Professional Documents

Culture Documents

Midterm Test - Code 37 - FA - Sem 2 - 21.22

Uploaded by

Đoàn Tài ĐứcOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Midterm Test - Code 37 - FA - Sem 2 - 21.22

Uploaded by

Đoàn Tài ĐứcCopyright:

Available Formats

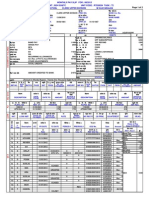

MID-TERM EXAM

ACADEMY OF

April 2022

POLICY AND DEVELOPMENT

International School of Economics and Finance Financial Accounting

Duration: 120 minutes

TEST CODE: 37

Instructions

Please read the instruction carefully before you start.

✓ There are 10 MCQs and 3 short-answer questions in this paper.

✓ Each question carries different marks and full marks can be obtained for complete

answers to all the questions.

✓ There are 10 marks available on this paper.

✓ A hand-held calculator may be used when answering questions on this paper but it

must not be pre-programmed or able to display graphics text of algebraic equations.

✓ Other materials are not allowed in the examination.

✓ Cheating is forbidden and will result in the mark of ZERO.

Note: This is closed-book exam. 1

SESSION 1: MULTIPLE CHOICE QUESTIONS

(0.2 point for each question – 10 questions – Total mark: 2.0 points)

1. Which of the following adjustments to convert net income to net cash provided by

operating activities is incorrect?

Add to Net Income Deduct from Net Income

a. Salary payable decrease increase

b. Accounts Receivable decrease increase

c. Inventory decrease increase

d. Accounts Payable increase decrease

2. The statement of cash flows reports each of the following except

a. cash receipts from operating activities.

b. cash payments from investing activities.

c. the net change in cash.

d. cash sales.

3. Indicate where the issuance of common stock issued for cash would appear, if at all, on the

indirect statement of cash flows.

a. Operating activities section

b. Investing activities section

c. Financing activities section

d. Does not represent a cash flow

4. A company receives $396, of which $36 is for sales tax. The journal entry to record the

sale would include a

a. debit to Sales Tax Expense for $36.

b. debit to Sales Revenue for $396.

c. debit to Cash for $360.

d. credit to Sales Taxes Payable for $36.

5. On January 1, 2015, Donahue Company, a calendar-year company, issued $600,000 of

notes payable, of which $150,000 is due on January 1 for each of the next four years. The

proper balance sheet presentation on December 31, 2015, is

a. Current Liabilities, $600,000.

b. Current Liabilities, $150,000; Long-term Debt, $450,000.

c. Long-term Debt, $600,000.

d. Current Liabilities, $450,000; Long-term Debt, $150,000.

Note: This is closed-book exam. 2

6. A $1,000 face value bond with a quoted price of 106 is selling for

a. $1,000.

b. $1060.

c. $106.

d. $1106.

7. The discount on bonds payable or premium on bonds payable is shown on the balance sheet

as an adjustment to bonds payable to arrive at the carrying value of the bonds. Indicate the

appropriate addition or subtraction to bonds payable (BP):

Premium on BP Discount on BP

a. Add Add

b. Deduct Add

c. Deduct Deduct

d. Add Deduct

8. Tomlinson Packaging Corporation began business in 2014 by issuing 30,000 shares of $5

par common stock for $8 per share and 5,000 shares of 6%, $10 par preferred stock for par.

At year end, the common stock had a market value of $10. On its December 31, 2014

balance sheet, Tomlinson Packaging would report

a. Common Stock of $300,000.

b. Common Stock of $150,000.

c. Common Stock of $240,000.

d. Paid-in Capital of $200,000.

9. What is the total stockholders’ equity based on the following account balances?

Common Stock $1,800,000 Retained Earnings 570,000

Paid-In Capital in Excess of Par 120,000 Treasury Stock 60,000

a. $1,680,000.

b. $2,190,000.

c. $2,430,000.

d. $2,550,000.

10. The number of shares of issued stock equals

a. authorized shares minus treasury shares.

b. unissued shares minus authorized shares.

c. outstanding shares plus treasury shares.

d. outstanding shares plus authorized shares.

Note: This is closed-book exam. 3

SESSION 2: THREE QUESTIONS – TOTAL MARKS: 8.0 POINTS

Question 1 (3.0 points):

The following information is available for Kento Corp. for the year ended December 31, 2021:

Acquisition of a new equipment for cash 6,200

Proceeds from the sale of an investment which has book value of $18,500 14,200

Issuance of common stock for cash 32,000

Depreciation expense 14,100

Payment of cash dividends 15,000

Net income 29,300

In addition, the following information is available from the comparative balance sheet for Kento

at the end of 2021 and 2020:

. 2021 2020

Cash $94,200 $22,500

Accounts receivable (net) 7,500 9,300

Inventory 8,400 6,200

Accounts payable 9,100 11,400

Unearned revenue 7,900 6,200

Instructions

a. Prepare Kento's statement of cash flows for the year ended December 31, 2021, using the

indirect method. (2.5 points)

b. The owner of Kento could not understand why the net income for the year was $29,300 but

the cash at bank increased by nearly $72,000. With reference to the cash flow statement,

explain why this was happening. (0.5 point)

Question 2 (3.0 points):

On Nov. 1st, 2021, Pixie Corp. issued $5,200,000, 9.5%, 7-year bonds. The market discount rate

at that time was 9.0%. The bonds were dated Nov. 1st, 2021, and pay interest semi-annually on

May 1st and Nov. 1st. Financial statements are prepared annually on Dec. 31st.

Requirements

a. Prepare the journal entry to record the issuance of the bonds on Nov. 1st, 2021. (1.5 point)

b. Prepare the journal entry to accrued bond interest on Dec. 31st, 2021. (0.5 point)

st

c. Prepare the journal entry to record the interest payment on May 1 , 2022 (1.0 point)

Notes: Rounding the results to the nearest dollar.

Note: This is closed-book exam. 4

Question 3 (2.0 points):

The stockholders’ equity accounts of Marley Corp. on Jan. 1, 2021 were as follows:

Preferred Stock (14%, $36 par, 10,000 shares authorized) $ 295,200

Common Stock ($14 stated value, 350,000 shares authorized) 4,410,000

Paid-in Capital in Excess of Par Value – Preferred Stock 12,300

Paid-in Capital in Excess of Par Value – Common Stock 504,000

Retained Earnings 226,000

Treasury Stock (12,500 common shares) 177,500

During 2021, the corporation had the following transactions and events pertaining to its

stockholder’s equity.

Jan. 7 Issued 1,800 shares of preferred stock for $68,400

Apr. 14 Purchased 14,200 shares of common treasury stock at $15.1 per share.

Oct. 20 Declared a 14% cash dividend on preferred stock, payable November 20.

Nov. 20 Paid the dividend declared on October 20

Dec. 05 Declared a $1.21 per share cash dividend to common stockholders of

record on December 21, payable December 31, 2021

31 Determined that net income for the year was $810,000. Paid the dividend

declared on December 5.

Requirements

Journalize the transactions. (2.0 points)

---------- END ---------

Note: This is closed-book exam. 5

You might also like

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CH 10Document9 pagesCH 10Tien Thanh DangNo ratings yet

- Solutions in AppendixDocument13 pagesSolutions in Appendixtfytf70% (2)

- Final Exam QuestionDocument4 pagesFinal Exam QuestionHồng XuânNo ratings yet

- Group Assignment 3 - Fall 2021 - Ashwin BaluDocument16 pagesGroup Assignment 3 - Fall 2021 - Ashwin Baluhalelz69No ratings yet

- ACCT2542 Final Exam With SolutionsDocument16 pagesACCT2542 Final Exam With SolutionsAnhPham100% (2)

- Mid-Term Exam Financial Accounting ReviewDocument5 pagesMid-Term Exam Financial Accounting ReviewĐoàn Tài ĐứcNo ratings yet

- Midterm Test - Code 36 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 36 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- Midterm Test - Code 4 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 4 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- Midterm Test - Code 40 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 40 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- ACCT 312 - Exam 2 (Part 1) - Spring 2022 FinalDocument8 pagesACCT 312 - Exam 2 (Part 1) - Spring 2022 FinalMercy Jerop KimutaiNo ratings yet

- Mock Midterm Exam - Financial AccountingDocument3 pagesMock Midterm Exam - Financial Accountinglamvolamvo0912No ratings yet

- Barclay Corp cash flow statement and explanationDocument4 pagesBarclay Corp cash flow statement and explanationTRANG NGUYỄN THỊ HÀNo ratings yet

- THPS 1 - Summer 2023Document9 pagesTHPS 1 - Summer 2023Ruth KatakaNo ratings yet

- Terminal Exam Male CampusDocument3 pagesTerminal Exam Male CampusAzmi KhanNo ratings yet

- Tee 1as Level QP Acc 2021Document10 pagesTee 1as Level QP Acc 2021Kalash JainNo ratings yet

- Liabilities QuizDocument5 pagesLiabilities QuizVanshee 11No ratings yet

- CA Zambia Qa March 2022Document406 pagesCA Zambia Qa March 2022Johaness Boneventure100% (1)

- CF MBA S23 Ch2 (B2) QsDocument6 pagesCF MBA S23 Ch2 (B2) QsWaris 3478-FBAS/BSCS/F16No ratings yet

- SOLUTION Midterm Exam Winter 2016 PDFDocument13 pagesSOLUTION Midterm Exam Winter 2016 PDFhfjffjNo ratings yet

- Auditing BS 2Document4 pagesAuditing BS 2Gletzmar IgcasamaNo ratings yet

- Tevis Company Inventory Costing MethodsDocument6 pagesTevis Company Inventory Costing MethodsMinh HiềnNo ratings yet

- Practice Questions Code 313, With AnswersDocument19 pagesPractice Questions Code 313, With AnswersChang QiNo ratings yet

- Financial Reporting & Statement AnalysisDocument12 pagesFinancial Reporting & Statement AnalysisMariam YasserNo ratings yet

- 2021-22 F5 BAFS Mid-Year Exam (Question)Document7 pages2021-22 F5 BAFS Mid-Year Exam (Question)Anna TungNo ratings yet

- ACF 103 Fundamentals of Finance Tutorial SolutionsDocument8 pagesACF 103 Fundamentals of Finance Tutorial SolutionsRiri FahraniNo ratings yet

- ENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 2022Document9 pagesENG - Soal Mojakoe Pengantar Akuntansi UAS Genap 2021 - 202202Adibah Seila NafazaNo ratings yet

- Review Session1-MidtermDocument7 pagesReview Session1-MidtermBich VietNo ratings yet

- FIN300 Homework 1Document7 pagesFIN300 Homework 1JohnNo ratings yet

- Practice Midterm Questions JAN 2022 Second With SOLUTIONS v7Document17 pagesPractice Midterm Questions JAN 2022 Second With SOLUTIONS v7Aryan JainNo ratings yet

- Module 1, Chapter 1 Handout Introduction To Financial StatementsDocument5 pagesModule 1, Chapter 1 Handout Introduction To Financial StatementssdfsdfuignbcbbdfbNo ratings yet

- Soal Test Intermediate 2 MAC 2020Document6 pagesSoal Test Intermediate 2 MAC 2020DikaGustianaNo ratings yet

- Disposal Group and Subsequent Events Journal EntriesDocument4 pagesDisposal Group and Subsequent Events Journal EntriesSmelly DonkeyNo ratings yet

- Midterm Winter 2013 With Final Winter 2013 For Posting FallDocument10 pagesMidterm Winter 2013 With Final Winter 2013 For Posting FallMiruna CiteaNo ratings yet

- 8901 Audit of Shareholders Equity Self TestDocument6 pages8901 Audit of Shareholders Equity Self TestYahlianah LeeNo ratings yet

- ACCT 3001 Exams 1 and 2 All QuestionsDocument7 pagesACCT 3001 Exams 1 and 2 All QuestionsRegine VegaNo ratings yet

- ENGM 401 & 620 Sample Midterm Exam GuideDocument9 pagesENGM 401 & 620 Sample Midterm Exam GuidehjgNo ratings yet

- ACF 103 Fundamentals of Finance Tutorial 1 QuestionsDocument3 pagesACF 103 Fundamentals of Finance Tutorial 1 QuestionsRiri FahraniNo ratings yet

- Comm 457 Practice MidtermDocument9 pagesComm 457 Practice MidtermJason SNo ratings yet

- FINMAN Answer KeyDocument7 pagesFINMAN Answer KeyReginald ValenciaNo ratings yet

- Quiz 2 DeliveryDocument20 pagesQuiz 2 DeliveryAli Zain ParharNo ratings yet

- 1BSA Final ExamDocument11 pages1BSA Final ExamcamillaNo ratings yet

- Workshop 2 - Questions - Introduction To Accounting and FinanceDocument7 pagesWorkshop 2 - Questions - Introduction To Accounting and FinanceSu FangNo ratings yet

- Klausur WS2021-22-1Document6 pagesKlausur WS2021-22-1marynayarmak.stNo ratings yet

- Chapter 4Document12 pagesChapter 4jeo beduaNo ratings yet

- Solutions 2021 MockExamDocument15 pagesSolutions 2021 MockExamdayeyoutai779No ratings yet

- AUDITING-Adjusting Entries-Correction of ErrorsDocument10 pagesAUDITING-Adjusting Entries-Correction of ErrorsJamhel MarquezNo ratings yet

- 2022 FIA132 Term Test 1 FinalDocument9 pages2022 FIA132 Term Test 1 FinalkaityNo ratings yet

- BACC 2021 - 22 Sem 2 - MST Questions 2Document5 pagesBACC 2021 - 22 Sem 2 - MST Questions 2xa. vieNo ratings yet

- CA Zambia June 2022 Q ADocument394 pagesCA Zambia June 2022 Q AChanda LufunguloNo ratings yet

- Fin Exam 1Document14 pagesFin Exam 1tahaalkibsiNo ratings yet

- Acct 2251 Enlarged Review Qs Final ExamW07Document9 pagesAcct 2251 Enlarged Review Qs Final ExamW07hatanolove100% (1)

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- AC 310 Lab Problems - 9.7.2021Document2 pagesAC 310 Lab Problems - 9.7.2021Abdullah alhamaadNo ratings yet

- Finalterm Fabm2 Reviewer Sy 21 22Document31 pagesFinalterm Fabm2 Reviewer Sy 21 22Jemiza FallesgonNo ratings yet

- Accounting Mock ExamDocument6 pagesAccounting Mock ExamKiran alex ChallagiriNo ratings yet

- Qa Ca Zambia Programme December 2019 ExaminationDocument449 pagesQa Ca Zambia Programme December 2019 ExaminationimasikudenisiahNo ratings yet

- Term Exam 2edited Answer KeyDocument10 pagesTerm Exam 2edited Answer KeyPRINCESS HONEYLET SIGESMUNDONo ratings yet

- Acct CH1Document10 pagesAcct CH1j8noelNo ratings yet

- Quiz 2 AuditingDocument18 pagesQuiz 2 Auditingaldrin elsisuraNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Problem 1Document8 pagesProblem 1HazeNo ratings yet

- Practice Problems Far Chap 1-5Document13 pagesPractice Problems Far Chap 1-5Micah Danielle S. TORMONNo ratings yet

- SD Caterpillar BasicsDocument146 pagesSD Caterpillar BasicsNagaraja Reddy Rasi ReddyNo ratings yet

- UGRD1Document5 pagesUGRD1Jamyr BarrioquintoNo ratings yet

- General Journal Date Particulars FolioDocument4 pagesGeneral Journal Date Particulars FolioJelaina Alimansa100% (1)

- 3.2 - Cash and Cash Equivalents (MCQ)Document7 pages3.2 - Cash and Cash Equivalents (MCQ)kenma kozumeNo ratings yet

- Grade 11 Accouting ExamDocument17 pagesGrade 11 Accouting ExamRené Puerta100% (1)

- MPS R7520534 GS167539L 08 2013Document2 pagesMPS R7520534 GS167539L 08 2013CS Narayana100% (1)

- To Add The Journals Through ADI Wizard Navigate To Journals Launch Journal WizardDocument11 pagesTo Add The Journals Through ADI Wizard Navigate To Journals Launch Journal WizardKiran NambariNo ratings yet

- Accouts ReceivableDocument2 pagesAccouts Receivablerhysakhil catamponganNo ratings yet

- Estimating Bad Debts with Allowance Method TechniquesDocument2 pagesEstimating Bad Debts with Allowance Method Techniquesah7anNo ratings yet

- Suspense Account and ErrorsDocument11 pagesSuspense Account and ErrorsshadedroseNo ratings yet

- Accounting Cycle of A Service BusinessDocument27 pagesAccounting Cycle of A Service BusinessTariga, Dharen Joy J.No ratings yet

- Transaction History Report101545ces81811112021104949Document14 pagesTransaction History Report101545ces81811112021104949Ces RiveraNo ratings yet

- Praktiswan Complete WorksheetDocument12 pagesPraktiswan Complete WorksheetMiranda, Aliana Jasmine M.No ratings yet

- Bank Reconciliation Process: Step 1. Adjusting The Balance Per BankDocument5 pagesBank Reconciliation Process: Step 1. Adjusting The Balance Per BankSulaimon AbiodunNo ratings yet

- Fund Flow Statement Changes in FinancialDocument37 pagesFund Flow Statement Changes in FinancialRaju Net CafeNo ratings yet

- Control accounts streamline accountingDocument14 pagesControl accounts streamline accountingXue YikNo ratings yet

- FAR Activity1 - Emana, MonicaDocument8 pagesFAR Activity1 - Emana, MonicaAlsim EljNo ratings yet

- Canada_Carbon_Rebate_notice_2024_03_01_10_35_52_219607Document3 pagesCanada_Carbon_Rebate_notice_2024_03_01_10_35_52_219607bzbd72k7fmNo ratings yet

- 233 Printing Flashcards of Accounting I Basics)Document11 pages233 Printing Flashcards of Accounting I Basics)cpears56No ratings yet

- Group Assign 1 - Draft Acc407Document4 pagesGroup Assign 1 - Draft Acc407Syed IbrahimNo ratings yet

- Resit Examinations For 2004 - 2005 / Semester 2: Module: Financial AccountingDocument6 pagesResit Examinations For 2004 - 2005 / Semester 2: Module: Financial AccountingBasilio MaliwangaNo ratings yet

- Final ReviewDocument53 pagesFinal ReviewLalalaNo ratings yet

- Reynaldo Gulane Cleaners Financial Statement for Year Ended Sep 2016Document1 pageReynaldo Gulane Cleaners Financial Statement for Year Ended Sep 2016Seijuro Akashi100% (1)

- F.13 Compensación AutomáticaDocument6 pagesF.13 Compensación Automáticaerojas_140967No ratings yet

- Multiple Choice Partnership and CorporationDocument14 pagesMultiple Choice Partnership and CorporationTrina Joy HomerezNo ratings yet

- Entrep 5 6 Edited 23 24Document14 pagesEntrep 5 6 Edited 23 24Godofredo HermosuraNo ratings yet

- Problems On DepreciationDocument13 pagesProblems On DepreciationEkansh DwivediNo ratings yet