Professional Documents

Culture Documents

Sanitary Protection in Vietnam - Analysis: Country Report - Apr 2022

Uploaded by

Thảo Mai NguyễnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sanitary Protection in Vietnam - Analysis: Country Report - Apr 2022

Uploaded by

Thảo Mai NguyễnCopyright:

Available Formats

SANITARY PROTECTION IN VIETNAM - ANALYSIS

Country Report | Apr 2022

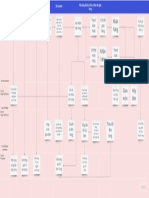

KEY DATA FINDINGS Market Sizes

Retail value sales grow by 8% in current terms in 2021 to VND9.6 trillion Sales of Sanitary Protection

Pantyliners is the best performing category in 2021, with retail value sales growing Retail Value RSP - VND billion - Current - 2007-2026

by 10% in current terms to VND921 billion

Diana JSC is the leading player in 2021, with a retail value share of 41%

9.612 Forecast

20.000

Retail sales are set to rise at a current value CAGR of 10% (2021 constant value CAGR

of 6%) over the forecast period to VND15.4 trillion

15.000

2021 DEVELOPMENTS

Sanitary products distribution faced with difficulties during the 2021

10.000

lockdown

During the strict lockdown in the south of Vietnam, which lasted from May to October

2021, sanitary protection products were not classified as essentials and, therefore, did

5.000

not make it onto the government’s list of necessities. This challenged the category’s

logistics and the distribution of sanitary protection products to rural areas. Noticeably,

in July 2021, the leading player’s Diana products were temporarily not to be seen on the

shelves of Vinmart supermarkets. This state of affairs led to a lot of discussion on social 0

media, which resulted in the company having to explain that the shortage of products 2007 2021 2026

was due to the considerable impact of the COVID-19 crisis on its key Bac Ninh factory

and difficulties in distribution networks.

Sales Performance of Sanitary Protection

Overall, however, sanitary products still recorded positive growth during the year,

% Y-O-Y Retail Value RSP Growth 2007-2026

supported by rising hygiene standards amongst consumers and growing consumer

product-awareness. Vietnamese women now have greater awareness of sanitary

products, while educational efforts by the Ministry of Education and Training are also

helping young Vietnamese girls to gain knowledge about menstruation and how to

7.7% Forecast

25%

use/change sanitary protection in the right way.

While slim/thin/ultra-thin sanitary towels are used more from the third day of menses 20%

onwards in Vietnam, standard (maxi) sanitary towels remain a safe choice for

consumers. As they have a similar unit price (although the slim/thin towels cost slightly

more), Vietnamese women tend to buy both types every month. However, standard 15%

sanitary towels continued to account for a larger percentage of sales due to the strong

preference in suburban and rural areas where people feel the standard products are

safer, as well as offering better value for money. Pantyliners continued to appeal to a 10%

wide range of women, especially as they cost less than other sanitary protection

products. Tampons, on the other hand, continued to account for an insignificant share

of value sales in the country due to Vietnamese cultural taboos, with such products 5%

only sold in large cities. However, tampons are becoming more widely accepted

amongst younger Vietnamese women and those exposed to Western lifestyles.

Usage of night-time sanitary protection in a pants format as an alternative to retail 0%

2007 2021 2026

adult incontinence is a trend in large cities due to its lower price and good quality.

Along with the green living trend, reusable sanitary protection has also been seen. This

space features the Green Lady Vietnam brand, which is being pioneered in Ho Chi Minh

and Hanoi. The brand targets environmentally-conscious young white-collar co-workers Sales of Sanitary Protection by Category

and university students who prefer to use reusable cloth sanitary towels that can help Retail Value RSP - VND billion - Current - 2021 Growth Performance

prevent 20 used regular pads from being thrown away every month. Green Lady

Vietnam offers reusable sanitary products through e-commerce sites. It also organises Pantyliners

workshops on menstruation and the environment to raise awareness of both. Not only 921,2

is the brand gaining success in Vietnam, but it is also exporting to neighbouring Tampons

countries such as Cambodia, Myanmar and Indonesia. However, while reusable sanitary 13,1

towels are certainly better for the environment, there are some concerns about Towels

whether they are capable of maintaining good hygiene. 8.677,5

Sanitary Protection Including In...

Cooling, freshness and softness remain key factors for sanitary 9.611,8

protection 0% 10% 15%

SANITARY PROTECTION 9.611,8 CURRENT % CAGR % CAGR

In general, in an era of green living and healthier lifestyles, there is growing demand in YEAR % 2016-2021 2021-2026

Vietnam for sanitary protection products with value-added features such as cooling, GROWTH

freshening and antibacterial properties, natural scent, superior absorption levels and

comfortable design. In a continuation from the previous year, demand for products

with cool and fresh properties and natural scents rose significantly amongst younger

generations of women in 2021. Companies focused on improving their products,

© Euromonitor Interna onal 2022 Page 1 of 3

providing clear usage instructions and highlighting the manufacturing origin on their Competitive Landscape

packaging. The Diana brand continued to perform especially well with constant

innovation and by using new technologies and cool, refreshing ingredients in its

sanitary protection products as a result of continuous research to study and understand Company Shares of Sanitary Protection

Vietnamese consumers’ consumption habits and behaviour. % Share (NBO) - Retail Value RSP - 2021

Cooling fresh menthol technology innovated by Unicharm (Diana JSC) has been very Diana JSC 40.9%

successful since launching in the Vietnamese market. In fact, it became a key Kimberly-Clark Vietnam C... 39.3%

differentiating feature for its products over its competitors. However, since the initial

launch, this technology has also been applied in other brands. For instance, it is now Procter & Gamble Vietnam... 5.5%

present in Kotex’s Herbal Cool and in Kao’s Laurier Super Slimguard Cool variant, both

Johnson & Johnson Inc 3.4%

of which have also become popular. Kotex’s Max Cool products have recently applied

the concept to various areas, including pantyliners and overnight sanitary towels, which Kao Vietnam Ltd 2.5%

is proving popular amongst teenagers. In addition, herbal scents combined with cooling

technologies are exciting for consumers in the high-end segment. However, due to the Taisun Vietnam Ltd 1.3%

high price of those products consumers also expect to have added features such as Others 7.2%

antibacterial properties and/or extra softness for sensitive skin. Moreover, products

with an antibacterial functionality were also boosted by heightened health and

hygiene concerns stimulated by the COVID-19 pandemic, with industry players focusing

heavily on this attribute in their marketing campaigns.

Brand Shares of Sanitary Protection

Diana and Kimberly-Clark remain largest players % Share (LBN) - Retail Value RSP - 2021

In 2021, Diana JSC and Kimberly-Clark Vietnam remained the largest players in sanitary Diana 40.9%

protection with their respective Diana and Kotex brands. With investment from its

global brand owner, the Japanese company, Unicharm, the Diana brand has sustained Kotex 39.3%

growth, while Kimberly-Clark has intensified its advertising efforts to regain its leading Whisper 5.5%

position. Diana’s products reflect a deep local understanding while its iconic Cool Fresh

sanitary pads have become the best seller across all channels. In the night segment, Laurier 2.5%

Kotex has been present since 2018, however, Diana’s Super night pants have been Carefree 1.8%

more notable and proven to be an appreciated innovation amongst women seeking

convenience. Modess 1.6%

Sunfree 1.3%

The market has become more competitive with many brands beside Diana and Kotex.

Procter & Gamble’s Always/Whisper gained value share in 2021 as did the Japanese Others 7.2%

brand, Laurier, by Kao Vietnam. Moreover, a number of local and small brands focus on

rural areas, where consumers are traditionally much more price-sensitive and 5-Year Trend

Increasing share Decreasing share No change

demonstrate lower demand for sanitary products. Nonetheless, thanks to their offer of

cheaper price ranges, better quality, and wisely chosen distribution networks, local

brands are gaining trust amongst these consumers. Due to the strong brand-loyalty that

has been generated in this category, Vietnamese consumers rarely switch to other

brands. As such, all brands are extending their reach through different channels to

improve the ease of purchase and to offer wider availability.

E-commerce players such as Tiki, Lazada and Shoppe became a fast and more

convenient choice during the COVID-19 crisis, as consumers opted to avoid contact with

other people as much as possible. This channel also benefited from promotional offers.

PROSPECTS AND OPPORTUNITIES

Sanitary protection expected to see stable growth over forecast period

According to government statistics, women comprised 50.2% of the Vietnamese

population in 2020. Improving income levels and hygiene standards are expected to

offer stable growth for the sanitary protection market in Vietnam over the forecast

period. Rural areas offer particularly strong growth potential as sex education, which

has been a focus for the government, grows in these regions. In addition, according to

The Ministry of Health, the frequency of early puberty in children has increased and has

become relatively common amongst girls around 12 years of age. Therefore, it is

important to educate young girls on puberty and menstruation. Brands could look to

cooperate with the government on educational activities which could help to drive

strong product- and brand awareness.

Attractive packaging and combo packs to help drive sales

Over the forecast period, features such as attractive packaging and combo packs are

expected to help drive sales in the sanitary protection category. For instance, Kotex

Mini Meow introduced packaging with endearing elements and attractive colours,

which was widely available through supermarkets and was well received by teenagers.

This trend is expected to continue over the forecast period as such packaging is

appealing for younger consumers. Selling combo packs, such as buy two slim/standard

packs and get one night towel or pantyliner product free, is already a prominent

strategy in supermarkets and is likely to remain popular during the forecast period. Due

to demand for different product types across different days of the period, consumers

are expected to invest in such combo packs, which offer them variety and convenience.

Stronger brand presence expected through e-commerce

The dynamic expansion of e-commerce during the COVID-19 crisis, when consumers

appreciated the channel’s reduced risk of viral transmission through social contact as

well as its convenience, has made an online presence essential for sanitary protection

brands. This has already led many brands to open their own official brand stores on

© Euromonitor Interna onal 2022 Page 2 of 3

platforms such as Shopee, Lazada and Tiki, and this number is expected to increase as

more players look to establish an online presence. From a consumer perspective, as

fake sanitary protection products have been found in the market recently, consumers

are expected to prefer purchasing from brands’ official stores rather than from third

party sellers. As a result, it is becoming crucial for players to have their own official

online stores.

© Euromonitor Interna onal 2022 Page 3 of 3

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Factors in Uencing Consumer Behaviour: A Case of Mcdonald'S: December 2020Document11 pagesFactors in Uencing Consumer Behaviour: A Case of Mcdonald'S: December 2020Thảo Mai NguyễnNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Impact of Advertising Strategies On Consumer Buying Behaviour: A Case Study On MC Donald's (India)Document6 pagesImpact of Advertising Strategies On Consumer Buying Behaviour: A Case Study On MC Donald's (India)Thảo Mai NguyễnNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Coursework Header SheetDocument17 pagesCoursework Header SheetThảo Mai NguyễnNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Gestures to Communication: Nonverbal SignalsDocument4 pagesGestures to Communication: Nonverbal SignalsThảo Mai NguyễnNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- PepsiCo Financial AnalysisDocument11 pagesPepsiCo Financial AnalysisThảo Mai NguyễnNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Core Vocabulary StudentsDocument29 pagesCore Vocabulary StudentsThảo Mai NguyễnNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Service BlueprintDocument1 pageService BlueprintThảo Mai NguyễnNo ratings yet

- 1 - 20.09.2018 - Corriogendum 1aDocument1 page1 - 20.09.2018 - Corriogendum 1achtrpNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Women's Changing Roles in the U.S. MilitaryDocument9 pagesWomen's Changing Roles in the U.S. Militaryamandeep raiNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Mechanical Engg. Market SurveyDocument6 pagesMechanical Engg. Market SurveyDhaval GamechiNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Jam 2023Document35 pagesJam 2023iamphilospher1No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Action Plan Set Up Approval S No 4M Category Retroactive Inspection (Checking of Parts After Change) (Checking of Parts Before & After Change)Document4 pagesAction Plan Set Up Approval S No 4M Category Retroactive Inspection (Checking of Parts After Change) (Checking of Parts Before & After Change)Heart Touching VideosNo ratings yet

- From Inception of Operations To December 31 2008 Blaise PascalDocument1 pageFrom Inception of Operations To December 31 2008 Blaise PascalM Bilal SaleemNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Governance of EU Competition Policy Over Luxury BrandsDocument10 pagesGovernance of EU Competition Policy Over Luxury BrandsPATRICIA NIKOLE PEREZNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- KL 39 H 3095 PDFDocument1 pageKL 39 H 3095 PDFSujith Raj SNo ratings yet

- Astrologer H. Spencer Lewis (1908)Document1 pageAstrologer H. Spencer Lewis (1908)Clymer777No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Business Ethics and Social Responsibility: The Core Principles of Good Corporate GovernanceDocument16 pagesBusiness Ethics and Social Responsibility: The Core Principles of Good Corporate GovernanceRecy Beth EscopelNo ratings yet

- Yacapin Legal Services Adjusted Trial BalanceDocument3 pagesYacapin Legal Services Adjusted Trial BalanceCleah WaskinNo ratings yet

- Value Chain Method For Indigo Airlines.: Primary ActivitiesDocument4 pagesValue Chain Method For Indigo Airlines.: Primary ActivitiesSumant RajputNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- GDP Chapters 21 Expenditure Income Real NominalDocument5 pagesGDP Chapters 21 Expenditure Income Real NominalElio BazNo ratings yet

- A Large Refinery and Petrochemical Complex Is Plan...Document4 pagesA Large Refinery and Petrochemical Complex Is Plan...Abdullah QureshiNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Lloyds Banking Group PLCDocument20 pagesLloyds Banking Group PLCImran HussainNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- IN Classguide en-GBDocument54 pagesIN Classguide en-GBcatalin9494No ratings yet

- FSA - Ch06 - Liquidity of Short-Term Assets Related Debt-Paying AbilityDocument46 pagesFSA - Ch06 - Liquidity of Short-Term Assets Related Debt-Paying AbilityAmine AbdesmadNo ratings yet

- InvoiceDocument1 pageInvoiceashish tripathiNo ratings yet

- Islamic Banking and Finance Review (Vol. 2), 166-Article Text-412-1-10-20191121Document12 pagesIslamic Banking and Finance Review (Vol. 2), 166-Article Text-412-1-10-20191121UMT JournalsNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Branding and Promotion: Learning ObjectiveDocument20 pagesBranding and Promotion: Learning Objectivesk001No ratings yet

- Effect of Standard Costing On Profitability of Manufacturing Companies: Study of Edo State, NigeriaDocument8 pagesEffect of Standard Costing On Profitability of Manufacturing Companies: Study of Edo State, NigeriamohamedNo ratings yet

- Reverse Take-Overs in Canada: Osler GuideDocument15 pagesReverse Take-Overs in Canada: Osler GuidePolina ChtchelockNo ratings yet

- Von Thünen Model Exercise: Prepared by Spinlab Vrije Universiteit AmsterdamDocument6 pagesVon Thünen Model Exercise: Prepared by Spinlab Vrije Universiteit AmsterdamHải Vũ100% (1)

- Service Department and Joint Cost Allocation: True / False QuestionsDocument246 pagesService Department and Joint Cost Allocation: True / False QuestionsElaine GimarinoNo ratings yet

- Maintenance Kit (HB 7000) Lower Breaker Part BronzeDocument4 pagesMaintenance Kit (HB 7000) Lower Breaker Part BronzedrmassterNo ratings yet

- Value PropositionDocument8 pagesValue PropositionDabon Jade Denver MacalitongNo ratings yet

- Proforma Balance Sheet with Financing OptionsDocument6 pagesProforma Balance Sheet with Financing OptionsJohn Richard Bonilla100% (4)

- Car Policy: Salient FeaturesDocument2 pagesCar Policy: Salient FeaturesZahid Shaikh100% (1)

- Staples Inc.Document6 pagesStaples Inc.sid lahoriNo ratings yet

- 061B Jsa Land Clearing 0+00Document10 pages061B Jsa Land Clearing 0+00sas13No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)