Professional Documents

Culture Documents

Self Study Assessment

Uploaded by

RENUKA THOTECopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Self Study Assessment

Uploaded by

RENUKA THOTECopyright:

Available Formats

SELF-STUDY ASSESSMENT

Instructions :

1. Maximum Marks – 10

2. Last Date for Submission – April 2, 2022

3. Answer (Any Two) Sub-Questions from Q.1 and Q.2

______________________________________________________________________________

Q.1 Explain briefly (Any two) of the followings (in not more than 500 words) : (5 Marks)

A. Indian Financial Markets

B. Factors affecting capital structure

C. Fintech

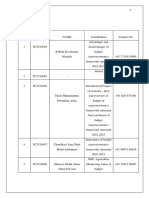

Q. 2 Solve the following exercises (Any two) (5 Marks)

A. An investor deposits `10,000 in a bank account for 5 years at 8% interest. Find out the

amount which he will have in his account if interest is compounded (a) annually (b) semi-

annually (c) quarterly and (d) continuously.

B. If the discount/required rate is 10%, compute the present value of the cashflow streams

detailed below: (a) `100 at the end of year 1 (b) `100 at the end of year 5 (c) `100 for the

next 10 years (for year 1 to 10)

C. A firm has EBIT of `40,000. The firm has a 10% debentures of `1,00,000 and its current

equity capitalization rate is 16%. Calculate the current value of the firm and its overall cost

of capital according to traditional approach?

The firm is considering increasing the leverage by issuing additional `50,000 debentures

and using the proceeds to retire that amount of equity. If, however, as the firm increases

the proportion of debt, cost of debenture would rise to 11% and cost of equity to 17%.

But if the firm issues `1,00,000 debentures instead of `50,000 (that is having `2,00,000

debentures) and uses the proceeds to retire that amount of equity, than due to increased

financial risk cost of debt would be 12.50% and cost of equity would be 20%. Advice the

firm about the optimum capital structure. Also calculate the total value of the firm and the

overall cost of capital for all the three alternatives.

--------------------------------

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Pestle Analysis of Hero Motocorp Case Study HelpDocument24 pagesPestle Analysis of Hero Motocorp Case Study HelpRENUKA THOTENo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Sample Masthead For Question PaperDocument2 pagesSample Masthead For Question PaperRENUKA THOTENo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Macroeconomic Framework Statement of Budget Macroeconomics Framework Statement 2022-2023 Group No - 16Document16 pagesMacroeconomic Framework Statement of Budget Macroeconomics Framework Statement 2022-2023 Group No - 16RENUKA THOTENo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Numericals On Corporate ActionsDocument2 pagesNumericals On Corporate ActionsRENUKA THOTENo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Fundamental Analysis of AEGIS LOGISTICS Using PorterDocument4 pagesFundamental Analysis of AEGIS LOGISTICS Using PorterRENUKA THOTENo ratings yet

- Business Environment and Its Salient FeaturesDocument7 pagesBusiness Environment and Its Salient FeaturesRENUKA THOTENo ratings yet

- Security Analysis and Portfolio Mgmt.Document3 pagesSecurity Analysis and Portfolio Mgmt.RENUKA THOTENo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Goods and Services Tax (GST)Document5 pagesGoods and Services Tax (GST)RENUKA THOTENo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Role of Government in BusinessDocument4 pagesThe Role of Government in BusinessRENUKA THOTENo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Covid-19 and Its Impact On Business EconomyDocument8 pagesCovid-19 and Its Impact On Business EconomyRENUKA THOTENo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Atma Nirbhar Bharat PGDMDocument3 pagesAtma Nirbhar Bharat PGDMRENUKA THOTENo ratings yet

- Five Year Plans in IndiaDocument5 pagesFive Year Plans in IndiaRENUKA THOTENo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Future and Growth of Life InsuranceDocument4 pagesFuture and Growth of Life InsuranceRENUKA THOTENo ratings yet

- Green EconomyDocument5 pagesGreen EconomyRENUKA THOTENo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- DemonetisationDocument6 pagesDemonetisationRENUKA THOTENo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)