Professional Documents

Culture Documents

Pepsi Vs Leyte

Uploaded by

RobertOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pepsi Vs Leyte

Uploaded by

RobertCopyright:

Available Formats

Pepsi-Cola Bottling Company of the Philippines, Inc. vs.

Municipality of Tanauan Leyte

G.R. No. L-31156; February 27, 1976

Facts:

Pepsi Cola has a bottling plant in the Municipality of Tanauan, Leyte. In September 1962, the

Municipality approved Ordinance No. 23 which levies and collects “from soft drinks producers and

manufacturers a tax of one-sixteenth (1/16) of a centavo for every bottle of soft drink corked.”

In December 1962, the Municipality also approved Ordinance No. 27 which levies and collects “on soft

drinks produced or manufactured within the territorial jurisdiction of this municipality a tax of one

centavo P0.01 on each gallon of volume capacity.”

Pepsi Cola assailed the validity of the ordinances as it alleged that they constitute double taxation in

two instances: a) double taxation because Ordinance No. 27 covers the same subject matter and impose

practically the same tax rate as with Ordinance No. 23, b) double taxation because the two ordinances

impose percentage or specific taxes.

Pepsi Cola also questions the constitutionality of Republic Act 2264 which allows for the delegation of

taxing powers to local government units; that allowing local governments to tax companies like Pepsi

Cola is confiscatory and oppressive.

Issue:

1. Whether or not there is undue delegation of taxing powers.

2. Whether or not there is double taxation.

Held:

1. No. Under the New Constitution, local governments are granted the autonomous

authority to create their own sources of revenue and to levy taxes. Section 5, Article XI

provides: “Each local government unit shall have the power to create its sources of revenue

and to levy taxes, subject to such limitations as may be provided by law.” Thus, legislative

powers may be delegated to local governments in respect of matters of local concern.

2. No. There is no double taxation. The intention of the Municipal Council of Tanauan in

enacting Ordinance No. 27 is thus clear: it was intended as a plain substitute for the prior

ordinance no. 23 and operates as a repeal of the latter, even without words to that effect.

The tax is not a percentage tax as the volume capacity of the taxpayer’s production of

softdrinks is considered solely for purposes of determining the tax rate on the products but

there is no set ratio between volume of sales and amount of the tax. Nor can the tax levied be

treated as a specific tax. Softdrink is not one of those specified articles.

It must be observed that the delegating authority specifies the limitations and enumerates the

taxes over which local taxation may not be exercised. The reason is that the State has

exclusively reserved the same for its own prerogative. Moreover, double taxation, in

general, is not forbidden by our fundamental law unlike in other jurisdictions. Double

taxation becomes obnoxious only where the taxpayer is taxed twice for the benefit of the

same governmental entity or by the same jurisdiction for the same purpose, but not in a

case where one tax is imposed by the State and the other by the city or municipality.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- People Vs ReyesDocument2 pagesPeople Vs ReyesRobertNo ratings yet

- Adlawan Vs PeoplDocument2 pagesAdlawan Vs PeoplRobertNo ratings yet

- People Vs RonquilloDocument4 pagesPeople Vs RonquilloRobertNo ratings yet

- People Vs PanerioDocument2 pagesPeople Vs PanerioRobertNo ratings yet

- People Vs ZZZZZDocument15 pagesPeople Vs ZZZZZRobertNo ratings yet

- People Vs ZZZDocument13 pagesPeople Vs ZZZRobertNo ratings yet

- People Vs HHHDocument11 pagesPeople Vs HHHRobertNo ratings yet

- Roxas Vs CTADocument1 pageRoxas Vs CTARobertNo ratings yet

- Commissioner of Internal Revenue Vs BotelhoDocument1 pageCommissioner of Internal Revenue Vs BotelhoRobertNo ratings yet

- The Apostolic Prefect of The Mountain Province Vs El TesoroDocument1 pageThe Apostolic Prefect of The Mountain Province Vs El TesoroRobertNo ratings yet

- Republic Vs MambulaoDocument1 pageRepublic Vs MambulaoRobertNo ratings yet

- MCIAA Exemption From Realty TaxesDocument1 pageMCIAA Exemption From Realty TaxesRobertNo ratings yet

- People Vs ContiDocument5 pagesPeople Vs ContiRobertNo ratings yet

- Cando Vs SolisDocument6 pagesCando Vs SolisRobertNo ratings yet

- Notes RulesDocument5 pagesNotes RulesRobertNo ratings yet

- Abra Valley College Vs AquinoDocument1 pageAbra Valley College Vs AquinoRobertNo ratings yet

- Delpher Trades Corporation Vs IACDocument1 pageDelpher Trades Corporation Vs IACRobertNo ratings yet

- Death Penalty or Life ImprisonmentDocument1 pageDeath Penalty or Life ImprisonmentRobertNo ratings yet

- Sanlakas VDocument2 pagesSanlakas VRobertNo ratings yet

- Villanueva Vs City of IloiloDocument1 pageVillanueva Vs City of IloiloRobertNo ratings yet

- In The Case of McBurnie VDocument1 pageIn The Case of McBurnie VRobertNo ratings yet

- Republic Vs MambulaoDocument1 pageRepublic Vs MambulaoRobertNo ratings yet

- Delpher Trades Corporation Vs IACDocument1 pageDelpher Trades Corporation Vs IACRobertNo ratings yet

- Villanueva Vs City of IloiloDocument1 pageVillanueva Vs City of IloiloRobertNo ratings yet

- Perez Vs CTADocument1 pagePerez Vs CTARobertNo ratings yet

- Roxas Vs CTADocument1 pageRoxas Vs CTARobertNo ratings yet

- Contoh Proposal Permohonan Jalan Tani ProduksiDocument2 pagesContoh Proposal Permohonan Jalan Tani ProduksiDesa BalidaNo ratings yet

- The Apostolic Prefect of The Mountain Province Vs El TesoroDocument1 pageThe Apostolic Prefect of The Mountain Province Vs El TesoroRobertNo ratings yet

- Commissioner of Internal Revenue Vs BotelhoDocument1 pageCommissioner of Internal Revenue Vs BotelhoRobertNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Past Simple Complex TestDocument3 pagesPast Simple Complex TestSerban ElenaNo ratings yet

- Distillation Technology and Modelling Techniques: Part 3: Walkthrough and Analysis of A Continuous Brandy DistilleryDocument4 pagesDistillation Technology and Modelling Techniques: Part 3: Walkthrough and Analysis of A Continuous Brandy DistillerycsandrasNo ratings yet

- Party Event ProposalDocument19 pagesParty Event ProposalMary Cris CruzadaNo ratings yet

- LiqueursDocument18 pagesLiqueursAkanksha AhujaNo ratings yet

- Cookery 11 q1 w3 Mod3Document23 pagesCookery 11 q1 w3 Mod3romarchristianorigenesNo ratings yet

- Energy Efficiency and Cost Saving Opportunities For DistilleriesDocument171 pagesEnergy Efficiency and Cost Saving Opportunities For Distilleries95654692229No ratings yet

- Strategic Business UnitDocument7 pagesStrategic Business Unitcancer4u28100% (2)

- Answer RsaDocument11 pagesAnswer RsaMayra Alejandra Murcia Castro100% (1)

- Indian Made Foreign LiquorDocument9 pagesIndian Made Foreign LiquormanagementNo ratings yet

- WSET L2 Practice Review QuestionsDocument58 pagesWSET L2 Practice Review Questionsdonhankiet100% (9)

- Mosel Fine Wines No59 Nov 2021Document117 pagesMosel Fine Wines No59 Nov 2021jack13577No ratings yet

- Ville Saint John Academy Marcelo Green Village, Parañaque: An Investigatory ProjectDocument20 pagesVille Saint John Academy Marcelo Green Village, Parañaque: An Investigatory ProjectArila RobertsNo ratings yet

- Quiz Unit 6 Student's Name: CARRERA RICRA Mariamercedes ElenaDocument6 pagesQuiz Unit 6 Student's Name: CARRERA RICRA Mariamercedes ElenaMariamercedes Elena CARRERA RICRA50% (2)

- THE STATES - October 2019Document42 pagesTHE STATES - October 2019Kanta PromsrisawatNo ratings yet

- Chapter 2 Bar OrganizationDocument28 pagesChapter 2 Bar OrganizationZon Laurence Mabalot BautistaNo ratings yet

- Elias GebremedhinDocument53 pagesElias GebremedhinNubyan Kueen KebiNo ratings yet

- Direct Variation LessonDocument10 pagesDirect Variation Lesson04.Khemakrit sawaengsriNo ratings yet

- Beer Industry in Colombia - FinalDocument22 pagesBeer Industry in Colombia - FinalAna Maria RodriguezNo ratings yet

- P3A Taking Order BeveragesDocument2 pagesP3A Taking Order BeveragesRavi KshirsagerNo ratings yet

- D'Arenberg Dead Arm Shiraz 2017Document1 pageD'Arenberg Dead Arm Shiraz 2017ericwc123456No ratings yet

- OligopolyDocument34 pagesOligopolySaya Augustin100% (1)

- Samsung Rs25j5008sg AP Manual de UsuarioDocument112 pagesSamsung Rs25j5008sg AP Manual de UsuarioJosue Alvarez GomezNo ratings yet

- Most Popular Coke VariantDocument59 pagesMost Popular Coke VariantNick Salao50% (2)

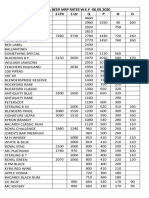

- Liquor & Beer MRP Rates Wef 17.12.2019 (1) - 1Document2 pagesLiquor & Beer MRP Rates Wef 17.12.2019 (1) - 1Kondu Krishna Vamsi ChowdaryNo ratings yet

- Ken481 en 1 1Document15 pagesKen481 en 1 1spirittechconsultancyNo ratings yet

- Vodka Brochure PDFDocument19 pagesVodka Brochure PDFvolter3No ratings yet

- 1-300-Things I Wanted To Say But Ne - Monica MurphyDocument300 pages1-300-Things I Wanted To Say But Ne - Monica MurphyVivian SuellenNo ratings yet

- 1.introduction To Heineken: MillingDocument3 pages1.introduction To Heineken: MillingNhư Quỳnh NguyễnNo ratings yet

- Processed Food: What Is The Purpose of Food Processing?Document9 pagesProcessed Food: What Is The Purpose of Food Processing?Fasra ChiongNo ratings yet

- SABMiller IndiaDocument19 pagesSABMiller Indiaadiahuja100% (1)