Professional Documents

Culture Documents

8T8lljRTa159nS39 903

8T8lljRTa159nS39 903

Uploaded by

Virat Pandey0 ratings0% found this document useful (0 votes)

7 views55 pagesOriginal Title

8T8lljRTa159nS39-903

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views55 pages8T8lljRTa159nS39 903

8T8lljRTa159nS39 903

Uploaded by

Virat PandeyCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 55

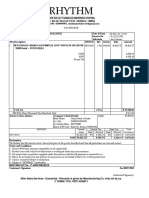

TAX AUDIT REPORT u/s. 44AB OF

INCOME TAX ACT, 1961

OF

M/S. PARAGON TELELINKS PVT. LTD.

A.Y. 2020-21

Scanned with CamScanner

AY, 2020-2021

Name + PARAGON TELELINKS PVT LTD Previous Yaar = 2019-2020

PAN 1 AAEGP 9052 G

Address: SHOPNOS

‘SATYAM APARTMENT Status + Domestic Company

JUNCTION OF MG ROAD AND GOKHALERD © 0, 0.1, 21-Feb-2009

NAUPADA THANE WEST, THANE - 400 602

Statement of Income

“Income from House Property.

Let-out aropertios

Property-1: SHOP NO 38, ORION BUSINESS PARK, Tenant -

IRB INDUSTRIES LTD j

Rent

(Grose annual valve

‘Less: Municipal taxes

Net annual value Hae 88

Less: Standard deduction ufs 24(3} 10,04.655

Baie

Amount

Net Incoma fort Property-#

Property2 Shop no 6, Ground Floor, Geet Ganga, Tanant-

Pace Tel Systems

‘Net Profil Before Tax as per P 8 L afc

‘Add: inadmissible expenses & Income not included

Depreciation debited to P & L alc

‘3? disallowance: £

Expenses | Losses considered under ainer heads:

Scanned with CamScanner

40 diusilowance: 6 38,109 85.72.3158

34.88.8657

Less Deductible expenditure & income to be excluded

Incomes considered separatoly. ¥ 68.20.e89

“Adjusted Profit of Business-1 _Sibies

‘Total ncome of Business and Frofestion MSs

‘Less: Depreciation as per IT Act 4 60.85 374

Inoame chargeatie under the nead "Businass and Profession* —_

"income from other sources

Rental ncama: From plant & machinery etc 8

interes! income 9

Income chargeable under the head ‘ether sources"

Total

‘Unabsorbed Losses - Ci a

‘Lets - Brought forward oases set of ‘ai

"=Total income

Tax on toil income

Minimum Atemative Tax. # 2

Par eetie al teal: z

‘Advance Tax mi Bar 930

Totat prepaid taxes e 1.80.00

*Retund Dus.

TAN Sector

Tee Fo

munansa7sa ren

‘Seif

100

- ee TAN sexo

Scanned with CamScanner

Pace Tel Systems

Details of Owner

Owner

‘Assessee's share in the propeity (36)

Schedule 3

‘Assessee's share in the property (%4)

Schedule 4

‘Disallowances of expenditure ws 37

Personal expenditure

Donation

Interest on taxes:

Total Disallowance

“40(a)\ia) Fees for professional or technical services

40(a)lia): Payments to contractors or sub contractors:

‘Total Disallowance

Ex without TDS / Eg. Levy disallowed earlier B/E

194-1 (Form

DELP1E360A a

Soll

100

ee TAN Section

18441 (Form

MuMonesst A, faa

Expenditure % disallowed Disallowance

39,000 100 30,000

14,088 100 14,088

44,088

Scanned with CamScanner

‘Schedule 11

Financial statements are: drawn ea pot Ind AS?

‘Minimum alternative tax

[Not profit before tax 38 par P & | Ate

Less: Provision for Tax in P&L Alc

Net profit after tax (A)

(Deductor TAN

Home Credit India Finance Private Limited. TAN

Hb Indusinies Limited, TAN- MuMinga7aG

Inlead Electronics Private Limited, TAN: MUMOO6881A.

{lead Electronics Private Limited, TAN- MUMOOGEE1A

Pave Tel Systems Private Limted, TAN- DELP1a368q

Pca Tel Systams Private Limited TAN: DELP163684

Rohan Anil Tasgeonkar, TAN- PNER24097D.

\Vinit Narandas Panchmatia, TAN- PNEVOASS2A,

Total

‘Schedule +3

‘Advance tax paid

IDBI Bank-8610333

(D8! Bank-6910333.

Total tax

fasees = 3/94,885 —39.46,846

hung 61689 ‘50,000

13Dec19 e7qra __1,00.000

50.000

‘Bank Ai for Refund: KOTAK MAHINDRA BANK 1411902392 IFSC: KKBKO000855

For PARAGON TBLELINKS PVT LTD

:

‘See

Scanned with CamScanner

INDEPENDENT AUDITOR'S REPORT

‘To the Members of PARAGON TELELINKS PRIVATE LIMITED

Report on the Standalone Financial Statements

‘We have audited the accompanying financial statements of Paragon Telelinky Private Limited ("the

Company"), which comprises the Balance Sheet as at 311 March, 2020, the Statement of Profit and

‘Loss and the Cish Flow Statement for the year then ended and a summary of the signficars secounfing

‘policies and other explanatory information.

‘Management's responsibility for the Financial Statements

‘The Company's Board of Directors is responsible for the matiers stated in Section 134(S) of the

‘Companies Act, 2013 (“the Act”) with respect to the preparation and preseatation of the financial

‘Mmements that give a trec and fait view of the financial position, financial performance and cash flows

of the Company in accordance with the accounting principles generally accepted in India, including the

Accounting Standards specified under Section 133 of the Act, read with Rule 7 of the Companies

(Accounts) Rules, 2014. This responsibility also includes inaintenance of a¢equare accounting records

in accordance with the provisions of the Act for safeguarding the assets of the Company and for

preventing and detecting ‘fonds and other iregularties: selection and spplication of appropriate

‘accounting policies; making judgments and estimates that are reasonable and prudent; and design,

‘implementation and maintenance of adequate internal financial controls, that were operating effectively

‘for ensuring the accuracy and completeness af the accounting records, relevant to the preparation and

Presentation of the financial statements that give a true and fir view and are free from mutenal

“misstatement, whether due to fraud or error

Auditor's Respansibiity

‘Ourresponsibility i to express an opinion om these standalone financial strements based on our nuit.

‘We have taken into account the provisions of the Act, the sccounting and auditing standards and

matters which are required t0 be included in the audit report under the provisions of the Act and the

Rules made thereunder.

We conducted our audit in accordance with the Standards on Auditing specified under Section 143/10)

‘ofthe Act. Those Standards require that we comply with ethical requirements an

audit (0 obtain reasonable assurance about whether the financial. state

Scanned with CamScanner

slisclosures in the financial statements. ‘The procedures selecied depend on the auditor's judgment,

‘including the ¢ssessment of the risks of material misstatement of the financial statements, whether due

‘0 tran or error [n making those risk assessments, the auditor considers intemal financial contr

relevant to the Company's preparation of the financial statements Una give a true and fir view in ordet

to design audit procedures that are appropriate inthe circumstances. An audit also includes eveluating

the appropriateness of the accounting policies used and the reasonableness of the accounting estimates

made by the Company's Directors, ns well as evaluating the overall presentation of the financial

statements,

‘We belicve thar the audit evidence we have obtained is sufficient and appropriate to provide a basis for

uF audit opinion othe standalone financial statements.

Opinion

In our opinion and to the best of our information and according to the explanations given to ws, the

aforesaid standalone financial statements give the information required by the Act in the manner 50

‘equired and jive a true and fair view in conformity with the accounting principles generally accepted

in India, of the state of affairs of the Company’ es at 31 March 2020 and its loss and its eash flows for

the year ended on that date.

Report om Other Legal Regulatory Requirements

1. As required by The Companies (Auditor's Report) Order 2016 ("the Order") issued by the Central

Government of India in terms-of section 143(11) of the Companies Act 2013, we give in the

“Annexure A". i statetnent on the matters specified in paragraphs 3 and 4 of the Order. to the

extent applicable,

‘2 As required by the section 143 (3) of the Act, we report that:

fa) we have sought and obtained all the information and explanations, which to the best of our

Anowledge and beliefs were necessary for the purpose of our audit,

() in our opinion, proper books of wecount as required by law have been kept by the Company’ so

‘ar as appears from our examinaticm of those books.

(¢) the Balance Sheet, the Statement of Profit and Logs and the Cash Flow Statement dealt wath

by this report are im agreement with the books of account,

(4) im our opinion, the aforesaid Financial Sintements comply with the Accounting Standards

specified under section 133 of the Act, read with Rule 7 of the Companies (Accounts) Rule,

2014,

(6) on the basis of written representations received from the: directors as on March 31, 2020, and

‘twken on record by the Board of Directors, none of the directors are disqualified as on March

M1, 2020, from being appointed us a director in terms of sub-section (2) of section [fel of the

Act,

(1) with respect to the adequacy of the internal financial

‘company and the operting effectiveness of

“Amnexune | s

Scanned with CamScanner

(a) Weds rexpoct to doe ober manars to be amchudd othe Auditat's Report ot aceoritence with

Hake 11 of the Compares (Audit and Auditors) Rules 2014, m ct open ana to the best of

mioreaton a accountng © he cxpanabom BE bw

# The Company doen not Rae ay pemaliny bigations toch mond ompect te Bena

ance

The Company dif net have ey bmp tem comeracts wchatang derivetrve commen for

ehech there were ain tuaterual fiecureable bases,

St There wore mor emcees which were repre! 4: he transferred to the Irventon Fanti

ead Protectan Fund ny the Comgues

Place Thane

Date. 3s) 26 Member Santer (490

UDIN 21cageg AMARC 6192

Scanned with CamScanner

Paragon Telelinks Private Limited EY 226

ANNEXURE - A TO THE INDEPENDENT AUDITORS' REPORT

(Referred to in Paragraph 1 under the heading of "Report an Other Legal & Regulatory Requirements’

‘of our report of even date)

1 (a) The Company has maintained proper records showing full particulars, including quantitive details and

situaton of fixed assets,

(b) All the assets have been physically verified by the management during. the year, according to the

{information and explanations given to us, and in our opinion the intervals for verification Are

reasonable having regard to the size of the company and the nature of its assets, No material

dliscecpancies were noticed on such verification

(8) According to the information and explanations given to us and on the basis of our examination of the

reconds of the Company, the title deeds of immovable properties are held in the name ofthe company

2 Imrospect of the inventories of the Company:

(a) As explained to us, the inventories were physically verified during the year by the management at

reasonable intervals and im our opinion the frequency of verification 1s rensonable.

4b) The procedures explained to ws, which aré followed by the management for physical vesification of

imventories are reasonable and adequate in relation to the size of the Company and the nature of its

Iousincss.

{) (¢) On the basis of our examination of the records of inventories, we are ofthe opinion thatthe

‘company has maintained proper records of inventories and no material discrepancies were noticed on

physical verification.

3 The Company has not granted any loans secured or unsecured to companies, firms , limited linbitity

pparinerships.or other parties under section 189 of the Companies Act.2013. Thus paragraph Hit) of the

(Order is not applicable to the Company.

4 In our opinion and according fo the information and explanations given to us, the Company bas

Comiplied with the provisions of section 185 und 186 of the Act, with respect to the loans, investments

and guarantees made.

5 The Company has not accepted any deposits from the public, thus paragraph 3(v) of the Order is not

applicable tw the Company.

6 ‘The Central Government has not prescribed the maintenance of cost records under section (48(1) of

‘the Act. Thus, paragraph 3(1) of the Order is nat applicable.

7 (a) According to the informarion and explanation given to us and according to the books and records as

produced and examined by us, in our opinion,the company is regular in depusiting the undisputed

‘Matutory dues in respect of provident fund, employee's state insurance, income tux, sales tax, wealth

ta, service tax, duty of customs, duy of excise , value-added tax, cess and others as applicable danny

the yar with appropriate authorities,

Scanned with CamScanner

Paragon Telelinks Privite Limited EY.2018-10

‘There are no undisputed amounts payable in respect of provident fund , employee's state insurmnce,

income tax , sales tax, wealth tax . sevice tmx, duty of customs, duty of excise, cess were outstanding,

488 at 31/03/2017 for a period of more than & months from the date they become payable.

(b) According (0 the information ind explanation given to us, there are no dues outstanding of VAT,

income tax, custom duty, wealth tx, service tax. excise duty and cess, which have not been depastied

‘on acsount of any dispute

§_Ascording to information and explanations given to us, the Company has not defaulted in repayment of

dues to any financial institution or benk or debenture holders during the year. Accordingly, paragraph

3( ti) of the Order is not applicable.

9, According to the information and expatantions given to us, the Company has not raised money by way

‘of term foans during the year

19 According to the mformation and explanations given to us, no material fraud by the Company or on the

‘Company by its officers or employees has been noticed or reported during, the course of our audit

11 According to the information and explanations givea to us aiid bascd on our examination of the records

of the Company, the Company has paid/provided for managerial remuneration in accordance: with the

‘requisite approvals mandated by the provisions of section 197 rcad with Schedule V to the Act.

12. fmour opinion and according to the information and explanations given to us, the Company is not a

‘iidhi company- Accordingly, paragraph 3(xii} of the Order is not applicable

13. According to the information and explanations given t0 us atid hased on our examination, the company’

‘has not made any transactions with related partics. Accordingly , paragrsplt 3 (xii) ofthe order is not

plicable,

4 Aveording to the information and explanations give to us and based on our examination af the records:

the company has not made any private placement of share during the year, Accordingly . paragraph

Sixiv) of the onder is not applicable,

15 Asconding-to the information and explanations given to-us and based on our examination of the records

oo the Company, the Company has not entered inte non-cash transactions with directors or persons

‘connected with him Accordingly, paragraph (x) of the Order isnot applicable

16 The Company is not required to be registered under section 4S-1A of the Reserve Bank of India Act

1934,

For Chiatan D.Sajya & Co

‘Chartered Accountants

Ge (Ficm Registeation Number: 136224W)

eh sg

Place: Thane :

‘Date:a1})3\ 90 Membership: Nuinber- 153689

URNS 2 SES SARA CT O82

Scanned with CamScanner

Paragon Telelinks Private Limited EY, 2019:20

Annexure - B to the Independent Auditor's Report

Report om the Internal Financial Controls under Clause (i) of Sub-section 3 of Section 143 of

the Companies Act, 2013 ("the Aet™)

‘We have aodited the intemal financial controls over financial reporting of Paragon Telelinks Private

Limited ("the Company") as of 31 March 2020 in conjunction with our audit of the standalone

financial statements of the Company for the wear ended om thal date.

Management 's Responsibility for Internal Financials Controls

‘The Company's management is responsible for establishing and maintaining internal financial

coutrols. based on the infernal control over financial reporting oriteris established by the Company

considering the essential components of intemal control stated in the Guidance Note on Audit of

Internal Financial Controls over Financial Reporting issued by the Institue of Chartered

Accountants of India (‘ICAI"), These responsibilities include the design, implementation and

maintenance of adequsie internal financial controls that were operating effectively for ensuring the

orderly and efficient conduct of its business, including adherence to company’s policies, the

safeguarding of its assets, the prevention and detection of frauds and errors, the accuracy and

completeness of the accounting records, and the timely preparation of reliable financial

information, as required under the Companies Act, 2013

Auditors Responsibility

Our responsibility is to express an opinion on the Company's internal financial controls over

financial reporting based on our audit. We conducted our audit in aceordance with the Guidance

Note on Audit of Internal Financial Controls over Financial Reparting (the, “Guidance Note”) and

‘the Standards on Auditing, issued by ICAI and deemed to be prescribed under section 143(10} of

‘the Companies Act, 2013, t0 the extent applicable to an audit of internal financial controls, both

‘applicable to an audit of Internal Financial Controls and, both issued by the Institute of Chartered

Accountants of India. Those Standards and the Guidance Note require that we comply with ethical

‘requirements and plan and perform the audit to obtain reasonable assurance about whether

adequate internal financial controls ever financial reporting was established and maintained and if

‘such controls operated effectively in all material respects

‘Our audit involyes performing procedures to obtain audit evidence abou the adequacy of the

‘intemal financial. controls system over financial reporting and their operating effectiveness, Our

audit of internal financial controls over financial reporting included obtaming an understanding of

internal financial controls over financial reporting, assessing the risk that a material weakness

‘exists, and testing and evaluating the design and operating effectiveness of internal control based

‘On the assessed risk. The procedures selected depend on the auditor's judgment, including the

assessment of the risks of material misstatement of the financial statements, whether duc to fraud or

errar,

Commensurate to the size and nature of the business, We believe that the audit evidence we have

obtained is: sufficient and appropriate to provide a basis for our audit opimion on the Company's

‘ntemal financial controls system over financtal reporting,

work

Scanned with CamScanner

Scanned with CamScanner

PARAGON TELELINKS PRIVATE LIMITED

Shop No. 4, Satyam Apartment.Junction of M.A. Road & Gokhale Rand,Naupaula, Thane west 400602

(CORPORATE IDENTITY NUMBER: (/52335M1112009TC190487

AUDITED STATEMENT OF ASSETS AND LIABILITIES AS ON 31ST MARCH, 2020

phe | ees

evict | sain

fH. eQUITY AND Liammiries:

590,000

$493,371

6,8845,827 6,59,15,034

28.99.6606 35,88,591

5.80,57.211 160.48,973

2.28,73,030 1,75,62,675

15,33, 1896497

1435,93,834 |

3.6011 288 |

: 10.75.82,

1aga0s 138325

49.200 6.792240

107,601 615,356

1.68, 40,96) Laaor4s9 |

40,596,430 37,11,989) |

6217835 23,84,122

- 30,000

92.26915 $9,05,610

195533 107

Sk aad eh Wt alt cach Dae fa ey ler ft daca Pt Senin

[ht es he Statement ef Assets end Laas neered wt ar Reprt of even cate

FOR AWD ON BEHALF OF THE BOARD

PARAGON TELELINKS PRIVATE LIMITED,

3

PUL J. SHAM. HMLIREEY 4, SHAHN

{DIKECTOR) (DIRECTOR)

DIN A2400766 DINman0770

DATE sY/I272020

PLACE. THANE

Scanned with CamScanner

PARAGON THLELENNS PRIVATE LIMITED:

Shop No.4, Satyam Apartment Junction of MG. Road & Gakinale Rond.Naupada, Thane west» 400602

CORPORATE IDENTITY NUMBER: US2U3SMN009FTCI9OA87

AUDITED CASHFLOW STATEMENT AS ON 31ST MARCH, 2030

‘Amount aa uesiee | Amount av ati Tat

Mar, 2020, Mar 3013,

Note Na

(S.02.467)) aa

L428 45.68.2867]

|___rasizoo]_sa,t

TIS

0.70]

nar

330.878

raz0772

644 Ra1)

(23,32.502)

5.30,103

30,

308,753

satis]

‘Sa9e7) PHA 28

TasaNas| 1,29.43,250

@laeuia)

220s

FOR ANDON BEHALFOP THE GOAN

PARAGON TELELINKS PRIVATE LIMITED

‘ a

ard, saat MIRE SHLAH

SARECTOR (OMRECTOR,

DIN w2an074 DIGRoNT70

DATE: 51/12/2020

PLACE THANE

CHINTAN D. SALVA,

ND 69 Us

Scanned with CamScanner

ARAGON TELELINKS PRIVATE LIMITED.

‘Shop No. 4: Satyam Apartment Juartion of M.G. Rond & Gobbale Road,Naupada, Thane west - 400602

CORPORATE IDENTITY SUMMER: Us2335MH00F TCI 90487

AUDITED STATEMENT OF FROMIT & LOSS POR THE PERIOD ENDED ON SST MARCH, 2020

Amicucat ws wittot | cLeownt as atttat

Mar, 2020 Mur. 2019

Particulars Nate'No.

yenue From Operations ( Net of Taxes ) 45,39, 71,710

cme Frost Noe-Operation ik 1 7m05,147 197,19, 768

Ts eae [aa

{Purchases of Stock in Trade(net of Scheme) 43,234,290] 56,66,06, 268)

fCmanges in inves of Stock-in‘Trade 9 23.52.502)

.05,00:753

JF mance Expenses 2 105.2856}

opreciation & Amoctzation Expenss 1 maa

1.73,08:408

($402,467)

(0) fncome Tax Provision

Current Tax

Excess / Short Provision

(2) Deferred tax

845,799.00

471,564.00

-9,16,925 90

JPrafiu( Loss) forthe peciod After Tax» PAT

$0,000)

(89.70)

fc)

ols refer nao and Notes ta Acoounts attached there ta form an anegral parvaf dhe Audited Financial Statement

[This is the Statement of Profit & Las referred te in our Report of even date.

POR AND ON BEHALF OF THE BOARD.

PARAGON TEEELINKS PRIVATE LIMI

:

ne

VIPUL 4. SHAM HIRES 3, SHAM

(DIRECTOR) (DIRECTOR)

Dino2400760 DiN-02490770

DATE: 31/12/2020

PLACE THANE

Scanned with CamScanner

|

PARAGON TELELINKS PRIVATE LIMITED

Notes Forming Integral Purt of the Balance Sheet as nt 31st March, 2020

focet: Shave Capit!

Ninount as] Amount a aiSlst

ent 1st Mar, 2020] Mar. 2019

neon 0,000

gy Shaves of Rs, 10 each ono 10,

1,00,000 Equity ae es

ISSUED. SUBSCRIBED & PAID UP CAPITAL, —

[Ta the Subseeibers af the Memoranstons +5,00,000 $00,000)

10,000 Fut Sbars oF Rs 1 ce fly pad up,

[ial Vator 3,50,000 5.00.00]

11 The recoweiliation of the number of shares outstanding is set out below:

TT Asai Maren 3010

‘As ari March 2018

Number

[Shares outstanding at the beginaing of the year

[Shares Issued during he year

bought back during the year

[Stuares outstanding atthe er ofthe year

LE The details of Shareholders holdings =

Name of Shareholder

‘As ata) March 2079

NelofShares | % of Holding

No of

held Shares

_ held

VigalFayntlal Shah 30000 @r] 30,000

[Hiren Jayaneital Shah 3,000) 10% = 5,000

agra Vipl Sbah 7,800 tnd 7,300

[Dfiruti Robit Shah 7,500 1s 7,500

‘Amount as wid

patenos at3tst Mar.2020] Mar. 2019

[Opening Balances 98,5782 60,02,036

|e: ProftLens) forthe period (44,85,543)) 40,21,601

‘Ascts with no residual if persuane wo Companies Act (44,764) :

in Reserves 166,245

23.971

‘Amooat-ay a3

Mar. 2019

es Bank Cor Loay (Secuced ‘Against Car} . .

New tore actss0 (Secured Against Property) 1,99,27,193, 14454459

21.09.5990 27913

(TSB. Lown Ate No 24aariy : saat

8,80,403

4,29,28,529

42

650.1ene

Scanned with CamScanner

_- ©

PARAGON TELELINKS PRIVATE LIMITED

\Notes Forming Integral Part of the Balance Sheet as at Xi March, 2020

15,00,000

1.48,208

30,000

15,00,000

978 585

[Loan trom Chere : =

fatal Wale in INR 33057201 S487

ier S Trades Payable

c ‘Aimownt as | Amowat an ait

iiargad lucie Mar, 2020| ‘Mar. 2019

[Trude Payables: Group Companies / Rclaicd Parties

Retaed pares Trae Payables

Ireade Pave: , Noo G

[Now Group Trade Payables 228,793,830 1,75,620673

eerie 228,73,000 17562675)

5 Other Current Liabiiies|

‘Amount a | Amouat as atin

lausist Mar. 2020] Mar, 2019

‘Amount as | Amount as wiTst

Sit Mar. 2026] Mar, 2019

59,400 59,400,

17,280 Lagos

31,600

11,16,189 H.t6229

|,60,03s 8.000

37016

353,760

Scanned with CamScanner

AEOE"WLNHN FIC Ho megs anume omn po ong stone Bem

GALIATT TLV AR SHNITATAL NODVEVE

Scanned with CamScanner

PARAGON TELELINKS PRIVATE LIMITED

Notes Forming Lategral Pari of the Balance Sheet as at 31st Murch, 2020

Armouit ws at3 st

Mar. 2019

6,79,240

Amount as at3ist

Mar, 2019

|Balanses with Govt Authorities

IMVAT ( 16-17) 1,07,601 107,601

MVAT (15-16) 505.755

Note 1 Current Investment

Particulars

[Bank Fo

{Total Value in TNR

Note: 12 Inventories

Amount as at31st | Amount as atSist

Mar, 2020

1.58-49,961

Amount as uti st

Mar. 2019

|

(yh

Scanned with CamScanner

PARAGON TELELINKS PRIVATE LIMITED

‘Notes Forming Integral Part af the Balance Sheet as at 31st March, 2020

Group Companies :

{Non Group Compares 40,356,830 97,1 1,989

[Fito Vatoe in IN ra we?

Particulars

Amount as ai31st

Mar, 2020

Amount ns at St

Mar. 2019

[Cash 8 Cosh Eauivalent

}Cash Balance: 40,562,985 7,65,701

datances with Bank.

|HDPC Bark 73,746 151,186

|Amnerican Express: 76,600

fiCIC] Bank 16 16

MDPC Bank Card Swipe 20,65,835 10,10,162

Yes Bunk ~ .

|TBSB CC-5S68 18,378 18,378

/TBSB CC. 456 0 202

|andhan Bank 26,422

[Kotak Mahindra Bank 20,153, 361,876

[Total Value in INR 62,17 535 2384121

'S Short Terms Loans and Advances

- Amount as at31st | Amount as at3ist

oer Mar. 2020, Mar. 2019

[sas & Advances

‘Note 16 Other Current Assets

Particulars

aes = 30,000

[Total Value in INR = 30,000.

Acnount a4 a3 It

Mar.2019)

2333

14,593,712

143,350,

333

‘912810

8716

Scanned with CamScanner

Scanned with CamScanner

PARAGON TELELINKS PRIVATE LIMITED.

Notes Forming Part of the Profit & Loss Accounts as at 31st March, 2020

‘Amount as atSist

‘Mar. 2020

Amount as aeSist

Mar, 2019

45,39,71, 710

39,82,07,735

Ta Income From Non Operation

39,42,07,735,

9,71. 710

Particulars

income from Schemes

[insurance

Leet tncome

[Dividend tincome

Discouat

|saintemance:

Price DROP 14.91,228,

Interest Income 12,040

Sundry Cr & Dr Written OFF 58,203

Commission Received 10,00,880

Sales Tax Refund . 551,984

Sales Allowance Alc 785441 4147921

[Transitional Stock Credit 434439

Round off 627

[Total Valve i INR. 1.3719, 764

19. Changes in inventories of Finished Goods, Work-in- progress and Stock In trade

‘Amount as ait

‘Mar. 2020

1,68,49,561

1,44,97,459

(23,52,502)|

Amount my aBlat

Mar. 2019

1:44,97,459

146,17,751

120,302

‘Amount as a3 ist

‘Mar. 2020

38,73,648

Amount as atl Int

Mar, 2019

34,871,009)

1,094,769)

72.00,000)

87.105

Scanned with CamScanner

PARAGON TREELINKS PRIV.

Notes Forming Pat of the Profit eet

Hoss Necounee an at 31st Mareh, 2020

21st

AL 81454

12,27,230

499,583

35.20.83

317.967

&.05,000

29,09,577

423007

3.793

59,29,477

2993

167.993

38,286

1.07,000

36,950

BRATS

149,504

00

10,349

2,20,168

82,997

348.947

29,742

42270

106,362

4212

969,082

82499

45,000

72,200

40,000

164,296,

$900

46848

Scanned with CamScanner

Scanned with CamScanner

PARAGON TELELINKS pRIv.

Notes to Accounts ax at 399 ene a mee

Ae ar SUS

Profit{ Lom) attributable to Shareholders

jeighind average number of equity shares outstancting at the

od

b

[sic and duced earning per share of Ris.10/- each

39,75889.00

30,000

25 Provision for Current and deferred Taxation:

‘The Company has adapted Accounting Standard 22" Accourting for taxes.on Income” The Company has

et deferred tas assets as at 31st Mach, 2000 Defered Tax assets ating on account of depreciation

Javetbeen considered for recognution as there is reasanuibie certainty that sufficient taxable insome will be

suvailable in near flsture, against which such deferted tars asset can be realrred

726 Dues of Micro, Small & Medium Enterprises

‘Tnformation 2s per Section 22 of the Micro, Small and! Mesum Enterpeises Development Act.2006 is not

ive asthe company’ still in the process of gathering the information about the identification of the

suppliers covered hy the said pravisions

te * 27 Confirmations

‘Balances of Curent Asset , Lawns & Advances and sundry credstors are subject to confirmation and

“Sonsequent adjustment and reconciliation if any.

eas Tn Presentation And Disclosure Of Financial Statements

‘The figures forthe previous year have boen reclassified wherever necessary to confirm withthe curren

‘Yeu classification

Scanned with CamScanner

PARAGON TELELINKS PRIVATE LIM

Notes 0 Accounts as at 31st Murch, 2020 noe

“The company's operation comprise of only one segment and therefore there areno-ather business /

eqrophical Segments 10 be reported as equized under Accounting Standard 17 "Segment Reporting”

730 Reluted Party Diselowere

‘psper Accounting Standard (AS-18) on Retated Party Disclosures issued by th es (Account

se ule006 te tone of nso whe eas pats mated Roomy

‘Standard are given below

List of Related Parties

Key Management Personnel

Name Relation

1 Vipul Jayanti Shah Director

2 Doni Rohit Sbah Director

3 Jagruti Vipul Shah Director

4 Hien Jayartlal Shah Director

Disclosure of transactions with above parties:

1955203

72.00.00

31,73,910

5972378 55.12.3783

36,19,212 3B

FOR AND ON BEMALF OF THE BOARD

*ARAGOE IKS PRIVATE LIMITE)

y

Sh \

iLs.Suam MON SHAM

DIRECTOR, DIRECTORS

pinecwores ——INaBGATO

Scanned with CamScanner

GON TELEDINKS PRIVATE LIMITED

Significant Accounting Polictes

‘The financial statements are prepared under the Historical cost convention, in respect ofall materi aspects

inecordance with the Generally Accepted Accounting Practices ( GAAP ) which comprise of Accourting

Stnndarts Accounting Standards specified under Section 133 of the Act, read ath Rule 7 ofthe

Compania (Accounts) Rules, 2014.and the provision of the Companies Act, 2013 on accrual basi, #

adopted consistently by the company

Use of Estimates

‘The preparation of financial statemcas, in conformity with the generally accented principles, sequires

management to make etnies and wssumpeions 1 Be made that affect the reporied amounts of ase and

Tailties onthe date of the financial siaements and the reported amounts of teverwes and expenses GUNS

the reporting period. Those eaimates are based upon managernent's best owledge of curren cvents and

Actions Diferences between the acual real and estates are recognize inte period in which th result

re ksown/materalize

1.3 Revenue Recognition

Income and expenditure are recognized on accrual busit

Revenue time ant mateis]commcts are recognized ws the relate sernes are performed other income

are recognizes on accra basis except when thete are sigifcant unceriaintes

14 Morrowing Cost

oeroming. coms tht are atriurableto the acqustoa or contruction of qualify axsets are captained

‘spat of the outa such ase in necordance with AS 16 unt the qualifying asset becomes ready for its

limended wie “Thereafter such harrowing cost ix charged 10 P&L afc

Fixed Assets

Fined assets ate sated at cont leas accursed deprecation Cost comprises the purchase price and any

‘918 attributable for bringing the asses to its working condition for its intended une

us

Depreciation

|. Depreciation on fixed assets ix provided using the Written Down Value (WDV) rates as calculated

‘considering the useful life prescribed in Schedule 11 to the Companies Act, 2013

i Depreciation a fixed users adediaposed off during the year has been provided on pro-rata bass

Employees benetits

Al employee benefit obligations payable wholly within twelve months of the rendering the services wre

celasuiied as Short Term Employee Benefits. Such Benofits are cxtimated and provided for in the period in

‘which the employes: renders the related service

18 Iavestmenis

‘Longe-term Investments ae sated at cowt ater deducting provision ifary, for other than semperory

[sop stn nan eee eae ad

(p>

Scanned with CamScanner

PARAGON TELELINKS PRIVATE LIMITED

Significant Accounting Policies

‘Trinsachonis in foreign currency are accoutied fut the exchange rates prevailing on tbe date af

transactions: The Exchange differences arising on foreign currency transactions setthed during the year are

recognized in the Profit ard Loss Account forthe year All monetary items denominated in foveign currency

are translated at exchange raves prevailing on the Balance siet date Now Monetary items in foreign

umrencios ae Carried at cost The resultant exchange differences are recognized in the Profit and Loss

‘Account for the year

‘Taxes on Income

Provision for Income Tax, comprising current tax and deferred tax, is made om the bast of the results of th

gear. In Accordance with Accounting Standard 22 Accounting for Taxes on Income, isu by the Institute

of Chartered: Accountants of India, the defested 18x for timing differences between the book and the tax

profits for the year is accounted for using the tax rates and law that have been enacted or substantively

‘enacted as of the balance sheet date: Deferred tx assets arising from temporary timing differences are

recoggsiznd to the extent there ix w reasonable certainty that the assets can be realined in the future

Statwtery Dues

Statutory Dues like Professional Tax and Tax Deducted at Sources are deducted from employers: account

‘on acenial basis and the same are deposited with the Governmect authorities within the prescribed time

fimit as pes the Act There are a abort deductions ar non deductioas observed.

impairment of Assets

‘An amet is treated a8 impaired when the carrying cast of asset exceeds is recoverable value. An imp

joss ix charge to the Profit and Loss Account inthe year ia which an assets ideniied as impaired. The

there has been as change inthe estimate

‘impairment loss recognised in prior eccountiag period is reversed if

of recoverable amount

(Cath & cash equivalents

‘The Connpany coesiers all ight liquid financial instruments, which are renclly convertible into cash and

hueve original maturities of three moathsor less from the date of purchase, to be cash equivalents

(Cash Flow Statements

‘The Csh-Flow Statement is prepared in accordance with the “Indirect Method” as explained in the

‘Accounting Standard (AS) 3 on Cash Flow Statements:

Provisions and Contingent Liabilities

‘The Company recognizes a provision when there is a present obfgation as a result of & past event that

probably requtes an outflow of resources ands reliable catimate can be made of the asount ofthe

‘ligation. A disclosure fora contingent lability is made when there ts «possible obligation or a present

otiigacon that may, but probly will nx, require an outflow of resources. Where there is a possible

‘obligation or « present obligation that the likelihood of outflow of resources is remote, no provision or

Scanned with CamScanner

z FORM NO, 3CA

[See rule 63¢ (ai)

Audit report under section 4448 of the Incarne-tax Act, 1961, in a case where the accounts

‘of the business or profession of a person have toe aualted under any other few

| we report that the StALUtOTY. oud of M/s. PARAGON TELELINKS PVT LTD, SHOP NOA, SATYAM

JENT, JUNCTION OF MG ROAD AND GOKHALE RD, NAUPADA THANE WEST, THANE 490 602, PAN ~

AAECP 9852 G was conducted by us in pursuance of the piovisions of the Companies Act. 2013, and We

_aonex henelo 8 COPY OF OUF AuCiR report dated 31-Dec-2020 along with a copy of each of

a) the-gudited Profit and loss account forthe period beginning from @3-Apr-2019 to ending on 34-Mar~

3020.

{p) the aucited batance sheet as at 21-Mar-2020; ana

je) documents declared by the said Act to be pect of, or annexed to, the profit 8 Joss account and balance

sreet.

1) The statement of particulars required to be furnished under section 4448 is annexed herewith in Form No,

300,

43, our opinion and to the best of our infermation and according to exemination of Books ef account Including

ther relevant documents and explanations given to us, the particulars given In the said Farm No, 36D are

tre and correct: subject to the fotowing ebservations/qualifications, if any.

1 GST Liability is subject to avatt under GST Act.

2 Creditors under Micro, Smal and Medium Enterprises Develpment Act, 2006 are not ascertainable

4 ts not possible for me/us to verify whether the loans/deposits exceeding Ms, 20,000 accepted or repait

otherwise then by am account payee cheque, bank draft, ECS or electronic modes prescribed in Rule

GABBA, as the necess#ry information iS nat in the possession of the assessee.

‘it isnot possible for ma/ur to varity whether the payments exceeding Rs. 10,000 (Rs.35,000 n case-of

‘nly, hiring or leasing 000s carnages) have been mace otherwise than by account payee cheque bark

draft ECS ar efectrontc modes prescribed in Rule 6488, as the necessary evidence is nat in the

possession of the assesree.

5 During the pear an amount of RS. has been added to block of wsset Buildings to rectify incorrect removal af

WOV in AY 18-19 in respect of shop given on rent.

For CHINTAN D. SAIVA & CO,

(Sigatare and same/'seal ofthe slanatary)

ee cai CHINTAN DHIRAL Sava

oni‘ ot} 2.00 hath i, ssen0

rt Firm reg, Mo, 136224W

‘Address; 101 SIDDHIVINAYAK, NEAR BHAGWATT

SCHOOL, VISHNU NAGAR, THANE WEST

+400 602 Maharashtra

UDINS 283689 ABAB cc £9.39

Scanned with CamScanner

(Sen rte wa

statement of particulars required to pe furnished alas

4448 of tne income tax 1961

PART - a, =

4 name of the assessae

, M/s. PARAGON TELELINKS PVT LTD.

address SHOP NOM, SATYAM APARTMENT. JUNCTION

{0F MG ROAD AND GOKHALE RO, NAUPADA

i Drala MANE WEST, THANE -499 802. Mahsrashira

Parianant Accourk Number a EAAECP 9889.6

the B5s85568 i lable to pay indirect

k Sete Pe

uty v8S, DlBSe Furnish the repistration numero, AB DR ach

St number or any other idenueston numer ences,

hesame

: satis = Domesric company

Previous, ‘01-Apr-2019 to 31-Mar-2020

a acca aad

Section 4448 under wi

eset 1B under which the ‘aaantay

Wnedher the assessee has opted for taxation uncer

pte aon mation undersection ys

PART - B

9, Iffirm or Association af Persons, indicate =

(9) and ther profit shaving ratios. ic i

| itthere is any change in tne partners or members or in thelr profit

a oy ratio since the last date of tha preceding yeer, the particulars of

Nature of business or profession (if more than one business er profescion

coe ——. ‘the previous year, nature of every business or

(e) Wthere is any enange in the nature of business or profession, the

Particulars ef sucn change.

ay Nhat books of account are prescribed under section 44hA, i yes,

‘Books so prescribed,

oe books of account maintained and the address at which the books

Sf accounts are kept,

yy Un fase books of account are maintained in a computer system, mention

(0) the books of account generated by such computer system. if the books of

‘Stounts are not kept at one location, please furnish the addresses at

___Iieetions atong with the details of backs of accounts maintained at each

A UstoF books of account and nature of relevant documents examined

Draft and | udes any profits and.gains assessable on

ee a Fano Ig ror te

RF, 248, 4408, 44554, 44088, Chapter XE1-G, First Schedule or

of accounting employed in the previous year-

had / change in the metiod of accounting employed

: Taos encore in the immediately preceding previous Year,

{0} above js in the affirmative, give details of such change, and

hereof on the profit or 05S. Gar

Particulars Increase in promt (R5:) (as)

- 1

Not Applicat

‘Not Applicsble

As per seh.10

No.

As per sch. 1 1b

Axper sch. Ie

No

oe

Scanned with CamScanner

‘ether any adjustment fs required to be made to the pronts

© Sampling with the provisions at ncome amputation and eisissure var

fotited under section 145 (2) ee ke

(a) Hantier to (4) above's in the attiemative, give oatais of such ajustments

Tnerease in Decrease in

Prom (Rs.) —promuney, NRC ENACE RE

5 1» Accounting Policies

4605 IT - Valuation of inventories

1g03 IH ~ Construction Contracts

|c08 IV ~ Revenuie Recognition

sCDS V'- Tangible Fixed Assets

j¢DS VI - Changes in Foreign

exchange Rates

1¢D5 VII - Governments Grants

4105 VIII - Securities

ICDS IX- Borrowing Costs

EDS X = Provisions, Contingent

‘Lsbilties and Contingent Assets

Disclosure as per CDS:

ICDS I - Accounting Policies

ICDS IT - Valuation of inventories

gy KSI Construction Contracts Aspersch 13f

ICDS IV ~ Revenue Recognition

ICDS V - Tangible Fixed Assets

ICDS Vit - Governments Grants

ICDS 1X - Borrowing Costs

_ICDS X - Provisions, Cantingent Liabilities eng Contingent Assets

‘Not Applicable

rom Lower af cost of net

{a} Method of valuation of closing stock emplayad in the previous year realisable value

[Section 145A}

() Incase of deviation from the method of valuation prescribed under section No

145A, and the effect thereaf on the profit ar loss, please furnish:

‘SI. No. Particulars: ‘Increase in profit (Rs.} (Rs) a

15 Give the following particulars of the capital asset converted into stock-in-trade: - NIL

fa) Description of capital asset;

{bd} Date-of acquisition;

(©) Cast ef acquisition,

i) Amount at which the asset is converted Into stock-in-trade.

46 Amounts not erecited to the profit and loss account, being, -

(@)_ the tems fang within NIL

the pro forma credits, drawbacks, refund of duty of customs or excise or

(0) Service tax, oF refund of sales tax or value added tax, where SUCH credits, NIL

| ‘dritted as due by the authorities concerned;

during the previous year; NIL

BN nim me NIL.

(0) pital receipt, any, NIL

47 ‘Were any land or bullding or both is transferred during the previous year for a NIL

f Hess than vais adopted or assessed of assessable by any authority af

2 State Ge ‘Where fn section 49GA of SOG, lease tune,

ska ‘Consideration received or Value adopted of assessed or

18 Poricsiars of depraciaton allowable as per the Iocome-tax Act, 2961 in respect

‘each asset or Dock of assets, as the ase roy be; ir Se ohewing =

__ Description of asset/biock of assets. _

Rate of depreciation.

Scanned with CamScanner

{€)__Artua cost or wetten down value, as the case my Be

@ popenmek made ta the wren down value une sect THSBAA (OE

‘year 2020-21 oniy}

| 460) Adhused written down oniae

Additions/dequctions during ‘with dates; in the case of any

() enon of a asad bat ae acing sh EMST ‘account

|

Aided To med and aiowed under the Cantal

7 Seen beget sou pees eM

| fil) change in rate of exchange of currency, and

\, (9) ss or grr rromtrsra by wave ame Sale

(@) Depreciation allowable.

(0 Witten down value at the end of the year.

_ ae et os (A) 38U4)¢iia), (9) NIL

32AD, (b) 33AB, (c) 33ABA, (d) 35(1}( 350i), 4

A}(lH, CM) 3SC4)(04), (1) 352A) (2A), (ki) 35ABA, (I) 3SABB,

ines a ae oh ae (a) 380, (93505) ()3500%

ec eck ose sau

fours agricable ae ger me provions fhe Income Tx At 1961 or

also fulfils the conditions, #f ay specified under (he relevant provisions:

Ie Teche El rem tes haaee oy oe pe,

‘Circular, etc., issued in tnis penal.

20 ANY Sum paid to an employee as bonus or commission for services: NIL

i (2) rendered, where such sum was otherwise payable to him as profits or

il ___ dividend. (Section 36¢4)(i)]

i © ‘Deals of contributions rectived from emiskovees for various funds 2s RE

‘referred to in section 36(1)\v8):.

o

Seriah Nature of SU TECRWE Oye aace for pot The Actual date

furnber he payment Amount PAYNE LORE

23 (0) Pasa Tumis te otal of smounis dein tothe proton lees accu,

i being in the nature

pd eesti,

Personal expenditure

} ‘Advertisement expenciture in any souvent, brochure, tract, pamnphiet er the

- We, published by a politcal party “ats

Expenditure incurred at clubs being entrance fees and subscriptions seperate

Expenciture incurred at dubs being cost for cub services and faclities used

| pana way of peat fie fr vlan of ny iw fr the tie

‘Expenditure by way of any other penalty or fine not covered above

Erato aed any rcs nen an oence or wh sponte

5 payment to nan-teicen efered ton gubssause ()

(A) Detauss of payment on which tax is nat deducted: NIL

NaS been deducted but

ao icaeeares NIL

Scanned with CamScanner

11) amount of payment

(11D nature of paymene

‘ (IV) name and address of the

payee

AV) amount of tax deductes

{W) Payment referred to in sub-ctause (a)

(A) Details of payment on which tax is not d

edited’ biti A)

(1) date of payment . oe

(11) _amount of payment

(21) nature: of payment

__{HV) name and address of tne payee

Details of payment on which tax has bean deducted b

(8 Bald on o lore the due dite species msi set (3) oF secon

(2) date oF payment

(1) amount of payment

(211) nature of payment

(IV) name and address of the payee

(¥). amount of tax deducted

_ (VB) amount aut of (¥) deposited, itary

(Mi) 95 payment referred to in sub-clause (1b)

(Details of payment on which levy t not deducted: NIL

(0) date of payment

(AY (IQ, amount of payment

(111) nature of payment

GV) name and adaress of tne payee

‘Details of payment on which levy has been deducted ut nas not been NIL.

‘paid on or before the due date specified in sub- section (1) of section

138,

NIL

(2) date of payment

{8) (1) amount of payment

(111) nature of payment

| (IV) name and adcress of the payer

(V) amount of tevy deducted

(V1) amount out of (¥) denosted, i any

| Ah) under sub-clause (ic) [Wherever applicable] Lie

©} nder sub-clouse (a) MIL.

_(¥)_under sub-ciause (ib) ate

(vi) under sub-clause (il) Nik

(A) date of payment

{8) amount of payment

i (©) name and address of the payee

1 NIL.

© (em) unter sub-ciause (v) NIL

Amounts debited ‘logs account being, interest, selary, bonus.

ee ea ean ee under section 40(0)/40(Da) and Not Applicable

‘asallonence/Seemed jncore under suction 404(3)

“On the | ‘eeamination of books of account and other relevant

(ay See es whether the. cowered under section Yo

40a(3) ie 6DD were made by account payee cheque dravn

e BAGS zoo payee bark ra. feat, please furnish te eas

(we

Scanned with CamScanner

Name and Permanent Aecount

‘Serat Date of Nature of or Aadhaar Number of

Mater’ pevmentfaymeee fomue fumis & Maas

On ' books of account and other relevant

Sats ot wanton of eee

(8) SAGA) read wath rule 600 were mode by account payee cheque drawn

7.4 bank or account payee bank draft If not, please furnish the detads

OF amount deemed to be the profits and gains of Business. or profession

UNGer section 40A(3A);

Name and Permanent Account

Serial Date of Nature of ‘pacire ve

Number or Aadnaar Number of

Umber payment payment the payee, if availabia

@

Provision fer payment of gratuity not allowable under section 40A(7);

(Tangy OMG DY the assesses as an employer not allowable under section

(0) _parvculars of any tabiity of @ contingent nature;

SUNT of deduction inaémissible in terms of section 144A in respect of tne

{) Teng ture locurred in relation to income which does mot form part af the

(amount inacrmssibie weer the Proviso to section 36(1)(lit)

Amount of interest Inagmissible under section 23 of the Micro, Small and Medium

Enterprises ‘A, 2008.

Particulars ot payments made to persons specified under section40A (2)(b):

24 Amounts deemed

to be profits and gains under section 52AC or 32AD or 338 or

S3ABA or 334C_

5 ‘Any-amount of profit chargeable to tax under section 41 and computation thereat

26 In respect of any sum referres to in

Causes (a). (b). (€), (4), (a), (for toh oF

‘section 438, the liability for which:-

(ay, BERR on the frst day ofthe previous year but wes not elowed In

‘the assessment of any preceding previous year and was

{) paid curing tne previous year:

(ho) nat gait aunng the previous year,

(8). Was incurred in the previous year and was

Bai6 08 before the due date for fureshing

(2) of tne previous veer under secuon $3961)

(2) _ not pai on or before the aloresaia dave.

the return of income:

Yes

NIL

Nil

Nil

Nit

Nit

NIL

AS per sch 23

NIL

NIL

Ni

Yes

NIL

NIL

Not Apa

Scanned with CamScanner

Whether any amount s to be included as income

(2) ncame trom other sources” as To seer eae |

|(p) I yes, please furnish the fatlowing details

(Nature of income

(i) Amount (in Rs.) thereat

Details of any mount borrowed!

ee ar Dorrowed} rapes epenr ome du thereon tindng

es oo (Otherwise than through ant account payee NEL.

‘whether primary adjustment sation

(#) 92Ce(2), nas been ie oe eee ae »

(0) Iy®s, please furnish the following detaiic

cide wich cause of section 92CE(1) primary adjustment i= NIL

(W Amount (in Rs.) of primary adjustment

Whether the excess money available with the associated enterprise

‘(Is required to be repatriated to India as per the

‘section 92CE(2)? ESR See

Hf yes, whether the excess money has been repatriated within the

(prescribed tie : a

f'n, the amount (in RS.) of imputed interest incame on such

(¥)@ecess money which has not been repatriated within the prescribed

time

Whether the assessee has incurred expenditure during the previous year | No

by way of interest or of simitar nature exceeding one crore rupees as

__feferred to in section 948(1)?

Yes, please furnish the folloning details:

“Amount (in Rs.) of expenditure by way of intarest or of similar nature

(0 incurred

‘Earnings before interest, tax, depreciation and amortization (EBITDA)

during the previous year (in Rs.)

Amount (is RS.) of expenditure by way of interest or of similar nature as

Si) Ger (i) above which exceeds 30% of EBITDA as per (i above

Dataiis of interast expenditure brought forward as per sub-section (4) of NIL.

948

(of interest expenditure carried forward as per sub-section (4) of NIL.

998

‘te assessee has entered into an impermissible avoidance ‘This clause is kept in

‘a5 referred to in section 96, during the previous year? sbeyecce ait ST Sle

ge specify: 2021

f the impermissible avoivance arrangement:

.) of tax banent in the previaus year arising,

parties to the arrangement:

deposit in an amount exceeding the limit specified AS persch 31a

during the previous year:

‘Account Number or Aadhaar Nuribier

3} Of the lender or depositar;

‘or accepted

juered up during the previous

count at any time during

tied by cheque or

mm thvough a bark

d by cheaie or

pied by on erount

( jo

Scanned with CamScanner

Persea of 880) SACHS Sam my amcurt cnecing ove epactiats

‘secon 1655S taaer oF actectad Gunng Ine pews ee

‘seem, scdress and Permnnent accsunt Number or Asctaay turion fi

() wvplatle wes the sssessee) af tie nérson from whem soecrce eon

vmoeves,

(meee of species som tame or srcested:

sehemer Die soecfied som was taken oy accestes ea

wo SEES Sa hee emery ores

ket

1) Gast Ihe specter sum was taken or accagtes

‘Sop Sete he See was token or accentes by 2° ecazort

Daves cregve oF an account cayse bank oat,

(SeScuers Hg) ane (E) nee not be gwen m ne case of a Goverment

‘Sepey. 2 Samaang company or 2 corporation estebishe: by tne Centre, State

Prowncal Act)

Oo

Ge) SSPE Pansecten of ws rescect of

‘Setasion froma person, during the previous year, where Such receise

‘Smienwse Den by 2 cheque of bank craft or use of siectronic sang

fester trough = bank account

(NOt, aderess anc Permanent Account Namber or Aacihaar Mumba OF

sveindie meth ihe assesses) of the caver:

(8) Nene of ransacnen

relating to one event,

(& Gccasion tb 8 person. otherwise than by a chequt or bank dram,

SS caer eT es oe eee

ao ‘during the previous

Same, sccress anc Permanent Account Number or ABthaar

© peeiabie wan Ue accesses) of te peyen, nee

() Netre of rarsaccee;

(B) Amaure of payment (im Rs),

Oar:

Scanned with CamScanner

as

(a)

Xb)

©

ay

ke

33 Section-wise geta Mikor

| its of /, admissible under Chapter Chapter 4.

Bieter oh coca, oy NIL,

eduction ig 274 fulfils the congitions, any, specified under the relevant provisions,

ns

Tax deduction

!and collection ype-ot. pul Sate. (Date of

ACE NUMOR FT hing formined “awed Wo be Ford Pak

‘Amounts aamissibie as per te provision af the Income Tax Act, 1961

‘of Income Tax Act, 1961 o¢ Income Tax Ausles,1962 oF any other

Guidelines, circular, etc, issued in this behalf.

MMether the assessea is required to deduct or collect tax as per the pravisions

8 As

OF Chapter XVI1-B or Chapter XVII-B8, i yes please furnish: Poach y

Tax deduction and eallctian Account Number (TAN)

Nature of payment

Total amount ot payiment or receipt of the nature-speciied in column (3)

{BP orem on wn tax was required ta be deducted or collected ovt of

at areunt on wnicn tax was cecueted or coectad at spectied rete out of

Amount af tax deducted or collected out oF (6)

8 Total amount on which tax was Geducted or collected at lass than

‘Specified rate out of (5)

a Amount of tax deducted or coliacted on (8)

Amount of tax destucted or collected not deposited to the credit of the

Sena Severmant oto 6) 98 (8)

wether the assesses is required to furnish the statement of tax deducted or 4

‘Tox collected. It yes, please furnish the details: Me Aspe nk

‘Whether the statement of tax

‘deducted oF collected contains

information about all

‘Setaisftransactions which are

o weune

please furnish Ist of

details/transactions which are

not reported

Whether tne assessee 5 lable to pay interest under: , ‘

— to poy Under section 208(44) oF section No

‘Amount oF interest

‘Tx deduction and collection under section ‘Amount Bid: out of cola

sccoUne Number (TaN) 201L1AY/206CC7) 6 along th date of paymont

payal

in the case Of & trading concern, giva quantitative details of principal iterms of Not Applicable

(0) opening Stock:

(8) purchases during the previous yaar;

(ii) sales during the previous year;

(rw) cosing Stock;

(¥)___shortageyexcess, if any.

19 the case of manufacturing concern, give quentitative detais ofthe principal

‘Items of raw materials, finished products and by-products. Not Applicable

Scanned with CamScanner

; (i) purchases during the previous

i ves;

| (iH) quantity menutactures dung the prevous years

(iv) sales during the previous year; .

{¥)_ losing stock;

|, yrine case of 3 domestic

Ioan 115-014 efor fr nO Stroud rs ner Nile

{tobi AMOUNE OF distributed profts;

amount of reduction as referres to mn section 135-0(tay0);

‘emount OF reduction as referred to in section 145-0(4ay(1);

‘total tax paict thereon; \

dates of payment with amounts.

whether the assessee has received

Cy To SeOn ot RTO the nature aden No

IE yes, please furnish the folkewing detalis;

(i) Amount received (in Rs.) NIL

{H) Date of receipe

Whether any Cost audit was carried out, If yes, give the detail, if any, of

+ Sennanenvon ‘of disagreement on any atter/tamyeloafatia by 8 may be NA

reported /idantified by the cost auditor

whether any audit was conducted under the Central Exci 1944, if yes,

PF tneaets, any, of cisquateaton or sgseemrt ony mote NA

fitem/walue/quantity as may be reported/identified by the auditor.

p Whether any audit wes conducted under section 72A of the Finance Act, 1994 in

‘elation to valuation of taxable services, if yes, give the details, if any, oF NA

a fsease

or disagreement on any matter/item/vatue/quantity as may De

reported/identiied by the auctor:

(0 Details regarding timaver, gross profit, etr., for the previous year and preceding Axper sch.40

year:

‘5, Material Consumed/finished goods produces

“(rhe details required to be furnished for principal Items of goods traded or

peor ice rendered) er aaioeea

ised ar refund issued

Hea ares he ote re cra Tox A L951 ore Wann tx AC, 1957 NIL

‘with details of relevant proceedings,

by ‘Whether tne accesses is required to furnish statement in Form No.61 Or FOr Ne.

(8) No. 61A or Form No, 618?

‘NIL

Ch

“yes, plaase furs aa

“Ineome-tax information about all ea

Department hyp pate of transactions which ore req

Reporting or coneiad furnishing, ibe ie reported not, please

Fr Fermin _detalis/teansactions which are nat

Scanned with CamScanner

| (2 not due, expected ate of ing —

_S* Break-up of total expenditure of entities registers or not registered under the GST: Ri:

Total mount. Expenciture in respect of entities registered unde? GST eo, sengiture ac

2021 Mig,

Ou

: (Snare and Sa ofSl fn pa,

THANE WEST Name of the signatory: CHINTAN DHIRA) sary,

Dace: shi] 9.4 Partner, M. Wo. 153699

Firm reg. No, 1352249

‘Ful goress 101 SIDDHIVINAYAK, NEAR i,

SCHOOL, VISHNU NAGAR, THane woe

602 Maharashtra *

~~ Scanned with CamScanner

‘Schedules to Form SCD - M/s. PARAGON TELELINKS PVT LTD - &.¥, 2020-21

“ ndienet tax Reg. Numbers

indirect Tax law details

VAT Act Maharashtra

Other: LET

i GST Act: Maharashtra

stalls of business | profession

Sector

| Whoiesate / Retail Trade

Books maintained

‘Bank book

‘Cash book

Journat

Ledger

Purchase register

Sales register

Stock register

ow ee

{c: Books f documents examined

Bank book

‘Cash book

Journal

Ledger

Purchase register

Sales register

‘Stock register

‘Bank Statements

Purctase Invoices

Sales Invoices

Expense Vouchers

‘Credit totes

Ne DE oO ee

[8f; Disctosure as per ‘COS

ICDS

| eps 1~ Accounting Policies

Reg. No.

378807032960

TMC-LBT-0006739-13

‘27 AAECPSBS2G 121

Sub-Sector Code Particulars of change:

Retail sale of other products 99028 ‘No Change

SHOP NO¢, SATYAM APARTMENT, JUNCTION OF MG ROAD AND

GOKHALE AD, NA\IPADA THANE WEST, THANE-400 602, Maharashtra

odor

Disciosure

Mercantila system of acceunting i followed during

tha year, As informadt to us, there no change in

rmathad of accounting From thas employed in

immediately praceeding previous year

Inventories are valued at cost oF NAV whichever is

Jower, Value of closing stack as an 31.03.20 is

As 1,68,49,960,99/-

thot applicable.

All revenues are recognised on accruai nasis

Fixed Assets are stated at Ost less depreciation

Assessee has not recelved any Gevernment Grants.

No borawing enéts were capttabsed during the yes.

‘Thare are no contingent iebilties

ie

2 (

Scanned with CamScanner

a

e

&

5

et B

=

5

oO

le

=

3

3

3

&

=

8

8

a

“{* nt i)

Teer Soares 16 es sco's ¢ z )

ceive eee B’se’09'9 = O'ee'er 'er't eo'aeee’s © o'es‘ee’s ath

rec're't sto'ee erezt'2 uN TIN EIS'SE Sop'29 ToS'erT IN Tos'et't) | WOP spenisup mepias og nan yt

wereo ts 1s9°60'6 Epe't2'09 TIN uN roo’st eae -ges’es"9S TIN Ste'ss'9S || KST

S9z'PE'S9 czc’ze’s © Sev'99"te UN nit Sesto: co'er's PBC'EE'S+ ear'se’se MOT

qostrs‘oe's © 6ee'2Z'9E Bape zg'¢ UN IN UN BP any Oarertege ope'stics'2 Nor

qecestos't «= TOES Fyraggey UN um UN UNTO es" qiv'oe'es't 45

oroeto te | Geeta vwestt © 6t'bo'T0

Cuunp 6 OTP «61 Ol r ar

sn aur ans nam PN ao fe

uo se om —boeDeudRa OL wonem@G — gy ind aoe suoMPpY OKI pmenipy ATM se wr

aad awaunsnfoy

* tus to Form 30 - M/s. PARAGON TELELINRS PvT.LTO - a, 2020-21

update of Adon to Fue anste

por never

eating (oon, factory),

[peur ctrl Miogs ey 105%

rr, electrical tings a 10%

“puntara, elacocalFiings @ 1095

ruta, abecineal ming 10%

umiture, electrical fitings i) 10%

Fare, ecical fings 10%

| Feiae,eeetnea tings @ 10%

‘Feeitre, slectncal tings @) 10%

| Furtue, elcid tings @ 10%

| Furies, eleciiea iengs @ 10%

| Ponte, alectncal fitings @ 10%

Pur, electro tings @ 10%

| Furiture elecrcal tings 10%

| Fortune, electrical tings @ 105%

| Future, efecarcal ings & 19%

| Fura, electrical Finge @ 10%

| Fumitare, eect tags @ 10%

+ Future, electees!Fings o& 10%

1 Fumitre, lacie Rings @ 10%

| Fuerte, elec figs @ 10%

Furies, wcicalRaings @ 10%

| Fumture, elecitcal tings @ 10%

| Furnture, elec fiings @ 10%

| Furtre elect tgs @ 10%

Lremture, eectieal ngs @ 10%

| rete ect ge @ 10%

Furnture, electrical ings (@ 10%

Furniture, slectica ftings @ 10%

Furniture, elcincalfitings @ 10%

Amount

4,04,08,030

17,310

95,000

25,000

20,000

20,000)

13,000

76,808

300,000

58,055

32

20,000

20,000

20,

20,000,

10,000

5,000

5,000

7.400

20,000

20,000

30,000

10,000,

20,000

40,009 10.

20,000

50,000

17,886

20,000

20,009

18,338

23,251

20,000

25,000

110,000

20,000

20,000

0,000

25,000

25,000

50,000

20,000)

34,000

4

Date of Date put to use Aqjustmentsif

purchase

O1-Apr-2019

28-Feb-2020

08-00-2019

05-04-2019

09-Oct-2019

14-Oct-2019

19-02-2019

210-2019

31-Oct-2019

(03-Dec:2019

05-Dec-2019

07-Dec-2019

09-Dec-2019

08-Dee-2019

09-Dec-2019

10-Dec-2019

28-Bec-2019

26-Dec-2019

30-Dec-2019

O3-ten-2020

‘g2-Ian-2020

‘03-2en-2020

(03-220-2020

04-2an-2020

-Baet-2020

10-Jan-2020.

40-¥an-2020

17-tan-2020

‘2i-tan-2020

2ian-2020

2a-lan-2020

22-4an-2020

24-4an-2020

26-1an-2020

26-tan-2020

‘26-4an-2020

O2-Feb-2020

02-Feb-2020

02-Feb-2020

06-Feb-2020

06-Feb-2020

09-Feb-2020

08-Feb-2020

13-Feb-2020

Ot-apr-2019

28-Fed-2020

(08-Octs 2019

05-Oct-2019

09-Oct-2019

44-Oct-2019

19-Oct-2019

MOet-2019

M-0ct-2019

03-Dec-2018

05-Dec-2019

07-Der-2018

09-Dec-2018

09-Dec-2019

40-Dec-2029

10-Dec-2019

28-Dec-2019

28-Dec-2019

30-Dec-2019

ot-an-2020

02-tan-2020

03-3an-2020

(03-30-2020

(04-3an-2020

$0-Jan-2020

10-Jan-2020

40-Jan-2020

17-3an-2020

21-Jan-2020

21-Jan-2020

22-Jan-2020

22-Jan-2020

24-200-2020

26-Jan-2029

26-tan-2029

24-tan-2020

o2-Feb-2020

02-Feb-2020

oz Feo-2020

06-Fan-2020

06-Feb-2020

09-Fen-2020

09-Feb-2020

13-Feb-2070

Scanned with CamScanner

Schedules to Form 3CD - M/s. PARAGON TELELINKS PYT LTD - A.¥. 2020-25

sect flags @ 16% 20,000 14-Feb-2020 14-Feb-2020

ection Ring @) 10% 4,932) 18-Feb-2020 18-Feb-2020

ecircalftings € 10% 20,000 19-Fet-2020 19-Feb-2020

cumin, electrical ftings @ 10% 10,000, 21-Feb-2020 21-Feb-2020

local ings @ 10% 20,000 24-Feb-2020 24-Feb-2020

pean Iatah ag 30 10,000, 03-Mar-2020 03-Mar-2020

umtue, eecanical tings gj 10% 15,000 12-Mar-2020 12-Mar-2020

Fomiur,aletrical tings @ 10% 10,760

puri, electca tings @ 10% 10,000

aiure, eleetneal Tings 10% 5,000, 16-Mar-2020 16-Mar-2020

rurnture eectcal Sings @ 109% 40,000 18-Mar-2020 18-Mar-2020

Furiture, electrical fithings 10% 24,612, 02-Mar-2020 02-Mar-2020

Fariture,elecbical tings € 10% 25,853 14-Mar-2020 14-Mar-2020

Future, ebecsical tings 10% 23,633 06-Mar-2020 06-Mar-2020

Fume. eect ings 107 10,350, 20-Feb-2020 20-Feb-2020

Fumtue, elects ings 10% $8,430 14-Oct-2019 14-Oct-2019

Furstue, alectncal rings <2 10% 36,790 18-0cv-2019 15-Oct-2019

Fuesbire, acta ings 10% 10,000 14-Oct-2019 14-Oct-2019

Furntir, wectncal tings @ 10% 9,168 20-Oct-2019 20-Oct-2019

Fomiture eectncal fins @ 103% 10,000 i1-Fep-2020 11-Feb-2020

Future, electrical Ftings @ 10% 1,955 2S-fen-2020 25-Feb-2020

Furie, Secincalfitngs @ 10% 134 05-Jan-2020 05-Jan-2020

Furniture, wlecircal Rings & 10% 2850 15-2015 15-Jul-2019

Fumiture, eecincal tings @ 10% 42,180 04-Jul-2015 04-JuL-2019

Fumaure,elctncal tings @ 10% 12,697 0-3-2019 10-1ul-2019

Foriture, elctrcal tess @ 10% 6.535 iG-Wur2018 16-Jul-2019

Furniture, electra tings @ 10% 90,000 03-Sep-2019 03-Sep-2019

Furniture, elactecal ftags @ 10% 7,200 OG-May-2019 03-May-2019

Furiture,electrca fitings @ 10% 29,000 O4-¥ul-201904-3u/-2019

Fumiture, slecinest fitings (10% 39,000 O4-Wul-2019 4-2u/-2019

Furriture, electrical ings @ 10% 39,000 O8-W-2019 0B-1u1-2019

Furitue, electrical tings @ 10% 49,500 Li-Wu-2019 L1-JuF-2019

Furture, slecirca tings © 10% 39,000 14-2ul-2019 L4-JuF-2019

Furniture, slecirca tings & 10% 39,000 47-Wl-2019 17-2u-2019

Fusriure, electrical fittings iB 10% 19,000 18-Jui-201918-u+-2019

Fesninure,stecticalftings (10% 19,000 18-Jul-2019 18-2ul-2019

Fuenure,elecincatftings @ 105% 39,000 21-Jul-2019 2i-2ul2019

Furniture, eloctncal ftings @) 10% 19,000 24-Jul-2019 24-Jul-2019

Furiure, slectrcalftings @ 10% 52,868 01-Aug-2019 01-Aug-2019

[Furrtsire: tories! tings © 10% 19,000 10-Aug-2019 10-Aug-2019

‘tecrrcal ngs @ 10% 8,800 12-Aug-2019 12-Aug-2019

slactnca ings & 10% 19,000 12-Aug-2029 12-Aug-2029

electrica’ fitings @ 10% 5,000 31-Aug-2019 31-Aug-2019 sy?

fangs t0% 20-sep-2019, 2tenanie (KM

2-Sep-2019 20-Sep-2019

28-Sep-2019 | 28-Sep-2019 in

30-Sep-2019 30-Sep-2019 Tw

03-May-2019 03-May-2019 :

Scanned with CamScanner

Fumiture, electrical fitings @ 10%

Fuminire electrical fitings @ 10%

Fumitre, iectcal mings @ 10%

Fume, sireal mings @ 10%

fot block 4

Caralup te 2-8-19), Plant, machinery @ 15%

Carslup to 228-19) Plant, machinery @ 15%

Cars{up to 22-8-19), Plant, machinery @ 154%

Carsup to 22-8-19), Pisnt, machinery @ 152%

Cars(up to 22-8-13), Plant, machinery @ 15%

47,581

7,935,

3,525

1,763

2,710

2,363

5,083,

88,350

2,975

3,305

305

7,332

12.116

74,125

4,800

3,250

5,090,

19,000

419,000

10,000

40,000

es

90,319

26,286,226

45,001

2,00,000

25,000

37,030

5.935

25,700

7,031

7,031

23,874

7,422

3.98

45,000

4,03,008

4,13

20,000

14,000,

18,305

5,400

15,300

23,400

6

06-2019

08-10-2019

09-2u-2019

1au-2019

253-2019

26-30-2015

153-2019

s39u-2019

io jue2019

1o-su-2019

2i-e2n9

03-Aug-2019

09-Aug-2019

26-Sep-2019

05-Aug-2019

22-Aug-2019

a5-Jun-2018

27-Jun-2019

26-Jule2019

P-hug 2019

2a-Aug-2019°

25-May-2019

33-3ule2019

28-Oct-2018

‘29-dun-2019

01-Aug-2019

sewe2019

23-74-2019

222ur2019

03-May-2019

21-May-2019

18-31-2019

13-Aug-2019

43-Jun-2019

27-2019

‘J1-Gec-2019

30-Jan-2020

09-Jan-2020

09-Jul-2019

16-Jul-2019

20-May-2019

15-Aug-2019

Schedules to Form JCD - M/s. PARAGON TELELINKS PYT LTD « A.Y. 2020-2

06-Jul-2018

08-)ul-2019

09-2u-2019

ad-sul-2019

25-4u-2019

26-4ul-2039

5-10-2019

43-tub-2019

10-34-2019

30-Jul-2019

Pid 2019

O3-hug-2013

09-Aug-2019

26-Sep-2019

Os-aug2018

22-Aug-2019

15-Jun-2018

27-Jun-2019

6-1-2019

22-aug-2019

22-Aug-2019

25-May-2019

‘Badu-2019

28-00-2019

25-Jun-2019

Di-Aug-2029

18-Jul-2019

23-2019

22-Jul-2019

Od-May-2018

Bi-May-2019

38-1u-2019

13-Aug-2039

13-Jun-2019

27-ur2019

AeDec-2019

30-Jan-2020

(09-Jan-2020

yu

bee

(se

99-Jul-2019

16-Jul-2019

20-May-2029 wy

18-Aug-2019

Scanned with CamScanner

‘Schestules.to Form 3CO = M/s. PARAGON TELELINKS PVT LTD - ALY, 2020-21

cof hock ® 97,918

Tota 1,35,37,172

15; Details of amounts debited to the profit and loos account

j. No. Particulars ‘Amount in Rs.

\gapital expenditure

|perscnal expenditure

4 Denatien 20,000,

2 Imerest on taxes 14,088

Total 44,088.

|,gvertisement expenditure im any souvenir, brochure, trac, pamphlet or the ike,

[published by 2 politic! party

[expenditure incurred at clubs being entrance fees and subscriptions

lexpenditure incurred at cubs being cost for club services and facilities used

lexpencitute by way of penalty or fine for vielation ef any law for the time being force

[expenditure by way of any other penaity or fine not covered above

‘expenditure incurred for any purpose which is an offence ar which Is prohibited by Faw

Pinna Amounts inadmissible uis 40(a}(ia) - Tax not deducted

ate ot payment AREWES nacre of payment Nene ond adres of epee

2 ee 50,000 FeesyRoyany Ana! Vaya, Thane, Thane, 400003,

2 oe 22,000 Fees/Rayaity Aru Valaya, Thane, Thane, 400001,

aoe 55,029 Works Contract Navin Motors PLtd, Thane, Thane, 400001,

| ‘Total 1,27,029

(23: Payments to specified persons ule A0A(2D)

Name ‘Amount Relation PAN Nature of Transaction

| het Shan 11,00,000 | Director AXLPS 6172. Salary

2 Hiren Snaty 22,00,000 Director ARCPS 89981 Spiary

[a segrutiv shan 11,09,000 Director AQPPS 4685 Salary

4 Vipul Snan 22,00,000 Director ACBPS 6219C Salary

‘5 Vipul Shah 32,76,204 Director ACBPS 6219 C Interest of loan

6 Dhruti Shah 5,50,337 Director “AKLPS 6172 P Interest on Loan

7 jagrut v Shah Director AOPPS 4665 A Interest on Loan

8 Hiren Shan Director ARCPS 8998} Interest on Loan

‘Total

Aaccapted | Accepted

Amaunt of squarea MONMUM "Sy by we

a lecesity tenn up) “TOUR Cheque/0 payee

AAFCK 1308. 40,00,000 Yes 40,00,000 RTGS = NA

“nceps62i9.c 3,40,80,000 No *89204 cnaque Yes:

AOPPS 4655.4 61,650,000 No 73,19,212 Cheque Yes.

avers ei72e 02,00,000 No MSE crenue | Yes

Scanned with CamScanner

sg — tras Sehetules to Form 3co - 7s, PARAGON TELELINAS PT LTD ~ 25% OEE

8h i AACPS 8988) 65,065,350 No 56,46,350 Cheque Yes

‘589,86,

va °

nat Deposits! vums repaid ws: 2697

Maximum Rapa! by Rapald by

Address mous

PAN nt of Chet) Ae ba

, ; repayment Amount chaqueyo0

press? loans ‘AAFCK 1308. | 40,00,000 40,00,000 Cheque aes

‘Thane ACRES 6219 ¢ | 30289.71' 9.60,20.43 chequa Yon

gagnal Shen Thane AOPPS 4655.4 76,00,000 73,19,212 Cheque —

‘phuti Shah Thane AXLES 6172p | 98,75,000 1978237 Cheque Yee

yiren3'Shan Thane ARCPS 8998) 63,50,000 56,46,350 Cheque Yes

581,247,

12

Brought forward Loss

Alliosses//—_Ameunt as

‘allowances adjusted by

| not withdrawal of

haere ot Amount allowed auicitional Amount Asst. ASS

ee itnce 8 under Gepreciation on as Order order Remarks,

run returned* action account of assensed No. ate

| 1:58n4 ‘optng for

takation under

L. section 115BAA

Assessed

| Amount

is as per

Depreciation 467,049 4,67,4489 self

“allowance ‘assessm

‘ent ws

1408.

Assessed

| Amount

| \s as per

‘eorecation | 90,99.58 becca sev

allowance assessm

ent u/s

140,

070 95,67,0

95, na NIL a

a4

ed deprecistion is tess and no appeal pending then lake assessed.

Scanned with CamScanner

ined with CamScanner

Scant

o 620d ‘oe zoe ees CWE Les eee asec

al we om raviete rvs oteier

9 7 esr use uarorie weve

Ti 1. oon 'ee% ‘o00'co'e ‘900'90'98 000°00'S8

oN 1 otOr 900's0" o00's0'® Tie ot

aN oon'e coz O08 0868 neces

WN ex's were nae oar 0 9 severe

@ i ) a

4s) joane () mo ir)

aie) payDeds te)

(a) wo (9) 0100 IEL peYIRdS Jo INO pEDAND :

pensanca 10 UES, paw 29 e pnoe> 10 49 PSNR Hess Kei