Professional Documents

Culture Documents

Bcom TM Corporateaccounting 4

Uploaded by

Singapore ServerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bcom TM Corporateaccounting 4

Uploaded by

Singapore ServerCopyright:

Available Formats

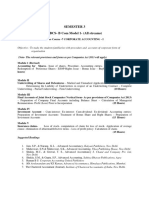

Jyoti Nivas College Autonomous

Department of Commerce and Management

Syllabus for IV SEMESTER B.Com TM

4.3 CORPORATE ACCOUNTING-II

Course Objectives:

1. To enable the students to learn and understand the intricacies of Corporate Accounting

from the fundamental level.

2. To familiarize a few changes necessitated by Accounting standards, SEBI guidelines and

the Companies Act.

3. To familiarize the methods of purchase consideration

Learning Outcome:

1. Students can understand mergers and acquisition and its impact on the company.

2. Students are able to prepare and analyze bank financial statements.

3. students are able to analyze and prepare the Liquidators statement of accounts

Content of the Subject

I Mergers and Acquisition of Companies

Meaning of Amalgamation and Acquisition – Types of amalgamation

– amalgamation in the nature of merger – amalgamation in the nature

of purchase – methods of purchase consideration – calculation of

purchase consideration(Ind AS 103) (AS14) – Net asset method , net

payment method, Accounting for amalgamation (problems on both the

methods) – Journal entries and preparation of balance sheet in the

16

books of transferee company (Vertical format).

II Internal reconstruction

Meaning – Objective – procedure – forms of reduction – passing of

journal entries – preparation of reconstruction Account – preparation

of balance sheet after reconstruction(Vertical format) problems 10

III Liquidation:

Meaning – types of liquidation – order of payment – calculation of

liquidators remuneration – preparation of liquidators final statement of

accounts. 10

IV Profit prior to incorporation

Meaning – calculation of sales ratio – time ratio – weighted ratio –

treatment of capital and revenue expenditure – ascertainment of pre 12

incorporation and post incorporation profits by preparing profit and

loss account – balance sheet

V Bank Final Accounts:

Business of banking companies – some important provision of

banking regulating act 1949 – special features of banking accounting 12

– non performing assets, non banking assets, preparation of bank final

accounts with schedule

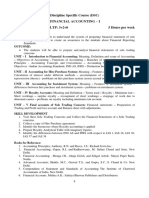

SKILL DEVELOPMENT

1. Calculation of purchase consideration with imaginary figures

2. List any 5 cases of merger and acquisition of joint stock companies

3. List out legal provision in respect of internal reconstruction

4. Collection of published final accounts of a bank and identified the value of

nonperforming assets

5. Write a note on International corporate accounting.

BOOKS FOR REFERENCE

1. S. P. Jain & K. L. Narang - Advance Accounting, Kalyani Publication- 2013

2. Dr. M. A. Arulanandam& K.S. Raman - Corporate Accounting, Himalaya Publishing

House, 2013

3. Dr. B.M Agarwal & Dr. M.P Gupta - Advanced Accounting, Suchitra PrakashanP)Ltd,

Allahabad

4. R L Gupta & M. Radha Swamy - Corporate Accounts, Theory, Methods & Application,

Sulthan Chand & sons, New Delhi, 2014

5. R L Gupta & M. Radha Swamy - Advanced Accountancy, Sulthan Chand & sons, New

Delhi, 2014

6. Jain and Narang, Corporate Accounting, Kalyani Publisher, Ludhiana, 2013.

7. Tulsian, Advanced Accounting, S. Chand & Co, Revised edition 2012

8. M. C Shukia, T.S Grewal, S. C. Gupta - Advanced Accountancy, Sulthan Chand & sons,

New Delhi, 2005

9. S. N. Maheshwari & K. N. Maheshwari - Advanced Accountancy, Vikas Publicating

House Pvt Ltd, Bangalore, 2013

10. Rajashekaran&Lalitha –Corporate Accounting – Pearson, New Delhi, 2011.

11. S. Anil kumar, V. Rajesh kumar and B. Mariyappa – Advanced Financial Accounting –

Himalaya Publishing House.

You might also like

- Corporate AccountingDocument2 pagesCorporate AccountingSunni ZaraNo ratings yet

- Old BBA1 Styear NEPpg 17Document2 pagesOld BBA1 Styear NEPpg 17gurulinguNo ratings yet

- ACCOUNTINGDocument13 pagesACCOUNTINGchinnimounika901No ratings yet

- 13743401e29e47e PDFDocument159 pages13743401e29e47e PDFMuhammad Sajid100% (1)

- Financial Accounting - 1 PDFDocument73 pagesFinancial Accounting - 1 PDFSudhanva RajNo ratings yet

- Basic Accounting 1Document33 pagesBasic Accounting 1Tejas BapnaNo ratings yet

- CBCS .AB Corporate Accounting I Model 1Document12 pagesCBCS .AB Corporate Accounting I Model 1anjuoh21No ratings yet

- Accounting For ManagersDocument185 pagesAccounting For ManagersFenny Todarmal100% (1)

- Accountancy - Class 11Document151 pagesAccountancy - Class 11Ketan ThakkarNo ratings yet

- AccountsDocument8 pagesAccountsYash Garg100% (1)

- Iv - SemesterDocument2 pagesIv - SemesterRyan CreationsNo ratings yet

- Mba I Accounting For Management (14mba13) NotesDocument58 pagesMba I Accounting For Management (14mba13) NotesAnonymous 4lXDgDUkQ100% (2)

- AFM Theory Notes-1Document58 pagesAFM Theory Notes-1pradeepNo ratings yet

- Accountancy For Dummies PDFDocument6 pagesAccountancy For Dummies PDFsritesh00% (1)

- MCA SyllabusDocument1 pageMCA SyllabusSenthil KumarNo ratings yet

- 1.3 Accounting For BusinessDocument2 pages1.3 Accounting For BusinessRahul RameshNo ratings yet

- BBA1003BCOM1003 Principles of Financial AccountingDocument325 pagesBBA1003BCOM1003 Principles of Financial AccountingBetter LaptopNo ratings yet

- Bace 24 D 9Document149 pagesBace 24 D 9qamarunisha455No ratings yet

- Sem-2 For Acca Students Basics of Financial AccountingDocument4 pagesSem-2 For Acca Students Basics of Financial AccountingNidhip ShahNo ratings yet

- BCOM 1 Financial Accounting 1Document63 pagesBCOM 1 Financial Accounting 1karthikeyan01No ratings yet

- 320 Accountancy-1 (Final PDFDocument279 pages320 Accountancy-1 (Final PDFNavyaNo ratings yet

- 1 Styear NEPPg 1 SyllabusDocument1 page1 Styear NEPPg 1 SyllabusgurulinguNo ratings yet

- Financial Accounting and AnalysisDocument65 pagesFinancial Accounting and AnalysisPiyushNo ratings yet

- Financial Accounting Notes B.com 1st SemDocument64 pagesFinancial Accounting Notes B.com 1st SemJeevesh Roy0% (1)

- Syllabus: Subject - Financial AccountingDocument74 pagesSyllabus: Subject - Financial AccountingAnitha RNo ratings yet

- Accounting For ManagersDocument2 pagesAccounting For Managersvivekgarg33.vgNo ratings yet

- Acc HelpfulDocument994 pagesAcc HelpfulMoksha JainNo ratings yet

- CBSE Accountancy Class 11 Term 1 Objective Question BankDocument141 pagesCBSE Accountancy Class 11 Term 1 Objective Question BankMohammed Roshan73% (11)

- FYBBA AccountingDocument6 pagesFYBBA AccountingcadkthNo ratings yet

- 1030120969session 2015-16 Class Xi Accountancy Study Material PDFDocument189 pages1030120969session 2015-16 Class Xi Accountancy Study Material PDFharshika chachan100% (1)

- B Com Accounting Finance SyllabusDocument15 pagesB Com Accounting Finance SyllabusAkash IngoleNo ratings yet

- Mbaf0701 - Far - SyllabusDocument2 pagesMbaf0701 - Far - SyllabusRahulNo ratings yet

- Advanced Financial AccountingDocument2 pagesAdvanced Financial AccountingJobin GeorgeNo ratings yet

- Chapter 1 IntroductionDocument30 pagesChapter 1 IntroductionVivek GargNo ratings yet

- 1stsem - BBAFBA2023 24 Revised - Syllabus 23Document2 pages1stsem - BBAFBA2023 24 Revised - Syllabus 23gurulinguNo ratings yet

- Fundsbasic Acctg ModuleDocument21 pagesFundsbasic Acctg ModuleLeizyl de MesaNo ratings yet

- Acct XIDocument41 pagesAcct XIsainimanish170gmailcNo ratings yet

- Account Full NotesDocument161 pagesAccount Full NotesAysha MariyamNo ratings yet

- Fa Msu PDFDocument254 pagesFa Msu PDFSelvakumar Thangaraj100% (1)

- Arellano University - Plaridel Campus: Basic Accounting ACTG. 101Document4 pagesArellano University - Plaridel Campus: Basic Accounting ACTG. 101KJ VillNo ratings yet

- CBSE Class 11 Accountancy Syllabus Updated For 20Document1 pageCBSE Class 11 Accountancy Syllabus Updated For 20AarushNo ratings yet

- Marks Weightage of CBSE Class 11 Accountancy Syllabus Term 1Document1 pageMarks Weightage of CBSE Class 11 Accountancy Syllabus Term 1AarushNo ratings yet

- Marks Weightage of CBSE Class 11 Accountancy Syllabus Term 1Document1 pageMarks Weightage of CBSE Class 11 Accountancy Syllabus Term 1AarushNo ratings yet

- Subject 5 - Accounts and AuditDocument220 pagesSubject 5 - Accounts and Auditusndcb.0014No ratings yet

- AccountingDocument336 pagesAccountingsparsh24computerNo ratings yet

- 1st Term s1 Financial AccountDocument22 pages1st Term s1 Financial Accountonasanyaolu0916No ratings yet

- Intro To Acc100 NotesDocument60 pagesIntro To Acc100 Notesdeklerkkimberey45No ratings yet

- 1st Term s1 Financial AccountDocument21 pages1st Term s1 Financial AccountAsabia OmoniyiNo ratings yet

- Bcom 1 6Document80 pagesBcom 1 6Saddam MullaNo ratings yet

- Financial AccountingDocument2 pagesFinancial AccountingAbbas BaiNo ratings yet

- BBA102-1N SyllabusDocument2 pagesBBA102-1N SyllabusRITIKNo ratings yet

- AcctXI PDFDocument41 pagesAcctXI PDFAshwin ChauriyaNo ratings yet

- Syllabus B.com 1st Semester IDocument14 pagesSyllabus B.com 1st Semester IRahul GautamNo ratings yet

- BBA 1st Sem. FULL SYLLABUS Basic AccountingDocument115 pagesBBA 1st Sem. FULL SYLLABUS Basic AccountingYash KhattriNo ratings yet

- Syllabus: Subject - Financial AccountingDocument30 pagesSyllabus: Subject - Financial AccountingGaurav KhatriNo ratings yet

- Principles of Financial AccountingDocument223 pagesPrinciples of Financial Accountingsabili cNo ratings yet

- ACC 105 SyllabusDocument2 pagesACC 105 Syllabusnaamsagar2019No ratings yet

- Fundamentals of Accounting CH 1-Chapter 7Document90 pagesFundamentals of Accounting CH 1-Chapter 7Dave DaveNo ratings yet

- Commerce: Accounting & Taxation: Learning OutcomeDocument1 pageCommerce: Accounting & Taxation: Learning Outcomecostumercare85No ratings yet

- Notes On BTMMDocument206 pagesNotes On BTMMconrad92% (13)

- Financial Ratio Analysis 1682974149 PDFDocument55 pagesFinancial Ratio Analysis 1682974149 PDFMerve Köse100% (1)

- BusFin PT 5Document5 pagesBusFin PT 5Nadjmeah AbdillahNo ratings yet

- Case - Chemlite (B)Document7 pagesCase - Chemlite (B)Vibhusha SinghNo ratings yet

- Methods of Market ManipulationDocument9 pagesMethods of Market ManipulationMiguel Luz RosaNo ratings yet

- Corporate Accounting BBA-IIIDocument9 pagesCorporate Accounting BBA-IIIFahad RashdiNo ratings yet

- Google Earnings ReportDocument8 pagesGoogle Earnings ReportNotice AlertNo ratings yet

- 15 Dse JournalDocument91 pages15 Dse JournalFetty Sato0% (1)

- Class 7 NotesDocument66 pagesClass 7 NotestimckjkjdfdNo ratings yet

- Risk Metrics Technical Doc 4ed PDFDocument296 pagesRisk Metrics Technical Doc 4ed PDFjamilkhannNo ratings yet

- Sas#12 Acc150 QuizDocument3 pagesSas#12 Acc150 QuizMekuh Rouzenne Balisacan PagapongNo ratings yet

- Accounting Equation IIDocument3 pagesAccounting Equation IIMondijar Klint D.No ratings yet

- IFRS Applications Questions and Solutions - PietersenDocument527 pagesIFRS Applications Questions and Solutions - PietersenPitso Vinger100% (1)

- Financial Statement Analysis Project - Fall 2012-1Document9 pagesFinancial Statement Analysis Project - Fall 2012-1rajesh934No ratings yet

- INVENTORY MANAGEMENT TechniquesDocument24 pagesINVENTORY MANAGEMENT TechniquesWessal100% (1)

- International Bond MarketDocument15 pagesInternational Bond MarketHarvinton LiNo ratings yet

- Lecture 2 Statement of Changes in Equity Multiple ChoiceDocument5 pagesLecture 2 Statement of Changes in Equity Multiple ChoiceJeane Mae Boo100% (1)

- Nama: Nurahma Amalia NIM: 20200070042 Kelas: AK20ADocument4 pagesNama: Nurahma Amalia NIM: 20200070042 Kelas: AK20Aedit andraeNo ratings yet

- Future Phoenix of WorldDocument10 pagesFuture Phoenix of WorldPradipta DashNo ratings yet

- TUGAS DOSEN Chapter 5Document15 pagesTUGAS DOSEN Chapter 5novita sariNo ratings yet

- CH 13Document97 pagesCH 13Noheul KimNo ratings yet

- Equity Research Analyst BasicDocument18 pagesEquity Research Analyst BasicShoaib Ali100% (1)

- Arbitrage CalculatorDocument10 pagesArbitrage CalculatornasirNo ratings yet

- Lump Sum RDocument14 pagesLump Sum RCharles LaspiñasNo ratings yet

- Low Risk InvestmentsDocument6 pagesLow Risk Investmentsmyschool90No ratings yet

- Cfs - Lecture Notes - Updated 2023Document49 pagesCfs - Lecture Notes - Updated 2023Thanh Uyên100% (1)

- Putri Anjjawati - G72217047 - P4-3Document4 pagesPutri Anjjawati - G72217047 - P4-3Putri anjjarwatiNo ratings yet

- RICI v1.2Document26 pagesRICI v1.2Samruddh KulkarniNo ratings yet

- Cost of Capital of AstraZeneca For 2015Document6 pagesCost of Capital of AstraZeneca For 2015Vicky GuleriaNo ratings yet

- Reinet Investments SCA - Rapport-AnnuelDocument92 pagesReinet Investments SCA - Rapport-Annuelphilip davisNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet