Professional Documents

Culture Documents

Assignment Public Finance and Taxation - 2022-Extension

Uploaded by

Mesfin Yohannes0 ratings0% found this document useful (0 votes)

27 views3 pagesThis document outlines tax-related assignment topics for seven student groups in a Public Finance and Taxation course. Each group is assigned a different tax topic and is instructed to write an essay of no more than 50 pages discussing relevant Ethiopian tax laws and regulations. The topics include: employment income tax, rental income tax, business income tax, other income taxes and exemptions, value added tax, turnover tax, and excise taxes. For each topic, the document lists key issues that should be addressed in the essay such as tax rates, assessments, exemptions, penalties, and administration procedures. Students are expected to cite specific provisions from Ethiopian tax laws and regulations to support their discussions and analyses.

Original Description:

Original Title

Assignment Public Finance and Taxation -2022-Extension

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines tax-related assignment topics for seven student groups in a Public Finance and Taxation course. Each group is assigned a different tax topic and is instructed to write an essay of no more than 50 pages discussing relevant Ethiopian tax laws and regulations. The topics include: employment income tax, rental income tax, business income tax, other income taxes and exemptions, value added tax, turnover tax, and excise taxes. For each topic, the document lists key issues that should be addressed in the essay such as tax rates, assessments, exemptions, penalties, and administration procedures. Students are expected to cite specific provisions from Ethiopian tax laws and regulations to support their discussions and analyses.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views3 pagesAssignment Public Finance and Taxation - 2022-Extension

Uploaded by

Mesfin YohannesThis document outlines tax-related assignment topics for seven student groups in a Public Finance and Taxation course. Each group is assigned a different tax topic and is instructed to write an essay of no more than 50 pages discussing relevant Ethiopian tax laws and regulations. The topics include: employment income tax, rental income tax, business income tax, other income taxes and exemptions, value added tax, turnover tax, and excise taxes. For each topic, the document lists key issues that should be addressed in the essay such as tax rates, assessments, exemptions, penalties, and administration procedures. Students are expected to cite specific provisions from Ethiopian tax laws and regulations to support their discussions and analyses.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Addis Ababa University

College of Business and Economics

Department of Accounting and Finance

Public Finance and Taxation

Assignment- Discussion questions and problems

Date Given:______________________

Submission Date: within 10 days

Refer to the relevant provision of Ethiopian Taxation (Proclamations, Regulations

and Amendment Proclamations) and write an essay of not more than fifty pages

on the Topic assigned to your group. Citing specific part and articles of the

provisions for your discussions and analysis is essential.

1. Employment Income Tax (Group 1)

Issues that should not be overlooked:

- Employment income tax in general

- Specific provisions dealing with employment income tax in Ethiopia

- Tax basis and tax rates

- Computation of employment income taxes

- Assessment and Administration of employment income tax

- Penalties for offences and evasions relating to employment income taxes

- Summary and conclusion

2. Rental Income Tax (Group 2)

Issues that should not be overlooked:

- The nature of rental income tax

- Determination of taxable rental income and the tax rates

- Assessment and administration issues relating to rental income tax

- Illustrative examples

- Penalties for evasions relating rental income tax

- Summary and conclusion

3. Business Income Tax (Group 3)

Issues that should not missed:

- The nature of business income tax

- Determination of taxable profit and the tax rates

Addis Ababa University

College of Business and Economics

Department of Accounting and Finance

Public Finance and Taxation

Assignment- Discussion questions and problems

Date Given:______________________

Submission Date: within 10 days

- Assessment, Declaration and administration issues relating to business

income tax (including the nature and classification of business for such

purposes, accounting and reporting issues, tax benefits)

- Appeal procedures for complaints against business income tax liabilities

- Income taxes from mining and petroleum operation

- Illustrative examples

- Summary and conclusion

4. Other Income Taxes and Incomes Exempted from Tax(schedule D and

Schedule E) (Group 4)

- Tax Basis for incomes under schedule D

- Tax rates relating to schedule D incomes

- General assessment and administration of schedule D income tax

- Declaration and payment of Schedule D income tax and penalties for

non compliance with the tax law

5. Value Added Tax (Group 5)

Issues that should not missed:

- The concept and history of Value Added Tax

- Taxable and exempted supplies in Ethiopia

- Registration procedures for VAT and Businesses eligible for registartion

- Assessment and computation (on domestic supplies, imports and

exports) of VAT in Ethiopia

- Administration (Declaration and payment) and mechanisms of VAT in

Ethiopia

- Penalties, payment and refund claim procedures

- Any Other issues

6. Turn Over Tax (Group 6)

- The application of Turn over tax in Ethiopia

- Taxable and exempted supplies in Ethiopia

- Assessment and computation of TOT in Ethiopia

Addis Ababa University

College of Business and Economics

Department of Accounting and Finance

Public Finance and Taxation

Assignment- Discussion questions and problems

Date Given:______________________

Submission Date: within 10 days

- Administration (Declaration and payment) and mechanisms of TOT in

Ethiopia

- Penalties, payment and refund claim procedures

- Any Other issues

7. Excise Taxes (Group 7)

- The Rationale for Excise tax provision in Ethioipia

- Excise tax Basis

- Assessment and computation of Excise tax in Ethiopia

- Administration (Declaration and payment) and mechanisms of Exise tax

in Ethiopia

- Penalties, payment and refund claim procedures

- Any Other issues

You might also like

- Topics On Income TaxationDocument4 pagesTopics On Income TaxationJessa Lopez GarciaNo ratings yet

- V Sem It Course Plan 2011Document4 pagesV Sem It Course Plan 2011Rohith MaheswariNo ratings yet

- Chapter 01 - PowerPoint - Introduction To Taxation in Canada - 2013Document32 pagesChapter 01 - PowerPoint - Introduction To Taxation in Canada - 2013melsun007No ratings yet

- Sample Syllabus For An Income Taxation CourseDocument2 pagesSample Syllabus For An Income Taxation Coursealexis ruedaNo ratings yet

- Why This Training Is ImportantDocument3 pagesWhy This Training Is ImportantAbu NaserNo ratings yet

- TOPICS Income TaxDocument9 pagesTOPICS Income TaxJaizer TimbrezaNo ratings yet

- Phinma - University of Iloilo SyllabusDocument2 pagesPhinma - University of Iloilo SyllabusctcasipleNo ratings yet

- ICGAB New Tax Syllabus (Sep-19)Document9 pagesICGAB New Tax Syllabus (Sep-19)Aminul HaqNo ratings yet

- Accounting Hounours 2nd Year SyllabusDocument11 pagesAccounting Hounours 2nd Year Syllabusmd shahriar samirNo ratings yet

- Tax Revision KitDocument260 pagesTax Revision KitEvans Lelach63% (16)

- Public Finance and TaxationDocument317 pagesPublic Finance and TaxationDennisNo ratings yet

- Queen's Collage Department of Business Administration: Addis Ababa, Ethiopia July 19/2021Document33 pagesQueen's Collage Department of Business Administration: Addis Ababa, Ethiopia July 19/2021abduNo ratings yet

- Nmba FM 03: Tax Planning and Management Max. Hours: 40Document1 pageNmba FM 03: Tax Planning and Management Max. Hours: 40swati82No ratings yet

- Income Taxation SyllabusDocument6 pagesIncome Taxation SyllabusAbegail Joy CabalfinNo ratings yet

- ProposalDocument9 pagesProposalDùķe HPNo ratings yet

- Final Level Advanced Taxation 2: ObjectiveDocument5 pagesFinal Level Advanced Taxation 2: Objectiveadibahhanaffi01No ratings yet

- Training, Teaching and Learning Materials (TTLM) : EIS ABS4160812 EIS ABS4 M 16 0812Document10 pagesTraining, Teaching and Learning Materials (TTLM) : EIS ABS4160812 EIS ABS4 M 16 0812NabuteNo ratings yet

- FNSACC512Document12 pagesFNSACC512amitchettri419No ratings yet

- Tax Management: Planning and ComplianceDocument12 pagesTax Management: Planning and ComplianceNidheesh TpNo ratings yet

- 2006 - TAX101 - Phil Tax System & Income TaxDocument7 pages2006 - TAX101 - Phil Tax System & Income Taxhappiness12340% (1)

- Course: A Practical Approach To Taxation (Personal and Business) Contact Hours: 18 Pre-Requisite: Basic Computerized Spreadsheet SkillsDocument2 pagesCourse: A Practical Approach To Taxation (Personal and Business) Contact Hours: 18 Pre-Requisite: Basic Computerized Spreadsheet SkillsDavide BoreanezeNo ratings yet

- Tax Management SyllabusDocument2 pagesTax Management Syllabusbs_sharathNo ratings yet

- Income Tax IDocument4 pagesIncome Tax InishatNo ratings yet

- Tax SolnDocument315 pagesTax SolnmohedNo ratings yet

- TaxationDocument1 pageTaxationmostafaali123No ratings yet

- Paper 4: Taxation: Level of Knowledge: Working Knowledge ObjectivesDocument2 pagesPaper 4: Taxation: Level of Knowledge: Working Knowledge ObjectivesHemaNo ratings yet

- ICAB Professional Level Syllabus Weight Based Tax Planning & Compliance QUESTION & ANSWER BANKDocument206 pagesICAB Professional Level Syllabus Weight Based Tax Planning & Compliance QUESTION & ANSWER BANKSaiful Islam MozumderNo ratings yet

- Taxation AssignmentDocument5 pagesTaxation Assignmentnareshkharol35No ratings yet

- ACC212 Student Notes 2019Document62 pagesACC212 Student Notes 2019preciousgomorNo ratings yet

- VAtDocument40 pagesVAtmubarek oumer100% (1)

- Vat Collection Problems in Case of Ethiopian Revenue and CusDocument41 pagesVat Collection Problems in Case of Ethiopian Revenue and CusABDIKARIN MOHAMEDNo ratings yet

- I.T.S-Mnagement & I.T. Institute Mohan Nagar, Ghaziabad Learning Objectives & Lesson PlanDocument5 pagesI.T.S-Mnagement & I.T. Institute Mohan Nagar, Ghaziabad Learning Objectives & Lesson PlanSourav SharmaNo ratings yet

- Public Finance and TaxationDocument315 pagesPublic Finance and TaxationB K100% (1)

- Learning Guide: Accounts and Budget SupportDocument17 pagesLearning Guide: Accounts and Budget Supportmac video teachingNo ratings yet

- Zed Proposal FinalDocument21 pagesZed Proposal FinalFilmawit MekonenNo ratings yet

- Wbut AcDocument1 pageWbut AcArchana BhattacharjeeNo ratings yet

- CUAC 408 Advanced Taxation Practical Assignments PresentationsDocument5 pagesCUAC 408 Advanced Taxation Practical Assignments PresentationsnsnhemachenaNo ratings yet

- Chapter 8 - Business Deductions and Accounting MethodsDocument9 pagesChapter 8 - Business Deductions and Accounting MethodsBartholomew SzoldNo ratings yet

- National University: SyllabusDocument9 pagesNational University: Syllabusforhad99No ratings yet

- Chapter 1. OverviewDocument38 pagesChapter 1. OverviewKhuất Thanh HuếNo ratings yet

- Corporate Tax Management EDU MBA Summer 2020Document100 pagesCorporate Tax Management EDU MBA Summer 2020Foyez HafizNo ratings yet

- Business Accounting: Chapter 1 - The Background and The Main Features of Financial AccountingDocument13 pagesBusiness Accounting: Chapter 1 - The Background and The Main Features of Financial AccountingShreshtha HegdeNo ratings yet

- OnsiteSpecialTopicsUpdate Tax FADocument4 pagesOnsiteSpecialTopicsUpdate Tax FABharathi AmmuNo ratings yet

- Course Outline (Laws and Tax Management) PGDMDocument2 pagesCourse Outline (Laws and Tax Management) PGDMAmritaNo ratings yet

- Ch03 - SL Tax Administration - 2024 - UoHDocument24 pagesCh03 - SL Tax Administration - 2024 - UoHMustafe MohamedNo ratings yet

- R12 EtaxDocument66 pagesR12 Etaxsatya_raya8022No ratings yet

- Acw 420 - Topic 3Document77 pagesAcw 420 - Topic 3Nor Ihsan Abd LatifNo ratings yet

- Applied Indirect TaxationDocument349 pagesApplied Indirect TaxationVijetha K Murthy100% (1)

- Slide C1-C4Document229 pagesSlide C1-C4Lê Hồng ThuỷNo ratings yet

- Identify The Problem On The Tax Assessment and Collection Activities of The Tabor Sub - City in Southern Ethiopia of Hawassa.Document35 pagesIdentify The Problem On The Tax Assessment and Collection Activities of The Tabor Sub - City in Southern Ethiopia of Hawassa.abceritreaNo ratings yet

- Lecture 2 - Tax Administration 1-1Document64 pagesLecture 2 - Tax Administration 1-1Ekua Baduwaa KyeraaNo ratings yet

- Atd TaxDocument4 pagesAtd TaxKafonyi JohnNo ratings yet

- Tax Israel Train The TrainerDocument98 pagesTax Israel Train The TrainerI GNo ratings yet

- Tax AccountingDocument7 pagesTax Accountingjeka0521No ratings yet

- Taxation PlanDocument2 pagesTaxation PlanNguyễn Anh RuanNo ratings yet

- Simonpoh@Nus - Edu.Sg: Mcgraw-Hill Isbn No 978-9-814-82199-5Document2 pagesSimonpoh@Nus - Edu.Sg: Mcgraw-Hill Isbn No 978-9-814-82199-5Chloe NgNo ratings yet

- J.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Ethiophonic Jazz PartenershipDocument1 pageEthiophonic Jazz PartenershipMesfin YohannesNo ratings yet

- Data Collection Hand OutDocument15 pagesData Collection Hand OutMesfin YohannesNo ratings yet

- All in One MinLetazezdocxDocument138 pagesAll in One MinLetazezdocxMesfin YohannesNo ratings yet

- Budget Ledger Card IllustrationDocument2 pagesBudget Ledger Card IllustrationMesfin YohannesNo ratings yet

- Brief Guideline To Prepare Research ProposalDocument4 pagesBrief Guideline To Prepare Research ProposalMesfin YohannesNo ratings yet

- Welkituma Baka Rere Cluster Kebeles ECC Main Database Regist - Jan.2021 - 3Document39 pagesWelkituma Baka Rere Cluster Kebeles ECC Main Database Regist - Jan.2021 - 3Mesfin YohannesNo ratings yet

- CIR Vs Benguet Corp. - GR 145559, 14 July 2006Document2 pagesCIR Vs Benguet Corp. - GR 145559, 14 July 2006ewnesssNo ratings yet

- RMC No. 68-2019 - DigestDocument3 pagesRMC No. 68-2019 - DigestAMNo ratings yet

- Chapter #2 - The Financial Market Environment - ProblemsDocument1 pageChapter #2 - The Financial Market Environment - ProblemsTania cruzNo ratings yet

- TAXATIONDocument9 pagesTAXATIONkekadiegoNo ratings yet

- Assessment and Returns of IncomeDocument13 pagesAssessment and Returns of IncomeMaster KihimbwaNo ratings yet

- Unit 2 (Income From House Property)Document3 pagesUnit 2 (Income From House Property)Vijay GiriNo ratings yet

- Ezra Daniels TaxDocument11 pagesEzra Daniels TaxJulio Romero100% (1)

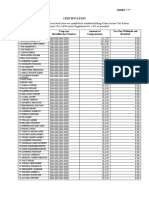

- Annex ' F '' Certification: Taxpayer Identification Number Amount of Compensation Tax Due Withheld and RemittedDocument4 pagesAnnex ' F '' Certification: Taxpayer Identification Number Amount of Compensation Tax Due Withheld and Remittedivs accountingNo ratings yet

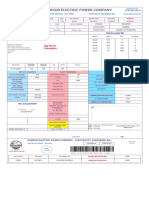

- Form Vat - 2: District PeriodDocument2 pagesForm Vat - 2: District Periodjaipal sharmaNo ratings yet

- Chap 12Document38 pagesChap 12mo hongNo ratings yet

- 1 AssignmentDocument4 pages1 AssignmentHammad Hassan AsnariNo ratings yet

- SS and SSS Chap 1 To 10 (2020)Document215 pagesSS and SSS Chap 1 To 10 (2020)Dinh TranNo ratings yet

- 292741-XLS-EnG (1) Butler LumberDocument3 pages292741-XLS-EnG (1) Butler LumberJessNo ratings yet

- Fixed and Variable Costing Test Bank PDFDocument6 pagesFixed and Variable Costing Test Bank PDFAB Cloyd0% (1)

- (D) Capital of The Surviving SpouseDocument3 pages(D) Capital of The Surviving SpouseAnthony Angel TejaresNo ratings yet

- Latest Income Tax Slabs - Fundfolio by Sharique SamsudheenDocument1 pageLatest Income Tax Slabs - Fundfolio by Sharique SamsudheensalmanNo ratings yet

- 22.d CIR vs. BPI (G.R. No. 178490 July 7, 2009) - H DigestDocument2 pages22.d CIR vs. BPI (G.R. No. 178490 July 7, 2009) - H DigestHarleneNo ratings yet

- Income Tax On IndividualsDocument12 pagesIncome Tax On IndividualsJames GuiruelaNo ratings yet

- Capital Gain and IFOS - SolutionDocument6 pagesCapital Gain and IFOS - SolutionVenkataRajuNo ratings yet

- Solved Night Inc A Domestic Corporation Earned 300 000 From Foreign ManufacturingDocument1 pageSolved Night Inc A Domestic Corporation Earned 300 000 From Foreign ManufacturingAnbu jaromiaNo ratings yet

- Sepco Online Bill PDFDocument1 pageSepco Online Bill PDFSyed Junaid BukhariNo ratings yet

- Business Accounting and Taxation BrochureDocument4 pagesBusiness Accounting and Taxation BrochureRudrin DasNo ratings yet

- Signed By:Bulusu Samba Murthy Reason:Security Reason Location:Mumbai Signing Date:16.07.2020 18:41Document8 pagesSigned By:Bulusu Samba Murthy Reason:Security Reason Location:Mumbai Signing Date:16.07.2020 18:41Aviral SankhyadharNo ratings yet

- Revenue Affidavit JamaicaDocument5 pagesRevenue Affidavit JamaicaAaliyah Jones100% (2)

- Name of The Company - Walkthrough - Revenue Cycle Flowchart No. 1 (Date) IDENTIFICATION OF TRANSACTION TYPES (Covered by One Flowchart)Document4 pagesName of The Company - Walkthrough - Revenue Cycle Flowchart No. 1 (Date) IDENTIFICATION OF TRANSACTION TYPES (Covered by One Flowchart)Kris Anne SamudioNo ratings yet

- BIR Forms and Deadlines ReviewerDocument8 pagesBIR Forms and Deadlines ReviewerJuday MarquezNo ratings yet

- Income Tax - Guidelines Financial Year 2022-23Document13 pagesIncome Tax - Guidelines Financial Year 2022-23Pradeep KVKNo ratings yet

- Minimum Corporate Income Tax 2Document5 pagesMinimum Corporate Income Tax 2NaikNo ratings yet

- Lifewood Airbnb PresentationDocument14 pagesLifewood Airbnb PresentationChristian Gilvin MendinaNo ratings yet

- Tax Sample ComputationDocument10 pagesTax Sample ComputationEryka Jo MonatoNo ratings yet