Professional Documents

Culture Documents

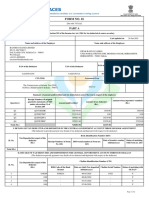

Midxx Prime Savings Form

Uploaded by

ankitshinde1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Midxx Prime Savings Form

Uploaded by

ankitshinde1Copyright:

Available Formats

COPY I COPY II

Version- XXI effective 01 June,2022 Version- XXI effective 01 June,2022

Your Branch Category: Your Branch Category:

MOST IMPORTANT DOCUMENT (TYPE I) - PRIME (SBEZY / SWEZY / SBGLT / SBLBR) MOST IMPORTANT DOCUMENT (TYPE I) - PRIME (SBEZY / SWEZY / SBGLT / SBLBR)

(One copy to be handed over to the Customer and one Copy to be retained by the Bank) (One copy to be handed over to the Customer and one Copy to be retained by the Bank)

The foundation of any strong relationship is Trust and we feel that Transparency builds Trust. So, we wish to begin this new relationship with a promise of The foundation of any strong relationship is Trust and we feel that Transparency builds Trust. So, we wish to begin this new relationship with a promise of

transparency. We request you to go through the charges related to your account before you sign up. transparency. We request you to go through the charges related to your account before you sign up.

Refer full list of charges, terms and conditions as related to account and debit card, visit www.axisbank.com or Axis Branch Refer full list of charges, terms and conditions as related to account and debit card, visit www.axisbank.com or Axis Branch

ACCOUNT TARIFF STRUCTURE - PRIME ACCOUNTS (NON SALARY) (Please tick applicable product) ACCOUNT TARIFF STRUCTURE - PRIME ACCOUNTS (NON SALARY) (Please tick applicable product)

Minimum Free Services a) Monthly E-statment / Passbook to track your account b) One free Multi City Cheque Book per year Minimum Free Services a) Monthly E-statment / Passbook to track your account b) One free Multi City Cheque Book per year

c) Internet Banking and Mobile Banking c) Internet Banking and Mobile Banking

Value Added SMS Fee Effective 1st July, 2021, SMS alert fee will be applied based on actual usage/SMS sent to the customer - 25 paise per SMS Max cap at INR 25 per month Value Added SMS Fee Effective 1st July, 2021, SMS alert fee will be applied based on actual usage/SMS sent to the customer - 25 paise per SMS Max cap at INR 25 per month

Easy Access (SBEZY)^

#

Easy Access (SBEZY)^

#

Service Fee Type Fee Service Fee Type Fee

# #

Easy Access Women (SWEZY) Liberty (SBLBR) Easy Access Women (SWEZY) Liberty (SBLBR)

Gold Loan Saving Account (SBGLT) Gold Loan Saving Account (SBGLT)

`12000 (Metro) `25,000 (All locations) `12000 (Metro) `25,000 (All locations)

`12000 (Urban) OR Monthly Spends of `25,000 through account /debit card `12000 (Urban) OR Monthly Spends of `25,000 through account /debit card

Monthly Average Balance `5,000 (Semi - Urban) towards merchant payments for SBLBR Monthly Average Balance `5,000 (Semi - Urban) towards merchant payments for SBLBR

(MAB) or `2,500 (Rural) Initial Funding : (MAB) or `2,500 (Rural) Initial Funding :

Total Relationship Value Initial Funding: `25,000 (All locations) Total Relationship Value Initial Funding: `25,000 (All locations)

(TRV) Requirement `16,000 (Metro) (TRV) Requirement `16,000 (Metro)

`15,000 (Urban) `15,000 (Urban)

Account Usage `6,000 (Semi- Urban) Account Usage `6,000 (Semi- Urban)

Charges `3000 (Rural) Charges `3000 (Rural)

Metro/Urban – ` 7.5 per 100 of the shortfall from AMB requirement or ` 600 Metro/Urban/Semi-urban / Rural - ` 7.5 per 100 of the shortfall from Metro/Urban – ` 7.5 per 100 of the shortfall from AMB requirement or ` 600 Metro/Urban/Semi-urban / Rural - ` 7.5 per 100 of the shortfall from

whichever is lower. AMB requirement or ` 600 whichever is lower. whichever is lower. AMB requirement or ` 600 whichever is lower.

Service Fee (Will not be Semi Urban – ` 7.5 per 100 of the shortfall from AMB requirement or ` 300 Service Fee (Will not be Semi Urban – ` 7.5 per 100 of the shortfall from AMB requirement or ` 300

levied if desired balance / whichever is lower. levied if desired balance / whichever is lower.

TRV is maintained) Rural – ` 7.5 per 100 of the shortfall from AMB requirement or ` 250 TRV is maintained) Rural – ` 7.5 per 100 of the shortfall from AMB requirement or ` 250

whichever is lower. whichever is lower.

First 5 transactions or `. 2 lakhs whichever is earlier. Cash transactions First 5transactions or `.2lakhs whichever is earlier. Cash transactions at

Monthly Free Cash at Non-Home Branch: Upto ` 25000 per day. Monthly Free Cash Non-Home Branch: Upto ` 25000 per day.

First 4 Transactions or `1.5 Lakhs whichever is earlier. First 4 Transactions or `1.5 Lakhs whichever is earlier.

Transaction Limits Transaction Limits

Transactions** Cash transactions at Non-Home Branch: Upto `25000 per day W.e.f. 1st July'22 - First 5 transactions or `1.5 lakhs whichever is Transactions** Cash transactions at Non-Home Branch: Upto `25000 per day W.e.f. 1st July'22 - First 5 transactions or `1.5 lakhs whichever is

earlier. Cash transactions at Non-Home Branch: Upto ` 25000 per day. earlier. Cash transactions at Non-Home Branch: Upto ` 25000 per day.

Self: Fee of `5 per `1000 or `150, whichever is higher Self: Fee of `5 per `1000 or `150, whichever is higher

Fees Third Party : Fee of `10 per `1000 or `150, whichever is higher Fees Third Party : Fee of `10 per `1000 or `150, whichever is higher

SBEZY: Secure + Debit Card SBEZY: Secure + Debit Card

Debit Card Type SWEZY: Chip Debit Card SBLBR: Liberty Debit Card Debit Card Type SWEZY: Chip Debit Card SBLBR: Liberty Debit Card

SBGLT: Chip Debit Card SBGLT: Chip Debit Card

Debit Card Fees Debit Card Fees

Issuance Fees SBEZY: `300 SWEZY: `200 SBGLT: `200 `200 Issuance Fees SBEZY: `300 SWEZY: `200 SBGLT: `200 `200

Annual Fees SBEZY: `300 SWEZY: `200 SBGLT: `200 `300 Annual Fees SBEZY: `300 SWEZY: `200 SBGLT: `200 `300

Issuance / Annual SBEZY Issuance / Annual SBEZY

Upgrade Debit Cards Delight `1500 / `999 SBLBR Upgrade Debit Cards Delight `1500 / `999 SBLBR

Fees Value + `750 / `750 Fees Value + `750 / `750

Online Rewards `500 / `500 Delight : `1500 / `999 Online Rewards `500 / `500 Delight : `1500 / `999

SWEZY Value + : `750 / `750 SWEZY Value + : `750 / `750

Online Rewards `500 / `500 Online Rewards `500 / `500

Terms for Personal Accident Insurance cover benefit on your Debit Card: Terms for Personal Accident Insurance cover benefit on your Debit Card:

The Debit Card entitles you to a Personal Accident Insurance cover. The insurance cover will be considered as active at the time of the incidence if you have made a successful The Debit Card entitles you to a Personal Accident Insurance cover. The insurance cover will be considered as active at the time of the incidence if you have made a successful

purchase transaction on your card within 90 days prior to the occurence of the incident. The incidence has to be reported within 50 days of occurence. purchase transaction on your card within 90 days prior to the occurence of the incident. The incidence has to be reported within 50 days of occurence.

# Insurance feature is only for Scheme SBEZY and SBLBR # Insurance feature is only for Scheme SBEZY and SBLBR

^Customers aged 57 or more will be auto migrated under Senior Privilege (SBSPA) scheme code ^Customers aged 57 or more will be auto migrated under Senior Privilege (SBSPA) scheme code

IMPORTANT TERMS & CONDITIONS: IMPORTANT TERMS & CONDITIONS:

Customer Name: Primary Holder Signature: Customer Name: Primary Holder Signature:

FOR OFFICE FOR OFFICE

USE ONLY Joint Holder Signature: USE ONLY Joint Holder Signature:

Barcode LC Code Signature Barcode LC Code Signature

COPY I COPY II

Version- XXI effective 01 June,2022 Version- XXI effective 01 June,2022

Your Branch Category: Your Branch Category:

MOST IMPORTANT DOCUMENT (TYPE I) - PRIME (SBSPA / SBFTS / SBAGT) MOST IMPORTANT DOCUMENT (TYPE I) - PRIME (SBSPA / SBFTS / SBAGT)

(One copy to be handed over to the Customer and one Copy to be retained by the Bank) (One copy to be handed over to the Customer and one Copy to be retained by the Bank)

The foundation of any strong relationship is Trust and we feel that Transparency builds Trust. So, we wish to begin this new relationship with a promise of The foundation of any strong relationship is Trust and we feel that Transparency builds Trust. So, we wish to begin this new relationship with a promise of

transparency. We request you to go through the charges related to your account before you sign up. transparency. We request you to go through the charges related to your account before you sign up.

Refer full list of charges, terms and conditions as related to account and debit card, visit www.axisbank.com or Axis Branch Refer full list of charges, terms and conditions as related to account and debit card, visit www.axisbank.com or Axis Branch

ACCOUNT TARIFF STRUCTURE - PRIME ACCOUNTS (NON SALARY) (Please tick applicable product) ACCOUNT TARIFF STRUCTURE - PRIME ACCOUNTS (NON SALARY) (Please tick applicable product)

Minimum Free Services a) Monthly E-statment / Passbook to track your account Minimum Free Services a) Monthly E-statment / Passbook to track your account

b) One free Multi City Cheque Book per year b) One free Multi City Cheque Book per year

c) Internet Banking and Mobile Banking c) Internet Banking and Mobile Banking

Effective 1st July, 2021, SMS alert fee will be applied based on actual usage/SMS sent to the customer - 25 paise per SMS Max cap at INR 25 per month Effective 1st July, 2021, SMS alert fee will be applied based on actual usage/SMS sent to the customer - 25 paise per SMS Max cap at INR 25 per month

Value Added SMS Fee quarter (only non mandatory SMS) Value Added SMS Fee quarter (only non mandatory SMS)

Service Fee Type Fee Senior Privillege (SBSPA) Future Stars (SBFTS) Insurance Agent (SBAGT) Service Fee Type Fee Senior Privillege (SBSPA) Future Stars (SBFTS) Insurance Agent (SBAGT)

Average Quarterly Balance (AQB) Monthly Average Balance (MAB) Monthly Average Balance (MAB) Average Quarterly Balance (AQB) Monthly Average Balance (MAB) Monthly Average Balance (MAB)

Average Balance or `12,000 (Metro / Urban) ` 2,500 (Metro / Urban / Semi-Urban) `5,000 (Metro / Urban) Average Balance or `12,000 (Metro / Urban) ` 2,500 (Metro / Urban / Semi-Urban) `5,000 (Metro / Urban)

Total Relationship `5,000 (Semi-Urban) ` 1,000 (Rural) - AMB `2,500 (Semi-Urban) Total Relationship `5,000 (Semi-Urban) ` 1,000 (Rural) - AMB `2,500 (Semi-Urban)

Value (TRV) `2,500 (Rural) - QAB `2,500 (Rural) - AMB Value (TRV) `2,500 (Rural) - QAB `2,500 (Rural) - AMB

Initial Funding: Initial Funding:

Requirement OR Maintain a TRV (Savings and Term Requirement OR Maintain a TRV (Savings and Term

Deposit of minimum 6 months) of `1 lakh Metro/Urban/Semi Urban - `3,000 Deposit of minimum 6 months) of `1 lakh Metro/Urban/Semi Urban - `3,000

Initial Funding: Rural - `1,500 Initial Funding: Rural - `1,500

Metro/Urban: `15,000 Metro/Urban: `15,000

Semi Urban: `6,000 Semi Urban: `6,000

Rural: `3,000 Rural: `3,000

Account Usage Account Usage

Charges Monthly Service Fees Metro/Urban – ` 7.5 per 100 of the shortfall from Metro/Urban – ` 7.5 per 100 of the shortfall from Charges Monthly Service Fees Metro/Urban – ` 7.5 per 100 of the shortfall from Metro/Urban – ` 7.5 per 100 of the shortfall from

AMB requirement or ` 600 whichever is lower. AMB requirement or ` 600 whichever is lower. AMB requirement or ` 600 whichever is lower. AMB requirement or ` 600 whichever is lower.

(MSF) Will not be (MSF) Will not be

levied if desired NA Semi Urban – ` 7.5 per 100 of the shortfall from Semi Urban – ` 7.5 per 100 of the shortfall from levied if desired NA Semi Urban – ` 7.5 per 100 of the shortfall from Semi Urban – ` 7.5 per 100 of the shortfall from

AMB requirement or ` 300 whichever is lower. AMB requirement or ` 300 whichever is lower. AMB requirement or ` 300 whichever is lower. AMB requirement or ` 300 whichever is lower.

balance/TRV is balance/TRV is

Rural – ` 7.5 per 100 of the shortfall from AMB Rural – ` 7.5 per 100 of the shortfall from AMB Rural – ` 7.5 per 100 of the shortfall from AMB Rural – ` 7.5 per 100 of the shortfall from AMB

maintained requirement or ` 250 whichever is lower. requirement or ` 250 whichever is lower.

maintained requirement or ` 250 whichever is lower. requirement or ` 250 whichever is lower.

Quarterly Service Fees Metro/Urban – ` 7.5 per 100 of the shortfall from Quarterly Service Fees Metro/Urban – ` 7.5 per 100 of the shortfall from

(QSF) Will not be AQB requirement or ` 600 whichever is lower. (QSF) Will not be AQB requirement or ` 600 whichever is lower.

levied if desired balance Semi Urban – ` 7.5 per 100 of the shortfall from AQB levied if desired balance Semi Urban – ` 7.5 per 100 of the shortfall from AQB

or TRV is maintained requirement or ` 300 whichever is lower. NA NA or TRV is maintained requirement or ` 300 whichever is lower. NA NA

Rural – ` 7.5 per 100 of the shortfall from AQB Rural – ` 7.5 per 100 of the shortfall from AQB

requirement or ` 250 whichever is lower. requirement or ` 250 whichever is lower.

First 4 transactions or `1.5 Lakhs whichever is First 4 transactions or `1.5 Lakhs whichever is First 4 transactions or `.1.5 lakhs whichever is First 4 transactions or `1.5 Lakhs whichever is First 4 transactions or `1.5 Lakhs whichever is First 4 transactions or `.1.5 lakhs whichever is

earlier. earlier. earlier. earlier.

Cash Transactions Monthly Free Cash earlier. Cash transactions at Non-Home Branch: Cash Transactions Monthly Free Cash earlier. Cash transactions at Non-Home Branch:

Cash transactions at Non-Home Branch: Cash transactions at Non-Home Branch: Cash transactions at Non-Home Branch: Cash transactions at Non-Home Branch:

Transaction Limits Upto `25000 per day Upto `25000 per day Upto ` 25000 per day. Transaction Limits Upto `25000 per day Upto `25000 per day Upto ` 25000 per day.

(Deposit / Withdrawal) (Deposit / Withdrawal)

Fees** Fees**

Fees Self: Fee of `5 per `1000 or `150, whichever is higher Fees Self: Fee of `5 per `1000 or `150, whichever is higher

Third Party : Fee of `10 per `1000 or `150, whichever is higher Third Party : Fee of `10 per `1000 or `150, whichever is higher

Debit Card Type Chip Debit Card Chip Debit Card Chip Debit Card Debit Card Type Chip Debit Card Chip Debit Card Chip Debit Card

Issuance Fees `200 `200 `200 Issuance Fees `200 `200 `200

Debit Card Fees Debit Card Fees

Annual Fees `200 `200 `200 Annual Fees `200 `200 `200

Upgrade Debit Cards Issuance / Annual Fees Online Rewards `500 / `500 Upgrade Debit Cards Issuance / Annual Fees Online Rewards `500 / `500

Terms for Personal Accident Insurance cover benefit on your Debit Card: Terms for Personal Accident Insurance cover benefit on your Debit Card:

The Debit Card entitles you to a Personal Accident Insurance cover. The insurance cover will be considered as active at the time of the incidence if you have made a successful The Debit Card entitles you to a Personal Accident Insurance cover. The insurance cover will be considered as active at the time of the incidence if you have made a successful

purchase transaction on your card within 90 days prior to the occurence of the incident. The incidence has to be reported within 50 days of occurence. purchase transaction on your card within 90 days prior to the occurence of the incident. The incidence has to be reported within 50 days of occurence.

^Customers aged 57 or more will be auto migrated under Senior Privilege (SBSPA) scheme code. ^Customers aged 57 or more will be auto migrated under Senior Privilege (SBSPA) scheme code.

IMPORTANT TERMS & CONDITIONS: IMPORTANT TERMS & CONDITIONS:

1) All important charges pertaining to your Savings Account are mentioned above. However, this list is not exhaustive and you may visit our website www.axisbank.com to view the other charges which are applicable. 2) 1) All important charges pertaining to your Savings Account are mentioned above. However, this list is not exhaustive and you may visit our website www.axisbank.com to view the other charges which are applicable. 2)

All accounts have monthly billing cycle in a year 1st to 30th / 31st of the month. 3) GST as applicable will be levied on all fees. 4) The Bank can at its sole discretion discontinue any service partially /completely or change All accounts have monthly billing cycle in a year 1st to 30th / 31st of the month. 3) GST as applicable will be levied on all fees. 4) The Bank can at its sole discretion discontinue any service partially /completely or change

fees by providing 30 days notice. All revision in fees will be displayed on the Notice Board of the branches of Axis Bank and also on our website www.axisbank.com. 5) Update Aadhar Number in your bank account to fees by providing 30 days notice. All revision in fees will be displayed on the Notice Board of the branches of Axis Bank and also on our website www.axisbank.com. 5) Update Aadhar Number in your bank account to

receive subsidies directly from Government (LPG, MGNREGA, etc.). 6) Axis Bank reserves the right, at its own discretion, to close the account in case a) Initial funding cheque is returned / bounced and funding as per receive subsidies directly from Government (LPG, MGNREGA, etc.). 6) Axis Bank reserves the right, at its own discretion, to close the account in case a) Initial funding cheque is returned / bounced and funding as per

scheme code is not received within 30 days of account opening or b) Non-activated instakits in case account is not activated within 30 days once initiated for activation or c) Branch Personnel is unable to successfully scheme code is not received within 30 days of account opening or b) Non-activated instakits in case account is not activated within 30 days once initiated for activation or c) Branch Personnel is unable to successfully

verify details of the account, post providing a 30-day notice to the customer. 7) Effective 1st April,2020, Average Balance maintenance cycle for rural locations is being revised from Quarterly (QAB) to monthly (AMB) verify details of the account, post providing a 30-day notice to the customer. 7) Effective 1st April,2020, Average Balance maintenance cycle for rural locations is being revised from Quarterly (QAB) to monthly (AMB)

basis for Rural Branches for SBEZY,SBSA3, SBSMT, SWEZY, SBAGT & SBFTS. 8) `500 fees will be charged if account is closed between 14 days and 1 year. 9) If your account has been opened inconjunction with a loan, basis for Rural Branches for SBEZY,SBSA3, SBSMT, SWEZY, SBAGT & SBFTS. 8) `500 fees will be charged if account is closed between 14 days and 1 year. 9) If your account has been opened inconjunction with a loan,

with a standing instruction for repayment of the loan, your account will be a zero-balance account till such time as the loan continues and the SI stands, after which, the balance requirement will apply.10) `50 per with a standing instruction for repayment of the loan, your account will be a zero-balance account till such time as the loan continues and the SI stands, after which, the balance requirement will apply.10) `50 per

transaction after banking hours (i.e. Between 5:00 pm to 9:30 am) and on Bank Holidays & State Holidays * 11) Axis Bank reserves the right to recover applicable service charges from account or set off any available transaction after banking hours (i.e. Between 5:00 pm to 9:30 am) and on Bank Holidays & State Holidays * 11) Axis Bank reserves the right to recover applicable service charges from account or set off any available

credit, including amounts flowing into the account from collection proceeds or any deposits. 12) For details on alerts under Value added SMS Alert facility, refer Axis Bank website/ Bank Smart/ SMS Banking 13). In case credit, including amounts flowing into the account from collection proceeds or any deposits. 12) For details on alerts under Value added SMS Alert facility, refer Axis Bank website/ Bank Smart/ SMS Banking 13). In case

of nil average balance for 2 consecutive months, your existing Savings A/c shall be auto migrated to Basic Savings A/c. Visit https://www.axisbank.com/retail/accounts/savings-account/basic-savings-account 14) Axis of nil average balance for 2 consecutive months, your existing Savings A/c shall be auto migrated to Basic Savings A/c. Visit https://www.axisbank.com/retail/accounts/savings-account/basic-savings-account 14) Axis

Bank has crafted the Insurance Agent Savings Account exclusively for Insurance Agents. The Bank holds all rights to auto migrate the Insurance Agent Savings A/c to Easy Access Savings A/c if the account holder is no Bank has crafted the Insurance Agent Savings Account exclusively for Insurance Agents. The Bank holds all rights to auto migrate the Insurance Agent Savings A/c to Easy Access Savings A/c if the account holder is no

longer an agent with its Insurance Partners. For details regarding Easy Access Savings A/c, please visit the Axis Bank website: https://www.axisbank.com/retail/accounts/savings-account/easyaccess-savings- longer an agent with its Insurance Partners. For details regarding Easy Access Savings A/c, please visit the Axis Bank website: https://www.axisbank.com/retail/accounts/savings-account/easyaccess-savings-

account/features-benefits account/features-benefits

Customer Name: Primary Holder Signature: Customer Name: Primary Holder Signature:

FOR OFFICE FOR OFFICE

USE ONLY Joint Holder Signature: USE ONLY Joint Holder Signature:

Barcode LC Code Signature Barcode LC Code Signature

You might also like

- Covid-19 Federal Agency Actions & Resources: Contacting Senator Paul For AssistanceDocument13 pagesCovid-19 Federal Agency Actions & Resources: Contacting Senator Paul For AssistanceSenator Rand PaulNo ratings yet

- CIBIL Credit Report SummaryDocument2 pagesCIBIL Credit Report Summaryamit tiwariNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Dgme Login: Access Employee Account atDocument6 pagesDgme Login: Access Employee Account atStacey L. TravisNo ratings yet

- Texas Sands PACDocument39 pagesTexas Sands PACHayden SparksNo ratings yet

- Chrome Operating SystemDocument29 pagesChrome Operating SystemSai SruthiNo ratings yet

- Annu Acc StatementDocument1 pageAnnu Acc StatementAHMAD ANTOINE DELAINENo ratings yet

- 10-02-26 BANK OF AMERICA CORP - DE - (Form - 10-K, Received - 02 - 26 - 2010 07 - 51 - 53 SDocument765 pages10-02-26 BANK OF AMERICA CORP - DE - (Form - 10-K, Received - 02 - 26 - 2010 07 - 51 - 53 SHuman Rights Alert - NGO (RA)No ratings yet

- 2019 Federal Tax Return Summary: Total IncomeDocument3 pages2019 Federal Tax Return Summary: Total IncomerayNo ratings yet

- CSF Fy12 990Document100 pagesCSF Fy12 990the wilsonsNo ratings yet

- BMO World Elite Mastercard Benefits Guide enDocument11 pagesBMO World Elite Mastercard Benefits Guide enTonyNo ratings yet

- Applicant Information (If More Than One Applicant, Copy Form and Complete For Each)Document1 pageApplicant Information (If More Than One Applicant, Copy Form and Complete For Each)NoeNo ratings yet

- Armstrong April Quarterly 2022Document108 pagesArmstrong April Quarterly 2022Rob PortNo ratings yet

- Reset Office Email Password in 3 Easy StepsDocument4 pagesReset Office Email Password in 3 Easy StepsJojoNo ratings yet

- Hot Fixes 14may22Document81 pagesHot Fixes 14may22bhherhfdr0% (1)

- Jessica LaplaceDocument2 pagesJessica Laplacejtm3323No ratings yet

- Jose JR Minoza Bernarte: Statement of AccountDocument4 pagesJose JR Minoza Bernarte: Statement of AccountjunbernartNo ratings yet

- Black Book AjayDocument59 pagesBlack Book AjayMarshall CountyNo ratings yet

- Cut, grab, crimp and punch with air nippersDocument32 pagesCut, grab, crimp and punch with air nippersUgiezRagielNo ratings yet

- 2014 Laminated ID RequirementsDocument2 pages2014 Laminated ID Requirementsj millerNo ratings yet

- Lucky Tiger Casino Card Authentication: XX XXXXDocument1 pageLucky Tiger Casino Card Authentication: XX XXXXบ่จัก ดอกNo ratings yet

- How To Crack A Router For Username and Password PDFDocument3 pagesHow To Crack A Router For Username and Password PDFbkchoudhury1993100% (1)

- Exemption Certificate - SalesDocument2 pagesExemption Certificate - SalesExecutive F&ADADUNo ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part AMirza Aftab BaigNo ratings yet

- Visa MCC CodesDocument23 pagesVisa MCC CodesChetanRajNo ratings yet

- Banks PAY YOU for Direct Deposit enrollmentDocument1 pageBanks PAY YOU for Direct Deposit enrollmentdiremommyNo ratings yet

- FG1561 2023 Lifetime - 12292022Document2 pagesFG1561 2023 Lifetime - 12292022Koushik RoyNo ratings yet

- PEB Steel Myanmar credit application formDocument2 pagesPEB Steel Myanmar credit application formyoeyar@gmail.comNo ratings yet

- Official Cuddle ApplicationDocument1 pageOfficial Cuddle ApplicationJhnny X HkimNo ratings yet

- Studying Burbot On The Missouri: A Whole Lotta LoveDocument10 pagesStudying Burbot On The Missouri: A Whole Lotta LoveBS Central, Inc. "The Buzz"No ratings yet

- Credit Card Reconciliation - Brianna Daguio 1Document9 pagesCredit Card Reconciliation - Brianna Daguio 1api-507868036No ratings yet

- APD Staffing Project FinalDocument65 pagesAPD Staffing Project FinalAnonymous Pb39klJNo ratings yet

- Yes Prosperity Credit Card Application Form: Personal InformationDocument4 pagesYes Prosperity Credit Card Application Form: Personal Informationranjithophir0% (1)

- FBF - ApplicationDocument1 pageFBF - ApplicationAnonymous WLOBYKE8NTNo ratings yet

- Sharing Options: Share or Embed DocumentDocument362 pagesSharing Options: Share or Embed DocumentGeorge parmaaroNo ratings yet

- Addedum AmexDocument12 pagesAddedum AmexOMOLAYONo ratings yet

- Free Credit Score and Report - Free Monthly Credit CheckDocument3 pagesFree Credit Score and Report - Free Monthly Credit CheckSagar Chandra KhatuaNo ratings yet

- AmBank Credit Card FeesDocument16 pagesAmBank Credit Card FeesChoon Zhe ShyiNo ratings yet

- United States v. Elton Lee Flenaugh, 11th Cir. (2015)Document5 pagesUnited States v. Elton Lee Flenaugh, 11th Cir. (2015)Scribd Government DocsNo ratings yet

- Direct Deposit Enrollment Form: Account Information AmountDocument1 pageDirect Deposit Enrollment Form: Account Information AmountClifton WilsonNo ratings yet

- Credit Cards D8Document5 pagesCredit Cards D8Isaac GonzalezNo ratings yet

- Configure vpopmail for qmailDocument21 pagesConfigure vpopmail for qmaild14n4dNo ratings yet

- Account Statement 240422 230722Document17 pagesAccount Statement 240422 230722Ravindra RajNo ratings yet

- Reliance ReceiptDocument12 pagesReliance ReceiptManas Jain MJNo ratings yet

- Groupon A63EFA1D2BDocument1 pageGroupon A63EFA1D2BSalif NdiayeNo ratings yet

- Preview W8 W9 PDFDocument1 pagePreview W8 W9 PDFEugene ChoiNo ratings yet

- TCA Travel Tourney InfoDocument15 pagesTCA Travel Tourney Infoelliesmith13229No ratings yet

- Direct Bill Authorization FormDocument8 pagesDirect Bill Authorization Formzodaq50% (2)

- CC Form (WPO)Document1 pageCC Form (WPO)Nancy SparlingNo ratings yet

- Adobe Scan 16-Dec-2022Document8 pagesAdobe Scan 16-Dec-2022PRADEEP PHOTOGRAPHY AND JOB NOTIFICATIONNo ratings yet

- Justin OsburnDocument3 pagesJustin OsburnJustinOsburnNo ratings yet

- Checks Issued by City of Boise Idaho - 14Document31 pagesChecks Issued by City of Boise Idaho - 14Mark ReinhardtNo ratings yet

- Dos BankDocument4 pagesDos BankheadpncNo ratings yet

- SSN Project Report PDFDocument27 pagesSSN Project Report PDFErlanggaAdinegoroNo ratings yet

- Borrower Must Read Thoroughly The Terms and Conditions BelowDocument3 pagesBorrower Must Read Thoroughly The Terms and Conditions BelowNgirp Alliv TreborNo ratings yet

- Current Statistics: EPW Research FoundationDocument1 pageCurrent Statistics: EPW Research FoundationshefalijnNo ratings yet

- Visa Inc. - PaperDocument12 pagesVisa Inc. - PaperJen AdvientoNo ratings yet

- Credit Card Pricing Strategy: Davide Capodici, Brooke Chang, Brian Feldman, Erica GluckDocument75 pagesCredit Card Pricing Strategy: Davide Capodici, Brooke Chang, Brian Feldman, Erica GluckBinay Kumar SinghNo ratings yet

- Onboarding ToolkitDocument17 pagesOnboarding Toolkitankitshinde1100% (3)

- 1 Info Zum SendenDocument4 pages1 Info Zum Sendenankitshinde1No ratings yet

- Glassdoor Visa Sponsorship JobsDocument6 pagesGlassdoor Visa Sponsorship Jobsankitshinde1No ratings yet

- CV Template Timeline CVDocument1 pageCV Template Timeline CVankitshinde1No ratings yet

- Example of Filled Cover LetterDocument1 pageExample of Filled Cover Letterankitshinde1No ratings yet

- Safe Deposit Locker AgreementDocument14 pagesSafe Deposit Locker Agreementankitshinde1No ratings yet

- Key Fact Statement and Most Important Information: Bank'SDocument3 pagesKey Fact Statement and Most Important Information: Bank'Sankitshinde1No ratings yet

- Midxx New and Other Products Sbkri Sbpen and SBSDF FormsDocument2 pagesMidxx New and Other Products Sbkri Sbpen and SBSDF Formsankitshinde1No ratings yet

- Most Important Document (Type Viii) - Sbez4: ACCOUNT TARIFF STRUCTURE - Farmer Savings Account (SBEZ4)Document2 pagesMost Important Document (Type Viii) - Sbez4: ACCOUNT TARIFF STRUCTURE - Farmer Savings Account (SBEZ4)ankitshinde1No ratings yet

- Importance of Coivd VaccineDocument1 pageImportance of Coivd Vaccineankitshinde1No ratings yet

- Debenture Trustee Terms and ConditionsDocument3 pagesDebenture Trustee Terms and Conditionsankitshinde1No ratings yet

- Application Repayment of 6.5% Savings Bonds, 2003Document1 pageApplication Repayment of 6.5% Savings Bonds, 2003ankitshinde1No ratings yet

- Report SolutionDocument1 pageReport Solutionankitshinde1No ratings yet

- How Freelance Developers Can Help Your Midsize BusinessDocument2 pagesHow Freelance Developers Can Help Your Midsize Businessankitshinde1No ratings yet

- Investment Proof Submission GuidelinesDocument6 pagesInvestment Proof Submission GuidelinessriharshamysuruNo ratings yet

- Quick Guide To NGCDS (Booklet)Document21 pagesQuick Guide To NGCDS (Booklet)Kim Anthony Acosta100% (1)

- Medical Invoice RecordsDocument6 pagesMedical Invoice RecordsPreet BamrahNo ratings yet

- Confirmation - Your Booking Confirmation and Reference - FlydubaiDocument2 pagesConfirmation - Your Booking Confirmation and Reference - FlydubaiMurugan Raja67% (9)

- Guide To Accounting For Income Taxes (PWC - 2nd Edition 2015)Document717 pagesGuide To Accounting For Income Taxes (PWC - 2nd Edition 2015)Piseth Chen100% (1)

- Clearing Department of IFICDocument2 pagesClearing Department of IFICTawhid Ahmed ChowdhuryNo ratings yet

- Format LPJ InternDocument6,470 pagesFormat LPJ InternElfan ApoyNo ratings yet

- GST registration rules and proceduresDocument10 pagesGST registration rules and proceduresPooja MauryaNo ratings yet

- Invoice 7846033Document1 pageInvoice 7846033Hassan Sarfraz AliNo ratings yet

- Tax Planning Guide for Employee RemunerationDocument34 pagesTax Planning Guide for Employee RemunerationRishabh Jain83% (6)

- Flipkart Labels 14 Apr 2023 10 11Document7 pagesFlipkart Labels 14 Apr 2023 10 11Sahil KochharNo ratings yet

- UnknownDocument2 pagesUnknownveersingh5521No ratings yet

- Sodexo Meal Pass FAQsDocument5 pagesSodexo Meal Pass FAQsJyothsna KotteNo ratings yet

- Procedure For Online Recharge of Prepaid MeterDocument7 pagesProcedure For Online Recharge of Prepaid MeterNikhil GuptaNo ratings yet

- BK ProjectDocument6 pagesBK ProjectAnonymous cQLioQ100% (4)

- E StatementDocument10 pagesE Statementsheheryar khanNo ratings yet

- Understanding Tax Laws and AdministrationDocument27 pagesUnderstanding Tax Laws and AdministrationNoeme LansangNo ratings yet

- TDS Notes in Hindi PDFDocument8 pagesTDS Notes in Hindi PDFRohit VermaNo ratings yet

- ULO A Analyze Act1Document5 pagesULO A Analyze Act1Marian B TersonaNo ratings yet

- The Imprest System: Format of Petty Cash BookDocument2 pagesThe Imprest System: Format of Petty Cash BookHasib QureshiNo ratings yet

- Chapter Four Brief Lecture Note For AAU Stu ExtDocument50 pagesChapter Four Brief Lecture Note For AAU Stu Extaddis adugenet100% (6)

- Smart Board QuoteDocument1 pageSmart Board QuoteJohnson OnuigboNo ratings yet

- Ias 12 Income TaxDocument36 pagesIas 12 Income Taxesulawyer2001No ratings yet

- Regional Express - Payoneer Payment Instructions 2019 PDFDocument2 pagesRegional Express - Payoneer Payment Instructions 2019 PDFAnonymous W5MBSnlONo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusBrianNo ratings yet

- There Are Two Target Groups That Use Information From Financial AccountingDocument9 pagesThere Are Two Target Groups That Use Information From Financial AccountingHari Chandan100% (1)

- In Re Atty Bernardo ZialcitaDocument3 pagesIn Re Atty Bernardo ZialcitaMCNo ratings yet

- AIOU Business Taxation Assignment GuideDocument4 pagesAIOU Business Taxation Assignment GuideUsman Shaukat Khan100% (1)

- Chapter 10 - Introduction To Government FinanceDocument26 pagesChapter 10 - Introduction To Government Financewatts175% (4)

- Donor's Tax Elements of Donation: Summary of Formal RequirementsDocument3 pagesDonor's Tax Elements of Donation: Summary of Formal RequirementsKristal SalinelNo ratings yet