Professional Documents

Culture Documents

39 - 1992 Spring

Uploaded by

Linda ZwaneCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

39 - 1992 Spring

Uploaded by

Linda ZwaneCopyright:

Available Formats

SPRING 1992 ISSUE 39

A PUBLICATION OF THE MARKET TECHNICIANS ASSOCIATION

71 BROADWAY, 2ND FLOOR, C/O NYSSA l NEW YORK, NEW YORK 10006 l (212) 344-l 266

MARKET TECHNICIANS ASSOCIATION JOURNAL

Issue 39 Spring 1992

Editor

James J. Bohan

Merrill Lynch

New York, New York

Associate Editors

John R. McGinley Michael J. Moody, CMT

Technical Trends Smith Barney Harris Upham

Wilton, Connecticut Los Angeles, California

Manuscript Reviewers

Frederick Dickson, CMT David Upshaw, C.F.A., CMT

TDA Capital Waddell and Reed Investment Management

Westport, Connecticut Shawnee Mission, Kansas

Richard Orr, Ph.D. Anthony W. Tabell

John Gutman Investments Delafield, Harvey, Tabell

Lexington, Massachusetts Princeton, New Jersey

Henry 0. Pruden, Ph.D.

Golden Gate University

San Francisco, California

Printer Publisher

Tritech Services Market Technicians Association

New York, New York 71 Broadway, 2nd Floor

New York, New York 10006

MTA JOURNAL / SPRING 1992 1

MARKET TECHNICIANS ASSOCIATION, INC.

Member and Affiliate Information

ELIGIBILITY: REGULAR MEMBERSHIP is available to those “whose professional efforts are

spent practicing financial technical analysis that is either made available to the investing public

or becomes a primary input into an active portfolio management process and for whom technical

analysis is the basis of their decision-making process.”

AFFILIATE category is available to individuals who are interested in keeping abreast of the field

of technical analysis, but who don’t fully meet the requirements for regular membership. Privileges

are noted below.

APPLICATION FEES: A one-time application fee of $10.00 should accompany all applications

for regular members, but is not necessary for affiliates.

DUES: Dues for Members, and Affiliates are $150.00 per year and are payable when joining the

MTA and thereafter upon receipt of annual dues notice mailed on July 1.

Benefits of MTA

Regular

Members Affiliates

Invitation to Monthly MTA Educational

Meetings Yes Yes

Receive Monthly MTA Newsletter Yes Yes

Receive MTA Journal Yes Yes

Use of MTA Library Yes Yes

Participate on Various Committees Yes Yes

Eligible to Chair a Committee Yes No

Eligible to Vote Yes No

Colleague of IFTA Yes Yes

Annual Subscription to the MTA Journal for non-members - $50.00 (minimum two issues).

Single Issue of MTA Journal (including back issues) - $20.00 each for members and affiliates,

and $30.00 for non-members.

2 MTA JOURNAL / SPRING 1992

STYLE SHEET FOR THE SUBMISSION OF ARTICLES

MTA Editorial Policy

The MARKET TECHNICIANS ASSOCIATION JOURNAL is published by the Market Technicians Associ-

ation, 71 Broadway, 2nd Floor, New York, NY 10006 to promote the investigation and analysis of

price and volume activities of the world’s financial markets. The MTA Journal is distributed to

individuals (both academic and practitioner) and libraries in the United States, Canada, Europe

and several other countries. The Journal is copyrighted by the Market Technicians Association

and registered with the Library of Congress. All rights are reserved.

Style For The MTA Journal

All papers submitted to the MTA Journal are ences should be put at the end of the article. Sub-

requested to have the following items as pre- mission on disk is encouraged by arrangement.

requisites to consideration for publication:

4. Greek characters should be avoided in the

text and in all formulae.

1. Short (one paragraph) biographical presenta-

tion for inclusion at the end of the accepted 5. Two submission copies are necessary.

article upon publication. Name and affiliation

will be shown under the title. Manuscript of any style will be received and ex-

amined, but upon acceptance, they should be

2. All charts should be provided in camera-ready prepared in accordance with the above policies.

form and be properly labeled for text reference.

Mail your manuscripts to:

3. Paper should be submitted double-spaced if

typewritten, in completed form on 8% by 11 James Bohan

inch paper. If both sides are used, care should Merrill Lynch, No. Tower

be taken to use sufficiently heavy paper to World Financial Center

avoid reverse side images. Footnotes and refer- New York, NY 10281-1214

MTA JOURNAL ! SPRING 1992 3

MARKET TECHNICIANS ASSOCIATION

Board of Directors, 1991-92

Officers/Office Manager

President Vice-President/Long Range Vice-President/Seminar

Bruce Kamich, CMT Philip Erlanger, CMT John Brooks, CMT

MCM Inc. Fidelity Management Davis, Mendel & Regenstein

71 Broadway, 11th Fl. 82 Devonshire Street-N9A 2100 River Edge Parkway, #750

New York, NY 10006 Boston, MA 02109 Atlanta, GA 30328

2121908-4326 6171570-7248 404/850-3838

Treasurer Secretary MTA Office Manager

Steven Nison, CMT Ken Tower, CMT Shelley Lebeck

Merrill Lynch, No. Tower Delafield, Harvey, Tabell Market Technicians Association

World Finl. Center, 21st Fl. 5 Vaughn Drive 71 Broadway, 2nd Fl., clo NYSSA

New York, NY 10281-1321 Princeton, NJ 08543-5209 New York, NY 10006

2121449-1859 609/987-2300 2121344-1266 FAX: 2121673-9334

Committee Chairpersons

Programs Education Marketing

James Stewart, CMT Ralph Acampora, CMT Ron Daino, CMT

NatWest USA Prudential Securities Inc. Smith Barney

175 Water Street, 20th Fl. 1 Seaport Plaza, 23rd Fl. 1345 Avenue of Americas, 27th Fl.

New York, NY 10038 New York, NY 10292 New York, NY 10105

2121602-1085 2121214-2273 212/698-6006

Newsletter Library Computer Applications

Jack Cahn Michael Moody, CMT David Runkle

CahniVince & Company Smith Barney Private Management

5100 Oakland, #221 333 So. Grand Avenue, 52nd Fl. 375 Indian Hills Court SE

St. Louis, MO 63110 Los Angeles, CA 90071 Salem, OR 97302

3141535-6810 213/486-8901 5031399-7992

Journal Ethics and Standards Futures/FX

James Bohan Philip Roth, CMT Andrew Humphrey

Merrill Lynch, No. Tower Dean Witter Reynolds Aubrey Lanston & Co.

World Financial Center 2 World Trade Center, 63rd Fl. 20 Broad Street, 15th Fl.

New York, NY 10281-1214 New York, NY 10048 New York, NY 10005

2121449-0552 2121392-3516 212/612-1628

Accreditation IFTA Liaison Regional

Alan Shaw, CMT David Krell, CMT Phillip (Skip) Becker

Smith Barney, 27th Fl. New York Stock Exchange Bufka and Rodgers

1345 Ave. of Americas 11 Wall Street, 23rd Fl. 425 No. Martingale Road, #1350

New York, NY 10105 New York, NY 10005 Schaumburg, IL 60173

2121698-6296 2121656-2865 708/240-2240

Membership Placement Past President

Mike Epstein Ken Spence Robert Prechter, Jr., CMT

Richard A. Rosenblatt 8z Co. c/o Market Technicians Assn. New Classics Library

20 Broad Street, 26th Fl. 71 Broadway, 2nd Fl. PO. Box 1618

New York, NY 10005 New York, NY 10006 Gainesville, GA 30503

2121943-5225 2121344-1266 4041536-0309

4 MTA JOURNAL / SPRING 1992

TABLE OF CONTENTS

Instability in the Moving Window Correlation

Stock Market .. .. . .. .. . .. .. .. . .. . 9 Stability and its Use in

Richard C. On; Ph.D. There appears to be Indicator Evaluation . . . . . . . . . .21

recurring patterns in markets and just about David Aronson One way to determine the

every natural phenomenon. Patterns don’t usefulness of an indicator is to correlate the

repeat in exactly the same way, however, and indicator with the future performance of the

we need indicators to provide a warning when market. David Aronson carries the concept

the market might be sensitive to external a step further by showing how the indi-

stimuli. Dick Or-r provides us with a tech- cator’s relationship to the market changes

nique, utilizing the concepts of volatility and over time and by providing an estimate of

instability, to judge the stock market’s vul- the indicator’s stability. A method of combin-

nerability to shock, based on the concept of ing indicators that have a low level of corre-

fractal dimension from chaos theory. lation with each other is also suggested.

Railroad Track Charts: The Barron’s

The Use of Trading Bands Confidence Index

in Stock Selection . . . . . . . . . . . . . .13 Revisited . . . . . . . . . . . . . . . . . . . . . . . . . .29

Michael Baum Technical analysts often Bruce M. Kamich For many years the

use chart patterns to determine the trend of Confidence Index was a tool employed by

a stock and oscillators show if an item is over- technicians to analyze the stock market.

bought or oversold. Trading bands, however, The indicator has declined in popularity in

can provide the information at a single recent years, but Bruce Kamich has found

glance. Michael Baum shows how he inter- a new use for the Confidence Index by

prets the performance of a stock from its relating it to the movement of bond prices.

fluctuations within a trading range.

MTA JOURNAL / SPRING 1992 5

A Sealed Room and Membership and

Only One Client.. . . . . . . . . . . . . . . .35 Affiliate

Henry 0. Pruden, Ph.D. How many times Information. . . . . . . . . . . . . . . . . . . . . . . . .2

has news, fundamental information or for

that matter the everyday mundane demands

of the job distracted you at a critical juncture

of the market? John Magee felt the need for

a private place to help him focus on the

market without distractions. Hank Pruden Style Sheet for the

carries the concept a step further by provid-

Submission

ing some practical suggestions on how we can

assimilate our own objectives with our clients of Articles . . . . . . . . . . . . . . . . . . . . . . . . . . .3

objectives to provide the best possible service.

The Impact of Commodity

Prices on Bonds and MTA Officers and

Stocks: An Intermediate Committee

Term View . . . . . . . . . . . . . . . . . . . . . . . .39 Chairpersons. . . . . . . . . . . . . . . . . . . . . . .4

John J Murphy For many years techni-

cians were content to analyze markets in

isolation. In recent years, however, there has

been a greater tendency to use information

derived from other markets. John Murphy

has popularized the use of inter-market

Editor’s

analysis and shows the linkages between Commentary . . . . . . . . . . . . . . . . . . . . . . .7

stocks, bonds and commodities.

6 MTA JOURNAL/SPRING 1992

Editor’s Commentary

by James Bohan, Editor

The Journal has published an extra edition that you we lack knowledge or have a bias towards. Reviewing

will find enclosed with the regular edition of the Jour- manuscripts for the Journal, however, forces one to

nal. The extra is an index of all the articles published open up and consider all forms of analysis and

since January of 1978. Seminar editions issued in approaches. Working with authors to qualify papers

May were excluded. The index contains a summary can be arduous at times, but most often leads to a new

of each article sorted by subject. An author sort is also working relationship with a peer. An increase in

included. knowledge of the publication process is another

The MTA would like to thank Shelley Lebeck and benefit. Mike Moody will take over as editor this sum-

John Blasic for conceiving the idea for the index. mer. I am sure that Mike, who chaired the Library

John is also responsible for organizing the index by Committee the last two years and has been on the

author and subject and for summarizing the articles. Journal Committee, will find the task rewarding. I

The members should find the index useful in their will continue to handle the production end for Mike.

research. It could prove to be especially helpful for The MTA is changing due to a broadening of the

those preparing new articles for the Journal, espe- membership. An important part of the change is the

cially those writing CMT papers. CMT program that is an attempt to increase the level

Back copies of the old Journals are available in of professionalism by qualifying technical analysts.

limited supply and copies of individual articles are The CMT had been a two part process consisting of

available from the MTA. A form at the back of the two examinations. The Journal became involved in

index should help expedite orders. The charge is to the accreditation process because a paper could take

cover MTA costs. Members and afiliates may also the place of the second exam. All CMT candidates

borrow a back journal from the MTA library. who started the process in 1991 will have to take a

The flow of articles to the Journal has slowed of second exam and a Journal paper will be mandatory.

late. Members and affiliates are encouraged to sub- Writing a paper on a technical topic can be a worth-

mit their manuscripts for publication. Keep in mind while learning experience for the candidate and it

that CMT articles have more stringent requirements contributes to the base of research in the field.

than regular Journal articles in terms of content. (See In May fifty candidates started the certification

the CMT guidelines.) The index of past articles can process and forty candidates took the second exam.

be a source. Consider reviewing an old topic bringing In coming years, therefore, the number of papers sub-

it up to date and providing some new insights. mitted to the Journal will increase sharply. The flow

The recent survey of members conducted by Phil could become a burden on the Accreditation and Jour-

Erlanger, chairman of the Long Range Planning nal committees. Various solutions to handle the

Committee, showed that the members value the MTA increased workload are being discussed. The most

Journal. To improve the content, however, we need obvious solution will be to increase the size of the

wider participation. In addition to writing an article, committees. An alternative solution will be to grade

consider passing on your views on an article or on a the papers. Those who fail to pass will be able to

topic affecting the membership. Frequently letters to resubmit the paper after having made the recom-

the editor can provide additional insight on a topic. mended changes. The Journal would then be able to

select papers for editing and publication.

Passing the Baton

Editing the MTA Journal over the past two years This Issue’s Articles

has been a rewarding experience. I recommend it to The MTA awarded three CMT designations for

anyone who wants to broaden their exposure within contributions to the current Journal to Michael

technical analysis. There is a tendency to stick with Baum, John Murphy and Bruce Kamich. David Aron-

tools we are comfortable with and avoid areas where son’s article fulfills the CMT requirement, but he

MTA JOURNAL / SPRING 1992 7

must fulfill the requirements to become a regular

member before using the CMT designation. Tech-

nical analysis is becoming a fusion of different

techniques and the current issue of the Journal

provides a blending of new and old approaches. Dick

Orr supplies us with a new indicator derived from

his work on Chaos. David Aronson adds to the

literature on selecting and combining indicators.

Michael Baum provides us with his approach to

trading bands while John Murphy gives insight to

inter-market analysis. Hank Pruden shows the im-

pact of psychology and remaining focused.

8 MTA JOURNAL / SPRING 1992

Instability in the Stock Market

by Richard C. Orr, Ph.D.

Introduction of these extremes, for the eight days in question. In

One of the problems facing all market modelers is order to simplify terminology, volatility and in-

the lack of a controlled environment in which to stability are defined as follows:

experiment. If an event occurs, we can only guess

Volatility = Eight-day Moving Average of Daily Range.

at its precise impact on coincident market behavior.

The premise to be explored here is that there is an Instability = Eight-day RangeNolatility.

underlying structure to the market which deter-

mines to a large degree how it will absorb or fail to Instability as defined above is inversely related

absorb shocks. A classic situation is that of the Ken- to the approximate fractal dimension of an eight-day

nedy assassination on November 22, 1963. Clearly fractal thumbprint of the market, a concept dis-

the market had not “discounted” this event, yet cussed in a previous paper (see3). The actual calcula-

within a week this very strong market had complete- tion of the approximate fractal dimension can be

ly absorbed the tragedy and had resumed its long rather overwhelming (see l), but our instability

bull move. On the other hand, the market was so value serves the purpose quite nicely. The eight-day

unstable in early October 1987 that a moderate range is then just the product of its instability fac-

decline became a crash. tor and its volatility factor. As Table 1 clearly

In previous articles (see 2 and 3), I have argued demonstrates, larger ranges tend to have both larger

that there is a very subtle structure in the equity instability and volatility factors. If we look at the

market which is chaotic, in the scientific sense of the eight-day range by decile over the period 1984-91,

word. More recently, a new book by Edgar Peters (see both the average instability and volatility factors are

4) makes the same point from a different perspec- higher for each larger decile of eight-day range.

tive. The purpose of this paper is to demonstrate a

technique based on the concept of fractal dimension

from chaos theory, but involving only relatively sim- TABLE 1.

ple calculations, that provides us with a way to

measure the market’s tendency to trend or to move GEOMETRIC AVERAGES OF INSTABILITY

in a trading range. This process can also act as an AND VOLATILITY FACTORS FOR A GIVEN

DECILE OF &DAY RANGE (l/84-12/91)

early warning signal for the occurrence of explosive

moves in the market, either up or down.

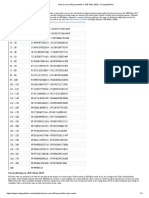

- S-DAY AVERAGE AVERAGE AVERAGE

RANGE &DAY INSTABILITY VOLATILITY

Instability and Volatility as Components DECILE RANGE FACTOR FACTOR

of Range 1.790 2.423 0.739

In general, the range of prices refers to the entire : 2.363 2.748 0.861

3 2.659 2.886 0.922

set of values taken on over someperiod of time: hourly, 2.951 3.037 0.972

daily, weekly, et cetera. For our purposes, we will 2 3.261 3.297 0.989

6 3.633 3.456 1.052

define the range over somespecific time interval to be: 4.096 3.710 1.105

ii 4.688 3.908 1.200

9 5.529 3.995 1.383

(Percent) Range = lOO(High-Low)/((High+Low)/B). 10 0.232 4.096 2.006

In what follows we will show that the daily range

behavior for the past eight days affects the total

range of prices for the next eight days. Using the A Dramatic Change in the Market’s Stability

above definition, the eight-day range of a series of In January 1984, the underlying structure of the

prices is just 100 times the difference between the market changed. If one looks at a graph of the B-day

highest and lowest prices divided by the midpoint range values from 1979 to 1990 (see Figure I), the

MTA JOURNAL / SPRING 1992 9

change is almost imperceptible. However if one looks these two components nearly offset each other, their

at the two components of 8-day range, namely product which is the eight-day range did not show

volatility and stability over the same period (see the change. Instability may be thought of as the

Figures 2 and 3), the shift is more obvious. What tendency of prices to run in one direction, rather

becomes clear is that very early in 1984 the market than moving in a trading range. The more unstable

decreased in volatility and increased in instability. the market, the less a sequence of bars will tend to

Whether or not this was the effect of the serious use overlap each other on a bar chart. Since 1984, the

of index futures by institutions is a matter of con- market has tended to trend more, but with smaller

jecture, but the timing suggests it may be so. Since average daily ranges.

40

30 --

20 --

0 -I I I-+

l/79 l/84 l/90

FIGURE 1. EIGHT DAY RANGE

7 6.4

a.4

6

7.4

5 6.4

5.4

4

4.4

3 3.4

24

2

1.4

1 0.4

ln9 1184 rns 1184

FIGURE 2. INSTABILITV FIGURE 3. VOLATILITY

10 MTA JOURNAL / SPRING 1992

Instability as an Early Warning Signal Figure 4 shows the price action of the S&P 500

We now consider four specific examples of volatil- index during October 1987. Notice the extremely

ity and instability readings during market action of high instability readings even five days before the

the past five years. In each case, distributions of crash. By October 16th, volatility had also reached

volatility and instability values for the eight years an extreme. This was hardly the time to assume

prior to the year in question are used. This gives us that the bottom has been reached. After the crash,

a moving sample of approximately 2000 days. The the market continued to “ring”. It moved sharply

values of volatility and instability for the period up and down, indicating a return of stability, but

being studied are then ranked with respect to the volatility remained high for weeks. While not as

distribution of the sample. For example, if the current dramatic, the one-day plunge in October 1989 was

value for volatility exceeds any volatility value in the more insidious than the drop two years earlier, in

sample, it gets a percentile ranking of 100 for volatili- that it appeared to happen without warning. As

ty. If the current value for instability is smaller than Figure 5 shows, however, the extremely low volatili-

any instability value in the sample, it is ranked 0 for ty readings were matched by extremely high in-

instability. These readings tend to define market ac- stability readings, suggesting the potential for a

tion over the subsequent eight trading days, so high surprise. Volatility never did become higher than

readings signal the potential for unusually large about average (a reading of 50), and by the end of

moves, while small readings suggest the relatively the month the market had returned to a normal

quiet times over the next eight days. profile.

330.03- 3a5m-

J2o.WJ p ’ - ’ 1

310.00-- rlL?I[ 360.99-- $9, o

3m.09-_ IQ

290.00-. I0 35sm -- It c

280.00-- 3m.00-. t t

no.* -.

2uJ.m Qtt+ woo -mr 1 1 11 ’ t ‘1 1 I@

?YI.M--

24o.w -. -1 Ii t,ttI it , “Cr @ z” :I/ 1

zmca --

220.00-. 339.00-.

210.00--

2m.M- s%m-

PERCEHTILES PERCEMILES

CASE DATE 1NSTASMJT-V VOLATlLrrY CASE DATE INSTABILlTY VOLATlLlTY

: 12OCT97

16OCT97 98.9

96.7 90.1

40.9 : 6OCT89

aocT99 98.1

99.9 6.6

3 19OCT97 100.0 104.0 3 13OCT69 W.6 El

4 30 OCT 67 34.7 1W.O 4 26 OOT 99 6a.4 44.6

5 18 NOV 97 26.0 86.9

FIGURE 4. S&P 500 INDEX: 29 SEPT 1987 THRU 18 NOV 1987 FIGURE 5. S6P 500 INDEX: 22 SEPT 1989 THRU 26 DCT 1989

w Q)flr

@ ,tJ 39s.m -.

mm -. Yt tttt 39am -.

I

0 -3m.m -.

t bl$

3zQ.w -. qvpr I

31ma -. :: -.t t ’

300.00 - 370.00 -

PERCENTILES PEFlCENTlLES

CASE DATE INSTABILITY VOLATlUrr CASE DATE INSTABlLrPl VOLATILITY

1 9 JAN 91 90.8 70.5 : 19 DEC 91 69.1 13.4

: 21 JAN 91

31 95.4

94.1 73.9

39.5 3 14JAN92

23 DEC 91 94.1

2.5 30.9

47.9

4 22 FEE 91 0.8 70.2

FIGURE 6. SLIP 500 INDEX: 26 DEC 1990 THRU 22 FEE 1991 FIGURE 7. SIP 500 INDEX: 10 DEC 1991 THRU 14 JAN 1992

MTA JOURNAL / SPRING 1992 11

Figures 6 and 7 compare and contrast the market Summary

action in early 1991 and 1992, respectively. Notice We have split eight-day range into two com-

that, in each case, very high instability eventually ponents, volatility and instability, each of which

turned to very low instability, although the process helps us forecast the range for the subsequent eight

took much longer in 1991. In addition, the volatili- days. Volatility is the name we give to the eight-day

ty levels in 1991 portended a larger move than in moving average of daily range, while instability is

1992. then defined to be the eight-day range divided by

volatility. We have investigated their behavior, both

Forecasting Large Eight-Day Range Values. on macro basis and for specific memorable periods

Instability and volatility values for the past eight in recent market history. In addition, we have

days do have an effect on the range of prices for the demonstrated that high values of one or both of these

next eight days. If we restrict our attention to large measures tend to be good predictors of high future

eight-day range values, those of at least 8 percent, eight-day range values, while low values of both of

we find that current low volatility and instability these measures suggest the absence of these high

values imply that no large moves will occur within eight-day range values. For this reason, instability

the next eight days, while high volatility and in- and volatility seem to be very useful measures for

stability values imply a disproportionately high monitoring the likelihood of a dramatic move in the

incidence of large moves within that same period. market.

Table 2 shows the distribution of the 75 cases in the

2022 days from 1984 through 1991 in which the

eight-day range was at least 8 percent. Note that in

BIBLIOGRAPHY

the vast majority of cases either the instability or

1. Mandelbrot, Benoit, The Fractul Geometry ofNature (Freeman,

volatility readings for the day just prior to the begin- 1983)

ning of the eight days in question fall into the fourth 2. Orr, Richard C., “Chaos I: Time Series Forecasts in Markets”,

or fifth quintiles. In no case do the instability and MTA Journal 33 (1989)

3. Orr, Richard C., “Chaos II: The Fractal Structure of Markets”,

volatility readings both fall into the first or second MTA Journal 35 (1990)

quintiles. This result is actually even stronger than 4. Peters, Edgar, Chaos and Order in the Capital Markets (John

it appears, since in all nine cases where neither in- Wiley, 1991)

stability or volatility is in the fourth or fifth quin-

tiles, a subsequent day reaches these levels before

the 8 percent move begins. The bottom line is that DI: Orr is president of Chronos Carp, a firm specializing

high instability or volatility readings give a warn- in Chaos related research for financial markets. In ad-

dition to actively trading Stock Index Futures, he is a

ing that the market is vulnerable to a “shock”, while frequent contributor to the MTA Journal.

low readings in both variables sound an all clear

signal.

TABLE 2.

COUNTS OF FUTURE 8-DAY RANGES OF AT

LEAST 8 PERCENT CORRESPONDING TO

CURRENT INSTABILITY AND VOLATILITY

READINGS BY QUINTILE (l/84-12/91)

INSTABILITY

QUINTILES

TN 3

I T

12 MTA JOURNAL / SPRING 1992

Railroad Track Charts

by Michael Baum

Overview must constantly shift his or her attention between

Sharp movements of common stocks well above or these charts.

below their trading ranges often provide excellent The Percentage Trading Bands are a set of

opportunities for profit. This occurs since most near parallel trendlines at a fixed percent above and

term price moves have proven to be unsustainable below a particular moving average. Most technical

and are usually followed by a counter-move that analysts draw their parallel lines, delete the moving

restores the prior period’s price equilibrium. As a average used in the chart’s construction and then

result of this observed phenomenon, an extensive list superimpose a closing price of the particular market

of indicators has been developed by market practi- under study. (See Chart B) This important innova-

tioners. A listing of some of these popular momen- tion was developed by Ichu Cheng3 who integrated

turn oscillators appears below. A variation on this the separate price and oscillator charts into one. He

work is spelled out in detail in this monograph. A suggested an actual price cross above or below the

caveat to consider, however, is that the over-bought/ trading bands themselves could well generate

over-sold approach to timing does not fit under all suitable entry and exit signals. Ichu Cheng made the

circumstances. A particular stock or market index small, but all-important step, of integrating the price

may remain in an over-extended position for a very and oscillator charts to create one all-inclusive indi-

long period of time. This usually occurs when a cator. The oscillator featured here is based to a large

powerful long term bullish or bearish wave of inves- extent on the original work of Ichu Cheng. To

tor psychology over-rides the more typical pattern differentiate this approach from the general scholar-

of an individual market’s ebb and flow. Examples of ship on momentum oscillators, the indicator dis-

this tendency will be explored in the article. cussed below will be referred to simply as “Railroad

Track Charts.”

Definitions

An oscillator is. . . “Any mathematically calcu-

CHARTA

lated line, or lines, that move up and down with

price activity in such a way that over-bought and

over-sold situations can be identified. (They). . . are

often at their extremes at tops and bottoms, and 44

visually illustrate the swings of the market from

over-bought to over-sold. . . .“I See Chart A. Over

the years, an extensive list of oscillators has been

developed and fine-tuned by market technicians. CHARTB

Most are now available in chart programs for per-

sonal computers. For example, the Dow Jones

Market Analyzer PLUS chart program carries a $

variety of indicators such as Stochastics, Wells-

Wilder’s Relative Strength, Williams’s %R, Moving

Average Convergence-Divergence, Commodity Chan- CHARTC

IDEALIZED

nel Index and Percentage Trading Bands? Most

BREAKDCWN

oscillator charts are presented by showing an indi- BREAKOUT

vidual issue or market index and its momentum

oscillator on the same computer screen. Two sepa-

rate charts are constructed on the same monitor.

To obtain market entry and exit signals an analyst

MTA JOURNAL / SPRING 1992 13

Gerald Appel also demonstrated the judicious use overcomes supply thus enticing some longs to

of Percentage Trading Bands as a market forecasting postpone their selling in the hopes of additional

tool before his colleagues at a regular Market Tech- gains. As a consequence, selling volume diminishes

nician’s Meeting in New York City? Christopher and and exaggerates the advance until it is carried to an

Peter Worden have cleverly fashioned a succession up-side extreme. Once demand is exhausted, a

of trading bands one and two standard deviations counter-move follows. The selling that was deferred

from the moving average itself? John A. Bollinger during the prior rise comes to market, creating a

more recently added trading bands that expand and selling wave that drives the market lower. This

contract a pre-set number of standard deviations decline is intensified as some potential buyers defer

above and below a moving average.6 All of these their purchases. As a result, buying volume dries up

analysts have contributed valuable innovations to accelerating the speed and force of the down trend.

the design of the Percentage Trading Band indicator Only after sell-side pressures carry the market to an

work. extreme, and selling volume finally diminishes, does

bargain hunting slowly emerge and the market

Mechanical, Emotional and Psychological begins to stabilize. At this stage, the market is posi-

Rationales for Periodic Market Fluctuations tioned to begin its’ complete price cycle again.

Around an Arithmetic Mean The late Michael G. Zahorchak suggested an

William C. Garrett provided a mechanical emotionally-based positive feed-back loop to explain

rationale for market fluctuations around a mean.7 periodic price cycles that yield over- bought and over-

He suggested that the forces of supply and demand sold conditions.8 Here is a brief synopsis of his

are constantly struggling for superiority. For exam- explanation. After an uptrend begins, sideline

ple, following a period of price equilibrium, demand money flows into the market driving it higher. As

CHART VERSION 2.1 CHART VERSION 4.1

CHARTVERSION 1.5 CHART VERSION 3.5 CHARTVERSION 4.5

CHARTVERSION 2.5

CHARTVERSION 4.6

CHART VERSION 4 9

RIGHTTRANSLATION BULGE

14 MTA JOURNAL / SPRING 1992

the market becomes stronger, it continues to attract expect future surprises to force prices toward their

fresh funds. Motivation to rush in and buy a strong mean more often than not.” Cootner referred to these

market stems from the emotional pressure within springboards for a move back towards their mean as

individual investors. As investment observers gain “Reflective Barriers”. (Many chartists refer to these

confidence from rising prices, a point is reached barriers as support and resistance). Martin E. Zweig

where some investors yield to greed. took Cootner’s model an important step further? He

When all the capital available for investment has incorporated the “Reflective Barrier” model in terms

been drawn aboard the market, demand tires and of a general theory of investor expectations. “When-

prices turn down. Sagging prices then activate a ever non-professional investors become significantly

bearish feedback loop within the personality of one-sided in their expectations about the future

investors. Lower prices build the pressures to sell. course of stock prices, the market will move in the

As investors reach the point where they can no direction opposite to that which is anticipated by the

longer tolerate the stress of holding a deteriorating masses.”

stock position, they close out their long positions.

Finally, a sellhng climax occurs under the pressure A Cyclic Framework for Railroad Track Charts:

of panic liquidations and a bottom is completed. The The Earnings Report Cycle

positive feed-back loop begins anew to push the Assuming the cyclic character of stock prices and

market to its next peak. the transient character of market extremes, the first

Paul H. Cootner introduced a model of market task is to find the most suitable time frame for the

behavior in 1962.9 “. . . Professionals . . . profit. . . moving average used to construct Railroad Tract

from observing the random walk of the stock market Charts. Many timers refer to price cycles of three to

prices produced by . . . (the) . . . non-professionals six months as the intermediate-term rhythm. It has

until the price wanders sufficiently far from the been observed that many stocks and stock groups

expected price to warrant the prospect of an ade- have price cycles of different periods. Furthermore,

quate return . . . When prices have deviated enough some issues peak and trough ahead of the average

from the expected price . . . (professionals) . . . can issue, others score their highs and lows in harmony

CHART D

OVER-EXTENDED CONDITION

AFTER A LONG RALLY

80- OVER-EXTENDED CONDITION -80

AFTER A CORRECTION

WEEKLY DATA

DISNEY (WALT)

60- -60

4% TRACKS PROJECTED

- ‘I’ FROM A 13 WEEK

I I

I I

MOVING AVERAGE

I I

1948’7 88 89 90 91 7% 1

MTA JOURNAL / SPRING 1992 15

with the average stock while some issues record their follows initiates the up phase of the next cycle.

peaks and valleys later.

The problem of cycle identification is further Idealized Model of the Intermim Earnings

obscured because some price cycles of three to six Cycle (Chart 0

months are distorted or overwhelmed by cyclic forces. Starting from a period of price decline with the

For example, an intermediate term uptrend may be tracks in a down mode, the first price cross above the

dampened by the bearish influence of a long term lower track is referred to as an Initial Rally Signal,

down wave. In addition, some price cycles have a (See Chart Version 1.0). This event marks the first

tendency to vary widely and then return. Perhaps evidence that selling dominance is beginning to

the most difficult roadblock to cycle identification exhaust itself and a market is moving toward equi-

is double-counting. In this instance, a stock may bot- librium or possibly a new interim cycle of advance.

tom, rally, peak and react within a six week period. Usually an up-side cross is followed immediately by

Then the stock repeats the round trip in seven weeks a Basing Phase or trading range inside the tracks

leaving two cycles. When this occurs, the chartist as the last of the selling by disappointed longs comes

must decide if the issue is running a shortened inter- to market. In this pattern, the tracks themselves

mediate term cycle, or two near term cycles that mark-off the extremes of price fluctuation. They are

make up one thirteen week movement. the “Reflective Barriers” discussed by Cootner and

Recognizing the difficulties involved, the iden- Zweig. In rare cases, the Basing Phase may be

tification of the intermediate term cycle could well characterized by a succession of up-side and down-

be considered within the reporting framework of cor- side violations followed swiftly by counter-moves

porate earnings which averages 13 weeks or 63 days. back inside the tracks (See Chart Version 1.5). In this

Actual reporting of income figures depends upon the erratic pattern, the forces of supply and demand are

accounting cycle for each firm. As a result, most continually shifting their dominance.

interim figures are released three to six weeks after An Up Phase is illustrated on Chart Version 2.0. .

the end of the quarter. First quarter data appears It is marked by a market cross-over the upper track.

from mid- April on, second quarter data begins This event is called an Initial Breakout Signal.

appearing in mid-July and third quarter results are When this occurs buying dominates the market and

distributed beginning in mid-October. Firms with prices move swiftly above their upper track and may

different fiscal periods report their earnings from remain overextended. The Up Phase suggests that

three to six weeks after the end ‘of their fiscal an opportunity to enter the market has already pass-

quarter. Year-end figures are usually delayed ed, and that existing positions should be maintain-

because of full year adjustments and full year num- ed. In this phase, market prices may rise swiftly and

bers may take four to eight weeks or more before create a pattern referred to as a “Left Translation

release. This stretch-out in reporting could well Bulge” (see Chart Version 2.1). This configuration

account for 73.56 days calculation for the complete suggests an absence of supply combined with aggres-

intermediate term cycle of the Standard and Poor’s sive demand. In cyclic terms the pattern suggests the

300 Index.” To fit within the reporting cycle, this bullish influence of longer term waves upon the

monograph has selected the 63 day or thirteen week interim price cycle. Version 2.5 is marked by a suc-

time period for determining cycles, but allowance is cession of cross-overs and cross-unders while the

made for a longer cycle at year end. track itself has an upward slope. In this instance, the

track itself is playing the part of a center-line for a

,

rhe Discounting Process series of short term cycles. The investment strategy

As a general rule the market begins to discount in this case is to hold all positions as the most ideal

i interim earnings figures a month or so before the time to enter the market was seen at an earlier

1release date. A stock usually moves higher in antici- phase. Chart Version 2.6 reveals an erratic market

1 pation of favorable news. If results meet the expecta- pattern. This volatile pattern provides numerous

1Lions of a majority of market practitioners, a peak short-term trading opportunities each time the

iin the price cycle is soon evident. The profit-taking market registers a cross-over or cross-under. Under-

1;hat usually follows generates an interim earnings lying the succession of these sharp movements is a

(cycle trough. The situation is reversed when poor conflict between the bullish influence of the Up

t:arnings are anticipated. Prior to the announce- Phase of the interim earnings cycle and the more

1ment, the stock is often subject to selling pressure bearish pressures of a longer term wave. Chart

‘ Ind price weakness. Some further liquidation is Version 2.9 is referred to as a “Right Translation

1 possible after the release of earnings, but selling Bulge.” It is a climactic buying surge after an over-

1Jsually ends quickly, often marking an intermediate extended rise fueled by short covering.

1;erm cycle trough. The bargain hunting phase that Selling opportunities often occur with the official

16 MTA JOURNAL / SPRING 1992

release of earnings or other pertinent news items. track so the lower track marks overhead resistance.

A Topping Phase usually follows (See Chart Version This configuration is the mirror image of the Up

3.0). It is ushered in with a market’s down-side cross Phase (Version 2.0) where the upper track provided

below an upper track. This event is referred to as an support for every short-term cycle trough. If the

“Initial Reaction Signal.” In this case the market’s Chart Version 3.0 Topping Phase Initial Reaction

short term fluctuations are contained inside the Signal was missed, the Initial Breakdown Signal in

tracks as a narrow trading range unfolds. Wider Chart Version 4.0 provides another opportunity to

short term cycle swings within this phase are lighten positions or exit the market. During the

depicted by Chart Version 3.5. Every upside cross- Down Phase, new buying is best deferred until sell-

over above the lower track is a trading buy signal- ing is exhausted. Following the initial breakdown,

while each down-side cross below the upper track is a sharp decline may occur. It is referred to as a Left

a reaction or trading sell signal. This configuration Translation Bulge (see Chart Version 4.1), and

and the one portrayed in the Basing Phase (version reveals the sellers are dominant. When the lower

1.5) represent a balancing between the longer term track bisects the short term cycles a Chart Version

forces of supply and demand. This provides an 4.5 is seen. A timer could well look to the slope of

environment for the weak but intense short term the lower track for help in assessing if this phase

cycle influences to show themselves. If the balance is still in force or finally giving way to a more bullish

of bullish and bearish forces are finally resolved on Basing Pattern. Here again, the chartist is caution-

the down-side, the Topping Phase soon gives way to ed not to anticipate a bottoming pattern, but wait

a Down Phase (See Chart Version 4.0). First evidence for the signals to show themselves.

of this final phase in the Interim Earnings Cycle is On occasion one may come upon a wildly erratic

a market cross-under of the lower track that is itself behavior pattern as seen in Version 4.6. In this con-

beginning to turn down. This indicator event is dition, short term cycles penetrate the upper and

called an “Initial Breakdown Signal.” It is often lower tracks providing trading opportunities within

followed by a free fall in the price of the stock. All a basically down market. Risks are higher under this

short term rally peaks are contained below the lower condition when trading the long side because the

CHART E

OVER-EXTENDED CONDITION AFTER

A LONG RALLY

95-

85-

OVER-EXTENDED CONDITION

-65

AFTER A LONG CORRECTION

WEEKLY DATA -55

MINNESOTA MINING

4% TRACKS PROJECTED

MTA JOURNAL / SPRING 1992 17

short-term-up-leg may be suppressed by the stronger normal rhythmic pattern. During the year-long rise,

interim earnings wave. If a stock or index crosses Disney shares remained in an over- bought condi-

above a lower track, flashes a Rally Signal, and tion. Reactions below the upper track proved tem-

immediately reverses by crossing below the lower porary. The overbought periods may have prompted

track again, the prior breakdown signal has been caution, but the fact that the lower band was not

restored. A down market is evidently still in force. penetrated during this period should have kept the

Trading strategy suggests quickly closing positions. analyst constructive. By late 1990 a more rhythmic

The final and most devastating pattern for most pattern was initiated by penetration of the four

investors is seen in Chart Version 4.9. It is called a percent.

“Right Translation Bulge” and usually appears as Chart E, Minnesota Mining, provides a more

a climatic selling wave at the end of a Down Phase. typical example for railroad track identification. In

The anatomy of Chart Version 4.9 is as follows: Sell- this example, four percent tracks calculated from a

ing begins to dominate in the 4.0 condition. As a thirteen week moving average are shown with the

decline proceeds, the ranks of bargain hunters weekly bar chart. Every over-extended condition in

become thinner until buying dries up. As a conse- this four year period proved unsustainable and was

quence, sellers overwhelm the internal balance of the followed by a counter-move back inside the tracks.

market and liquidate at distressed price levels. This The Standard & Poor’s 500, with two percent

creates the Right Translation Bulge, and sets the tracks based on a thirteen week moving average, is

stage for a counter-move that begins the Basing shown in Chart (Fj. This example provides a com-

Phase, Chart Version 1.0 and the new Interim Earn- bination of conditions found in Charts D and E. For

ings Cycle. example, in 1988, the index failed to break down

Normally the cycle runs from chart 1.0 through below the lower two percent tracks. The performance

4.9 and then starts anew. The timer should be aware shows the growing bullish influence of a long term

that the sequence may skip. In a bull market, the wave. By 1989 these positive forces lead to a S&P

charts may run 1.0, 1.5,2.0,3.0 and then start over Index rally of 35%. The first penetration of the lower

again at 2.0. In retrospect, it can be seen that 3.0 channel in late 1989 indicated that the advance was

is a congestion period or narrow trading range prior exhausted and equilibrium was restored. To simplify

to the resumption of the bull cycle. The opposite is the graphing, a chartist might find the weekly close

the case in a bear market. A stock may end a 4.0 easier to work with. In summary, two percent tracks

Down Phase, generate an Initial Rally Signal, have been found useful for the Dow Jones Industrial

display a Basing Phase only to quickly roll over and Average and Standard and Poor’s 500. The weekly

flash an Initial Breakdown Signal. In this case, the advance- decline line and most blue chip issues work

normal sequence was disrupted because the selling best with four percent tracks. In a study of about

pressure from the bear market suppressed the Up three dozen issues including many Dow Jones In-

Phase, overwhelmed the buy-side of the market and dustrial issues, several exceptions have been found.

pushed the cycle from 4.0 to 1.0 and immediately Included in this class special category are Eastman

into a 4.0 phase once again. Allowance should be Kodak, Mobil and Procter & Gamble. Here, three

made for the possibility of a back step to an earlier percent bands match up quite well. Listed secon-

phase once evidence of such a pattern appears. daries have been found to chart best with eight

percent tracks. No exceptions have been found in this

Railroad Track Chart Construction: lower price group after study of about four dozen

Real Life Examples issues. Finally, a daily advance-decline line also

Parameters are set from a review of past chart works well with the eight percent parameters.

history. Chart (0) shows weekly data covering a three Experimentation is needed to determine the best

to four year cycle in the common stock of Walt Disney. parameters for a particular market.

Four percent tracks above and below a thirteen week

moving average were drawn and a high-low-close Technical, Fundamental and Psychological

chart was superimposed. This example illustrates Aids in Pinpointing an Intermim

some of the problems that must be overcome to find Earnings Cycle

the most ideal parameters to measure over-bought This monograph covers in detail the technical

and over-sold conditions. In early 1988, Disney aspects of the Interim Earnings Cycle. The charts

shares broke down below its lower track on a few are a pictorial model (or representation) of where the

occasions. The issue subsequently snapped back stock has been and where it is positioned to go.

towards equilibrium, and in early 1989 the issue Knowledge of the accounting cycle and the release

took off on a long bull market surge. A positive long dates for earnings is also required. Those are

term wave of investor psychology over-rode the available in the Daily Graphs Chart Service?’ This

18 MTA JOURNAL / SPRING 1992

valuable listing reads EPS due, meaning the date to the market’s response. To a lesser extent, cor-

when Earnings Per Share were released in the prior porate news on backlog figures, contract awards,

year. The assumption is made that the latest release management changes or feature articles in the

will come on or around that date. media are valuable psychological clues. It is indeed

The Value Line Publishing Inc provides an excel- the market’s behavior following these various media

lent forecasting service of upcoming sales and earn- events that exposes the underlying supply-demand

ings figures.‘3 Many of the posted figures for interim condition and where the stock or market stands in

figures come out close to or precisely at the Value its cycle.

Line estimates. This excellent showing suggests the

service comes up with their own figures but may well Benefits to the Railroad Track Chart Approach

obtain some confirmation from the reporting com- Since stocks and the market spend most of their

pany prior to the release date. On occasion, reported time meandering inside their tracks, the Railroad

figures are far from the estimates issued by Value Track Chart Work frees the timer to focus upon an

Line and other analysts. The market had usually an- issue when it is at an unsustainable extreme. As a

ticipated this development and discounted it in the result, the analyst may be more alert to the signifi-

market price before the news release date. When the cance of a cross-over or cross- under and the poten-

interim figures are surprising to a majority of tials of such a signal. This approach also insulates

market practitioners, the market swiftly adjusts on the timer from the emotions in the market place and

or immediately following the news release date. A the media helping one to become psychologically

third aspect of this Interim Earnings Cycle is attuned to the possibilities of a stock or market’s

psychological. If the news is widely expected it will counter-move. Independence of thought, analytical

not upset the delicate supply-demand balance in the focus and sensitivity to rapidly changing price con-

market place. Conversely, If the news is not antici- ditions should not be underestimated. Furthermore,

pated, a dramatic move could follow. As a result, the the cross-overs and cross-unders provide actual intra-

true technical position of that market is suddenly day market entry and exit signals. When the initial

revealed. It is necessary for the timer to quickly shift signal is followed by a succession of signals, it pro-

from the fundamental aspects of the earnings release vides a valuable prompt to slowly accumulating

CHART F

OVER-EXTENDED CONDITION

AFTER A RALLY

380 -

340 -

OVER-EXTENDED CONDITION -

AFTER A CORRECTION

-260

WEEKLY DATA-S&P 500

2% TRACKS PROJECTED FROM -

A 13 WEEK MOVING AVERAGE

MTA JOURNAL / SPRING 1992 19

stock in a Basing Phase or distributing stock dur- of this timing approach. Still, the Railroad Track

ing a Topping Phase. approach highlights important changes in a

Divergence analysis is also possible. The market market’s behavior. It spotlights those rare occasions

being measured may make a succession of lower when a market is at an historic extreme. This in turn

price lows, but the lower track itself may well be fall- opens the door to a profit opportunity. After all, what

ing at a faster rate. It is “catching up ” to prices. As better moment is there to buy any stock or index

a consequence, the gap between lower tract and the than after an episode of selling finally spends itself

market narrows. This pattern reveals a loss of and the issue lifts its head enough to cross above a

downside momentum and a non-conformation is fast closing lower track? Conversely, after a long rise

recorded. On occasion these signals are generated what better time can be found for profit-taking or

quite close to the actual peaks and valleys. lightening up of positions than the instant a market

Since moving averages are the heart of the falls below a fast rising upper track for the very first

Railroad Track Chart construction process, the time?

Interim Earnings Cycle may be fit inside longer and

longer moving averages to gain a summing of all the

dominant waves impacting any market. Such a big

picture analysis is a topic which might be investi-

REFERENCES

gated before a Railroad Track analysis is attempted.

1. Walter Bressert, “The Power of Oscillator/Cycle Combinations”,

Walter Bressert and Associates (Tucson, AZ) 1991 p. 3-1

Limitsoto the Railroad Tract Chart Approach 2. “Dow Jones Market Analyzer PLUS” Version 2.03, RTR Soft-

Without question, the major limitation to this ware, Inc. and Dow Jones & Company, Inc (Princeton, N. J.) 1991

3. Ichu Cheng, Holt-Winter Channel: Taking the formula one step

work is the potential for false signals or whipsaws.

beyond, “Technical Analysis of Stocks and Commodities”,

To compensate for this limitation, the chartist is Technical Analysis, Inc. (Seattle, Wa.) August 1988, p.23-28

invited to look at the Railroad Tracks within a cyclic 4. Gerald Appel,“Timing the Market with Moving Averages and

Trading Bands”, Signaler-t Corp. (Great Neck, N.Y..) March 12,1966

framework. Being cognizant of earnings estimates,

5. Christopher and Peter Worden, “Optioneer”, Worden Brothers,

the release dates of interim figures and the sensi- Inc., (Chapel Hill, N.C.) 1991

tivity of the market to the release of data should be 6. John A. Bollinger, Financial News Network, (Los Angeles, Ca.)

7. William C. Garrett, “Investing for Profit with Torque Analysis

an aid in interpretation. of Stock Market Cycles”, Prentice-Hall, Inc., (Englewood Cliffs,

At least two exceptions will be encountered by N.J.) 1973, p. 25-28

an analyst running Railroad Track Charts. First, if 8. Michael G. Zahorchak, “The Art of Low Risk Investing”, Sec-

ond Edition, Van Nostrand Reinhold Company (New York, N.Y.)

a market replicates Chart Version 2.5 or 4.5 the 1977, p. 25-30

track being crossed and recrossed is really a mid- 9. Paul H. Cootner, Stock Prices: Random Vs. Systematic Changes,

point for short term fluctuation. Reliable entry and “Industrial Management Review”, Volume III, Spring 1962,

p.24-45

exit signals can not be obtained. In this instance, we

10. Martin E. Zweig, Investor Expectations: Why they are the key

would suggest trying new parameters. On another to stock market trends, Zweig Advisors, (New York, N.Y.) 1973

occasion, a timer may find a market low three or four 11. Cycle Projections, Foundation for the Study of Cycles, Inc.

points below a lower track. The issue may then (Irvine, Ca.1 Aug. 1990, p.1

12. Daily Graphs, William O’Neill & Co, Inc. (Los Angeles, Ca.)

rally slightly above an upper track, give a buy 13. Value Line Publishing Inc, 711 Third Ave, (New York, N.Y.)

signal, and immediately reverse and give a sell and

drop three or four points again. Here too the

parameters have been incorrectly cast. The lower

Michael Baum is a broker and analyst with Hampshire

track should have been drawn perhaps five or six Securities Corp., 919 Third Ave, New York, N.Y 10022.

percent below its centered moving average. He also teaches a market timing course in a computer

In addition to the earnings cycle, Bond and com- lab setting at New York University School of Continu-

modity cycles of different length may well effect par-

ticular common stocks. Examples include oil and

natural gas issues as well as some credit-sensitve

issues. This secondary impact could well distort the

effected markets being run on the thirteen week

time frame.

Discussion

The integration of line charts and oscillators into

one composite indicator can not provide a perfect

solution to investing and trading. None is implied.

Periodic whipsaw signals and trading losses are part

20 MTA JOURNAL / SPRING 1992

Moving-Window Correlation Stability and

Its Use in Indicator Evaluation

by David Aronson

Introduction practical use. Consider an indicator which has a

As the discipline of market analysis becomes more significantly positive CC of +.50 when measured

quantitative there is a growing interest in objective over an entire twenty year period, but when mea-

ways to measure the predictive power of an indicator. sured over one year sub-periods its value is so

One way would be to calculate the linear correlation variable that its sign occasionally reverses to nega-

coefficient (CC) between the indicator and subse- tive. During such sign reversals the indicator pro-

quent market changes! In general CC is used to vides false predictions. For example, high indicator

measure the strength of the linear relationship (i.e., readings, which should be followed by rising prices,

dependence) between two variables, a predictor vari- as implied by the positive full span CC, would in fact

able and a dependent variable. In the case of indi- be followed by a falling market. High CC instability

cator evaluation, the indicator serves as the predictor renders an indicator far less useful than another

variable while the market’s subsequent change plays whose average CC over the full span is lower, but

the role of dependent variable. For example, the more stable. Our thesis is that CC stability is an

dependent variable might be defined as the percent- important characteristic that should be incorporated

age change experienced by the market over the into indicator evaluation. We propose a method for

month following a given indicator reading. To the measuring and using CC stability.

extent that their relationship is linear, CC measures Our method measures CC stability by employ-

how well the indicator is able to predict the market’s ing a moving data window. The concept of a moving

future change. data window is common in time series analysis and

CC can assume any value from a maximum is used, for example, when constructing moving

value of + 1.0, indicating a perfect positive relation- averages. In contrast to a typical full span CC, the

ship between the two variables, to minimum value moving window correlation coefficient (MW-CC)

of - 1.0, indicating a perfect negative relationship. computes the CC value only for those observations

A negative relationship implies that high indicator contained in the data window, whose length, N, is

readings forecast a bearish market. If the two vari- defined by the analyst? After each calculation, the

ables are plotted against each other in a scatter window is moved forward in time by one observation,

diagram, a perfect linear relationship is indicated and the CC is recalculated. The MW-CC operation

when all observations lie on a straight line. Magni- produces a fluctuating time series that itself can be

tude is the important quantity when measuring measured in terms of its average, its standard devia-

predictive power so indicators displaying either tion and its trend. The standard deviation gives an

significantly positive or negative CC values would indication of the stability of CC. The average and

be useful predictors. CC values close to zero indicate standard deviation are combined into a ratio which

no linear relationship. The minimum CC required I have named SACC (Stability Adjusted Correlation

to evidence a statistically significant relationship Coefficient). Our thesis is that SACC is an infor-

depends upon the number of historical observations mative measure that adds a useful new dimension

used in its calculation and the level of confidence to indicator correlation analysis.

desired by the analyst?

Prior indicator research has focused on measur- The Correlation Coefficient:

ing CC over entire spans of historical data? For An Intuitive Explanation

example, given twenty years of weekly observations, The statistical theory behind the CC can be

the CC would be calculated for the full twenty years. found in any basic statistics book. It is not our pur-

However, such studies have ignored the stability of pose to review that material, however, for readers not

the CC over shorter time intervals. Clearly, stability familiar with the concept, a brief description and

is an important property, if the indicator is to be of some diagrams will provide an intuitive notion of its

MTA JOURNAL / SPRING 1992 21

basis. Readers already familiar with this material What is a “Significant” Correlation

may wish to skip to the next section. Since even the best market indicators carry scant

Suppose we have a set of historical data based amounts of predictive information, they don’t pro-

upon two variables. One variable is an indicator duce tight cigar-like patterns such as “b” or “e”, but

whose predictive power we wish to determine, while rather scatter plots that resemble “loose” rotund

the second variable is a measure of the market’s ovals such as “c” and “d”. These typical point clouds

future return. Imagine plotting this data on a 2-di- are often hard to distinguish visually from round

mensional plane, usually called a scatter plot. On point clouds ( e.g. “g”) which are produced by indi-

the plane are two mutually perpendicular axes. By caters with little or no value (i.e., CC = 0). Therefore

convention, we assign the market’s future return to we need an objective way to distinguish indicators

the vertical axis, while the indicator’s values are with and without statistically significant forecasting

assigned to the horizontal axis. The location of each information from those lacking it. This can be accom-

point on the plane represents the values of the two plished by applying a statistical test to determine

variables at a particular point in time. Depending if the magnitude of the CC is significantly different

on the strength and nature of the relationship we from zero. The logic for interpreting the significance

get a “cloud” of points that will resemble, to some test of CC is as follows. We start off with the

degree, one of the seven diagrams below. hypothesis that the indicator has no forecasting

DIAGRAM 1

l t

. .

.

9.

.

. l . .

-- . . mm..

.~ . 9.m. l 0’

. ‘9 . . .

. ..

C::!‘:!=:::::!C *;;;;.; ?f;;.:+

.- ‘9’ .

. . ..=.. -.= l

l 9. 0’~.

. .*.

.

. ~- mm

l .’ ..= . ‘9. . l. ’

. .=:. l mm.. .

.. ((=+I.0 ((=tJl . l l

. . K=+.2S

t f

(0) Perfect Positive (b) Strong Positive (c) Weak Positive

.

.~.’ .

9’ mu mm l

l

.. lm:.’ .

...‘.

’ l

l

” i. l ‘0 ‘-~.I

. mm ..‘..

rn’. ” *

l . .

. ’ urn’. ’ l

.

. .

. . ‘m

vedicol oxis is fufure ma&t return

l . K=O

horizontal axis is indicator value

t

(g) No Relationship

. . .

.

l mm. mm l .

l

.

. .

.

l *. l .= 9.‘.

. .‘.. .

mm. l . 0 .

...m..-*m . l . ‘rn~ .

l . . .

. l 9.0~‘. .

4 : :

0..

6.l J’...,‘.

? I,:!:::‘!!:

.. ::c

.’ l m* . l. . l .m

.’ ’ ’

.

mm . ... . .= . . ...= .

l . mm.= .

...I:mmm : ’ l l ’ l .

8 l . .

. l .

mm. l . K--LO

(d) Weak Negative

t l&-.25 (e) Strong Negative

h-.70

(1) Perfect Negative

22 MTA JOURNAL / SPRING 1992

value (i.e., that the CC=O). This is known as the null techniques, such as non-linear pattern recognition

hypothesis. Statistical inference proceeds on the and multi-layer neural networks can.5 These ad-

basis that if you can reject the null hypothesis you vanced methods are beyond the scope of this article.

are entitled to believe its opposite, (i.e., that the

indicator has some predictive value). The burden of Moving Window Correlation Coefficient

proof is on the indicator to show it has forecasting & SACC

information. Our approach to measuring CC stability is the

The significance test tells us how confident we MW-CC which employs a moving data window. The

can be that CC, does not equal zero. The test, which window length is a parameter specified by the

takes into account the number of data points used, analyst. MW-CC computes CC only for the data con-

is based on the statistical principle that many re- tained in the data window. After each computation,

peated measurements of the CC between two uncor- the data window is moved forward by one time

related variables, produces a normal distribution. period and CC is recomputed.

Moreover, the standard deviation of this distribution In this study the data window length was

is equal to: l/square root of the number of data specified as 208 weeks, or approximately four years.

points. The area bounded by one standard deviation There is nothing magical about this window length

above and below the mean is equal to 68% of the area and it was chosen simply because it corresponds

under the entire distribution. For example with 200 roughly to a major cyclic period in stock market fluc-

data points the CC has a standard deviation of 0.071. tuations. We could have just as easily used 100 or

This means that even if two variables are unrelated 50 weeks. Because of the window’s 208 week length,

and their true CC=O, there is a 68% chance that the four years of past weekly data were required to

CC will take on a value between -.071 and +.071. generate the first MW-CC value. For example, to

The region enclosed between -2 and +2 standard produce an MW-CC value for the first week of

deviations (i.e., between CC values of -.142 and January, 1965, data back to January 1961 was re-

+.142) is 95% of the area under the normal distribu- quired. Moreover, the value computed for January

tion. Therefore, CC values can occur within this 1965 would not have been knowable until some later

range with a 95% probability even if the true CC=O. date, when the value of the market’s future change

Continuing this logic, if an indicator has a CC value became known. In this study the future return

greater than +.142 or less than -.142, which will variable required one year of future data. Thus the

occur by chance only 5% of the time when the true MW-CC for January 1965 would not have been

CC=0 we can be 95% confident that CC does not knowable until January 1966 even though on our

equal zero and the indicator has some forecasting plots the value is posted as of January 1965. This

value. CC values beyond +3 or -3 standard devia- is simply a convention we have adopted for this

tions give us confidence that our indicator has some study and there is nothing sacrosanct about this

value with 99.7%. Below we give some key values choice. This explains why our plots end on 6/30/89

whichCC must exceed to be significant at the 95% even though our available data extended through

and 99% levels of confidence. 6/30/90. Also, to reduce computation, the data win-

dow was moved forward by 13 weeks instead of one

week each time a new MW-CC value was computed.

Number Data Points

# weeks/years CC magnitude for 99.7% Our indicator figure of merit is derived from the

of data 95% Signif Signif statistical characteristics of the time series gen-

erated by the MW-CC technique. Specifically we

104 2 yrs .20 .30

measure its average value and its standard devia-

208 4 yrs .14 .21

tion over a period 24.5 years. From these two

520 10 yrs .09 .13

statistics we created a ratio that called the SACC

1040 20 yrs .062 .093 (Stability Adjusted Correlation Coefficient) using

1300 25 yrs .055 .083 the following formula: (note the vertical lines indi-

cate the absolute value of the ratio is used).

As pointed out above, this article is confined to

SACC= IMW-CC AverageMW-CC Standard Deviation1

a discussion of the linear CC which measures how

closely the point cloud “hugs” a straight line. Al- Either a low value for the numerator, or a large

though linear relationships are the type most often value in the denominator will produce a low value

explored in statistics, significant non-linear relation- for SACC. Indicators with stable predictive power

ships may exist. While the standard linear CC will will tend to have small denominators resulting in

fail to detect them, more sophisticated statistical higher SACC values. It is our contention that SACC

MTA JOURNAL i SPRING 1992 23

provides greater insight into an indicator’s utility as with the dependent variable. Therefore we defined

a market predictor than CC alone. For example, sup- the indicator as the inverse of the ratio (i.e., the ratio

pose we have two indicators. Indicator #l has an MW- of the 26 TWMA to the 4 week TWMA).

CC average of + 50 and indicator #2 has an MW-CC

average of + .25. Knowing nothing else about them Indicator Descriptions

we would be tempted to rely on indicator #l over #2. 1. CPRM (COMMERCIALPAPERRATEMOMENTUM)

But if the MW-CC of indicator #l has a standard The data series used was the weekly interest rate

deviation of .50 while that of indicator #2 is 0.125, #2 on 3 month high grade commercial paper (CP3). The

is substantially better in terms of the SACC criterion. indicator is the log of the ratio of the 26 week TWMA

of CP3 to the 4 week TWMA of CP3.

Indicator #l SACC=.50/.50=1.0

CPRM = log(26 weekTWMA CP3/4 weekTWMACP3)

Indicator #2 SACC=.25/0.125=2.0

2. FFRM (FEDERALFUNDSRATEMOMENTUM)

The Tested Indicators The data series used was the weekly federal

We have applied SACC analysis to a number of funds rate quoted on Friday (FFR). The indicator is

indicators which are defined below. Each indicator the log of the ratio of the 26 week TWMA of FFR

was correlated with a measure of the market’s future to the 4 week TWMA of FFR.

change using the MW-CC technique. The definition FFRM = log(26weekTWMAFFR/4weekTWMAFFR)

of future market change is defined below. A plot of

the MW-CC for each indicator is presented along 3. PRM (PRIME RATE MOMENTUM)

with a table comparing the SACC values. Each plot The data series used was the weekly Prime in-

has superimposed on it a regression line that depicts terest rate quoted on Friday (PR). The indicator is

the trend of the MW-CC over time and gives an indi- the log of the ratio of the 26 week TWMA of PR to

cation of improvement or deterioration in predictive the 4 week TWMA of PR.

power. An upward sloping regression line indicates PRM = log(26 week TWMA PR/4 week TWMA PR)

improvement while a downward sloping line indi-

4. DIVYLD (DIVIDEND MELD ON ~8~~500)

cates deterioration.

The data series used was the weekly yield on the

All indicators were derived from weekly data and

S&P500 stock index as quote in Barron’s.

were calculated for the period l/1/61 through

7/20/90. Indicators that involved moving averages 5. DIVBILL (DIVIDEND YIELD s&p500/3 MONTH

were generated using a triangular weighted moving TBILLS YIELD)

average (TWMA). In contrast to the simple moving The data series used were the weekly yield on

average that assigns equal weight to all observations the S&P500 stock index (DIV) and the yield on 3

in the moving data window, TWMA assigns the month tbills (BILL). The indicator is the log of the

greatest weight to the observation in the middle of ratio of dividend yields divided by tbill yields.

the window and smaller weights assigned to observa- DIV/BIL = log (DIVBILL)

tions at the end points of the window. For example

the weights in a 5 period TWMA would be: 1,2,3,2,1. 6. MFACR (MUTUALFUNDCASHTOASSETSRATIO)

Each datum in the window is multiplied by its The data series were those published by the

respective weight, these products are summed and Investment Company Institute. Cash were divided

then divided by the sum of the weights by assets and lagged by five weeks to compensate

(9=1+2+3+2+1). The advantage of the TWMA over lags in reporting the figures.

ordinary moving averages is that of it is less sensi- MFCAR=(MUTUALFUNDCASH/MUTUALFUND

tive to large differences between the latest addition ASSETS)LAG5

and deletion from the data window. All indicators

are based on the natural log. 7. HILO (HILO LOGIC INDEX)

To permit easier graphical comparison, all in- Weekly number of new highs and new lows as

dicators were defined so as to have positive correla- reported in Barron’s were used to construct an indi-

tions with the dependent variable. This involved cator developed by Norman Fosback of the Institute

defining the indicators in a manner that is the for Econometric Research. The indicator is the total

reverse of what might make the most common sense. number of issues traded for the week divided by the

For example the commercial paper rate momentum lesser of weekly new highs or weeky new lows. This

indicator might typically be defined as the ratio of ratio was smoothed with a 13 week TWMA.

a 4 week TWMA to a 26 week TWMA . This would HILO=13WEEKTWMA(TOTALISSUES/LESSEROF

produce an indicator that is negatively correlated (NEW HIGHS, NEW LOWS))

24 MTA JOURNAL / SPRING 1992

CPRM VS S&P500 FUTURE RETURN DWLD VS. S&P500 FUTURE RETURN

208 WK MOMNG WINDOW CORRELATION 208 WK MOVlNG WINDOW CORRELATION

QUARTERLY DATA QUARTERLY DATA

so , I .00

.40 .70

n .60

z+s .30 -I

oz t .50

a >

0 .20

- .40

n

cl .lO .30

v 0

1 0.00 0 .20

3

5 .lO

i

= 0.00

-.20

-.lO 1 -.lO

FFRM VS. S&P500 FUTURE RETURN DIV/BIL VS. S&P500 FUTURE RETURN

208 WK MOVlNG WINDOW CORRELATION ’ 200 WK MOVlNG WlNDOW CORRELATION

QUARTERLY DATA QUARTERLY DATA

.60 _I .a I

-I .6

.40 -

I

CY

m

.30 \

LL

LL .20 >

-

c-l .lO cl

y 0.00

3 -.lO

I

-.20