0% found this document useful (0 votes)

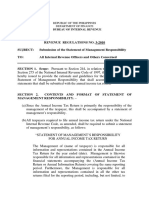

57 views1 pageStatement of Management'S Responsibility For Annual Income Tax Return

The document is a statement of management's responsibility for an annual income tax return. It states that Cassandra Fernandez is responsible for all information in the tax return and financial statements. It also affirms that the financial statements and tax return were prepared according to tax laws and regulations.

Uploaded by

AliceCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

57 views1 pageStatement of Management'S Responsibility For Annual Income Tax Return

The document is a statement of management's responsibility for an annual income tax return. It states that Cassandra Fernandez is responsible for all information in the tax return and financial statements. It also affirms that the financial statements and tax return were prepared according to tax laws and regulations.

Uploaded by

AliceCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd