Professional Documents

Culture Documents

Income Statement Questions

Income Statement Questions

Uploaded by

MAOMOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Statement Questions

Income Statement Questions

Uploaded by

MAOMCopyright:

Available Formats

APDE-CAMPOALEGRE

SECONDARY SECTION

ACCOUNTING III COURSE

HOMEWORK ACTIVITY

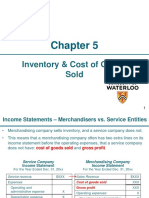

The Trading Account

Vocabulary:

Inventories and stocks are raw materials or goods that have been acquired by the firm for future sale

but have not yet been sold.

Revenues are monies from the sale of goods, or Price x Quantity. Sales can be a money value or a unit

depending on context but revenues are always a money amount.

The trading account shows GROSS PROFIT. It is the first section of the Income Statement.

Gross indicates that nothing has been subtracted.

Gross Profit is profit without any subtractions, i.e. with expenses still included. When compared with

revenue, it indicates the role or impact of direct costs on business profits.

Gross profit is the difference between the sales revenue and the cost to the business of its sales.

Revenues from Sales $ XXXX

minus Cost of Goods - XX

equals Gross Profit $ XXX

Revenue from sales is the income earned from the sale of goods (trading activity).

Cost of sales means the direct costs needed to earn the revenues. Cost of goods has effectively the same

meaning as cost of sales. The two terms are used interchangeably; both refer to direct costs.

Cost of goods is the direct cost of producing or buying the goods sold during the period.

Opening Stock $ XXXX

plus New Stock + XX

minus Closing Stock - XX

equals Cost of Goods = XXX

Problem Set 1

a. A business has inventories (stock) worth $700 at the start of a trading period. It purchased $300

additional inventories. At the end of the period it had $200 worth of inventories. What is CoGs?

b. A business used $1000 worth of materials and paid workers $1500 to earn $5000 during a

trading period. What is CoGs?

c. A firm valued its opening stock at $3000 and made additional purchases of $1000 during the

period that followed. If its CoGs was $2000, what is the value of closing inventory?

d. A business had opening inventories of $20 000 and purchased $5 000 new items. The closing

inventory was $7 000. If it had sales revenues of $15 000, what was CoGs? What gross profit was

earned during the period?

e. A business had closing inventories of $2 000 and opening inventories of $3000 with additional

purchases of $500 made during the period. If Sales of $1000 were booked, how much Gross

Profit did the firm make?

Problems Set 2

a. Business A has a gross profit of $200 on sales of $1 000, while business B has gross profit of $200

on sales of $500. Which company has the lower cost of sales? Which company is the “better”

company in terms of its profit, and in terms of its cost of sales?

b. A firm at the start of a trading period had $3 000 worth of stock and then it bought an additional

$500. The company closed the period with stock valued at $1000. What is CoGs?

What would its gross profit be if it sold 600 units of a product at $5 each?

c. A firm has gross profits of $2 000 on sales of $5 000. If starting inventories were $1 000 and

ending inventories were $2 000, what additions were made to inventories?

SUMMARY

The trading account shows how much direct cost it takes for the business to earn its revenues. Direct

costs are subtracted from revenues to give Gross Profit. Gross Profits are largely determined by market

forces and so they are beyond the immediate control of managers. Gross Profit is a reflection of the

profits available in the industry.

You might also like

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Chapter 3 Inventories and Cost of Goods SoldDocument84 pagesChapter 3 Inventories and Cost of Goods SoldSampanna Shrestha100% (1)

- Medoc CompanyDocument2 pagesMedoc CompanyPriyanka Kelgandre67% (3)

- MM Chapter 2Document26 pagesMM Chapter 2Robin Van SoCheat100% (3)

- Business Math 11 Q1M5Document16 pagesBusiness Math 11 Q1M5Lalie ESCNo ratings yet

- q1 Business Math Module 5Document17 pagesq1 Business Math Module 5Reigi May100% (2)

- Profit and GainDocument3 pagesProfit and GainS K MahapatraNo ratings yet

- LAS ABM - FABM12 Ic D 7 Week 3Document9 pagesLAS ABM - FABM12 Ic D 7 Week 3ROMMEL RABONo ratings yet

- Ch.5 - Inventory and COGS - MHDocument61 pagesCh.5 - Inventory and COGS - MHSamZhaoNo ratings yet

- Merchandising Accounting: Youtube Channel Link (Also Subscribe) Because I Need Your FeedbackDocument27 pagesMerchandising Accounting: Youtube Channel Link (Also Subscribe) Because I Need Your FeedbackBharti PahujaNo ratings yet

- Ch.5 - Inventory and COGS - MH - Obj1Part1Document15 pagesCh.5 - Inventory and COGS - MH - Obj1Part1SamZhaoNo ratings yet

- Retail Math'Sppt1Document40 pagesRetail Math'Sppt1nataraj105100% (9)

- Blue White and Black Geometric Mathematics Lesson Math Creative Presentation SlidesCarnivalDocument23 pagesBlue White and Black Geometric Mathematics Lesson Math Creative Presentation SlidesCarnivalUmer HanifNo ratings yet

- LS4-7 (3) MARIANO - EditedDocument16 pagesLS4-7 (3) MARIANO - EditedarnelNo ratings yet

- 08-ACCA-FA2-Chp 08Document28 pages08-ACCA-FA2-Chp 08SMS PrintingNo ratings yet

- Lesson 1 Profit or Loss For A Business: Let's Explore and DiscoverDocument8 pagesLesson 1 Profit or Loss For A Business: Let's Explore and DiscoverScarlet VillamorNo ratings yet

- Accounting Slides Income StatmentDocument20 pagesAccounting Slides Income StatmentEdouard Rivet-BonjeanNo ratings yet

- The Trading and Profit and Loss Account and The Balance SheetDocument62 pagesThe Trading and Profit and Loss Account and The Balance SheetMir AqibNo ratings yet

- sheet (6) ازهر E1Document10 pagessheet (6) ازهر E1magdy kamelNo ratings yet

- Financial StatementDocument7 pagesFinancial StatementZaara AshfaqNo ratings yet

- Fundamentals of Accountancy, Business and Management 2: Statement of Comprehensive IncomeDocument9 pagesFundamentals of Accountancy, Business and Management 2: Statement of Comprehensive IncomeBea allyssa CanapiNo ratings yet

- Discussion Guide - Chapter 5Document7 pagesDiscussion Guide - Chapter 5Khoi NguyenNo ratings yet

- ECON 1033 Handout 1Document3 pagesECON 1033 Handout 1Dennn TerencioNo ratings yet

- Abm Fabm1 Airs LM q4-m14Document12 pagesAbm Fabm1 Airs LM q4-m14Rudyna MarzanNo ratings yet

- Buying and SellingDocument14 pagesBuying and Sellinglun3l1ght18No ratings yet

- Bepmc 311: Managerial Economics: Module 4: Analysis of The Theory of Production, Cost, Revenue and ProfitDocument21 pagesBepmc 311: Managerial Economics: Module 4: Analysis of The Theory of Production, Cost, Revenue and ProfitAliezaNo ratings yet

- Monday November 25, 2020 Turnover and Net Profit Learning ObjectivesDocument3 pagesMonday November 25, 2020 Turnover and Net Profit Learning ObjectivesChikanma OkoisorNo ratings yet

- F2 ACCA Financial Accounting - Inventory by MOCDocument10 pagesF2 ACCA Financial Accounting - Inventory by MOCMunyaradzi Onismas Chinyukwi100% (1)

- Cost Volume Profit ERDocument17 pagesCost Volume Profit ERIris BalucanNo ratings yet

- EntrepMod7 9summaryDocument6 pagesEntrepMod7 9summaryMarc BorcilloNo ratings yet

- EntrepDocument24 pagesEntrepniña kris paatNo ratings yet

- Week4 Handout WORKEDDocument14 pagesWeek4 Handout WORKEDLecia Lebby CNo ratings yet

- Fundamental I CH IIIDocument18 pagesFundamental I CH IIIEllii YouTube channelNo ratings yet

- Business Math - Q1 - Week 6 - Module 4 - MARGINS AND DISCOUNTS REPRODUCTIONDocument20 pagesBusiness Math - Q1 - Week 6 - Module 4 - MARGINS AND DISCOUNTS REPRODUCTIONJhudiel Dela ConcepcionNo ratings yet

- Fabm1 Q4 M17Document16 pagesFabm1 Q4 M17Cyrine PlacidoNo ratings yet

- Final Accouts of Sole Trader FIMS NOTE No - 1Document3 pagesFinal Accouts of Sole Trader FIMS NOTE No - 1arshadpcmongam9895No ratings yet

- E-Management Analysis Is Aided. The Special Journal Can Be Useful To Management inDocument14 pagesE-Management Analysis Is Aided. The Special Journal Can Be Useful To Management inTIZITAW MASRESHANo ratings yet

- Software Packages Project-Analysis of Camping Sales of A CompanyDocument7 pagesSoftware Packages Project-Analysis of Camping Sales of A CompanyAlexandra IonascuNo ratings yet

- Inventory Turnover ExamplesDocument4 pagesInventory Turnover ExamplesAlexGarcia100% (1)

- Week 006 007 Types of Business According To ActivitiesDocument62 pagesWeek 006 007 Types of Business According To ActivitiesKatherine Jane GeronaNo ratings yet

- Types of GoodwillDocument4 pagesTypes of GoodwillNitesh KotianNo ratings yet

- GMROIDocument3 pagesGMROIlimaquicaNo ratings yet

- CH 6Document51 pagesCH 6anjo hosmerNo ratings yet

- Think of Words That Best Describe Revenues. Expenses Statement of Comprehensive IncomeDocument30 pagesThink of Words That Best Describe Revenues. Expenses Statement of Comprehensive IncomeJasy Nupt GilloNo ratings yet

- ENTREPRENEURSHIP 12 Q2 M8 Computation of Gross ProfitDocument18 pagesENTREPRENEURSHIP 12 Q2 M8 Computation of Gross ProfitMyleen CastillejoNo ratings yet

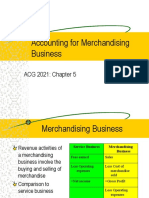

- Accounting For Merchandising BusinessDocument34 pagesAccounting For Merchandising BusinessErleNo ratings yet

- Accounting For MerchandisingDocument45 pagesAccounting For Merchandisingcristin l. viloriaNo ratings yet

- Income Statement 2Document7 pagesIncome Statement 2Jonabed PobadoraNo ratings yet

- Part - 2 - Dashboard - Cost of Sales and The Different Profit MarginsDocument4 pagesPart - 2 - Dashboard - Cost of Sales and The Different Profit MarginsJaquelyn JacquesNo ratings yet

- EL201 Accounting Learning Module Lessons 51Document19 pagesEL201 Accounting Learning Module Lessons 51BabyjoyNo ratings yet

- Module 5Document45 pagesModule 5Rafael100% (1)

- Gross Profit Operating Revenue CogsDocument11 pagesGross Profit Operating Revenue CogskyoNo ratings yet

- Cot 1-Computation of Gross ProfitDocument24 pagesCot 1-Computation of Gross ProfitRuffa L100% (1)

- CVPDocument8 pagesCVPJessica EntacNo ratings yet

- CBSE Class 11 Accounting-End of Period AccountsDocument34 pagesCBSE Class 11 Accounting-End of Period AccountsRudraksh PareyNo ratings yet

- Gross Profit PDFDocument20 pagesGross Profit PDFJanelle Ghia RamosNo ratings yet

- Fabm 121.week 6-10 ModuleDocument22 pagesFabm 121.week 6-10 Modulekhaizer matias100% (1)

- Types of Business According To Activities: Prepared By: Prof. Jonah C. PardilloDocument60 pagesTypes of Business According To Activities: Prepared By: Prof. Jonah C. PardilloShaneil MatulaNo ratings yet

- Chapter 1Document27 pagesChapter 1Tasebe GetachewNo ratings yet

- Unit 3. Accounting For Merchandising BusinessesDocument10 pagesUnit 3. Accounting For Merchandising BusinessesHussen AbdulkadirNo ratings yet

- Introduction to Business English (Words and Their Secrets)From EverandIntroduction to Business English (Words and Their Secrets)No ratings yet

- PrimacordDocument2 pagesPrimacordgattopazzo54No ratings yet

- HR PolicyDocument6 pagesHR PolicyAmbientNo ratings yet

- ReadmeDocument4 pagesReadmeRaulSemeleNo ratings yet

- Mortati C Resume - Clean 2Document2 pagesMortati C Resume - Clean 2api-459797233No ratings yet

- Sales Training GuideDocument13 pagesSales Training GuideThomas Niconar PalemNo ratings yet

- Gross Profit Method: (Estimating Inventory)Document11 pagesGross Profit Method: (Estimating Inventory)Jo MalaluanNo ratings yet

- Retail 1 PDFDocument381 pagesRetail 1 PDFromakanta patroNo ratings yet

- Project On Britannia - FinalDocument55 pagesProject On Britannia - FinalParveen SinghNo ratings yet

- 11-1 - Assessment of Entrepreneurial OpportunitiesDocument24 pages11-1 - Assessment of Entrepreneurial Opportunitiesmaverik Ad100% (1)

- Tableau Incoterms 202000Document5 pagesTableau Incoterms 202000souleymane sow100% (6)

- The Groove Merchant by NUS Jazz Band - 1Document2 pagesThe Groove Merchant by NUS Jazz Band - 1Oliver QuekNo ratings yet

- LP ExercisesDocument12 pagesLP Exerciseszachryprolahok80yaho100% (1)

- GST Assignment PDFDocument15 pagesGST Assignment PDFAzharNo ratings yet

- Principles of Rural MarketingDocument67 pagesPrinciples of Rural MarketingHarshdeep Bhatia0% (1)

- Business PlanDocument6 pagesBusiness PlanWilson AgustinNo ratings yet

- The Aircraft Depreciation DilemmaDocument19 pagesThe Aircraft Depreciation DilemmaAdyb A SiddiqueeNo ratings yet

- SHFL 2012 Annual ReportDocument13 pagesSHFL 2012 Annual ReportSHFL entertainment, Inc.No ratings yet

- Operating Budget ExampleDocument10 pagesOperating Budget ExampleImperoCo LLCNo ratings yet

- Sales Force AutomationDocument6 pagesSales Force Automationbdm5635No ratings yet

- Taxi ServiceDocument25 pagesTaxi ServiceAmitsinh ViholNo ratings yet

- Chapter 6 ADVACC 2Document21 pagesChapter 6 ADVACC 2Angelic100% (1)

- CatalogPage001 133 Uid12202012253512Document136 pagesCatalogPage001 133 Uid12202012253512Ioana MarișNo ratings yet

- Story of Stuff - Victor LebowDocument9 pagesStory of Stuff - Victor LebowJeff100% (8)

- The Acquisition ProcessDocument3 pagesThe Acquisition ProcessYuriUstinovNo ratings yet

- Service Quality (Questionnaire Shodhganga)Document12 pagesService Quality (Questionnaire Shodhganga)Hiren SojitraNo ratings yet

- Chapter 31 1Document16 pagesChapter 31 1shefalimalsheNo ratings yet

- Grand Strategy Selection MatrixDocument1 pageGrand Strategy Selection MatrixGaurang MagdaniNo ratings yet

- Human Resources/Operations ManagementDocument3 pagesHuman Resources/Operations Managementapi-78026736No ratings yet