Professional Documents

Culture Documents

FIN546 - Exam Question

Uploaded by

Luqmanulhakim JohariCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FIN546 - Exam Question

Uploaded by

Luqmanulhakim JohariCopyright:

Available Formats

1

CONFIDENTIALBA/JULY2021/FIN546

FACULTY OF BUSINESS AND MANAGEMENT

FINAL ASSESSMENT

COURSE : ISLAMIC FINANCE

COURSE CODE : FIN546

EXAMINATION : JULY 2021

TIME : 3 HOURS

INSTRUCTIONS TO CANDIDATES

1. This question paper consists of 2 parts: PART A (30 Questions)

PART B (4 Questions)

2. Please make sure you have a stable internet connection and well-functioning devices

before attempting to take the examination to avoid any unwanted disruptions.

3. Use any suitable PLATFORM

4. No resources including digital notebooks, external websites, notes stored within local

storage, other software applications or hard-copy resources are permitted during the

final assessment. All other web browser windows must be closed during the

examination.

5. Mobile phones and other electronic devices must be switched off during final

assessment unless it is used to take the assessment.

6. Students are strictly prohibited from interacting with others during the final

assessment by any means of communication other than with the respective

lecturer/invigilator for technical support or any issues considered appropriate and

important.

7. Please keep an eye on the clock. You may want to set the alarm to remind you of the

remaining time in your exam (e.g., 30 minutes).

8. Students must click the submit button before the time off to allow the system to

record the answers. You can only submit your answers ONCE.

9. Please contact your lecturer for any technical difficulties experienced or any error

messages shown during the examination. It would be useful to take a screenshot or

video of the problem so that improvements can be enforced.

10. Disciplinary action will be taken against the student who violates any of the general

final assessment guidelines or additional instructions in place from time to time.

11. ALL answer must be HANDWRITTEN, CLEAR and READABLE.

12. Answer ALL questions in English.

13. Scan or take picture and converted to PDF form.

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 8 written pages

©Hak Cipta Universiti Teknologi MARACONFIDENTIAL

2

CONFIDENTIALBA/JULY2021/FIN546

PART A

1. Islamic banks rely on the following two (2) major sources of funds:

A) Transaction deposits and accounts receivables.

B) Investment deposits and current accounts.

C) Transaction deposits and investment deposits.

D) Accounts payable and investment accounts.

(2 marks)

2. A muslim can continue earning rewards even after death. Waqf is the best instrument

for facilitating this through the followings, EXCEPT:

A) Property waqf involves physical assets such as mosques, plots of land,

houses, hospitals, offices, buildings, and other properties.

B) Corporate waqf in the form of corporate shares are issued and managed by a

corporate body.

C) Cash waqf differs from the ordinary property of waqf in its original capital

consisting of purely or partially cash.

D) Revenue waqf created for a limited or fixed period such as from the

agricultural project selling and buying crops under the contract of Bai’ As-

Salam.

(2 marks)

3. Religious Supervisory Board of Islamic banks play an important role in;

A) Determination of the ratio of profit-sharing according to Islamic principles.

B) Raising capital for the banks according to Islamic principles.

C) Introduction of new product and services that comply with Islamic principles.

D) Mobilization of funds according to Islamic principles.

(2 marks)

4. The followings are the issues of Islamic money market on a global perspective,

EXCEPT:

A) There is limited availability of Shari’ah compliant money market instruments.

B) There is variability of the instruments among member countries.

C) In some countries, money market participants tend to buy and hold these

securities until the maturity rather than trade them.

D) Determining the prices of these securities is not a problem.

(2 marks)

5. All of the statements below concerning Government Investment Issues (Gll) are

correct EXCEPT;

A) The government is obliged to return the principal amount to the providers on

funds at maturity.

B) To provide Islamic banks a Shari’ah compliant avenue to meet the statutory

liquidity requirements.

C) The successful bidders will pay cash to the government at par based on credit

term.

D) It is governed by Government Investment Act (Malaysia) 1983.

(2 marks)

6. Islamic credit cards use which Shariah concepts?

A) Qard and Murabahah

B) Ujrah and Tawarruq

C) BBA and Bai Al-Inah

D) Musyarakah and Ijarah

©Hak Cipta Universiti Teknologi MARACONFIDENTIAL

3

CONFIDENTIALBA/JULY2021/FIN546

(2 marks)

7. Islamic Bank Guarantee and Islamic Shipping Guarantee are based on the same

Shariah principles. They are;

A) Murabahah and Kafalah

B) Kafalah and Wakalah

C) Mudharabah and Kafalah

D) Kafalah and Bai Al-Inah

(2 marks)

8. Which of the following statement about Islamic interbank money market is NOT

TRUE?

A) The overnight market is where the Islamic Financial Institutions trade their

reserve balances among themselves to meet their day-to-day liquidity

requirements.

B) Islamic Interbank money market is a place where banks trade money market

instruments among themselves.

C) A short-term market rate, in particular the interbank overnight rate, may be

used to serve as an operational guide for monetary operations of central

banks.

D) The Shari’ah contracts typically used in the Islamic interbank market are

Mudharabah, Murabahah, Bay’ al-dayn, Bay’ al-Inah and Wakalah.

(2 marks)

9. The following are the steps of Islamic personal financing based on Tawarruq,

EXCEPT;

A) Bank sells commodity to customer at Murabahah.

B) Bank buys commodity from commodity broker once bank receives customer

request.

C) Instruct agent to dispose commodity for immediate settlement.

D) Bank pays purchase price of commodity to customers.

(2 marks)

10. The following are the roles of Bursa Malaysia in Islamic Capital Market development

EXCEPT;

A) Regulatory and risk management duties.

B) Explore for potential growth and develop infrastructures of Islamic Capital

Market.

C) Develop dual market systems.

D) Encourage companies to be Shari’ah compliant.

(2 marks)

11. Which of the following is CORRECT on Malaysian approach in regulating Islamic

Capital Market?

A) Islamic instruments must fulfill the specific requirement for Shariah compliant

first, before fulfilling the general regulatory requirement.

B) Guidelines on offering Islamic securities are the example of General

Regulatory Requirement.

C) The specific requirement for Shariah compliant involve the appointment of

Shariah advisor and approval by Shariah advisory council.

D) Conventional instrument must not fulfill the General Regulatory Requirement

only.

(2 marks)

©Hak Cipta Universiti Teknologi MARACONFIDENTIAL

4

CONFIDENTIALBA/JULY2021/FIN546

12. Mulia and Milia are interested to venture in a business and they are agreed to

contribute the capital of RM15,000 and RM35,000 respectively. They were also

agreed to have predetermined profit sharing at ratio of 40:60 (Mulia:Milia). However,

if the business suffered losses of RM6,000, calculate the difference of total losses to

be borne by them.

A) RM2,571.43

B) RM2,400.00

C) RM2,000.00

D) RM1,800.00

(2 marks)

13. Purification in Islamic mutual fund can be done in two (2) ways;

A) Capital gain and loss purification.

B) Non-halal and cleansing purification.

C) Dividend and impermissible income purification.

D) Management and earning purification.

(2 marks)

14. Miss Rina approaches an Islamic bank and applies for financing under the concept of

BBA. The purchase price of the house is RM800,000 and the profit rate offered is 7

percent. The financing period is 15 years and she has to pay the selling price in 180

equal monthly installments. Please calculate the total profit of the bank given the

annuity factor based on 0.008988.

A) RM7,190.40

B) RMM1,294,272

C) RM56,000

D) RM494,272

(2 marks)

15. The following are the reasons for the needs of regulation of Islamic Financial

Institution

EXCEPT;

A) To protect the interest of depositors and investment account holders of

Islamic Financial Institutions.

B) To ensure the products offered are comply with Shariah.

C) To facilitate development and national financial markets by delineating

relative investment or credit risk.

D) To support the integration of Islamic Financial Institutions in the International

Financial System.

(2 marks)

16. Which of the following is FALSE about Islamic savings deposit?

A) The bank can offer incentives to attract new depositors in the form of gift,

promotional item and etc.

B) The banks need to offer competent and solid money and capital market.

C) To be founded upon an established and secure payment system.

D) To help in the reduction of information and provisional costs.

(2 marks)

©Hak Cipta Universiti Teknologi MARACONFIDENTIAL

5

CONFIDENTIALBA/JULY2021/FIN546

17. Which of the following is CORRECT about the role of an efficient Islamic financial

intermediary.

A) To serve as One Stop Islamic Finance Reference Centre for the Islamic

Finance industry.

B) To provide with the understanding and support, necessary to succeed in the

implementation and offering of Islamic financial products and services.

C) To prepare accounting, auditing, governance, ethics and Shariah standards

for Islamic Financial Institutions and the industry.

D) To have a well-developed market for risk trading to protect economic agents

from both event risks and financial risks.

(2 marks)

18. An entrepreneur was offered Musharakah financing contract with the following

details:

Principal = RM100,000

Rate of return = 8% p.a.

Profit sharing ratio = 70:30 (Bank: Entrepreneur)

Term = 6 months

Calculate the entrepreneur’s gain from this contract.

A) RM2,800

B) RM1,200

C) RM33,600

D) RM14,400

(2 marks)

19. The following are the features of Qard based deposit EXCEPT;

A) It will be returned by the borrower to the lender at the end of the agreed

period at full amount, without incurring any extra amount.

B) It is based on Tawarruq which requires the customers to appoint the Islamic

bank as an authorized agent.

C) The bank is entitled to use these deposited funds at its own risk without any

authorization from the depositor.

D) The principal amount is guaranteed by the bank to the depositor even if there

is negligence or loss from the side of the bank.

(2 marks)

20. Mudharabah Muqayyadah is;

A) a form of contract where the capital provider restricts manager to a particular

type of business or to a particular location.

B) is a form of contract whereby two (2) or more parties into a contract to exploit

their labor and capital jointly and to share the profits & losses of the

partnership.

C) is a form of contract where the capital provider does not restrict manager and

give him full freedom in terms of capital administration.

D) is a form of contract of participation, whereby the funding party agrees to

deliver a commodity or an asset at a pre-determined future time at an agreed

pre-determined future time at an agreed price.

(2 marks)

21. Yield on ___________ are typically higher than government securities. These flexible

©Hak Cipta Universiti Teknologi MARACONFIDENTIAL

6

CONFIDENTIALBA/JULY2021/FIN546

instruments may help issuers to meet their short-term funding needs in that the

issuers may roll over the debt by issuing new papers to redeem outstanding ones.

A) Commercial Paper

B) Negotiable Certificate of Deposit

C) Treasury Bills

D) Repurchase Agreement

(2 marks)

22. Islamic banks also provide automobile financing facilities similar to the conventional

hire purchase. The following information is an example of car financing provided by

Kuwait Islamic Bank;

Concept : Al-Ijarah Thumma Al-Bai

Tenure : 9 years

Bank’s profit rate : 3.3% per annum

Amount to be financed : RM150,000

Calculate the monthly payments due to Kuwait Islamic Bank.

A) RM4,550.00

B) RM1,388.90

C) RM1,945.00

D) RM1,801.40

(2 marks)

23. Which of the following is NOT the money market instrument?

A) Banker’s Acceptance

B) Factoring

C) Repurchase Agreement

D) Commercial Paper

(2 marks)

24. The benefits of Islamic Working Capital Financing are as follow EXCEPT;

A) Provide flexibility in utilization of customer’s credit facility.

B) Competitive pricing and margin of financing.

C) No commitment fee on unutilized limit.

D) Only national accepted Shariah concept used.

(2 marks)

25. Any of two (2) roles and functions of Securities Commission are;

i) To ensure speedy processing and approval of corporate transactions.

ii) To influence the credit situation to the advantage of Malaysia.

iii) To operate a fully integrated exchange, offering the complete range of

exchange related services.

iv) To execute regulatory and investigating powers with regard to compliance

under the Securities Industry Act 1983 and Securities Industry (Central

Depositories) Act 1991.

A) i, ii

B) i, iv

C) ii, iii

D) iii, iv

(2 marks)

26. The following statements are true for Banker Acceptance (BA) and Islamic Accepted

Bill (IAB), EXCEPT;

A) IAB is a bill that could be accepted by the bank (IAB/export) or customer

(IAB/import).

B) BA is a bill that is only accepted by the bank.

C) IAB-import/purchase is based on lending; hence interest penalty is imposed.

©Hak Cipta Universiti Teknologi MARACONFIDENTIAL

7

CONFIDENTIALBA/JULY2021/FIN546

D) There is no restriction on only halal goods to be transacted in BA.

(2 marks)

27. Initiative taken by Malaysian government in supporting Islamic Capital Market

EXCEPT;

A) Addressing regulatory and tax issues.

B) Issuance of Islamic Capital Market guidelines.

C) Establishment of dedicated Shariah court to sit in judgment on matters

relating to Islamic Capital Market.

D) Establishment of Shariah framework.

(2 marks)

28. The description of Islamic letter of credit musharakah is/are as below:

A) The Islamic bank requires the customer to deposit a certain percentage of

money prior to the importation of goods.

B) The Islamic bank will then issue an ILC and make the payment using both the

customer’s and its own funds.

C) The customer is responsible for selling the goods and returning the bank’s

portion of capital together with a predetermined portion of the profit.

D) All of the above.

(2 marks)

29. Which statement is CORRECT about Takaful.

A) Takaful operator makes a profit when there are underwriting surplus.

B) Contract of exchange (sale and purchase) between insurer and insured.

C) Participant’s duty to make contributions to the scheme and is expected to

mutual share the surplus.

D) There is no restriction in investment of funds.

(2 marks)

30. Islamic Bank Guarantee may fall into the following categories EXCEPT;

A) Tender Guarantee

B) Export Guarantee

C) Performance Guarantee

D) Guarantee of subcontracts

(2 marks)

©Hak Cipta Universiti Teknologi MARACONFIDENTIAL

8

CONFIDENTIALBA/JULY2021/FIN546

PART B

QUESTION 1

Islamic banks have face challenges in implementing Musyarakah as a mode of financing

although it was the most desired form of financing in the eyes of Shari’ah. Interpret four (4)

challenges in implementing Musyarakah financing.

(10 marks)

QUESTION 2

The objectives of Shari’ah are to promote the well-being of all mankind. Explain any five (5)

objectives of Shari’ah.

(10 marks)

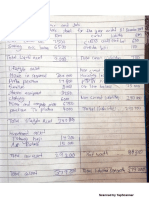

QUESTION 3

Yuyu purchased one (1) lot of Tup Tang Berhad (a shariah-compliant stock) share on 2nd of

June 2020 at price of RM3.85 per share. However, on 29th of November 2020, Securities

Commission has announced that Tup Tang Berhad shares has been declassified from

Shariah compliant list.

The prices per unit share of Tup Tang Berhad are as follows:

Transaction Date Closing price per unit share

Oct 22nd, 2020 RM 6.10

Nov 29th, 2020 RM 6.60

Nov 30th, 2020 RM 6.65

January 10th, 2021 RM 4.50

Calculate the amount of capital gain per unit of share she received and she can keep based

on each date of transaction.

(10 marks)

QUESTION 4

Prepare the distinguish between the Islamic Letter of Credit and Islamic Bank Guarantee.

(10 marks)

END OF QUESTION PAPER

©Hak Cipta Universiti Teknologi MARACONFIDENTIAL

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- 1.0 Introduction To Islamic Mu'amalatDocument31 pages1.0 Introduction To Islamic Mu'amalatLuqmanulhakim JohariNo ratings yet

- Bidding Patterns, Experience, and Avoiding The Winner's Curse in Online AuctionsDocument28 pagesBidding Patterns, Experience, and Avoiding The Winner's Curse in Online AuctionsLuqmanulhakim JohariNo ratings yet

- Towards A Digital Workerism Workers Inquiry MethoDocument13 pagesTowards A Digital Workerism Workers Inquiry MethoLuqmanulhakim JohariNo ratings yet

- MGT657 - Muhamad Faris Bin Yusof - Individual Assignment 2Document5 pagesMGT657 - Muhamad Faris Bin Yusof - Individual Assignment 2Luqmanulhakim JohariNo ratings yet

- Assignment Elc 231Document14 pagesAssignment Elc 231Luqmanulhakim JohariNo ratings yet

- Astro Malaysia Holding Case Study AnalysisDocument54 pagesAstro Malaysia Holding Case Study AnalysisLuqmanulhakim JohariNo ratings yet

- Fin533 Individual Assignment: Topic: Your Family'S Financial Planning Assignment 1 (10%)Document1 pageFin533 Individual Assignment: Topic: Your Family'S Financial Planning Assignment 1 (10%)Luqmanulhakim JohariNo ratings yet

- Ent530 - Social Media RubricsDocument3 pagesEnt530 - Social Media RubricsLuqmanulhakim JohariNo ratings yet

- Strategic Management (MGT657) : Individual Assignment 3 (Case Study)Document21 pagesStrategic Management (MGT657) : Individual Assignment 3 (Case Study)Luqmanulhakim JohariNo ratings yet

- BBA Finance Group AssignmentDocument8 pagesBBA Finance Group AssignmentLuqmanulhakim JohariNo ratings yet

- Analysis of Oil and Gas Stocks Using Support, Resistance and TrendlinesDocument9 pagesAnalysis of Oil and Gas Stocks Using Support, Resistance and TrendlinesLuqmanulhakim JohariNo ratings yet

- Luqmanul Hakim 2020977427Document1 pageLuqmanul Hakim 2020977427Luqmanulhakim JohariNo ratings yet

- Research Proposal The Macroeconomic Determinants of Housing PriceDocument87 pagesResearch Proposal The Macroeconomic Determinants of Housing PriceLuqmanulhakim JohariNo ratings yet

- Nurmaizierah Binti Rohaizad 2020177263Document9 pagesNurmaizierah Binti Rohaizad 2020177263Luqmanulhakim JohariNo ratings yet

- MGT657 - Case Study 2 - Saif Al Hanif Bin Suryono - 2020791857 - Jba2425cDocument5 pagesMGT657 - Case Study 2 - Saif Al Hanif Bin Suryono - 2020791857 - Jba2425cLuqmanulhakim JohariNo ratings yet

- FACULTY OF BUSINESS AND MANAGEMENT BACHELOR OF BUSINESS ADMINISTRATION (HONS) FINANCE FIN552 INVESTMENT AND PORTFOLIO ANALYSIS INDIVIDUAL ASSIGNMENT TRADING SIMULATIONDocument17 pagesFACULTY OF BUSINESS AND MANAGEMENT BACHELOR OF BUSINESS ADMINISTRATION (HONS) FINANCE FIN552 INVESTMENT AND PORTFOLIO ANALYSIS INDIVIDUAL ASSIGNMENT TRADING SIMULATIONLuqmanulhakim JohariNo ratings yet

- Individual Ict500 Luqmanul Hakim Bin Johari 2020977427 Jba2425b Assignment1 PDFDocument32 pagesIndividual Ict500 Luqmanul Hakim Bin Johari 2020977427 Jba2425b Assignment1 PDFLuqmanulhakim Johari67% (3)

- Luqmanul Hakim Bin Johari (2020977427) Individual Assignment Case Study 1Document7 pagesLuqmanul Hakim Bin Johari (2020977427) Individual Assignment Case Study 1Luqmanulhakim JohariNo ratings yet

- Luqmanul Hakim Bin Johari - 2020977427Document14 pagesLuqmanul Hakim Bin Johari - 2020977427Luqmanulhakim JohariNo ratings yet

- Fin 533 Luqmanul Hakim 2020977427 JBC2422BDocument5 pagesFin 533 Luqmanul Hakim 2020977427 JBC2422BLuqmanulhakim JohariNo ratings yet

- Challenge of Zakat ManagementDocument10 pagesChallenge of Zakat ManagementLuqmanulhakim JohariNo ratings yet

- Luqmanul Hakim 2020977427Document1 pageLuqmanul Hakim 2020977427Luqmanulhakim JohariNo ratings yet

- Case Study MGT657 Fatin Nur Shahira Jono 2019359357 PDFDocument6 pagesCase Study MGT657 Fatin Nur Shahira Jono 2019359357 PDFLuqmanulhakim JohariNo ratings yet

- Profiling Report Ubm599 - Nurul Ashiqin Binti Ariffin - 2020969063 - Ba2424dDocument82 pagesProfiling Report Ubm599 - Nurul Ashiqin Binti Ariffin - 2020969063 - Ba2424dLuqmanulhakim Johari100% (4)

- Assignment 1 Fin 430Document12 pagesAssignment 1 Fin 430Luqmanulhakim JohariNo ratings yet

- Challenge of Zakat ManagementDocument10 pagesChallenge of Zakat ManagementLuqmanulhakim JohariNo ratings yet

- Topic: Effect of Covid19 Toward Bank Islam Malaysia Berhad (BIMB) ProfitabilityDocument7 pagesTopic: Effect of Covid19 Toward Bank Islam Malaysia Berhad (BIMB) ProfitabilityLuqmanulhakim JohariNo ratings yet

- Topic: Effect of Covid19 Toward Bank Islam Malaysia Berhad (BIMB) ProfitabilityDocument7 pagesTopic: Effect of Covid19 Toward Bank Islam Malaysia Berhad (BIMB) ProfitabilityLuqmanulhakim JohariNo ratings yet

- Luqmanul Hakim Jbc2423bDocument8 pagesLuqmanul Hakim Jbc2423bLuqmanulhakim JohariNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Iibf & Nism Adda: Certified Treasury ProfessionalsDocument365 pagesIibf & Nism Adda: Certified Treasury Professionalsnageswara kuchipudi0% (1)

- Econ 121 Money and Banking Instructor: Chao WeiDocument3 pagesEcon 121 Money and Banking Instructor: Chao WeiSyed Hassan Raza JafryNo ratings yet

- BFB4133 Financial Markets and Institutions Course NotesDocument101 pagesBFB4133 Financial Markets and Institutions Course NotesMakisha NishaNo ratings yet

- Management of Transaction ExposureDocument22 pagesManagement of Transaction ExposurePeter KoprdaNo ratings yet

- Focus and Question: Erica Cristsl Bolante Bsba FM 1Document6 pagesFocus and Question: Erica Cristsl Bolante Bsba FM 1Erica BolanteNo ratings yet

- Transaction Exposure: Prepared by Mr. Amit A Rajdev, Faculty of Finance, VMPIMDocument32 pagesTransaction Exposure: Prepared by Mr. Amit A Rajdev, Faculty of Finance, VMPIMNishant RaghuwanshiNo ratings yet

- FIM Anthony CH End Solution PDFDocument287 pagesFIM Anthony CH End Solution PDFMosarraf Rased50% (6)

- A PROJECT REPORT On Mutual Fund A Safer InvestmentDocument56 pagesA PROJECT REPORT On Mutual Fund A Safer InvestmentBabasab Patil (Karrisatte)100% (1)

- Commercial Bills MaktDocument18 pagesCommercial Bills MaktHaresh Kansara100% (1)

- CH 1 FIIMDocument28 pagesCH 1 FIIMKume MezgebuNo ratings yet

- Part III Money Market (Revised For 2e)Document31 pagesPart III Money Market (Revised For 2e)Harun MusaNo ratings yet

- Indian FSDocument27 pagesIndian FSnitishbhardwaj123No ratings yet

- Unit 1-The Organisation of The Financial Industry PDFDocument25 pagesUnit 1-The Organisation of The Financial Industry PDFNguyễn Văn NguyênNo ratings yet

- International Financial Reporting StandardsDocument23 pagesInternational Financial Reporting StandardsAneela AamirNo ratings yet

- Structure of Banking IndustryDocument13 pagesStructure of Banking IndustryMarwa HassanNo ratings yet

- GsnubeDocument169 pagesGsnubeAnonymous 4yXWpDNo ratings yet

- ICICI Pru LifeTime Classic BrochureDocument62 pagesICICI Pru LifeTime Classic Brochurenethaji74No ratings yet

- Senior School Certificate Examination March - 2023 Marking Scheme - Business Studies 66/1/1, 66/1/2, 66/1/3Document26 pagesSenior School Certificate Examination March - 2023 Marking Scheme - Business Studies 66/1/1, 66/1/2, 66/1/3bhaiyarakeshNo ratings yet

- An Overview of The Financial System: ChoiceDocument32 pagesAn Overview of The Financial System: ChoiceHaris Fadžan0% (1)

- Bank of Punjab ReportDocument44 pagesBank of Punjab ReportMonaaa79% (14)

- Far 1 Notes Chapter 4Document66 pagesFar 1 Notes Chapter 4Nagaeshwary MuruganNo ratings yet

- Topic 2 Financial EnvironmentDocument11 pagesTopic 2 Financial EnvironmentMardi UmarNo ratings yet

- Chapter 1Document11 pagesChapter 1xyzNo ratings yet

- Financial Markets and Institutions 6Th Edition: Powerpoint Slides ForDocument33 pagesFinancial Markets and Institutions 6Th Edition: Powerpoint Slides ForPratik PatelNo ratings yet

- Indian Financial SystemDocument75 pagesIndian Financial SystemVipul TandonNo ratings yet

- MAF653 June 2017 Exam SolutionsDocument7 pagesMAF653 June 2017 Exam SolutionsANo ratings yet

- Mutual Fund Faysal Bank Asignment 3Document10 pagesMutual Fund Faysal Bank Asignment 3Zohaib Jamil WahajNo ratings yet

- Financial Market PDFDocument64 pagesFinancial Market PDFsnehachandan91No ratings yet

- Discount MarketDocument13 pagesDiscount MarketAakanksha SanctisNo ratings yet

- GEC Elect 2 Module 4Document10 pagesGEC Elect 2 Module 4Aira Mae Quinones OrendainNo ratings yet