Professional Documents

Culture Documents

Tugas Akbi

Uploaded by

Tazul Arifin0 ratings0% found this document useful (0 votes)

8 views4 pagesThe document contains examples of calculating equivalent units and unit costs under different costing methods including weighted average, FIFO, and direct. It provides physical flow schedules and calculations for equivalent units, unit costs, valuation of inventories, and journal entries to transfer costs of completed goods between departments. The examples demonstrate how to apply different costing methods to determine equivalent units, unit costs, and valuation of work in process and finished goods inventories.

Original Description:

Original Title

tugas akbi

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains examples of calculating equivalent units and unit costs under different costing methods including weighted average, FIFO, and direct. It provides physical flow schedules and calculations for equivalent units, unit costs, valuation of inventories, and journal entries to transfer costs of completed goods between departments. The examples demonstrate how to apply different costing methods to determine equivalent units, unit costs, and valuation of work in process and finished goods inventories.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views4 pagesTugas Akbi

Uploaded by

Tazul ArifinThe document contains examples of calculating equivalent units and unit costs under different costing methods including weighted average, FIFO, and direct. It provides physical flow schedules and calculations for equivalent units, unit costs, valuation of inventories, and journal entries to transfer costs of completed goods between departments. The examples demonstrate how to apply different costing methods to determine equivalent units, unit costs, and valuation of work in process and finished goods inventories.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

NAMA : AI INGGA LESTARI

NIM : 17116006

PRODI : AKUNTANSI KARYAWAN

AKUNTANSI BIAYA

Exercise 6-18

Weighted average method

a. unit started = 19.000

unit started & complete = 19.000 – 4.000

unit complete = 15.000 + 3.000

equivalent unit schedule A

direct method conversion cost

unit complete 18.000 18.000

add : units in ending wip x percentage complete

4.000 x 100% 4.000 -

4.000 x 20% - 800

Equivalent unit of output 22.000 18.800

b. unit started = 20.000

unit started & complete = 20.000 - 0 = 20.000

unit complete = 20.000 + 2.000 = 22.000

eavivalent units schedule B

direct method conversion cost

unit complete 18.000 18.000

add : units in ending wip x percentage complete

- x 0% - -

- x 0% - -

eavivalent unit of output 22.000 22.000

c. equivalent unit schedule C

direct method conversion cost

unit started & complete 40.000 40.000

add: unit in beginning WIP x percentage complete

- x 0% - -

- x 0% - -

add: unit in beginning WIP x percentage complete

8.000 x 100% 8.000 -

8.000 x 25% - 2.000

Eavivalent unit of output 48.000 42.000

d. equivalent unit started schedule D

direct method conversion cost

unit started & complete 25.000 25.000

add: unit in beginning WIP x percentage complete

25.000 x 0 % - -

25.000 x 40 % - 10.000

add: unit in beginning WIP x percentage complete

10.000 x 100% 10.000 -

10.000 x 10% - 1.000

Eavivalent unit of output 35.000 36.000

EXERCISE 6-19

FIFO Method

a.equivalent units schedule A

direct method conversion cost

unit started & complete 15.000 15.000

add: unit in beginning WIP x percentage complete

3.000 x 0 % - -

3.000 x 70 % - 2.100

add: unit in beginning WIP x percentage complete

4.000 x 100% 4.000 -

4.000 x 20% - 800

Eavivalent unit of output 19.000 17.900

b.equivalent unit schedule B

direct method conversion cost

unit started & complete 20.000 20.000

add: unit in beginning WIP x percentage complete

2.000 x 0 % - -

2.000 x 25 % - 5.000

add: unit ending WIP x percentage complete

- x 0% - -

- x 0% - -

Eavivalent unit of output 20.000 20.500

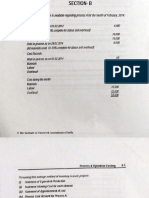

EXERCISE 6-20

a. cost

Beginning WIP Current cost

- Direct method 30.000 - Direct Method 25.000

- Conversion cost 5.000 - Conversion cost 65.000

35.000 90.000

Unit cost = unit material cost + unit conversion cost

= 30.000 + 25.000 + 15.000 + 65.000

11.000 8.000

= 5 + 8,75

= 13,75

b. valuation of inventories

unit of goods transfered out:

- unit complete = 13,75 x 5.000 = 68.750

- ending wip = ( 5 x 6.000 ) + ( 8,75 x 3.000 ) = 30.000 + 26.250 = 56.250

Total cost assigned 125.000

EXERCISE 6-21

1. unit started & complete = 40.000

unit started = unit started & complete + units ending WIP

= 40.000 + 20.000 = 60.000

Physical flow schedule: costing DEPARTEMENT

Unit to account for:

- units beginning WIP ( 50& complete ) 10.000

- units started during April 60.000

Total 1 units to account for 70.000

Units account for:

- unit complete and transfered out

- Started & complete 40.000

- From beginning WIP 10.000 50.000

Unnit in ending WIP ( 25% complete ) 20.000

Total units accounted for 70.000

2. units cost for equivalent unit

cost

Beginning WIP Current cost

- Direct method 20.000 - Direct Method 240.000

- Conversion cost 80.000 - Conversion cost 320.000

100.000 560.000

Unit cost = 240.000 + 320.000

60.000 50.000

= 4 + 6,4

= 10,4

3. valuation

unit of goods transfered out

- from beginning WIP 100.000

- to complete beginning WIP ( 6,4 x 5.000 ) 32.000

- started & complete (10,4 x 40.000 ) 416.000

548.000

ending WIP

( 4 x 20.000 ) + ( 6,4 x 5.000 )

80.000 + 32.000 112.000

Total cost assigned 660.000

4. Jurnal transfered of cost of good complete from costing to sewing

(o) WIP – costing 548.000

(k) WIP – sewing 548.000

You might also like

- Solution Manual For International Accounting 5th DoupnikDocument28 pagesSolution Manual For International Accounting 5th DoupnikChristopherCollinsifwq100% (43)

- Laundromat Sample Business Plan - Appendix - Bplans 7Document4 pagesLaundromat Sample Business Plan - Appendix - Bplans 7Firoz AlamNo ratings yet

- Problem 1. The Mexico Company Manufactures A Single Product That Goes Through Two Departments. The Data Relating ToDocument14 pagesProblem 1. The Mexico Company Manufactures A Single Product That Goes Through Two Departments. The Data Relating ToTokkiNo ratings yet

- Holly Fashions CaseDocument6 pagesHolly Fashions CaseMarekNo ratings yet

- Managerial Accounting-Solutions To Ch06Document7 pagesManagerial Accounting-Solutions To Ch06Mohammed HassanNo ratings yet

- Exercise AKBI (TAZUL ARIFIN 17116025)Document5 pagesExercise AKBI (TAZUL ARIFIN 17116025)Tazul ArifinNo ratings yet

- ImamTantowi AkuntansiManajemenDocument2 pagesImamTantowi AkuntansiManajemenImam TantowiNo ratings yet

- Material Conversion Equivalent Units of Production 13,000 11,200Document4 pagesMaterial Conversion Equivalent Units of Production 13,000 11,200Anonymous ps3caENgNo ratings yet

- Exercise 1 (A) :: RequiredDocument6 pagesExercise 1 (A) :: RequiredC XNo ratings yet

- Process CostingDocument16 pagesProcess CostingvijayNo ratings yet

- S09-s1-CTOS IndustrialDocument19 pagesS09-s1-CTOS Industrialyoridecast123No ratings yet

- Sunspot Beverages Ltd. of Fiji Uses The Weighted-Average Method 160000Document9 pagesSunspot Beverages Ltd. of Fiji Uses The Weighted-Average Method 160000laale dijaanNo ratings yet

- MIDTERM - Learning Task SolutionsDocument8 pagesMIDTERM - Learning Task SolutionsLEANNE ROSE REYESNo ratings yet

- Chapter 22Document14 pagesChapter 22Nguyên BảoNo ratings yet

- Strategic Cost ManagementDocument12 pagesStrategic Cost ManagementvionysusgoghNo ratings yet

- Cost of Production ReportDocument10 pagesCost of Production ReportNo NotreallyNo ratings yet

- 2m00154 S.y.b.com - Bms Sem Ivchoice Based 78512 Group A Finance Strategic Cost Management Q.p.code53273Document5 pages2m00154 S.y.b.com - Bms Sem Ivchoice Based 78512 Group A Finance Strategic Cost Management Q.p.code53273Navira MirajkarNo ratings yet

- Chapter 6 Managerial AccountingDocument4 pagesChapter 6 Managerial AccountingLydia SamosirNo ratings yet

- See Zhao Wei U2003083Document5 pagesSee Zhao Wei U2003083zhaoweiNo ratings yet

- Activity Cost BehaviorDocument28 pagesActivity Cost Behaviorangel caoNo ratings yet

- Solution Pricing DecisionDocument2 pagesSolution Pricing DecisionAnn SalazarNo ratings yet

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 23Document8 pagesCost & Management Accounting - MGT402 Power Point Slides Lecture 23Mr. JalilNo ratings yet

- Process and Operating CostingDocument20 pagesProcess and Operating CostingBHANU PRATAP SINGHNo ratings yet

- Management AccountingDocument11 pagesManagement AccountingMd. Showkat IslamNo ratings yet

- Multiple Choice: Basadre, Jessa G. Bsa 3 Yr. Managerial Accounting Assignment No. 1Document4 pagesMultiple Choice: Basadre, Jessa G. Bsa 3 Yr. Managerial Accounting Assignment No. 1Jessa BasadreNo ratings yet

- SCM 2nd RecitDocument5 pagesSCM 2nd RecitMaxine ConstantinoNo ratings yet

- Raw Materials InventoryDocument4 pagesRaw Materials InventoryMikias DegwaleNo ratings yet

- Assignment 2Document4 pagesAssignment 2Sahil KumarNo ratings yet

- ABC - Process.Cost Allocation.Document21 pagesABC - Process.Cost Allocation.Keyt VintageNo ratings yet

- Problem 4 Process CostingDocument3 pagesProblem 4 Process CostingKloie SanoriaNo ratings yet

- 15 Marginal CostingDocument14 pages15 Marginal CostingHaresh KNo ratings yet

- 15 Marginal Costing PDFDocument14 pages15 Marginal Costing PDFSupriyoNo ratings yet

- Sunspot BeveragesDocument6 pagesSunspot BeveragesDeep GandhiNo ratings yet

- Erratum - Activities - Process CostingDocument4 pagesErratum - Activities - Process CostingRoselyn LumbaoNo ratings yet

- Process Costing Problems and SolutionsDocument30 pagesProcess Costing Problems and SolutionsErika GuillermoNo ratings yet

- Process Costing Dept1Document2 pagesProcess Costing Dept1Allysa kim RubisNo ratings yet

- Prelim ReviewerDocument19 pagesPrelim ReviewerMah2SetNo ratings yet

- Cost Accounting Quiz 2Document13 pagesCost Accounting Quiz 2Camille G.No ratings yet

- Ridgely Manufacturing Company Production Report Jul-92 Quantity of ProductionDocument3 pagesRidgely Manufacturing Company Production Report Jul-92 Quantity of ProductionJessa BasadreNo ratings yet

- Process Costing ReviewDocument12 pagesProcess Costing ReviewAbraham ChinNo ratings yet

- ACC60181H619 Managerial AccountingDocument9 pagesACC60181H619 Managerial AccountingaksNo ratings yet

- Costco1 - Assign 5Document7 pagesCostco1 - Assign 5Deryl GalveNo ratings yet

- Quiz 1 Problem Sol1Document9 pagesQuiz 1 Problem Sol1acidoleannamaeNo ratings yet

- ProbbbDocument19 pagesProbbbacidoleannamaeNo ratings yet

- Chapter 7Document4 pagesChapter 7syramaebillones26No ratings yet

- Costing ProblemsDocument74 pagesCosting Problemsmeenakshimanghani85% (47)

- Task Performance - Managerial AccountingDocument4 pagesTask Performance - Managerial AccountingJenNo ratings yet

- AssssDocument10 pagesAssssshimelisNo ratings yet

- Cost Lectures DR - Mohiy SamyDocument12 pagesCost Lectures DR - Mohiy SamyEiad WaleedNo ratings yet

- Compute The Equivalent Units of ProductionDocument1 pageCompute The Equivalent Units of Productionsb73_817No ratings yet

- Accounts Assignment 104Document6 pagesAccounts Assignment 104busybeefreedomNo ratings yet

- Module 3 Practice ProblemsDocument13 pagesModule 3 Practice ProblemsLiza Mae MirandaNo ratings yet

- Problem Set 7 Process Costing SOLUTIONS PDFDocument7 pagesProblem Set 7 Process Costing SOLUTIONS PDFGray Panie AsisNo ratings yet

- Class WorkDocument10 pagesClass WorkRajesh MongerNo ratings yet

- Prepared by DR - Hassan Sweillam University of 6 of October, EgyptDocument18 pagesPrepared by DR - Hassan Sweillam University of 6 of October, EgyptjgjghNo ratings yet

- CAC Computations Chap 4 1 20Document9 pagesCAC Computations Chap 4 1 20rochelle lagmayNo ratings yet

- Universidad Interamericana de Puerto Rico Recinto de San Germán Departamento de Ciencias EmpresarialesDocument5 pagesUniversidad Interamericana de Puerto Rico Recinto de San Germán Departamento de Ciencias EmpresarialesAqib LatifNo ratings yet

- Week 2 - BUS 5431 - HomeworkDocument4 pagesWeek 2 - BUS 5431 - HomeworkSue Ming Fei100% (1)

- Absorption & Marginal Costing-1Document6 pagesAbsorption & Marginal Costing-1田淼No ratings yet

- Final Managerial 2016 SolutionDocument10 pagesFinal Managerial 2016 SolutionRanim HfaidhiaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Calculus Know-It-ALL: Beginner to Advanced, and Everything in BetweenFrom EverandCalculus Know-It-ALL: Beginner to Advanced, and Everything in BetweenNo ratings yet

- Project On Working Capital Management On Cement IndustriesDocument74 pagesProject On Working Capital Management On Cement IndustriesJofin JoseNo ratings yet

- Relaxo Cogs CashDocument40 pagesRelaxo Cogs CashRonakk MoondraNo ratings yet

- AccountingDocument30 pagesAccountingFahad NasirNo ratings yet

- Working Capital Management (A Lecture)Document9 pagesWorking Capital Management (A Lecture)Anupam DeNo ratings yet

- Project Implementation Manual: Yes No N/A Comments / Notes A. Internal Control EnvironmentDocument8 pagesProject Implementation Manual: Yes No N/A Comments / Notes A. Internal Control EnvironmentrajsalgyanNo ratings yet

- Top Accounting Interview Questions With Answers UpdatedDocument26 pagesTop Accounting Interview Questions With Answers Updatedsatyam pandhareNo ratings yet

- Agenda General MeetingDocument327 pagesAgenda General MeetingHNo ratings yet

- Gaap - Stephen J BigelowDocument4 pagesGaap - Stephen J BigelowInnocent MundaNo ratings yet

- Simple LBO ModelDocument14 pagesSimple LBO ModelSucameloNo ratings yet

- Vu Anh TueDocument21 pagesVu Anh TueVy PhạmNo ratings yet

- Ia Activity 4Document23 pagesIa Activity 4WeStan LegendsNo ratings yet

- 2.valuation of Goodwill &sharesDocument41 pages2.valuation of Goodwill &sharesvivekbNo ratings yet

- Reviewer IN Management Advisory Services: Teacher S ProfileDocument6 pagesReviewer IN Management Advisory Services: Teacher S ProfileAnna AldaveNo ratings yet

- Meaning and Classification of CostDocument13 pagesMeaning and Classification of Costpooja456No ratings yet

- Vaishnavi FPC - Vegetables NarrationDocument17 pagesVaishnavi FPC - Vegetables NarrationSamakoi freshNo ratings yet

- Module 1 - AgricultureDocument5 pagesModule 1 - AgricultureLuiNo ratings yet

- Presentation ON Cash Management OF Ans Steel Tubes Ltd. (JBM Group)Document23 pagesPresentation ON Cash Management OF Ans Steel Tubes Ltd. (JBM Group)soniaNo ratings yet

- 11 Accountancy Keynotes Ch02 Theory Base of Accounting VKDocument9 pages11 Accountancy Keynotes Ch02 Theory Base of Accounting VKAnonymous 1Zepq14UarNo ratings yet

- Syllabus Intermediate Accounting 1 2021Document21 pagesSyllabus Intermediate Accounting 1 2021John Lucky MacalaladNo ratings yet

- Aguilar QuizDocument5 pagesAguilar QuizIankyle AguilarNo ratings yet

- Audit of PPEDocument7 pagesAudit of PPEGille Rosa AbajarNo ratings yet

- Fnce2121 PeDocument20 pagesFnce2121 Pechristianorsf1No ratings yet

- Chapter 18Document34 pagesChapter 18Christine Marie T. RamirezNo ratings yet

- CombiDocument45 pagesCombiTeena Marie SantosNo ratings yet

- Financial Statement Analysis of Techcombank: University of Economics and Law Faculty of Accounting and AuditingDocument55 pagesFinancial Statement Analysis of Techcombank: University of Economics and Law Faculty of Accounting and AuditingLê NaNo ratings yet

- 2O Multiple Choice Questions About PAS 1Document4 pages2O Multiple Choice Questions About PAS 1jahnhannalei marticioNo ratings yet

- Group Reporting II: Application of The Acquisition Method Under IFRS 3Document77 pagesGroup Reporting II: Application of The Acquisition Method Under IFRS 3فهد التويجريNo ratings yet