Professional Documents

Culture Documents

Form GSTR-3B: (See Rule 61 (5) )

Uploaded by

Maddy GamerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form GSTR-3B: (See Rule 61 (5) )

Uploaded by

Maddy GamerCopyright:

Available Formats

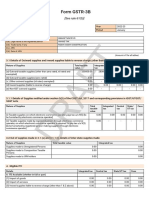

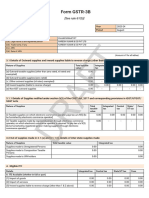

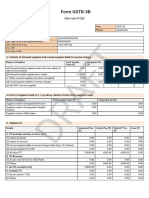

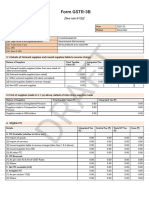

Form GSTR-3B

[See rule 61(5)]

Year 2022-23

Period Apr-Jun

1. GSTIN 01HGDPK7454L1Z6

2(a). Legal name of the registered person KESHAV KHAJURIA

2(b). Trade name, if any KHAJURIA ENTERPRISES

2(c). ARN

2(d). Date of ARN

(Amount in ₹ for all tables)

T

3.1 Details of Outward supplies and inward supplies liable to reverse charge

Nature of Supplies Total taxable Integrated Central State/UT Cess

value tax tax tax

(a) Outward taxable supplies (other than zero rated, nil rated and 0.00 0.00 0.00 0.00 0.00

exempted)

(b) Outward taxable supplies (zero rated)

AF

(c ) Other outward supplies (nil rated, exempted)

(d) Inward supplies (liable to reverse charge)

(e) Non-GST outward supplies

0.00

0.00

0.00

0.00

-

-

0.00

0.00

-

-

-

0.00

-

-

-

0.00

0.00

-

0.00

-

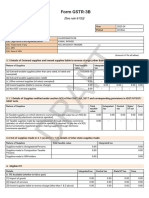

3.2 Out of supplies made in 3.1 (a) above, details of inter-state supplies made

Nature of Supplies Total taxable value Integrated tax

Supplies made to Unregistered Persons 0.00 0.00

Supplies made to Composition Taxable 0.00 0.00

DR

Persons

Supplies made to UIN holders 0.00 0.00

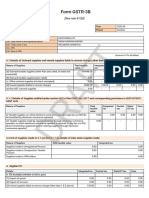

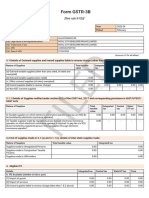

4. Eligible ITC

Details Integrated tax Central tax State/UT tax Cess

A. ITC Available (whether in full or part)

(1) Import of goods 0.00 0.00 0.00 0.00

(2) Import of services 0.00 0.00 0.00 0.00

(3) Inward supplies liable to reverse charge (other than 1 & 2 above) 0.00 0.00 0.00 0.00

(4) Inward supplies from ISD 0.00 0.00 0.00 0.00

(5) All other ITC 0.00 0.00 0.00 0.00

B. ITC Reversed

(1) As per rules 42 & 43 of CGST Rules 0.00 0.00 0.00 0.00

(2) Others 0.00 0.00 0.00 0.00

C. Net ITC available (A-B) 0.00 0.00 0.00 0.00

D. Ineligible ITC 0.00 0.00 0.00 0.00

(1) As per section 17(5) 0.00 0.00 0.00 0.00

(2) Others 0.00 0.00 0.00 0.00

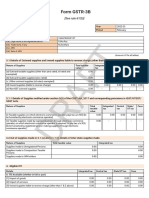

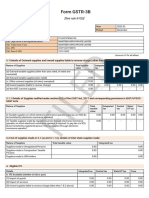

5 Values of exempt, nil-rated and non-GST inward supplies

Nature of Supplies Inter- State supplies Intra- State supplies

From a supplier under composition scheme, Exempt, Nil rated supply 0.00 0.00

Non GST supply 0.00 0.00

5.1 Interest and Late fee for previous tax period

Details Integrated tax Central tax State/UT tax Cess

System computed - - - -

Interest

Interest Paid 0.00 0.00 0.00 0.00

Late fee - 0.00 0.00 -

T

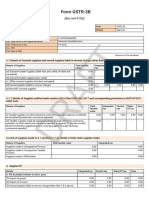

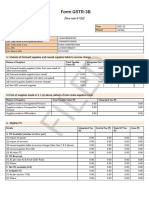

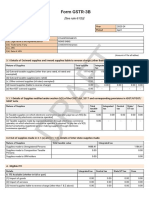

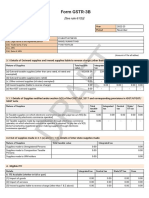

6.1 Payment of tax

Description Total tax Tax paid through ITC Tax paid in Interest paid in Late fee paid in

payable cash cash cash

Integrated Central State/UT Cess

tax tax tax

(A) Other than reverse charge AF

Integrated 0.00 0.00 0.00 0.00 - 0.00 0.00 -

tax

Central tax 0.00 0.00 0.00 - - 0.00 0.00 0.00

State/UT tax 0.00 0.00 - 0.00 - 0.00 0.00 0.00

Cess 0.00 - - - 0.00 0.00 0.00 -

(B) Reverse charge

Integrated 0.00 - - - - 0.00 - -

tax

Central tax 0.00 - - - - 0.00 - -

State/UT tax 0.00 - - - - 0.00 - -

DR

Cess 0.00 - - - - 0.00 - -

You might also like

- GSTR3B 29CHKPJ6990H1ZN 062022Document2 pagesGSTR3B 29CHKPJ6990H1ZN 062022Ashwet JadhavNo ratings yet

- GSTR3B 08bkqpt4567e1zi 012023-1Document2 pagesGSTR3B 08bkqpt4567e1zi 012023-1Prakash KumawatNo ratings yet

- GSTR3B 29dippk5985j1z7 122023Document2 pagesGSTR3B 29dippk5985j1z7 122023Arush KapoorNo ratings yet

- GSTR3B 21acgpd6446d2z5 062023Document2 pagesGSTR3B 21acgpd6446d2z5 062023samir ranjan dhalNo ratings yet

- GSTR3B 24czcpa4819a1z3 102023Document2 pagesGSTR3B 24czcpa4819a1z3 102023yadavdurgen276No ratings yet

- GSTR3B 27DSRPS9946D2ZS 122022Document2 pagesGSTR3B 27DSRPS9946D2ZS 122022Robin PathakNo ratings yet

- GSTR3B 18actpi6464p1zk 122021Document2 pagesGSTR3B 18actpi6464p1zk 122021IMRADUL HUSSAINNo ratings yet

- GSTR3B 33afcfs7231n1zr 012024Document2 pagesGSTR3B 33afcfs7231n1zr 012024saravanakumarNo ratings yet

- GSTR3B 03aabcn2864p1z7 082023Document2 pagesGSTR3B 03aabcn2864p1z7 082023Sumit K JhaNo ratings yet

- GSTR3B 19awjpr1906k1z3 092023Document2 pagesGSTR3B 19awjpr1906k1z3 092023ashiskarmakar93taxNo ratings yet

- GSTR3B 29ahgpn7320k3zy 122021Document2 pagesGSTR3B 29ahgpn7320k3zy 122021Venkatadri SNo ratings yet

- GSTR3B 19BBSPR1755D1Z8 062023Document2 pagesGSTR3B 19BBSPR1755D1Z8 062023b2bservices007No ratings yet

- GSTR3B 10caepk0695k1zs 032024Document2 pagesGSTR3B 10caepk0695k1zs 032024Pankaj SinghNo ratings yet

- GSTR3B 09aaecd7495d2zd 042020Document2 pagesGSTR3B 09aaecd7495d2zd 042020Rajesh KushwahNo ratings yet

- GSTR3B 07afhpj8662d1zd 092022Document2 pagesGSTR3B 07afhpj8662d1zd 092022Deepak JainNo ratings yet

- GSTR3B 07crups2662f1z8 062021Document2 pagesGSTR3B 07crups2662f1z8 062021Gaurav KumarNo ratings yet

- GSTR3B 29cyqpp7381f1zl 122021Document2 pagesGSTR3B 29cyqpp7381f1zl 122021Venkatadri SNo ratings yet

- GSTR3B 09aocpg6070l1zr 042020Document2 pagesGSTR3B 09aocpg6070l1zr 042020Harshit KumarNo ratings yet

- GSTR3B 23azopr4397n1ze 122023Document2 pagesGSTR3B 23azopr4397n1ze 122023vikas guptaNo ratings yet

- GSTR3B 23aywpp5389h1zl 122023Document2 pagesGSTR3B 23aywpp5389h1zl 122023riturajasati4205No ratings yet

- GSTR3B 23aeofs8901c1z2 122021Document2 pagesGSTR3B 23aeofs8901c1z2 122021Saurabh ShrivastavaNo ratings yet

- GSTR3B 36ablfm5302k1z4 012021Document2 pagesGSTR3B 36ablfm5302k1z4 012021venkyNo ratings yet

- GSTR3B 29barpp0608p2zw 122021Document2 pagesGSTR3B 29barpp0608p2zw 122021Venkatadri SNo ratings yet

- GSTR3B 08bgupy2691a1zt 082021Document2 pagesGSTR3B 08bgupy2691a1zt 082021GST COMPLIANCENo ratings yet

- GSTR3B 08bgupy2691a1zt 042021Document2 pagesGSTR3B 08bgupy2691a1zt 042021GST COMPLIANCENo ratings yet

- GSTR3B 36ablfm5302k1z4 022021Document2 pagesGSTR3B 36ablfm5302k1z4 022021venkyNo ratings yet

- GSTR3B 08bgupy2691a1zt 052021Document2 pagesGSTR3B 08bgupy2691a1zt 052021GST COMPLIANCENo ratings yet

- GSTR3B 09jakpk9931b1zc 092021Document2 pagesGSTR3B 09jakpk9931b1zc 092021Satyendra SinghNo ratings yet

- GSTR3B 19bxipr2995f1zt 022023Document2 pagesGSTR3B 19bxipr2995f1zt 022023Booky TrendsNo ratings yet

- GSTR3B 07hozpd0647l1z9 112023-2Document2 pagesGSTR3B 07hozpd0647l1z9 112023-2Ayush KumarNo ratings yet

- GSTR3B 08bgupy2691a1zt 072021Document2 pagesGSTR3B 08bgupy2691a1zt 072021GST COMPLIANCENo ratings yet

- GSTR3B 19anapb5865f2z2 122021Document2 pagesGSTR3B 19anapb5865f2z2 122021Bikram PaulNo ratings yet

- GSTR3B 19aoppr3859h1z4 012022Document2 pagesGSTR3B 19aoppr3859h1z4 012022nkbiNo ratings yet

- GSTR3B 19anapb5865f2z2 092021Document2 pagesGSTR3B 19anapb5865f2z2 092021Bikram PaulNo ratings yet

- Feb 2019 3BDocument2 pagesFeb 2019 3BNibedita PadhyNo ratings yet

- GSTR3B 19anapb5865f2z2 062021Document2 pagesGSTR3B 19anapb5865f2z2 062021Bikram PaulNo ratings yet

- Form GSTR-3B: (See Rule 61 (5) )Document2 pagesForm GSTR-3B: (See Rule 61 (5) )Prasoon MohantyNo ratings yet

- GSTR3B 33auwpm2708d1zm 092021Document2 pagesGSTR3B 33auwpm2708d1zm 092021Maniyarasu NatarajanNo ratings yet

- GSTR3B 36aafcr5625q1zr 022024Document3 pagesGSTR3B 36aafcr5625q1zr 022024Kri ShnaNo ratings yet

- Gstr3b PurchaseDocument3 pagesGstr3b PurchaseAVR CONSULTANCYNo ratings yet

- GSTR3B 08aerpr6003h1z8 062021Document2 pagesGSTR3B 08aerpr6003h1z8 062021Akash JainNo ratings yet

- GSTR3B 18alipd4509l1zz 022023Document3 pagesGSTR3B 18alipd4509l1zz 022023Gaurav Ujjal BharaliNo ratings yet

- GSTR3B 07HMSPS9294B1Z5 042023Document2 pagesGSTR3B 07HMSPS9294B1Z5 042023Ajay rawatNo ratings yet

- GSTR3B 27ajhpc7391j2zv 012023Document3 pagesGSTR3B 27ajhpc7391j2zv 012023Aman JaiswalNo ratings yet

- GSTR3B 07abwpt4073b1zb 112022Document2 pagesGSTR3B 07abwpt4073b1zb 112022Deepak JainNo ratings yet

- GSTR3B 24FDSPM9863D1ZX 092022Document3 pagesGSTR3B 24FDSPM9863D1ZX 092022Atmos GamingNo ratings yet

- GSTR3B 01bcupl5374b1zo 062023Document3 pagesGSTR3B 01bcupl5374b1zo 062023imt caNo ratings yet

- Form GSTR-3B: (See Rule 61 (5) )Document2 pagesForm GSTR-3B: (See Rule 61 (5) )DHARMAVARAPU Bala sriramNo ratings yet

- MH GSTR3B Dec'22Document3 pagesMH GSTR3B Dec'22crmfinance.tnNo ratings yet

- GSTR3B 10cespr1366g1ze 012023Document3 pagesGSTR3B 10cespr1366g1ze 012023Mega GuideNo ratings yet

- MH GSTR3B Nov'22Document3 pagesMH GSTR3B Nov'22crmfinance.tnNo ratings yet

- GSTR3B 09ehmpm8928j1zf 062021Document2 pagesGSTR3B 09ehmpm8928j1zf 062021Ankur mittalNo ratings yet

- GSTR3B 36bmypp9150m1zx 012023Document3 pagesGSTR3B 36bmypp9150m1zx 012023RAJESH DNo ratings yet

- GSTR3B 23aakpn8746q1zu 092021Document2 pagesGSTR3B 23aakpn8746q1zu 092021HIMANSHU NNo ratings yet

- GSTR3B 33aivpc1432h1zi 062023Document3 pagesGSTR3B 33aivpc1432h1zi 062023crmfinance.tnNo ratings yet

- GSTR3B 07aonpj7130d2z2 112022Document3 pagesGSTR3B 07aonpj7130d2z2 112022Rudra JhaNo ratings yet

- Dec 22-23Document3 pagesDec 22-23crmfinance.tnNo ratings yet

- GSTR3B - 08bhupa6318m2zt - 122022 Oct To Dec 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 122022 Oct To Dec 2022Rahul SharmaNo ratings yet

- GSTR3B 29CCJPB0206J1ZW 112022Document3 pagesGSTR3B 29CCJPB0206J1ZW 112022naveenjr4No ratings yet

- Electrochemistry AssignmentDocument3 pagesElectrochemistry AssignmentMaddy GamerNo ratings yet

- English HomeworkDocument4 pagesEnglish HomeworkMaddy GamerNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BDocument7 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BMaddy GamerNo ratings yet

- Course PaidDocument1 pageCourse PaidMaddy GamerNo ratings yet

- Project ProposalDocument5 pagesProject ProposalainjelNo ratings yet

- Code of Professional Ethics For School TeachersDocument9 pagesCode of Professional Ethics For School TeachersDr. Tapan Kr. DuttaNo ratings yet

- Diet - Brown Rice FastingDocument6 pagesDiet - Brown Rice Fastingknowingthevoid100% (1)

- Fever and Rash in The Immunocompetent PatientDocument62 pagesFever and Rash in The Immunocompetent PatientsunilchhajwaniNo ratings yet

- Study Material Class Xi Chemistry FinalDocument176 pagesStudy Material Class Xi Chemistry FinalHARSH VARDHAN 38 10CNo ratings yet

- The Economist - 27.05.23Document80 pagesThe Economist - 27.05.23Paulo4255100% (1)

- Letter To Eng From PokornyDocument3 pagesLetter To Eng From PokornyNewsdayNo ratings yet

- Augmentin Paed Susp MF gdsv26 Ipiv14 Dated 13 June 2019 24022021Document15 pagesAugmentin Paed Susp MF gdsv26 Ipiv14 Dated 13 June 2019 24022021Phisit PanasophonkulNo ratings yet

- J and e Hall Screw Compressor Model 4200Document50 pagesJ and e Hall Screw Compressor Model 4200Patrick Clarke60% (5)

- Maria Umar - Entrepreneurship Assignment 1Document3 pagesMaria Umar - Entrepreneurship Assignment 1Faizan AhmedNo ratings yet

- Natural Gas Filters PDFDocument10 pagesNatural Gas Filters PDFKirthiga RamaswamyNo ratings yet

- Proposal For Establishment of A Rabbit Multiplication & Training CentreDocument18 pagesProposal For Establishment of A Rabbit Multiplication & Training CentreNashran Harith NazreeNo ratings yet

- 038 Health In1Document281 pages038 Health In1Naren Mukherjee100% (11)

- Property Issue Agreement: Vinod Patel Group It DepartmentDocument3 pagesProperty Issue Agreement: Vinod Patel Group It DepartmentMaloni SavikeNo ratings yet

- Technical Reference - Lightning Protection To Nfpa and Ul StandardsDocument1 pageTechnical Reference - Lightning Protection To Nfpa and Ul StandardsMarcons Jon Maturan CasabaNo ratings yet

- Practical Project Management 101: Unit StandardsDocument109 pagesPractical Project Management 101: Unit StandardsHrh Charmagne Thando NkosiNo ratings yet

- On Agents of MutationDocument22 pagesOn Agents of Mutationmine_ne361No ratings yet

- Emkarate Rl220h Msds v1.5Document11 pagesEmkarate Rl220h Msds v1.5luanacompany954No ratings yet

- ABB VFD CatalogesDocument25 pagesABB VFD CatalogesadehriyaNo ratings yet

- XMTC DatasheetDocument4 pagesXMTC DatasheetSelva RajNo ratings yet

- BIOL 3140 Lab Report 3Document21 pagesBIOL 3140 Lab Report 3Tabashir AhmedNo ratings yet

- Chapter - 5 Organic MaterialsDocument36 pagesChapter - 5 Organic MaterialsJayvin PrajapatiNo ratings yet

- The First Battle of GroznyDocument71 pagesThe First Battle of GroznyScimitar Mcmlxv100% (1)

- Code of Business Conduct For Suppliers To The Coca-Cola CompanyDocument1 pageCode of Business Conduct For Suppliers To The Coca-Cola CompanyMonicaNo ratings yet

- 07-Drug and Substance Use Among Filipino Street Children in An Urban SettingDocument5 pages07-Drug and Substance Use Among Filipino Street Children in An Urban SettingJohn Felix AndalNo ratings yet

- Lampiran 1 Amandemen-1 Kesepakatan Harga Satuan (KHS)Document5,697 pagesLampiran 1 Amandemen-1 Kesepakatan Harga Satuan (KHS)YeremiaNo ratings yet

- Ied Product Disassembly Chart 1 2Document2 pagesIed Product Disassembly Chart 1 2api-672283531No ratings yet

- Anti Fraud PMJAY Guidelines 1 2 RemovedDocument26 pagesAnti Fraud PMJAY Guidelines 1 2 RemovedChota ChawalNo ratings yet

- Passive MovementDocument16 pagesPassive Movementjetindar33% (3)

- BÜHLMANN Laboratories AG Receives FDA Clearance For Its fCAL® Turbo Automated, Random Access Calprotectin TestDocument3 pagesBÜHLMANN Laboratories AG Receives FDA Clearance For Its fCAL® Turbo Automated, Random Access Calprotectin TestPR.comNo ratings yet