Professional Documents

Culture Documents

Income Tax Basics for Individuals

Uploaded by

Isabelle HanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Basics for Individuals

Uploaded by

Isabelle HanCopyright:

Available Formats

UNIT 2 – INCOME TAX ON INDIVIDUALS

INCOME TAX

- tax on a person's income, emoluments, profits arising from property, practice of profession, conduct of trade or business or on the

pertinent items of gross income specified in the Tax Code of 1997 (Tax Code), as amended, less the deductions and/or personal and

additional exemptions, if any, authorized for such types of income, by the Tax Code, as amended, or other special laws

PERSON:

1. Natural Person – an individual

2. Juridical Person – Corporations, Partnerships, Joint Ventures

CLASSIFICATION OF INDIVIDUALS:

1. Citizen

A. Resident (Under Sec. 1, Art. IV of the 1987 Constitution)

- citizen of the Philippines at the time of the adoption of this Constitution

- whose fathers or mothers are citizen of the Philippines

- born before January 17, 1973, of Filipino mothers, who elect Philippine citizenship upon reaching

the age of majority

- naturalized in accordance with law

B. Non-Resident

Citizen of the Philippines:

- whose physical presence abroad is with a definite intention to reside therein

- leaves the Philippines to reside abroad as an immigrant or for employment on a permanent basis

(e.g. OCW & OFW)

- works and derives income from abroad whose employment thereat requires him to be physically present abroad “most of the

time” (at least 183 days) during the taxable year

- has been previously considered as non-resident citizen and who arrives in the Philippines at any time during the taxable year to

reside permanently in the Philippines

2. Alien

A. Resident

- lives in the Philippines with no definite intention as to his stay

- comes to the Philippines for a definite purpose which in its nature would require an extended stay and to that end makes his

home temporarily in the Philippines

- has acquired residence in the Philippines and retains his status as such until he abandons the same and actually departs from the

Philippines

B. Non-Resident

- comes to the Philippines for a definite purpose which in its nature may be promptly accomplished

- may either be: ETB or NETB

- if has stayed for an aggregate of more than 180 days—NRAETB

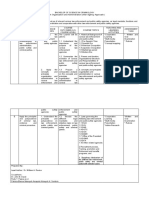

TAXABILITY OF INDIVIDUALS

TYPE Earned within the Philippines Earned outside the Philippines

Resident Citizen Taxable Taxable

Non-Resident Citizen Taxable Non-Taxable

Resident Alien Taxable Non-Taxable

Non-Resident Aline (whether engaged

Taxable Non-Taxable

in trade or business or not)

TAXABILITY OF CORPORATIONS

TYPE Earned within the Philippines Earned outside the Philippines

Domestic Corporations Taxable Taxable

Resident Foreign Corporations Taxable Non-Taxable

Non-Resident Foreign Corporations Taxable Non-Taxable

RULES ON SITUS (whether earned within or outside the Philippines)

INCOME SITUS

1. Interest - residence of the debtor

2. Dividends within if coming from:

A. Domestic Corporation

B. Foreign Corporation (50% of gross income

earned within PH)

3. Services - where performed

4. Rentals and Royalties - where the property is located or the place of

use of the intangible

5. Sale of Real Property - where the real property is located

6. Sale of Personal Property Purchase: where the property is sold

Produced: partly within/without

7. Income earned partly within

and outside the Philippines

REQUISITES OF INCOME

1. There must be gain or profit.

2. The gain must be realized or received

3. The gain must not be excluded by law or treaty from taxation.

SOURCES OF INCOME FOR INDIVIDUAL TAXPAYERS

1. Compensation

- remuneration received under an employee-employer relationship

2. Business or Professional Income

- sole proprietorship business, from practice of profession, share in the income of GPP (General Professional Partnership)

3. Passive Income

- income generated without any active conduct (Interest, Royalties, Dividends, etc.)

4. Capital Gains

- from the sale of capital assets

ALLOWABLE DEDUCTIONS FOR INDIVIDUAL TAXPAYERS

1. Itemized Deductions

- expenses incurred in conducting the business or in the practice of profession provided that they meet all

the requirements for deductibility

2. Optional Standard Deduction (OSD)

- 40% of Gross Sales or Receipts

- if mixed income, 40% will not include compensation income

3. Special Allowable Itemized Deductions

A. Rooming-in and Breast-feeding Practices (RA 7600)

B. Adopt a School Program (RA 8525)

NOTE: No longer available starting January 1, 2018 (due to TRAIN Law)

4. Basic Personal Exemption

5. Additional Exemption

6. Premium Payment on Health and/or Hospitalization Insurance (PPHHI)

BASIC FORMAT OF COMPUTATIONS

1. Pure Compensation Income

Gross Taxable Compensation Income P xxx

Less: Non-Taxable Compensation Income* (xxx)

Taxable Income** xxx

Tax Due xxx

Less: Withholding Tax on Compensation (xxx)

Tax Payable (Refundable) xxx

*includes those benefits provided by the employer which are considered de minimis or otherwise exempted from income tax such as

mandatory government and other contributions

**less Basic and Personal Exemptions if prior to Jan. 1, 2018

2. Pure Business or Professional Income Availing of the Graduated Fees

Gross Sales/Receipts from Business or Professions* P xxx

Less: Costs and Allowable Deductions (OSD or Itemized) (xxx)

Taxable Income** xxx

Tax Due xxx

Less: Withholding Tax xxx

(xxx)

Creditable Tax xxx

Tax Payable (Refundable) xxx

*shall be gross of any applicable withholding taxes—note that creditable withholding taxes are deducted from the Tax Due; not as

reductions to gross income to arrive at Taxable Income

**less Basic and Personal Exemptions if prior to Jan. 1, 2018

3. Pure Business or Professional Income Availing of the 8% Income Tax

Gross Sales/Receipts* P xxx

Other Operating Income xxx

Less: First P250,000 exempt from Income Tax (P250,000)

Taxable Sales/Receipts xxx

Tax Rate 8%

Income Tax xxx

Less: Withholding Tax xxx

(xxx)

Creditable Tax xxx

Tax Payable (Refundable) xxx

*no deduction for costs or any other items of deduction, save for sales returns, discounts and allowances.

4. Mixed Income Earners

Compensation Income – always subject to the graduated rights

Income from Business/Practice of Profession:

1. less than or equal to P3,000,000

a) 8% income tax rate without the first P250,000 exempt (already considered in the compensation income)

b) graduated rights

2. more than P3,000,000 – graduated rights

You might also like

- Tax1 SummaryDocument8 pagesTax1 SummarychimchimcoliNo ratings yet

- Tax 2 TSNDocument38 pagesTax 2 TSNCamille EveNo ratings yet

- Compensation IncomeDocument21 pagesCompensation IncomeRyDNo ratings yet

- (Tax1) - Income Tax On Individuals - Discussion and ActivitiesDocument12 pages(Tax1) - Income Tax On Individuals - Discussion and ActivitiesKim EllaNo ratings yet

- TAX - Income Tax On IndividualsDocument10 pagesTAX - Income Tax On Individualsall about seventeenNo ratings yet

- NT - Items of Gross Income 0510 - Income TaxDocument7 pagesNT - Items of Gross Income 0510 - Income TaxElizah PorcadoNo ratings yet

- Individual Income Tax (Summary)Document12 pagesIndividual Income Tax (Summary)Random VidsNo ratings yet

- Individual Income Tax GuideDocument15 pagesIndividual Income Tax GuideChristelle JosonNo ratings yet

- Individual Income TaxDocument6 pagesIndividual Income Taxira concepcionNo ratings yet

- Deductions From Gross Income - 020807Document9 pagesDeductions From Gross Income - 020807Hilarie JeanNo ratings yet

- Notes Income Taxation IndividualDocument10 pagesNotes Income Taxation IndividualTriscia QuiñonesNo ratings yet

- 1B Introduction To Income TaxDocument9 pages1B Introduction To Income Taxnoir cunananNo ratings yet

- Basic Principles On Income TaxationDocument7 pagesBasic Principles On Income TaxationMark Kyle P. AndresNo ratings yet

- Income Tax Prelims.Document13 pagesIncome Tax Prelims.Amber Lavarias BernabeNo ratings yet

- Income Taxation of Individual Taxpayers in The Philippines: 25k/child 25k/child 25k/childDocument7 pagesIncome Taxation of Individual Taxpayers in The Philippines: 25k/child 25k/child 25k/childLet it beNo ratings yet

- ERG TAX 7.0 CorporationDocument22 pagesERG TAX 7.0 CorporationRiyo Mae MagnoNo ratings yet

- Lesson 3 - CopopopopopDocument2 pagesLesson 3 - Copopopopop在于在No ratings yet

- Income Tax BasicsDocument7 pagesIncome Tax BasicsRonn Robby RosalesNo ratings yet

- Tax1 Notes With TrainDocument57 pagesTax1 Notes With TrainYeahboi100% (1)

- Lesson 3 - Fundamentals of Income Taxation PDFDocument9 pagesLesson 3 - Fundamentals of Income Taxation PDFErika ApitaNo ratings yet

- Income Taxation IndividualDocument6 pagesIncome Taxation IndividualJessa BeloyNo ratings yet

- Lecture 2 Income Taxation IndividualDocument5 pagesLecture 2 Income Taxation IndividualJohn Daryl P. DagatanNo ratings yet

- Lesson 5: Taxation of CorporationsDocument14 pagesLesson 5: Taxation of CorporationsGio yowyowNo ratings yet

- College of Accountancy & Business Administration Taxation I: Santiago City, PhilippinesDocument3 pagesCollege of Accountancy & Business Administration Taxation I: Santiago City, PhilippinesVel JuneNo ratings yet

- Income Tax Rates & ClassificationsDocument216 pagesIncome Tax Rates & ClassificationsalicorpanaoNo ratings yet

- Gross Income: Lecture Notes OnDocument2 pagesGross Income: Lecture Notes Onmigueltanfelix149No ratings yet

- Taxation Income TaxationDocument73 pagesTaxation Income TaxationB-an Javelosa0% (1)

- Ch04 Taxation of Corp. TRAIN With Answers 1Document15 pagesCh04 Taxation of Corp. TRAIN With Answers 1Nicole100% (1)

- Income Taxation Lesson 3Document6 pagesIncome Taxation Lesson 3DYLANNo ratings yet

- Introduction of Income TaxDocument29 pagesIntroduction of Income TaxKathlyn PostreNo ratings yet

- W4 Module 4-Concept of Income and Gross IncomeDocument24 pagesW4 Module 4-Concept of Income and Gross IncomeElmeerajh JudavarNo ratings yet

- Income-Tax OutlineDocument41 pagesIncome-Tax OutlineAnonymous YNTVcDNo ratings yet

- Report Tax RevDocument10 pagesReport Tax RevMarga ErumNo ratings yet

- Lecture 2 - Income Taxation (Individual)Document8 pagesLecture 2 - Income Taxation (Individual)Lovenia Magpatoc100% (1)

- Tax Booklet As of 10 November 2016 PDFDocument20 pagesTax Booklet As of 10 November 2016 PDFmaronbNo ratings yet

- CTT ReviewerDocument28 pagesCTT ReviewerAlexa Mae BuenafeNo ratings yet

- Income Taxation: Preliminary ModuleDocument28 pagesIncome Taxation: Preliminary ModuleNovelyn Cena100% (1)

- Ch04 Taxation of CorporationsDocument13 pagesCh04 Taxation of CorporationsKyla ArcillaNo ratings yet

- Taxation Chapter Explains Individual Income Tax RatesDocument31 pagesTaxation Chapter Explains Individual Income Tax RatesDerick Ocampo FulgencioNo ratings yet

- Intro RIT - Exclusion in GIDocument23 pagesIntro RIT - Exclusion in GIdelacruzrojohn600No ratings yet

- Income Tax On Individuals - Ust PDFDocument15 pagesIncome Tax On Individuals - Ust PDFKana Lou Cassandra Besana100% (1)

- Introduction To Taxation What Is Taxation?Document5 pagesIntroduction To Taxation What Is Taxation?Monica MonicaNo ratings yet

- Lecture 3 - Income Taxation (Corporate)Document5 pagesLecture 3 - Income Taxation (Corporate)Paula MerrilesNo ratings yet

- Name of Form Bir Form Filing and Payment DescriptionDocument4 pagesName of Form Bir Form Filing and Payment DescriptionMelrose Eugenio ErasgaNo ratings yet

- TAX Notes AdditionalDocument18 pagesTAX Notes AdditionalJoben Vernan CuencaNo ratings yet

- Income Tax: Global Income TaxDocument4 pagesIncome Tax: Global Income TaxMichelle Muhrie TablizoNo ratings yet

- Rule:: Revenue From Sales Revenue From ProfessionDocument2 pagesRule:: Revenue From Sales Revenue From Profession在于在No ratings yet

- Guide to Philippine Income and Withholding TaxesDocument8 pagesGuide to Philippine Income and Withholding TaxesEunice SerneoNo ratings yet

- Introduction to Income TaxationDocument34 pagesIntroduction to Income TaxationKaryl Magno Pajaroja100% (1)

- Income Tax On IndividualsDocument29 pagesIncome Tax On IndividualsJamielene TanNo ratings yet

- Unit 3 - Concepts of Income & Income TaxationDocument10 pagesUnit 3 - Concepts of Income & Income TaxationJoseph Anthony RomeroNo ratings yet

- Individual Income TaxDocument12 pagesIndividual Income TaxNica Jane MacapinigNo ratings yet

- Regular Income Tax: Inclusion in Gross IncomeDocument9 pagesRegular Income Tax: Inclusion in Gross IncomeE.D.JNo ratings yet

- References: Philippine Tax Code CREATE Law TRAIN Law Income Taxation, Banggawan RR8-2018 RR14-2001 RR12-2007 RA 9520Document16 pagesReferences: Philippine Tax Code CREATE Law TRAIN Law Income Taxation, Banggawan RR8-2018 RR14-2001 RR12-2007 RA 9520Mark Lawrence YusiNo ratings yet

- LPU Manila Tax Lecture on Individual Income TaxDocument3 pagesLPU Manila Tax Lecture on Individual Income TaxAbby TañafrancaNo ratings yet

- Income Tax PDFDocument16 pagesIncome Tax PDFMay Tan100% (1)

- Regular Income Tax CharacteristicsDocument12 pagesRegular Income Tax CharacteristicsMa. Alessandra BautistaNo ratings yet

- Chapter8 TaxationonindividualsDocument12 pagesChapter8 TaxationonindividualsChristine Joy Rapi MarsoNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- DeCrescenzo v. Scientology: Motion For Stay During AppealDocument17 pagesDeCrescenzo v. Scientology: Motion For Stay During AppealTony OrtegaNo ratings yet

- Sulapas Report - Art. 219220221222 2Document40 pagesSulapas Report - Art. 219220221222 2Loid AguhobNo ratings yet

- Late Payment - What Can We Do When We Don't Get Paid - Claims ClassDocument4 pagesLate Payment - What Can We Do When We Don't Get Paid - Claims ClassChelimilla Ranga ReddyNo ratings yet

- Effects of Loss When Thing Sold is DestroyedDocument34 pagesEffects of Loss When Thing Sold is DestroyedPalangkikay WebNo ratings yet

- Thief in LawDocument7 pagesThief in LawG. Gordon LiddyNo ratings yet

- The Works of The Right Honorable Edmund Burke 12 5eDocument448 pagesThe Works of The Right Honorable Edmund Burke 12 5egubanuleNo ratings yet

- Social Committee Charter-1Document3 pagesSocial Committee Charter-1api-295465531No ratings yet

- The West Indian Slave LawsDocument4 pagesThe West Indian Slave Lawsmickaylia greenNo ratings yet

- 5.11 v. Wal-Mart - Taclite Pro Pants PDFDocument57 pages5.11 v. Wal-Mart - Taclite Pro Pants PDFMark JaffeNo ratings yet

- Tommy G. Perkins v. United States, 962 F.2d 7, 4th Cir. (1992)Document2 pagesTommy G. Perkins v. United States, 962 F.2d 7, 4th Cir. (1992)Scribd Government DocsNo ratings yet

- Supreme Court Rules Against Double Jeopardy in Fatal Car Accident CaseDocument10 pagesSupreme Court Rules Against Double Jeopardy in Fatal Car Accident CaseVic FrondaNo ratings yet

- Bryskman ComplaintDocument12 pagesBryskman ComplaintasamahavvNo ratings yet

- The Meaning and Making of EmancipationDocument215 pagesThe Meaning and Making of EmancipationPrologue Magazine100% (6)

- MEEDocument2 pagesMEEGraile Dela CruzNo ratings yet

- Law of Evidence & Legal Ethics 5 yDocument5 pagesLaw of Evidence & Legal Ethics 5 yZeesahnNo ratings yet

- Tamil Nadu Buildings Lease and Rent Control Act 1960Document62 pagesTamil Nadu Buildings Lease and Rent Control Act 1960arunithiNo ratings yet

- Analysis of Rehabilitation Programs in Pasig City JailDocument2 pagesAnalysis of Rehabilitation Programs in Pasig City JailJohn Kevin DizonNo ratings yet

- Yale Law Journal Article Exploring the Exercise of Presidential Pardoning Power in the PhilippinesDocument15 pagesYale Law Journal Article Exploring the Exercise of Presidential Pardoning Power in the PhilippinesNico NicoNo ratings yet

- Crim1 Case DigestsDocument50 pagesCrim1 Case DigestsJanneil Monica Morales78% (9)

- Japzon Vs COMELECDocument3 pagesJapzon Vs COMELECKryss Angelie RoseroNo ratings yet

- ART+COM Innovationpool v. GoogleDocument12 pagesART+COM Innovationpool v. GooglePriorSmartNo ratings yet

- Evanston - Northwestern University Memorandum of Understanding Regarding Annual PaymentsDocument23 pagesEvanston - Northwestern University Memorandum of Understanding Regarding Annual PaymentsJonah MeadowsNo ratings yet

- Narte, Luzvminda - Deed of Sale of Parcel of LandDocument2 pagesNarte, Luzvminda - Deed of Sale of Parcel of LandRL AVNo ratings yet

- Procedure for Disconnecting Electricity SupplyDocument2 pagesProcedure for Disconnecting Electricity SupplyAdv Atul SuryavanshiNo ratings yet

- Specific Performance - Section 53 A - Transfer of Property ActDocument13 pagesSpecific Performance - Section 53 A - Transfer of Property ActSudeep Sharma100% (1)

- Crime That PaysDocument3 pagesCrime That PaysTrd CatNo ratings yet

- Terms and ConditionsDocument2 pagesTerms and ConditionsAdrienne87aNo ratings yet

- Law Enforcement Organization and Administration (Inter-Agency Approach)Document3 pagesLaw Enforcement Organization and Administration (Inter-Agency Approach)Seagal Umar100% (3)

- Mayer Steel Pipe vs. CA: 273 SCRA 432 (1997)Document4 pagesMayer Steel Pipe vs. CA: 273 SCRA 432 (1997)jirah cheeNo ratings yet

- DOE Application FormDocument2 pagesDOE Application FormAlyssa ValerioNo ratings yet