (15)

IX. Discuss in detail various offences and penalties in GST. Explain the norms of levy

1 (15)

and collection of IG!

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Adobe Scan 31-Mar-2021Document1 pageAdobe Scan 31-Mar-2021Sumit SharmaNo ratings yet

- Panjab University, Chandigarh: Examination (Offline Mode) To Be Held in July - 2022Document2 pagesPanjab University, Chandigarh: Examination (Offline Mode) To Be Held in July - 2022Sumit SharmaNo ratings yet

- Issues in Marketing in Developing Economy-IDocument42 pagesIssues in Marketing in Developing Economy-ISumit SharmaNo ratings yet

- School Sarpanch FormDocument2 pagesSchool Sarpanch FormSumit SharmaNo ratings yet

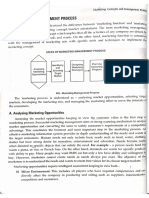

- Marketing Management ProcessDocument4 pagesMarketing Management ProcessSumit SharmaNo ratings yet

- Business Card 7 Jun 2022Document17 pagesBusiness Card 7 Jun 2022Sumit SharmaNo ratings yet

- Adv AccountingDocument38 pagesAdv AccountingSumit SharmaNo ratings yet