Professional Documents

Culture Documents

Insurance Policy Floater

Uploaded by

LIGAYA SILVESTREOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Insurance Policy Floater

Uploaded by

LIGAYA SILVESTRECopyright:

Available Formats

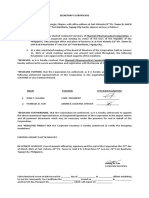

Fair Trade Enforcement Bureau

Business Licensing and Accreditation Division

Accreditation of Freight Forwarders (PSB AO No. 6 Series of 2005)

POLICY TYPE : MERCHANDISE FLOATER WITH TRUCK RISKS PLUS ROBBERY AND

HI-JACKING

A. Covers losses and damages due to:

1. Fire

2. Explosion

3. Collision

4. Overturning or upset of conveyance

5. Collapse of bridges

6. Flood

7. Lightning

8. Cyclone and Tornado

9. Robbery

10. Hi-Jacking

11. Losses and damages due to loading & unloading

12. Losses and damages whilst the vehicle is on stop overnight at an allowed territory

B. Conveyance covered : Owned/leased/hired vehicles.

C. Property covered : Merchandise/goods owned or held in trust or in commission for and

which they are held responsible.

D. Territorial Limits : From point of pick-up whilst in land only to various ports and vice-

versa or as stated in the policy.

Note :

For Domestic Freight Forwarders application, coverage should be within Philippines.

For Branch application, coverage should include the clause: “covers _______ branch

area of operations” where _________ - place of branch (e.g.: Cebu, Iloilo, Davao)

E. Deductible : 80/20% co-insurance or losses due to robbery & hi-jacking. 1% on losses

and damages other than robbery & hi-jacking.

F. Coverage : Minimum required coverage are the following: (highest category applies if

applying for more than one {1} category):

NVOCC - P 1,000,000.00

International Freight Forwarder - 500,000.00

Domestic Freight Forwarder - 250,000.00

Note : Per Anyone Loss or per occurrence or per accident should be at least equal to

minimum required coverage.

Examples:

NVOCC IFF

Agreed Value = PhP1,000,000.00 Agreed Value = PhP500,000.00

Per Anyone Loss = PhP1,000,000.00 Per Anyone Loss = PhP500,000.00

DFF

Agreed Value = PhP250,000.00

Per Anyone Loss = PhP250,000.00

CPG-FTEB-BLAD-Form No.27/rev.02/04.12.19

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Ditctncd20094 enDocument45 pagesDitctncd20094 enLIGAYA SILVESTRENo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Secretary Cert-For ReportDocument1 pageSecretary Cert-For ReportLIGAYA SILVESTRENo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- CPRS - Importer Profile InformationDocument5 pagesCPRS - Importer Profile InformationLIGAYA SILVESTRENo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Sample CPRS ApplicationDocument9 pagesSample CPRS ApplicationLIGAYA SILVESTRENo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Adbi Creative Economy 2030Document339 pagesAdbi Creative Economy 2030LIGAYA SILVESTRE100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A. APPLICANT INFORMATION (Embassy/International Organization)Document3 pagesA. APPLICANT INFORMATION (Embassy/International Organization)LIGAYA SILVESTRENo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Vendor & Customer Setup: Login To Opsdog To Purchase The Full Workflow Template (Available in PDF, VisioDocument1 pageVendor & Customer Setup: Login To Opsdog To Purchase The Full Workflow Template (Available in PDF, VisioLIGAYA SILVESTRENo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- List of Foreign and Domestic Principal/Agents: Shipping Bbbox To The Philippines? Y / NDocument1 pageList of Foreign and Domestic Principal/Agents: Shipping Bbbox To The Philippines? Y / NLIGAYA SILVESTRENo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Organization: Project Overview Plan TemplateDocument9 pagesOrganization: Project Overview Plan TemplateLIGAYA SILVESTRENo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)