Professional Documents

Culture Documents

Nigeria Taxation Post Covid - What To Expect

Uploaded by

Omotayo AlabiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nigeria Taxation Post Covid - What To Expect

Uploaded by

Omotayo AlabiCopyright:

Available Formats

bloombergindustry.

com

Reproduced with permission. Published December 08, 2020. Copyright R 2020 The Bureau of National Affairs, Inc. 800-

372-1033. For further use, please visit https://www.bloombergindustry.com/copyright-and-usage-guidelines-copyright/

Nigeria: Taxation Post Covid—What to Expect

BY ADEGBOLA THOMAS AND ADEOLA AKINDELE ever, the revenue projections were not realistic because

of Covid-19, which triggered a sudden drop in demand

The first case of Covid-19 in Nigeria was recorded in

for oil and consequently a plunge in global oil prices.

Lagos State on February 28, 2020, and the Federal Gov-

The Federal Executive Council, therefore, approved the

ernment of Nigeria subsequently directed a complete

review of the 2020 budget to 10.81 trillion Nigerian

lockdown of Lagos and Abuja, the nation’s economic

naira ($28.4 billion), from the original approved amount

and political capitals respectively, for 28 days, in a bid

of 10.58 trillion naira.

to curtail the spread of the virus. The lockdown in Nige-

Despite the revision, Nigeria’s economy is still in a

ria, while critical for disease containment, impacted the

delicate balance, as there are no clear indications that

economic and social structures of the country and led to

the country will be able to meet its revenue targets.

demand and supply disruptions. Some businesses were

Based on the 2020 first quarter report of the Federal In-

faced with going concern issues and had to employ

land Revenue Service (FIRS) and the Medium-Term Ex-

varying degrees of cost-cutting measures for survival.

penditure Framework and Fiscal Strategy (MTEF/FSP)

A United Nations Development Program report esti-

report released by the Federal Ministry of Finance, Bud-

mates that about 3.84 million persons in Nigeria have

get and National Planning, Nigeria may only be able to

experienced direct job loss with a further projection of

achieve about 50% of its revenue targets in 2020.

13 million persons who may have experienced collat-

As if the situation is not overwhelming enough, the

eral damage (Brief 3 | Potential Impact of Lockdown

first quarter MTEF/FSP report noted that the bulk of the

Policies on Poverty and Well-Being: A brief prepared by

revenue generated was used to meet debt service obli-

UNDP Nigeria on behalf of the UN System in Nigeria).

gations as the country’s debt service payments as a per-

As at October 30, 2020, there had been 62,521 con-

centage of revenue rose to 99% in the quarter.

firmed cases with over 1,141 deaths and 58,249 dis-

charged patients (Covid-19 Situation Report 114: Data

as reported and accurate by NCDC as at October 30, What Should We Expect Post

2020). The government and businesses now expect the Covid-19?

economy, which recently recovered from a 2016 reces-

sion, to shrink further this year. Given the above challenges, it is only a matter of time

Nigeria’s 2020 budgeted revenue was largely based before revenue agencies resort to ingenious means of

on crude oil production volume of 2.18 million barrels shoring up government revenue in the coming months.

per day with a price benchmark of $57 per barrel. How- However, revenue agencies and tax authorities will

need to proceed with caution in view of the saying that

no nation can ever tax itself into prosperity.

Adegbola Thomas is a Manager and Adeola Therefore, whilst the Nigerian government will be

Akindele is an Experienced Staff Analyst, Tax, bogged down with the question of how to generate

Regulatory and People Services Division, with enough revenue to finance the revised budget, the gov-

KPMG in Nigeria. ernment should also be concerned with measures that

can stimulate business and economic activities.

COPYRIGHT R 2020 BY THE BUREAU OF NATIONAL AFFAIRS, INC.

2

light of the greater risks and economic upheaval that

most businesses may be facing. It is, however, a wel-

come development that the tax authorities are showing

Government Measures some level of support to businesses during these un-

The Federal Government has already put together precedented times.

some palliative measures, with the Central Bank of Ni- Nevertheless, the tax authorities could also consider

geria (CBN) unveiling a series of interventions, includ- the possibility of adapting a more inclusive and exten-

ing a 50 billion naira Targeted Credit Facility (TCF); sive approach to helping businesses cushion the effect

100 billion naira health sector loan; injection of 3.6 tril- of post-Covid-19 challenges. For instance, the tax au-

lion naira into the banking system; reduction of interest thorities could comfortably extend the waiver of penalty

rates from 9% to 5%; and introduction of a one-year and interest charges on additional tax audit assess-

moratorium on applicable CBN interventions. ments and self-assessed tax liabilities that have re-

The CBN has also started disbursing the 50 billion mained unpaid after their statutory payment timelines

naira TCF via the Nigeria Incentive-based Risk Sharing to a much later date, such as the end of the year, when

System for Agricultural Lending Microfinance Bank to there may be an upswing in economic activities.

the beneficiaries. Out of the 80,000 applicants, about

1,000 have been able to access the loan, and it is ex- Communicating with Tax Authorities

pected that this number will rise in the coming months.

The House of Representatives, through the Economic Tax audits/investigations were initially suspended, al-

Stimulus Bill, proposed some tax rebates for businesses though the FIRS since resumed the exercise on June 30,

and organizations that retained their employees 2020. Given Covid-19 social distancing protocols, it is

through the Covid-19 crisis, subject to their satisfying unthinkable that taxpayers would be comfortable host-

some conditions. Although details on the applicability ing revenue officials within their office premises for tax

of the rebate to taxpayers and businesses are still audit exercises. Therefore, it may be necessary to con-

sketchy, it appears that oil-producing companies may sider a paradigm shift towards virtual tax audits using

be excluded from eligibility for the palliative. This may web-based or cloud-based systems.

be counterproductive, given that most oil producers are Taxpayers would be open to electronic transmission

the worst hit, with the twin shock of the Covid-19 pan- of documents via emails, holding tax audit meetings via

demic and dwindling oil prices. video conferencing platforms, and utilizing cloud-based

It is expected that there will be greater clarity and in- document storage systems, provided that the appropri-

clusiveness on the applicability of the Bill before it is ate data encryption and security systems are available

passed by the Nigerian parliament and assented to by to the tax officials. This would eliminate the challenges

the President. associated with travel time, document security, docu-

ment retention and space constraints.

Tax Measures Similarly, it is expected that there will be less fre-

quent visits to tax offices for routine tasks such as sub-

The FIRS also communicated, through its official mission of tax returns and letters, payment notifica-

publications, palliative measures such as: tions, processing of tax clearance certificates and re-

s waivers of late return penalty for taxpayers who ceipts etc., as taxpayers adopt the various online means

pay early and file late; of document exchange to process their applications,

submit their tax returns and obtain the relevant

receipts/confirmations.

s extension of timeline for filing of value-added tax

The Finance Act, 2019 has already clarified that a no-

(VAT) and withholding tax, from the statutory 21 days

tice of objection submitted via electronic means such as

to the last working day of the month, following the

email is valid. Thus, it is only natural for taxpayers to

month of deduction;

explore this alternative for exchanging correspondence

with the tax authorities.

s extension of transaction tax remittance deadline This is surely a wake-up call to tax authorities to de-

to last day of the month; velop a functional and robust online/electronic tax por-

tal that would accommodate the various needs of tax-

s suspension of tax audits and investigation; payers. The portal’s functionality should be akin to the

internet bank platforms of commercial banks and

should be capable of multiple functionalities, including

s extension of the due date for filing of companies download of tax position of business/individual, re-

income tax by one month; ceipts and tax clearance certificates.

Another post Covid-19 expectation will be the digital

s submission of tax returns by taxpayers without au- migration of tax payments/collection. The coronavirus

dited financial statements which must be submitted pandemic has served as an accelerator for the digital

within two months of the revised due date of filing; payments industry, as consumers and businesses have

been forced to drastically change their purchasing hab-

its. Digital payment is characterized by lower fees,

s waiver of penalty and interest on additional tax as- prompt payment, greater security, and more flexible

sessments provided the liability was paid before August payment options. A number of utility and service deliv-

31, 2020, toward easing the effect of Covid-19 on tax- ery organizations have accentuated the need for their

payers. customers to move to digital/online based payments.

Some professionals and business owners have com- It is to be expected that taxpayers and tax authorities

mented that the above palliatives may be inadequate in will continue to adopt different digital platforms, in-

COPYRIGHT R 2020 BY THE BUREAU OF NATIONAL AFFAIRS, INC.

3

cluding contactless cash service providers, to respec- shortest possible time, and taxpayers can have a degree

tively pay and collect tax liabilities. In fact, digital mi- of certainty in their decision-making process.

gration of tax payments fulfills the canon of taxation as

it relates to convenience and economy; with an intrinsic

capacity to significantly limit tax evasion and fraud. Looking Ahead

One easy way of collecting taxes is the integration of

tax collection platforms with different payment chan- It is commendable that the Federal Government of

nels. This is particularly important for indirect taxes, Nigeria, the CBN and the tax authorities continue to roll

such as VAT, given that the taxes occur simultaneously out fiscal stimulus packages to reduce the burden on

as the transaction is conducted. If the tax collection companies. It is our hope that more palliatives will be

platform is integrated into the transaction payment introduced in these trying times.

channels, the taxes are automatically collected and However, the global forecast is that the world

transferred into the relevant tax account of the revenue economy will plunge into a recession, post-Covid-19.

authorities. This will no doubt increase government rev- Some businesses will fold, while others will thrive and

enue from tax while also expanding the tax base of the grow from the opportunities that Covid-19 presents.

country. Beyond the immediate reactions highlighted above,

The Covid-19 crisis has caused an increase in press companies must look ahead, think and act strategically

releases from regulators and tax authorities, and it is in the context of the emerging new normal. Businesses

expected that the post Covid-19 era will usher in more need to build strategic risk management capabilities to

circulars, policy documents and updates to existing tax inform future strategy and better prepare them for the

and regulatory processes. Tax and regulatory updates world as we now know it.

are welcome developments, although it may be difficult

to keep track of them unless they are compiled into a This column does not necessarily reflect the opinion

single working document. It is also possible that tax- of The Bureau of National Affairs, Inc. or its owners.

payers and other stakeholders may not agree with some

of the contents of circulars and press releases, as they Adegbola Thomas is a Manager and Adeola Akindele

typically contain the FIRS’ opinions on contentious is- is an Experienced Staff Analyst, Tax, Regulatory and

sues in tax law. People Services Division, with KPMG in Nigeria.

It is, therefore, important that the process of arbitra- The authors may be contacted at: adegbola.thomas@

tion is timely so that clarity can be obtained within the ng.kpmg.com; adeola.akindele@ng.kpmg.com

COPYRIGHT R 2020 BY THE BUREAU OF NATIONAL AFFAIRS, INC.

You might also like

- Trinidad and Tobago National Budget 2022Document60 pagesTrinidad and Tobago National Budget 2022brandon davidNo ratings yet

- Zambia Introduces Fiscal Measures To Mitigate Impact of COVID-19Document4 pagesZambia Introduces Fiscal Measures To Mitigate Impact of COVID-19harryNo ratings yet

- Testing Times Ahead: #Budget 2020Document48 pagesTesting Times Ahead: #Budget 2020DarwinNo ratings yet

- Risk-Based Audit-A Tool For Voluntary Tax ComplianceDocument4 pagesRisk-Based Audit-A Tool For Voluntary Tax ComplianceOmotayo AlabiNo ratings yet

- Internally Generated Revenue Revolution in Kaduna State Nigeria: Emerging Revenue Sources and StrategiesDocument6 pagesInternally Generated Revenue Revolution in Kaduna State Nigeria: Emerging Revenue Sources and StrategiesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- PWCDocument47 pagesPWCDefimediagroup Ldmg100% (1)

- Laporan Tahunan DJP 2020 - EnglishDocument256 pagesLaporan Tahunan DJP 2020 - EnglishHaryo BagaskaraNo ratings yet

- Finance Act Era Critical Evaluation 1 1Document22 pagesFinance Act Era Critical Evaluation 1 1Folawiyo AgbokeNo ratings yet

- Union Budget 2021Document58 pagesUnion Budget 2021Mexico EnglishNo ratings yet

- The Effect of Liquidity, Leverage and Determined Tax Load On Profitability With Profit Management As Moderating VariablesDocument13 pagesThe Effect of Liquidity, Leverage and Determined Tax Load On Profitability With Profit Management As Moderating VariablesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- In Tax Budget Expectations NoexpDocument32 pagesIn Tax Budget Expectations NoexpMayurNo ratings yet

- Section 2Document14 pagesSection 2Hafiz TajuddinNo ratings yet

- Taxation of The Digital Economy - Evaluating The Nigerian and Global Approach - Lexology - Alliance Law FirmDocument5 pagesTaxation of The Digital Economy - Evaluating The Nigerian and Global Approach - Lexology - Alliance Law FirmMabruk Kunmi-OlayiwolaNo ratings yet

- Highlights Tax Policy ReformsDocument9 pagesHighlights Tax Policy Reformsvoyager8002No ratings yet

- YojanaMarch2020summary Part11586344521 PDFDocument29 pagesYojanaMarch2020summary Part11586344521 PDFVikin JainNo ratings yet

- Ey Mena Quarterly Banking Report q2 2020Document26 pagesEy Mena Quarterly Banking Report q2 2020Mira Hout100% (1)

- Tax and Business Strategy - Impact of New Ghanaian Tax LawsDocument6 pagesTax and Business Strategy - Impact of New Ghanaian Tax LawsM ArmahNo ratings yet

- Law Number 11 of 2020 Eases Tax BurdenDocument14 pagesLaw Number 11 of 2020 Eases Tax Burdentonitoni27No ratings yet

- Finance Act 2021 - PWC Insight Series and Sector Analysis Interactive 2Document25 pagesFinance Act 2021 - PWC Insight Series and Sector Analysis Interactive 2Oyeleye TofunmiNo ratings yet

- COVID 19: 4 Strategies to Help Businesses Recover from the PandemicDocument16 pagesCOVID 19: 4 Strategies to Help Businesses Recover from the PandemicGilbert LomofioNo ratings yet

- Capital Gains Taxes and Offshore Indirect TransfersDocument30 pagesCapital Gains Taxes and Offshore Indirect TransfersReagan SsebbaaleNo ratings yet

- 002-article-A002-enDocument11 pages002-article-A002-enLaurenNo ratings yet

- 02 OraclDocument12 pages02 OraclJuan Carlos MtzNo ratings yet

- Economic Impact of Relief Package in PakistanDocument10 pagesEconomic Impact of Relief Package in PakistanNadia Farooq100% (1)

- Probable RRLDocument3 pagesProbable RRLCharrey Leigh T. FORMARANNo ratings yet

- Trinidad and Tobago 2022 Budget HighlightsDocument6 pagesTrinidad and Tobago 2022 Budget Highlightsbrandon davidNo ratings yet

- Ken Ofori Atta Finance Statement To Parliament On Domestic Debt ExchangeDocument9 pagesKen Ofori Atta Finance Statement To Parliament On Domestic Debt ExchangeThe Independent GhanaNo ratings yet

- Federal Budget Summary - 1Document23 pagesFederal Budget Summary - 1Osama AtifNo ratings yet

- Kenya's FY 2020/21 Budget Statement focuses on economic stimulusDocument86 pagesKenya's FY 2020/21 Budget Statement focuses on economic stimulusOscar MasindeNo ratings yet

- Taxjournal July 2020Document60 pagesTaxjournal July 2020Venkatesh PrabhuNo ratings yet

- Acquisory News Chronicle September 2020Document8 pagesAcquisory News Chronicle September 2020Acquisory Consulting LLPNo ratings yet

- Budget Highlights - Crowe Nepal (78-79)Document72 pagesBudget Highlights - Crowe Nepal (78-79)binuNo ratings yet

- GRA 2022 Annual ReportDocument85 pagesGRA 2022 Annual ReportKaahwa VivianNo ratings yet

- 2902 10778 1 PBDocument11 pages2902 10778 1 PBOlivia OchaNo ratings yet

- Covid-19 Effect On Tax CollectionDocument7 pagesCovid-19 Effect On Tax Collectionannemorano126No ratings yet

- Treasury's Covid-19 Economic ScenariosDocument16 pagesTreasury's Covid-19 Economic ScenariosHenry Cooke100% (1)

- Strategies of Local Government Units (LGUs) To Improve Business Tax Collections During The Covid-19 PandemicDocument5 pagesStrategies of Local Government Units (LGUs) To Improve Business Tax Collections During The Covid-19 PandemicKomal sharmaNo ratings yet

- National Budget Bulletin 2022 23Document85 pagesNational Budget Bulletin 2022 23Lalit SinghNo ratings yet

- Deloitte Mauritius Covid Measures-Unlocked PDFDocument14 pagesDeloitte Mauritius Covid Measures-Unlocked PDFAvnish BassantNo ratings yet

- Tax Glimpses 2019Document97 pagesTax Glimpses 2019DarshanaNo ratings yet

- Indian BudgetDocument60 pagesIndian BudgetNirav SolankiNo ratings yet

- Namibias-National-Budget-2023_24.pdf-webDocument12 pagesNamibias-National-Budget-2023_24.pdf-webAmogh KothariNo ratings yet

- Nigeria Budget 2012Document6 pagesNigeria Budget 2012Mark allenNo ratings yet

- FinalDocument20 pagesFinalSonam Peldon (Business) [Cohort2020 RTC]No ratings yet

- ATR 3 - 1 - 82-92 - WordDocument11 pagesATR 3 - 1 - 82-92 - WordAkingbesote VictoriaNo ratings yet

- Time_has_come_to_rein_in_spiralling_public_debt___Cape_Times_The_Cape_Town_South_Africa___September_18_2023__p1Document2 pagesTime_has_come_to_rein_in_spiralling_public_debt___Cape_Times_The_Cape_Town_South_Africa___September_18_2023__p1elihlefass0No ratings yet

- Saputra (2022)Document24 pagesSaputra (2022)nita_andriyani030413No ratings yet

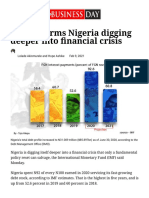

- IMF Confirms Nigeria Digging Deeper Into Financial Crisis - Businessday NGDocument4 pagesIMF Confirms Nigeria Digging Deeper Into Financial Crisis - Businessday NGAnneNo ratings yet

- 2022 Tax Expenditure Report FinalDocument43 pages2022 Tax Expenditure Report FinalKirimi StanleyNo ratings yet

- Concept Paper - Mandanas Ruling and The Lgu's Bigger Budget This Fy 2022Document3 pagesConcept Paper - Mandanas Ruling and The Lgu's Bigger Budget This Fy 2022Analou Agustin Villeza100% (2)

- 220 - PSU - Supporting MSMEs Digitalization Amid COVID-19Document9 pages220 - PSU - Supporting MSMEs Digitalization Amid COVID-19Francis Loie RepuelaNo ratings yet

- Namibia Announces Economic Stimulus PackageDocument4 pagesNamibia Announces Economic Stimulus PackageharryNo ratings yet

- Federal Budget 2020Document15 pagesFederal Budget 2020Muhammad FarazNo ratings yet

- Addressing Pakistan's Economic Challenges Through Budget 2020-21Document9 pagesAddressing Pakistan's Economic Challenges Through Budget 2020-21Asim EhsanNo ratings yet

- SBN 64 Merchant Loan ProgramDocument5 pagesSBN 64 Merchant Loan ProgramJSTNo ratings yet

- Policies To Supports SMEs - Korea - FinalDocument2 pagesPolicies To Supports SMEs - Korea - FinalYasmin AruniNo ratings yet

- MOSELESSON3Document2 pagesMOSELESSON3Sherry MoseNo ratings yet

- Investigacion Final MacroDocument12 pagesInvestigacion Final Macrodaniel servellonNo ratings yet

- Managerial Economics Assessment-2: Model SolutionDocument10 pagesManagerial Economics Assessment-2: Model SolutionR K SinghNo ratings yet

- Nanavati Ventures Limited: TH RDDocument25 pagesNanavati Ventures Limited: TH RDContra Value BetsNo ratings yet

- 01 ABM Financial Accounting Session1Document36 pages01 ABM Financial Accounting Session1DentatusNo ratings yet

- Hand Hygiene Action Plan - Final Draft For IPCGDocument10 pagesHand Hygiene Action Plan - Final Draft For IPCGAnton NaingNo ratings yet

- Chapter One Introduction To Accounting and BusinessDocument16 pagesChapter One Introduction To Accounting and Businessasnfkas100% (1)

- SPP Back Architional PDFDocument8 pagesSPP Back Architional PDFROMMEL VICTORINONo ratings yet

- FEM Transfer or Issue of Any Foreign Security Regulations Kampanisidhant17 Gmailcom 20211006 131928 1 25Document25 pagesFEM Transfer or Issue of Any Foreign Security Regulations Kampanisidhant17 Gmailcom 20211006 131928 1 25Sidhant KampaniNo ratings yet

- C13 Audit Question BankDocument27 pagesC13 Audit Question BankVINUS DHANKHARNo ratings yet

- Assignment ON Cadbury Report AND The RecomendationsDocument9 pagesAssignment ON Cadbury Report AND The RecomendationsSonam LodayNo ratings yet

- 7Document62 pages7BilalNo ratings yet

- Taxman CAFM ScannerDocument491 pagesTaxman CAFM Scannerdroom8521No ratings yet

- Oboase Crew ConstitutionDocument7 pagesOboase Crew Constitutionibrahimalhassan00233No ratings yet

- CA Final - Advanced Auditing StandardsDocument64 pagesCA Final - Advanced Auditing StandardsPraneethNo ratings yet

- Certification Company ProfileDocument20 pagesCertification Company ProfileFirman NugrahaNo ratings yet

- View The Un Audited Financial Results For The Second Quarter 30 September 2022 and Press Release - 0Document16 pagesView The Un Audited Financial Results For The Second Quarter 30 September 2022 and Press Release - 0Shradha mamNo ratings yet

- Practical Workbook - IsO27001 Lead Implementor CourseDocument24 pagesPractical Workbook - IsO27001 Lead Implementor CourseJacktone SikoliaNo ratings yet

- CHAPTER 8 - Financial Reporting and Management Reporting SystemsDocument6 pagesCHAPTER 8 - Financial Reporting and Management Reporting SystemsAngela Marie PenarandaNo ratings yet

- Aaud Cfap 6Document8 pagesAaud Cfap 6Muhammad AhmedNo ratings yet

- ASAL Accounting Workbook Starter PackDocument26 pagesASAL Accounting Workbook Starter Packcthiruvazhmarban100% (1)

- Procedure System of Control Procedure For AuditingDocument10 pagesProcedure System of Control Procedure For AuditingImtiyaz AkhtarNo ratings yet

- Implementation of The Balanced ScorecardDocument39 pagesImplementation of The Balanced ScorecardKeith WardenNo ratings yet

- Week 3 HomeworkDocument11 pagesWeek 3 Homeworkchaitrasuhas100% (1)

- AML Compliance Program GuideDocument11 pagesAML Compliance Program GuidelarissarovaneNo ratings yet

- Know Your JurisdictionDocument10 pagesKnow Your JurisdictionsamaadhuNo ratings yet

- DTLDocument5 pagesDTLBharat Natti RawatNo ratings yet

- 02 Code of EthicsDocument3 pages02 Code of EthicscarloNo ratings yet

- ACC111 Course CompactDocument2 pagesACC111 Course CompactKehindeNo ratings yet

- Responses To Norvan Reports 26.01.22Document3 pagesResponses To Norvan Reports 26.01.22Fuaad DodooNo ratings yet

- BSBFIM501 AAP v2.0Document135 pagesBSBFIM501 AAP v2.0Alicia AlmeidaNo ratings yet

- CPA Review Problems - Audit of LiabilitiesTITLE Philippines CPA Exam Questions on Auditing Liabilities TITLE Audit Liabilities Problems for CPA Review SchoolDocument6 pagesCPA Review Problems - Audit of LiabilitiesTITLE Philippines CPA Exam Questions on Auditing Liabilities TITLE Audit Liabilities Problems for CPA Review SchoolSirNo ratings yet

- Latihan Ac010 FicoDocument3 pagesLatihan Ac010 Ficonanasari85No ratings yet