Professional Documents

Culture Documents

Strategy StochEMA Cross

Uploaded by

henry0%(1)0% found this document useful (1 vote)

110 views3 pagesThis document describes a trading strategy that combines stochastic crosses in overbought/oversold areas with a trend determined by two exponential moving averages (EMAs). It uses stochastic, fast EMA, and slow EMA indicators to determine when to enter long or short positions. The strategy opens long positions when stochastic crosses into the oversold area and the EMA trend is up. It opens short positions when stochastic crosses into the overbought area and the EMA trend is down. It exits positions when stochastic exits the overbought/oversold areas or the EMA trend changes. It also includes optional take profit and stop loss levels.

Original Description:

improved strategy pinescript.

Copyright

© © All Rights Reserved

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document describes a trading strategy that combines stochastic crosses in overbought/oversold areas with a trend determined by two exponential moving averages (EMAs). It uses stochastic, fast EMA, and slow EMA indicators to determine when to enter long or short positions. The strategy opens long positions when stochastic crosses into the oversold area and the EMA trend is up. It opens short positions when stochastic crosses into the overbought area and the EMA trend is down. It exits positions when stochastic exits the overbought/oversold areas or the EMA trend changes. It also includes optional take profit and stop loss levels.

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0%(1)0% found this document useful (1 vote)

110 views3 pagesStrategy StochEMA Cross

Uploaded by

henryThis document describes a trading strategy that combines stochastic crosses in overbought/oversold areas with a trend determined by two exponential moving averages (EMAs). It uses stochastic, fast EMA, and slow EMA indicators to determine when to enter long or short positions. The strategy opens long positions when stochastic crosses into the oversold area and the EMA trend is up. It opens short positions when stochastic crosses into the overbought area and the EMA trend is down. It exits positions when stochastic exits the overbought/oversold areas or the EMA trend changes. It also includes optional take profit and stop loss levels.

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 3

//@version=2

//Strategy combining Stochastic Crosses in the Overbought/Oversold Area with a

trend determined by two EMAs

//Default setup seems to work best on 4HR timeframe for BTC

strategy(title = "Strategy Stoch/EMA Cross", shorttitle = "Strategy Stoch/EMA

Cross", overlay = true, pyramiding = 0, default_qty_type =

strategy.percent_of_equity, default_qty_value = 100, currency = currency.USD,

commission_value=0.01,commission_type=strategy.commission.percent,

initial_capital=1000)

// === GENERAL INPUTS ===

SectionInd = input(defval = true ,title = "------------ INDICATORS

------------")

maFastLength = input(defval = 55, title = "Fast MA Period", minval = 1)

maSlowLength = input(defval = 89, title = "Slow MA Period", minval = 1)

StochLength = input(defval = 14, title = "Stochastic Length", minval=1)

smoothK = input(defval = 6, title = "%K Smooth", minval=1)

smoothD = input(defval = 3, title = "%D Smooth", minval=1)

overbought = 80

oversold = 20

HighlightOBOS = input(defval = true, title = "Highlight Stoch Cross?")

HighlightTrend = input(defval = true ,title = "Highlight Trend?")

//DATE AND TIME

SectionFrom = input(defval = true ,title = "--------------- FROM

---------------")

fromDay = input(defval = 01, title = "From day", minval=1)

fromMonth = input(defval = 1, title = "From month", minval=1)

fromYear = input(defval = 2019, title = "From year", minval=2014)

SectionTo = input(defval = true, title = "---------------- TO

----------------")

toDay = input(defval = 31, title = "To day", minval=1)

toMonth = input(defval = 12, title = "To month", minval=1)

toYear = input(defval = 2020, title = "To year", minval=2014)

// === STRATEGY RELATED INPUTS ===

SectionStra = input(defval = true ,title = "------------- STRATEGY

-------------")

// Include Shorts or only trade Long Positions?

includeShorts = input(defval = true, title = "Include Short Positions?")

// === RISK MANAGEMENT INPUTS ===

inpTakeProfit = input(defval = 8, title = "Take Profit % (0 to deactivate)",

minval = 0)

inpStopLoss = input(defval = 0, title = "Stop Loss % (0 to deactivate)",

minval = 0)

StopLossPerc = inpStopLoss * 0.01

TakeProfitPerc = inpTakeProfit * 0.01

StopLossV = close * StopLossPerc / syminfo.mintick

TakeProfitV = close * TakeProfitPerc / syminfo.mintick

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to

disable it.

TakeProfitVal = inpTakeProfit >= 1 ? TakeProfitV : na

StopLossVal = inpStopLoss >= 1 ? StopLossV : na

// === EMA SERIES SETUP ===

maFast = ema(close, maFastLength)

maSlow = ema(close, maSlowLength)

diff = maFast - maSlow

// === STOCHASTIC SETUP ===

k = sma(stoch(close, high, low, StochLength), smoothK)

d = sma(k, smoothD)

// Stochastic Long/Short Entry determination

stochLong = crossover(k,d) and (k < oversold)

stochShort = crossunder(k,d) and (k > overbought)

// Stochastic Long/Short Exit determination

stochLongEx = (crossover (d, overbought)) or (crossunder(maFast, maSlow))

stochShortEx = (crossunder(d, oversold)) or (crossover (maFast, maSlow))

// === PLOTTING EMAs ===

fast = plot(maFast, title = "Fast MA", color = yellow, linewidth = 1, style = line,

transp = 10)

slow = plot(maSlow, title = "Slow MA", color = white, linewidth = 1, style = line,

transp = 10)

// === Vertical Coloring for Crosses in Overbought/Oversold zone and for MA Trend

Zones ===

b_color = stochLong ? green : stochShort ? red : na

bgcolor(HighlightOBOS ? b_color : na, title="Overbought / Oversold",

transp=65) //Highlight the Overbought/Oversold Stoch Crossings

t_color = diff>=0 ? green : diff<0 ? red : na

bgcolor(HighlightTrend ? t_color : na, title="Trend up / Trend down",

transp=90) //Highlight the EMA Trend

// Show EMA Trend as symbols at the bottom

bullTrend = diff>=0

bearTrend = diff<0

plotchar(bullTrend, title = "BullTrend", char="_", location = location.bottom,

color=#0CAB07, transp = 0, size=size.tiny)

plotchar(bearTrend, title = "BearTrend", char="_", location = location.bottom,

color=#DE071C, transp = 0, size=size.tiny)

// Show EMA Convergence/Divergence Trend as symbols at the top

//bullTrendCD = (diff>=0 and diff>=diff[1]) or (diff<0 and diff>diff[1])

//bearTrendCD = (diff<0 and diff<=diff[1]) or (diff>=0 and diff<diff[1])

//plotchar(bullTrendCD, title = "BullTrend CD", char="o", location = location.top,

color=#0CAB07, transp = 0, size=size.tiny)

//plotchar(bearTrendCD, title = "BearTrend CD", char="x", location = location.top,

color=#DE071C, transp = 0, size=size.tiny)

// === STRATEGY LOGIC ===

// Time Restriction

timeInRange = (time > timestamp(fromYear, fromMonth, fromDay, 00, 00)) and (time <

timestamp(toYear, toMonth, toDay, 23, 59))

// === STRATEGY - LONG POSITION EXECUTION ===

if stochLong and (diff >=0) and timeInRange //Open Long when Stoch crossing in

Oversold area and EMA Trend is up

strategy.entry(id = "Long", long = true)

if stochLongEx and timeInRange //Close Long when Stoch is getting

Overbought or Trend changes to Bearish

strategy.close(id = "Long")

// === STRATEGY - SHORT POSITION EXECUTION ===

if stochShort and (diff <0) and timeInRange and includeShorts //Open Short when

Stoch crossing in Overbought area and EMA Trend is down

strategy.entry(id = "Short", long = false)

if stochShortEx and timeInRange //Close Short when

Stoch is getting Oversold or Trend changes to Bullish

strategy.close(id = "Short")

// === STRATEGY RISK MANAGEMENT EXECUTION ===

strategy.exit("Exit Long", from_entry = "Long", profit = TakeProfitVal, loss =

StopLossVal)

strategy.exit("Exit Short", from_entry = "Short", profit = TakeProfitVal, loss =

StopLossVal)

You might also like

- Getting Started in Creating Your Own Forex RobotsFrom EverandGetting Started in Creating Your Own Forex RobotsRating: 1 out of 5 stars1/5 (1)

- FLI CodeDocument8 pagesFLI CodePerter DerminNo ratings yet

- Setup Mafia 3.5Document5 pagesSetup Mafia 3.5Gustavo rcNo ratings yet

- Breaking Free in Forex: How you can Make 400k+in the Forex Market with just $100 Start and Set a Platform for a Life of Wealth!From EverandBreaking Free in Forex: How you can Make 400k+in the Forex Market with just $100 Start and Set a Platform for a Life of Wealth!No ratings yet

- Vpa CandlesDocument15 pagesVpa Candlesankit1844No ratings yet

- 1 Mins StrategyDocument7 pages1 Mins Strategyshivus7337069No ratings yet

- Small Trend. ʜɪʜDocument14 pagesSmall Trend. ʜɪʜVipul AgrawalNo ratings yet

- Multiindicator MojaDocument14 pagesMultiindicator MojatoengsayaNo ratings yet

- Buy Sell Indicator Free 1Document4 pagesBuy Sell Indicator Free 1Sameer Khan0% (1)

- Hybrid CodeDocument19 pagesHybrid CodeThuận Nguyễn vănNo ratings yet

- Magic Candle Retest Paid Indicator FreeDocument4 pagesMagic Candle Retest Paid Indicator Freevikas100% (2)

- Entry & Exit in Same Candle - AFL Programming - Am PDFDocument7 pagesEntry & Exit in Same Candle - AFL Programming - Am PDFHitesh Chaudhary0% (1)

- JMK Strategy Use This OnlyDocument64 pagesJMK Strategy Use This OnlyhafeezNo ratings yet

- Hi LoDocument3 pagesHi LoPhillipe S. ScofieldNo ratings yet

- 8 Indicators TS 3.aflDocument24 pages8 Indicators TS 3.afludhaya kumarNo ratings yet

- AI Gold DiggerDocument5 pagesAI Gold DiggerEyüp YokNo ratings yet

- Stock - Warrior - Buy - Sale - Condition: For SL ChartDocument30 pagesStock - Warrior - Buy - Sale - Condition: For SL ChartRafael AlacornNo ratings yet

- Ema Macd Rsi ExploreDocument3 pagesEma Macd Rsi Explorebharatbaba363No ratings yet

- ZeroLagEMA IndicatorDocument2 pagesZeroLagEMA IndicatorPhillipe S. ScofieldNo ratings yet

- VPA Analysis - Pinescript R1Document13 pagesVPA Analysis - Pinescript R1SRIDHAR GOVARDHANANNo ratings yet

- Toptrading 2.aflDocument28 pagesToptrading 2.afludhaya kumarNo ratings yet

- Vwap Rsi Ema Supertrend SignalDocument1 pageVwap Rsi Ema Supertrend SignalAamirAbbasNo ratings yet

- Auto Buy Sell With SL For Amibroker (AFL)Document10 pagesAuto Buy Sell With SL For Amibroker (AFL)sakthiprimeNo ratings yet

- Pivot Boss Tools v3 (With Future Pivots)Document22 pagesPivot Boss Tools v3 (With Future Pivots)Ayo OmotolaNo ratings yet

- Half Trend With SSL HybridDocument31 pagesHalf Trend With SSL Hybridkashinath09No ratings yet

- DynReg EMA Levels SMART DIV - STR AlphaDocument36 pagesDynReg EMA Levels SMART DIV - STR Alphakashinath09No ratings yet

- Squeeze Indicator Pinescript (With Long Alerts)Document5 pagesSqueeze Indicator Pinescript (With Long Alerts)sb jazzduoNo ratings yet

- MarketScalper v5.5Document24 pagesMarketScalper v5.5Amir Fakhrunnizam SalingNo ratings yet

- Scalping 10 Sec., 30 Sec., M1 - ADX - Version 2010 March 07Document4 pagesScalping 10 Sec., 30 Sec., M1 - ADX - Version 2010 March 07Moody Infinity0% (1)

- Amibroker FileDocument9 pagesAmibroker FileNarendra BholeNo ratings yet

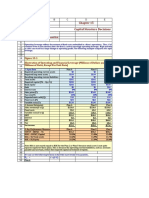

- Entry Data Here: High Low Yesteday Before YestdDocument25 pagesEntry Data Here: High Low Yesteday Before YestdMiner cand100% (1)

- Looping in AmiBroker AFL - Jbmarwood - Com (PDFDrive)Document22 pagesLooping in AmiBroker AFL - Jbmarwood - Com (PDFDrive)pderby1100% (1)

- USDJPY - 100 Pips Set and Forget Strategy - Apiary FundDocument32 pagesUSDJPY - 100 Pips Set and Forget Strategy - Apiary FundEko WaluyoNo ratings yet

- Martingale Trading Strategy - AflDocument9 pagesMartingale Trading Strategy - Aflanil singhNo ratings yet

- Reversal ZoneDocument1 pageReversal Zonejemehax138No ratings yet

- Fonte SUPER TDocument33 pagesFonte SUPER Tmusicmaker666No ratings yet

- A Complete Trading System Used by Professionals To Make MillionsDocument5 pagesA Complete Trading System Used by Professionals To Make MillionsRobNo ratings yet

- Auto Trend Line Support and ResistenceDocument10 pagesAuto Trend Line Support and Resistenceraj06740No ratings yet

- System5 PDFDocument15 pagesSystem5 PDFelisaNo ratings yet

- PRZ Backtesting With Harmonic Pattern Plus - v1.0Document11 pagesPRZ Backtesting With Harmonic Pattern Plus - v1.0Jafar SultanNo ratings yet

- Fakey Trading Strategy (Inside Bar False Break Out)Document8 pagesFakey Trading Strategy (Inside Bar False Break Out)Doug Trudell100% (1)

- FSM Early EntryDocument14 pagesFSM Early EntryAjith Moses100% (1)

- Algoji Intraday AflDocument5 pagesAlgoji Intraday AflPragnesh ShahNo ratings yet

- StrategyDocument6 pagesStrategyElango25489No ratings yet

- Final KSR Strategy CodeDocument3 pagesFinal KSR Strategy CodehelloNo ratings yet

- Schaff Trend Cycle Indicator - Forex Indicators GuideDocument3 pagesSchaff Trend Cycle Indicator - Forex Indicators Guideenghoss77100% (1)

- GlyconDocument2 pagesGlyconnikunj olpadwalaNo ratings yet

- Abonacci Trading v11-11Document12 pagesAbonacci Trading v11-11ghcardenas100% (1)

- Forex Power ProDocument30 pagesForex Power ProThế Anh Trần100% (1)

- AM - Premium Signals ScriptDocument2 pagesAM - Premium Signals Scriptrashi jpNo ratings yet

- Magic MomentumDocument16 pagesMagic MomentumCapitanu IulianNo ratings yet

- Forex King Trading SystemDocument4 pagesForex King Trading SystemPeter FrankNo ratings yet

- Range Breakout Strategy 7.0Document7 pagesRange Breakout Strategy 7.0maddy_i5No ratings yet

- 06 - Range Break Out - Trading S..Document7 pages06 - Range Break Out - Trading S..Baljeet SinghNo ratings yet

- Forex 1 Min Profit: DisclaimerDocument17 pagesForex 1 Min Profit: Disclaimersatyagodfather67% (3)

- Rejection Spike: Forex Income BossDocument19 pagesRejection Spike: Forex Income BosskrisnaNo ratings yet

- The Magic Momentum Method of Trading The Forex MarketDocument16 pagesThe Magic Momentum Method of Trading The Forex MarketBhavya ShahNo ratings yet

- Keltner Channels and CCI Forex Scalping Strategy - BLUEIBLOGDocument3 pagesKeltner Channels and CCI Forex Scalping Strategy - BLUEIBLOGcoachbiznesuNo ratings yet

- Serial ScalperDocument17 pagesSerial ScalperfxquickNo ratings yet

- Project Aurelius Pt1 01bDocument4 pagesProject Aurelius Pt1 01btestinoNo ratings yet

- Liberty - July 30 2019Document1 pageLiberty - July 30 2019Lisle Daverin BlythNo ratings yet

- Ch15 Tool KitDocument20 pagesCh15 Tool KitNino Natradze100% (1)

- Engineering Economy: Compound InterestDocument16 pagesEngineering Economy: Compound InterestLETADA NICOLE MAENo ratings yet

- Chapter 15Document25 pagesChapter 15Mohamed MedNo ratings yet

- 127 Winning Advertising HeadlinesDocument16 pages127 Winning Advertising HeadlinesDimitryKislichenko100% (15)

- PORT+ Modules FactsheetDocument1 pagePORT+ Modules FactsheetBing LiNo ratings yet

- Tiscon Case-Published Version Strategy Renewal at Tata SteelDocument29 pagesTiscon Case-Published Version Strategy Renewal at Tata Steelsuhasinidx2024No ratings yet

- Quizzes - Topic 5 - Impairment of Asset - Attempt ReviewDocument11 pagesQuizzes - Topic 5 - Impairment of Asset - Attempt ReviewThiện Phát100% (1)

- Quote 202210janDocument43 pagesQuote 202210janBilal AhmadNo ratings yet

- Market Efficiency PDFDocument17 pagesMarket Efficiency PDFBatoul ShokorNo ratings yet

- Equity Note - GPH Ispat LimitedDocument2 pagesEquity Note - GPH Ispat LimitedOsmaan GóÑÍNo ratings yet

- Article 5 - Advancing Financial Reporting in The Age of Technology An Interview With Robert H. HerzDocument9 pagesArticle 5 - Advancing Financial Reporting in The Age of Technology An Interview With Robert H. HerzFakhmol RisepdoNo ratings yet

- Tutorial 5 Jan 2022 Question OnlyDocument8 pagesTutorial 5 Jan 2022 Question OnlyMurali RasamahNo ratings yet

- Mipr 2022Document140 pagesMipr 2022Mohammad Azree YahayaNo ratings yet

- Classification of CostsDocument6 pagesClassification of CostsKate Crystel reyesNo ratings yet

- 2 - Buss Plan - Farm - Mst19pagesDocument19 pages2 - Buss Plan - Farm - Mst19pagesRaihan RahmanNo ratings yet

- Finmar Quiz MidtermDocument1 pageFinmar Quiz MidtermNune SabanalNo ratings yet

- Aan Qureshi IC-2100 Namra Saeed IC-2099 Saad Ahmed Malik IC-2106 Sajeel Abbas Zaidi IC-2107 Sir Malik Mazhar Hussain Business Research MethodDocument25 pagesAan Qureshi IC-2100 Namra Saeed IC-2099 Saad Ahmed Malik IC-2106 Sajeel Abbas Zaidi IC-2107 Sir Malik Mazhar Hussain Business Research MethodNamra SaeedNo ratings yet

- Les Reseaux Genoud Et Le Plan de Mettre Le Feu Au Moyen-Orient PDFDocument67 pagesLes Reseaux Genoud Et Le Plan de Mettre Le Feu Au Moyen-Orient PDFkarine888No ratings yet

- Harmonic Trading - AflDocument3 pagesHarmonic Trading - Aflpg_hardikarNo ratings yet

- Financial Management of HospitalsDocument13 pagesFinancial Management of HospitalsaakarNo ratings yet

- Paramount 93Document12 pagesParamount 93kevinfuryNo ratings yet

- Fama 1970 Efficient Capital Markets PDFDocument2 pagesFama 1970 Efficient Capital Markets PDFDesiree0% (1)

- Ey Ifrs 10 Consolidation For Fund Managers PDFDocument32 pagesEy Ifrs 10 Consolidation For Fund Managers PDFCindy Yin100% (2)

- D2C Marketing Manager - Job DescriptionDocument1 pageD2C Marketing Manager - Job DescriptionHakim DjerrariNo ratings yet

- Investment BankingDocument17 pagesInvestment BankingDhananjay BiyalaNo ratings yet

- FX Forward ContractsDocument2 pagesFX Forward ContractsQuant_GeekNo ratings yet

- Cash Flow Statements IIDocument7 pagesCash Flow Statements IIGood VibesNo ratings yet

- Research Paper On Credit Appraisal in BanksDocument7 pagesResearch Paper On Credit Appraisal in Banksh02ngq6c100% (1)