Professional Documents

Culture Documents

Lifeview Risk Tolerance Questionnaire

Uploaded by

Rafa AlbercaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lifeview Risk Tolerance Questionnaire

Uploaded by

Rafa AlbercaCopyright:

Available Formats

Save Draft Clear Form

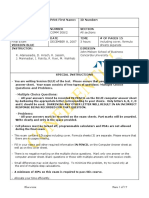

LifeView® Risk Tolerance

Questionnaire

This questionnaire will guide our analysis by helping us to define and understand your tolerance to risk.

NAME DATE COMPLETED (MM/DD/YYYY)

Questions 1–4. Please rank the following Investment Objectives from Most Question 7. In approximately how many years do you expect to begin

Important (1) to Least Important (4). withdrawing funds for your Primary Financial Need?

Income Immediately

Aggressive Income Less than 2 Years

Capital Appreciation 2–5 Years

Speculation 6–10 Years

11–20 Years

Question 5. Please choose the risk tolerance below that best describes your

More than 20 Years

attitude toward investing.

Conservative Moderate Aggressive Question 8. Once you begin to withdraw funds for your Primary Financial

Need, over how long of a period do you anticipate the withdrawals to

Question 6. Please choose the Primary Financial Need for the assets continue?

included in this analysis.

Immediately

Wealth Accumulation

Less than 2 Years

Retirement

2–5 Years

Major Purchase

6–10 Years

Education Planning

11–20 Years

Current Income

More than 20 Years

Health Care/Long-Term Care

Estate/Legacy Planning

Charitable

Any information that you provide to us or that we provide to you is for LifeView Goal Analysis), they will be acting in a brokerage capacity. When

investment education only. The information should not be viewed or relied your Financial Advisor prepares a Financial Plan (i.e., when using LifeView

upon as advice with respect to asset allocation or any particular investments. Advisor or LifeView Personal Wealth Advisor), they will be acting in an

A LifeView Goal Analysis or LifeView Financial Plan (“Financial Plan”) is based investment advisory capacity with respect to the delivery of your Financial

on the methodology, estimates, and assumptions, as described in your report, Plan. This Investment Advisory relationship will begin with the delivery of

as well as personal data provided by you in this material. The report should the Financial Plan and ends thirty days later, during which time your Financial

be considered a working document that can assist you with your objectives. Advisor can review the Financial Plan with you. To understand the differences

Morgan Stanley Smith Barney LLC (“Morgan Stanley”) makes no guarantees between brokerage and advisory relationships, you should consult your

as to future results or that an individual’s investment objectives will be Financial Advisor, or review our Understanding Your Brokerage and Investment

achieved. The responsibility for implementing, monitoring and adjusting your Advisory Relationships brochure, available at https://www.morganstanley.com/

financial goal analysis or financial plan rests with you. After your Financial wealth-relationshipwithms/pdfs/understandingyourrelationship.pdf.

Advisor delivers your report to you, if you so desire, your Financial Advisor Morgan Stanley, its affiliates and Morgan Stanley Financial Advisors and

can help you implement any part that you choose; however, you are not Private Wealth Advisors do not provide tax or legal advice. Clients should

obligated to work with your Financial Advisor or Morgan Stanley. consult their tax advisor for matters involving taxation and tax planning and

Important information about your relationship with your Financial Advisor their attorney for matters involving trust and estate planning and other legal

and Morgan Stanley Smith Barney LLC when using LifeView Goal Analysis, matters. Your LifeView analysis is provided to you on the condition that

LifeView Advisor, or LifeView Personal Wealth Advisor: When your Financial we are not acting as a fiduciary for purposes of the Employee Retirement

Advisor prepares and delivers a Financial Goal Analysis (i.e., when using Income Security Act of 1974 (“ERISA”) as a result.

© 2020 Morgan Stanley Smith Barney LLC. Member SIPC. LIFEVIEW® RISK TOLERANCE QUESTIONNAIRE

(06/2020) FPRLVRT

PAGE 1 OF 1

NY CS 9846942 06/2020

CRC 3107014 06/2020

PERSONAL AND CONFIDENTIAL

You might also like

- Automatic Passive Income - How the Best Dividend Stocks Can Generate Passive Income for Wealth Building.From EverandAutomatic Passive Income - How the Best Dividend Stocks Can Generate Passive Income for Wealth Building.Rating: 3.5 out of 5 stars3.5/5 (3)

- Section A-Client Information: Investor QuestionnaireDocument12 pagesSection A-Client Information: Investor QuestionnaireRafa AlbercaNo ratings yet

- The Orange Book Vol 20Document16 pagesThe Orange Book Vol 20Gokz LearningNo ratings yet

- 401k Enrollment Guide, Forms EditableDocument15 pages401k Enrollment Guide, Forms EditableMOHAMMED ALSHUAIBINo ratings yet

- Financial PlanningDocument91 pagesFinancial PlanningRakshit GoyalNo ratings yet

- Sample FHC ReportDocument24 pagesSample FHC Reportabhinav0115No ratings yet

- Risk Profile Questionnaire PDFDocument4 pagesRisk Profile Questionnaire PDFamicabletaureanNo ratings yet

- FinancialPlanning & MutualFundsDocument32 pagesFinancialPlanning & MutualFundsChris LukeNo ratings yet

- Shubhrakanti Nag: Financial Planning Report ForDocument60 pagesShubhrakanti Nag: Financial Planning Report ForRakesh IndianNo ratings yet

- Saving 101Document18 pagesSaving 101devinebugNo ratings yet

- A Discussion On Mutual Funds: With The Employees of HSBCDocument57 pagesA Discussion On Mutual Funds: With The Employees of HSBCSandeep BorseNo ratings yet

- Sample: John and Jane SmithDocument98 pagesSample: John and Jane Smithchen yahuiNo ratings yet

- Research Report Financial PlanningDocument43 pagesResearch Report Financial PlanningManasi KalgutkarNo ratings yet

- UITF Kit Individual ClientsDocument14 pagesUITF Kit Individual ClientsNoel MolitNo ratings yet

- Over Allgoal PlanningDocument2 pagesOver Allgoal Planninginfoassets4indiaNo ratings yet

- Financial Planning Guide SampleDocument10 pagesFinancial Planning Guide SampleBalakrishnanNo ratings yet

- Financial Planning Age WiseDocument4 pagesFinancial Planning Age WisercpawarNo ratings yet

- Portfolio ConstraintsDocument2 pagesPortfolio ConstraintsSohad ElnagarNo ratings yet

- FintooDocument70 pagesFintoorakeshNo ratings yet

- Piramal Group Mutual FundsDocument18 pagesPiramal Group Mutual FundsRajNo ratings yet

- Do Not Use Cut, Copy Paste Anywhere.: Need Based Financial Planning MR Anil GhaiDocument27 pagesDo Not Use Cut, Copy Paste Anywhere.: Need Based Financial Planning MR Anil GhaiAmit SheoranNo ratings yet

- Financial Planning: I Need A Plan?Document6 pagesFinancial Planning: I Need A Plan?Karim Boupalmier100% (1)

- 5 - Account Opening Form (Sun RISE)Document4 pages5 - Account Opening Form (Sun RISE)Noknik OllirecNo ratings yet

- Personal-Banking Investments Customer-Investment-profile en Cip QuestionnaireDocument7 pagesPersonal-Banking Investments Customer-Investment-profile en Cip QuestionnaireAbhishek SharmaNo ratings yet

- San DeepDocument17 pagesSan DeepSandeep NedunooriNo ratings yet

- Finance Bulb Stocks Investing Starter KitDocument21 pagesFinance Bulb Stocks Investing Starter KitHarbour MediaNo ratings yet

- Sample Financial PlanDocument45 pagesSample Financial PlanAmit Kumar Gupta100% (1)

- Product Disclosure StatementDocument30 pagesProduct Disclosure StatementfunctioneightNo ratings yet

- Investment PresentationDocument28 pagesInvestment Presentationsidharth guptaNo ratings yet

- Portfolio Casee StudyDocument26 pagesPortfolio Casee StudyKeertana Naidu A/P RajendranNo ratings yet

- Initial Planning Questionnaire: Ari CrandallDocument8 pagesInitial Planning Questionnaire: Ari CrandallBalaji DhanapalNo ratings yet

- W-4 Financial PlanningDocument27 pagesW-4 Financial PlanningRafly Septian PutraNo ratings yet

- Investment Optimisation: Applied Operations Research Case StudyDocument25 pagesInvestment Optimisation: Applied Operations Research Case Studyaayush jainNo ratings yet

- FIN 420 EXPERT Expect Success Fin420expertdotcomDocument20 pagesFIN 420 EXPERT Expect Success Fin420expertdotcomisabella45No ratings yet

- 2 Questionnaire CWMDocument4 pages2 Questionnaire CWMANUJA RAPURKARNo ratings yet

- Tax Saving RecommendationsDocument4 pagesTax Saving RecommendationslejyjacobNo ratings yet

- Id IciciDocument11 pagesId IciciKhaisarKhaisarNo ratings yet

- Financial Budgetsedited (2) (1) AMDocument7 pagesFinancial Budgetsedited (2) (1) AMpurity silaNo ratings yet

- Mark Mandy LongDocument15 pagesMark Mandy LongFinancial SenseNo ratings yet

- The Power of Compound Interest Over Time EngDocument2 pagesThe Power of Compound Interest Over Time Engmukeshmishra158No ratings yet

- The 5-Minute 401 (K) Investment Plan - DecDocument5 pagesThe 5-Minute 401 (K) Investment Plan - DecprodeepmNo ratings yet

- Sofia Times October 2017Document27 pagesSofia Times October 2017dhanrajkamatNo ratings yet

- Financial Planning For Young InvestorsDocument44 pagesFinancial Planning For Young InvestorsMateen QadriNo ratings yet

- 6622 DocumentDocument4 pages6622 DocumentKhursheed AhmadNo ratings yet

- Scanner CAP II Financial ManagementDocument195 pagesScanner CAP II Financial ManagementEdtech NepalNo ratings yet

- Investment 101 - Mutual Fund BasicDocument22 pagesInvestment 101 - Mutual Fund BasicR-Linn PerezNo ratings yet

- Pivotal Planning Winter Addition NewsletterDocument7 pagesPivotal Planning Winter Addition NewsletterAnthony WrightNo ratings yet

- Account-Opening-Individual - Meezan Sahulat Sarmayakari Account FinalDocument7 pagesAccount-Opening-Individual - Meezan Sahulat Sarmayakari Account FinalSalman ArshadNo ratings yet

- Fact Finding Sheet As at 26 September 2012Document19 pagesFact Finding Sheet As at 26 September 2012Winnie NgNo ratings yet

- Pivotal Planning Winter Addition NewsletterDocument7 pagesPivotal Planning Winter Addition NewsletterAnthony WrightNo ratings yet

- Newspaper FeatureDocument1 pageNewspaper FeatureDavid PeavoyNo ratings yet

- SREFP Brochure BookletDocument20 pagesSREFP Brochure BookletKaran GuptaNo ratings yet

- Assignment 1 214Document4 pagesAssignment 1 214nidhidNo ratings yet

- Financial Plan For Small Business Free PDF Template DownloadDocument32 pagesFinancial Plan For Small Business Free PDF Template DownloadRoNo ratings yet

- Wealth: HE Conomic ImesDocument7 pagesWealth: HE Conomic ImesDeepak GirotraNo ratings yet

- Wealth May Grow by Leaps and Bounds If Invested Step by StepDocument27 pagesWealth May Grow by Leaps and Bounds If Invested Step by StepdeepamjyotiroutrayNo ratings yet

- Financial Planning FullDocument283 pagesFinancial Planning Fullnamita agrawalNo ratings yet

- Introduction To Financial Planning Unit 1Document57 pagesIntroduction To Financial Planning Unit 1Joshua GeddamNo ratings yet

- Capital Expenditure - CapEx DefinitionDocument4 pagesCapital Expenditure - CapEx DefinitionMali MedoNo ratings yet

- Term Structure of Interest Rates With YieldDocument24 pagesTerm Structure of Interest Rates With Yield777priyankaNo ratings yet

- Entrepreneurship Chapter 8 NotesDocument4 pagesEntrepreneurship Chapter 8 NotesJamal ArshadNo ratings yet

- Bangladesh Power Sector An Appraisal From A Multi Dimensional PerspectiveDocument301 pagesBangladesh Power Sector An Appraisal From A Multi Dimensional PerspectiveShuvoNo ratings yet

- Impact of Strategic Planning On Profit PerformanceDocument9 pagesImpact of Strategic Planning On Profit PerformanceIbrahim Olasunkanmi AbduLateefNo ratings yet

- Pre-Trade Analysis (MSEOOPEN)Document4 pagesPre-Trade Analysis (MSEOOPEN)tul SanwalNo ratings yet

- A Study of Financial Planning and Invest2Document6 pagesA Study of Financial Planning and Invest2Saurav RanaNo ratings yet

- Capital Structure & Leverage Analysis: A Case Study of Steel Authority of India LTD (SAIL)Document23 pagesCapital Structure & Leverage Analysis: A Case Study of Steel Authority of India LTD (SAIL)lakshayNo ratings yet

- CAPE Management of Business 2012 U1 P2Document5 pagesCAPE Management of Business 2012 U1 P2Jolene GoolcharanNo ratings yet

- Accounting Standard - 4Document6 pagesAccounting Standard - 4api-298918505No ratings yet

- Stock ValuationDocument16 pagesStock ValuationHassaan NasirNo ratings yet

- Group 2 CaseAnalysisDocument2 pagesGroup 2 CaseAnalysismark florence B BrunoNo ratings yet

- 1 20Document3 pages1 20XhaNo ratings yet

- Swot Analysis: Strengths WeaknessesDocument3 pagesSwot Analysis: Strengths WeaknessesVanNo ratings yet

- Innoz Deepak Ravindran Saravanan RamasamyDocument8 pagesInnoz Deepak Ravindran Saravanan RamasamyRakesh BabuNo ratings yet

- Mohamed Ismail Mohamed Riyath - An Overview of Asset Pricing Models (2005, GRIN Verlag)Document39 pagesMohamed Ismail Mohamed Riyath - An Overview of Asset Pricing Models (2005, GRIN Verlag)EVERYTHING FOOTBALLNo ratings yet

- EPM Multiple Choice Questions 7 PDFDocument21 pagesEPM Multiple Choice Questions 7 PDFSittie Hashima MangotaraNo ratings yet

- Chapter 6 MCDocument4 pagesChapter 6 MCapi-3749577No ratings yet

- Nestle SA An Analysis of 5 Operations FuDocument55 pagesNestle SA An Analysis of 5 Operations FuNishta NishhNo ratings yet

- Chapter 1 Introduction To Finance For EntrepreneursDocument7 pagesChapter 1 Introduction To Finance For EntrepreneursBlancaNo ratings yet

- Project Report: Topic of The StudyDocument11 pagesProject Report: Topic of The StudySAGAR KHATUA50% (2)

- FM Unit 8 Lecture Notes - Capital BudgetingDocument4 pagesFM Unit 8 Lecture Notes - Capital BudgetingDebbie DebzNo ratings yet

- Technical Webinar 6 - Analyst Rajendra - (23-Aug-2020)Document46 pagesTechnical Webinar 6 - Analyst Rajendra - (23-Aug-2020)RajanmanuVarada0% (1)

- Financial Accounting - M1 NotesDocument15 pagesFinancial Accounting - M1 NotesSana BajpaiNo ratings yet

- Financial Management Assignment: Cash Flow Analysis OF Kwality Dairy LTDDocument4 pagesFinancial Management Assignment: Cash Flow Analysis OF Kwality Dairy LTDishant7890No ratings yet

- 02 - Cost of Capital Quizzer 1Document5 pages02 - Cost of Capital Quizzer 1Mary Grace MontojoNo ratings yet

- Idioms Class 3Document2 pagesIdioms Class 3LUISA FERNANDA BARRAGAN LOAIZANo ratings yet

- Article On Merger and AcquisitionDocument11 pagesArticle On Merger and AcquisitionSurbhi MishraNo ratings yet

- 01 Comm 308 Final Exam (Fall 2007) SolutionsDocument17 pages01 Comm 308 Final Exam (Fall 2007) SolutionsAfafe ElNo ratings yet

- Penentuan Kelayakan Finansial Usaha Produksi Pupuk Abc Pada CV - Xyz Dusun Sebotu Kabupaten SanggauDocument8 pagesPenentuan Kelayakan Finansial Usaha Produksi Pupuk Abc Pada CV - Xyz Dusun Sebotu Kabupaten SanggauArif SetiajayaNo ratings yet