Professional Documents

Culture Documents

Interest Calculation Under IDT

Interest Calculation Under IDT

Uploaded by

.0 ratings0% found this document useful (0 votes)

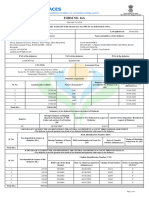

3K views5 pagesThis document provides an interest summary chart under the Indirect Tax laws of India. It outlines the various sections where interest is charged, the rates, period of applicability, and examples. Key details include:

1. Section 50(1) deals with interest for delayed payment of taxes at 18% per annum from the due date of payment till the actual date.

2. Section 50(2) provides for a 24% interest rate for undue reduction of tax liability.

3. Section 60(4) applies an 18% rate for delayed payment of taxes subsequent to provisional assessment, while section 60(5) charges 6% interest if any refund becomes due after provisional assessment.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an interest summary chart under the Indirect Tax laws of India. It outlines the various sections where interest is charged, the rates, period of applicability, and examples. Key details include:

1. Section 50(1) deals with interest for delayed payment of taxes at 18% per annum from the due date of payment till the actual date.

2. Section 50(2) provides for a 24% interest rate for undue reduction of tax liability.

3. Section 60(4) applies an 18% rate for delayed payment of taxes subsequent to provisional assessment, while section 60(5) charges 6% interest if any refund becomes due after provisional assessment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3K views5 pagesInterest Calculation Under IDT

Interest Calculation Under IDT

Uploaded by

.This document provides an interest summary chart under the Indirect Tax laws of India. It outlines the various sections where interest is charged, the rates, period of applicability, and examples. Key details include:

1. Section 50(1) deals with interest for delayed payment of taxes at 18% per annum from the due date of payment till the actual date.

2. Section 50(2) provides for a 24% interest rate for undue reduction of tax liability.

3. Section 60(4) applies an 18% rate for delayed payment of taxes subsequent to provisional assessment, while section 60(5) charges 6% interest if any refund becomes due after provisional assessment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

CA FINAL IDT | MARATHON FOR MAY 22 | Interest Summary Chart Under Indirect Tax

Interest computation under GST

Section Purpose Rate From Till Example

50(1) For delay in payment of – 18% p.a. 1st day after Date of payment Invoices having GST of `80,000 not reported in GSTR – 3B

• Self-assessed tax due date of GST of Nov 2022 and paid through GSTR – 3B of Dec 2022 filed

• TDS/TCS on 28/01/2022, using ECRL - `60,000 and ECL - `20,000.

Output Liability `80,000

Due date of Can be paid Input Tax Credit `60,000

Computed On payment of using ECL (or) Net GST Liability `20,000

- Gross liability (If an invoice is not tax is the due ECRL GST Pertains to Nov 2022

reported by due date, but paid date of filing Due date of payment 20/12/2022

through GSTR-3B at a later date) GSTR – 3B Actual date of payment 28/01/2023

[Or] and in case of Either date of Period of delay 39 Days

- Net liability (If GSTR – 3B of a TDS/TCS it is filing return

Interest `80,000*18%*39/365 = `1,539

month is filed after due date) [Or] the due date (GSTR – 3B/7/8)

- TDS/TCS payable of filing GSTR or DRC – 03.

– 7/8 GSTR – 3B of Nov 2022 with a gross liability of `80,000 filed

respectively. on 28/01/2022. Tax paid through ECRL is `60,000 and

through ECL is `20,000.

Output Liability 80,000

Input Tax Credit 60,000

Net GST Liability 20,000

GST Pertains to Nov 2022

Due date of payment 20/12/2022

Actual date of payment 28/01/2023

Period of delay 39 Days

Interest `20,000*18%*39/365 = `385

50(2) Undue or excess reduction in tax 24% p.a. 1st day after Date of payment (Not applicable at present)

liability due date of GST

60(4) In case any Tax amount becomes 18% p.a. from 1 day Date of Actual Differential Liability `1,50,000

payable subsequent to finalization of after the due Payment Applied for Provisional 28/04/2022

the provisional assessment date of Assessment

payment of Due date 20/05/2022

Tax Actual Payment date 12/07/2022

Period of delay 53 Days

Interest `1,50,000*18%*53/365 = `3,921

60(5) In case any Tax amount becomes 6% p.a. After expiry of Date of refund Amount Refundable `50,000

Refundable subsequent to finalization 60 days from Application for refund 08/08/2022

of the provisional assessment date of receipt Expiry of 60 days 07/10/2022

of application Interest start from 08/10/2022

of refund Actual Refund date 13/11/2022

Period of delay 37 Days

Interest `50,000*6%*37/365 = `304

1 | Page www.tharunraj.com © Tharun Raj

CA FINAL IDT | MARATHON FOR MAY 22 | Interest Summary Chart Under Indirect Tax

16 For non-payment of consideration + 18% p.a. From the first Date of addition Invoice dated 01.08.2021 1,00,000 (+) GST of `12,000

tax to the supplier by recipient within date after of such ITC to 180 days from Invoice 28/01/2022

180 days from the date of invoice availment of liability and paid. Date of Payment to 16/03/2022- (Payment not

ITC Supplier made within 180 days)

Interest start from 21/09/2021

Date of addition to liability 20/02/2020

Period of delay 153 Days

Interest `12,000*18%* 153/365 = `905

17 read ITC to be reversed w.r.to inputs and 18% p.a. 1st day of April Date of payment Mr. A Provided following Data with respect to FY 2021-22

with Rule input services > ITC reversed on of succeeding of such ITC reversed on 1,50,000 (Sum of all months in

42 provisional basis financial year difference provisional basis the year)

ITC to be reversed 180,000 (Annual basis)

Interest start from 01/04/2022

Differential ITC paid on 31/05/2022

Days 61 Days

Interest `30,000*18%*61/365 = `5,916

17 read Reversal of ITC pertaining to capital 18% p.a. 1st day after Date of addition Capital goods purchased on 1/4/2022 for `10,00,000

with Rule goods Availment of of proportionate (Excl. GST @ 12%) and used for both taxable and

43 ITC ITC to output tax exempted supplies

liability Monthly ITC `1,20,000(÷)60 = `2,000

Exempted (÷) Total 40 lakhs (÷) 100 lakhs = 0.4

supplies for June 2022

ITC to be reversed `2,000 X 0.4 = `800

Interest start from 21/05/2022

GSTR – 3B of June filed 20/07/2022

Period of delay 61 Days

Interest `800 X 18% X 61/365 = `24

73 & 74 Interest on account of 18% p.a. 1st day after Date of payment § This interest computation is similar to interest

- Non-payment of GST (or) due date (or) based on SCN computation in Sec. 50(1)

- Short payment of GST (or) 1st day after (or) Order § This interest is payable MANDATORILY, whether it is

- Wrong availment of ITC (or) availment of specified in SCN/ORDER (or) not.

- Wrong utilization of ITC (or) ITC (or)

- Erroneous Refund 1st day after

By reason of Fraud (S. 74) or other refund date

than fraud (S. 73)

76 Interest on amount collected as tax 18% p.a. 1st day after Date of payment Amount collected representing as GST `69,000 on 17th

but not paid collection of of such amount March 2021 and recovered by dept on 26th August 2021

such amount Interest start from 18/03/2021

Amount paid on 26/08/2021

Period of delay 162 Days

Interest `69,000 X 18% X 162/365 = `5,512

2 | Page www.tharunraj.com © Tharun Raj

CA FINAL IDT | MARATHON FOR MAY 22 | Interest Summary Chart Under Indirect Tax

39 Interest in case of QRMP Scheme – If 18% p.a. 26th of next Date of payment For July 2022, GST under FSM/SAM i.e., `3,00,000 paid

tax (Either FSM or SAM) not deposited month (i.e., deposit into on 31/08/2022

by 25th of the next month [Applicable ECL) Interest starts from 26/07/2022

for first 2 months in a quarter] GST paid on 31/08/2022

Period of delay 38 Days

Interest `3,00,000 X 18% X 38/365 = `5,622

39 Interest in case of QRMP Scheme – If 18% p.a. 1st day after Date of payment For the Quarter July to Sept 2022, GST paid under FCM

FSM opted, and difference between due date of difference for first 2 months of a quarter is `1,50,000 and actual tax

actual tax and tax under FSM for the (22nd or 24th of for the quarter is `2,90,000 to be paid by 22/10/2022 but

quarter not paid by due date next month) GSTR – 3B for that quarter filed on 31/10/2022.

Interest starts from 23/10/2022

GST paid on 31/10/2022

Period of delay 9 Days

Int. computed on `2,90,000 (-) `1,50,000 = `1,40,000

Interest `1,40,000 X 18% X 9/365 = `621

39 Interest in Case of QRMP Scheme – If 18% p.a. 26th of next Date of payment For July 2022, GST under SAM is `1,10,000 but actual tax

SAM opted, and there is a difference month of difference is `1,50,000. Such differential is paid on 22/10/2022

between tax under SAM and actual tax Interest starts from 26/07/2022

for the first two month of a quarter GST paid on 22/10/2022

Period of delay 89 Days

[This is not applicable, if FSM opted] Int. computed on `1,50,000 (-) `1,10,000 = `40,000

Interest `40,000 X 18% X 89/365 = `1,756

56 Interest on delay in refund – Refund 6% p.a. 61st day from Date of Refund Particulars Amount

sanctioned by officer the date of Amount Refundable `1,50,000

receipt of Receipt of Appln./ 08/08/2020

application Applied for Refund

Expiry of 60 days 07/10/2020

Interest start from 08/10/2020

In case of Refund paid on 12/11/2020

pre-deposit: Days 36 Days

From the date Interest `1,50,000*6%*36/365 = `888

of deposit

56 Interest on delay in refund – Arising 9% p.a. 61st day from Date of Refund Particulars Amount

on account of order of Adjudicating the date of Amount Refundable `1,50,000

authority; Appellate authority receipt of Receipt of Appln./ 08/08/2020

application Applied for Refund

Expiry of 60 days 07/10/2020

Interest start from 08/10/2020

Refund paid on 12/11/2020

Days 36 Days

Interest `1,50,000*9%*36/365 = `1,332

3 | Page www.tharunraj.com © Tharun Raj

CA FINAL IDT | MARATHON FOR MAY 22 | Interest Summary Chart Under Indirect Tax

Interest computation under Customs Act, 1962

Section Purpose Rate From Till Example

18 Interest on amount Payable under 15% p.a. 1st Day of month Actual Date of Date of Provisional 12/12/2021

Provisional assessment in which duty is payment of Duty Assessment

provisionally Date of Final Assessment 02/12/2022

assessed Duty demanded `1,80,000

Date of Payment of Duty 05/02/2022

Interest period 1/12/2021 to 5/02/2022

Days 67 Days

Interest Payable `1,80,000*15%*67/365 =

`4,956

18 Interest on amount Refundable 6% p.a. After expiry of 3 Date of refund of Date of Provisional 12/07/2021

under Provisional assessment months from such Duty Assessment

finalization of Date of Final Assessment 02/10/2021

assessment (+) 3 months 02/01/2022

Refund `4,20,000

Date of Refund 06/02/2022

Interest period 03/01/2022 to 06/02/2022

Days 35 Days

Interest Payable `4,20,000*6%*35/365 =

`2,416

47 Interest on Late payment of import 15% 1st Day after Actual Date of Date of Presentation of 12/10/2021

duty-In case of Immediate Payment Presentation of payment of Duty BOE

BOE Date of Payment 05/11/2021

Duty Amount `1,00,000

Interest period 13/10/2021 to 05/11/2021

Days 24 Days

Interest Payable `1,00,000*15%*24/365 = `986

47 Interest on Late payment of import 15% After Expiry of Actual Date of Date of Presentation of 05/10/2021

duty-In case of Deferred Payment due date as payment of Duty BOE

mentioned No. of holidays between 3

Period Due date under deferred 1/10 to 15/10

BOE between 16th Working scheme Due Date of Payment 19/10/2021

1st to 15th of a day of that Actual Date of Payment 10/11/2021

month month Duty Amount `1,00,000

BOE between 1st Working day Interest period 20/10/2021 to 10/11/2021

16th to end of in next month Days 31 Days

that month Interest Payable `1,00,000*15%*31/365 =

BOE between 31st March `1,274

16th to end of

March month

4 | Page www.tharunraj.com © Tharun Raj

CA FINAL IDT | MARATHON FOR MAY 22 | Interest Summary Chart Under Indirect Tax

75A(1) of Interest on delayed payment of 6% p.a. After expiry of 1 Date of payment Particulars Amount

Customs Drawback to claimant month from date of such drawback Duty Drawback `50,000

Act r/w S. of filing Applied for Claim 30/07/2021

27A of [Interest payable by Department] drawback claim Actual Receipt date 28/10/2021

Customs Interest period 31/08/2021 to 28/10/2021

Act Days 59 Days

Interest `50,000*6%*59/365 = `485

75A(2) of Interest on erroneous refund of 15% p.a. (If 1st day after Date of recovery Particulars Amount

Customs drawback claimant payment of such of such drawback DB Erroneously `20,000

Act r/w S. does not drawback to refunded

28AA of pay within claimant Date of erroneously 20/06/2021

Customs [Interest payable to Department] 2 months DB received

Act from date Demand raised by 28/08/2021

of demand, the department

recovery Refund of DB to the 20/10/2021

proceedin Department

gs will be Interest period 21/06/2021 to 20/10/2021

initiated) Days 122 Days

Interest `20,000*15%*122/365 = `1,003

61 Interest on warehoused goods 15% p.a. 91st day from the Date of actual Particulars Amount

date of clearance Order for warehousing 18/07/2021

warehousing of goods

order Goods cleared after 31/12/2021

filing ex-bond BOE

Customs duty payable `1,20,000

upon clearance

90 days from 16/10/2021

warehousing order

Interest period 17/10/2021 to 31/12/2021

Days 76 Days

Interest `1,20,000*15%*76/365 =

`3,748

5 | Page www.tharunraj.com © Tharun Raj

You might also like

- BI1001268978 - 1800792430MHC12023 - 06062023 - 1421 (1) MaxicareDocument1 pageBI1001268978 - 1800792430MHC12023 - 06062023 - 1421 (1) MaxicareJanet CafrancaNo ratings yet

- SVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsDocument20 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsMadhuram SharmaNo ratings yet

- Panuwat WancrueaDocument1 pagePanuwat WancrueaITNo ratings yet

- CDMA - RamayanpetDocument1 pageCDMA - Ramayanpetrohit panchariyaNo ratings yet

- SBI Card Statement - 7424 - 24-07-2022Document6 pagesSBI Card Statement - 7424 - 24-07-2022Seema HaldarNo ratings yet

- Krinapon ChungphaisalDocument1 pageKrinapon ChungphaisalITNo ratings yet

- Statement of Accounts - 144250953Document5 pagesStatement of Accounts - 144250953Sullapanchagrah Hiremath Panchagrah HiremethNo ratings yet

- Day 6 & 7Document23 pagesDay 6 & 7PrasanthNo ratings yet

- INV1793877810Document9 pagesINV1793877810thegameagain4No ratings yet

- Acknowledgement Slip: 38, Umer Street, Street No 3, HASAN TOWN MULTAN ROAD, Lahore, Iqbal Town. Muhammad ZubairDocument4 pagesAcknowledgement Slip: 38, Umer Street, Street No 3, HASAN TOWN MULTAN ROAD, Lahore, Iqbal Town. Muhammad ZubairMuhammad Dilawar HayatNo ratings yet

- Statement of Accounts - 183507327Document8 pagesStatement of Accounts - 183507327Diwakar SinghNo ratings yet

- Edamakallu BillDocument1 pageEdamakallu BillFree FireNo ratings yet

- Ht2329i002681770 2Document4 pagesHt2329i002681770 2Chegg tutorsNo ratings yet

- GST 12 To 18Document34 pagesGST 12 To 18Rajesh ChandelNo ratings yet

- Statement of Account - 79072589 - 221211314Document6 pagesStatement of Account - 79072589 - 221211314ishitasharma1793No ratings yet

- Mpdo Offce 26 Nov 22Document1 pageMpdo Offce 26 Nov 22Free FireNo ratings yet

- Purnachandra Samal: Account StatementDocument6 pagesPurnachandra Samal: Account StatementManika JenaNo ratings yet

- Mobile Services: This Month'S Charges Your Account SummaryDocument1 pageMobile Services: This Month'S Charges Your Account Summarysiva vNo ratings yet

- BM2324I001831442Document2 pagesBM2324I001831442Larson TubroNo ratings yet

- Screenshot 2023-11-13 at 8.43.44 PMDocument1 pageScreenshot 2023-11-13 at 8.43.44 PMÌshàq Ålì SýèðNo ratings yet

- No:-0000647261 - Issue Date 02.12.2022: Sristisanchar Webnet LTDDocument1 pageNo:-0000647261 - Issue Date 02.12.2022: Sristisanchar Webnet LTDsreyanshauddyNo ratings yet

- Congratulations! You Are On One Airtel 1349 PlanDocument11 pagesCongratulations! You Are On One Airtel 1349 PlanPrakash RajNo ratings yet

- Ht2406i000422645Document2 pagesHt2406i000422645Kumar TNo ratings yet

- Jul 23 MergedDocument40 pagesJul 23 Mergedsatish buddyNo ratings yet

- Aug 22Document3 pagesAug 22honey moneyNo ratings yet

- September 1-3613311284991 - BM2333I006304001Document9 pagesSeptember 1-3613311284991 - BM2333I006304001Jihoon BongNo ratings yet

- Aadcp9992n Q3 2023-24Document3 pagesAadcp9992n Q3 2023-24Harikrishan BhattNo ratings yet

- Due Date Calendar June 22Document1 pageDue Date Calendar June 22HAKIMI MZNNo ratings yet

- Statement of Accounts - 184545858Document5 pagesStatement of Accounts - 184545858DEEPAK KUMAR NANDANo ratings yet

- No:-0022682921 - Issue Date 15.12.2022: Alliance Broadband Services Pvt. LTDDocument1 pageNo:-0022682921 - Issue Date 15.12.2022: Alliance Broadband Services Pvt. LTDWalnut GroupNo ratings yet

- EtisalatDocument17 pagesEtisalatStena NadishaniNo ratings yet

- Statement of Accounts - 102830437Document5 pagesStatement of Accounts - 102830437Tabe alamNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailskathik MNo ratings yet

- Statement of Account - 21 - 38 - 42Document3 pagesStatement of Account - 21 - 38 - 42Srinadh JettiNo ratings yet

- Airtel Bill - MarDocument3 pagesAirtel Bill - MarKaran MitrooNo ratings yet

- KPR Bajaj PL Account STMNTDocument3 pagesKPR Bajaj PL Account STMNTVara Prasad AvulaNo ratings yet

- EtisalatDocument15 pagesEtisalatStena NadishaniNo ratings yet

- Ulb 114 11 75Document3 pagesUlb 114 11 75psatyam2921No ratings yet

- Foreclosure 14 07 11Document3 pagesForeclosure 14 07 11Muhammed Yazeen PMNo ratings yet

- Airtel Bill ChiragDocument8 pagesAirtel Bill Chiragutsav.gsuitNo ratings yet

- SBI Card Statement - 8643 - 23-12-2023Document7 pagesSBI Card Statement - 8643 - 23-12-2023vikashpratapkushwahaNo ratings yet

- Postpaid Bill 9354763608 BM2406I006370697Document4 pagesPostpaid Bill 9354763608 BM2406I006370697Mayank SainiNo ratings yet

- Airtel Fiber AugDocument2 pagesAirtel Fiber Augghanshyam sidhdhapuraNo ratings yet

- Inv Ka B1 76433376 102522632160 August 2022Document2 pagesInv Ka B1 76433376 102522632160 August 2022Chinta Rishi RaghavNo ratings yet

- Statement of Account H404HHL0889486Document2 pagesStatement of Account H404HHL0889486Prakash BattalaNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument1 pageMobile Services: Your Account Summary This Month'S Chargessaurav agrawalNo ratings yet

- Statement of Accounts - 175139622Document6 pagesStatement of Accounts - 175139622subbiahsubashaudiosNo ratings yet

- Emergency Amount After Due Date: 18002669944 (Tollfree) (022) - 68759400, (022) - 24012400Document2 pagesEmergency Amount After Due Date: 18002669944 (Tollfree) (022) - 68759400, (022) - 24012400sivan tharayilNo ratings yet

- Postpaid Bill NovDocument1 pagePostpaid Bill Novsiva vNo ratings yet

- Pooja Jaiswal: Account StatementDocument10 pagesPooja Jaiswal: Account StatementnosNo ratings yet

- Panchshil Domestic Bill-JuneDocument60 pagesPanchshil Domestic Bill-JuneUJJWALNo ratings yet

- Dec22 - Compliance CalendarDocument4 pagesDec22 - Compliance CalendarArman KhanNo ratings yet

- Statement of Account - 22!24!17Document3 pagesStatement of Account - 22!24!17Raghav SharmaNo ratings yet

- CardStatement - 2018 03 23Document6 pagesCardStatement - 2018 03 23Bipin RethinNo ratings yet

- Loan Account Statement For 4670Cdhx440551: Component Due (RS.) Receipt (RS.) Overdue (RS.)Document2 pagesLoan Account Statement For 4670Cdhx440551: Component Due (RS.) Receipt (RS.) Overdue (RS.)Prem kumarNo ratings yet

- Electronic Cash LedgerDocument4 pagesElectronic Cash LedgerBasavaraja C KNo ratings yet

- Fee Receipt - 22208522 - 2 - 15 - 2022 10 - 09 - 39 AMDocument1 pageFee Receipt - 22208522 - 2 - 15 - 2022 10 - 09 - 39 AMKRISHNo ratings yet

- CardStatement - 2018 02 08Document6 pagesCardStatement - 2018 02 08data worksNo ratings yet

- Postpaid Monthly Statement: 2829.64 ImmediatelyDocument7 pagesPostpaid Monthly Statement: 2829.64 ImmediatelyTushar SainiNo ratings yet

- Apr 22Document3 pagesApr 22honey moneyNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- RCM Expenses List Under GSTDocument5 pagesRCM Expenses List Under GSTAnonymous O3P3qkNo ratings yet

- Domestic Tender Enquiry Document: Under PMSSY Phase-IV &VDocument106 pagesDomestic Tender Enquiry Document: Under PMSSY Phase-IV &VAbhinav GNo ratings yet

- Implementation of GST in MalaysiaDocument2 pagesImplementation of GST in MalaysiashanursofNo ratings yet

- Matrushakti AgencyDocument4 pagesMatrushakti AgencyAnonymous joDvxoXYRx0% (1)

- GST in India: Prepared By:-Shubham SharmaDocument57 pagesGST in India: Prepared By:-Shubham Sharmamurali140No ratings yet

- GST AmendmentDocument14 pagesGST Amendmentbcomh2103012No ratings yet

- NASSCOM Annual Report 2018-19Document112 pagesNASSCOM Annual Report 2018-19Jayanth RameshNo ratings yet

- All About E-Ledgers Under GST - E-Cash Ledger, E-Credit Ledger & E-Liability LedgerDocument4 pagesAll About E-Ledgers Under GST - E-Cash Ledger, E-Credit Ledger & E-Liability LedgerDINESH CHANCHALANINo ratings yet

- Imp Dec GuideDocument68 pagesImp Dec GuideSrinivasa KirankumarNo ratings yet

- GSTR 3B Calculation Summary - JushTNDocument6 pagesGSTR 3B Calculation Summary - JushTNShail MehtaNo ratings yet

- Igst Cia 1Document15 pagesIgst Cia 1Ram SinghNo ratings yet

- Annual Plan and Budget - Resolutions of Rates and ChargesDocument98 pagesAnnual Plan and Budget - Resolutions of Rates and ChargesVaishnavi HallikarNo ratings yet

- FESCO ONLINE BILL - CompressedDocument1 pageFESCO ONLINE BILL - CompressedInternal Audit FESCONo ratings yet

- PODocument4 pagesPOA vyasNo ratings yet

- IGS Digital Center - Commission & SurchargeDocument23 pagesIGS Digital Center - Commission & SurchargeBikash KumarNo ratings yet

- SP Setia Strategic Management - Individual Coursework - 13 Jul 2016 - Yap Far LoonDocument8 pagesSP Setia Strategic Management - Individual Coursework - 13 Jul 2016 - Yap Far LoonBoobalan Suppiah100% (1)

- Document Checklist: Joint Venture / Sole-Proprietor / Unincorporated BodyDocument20 pagesDocument Checklist: Joint Venture / Sole-Proprietor / Unincorporated BodyEDWARD LEENo ratings yet

- Unit 4 - GST Liability & Input Tax CreditDocument13 pagesUnit 4 - GST Liability & Input Tax CreditPrathik PsNo ratings yet

- Goods and Services Tax (GST) in IndiaDocument30 pagesGoods and Services Tax (GST) in IndiarupalNo ratings yet

- Paper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaDocument5 pagesPaper 8 Indirect Tax Laws (Old Course) : © The Institute of Chartered Accountants of IndiaSourav AgarwalNo ratings yet

- GST Issues During Cir Process and Recent Important JudgementsDocument3 pagesGST Issues During Cir Process and Recent Important JudgementsAbhishek MathurNo ratings yet

- Generation-Skipping Transfer Tax Return For Terminations: General InformationDocument3 pagesGeneration-Skipping Transfer Tax Return For Terminations: General InformationIRSNo ratings yet

- Administration Brief Red BookDocument62 pagesAdministration Brief Red Bookpeter_martin9335No ratings yet

- TYB - Practical Questions - Final PDFDocument321 pagesTYB - Practical Questions - Final PDFChandana RajasriNo ratings yet

- For IT BPC 2023-2024Document7 pagesFor IT BPC 2023-2024Sankar ChinnasamyNo ratings yet

- ATC Schedule of Fees 2021Document4 pagesATC Schedule of Fees 2021rkseguNo ratings yet

- GST Practitioner AdvancedDocument20 pagesGST Practitioner AdvancedK.SENTHILKUMARNo ratings yet

- Personal Loan AgreementDocument10 pagesPersonal Loan AgreementchandanNo ratings yet

- Difference Between GSTRDocument4 pagesDifference Between GSTRdevNo ratings yet