Professional Documents

Culture Documents

Foreign Currency Accounting Basics

Uploaded by

Mulugeta NiguseOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Foreign Currency Accounting Basics

Uploaded by

Mulugeta NiguseCopyright:

Available Formats

WU, COBE.

ACF, ADVANCED ACCOUNTING-II CHAPTER FOUR HANDOUT

CHAPTER FOUR

FOREIGN CURRENCY ACCOUNTING

4.1. INTRODUCTION

Each country uses its own currency as the unit of value for the purchase and sale of goods and

services. The currency used in the United States is the U.S. dollar, the currency used in Mexico is

the Mexican peso, and so on. If a U.S. citizen travels to Mexico and wishes to purchase local

goods, Mexican merchants require payment to be made in Mexican pesos. To make a purchase, a

U.S. citizen has to acquire pesos using U.S. dollars. The foreign exchange rate is the price at

which the foreign currency can be acquired. A variety of factors determine the exchange rate

between two currencies; unfortunately for those engaged in international business, the exchange

rate can fluctuate over time.

4.2. Types of currency-related exposures

Foreign currency risk – the net potential gain or loss which can arise from exchange rate changes

to the foreign currency exposure of the enterprise. In this context foreign currency risks can be

viewed as having three components:

1. Translation exposure (accounting exposure):- this exposure results from the translation of

foreign currency denominated financial statements into dollars. Only those financial

statement items translated at current rate of accounting create an accounting exposure

2. Transaction exposure: - this exposure exists between the time of entering a transaction and

the time of settling it. It affects the current cash flows of the enterprise. The resulting cash

gains and losses are realized and affect the enterprise’s working capital and earnings

3. Economic exposure – it arises because of the possible reduction, in terms of the domestic

reporting currency of the discounted future cash flows generated from foreign investments

or operations due to real changes (inflation adjusted) in exchange rates. It represents a long-

term potential threat or benefit to a company carrying out business in foreign countries.

4.3. Accounting for Foreign Currency Transactions

A foreign currency transaction is a transaction that is denominated or requires settlement in a

foreign currency, including transactions arising when an entity:

buys or sells goods or services whose price is denominated in a foreign currency;

borrows or lends funds when the amounts payable or receivable are denominated in a

foreign currency; or

COMPILED BY: MESELE SH. 1

WU, COBE.ACF, ADVANCED ACCOUNTING-II CHAPTER FOUR HANDOUT

Otherwise acquires or disposes of assets, or incurs or settles liabilities, denominated in a

foreign currency.

In most countries foreign currency is treated as a commodity or a money-market instrument. The

buying and selling of foreign currency as commodity results in variation in its exchange rate. A

“Multi-National Company” is one that conducts its business in more than one country via

branches, joint ventures, subsidiaries etc. If all its transactions are accounted for in one currency,

no problem arises, however often local currencies are used which must be denominated in some

other currency – the country where the country is headquarter. The transactions engaged into by

the multinational company must be recorded in the reporting currency in the accounting records

of the enterprise. The company uses the appropriate spot rate is used for this purpose.

If the spot exchange rate for the foreign currency changes on the date of financial statement

preparation prior to settlement of the transaction, or on the settlement date itself, a foreign

currency transaction gain or loss is recognized for display in the income statement of the

enterprise for the accounting period in which the rate changes.For purchase of merchandise from a

foreign supplier, the selling spot rate is used to determine the local currency denomination.

There are many reasons why a country’s currency price changes of which the major one are the

following,

Inflation rates

Interest rates and

Trade surplus and deficits

Exchange rate showing the value of Canadian dollar in terms of other foreign currency are quoted

daily in many Canadian newspapers. The amounts that usually appear are called direct quotations,

which means that the amount represents the cost in Canadian dollar to purchase one unit of foreign

currency. For example a quotation of 1 pound = CDN$2.2972 means that it cost 2.2972 Canadian

dollars. An indirect quotation will state the cost in a foreign currency to purchase 1 Canadian

dollar

Illustration

Accounting for a foreign currency transaction is illustrated using the following rates:

Date Rate (US$ / C$)

Jan 31 1.53

Feb 28 1.55

COMPILED BY: MESELE SH. 2

WU, COBE.ACF, ADVANCED ACCOUNTING-II CHAPTER FOUR HANDOUT

Mar 30 1.56

A Canadian firm purchases merchandise with an invoice price of $1,000 US on January 31, with

payment due March 30, and a fiscal year end of February 28. What entries are necessary?

At the date of purchase, this entry would be made:

Purchases 1,530

Accounts Payable 1,530

By the end of the fiscal year, the firm has incurred a $20 loss, as the firm is now liable for

C$1,550, rather than the C$1,530 at which the transaction was initially recorded conceptually, the

firm has essentially three alternatives at year end:

Ignore the fluctuation

Adjust the amount of the purchase (called the one transaction approach)

Recognize the change in currency value as an exchange loss (the two transaction approach)

Ignoring the loss is potentially dangerous, Adjustment of the price of the transaction does not

reflect the real economic events

The two transaction approach is the preferred (and generally accepted) alternative

The recognition of the exchange rate fluctuation as a separate economic event is consistent with

the view that the purchase is entirely separate from any arrangement which may have been made

for payment

At fiscal year end, the recognition of the loss is recorded in the following manner

Foreign Currency Loss 20

Accounts Payable 20

At this time, the foreign currency liability is now reported at its Canadian dollar equivalent, and

the loss is recognized in the period in which it has occurred. At final payment, this entry is made:

Accounts payable 1,550

Foreign Currency Loss 10

Cash 1,560

This further loss is also recognized in the period in which it occurs

In all cases, the foreign currency loss is a period cost, recognized in the period in which the

change in exchange rates took place Canadian companies have no particular advantage when

dealing internationally, and must frequently accept that international transactions are to be

denominated in a foreign currency rather than Canadian. These foreign currency transactions must

be recorded in the reporting currency of the company. The assets and liabilities denominated in the

COMPILED BY: MESELE SH. 3

WU, COBE.ACF, ADVANCED ACCOUNTING-II CHAPTER FOUR HANDOUT

foreign currency must be repaid in that currency, so the Canadian company will bear the risks and

costs associated with the inevitable currency fluctuations.

How does accounting for foreign currency transactions work?

When the transaction is initially entered, the amounts are recorded in the reporting currency of the

companies entering into the transaction. At each statement date, the foreign currency amount is

restated to the reporting currency equivalent, and a gain or loss is recognized. At the time of

settlement of the asset or liability, the amount is again restated to the reporting currency

equivalent, and a further gain or loss is recognized

4 . 4 . F O R E I G N C U R R E N C Y T R A N S L AT I O N

Business firms conduct operations in countries other than their home country through branch

offices, subsidiaries, affiliates, joint ventures, and other entities. Domestic firms account for their

foreign investments following the same accounting principles that they use for domestic

investments:

1. The fair value method when the ownership percentage does not convey significant influence,

usually less than 20 percent

2. The equity method when the ownership percentage does convey significant influence,

usually between 20 percent and 50 percent

3. The consolidation method for majority-owned investments (unless government restrictions

severely constrain a parent company’s ability to exercise control of the foreign subsidiary)

The foreign entities keep their accounting records in their local currencies. To apply the

appropriate accounting method for these investments, the reporting entity (say, the U.S. parent)

must translate the foreign (say, U.K.) entity’s financial statements from the foreign currency

(pound sterling, £) into the reporting currency (dollar, $), a process known as foreign currency

translation.

Translating the financial statements of foreign entities requires responses to two questions:

1. Which exchange rate should a firm use to translate each account in a foreign entity’s

financial statements?

COMPILED BY: MESELE SH. 4

WU, COBE.ACF, ADVANCED ACCOUNTING-II CHAPTER FOUR HANDOUT

2. How should the firm treat any adjustment, analogous to a gain or loss that arises from

translation?

4.4.1. Exchange Rate Used in Translation

Accounting distinguishes between the historical exchange rate and the current exchange rate. The

historical exchange rate refers to the exchange rate in effect when a firm first recorded a

particular transaction. The historical exchange rate for inventories, property, plant, and equipment

is the exchange rate at the time the firm acquired these items. The historical exchange rate for

bonds payable and common stock is the exchange rate at the time the firm issued these securities.

The current exchange rate refers to the exchange rate at the date of the balance sheet for balance

sheet items and to the actual exchange rate at the time of income transactions during the current

period (or the average exchange rate as an approximation to the actual exchange rate) for income

statement items. Firms could conceivably use the historical exchange rate for each financial

statement item, the current exchange rate for each item, or some combination of the two.

4.4.2. Treatment of Changes in Amounts that Result from Translation

Translating the amount of a financial statement account measured in a foreign currency into units

of the reporting currency may give rise to an adjustment, depending on the exchange rate used in

translation.

When firms translate foreign currency amounts into reporting currency amounts using the

historical exchange rate, changes in exchange rates do not affect the reporting currency

amount of that item because, by definition, those items appear in the reporting currency at

their acquisition cost translated at the exchange rate on the date of acquisition for assets (or on

the date of issue for equities).

When firms translate foreign currency amounts into reporting currency amounts using the

current exchange rate, changes in exchange rates do affect the reporting currency amount of

that item because those items have reporting currency amounts different from those at the date

of acquisition for assets (or at the date of issue for equities).

When the reported amount of these items varies as a result of a change in the exchange rate,

accountants refer to the amount as a foreign exchange adjustment. Firms might conceivably treat

the foreign exchange adjustment in one of two ways:

COMPILED BY: MESELE SH. 5

WU, COBE.ACF, ADVANCED ACCOUNTING-II CHAPTER FOUR HANDOUT

1. Include the amount as a foreign exchange gain or loss in the computation of net income for

the period, which firms then close to retained earnings.

2. Include the amount as a foreign exchange adjustment in other comprehensive income, a

separate component of the shareholders’ equity account, bypassing the income statement.

This treatment resembles that for unrealized holding gains and losses on marketable equity

securities classified as available for sale.

These two treatments result in identical total shareholders’ equity. They differ with respect to the

effects that the foreign exchange adjustment has on net income and on particular shareholders’

equity accounts. U.S. GAAP and IFRS require firms to use the historical exchange rate in some

situations and the current exchange rate in others. The appropriate exchange rate depends both

on whether a particular foreign operation uses a foreign currency as the primary currency for

conducting its operations or whether it uses the reporting currency as its primary currency for

operations. The next section explains U.S. GAAP and IFRS more fully.

4.5. U.S.GAAP and IFRS FOR FOREIGN CURRENCY

T R A N S L AT I O N

We discuss and illustrate next the U.S. GAAP and IFRS provisions for foreign currency

translation. We begin with a discussion of the functional currency and then illustrate foreign

currency translation procedures. FUNCTIONAL CURRENCY U.S. GAAP and IFRS require firms

to identify the functional currency of each foreign entity. The functional currency refers to the

currency of the primary economic environment in which each foreign entity operates. The

functional currency depends on the operating characteristics of the foreign entity. Statement of

Financial Accounting Standards (SFAS) No. 52 requires firms to classify each foreign entity into

one of two categories:

1. Autonomous: foreign operations are primarily contained within a particular foreign country.

That is, the foreign entity obtains capital, acquires inventories and labor services, sells to

customers, and retains earnings within the foreign country. The currency of the foreign

entity is the functional currency for self-contained foreign operations.

2. Extension of parent entity’s operations: foreign operations are primarily an extension of the

parent’s operations. That is, the foreign entity obtains capital from the parent company or

borrows in the currency of the parent, acquires inventories from the parent, and remits

COMPILED BY: MESELE SH. 6

WU, COBE.ACF, ADVANCED ACCOUNTING-II CHAPTER FOUR HANDOUT

earnings back to the parent. The reporting currency is the functional currency for foreign

units that operate as extensions of the parent.

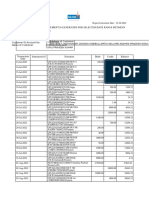

Exhibit 1 lists the five attributes of SFAS No 52 for identifying the functional currency and

characteristics that suggest use of the currency of the foreign entity as the functional currency and

those that suggest use of the reporting currency as the functional currency.

Exhibit 1

Factors for Identifying the Functional Currency of a Foreign Unit under U.S. GAAP

Currency of Foreign Entity Reporting Currency is the

Attributes is the Functional Currency Functional Currency

Cash Flows of Foreign Receivables and payables Receivables and payables

Entity denominated in foreign denominated in reporting

currency and not usually currency and readily

remitted to parent currently available for remittance to

parent

Sales Prices Influenced primarily by local Influenced by worldwide

competitive conditions and competitive conditions and

not responsive on a short- responsive on a short-term

term basis to exchange rate basis to exchange rate

changes changes

Cost Factors Foreign entity obtains labor, Foreign entity obtains labor,

materials, and other inputs materials, and other inputs

primarily within its own primarily from the country of

country the reporting entity

Financing Financing denominated in Financing denominated in

currency of foreign entity or currency of the reporting

generated internally by the entity or ongoing fund

foreign entity transfers from the parent

COMPILED BY: MESELE SH. 7

WU, COBE.ACF, ADVANCED ACCOUNTING-II CHAPTER FOUR HANDOUT

Relations between Parent Low volume of High volume of

and Foreign Entity intercompany transactions intercompany transactions

and little operational and extensive operational

interrelations between parent interrelations between parent

and foreign entity and foreign entity

The facts need not clearly signal a unique classification: a particular foreign operation can

combine aspects of the self-contained entity while still being integrated with the parent. For

example, a foreign unit may acquire raw materials from the reporting entity and remit 50 percent

of its earnings back to the reporting entity but may obtain funds within the foreign country and

sell primarily to local customers. Management must weigh all of the evidence to decide which

characterization better describes the foreign operation.

International Accounting Standard (IAS) 21 uses similar factors to SFAS No. 52 in identifying the

functional currency but places different weights on the various factors. The primary economic

environment in which a foreign entity operates, the determinant of the functional currency, is the

one in which it generates and expends cash. The cash flows of primary importance are those

related to the purchase and sale of goods and services. Firms consider:

1. The currency that primarily influences sales prices for goods and services (usually the

currency in which the foreign entity denominates and settles sales of its goods and

services).

2. The currency of the country whose competitive forces and regulations primarily

influence the sales prices.

3. The currency that primarily influences labor, material, and other costs of providing

goods and services (usually the currency in which suppliers denominate and require

settlement of such goods and services).

These three factors are the primary factors in identifying the functional currency under IFRS.

Additional factors to consider if these three factors do not clearly identify the functional currency

include the following:

1. The currency in which the foreign entity generates funds from financing.

2. The currency in which the foreign entity retains cash flows from operating activities.

3. The proportion of the activities of the foreign entity with the reporting entity.

COMPILED BY: MESELE SH. 8

WU, COBE.ACF, ADVANCED ACCOUNTING-II CHAPTER FOUR HANDOUT

4. The extent to which the cash flows from the activities of the foreign entity remain with

the foreign entity or are readily available for remittance to the reporting entity.

5. The extent to which the cash flows of the foreign entity are sufficient to service debt

obligations without funds from the reporting entity.

6. Whether the activities of the foreign entity are an extension of the reporting entity

instead of carried out with a significant degree of autonomy.

Note two important differences between U.S. GAAP and IFRS with respect to identifying the

functional currency:

1. U.S. GAAP uses a broad set of operating and financing criteria, whereas IFRS places

heavier weight on the currency in which a foreign entity makes purchases and sales of

goods and services.

2. U.S. GAAP uses the distinction between an autonomous foreign unit and a unit operating

as an extension of the as a primary scheme for identifying the functional currency,

whereas IFRS treats this distinction as only one additional factor to consider.

Thus, the functional currency of a foreign entity might differ depending on whether a reporting

entity uses U.S. GAAP or IFRS.

4.5.1. Foreign Currency Translation Provisions

The following summarizes the provisions for foreign currency translation

1. Both SFAS No. 52 and IAS 21 require the all-current translation method for self-

contained, or autonomous, foreign entities (functional currency is that of the foreign

entity or some foreign currency other than that of the reporting entity).

2. SFAS No. 52 requires the monetary-nonmonetary translation method for foreign entities

that operate as extensions of the reporting entity (functional currency is that of the

reporting entity). IAS 21 also requires use of the monetary-nonmonetary method in

these cases, but recall that for the functional currency of a foreign entity to be that of

the reporting entity under IFRS requires use of the additional factors in identifying the

functional currency.

4.6. Rationale for Foreign Currency Translation Provisions

Implicitly underlying the foreign currency translation procedures required by U.S. GAAP and

IFRS are two types of U.S. management control patterns for foreign operations:

When a domestic parent invests in self-contained foreign operations and does not expect to

recapture its investment for several years, it puts its investment at risk to exchange rate

COMPILED BY: MESELE SH. 9

WU, COBE.ACF, ADVANCED ACCOUNTING-II CHAPTER FOUR HANDOUT

changes. It delegates to managers in the foreign country the day-to-day management

decisions. Whether those foreign managers choose highly leveraged or conservative

financing, the U.S. parent considers only its own investment at risk and has put that

investment at risk for several years. The next section illustrates the method required for

self-contained foreign operations—the all-current translation accounting method. This

method calculates an exchange adjustment based on the parent’s investment in the

shareholders’ equity (= assets – liabilities) of the foreign unit. Because the parent intends to

allow the foreign unit to retain the net assets represented by its investment for many years,

U.S. GAAP and IFRS require firms to include the exchange adjustment in Accumulated

Other Comprehensive Income, a separate shareholders’ account, not in periodic net income.

For the investor in a self-contained foreign operation, U.S. GAAP and IFRS attempt to

present results as though the investor sees only its investment at risk, not the individual

assets and liabilities or the results of day-to-day operations.

In contrast, management of a domestic parent extending its operations into a foreign country

has day-today control of assets, liabilities, and operations. It intends to require the foreign

entity to remit assets generated by earnings to the parent on an ongoing basis. Remitting

assets generated by periodic earnings will likely require the foreign entity frequently to

convert foreign currency into currency of the reporting entity. Thus, the assets generated by

foreign earnings are subject to exchange rate changes on a current basis. U.S. GAAP and

IFRS require such firms to include the exchange adjustment in net income each period by

using the monetary-nonmonetary translation method. The managers of the parent concern

themselves with the affiliate’s day-to-day operations. The monetary-nonmonetary translation

method attempts to reflect, in the reporting entity’s financial statements, this day-to-day

control that managers have over their integrated and extended foreign operations.

4.7. Foreign Currency Translations Methods \

a. ALL-CURRENT TRANSLATION METHOD

Self-contained foreign operations (where the functional currency is a foreign currency) must use

the all-current translation method. The all-current method translates assets and liabilities using the

exchange rate on the date of the balance sheet. It translates revenues, expenses, and net income

using the actual exchange rate at the date of transactions during the period (or the average

exchange rate during the period as an approximation). The foreign exchange adjustment that

results from applying the all-current method appears in other comprehensive income and then

COMPILED BY: MESELE SH. 10

WU, COBE.ACF, ADVANCED ACCOUNTING-II CHAPTER FOUR HANDOUT

Accumulated Other Comprehensive Income, a separate shareholders’ equity account, and does not

affect net income each period. The rationale for the all-current method for self-contained foreign

operations results from the fact that only an investor’s investment in the net assets of the foreign

unit is at risk to exchange rate changes. That is, the U.S. investor has put at risk an amount equal to

the shareholders’ equity of the foreign unit. A decision to invest in a foreign unit and to permit the

foreign unit to retain, for internal growth, assets generated by earnings means that the parent will

not realize the benefit or incur the loss from exchange rate changes inherent in its net asset position

until either the foreign unit remits a dividend or the parent sells the foreign unit. Because such

events will not likely occur for many years, net income excludes the foreign exchange adjustment

each period under the all-current translation method.

b. MONETARY-NONMONETARY(TEMPORALMERHOD)TRANSLATION

METHOD

The accounting for foreign operations either highly integrated with a U.S. parent company (U.S.

GAAP) or where the functional currency of a foreign entity is the reporting currency must use the

monetary-nonmonetary translation method. The monetary-nonmonetary translation method

provides translated amounts for a foreign unit similar to the amounts that the parent would report if

it engaged in export transactions to carry out its foreign operations (that is, if it manufactured

goods in the country of the parent and then sold them to customers abroad) instead of operating

through a foreign entity. Because the operations of integrally related foreign units resemble export

activities, domestic firms achieve comparable reported amounts for both types of activities by

using the monetary-nonmonetary translation method.

The monetary-nonmonetary method translates monetary assets and liabilities using the current

exchange rate and translates nonmonetary assets and liabilities using the historical exchange rate.

Monetary items represent claims receivable or payable in a fixed number of foreign currency units

regardless of changes in exchange rates. Monetary items include cash, accounts receivable,

accounts payable, bonds payable, and most liabilities other than Advances from Customers.

Because firms translate monetary items using the current exchange rate, a foreign exchange

adjustment arises for these items when exchange rates change. The firm includes the foreign

exchange adjustment as an exchange gain or loss in measuring net income each period under the

monetary-nonmonetary method. The rationale results from noting that the foreign unit must

regularly convert currency (in this case from dollars to pounds or vice versa) to settle its

receivables or payables and will therefore realize the gain or loss in the near term. This near-term

COMPILED BY: MESELE SH. 11

WU, COBE.ACF, ADVANCED ACCOUNTING-II CHAPTER FOUR HANDOUT

realization contrasts with the longer-term realizability of the foreign exchange adjustment from

self-contained foreign operations translated using the all-current method.

Nonmonetary items include inventories, prepayments, property, plant and equipment,

intangible assets, advances from customers, and common stock. Unlike monetary items,

nonmonetary items do not result in a fixed future cash inflow or outflow. Translating nonmonetary

items using the historical exchange rate results in reporting them at constant reporting-currency

amounts regardless of changes in the exchange rate.

COMPILED BY: MESELE SH. 12

You might also like

- Foriegn Currency HandoutDocument11 pagesForiegn Currency Handoutdemeketeme2013No ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Class 3 & 4 Chapter 3. Reporting Financial PerformanceDocument34 pagesClass 3 & 4 Chapter 3. Reporting Financial PerformanceTowhidul IslamNo ratings yet

- Overview of Foreign Exchange Fluctuations AccountingDocument5 pagesOverview of Foreign Exchange Fluctuations AccountingJaquelyn JacquesNo ratings yet

- Accounting for Foreign Currency TransactionsDocument3 pagesAccounting for Foreign Currency TransactionsChincel G. ANINo ratings yet

- Module 3-Topic 1Document15 pagesModule 3-Topic 1MILBERT DE GRACIANo ratings yet

- Unit 3 Foreign exchange risk limitDocument16 pagesUnit 3 Foreign exchange risk limitaryait099No ratings yet

- 15 Handle Foreign Currency TransactionsDocument27 pages15 Handle Foreign Currency TransactionsTegene TesfayeNo ratings yet

- Foreign Currency Transactions (3)Document9 pagesForeign Currency Transactions (3)firaolmosisabonkeNo ratings yet

- IAS21SBRDocument29 pagesIAS21SBRademoji00No ratings yet

- Chapter 6 InternationalDocument55 pagesChapter 6 Internationalmuudey sheikhNo ratings yet

- Advance Chaper 7 & 8Document27 pagesAdvance Chaper 7 & 8abel habtamuNo ratings yet

- Advance Chaper 5 & 6Document27 pagesAdvance Chaper 5 & 6abel habtamuNo ratings yet

- Chapter 6 Foreign Currency TransactionsDocument10 pagesChapter 6 Foreign Currency Transactionsfitsum tesfayeNo ratings yet

- FOREXDocument50 pagesFOREXShubham AgarwalNo ratings yet

- AFAR 12 Foreign Currency TransactionsDocument6 pagesAFAR 12 Foreign Currency TransactionsLouie RobitshekNo ratings yet

- 2022 PPT Topic 1 V2 Effects of Changes in Foreign Exchange RatesDocument31 pages2022 PPT Topic 1 V2 Effects of Changes in Foreign Exchange RatesDarryl AgustinNo ratings yet

- Session 2 - Balance of PaymentsDocument5 pagesSession 2 - Balance of PaymentsRochelle DanielsNo ratings yet

- Types of Risk ExposureDocument9 pagesTypes of Risk ExposurePuja DuaNo ratings yet

- Effects of Foreign Currency Exchange RatesDocument14 pagesEffects of Foreign Currency Exchange RatesAddi Såïñt GeorgeNo ratings yet

- Chapter 6–Foreign Currency TranslationDocument21 pagesChapter 6–Foreign Currency TranslationRakeshNo ratings yet

- BOP, Exchange Rates & Double-Entry AccountingDocument7 pagesBOP, Exchange Rates & Double-Entry AccountingNeva TVNo ratings yet

- Foreign Exchange Risk Management StrategiesDocument13 pagesForeign Exchange Risk Management Strategieskenedy simwingaNo ratings yet

- p2 - Guerrero Ch10Document28 pagesp2 - Guerrero Ch10JerichoPedragosa67% (3)

- PAS 21 EFFECTS OF FOREIGN EXCHANGE RATESDocument7 pagesPAS 21 EFFECTS OF FOREIGN EXCHANGE RATESElizabeth DumawalNo ratings yet

- Effects of Foreign MeDocument25 pagesEffects of Foreign MeabdisawinsoNo ratings yet

- Translation of Foreign Financial Statements (IAS 21)Document6 pagesTranslation of Foreign Financial Statements (IAS 21)misonim.eNo ratings yet

- p2 Guerrero Ch10 CompressDocument28 pagesp2 Guerrero Ch10 CompressLaiza Grace FabreNo ratings yet

- 11 Foreign Currency Transactionsxx PDFDocument111 pages11 Foreign Currency Transactionsxx PDFAnjell Reyes71% (17)

- Running Head: Thes Balance of Payment 1Document4 pagesRunning Head: Thes Balance of Payment 1Ramadhan IssaNo ratings yet

- Exposure and Risk in International FinanceDocument24 pagesExposure and Risk in International Financemanojpatel51100% (6)

- 2 Balance of PaymentDocument26 pages2 Balance of PaymentkayeNo ratings yet

- Accounting For Global Commerce Chapter 14Document41 pagesAccounting For Global Commerce Chapter 14Rupesh PolNo ratings yet

- INTL FUNDS: BALANCE, TRADE, GROWTHDocument8 pagesINTL FUNDS: BALANCE, TRADE, GROWTHRose Enor100% (1)

- PAS 21 and PFRS 2Document15 pagesPAS 21 and PFRS 2VernnNo ratings yet

- 1112 Ias 21 Consolidation of Foreign Subsidiary Practice RevisionDocument24 pages1112 Ias 21 Consolidation of Foreign Subsidiary Practice RevisionsandeepvempatiNo ratings yet

- Foreign Exchange Risk ManagementDocument17 pagesForeign Exchange Risk ManagementPraseem KulshresthaNo ratings yet

- Afar 2 Module CH 13Document12 pagesAfar 2 Module CH 13Joyce Anne Mananquil100% (1)

- IND AS 21 RevisionDocument11 pagesIND AS 21 RevisionPrakashal shahNo ratings yet

- Exposure and Risk in International FinanceDocument26 pagesExposure and Risk in International FinancePakassignmentNo ratings yet

- Assignment 2Document16 pagesAssignment 2Aaqib NawazNo ratings yet

- QuestionsDocument24 pagesQuestionspranjal meshramNo ratings yet

- International EconomicsDocument58 pagesInternational EconomicsMadushaNo ratings yet

- Accounting for International Operations and Foreign ExchangeDocument4 pagesAccounting for International Operations and Foreign ExchangeAgatha de CastroNo ratings yet

- Solution Manual Advanced CH 12Document78 pagesSolution Manual Advanced CH 12Marietha Ayu SafitriNo ratings yet

- Presentation On Balance of Payment (BOP)Document22 pagesPresentation On Balance of Payment (BOP)Prabhu SNo ratings yet

- EconDev Final-Term LectureDocument124 pagesEconDev Final-Term LectureCj GarciaNo ratings yet

- ForeignDocument70 pagesForeignadsfdgfhgjhkNo ratings yet

- Unit Two & ThreeDocument14 pagesUnit Two & ThreeKassawmar DesalegnNo ratings yet

- Crisk MGMTDocument39 pagesCrisk MGMTRavi GuptaNo ratings yet

- FA ProjectDocument14 pagesFA ProjectxyzhjklNo ratings yet

- Prayoga Dwi Nugraha - Summary CH 12 Buku 2Document10 pagesPrayoga Dwi Nugraha - Summary CH 12 Buku 2Prayoga Dwi NugrahaNo ratings yet

- International Economics II Ch-3 PPTDocument62 pagesInternational Economics II Ch-3 PPTTerefe Bergene bussaNo ratings yet

- AS 11 Foreign Exchange Rates SummaryDocument19 pagesAS 11 Foreign Exchange Rates SummaryShakti ShivanandNo ratings yet

- Foreign Exchange Accounting Transaction Customer Foreign Currency SupplierDocument3 pagesForeign Exchange Accounting Transaction Customer Foreign Currency SupplierenchantadiaNo ratings yet

- Chapter 18 Issues in INternational AccountingDocument3 pagesChapter 18 Issues in INternational AccountingindraakhriaNo ratings yet

- IAS 21 Overview: Accounting for Foreign Currency Transactions and Foreign OperationsDocument22 pagesIAS 21 Overview: Accounting for Foreign Currency Transactions and Foreign OperationsJayesh S BoharaNo ratings yet

- IAS 21 Foreign CurrencyDocument3 pagesIAS 21 Foreign CurrencyYogesh BhattaraiNo ratings yet

- Noel Bergonia's Accounting Policies and Estimates GuideDocument8 pagesNoel Bergonia's Accounting Policies and Estimates GuideMika MolinaNo ratings yet

- Intrinsic Value Formula (Example) - How To Calculate Intrinsic ValueDocument17 pagesIntrinsic Value Formula (Example) - How To Calculate Intrinsic Valuehareeshac9No ratings yet

- The Mpassbook Statement Is Generated For Selected Date Range Between 14-07-2022 TO 12-10-2022. Customer DetailsDocument5 pagesThe Mpassbook Statement Is Generated For Selected Date Range Between 14-07-2022 TO 12-10-2022. Customer DetailsPraveen kumarNo ratings yet

- 6 Financial Performance Analysis of Islamic BANK PDFDocument12 pages6 Financial Performance Analysis of Islamic BANK PDFakuNo ratings yet

- Bank PDFDocument24 pagesBank PDFDeepak RajeNo ratings yet

- Chapter 13 Bonds Payable and InvestmentsDocument45 pagesChapter 13 Bonds Payable and Investmentsspur iousNo ratings yet

- Financial Management Theory Practice 15th Edition Ebook PDFDocument51 pagesFinancial Management Theory Practice 15th Edition Ebook PDFdon.anderson433100% (35)

- Chapter 22 - Business Finance - Needs and SourcesDocument3 pagesChapter 22 - Business Finance - Needs and SourcesKhoa DaoNo ratings yet

- Performance Appraisal in BanksDocument54 pagesPerformance Appraisal in BanksParag More100% (1)

- Mortgage - Hoover's Industry Snapshots, 2009Document1 pageMortgage - Hoover's Industry Snapshots, 2009Patrick AdamsNo ratings yet

- NJAILTA Vetting LetterDocument2 pagesNJAILTA Vetting Letter51 PegasiNo ratings yet

- Amendments To Regulations On Electronic Banking Services and Other Electronic OperationsDocument13 pagesAmendments To Regulations On Electronic Banking Services and Other Electronic OperationsKat GuiangNo ratings yet

- ICICI Prudential Multi-Asset Fund Tactical Note-1Document7 pagesICICI Prudential Multi-Asset Fund Tactical Note-1sdaobtrinNo ratings yet

- Business FinanceDocument6 pagesBusiness FinanceAnn Candole0% (1)

- Compound Financial InstrumentDocument2 pagesCompound Financial Instrumenthae1234No ratings yet

- Goodwill P 700,000: Multiple Choices - ComputationalDocument14 pagesGoodwill P 700,000: Multiple Choices - ComputationalLove FreddyNo ratings yet

- Razelle Ann B. Dapilaga 11 Abm, Peter DruckerDocument3 pagesRazelle Ann B. Dapilaga 11 Abm, Peter DruckerJasmine ActaNo ratings yet

- BPI Philippine High Dividend Equity Fund - November 2023 v2Document3 pagesBPI Philippine High Dividend Equity Fund - November 2023 v2Gabrielle De VeraNo ratings yet

- Aegon Annual Report 2016Document386 pagesAegon Annual Report 2016rohitmahaliNo ratings yet

- Cost and Financial Management QuizDocument3 pagesCost and Financial Management QuizNeha ArifNo ratings yet

- Finance 16UCF620-MANAGEMENT-ACCOUNTINGDocument27 pagesFinance 16UCF620-MANAGEMENT-ACCOUNTINGAkhil rayanaveniNo ratings yet

- BOP GUIDEDocument9 pagesBOP GUIDESujataNo ratings yet

- Sales ResumeDocument1 pageSales Resumeapi-517062850No ratings yet

- Buy Verified Stripe AccountDocument10 pagesBuy Verified Stripe AccountUddin PhonesNo ratings yet

- Lec8 - Class Exercise 4aDocument2 pagesLec8 - Class Exercise 4aMUHAMMAD HAMIZAN BIN ROSMAN MoeNo ratings yet

- Chapter 13 - Basic - ET3Document3 pagesChapter 13 - Basic - ET3anthony.schzNo ratings yet

- Cases RemedialDocument4 pagesCases RemedialVanillaSkyIIINo ratings yet

- United Commercial Bank's Agent Banking ModelDocument21 pagesUnited Commercial Bank's Agent Banking Modelকাজী জিয়া উদ্দিনNo ratings yet

- Focus On Personal Finance 5Th Edition Kapoor Solutions Manual Full Chapter PDFDocument45 pagesFocus On Personal Finance 5Th Edition Kapoor Solutions Manual Full Chapter PDFmiguelstone5tt0f100% (11)

- Unit 03 The Financial Statement AuditDocument31 pagesUnit 03 The Financial Statement AuditYeobo DarlingNo ratings yet

- The War Below: Lithium, Copper, and the Global Battle to Power Our LivesFrom EverandThe War Below: Lithium, Copper, and the Global Battle to Power Our LivesRating: 4.5 out of 5 stars4.5/5 (8)

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationFrom EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationRating: 4 out of 5 stars4/5 (11)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- The Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaFrom EverandThe Trillion-Dollar Conspiracy: How the New World Order, Man-Made Diseases, and Zombie Banks Are Destroying AmericaNo ratings yet

- Narrative Economics: How Stories Go Viral and Drive Major Economic EventsFrom EverandNarrative Economics: How Stories Go Viral and Drive Major Economic EventsRating: 4.5 out of 5 stars4.5/5 (94)

- The Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumFrom EverandThe Infinite Machine: How an Army of Crypto-Hackers Is Building the Next Internet with EthereumRating: 3 out of 5 stars3/5 (12)

- The Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldFrom EverandThe Genius of Israel: The Surprising Resilience of a Divided Nation in a Turbulent WorldRating: 4 out of 5 stars4/5 (17)

- Kleptopia: How Dirty Money Is Conquering the WorldFrom EverandKleptopia: How Dirty Money Is Conquering the WorldRating: 3.5 out of 5 stars3.5/5 (25)

- Vulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomFrom EverandVulture Capitalism: Corporate Crimes, Backdoor Bailouts, and the Death of FreedomNo ratings yet

- Second Class: How the Elites Betrayed America's Working Men and WomenFrom EverandSecond Class: How the Elites Betrayed America's Working Men and WomenNo ratings yet

- The Finance Curse: How Global Finance Is Making Us All PoorerFrom EverandThe Finance Curse: How Global Finance Is Making Us All PoorerRating: 4.5 out of 5 stars4.5/5 (18)

- Chip War: The Quest to Dominate the World's Most Critical TechnologyFrom EverandChip War: The Quest to Dominate the World's Most Critical TechnologyRating: 4.5 out of 5 stars4.5/5 (227)

- Nudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentFrom EverandNudge: The Final Edition: Improving Decisions About Money, Health, And The EnvironmentRating: 4.5 out of 5 stars4.5/5 (92)

- Look Again: The Power of Noticing What Was Always ThereFrom EverandLook Again: The Power of Noticing What Was Always ThereRating: 5 out of 5 stars5/5 (3)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationFrom EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationRating: 4.5 out of 5 stars4.5/5 (46)

- The Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetFrom EverandThe Myth of the Rational Market: A History of Risk, Reward, and Delusion on Wall StreetNo ratings yet

- Principles for Dealing with the Changing World Order: Why Nations Succeed or FailFrom EverandPrinciples for Dealing with the Changing World Order: Why Nations Succeed or FailRating: 4.5 out of 5 stars4.5/5 (237)

- Economics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsFrom EverandEconomics 101: From Consumer Behavior to Competitive Markets—Everything You Need to Know About EconomicsRating: 5 out of 5 stars5/5 (2)

- Doughnut Economics: Seven Ways to Think Like a 21st-Century EconomistFrom EverandDoughnut Economics: Seven Ways to Think Like a 21st-Century EconomistRating: 4.5 out of 5 stars4.5/5 (37)

- The Lords of Easy Money: How the Federal Reserve Broke the American EconomyFrom EverandThe Lords of Easy Money: How the Federal Reserve Broke the American EconomyRating: 4.5 out of 5 stars4.5/5 (69)

- How an Economy Grows and Why It Crashes: Collector's EditionFrom EverandHow an Economy Grows and Why It Crashes: Collector's EditionRating: 4.5 out of 5 stars4.5/5 (102)