Professional Documents

Culture Documents

Change of Bank Mandate Form

Uploaded by

Prabhas ChandraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Change of Bank Mandate Form

Uploaded by

Prabhas ChandraCopyright:

Available Formats

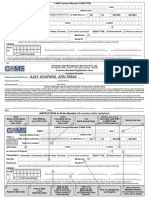

CHANGE OF BANK MANDATE FORM

Change of Bank Mandate Form - Acknowledgement

Sponsor : State Bank of India

Investment Manager : SBI Funds Management Ltd.

I / We request you to update the following details in your records. (A Joint Venture between SBI and AMUNDI)

Change of Bank Mandate Form received

Name (Mr./Ms./M/s.):

from................................................................

Folio No/s.:

for Folios.........................................................

Mobile No.: Tel. (Landline): (STD) (subject to verification of documents)

Investment Manager:

SBI Funds Management Ltd.,

Tel. (Office): (STD) E-mail ID: 9th Floor, Crescenzo, C-38 & 39, G Block, Bandra-Kurla Complex,

Change of Bank Mandate: (Refer Instruction for documents to be submitted) Account Type (Please 3 ) Bandra (East), Mumbai - 400 051, Tel.: 91-22 - 61793537

Email: customer.delight@sbimf.com | Website: www.sbimf.com

Savings NRO FCNR Registrars:

Bank Account No.: Computer Age Management Services Pvt. Ltd.

Current NRE Others SEBI Registration No.: INR000002813, Rayala Towers, 158, Anna

Salai, Chennai - 600 002, Tel.: 044-28435797

Name of Bank: Email: enq_sbimf@camsonline.com | Website: www.camsonline.com

Signature, Date & Stamp of

Branch Name & Address: Receiving Branch of SBI Mutual Fund

City: Pin:

MICR Code (9-Digit): IFS Code (11-Digit): INSTRUCTIONS

(This is 9-digit number next to the cheque number.) CHANGE OF BANK: please submit any one of the following

Declaration: document / s:

I. “CANCELLED” original cheque leaf of the New as well as the

I / We have read and understood the contents of the Statement of Additional Information, Scheme Information Document and Key Information Existing registered bank account in the Folio/s (where the first

Memorandum to the respective Scheme(s) and agree to abide by the same, including any addendum(s) thereto and any terms, conditions, rules and unitholder / investor's name is printed on the face of the cheque).

II. Copy of the Bank Passbook / Bank Statement (with entries not

regulations of the scheme(s) applicable from time to time. I / We will not hold SBI Funds Management Pvt. Ltd. and its Registrar liable for any loss due older than 3 months) of the new bank account as well as the

to delayed execution or rejection of the request for reason of incomplete/incorrect information. existing bank account wherein the first unitholder / investor's

name, bank a/c no. and bank branch is clearly legible.

Signature/s as per mode of holding in the Folio: III. A letter from the bank on its letterhead certifying investors' bank

account information (new and existing bank mandate) viz.

account holders' name, bank a/c no., bank branch, a/c type,

MICR and IFS code. In case the existing bank account is already

closed, investors may submit letter from such bank on its

letterhead, confirming the closure of the account with relevant

account details.

IV. In case investors are unable to submit proof of existing bank

First Unit Holder / Guardian / POA / Second Unit Holder / Third Unit Holder / account (in line with points I, II, III above) they may submit a self-

attested copy of PAN (where PAN is registered in the folio) in lieu

Authorised Signatory Authorised Signatory Authorised Signatory of existing bank account proof.

V. If Pan is not registered in the folio and the investor does not have

the existing bank proof, a self-attested PAN copy should be

In case of change/variation in signature (as per folio), kindly get your signature/s attested by the Bank Manager in the bellow given format. submitted where the PAN is KYC verified.

VI. Please note that change of bank details from Savings Account to

NRE Account and from NRO Account to NRE Account is not allowed.

Investor Name : VII. COOLING PERIOD: Whenever any change of bank mandate

request is received simultaneously with or just prior to

(As per bank Record) submission of a redemption request, Mutual Funds/ RTA’s

maintain a cooling period of ten (calendars days) as a matter of

precaution against unauthorized / fraudulent transactions.

PAN Number : From the day of Change of Bank is implemented the payment of

Signature/s Verified

(As per bank Record) the redemption proceeds will be paid after completion of cooling

*(Signature of the Branch Manager/Authorized Official with their Seal and Bank Stamp) period.

VIII. If the IMPS validation of the investor’s account fails, payment will

*Name: *Designation: be made through cheque and dispatch to the investors’

registered address in the folio.

(Copies of above documents can be submitted along with the original

documents at any of the branches of SBI Mutual Fund and the original

*Employee Code: Phone Number: document/s will be returned to investors after due verification and

attestation. In case the original of any document is not produced for

verification, then the copy can be attested by an authorized official of

*Mandatory Date: _________________________ the bank (Officer grade and above) clearly mentioning the name,

designation and employee number with bank branch seal).

You might also like

- 7S Electronic Payout MandateDocument1 page7S Electronic Payout MandateB RanaNo ratings yet

- TT FormDocument1 pageTT FormStephanos SamarasNo ratings yet

- SBI MF COMMON Transaction Form COA & COBDocument2 pagesSBI MF COMMON Transaction Form COA & COBBvenkata SivaNo ratings yet

- Zero Only: Application For Funds Transfer Under Rtgs/NeftDocument1 pageZero Only: Application For Funds Transfer Under Rtgs/NeftHemanth KumarNo ratings yet

- JsoDocument11 pagesJsovenkat yeluriNo ratings yet

- Electronic Payout Mandate ICICIDocument1 pageElectronic Payout Mandate ICICIvegane1581No ratings yet

- Pay Card Application FormDocument1 pagePay Card Application FormMARIBEL LENDIONo ratings yet

- Net Banking Form PDFDocument3 pagesNet Banking Form PDFDr. Nitin PurohitNo ratings yet

- SBI MF SIP ECS FormDocument1 pageSBI MF SIP ECS FormSHIRISH1973No ratings yet

- Internet Banking Application Form: (Sibernet)Document6 pagesInternet Banking Application Form: (Sibernet)Rony JamesNo ratings yet

- Cash Voucher For Fee PaymentDocument1 pageCash Voucher For Fee PaymentAmrit VirdiNo ratings yet

- 7S Electronic Payout MandateDocument1 page7S Electronic Payout MandateMatri SearchNo ratings yet

- Deposit Receipt ClerksDocument1 pageDeposit Receipt ClerksDheeraj KushwahaNo ratings yet

- Bank Copy CandidateDocument1 pageBank Copy CandidateMuhammed ThanzeelNo ratings yet

- IDFCFIRSTBankstatement 10051177724 170334404Document2 pagesIDFCFIRSTBankstatement 10051177724 170334404Samson PereiraNo ratings yet

- Common Transaction For FilledDocument2 pagesCommon Transaction For FilledPay CashNo ratings yet

- The Kangra Central Co-Operative Bank LTD.: H.O. Dharamshala, Distt. Kangra (H.P.) - 176 215Document5 pagesThe Kangra Central Co-Operative Bank LTD.: H.O. Dharamshala, Distt. Kangra (H.P.) - 176 215MukulNo ratings yet

- Giro-Cards dbsv2Document1 pageGiro-Cards dbsv2Julius Putra Tanu SetiajiNo ratings yet

- Application Form For Interbank Giro For Payment of Credit / Charge Card AccountDocument1 pageApplication Form For Interbank Giro For Payment of Credit / Charge Card AccountYei YanNo ratings yet

- Cis BlankDocument1 pageCis BlankMarideth Gonzales DiazNo ratings yet

- Application Form For Change in Bank Account DetailsDocument1 pageApplication Form For Change in Bank Account DetailsARNo ratings yet

- BvA - Budget Versus Actuals PDFDocument1 pageBvA - Budget Versus Actuals PDFAssad CamajeNo ratings yet

- Selvam: 47480: 320: AddressDocument1 pageSelvam: 47480: 320: AddressmagicpalNo ratings yet

- Scripbox Nach Mandate Form - pdf20230609-1-n2nlp8Document1 pageScripbox Nach Mandate Form - pdf20230609-1-n2nlp8shazil.bajajNo ratings yet

- Welcome To SBI - Application Form PrintDocument1 pageWelcome To SBI - Application Form PrintmoneythindNo ratings yet

- Signature Change FormDocument1 pageSignature Change FormDr Monal YuwanatiNo ratings yet

- Challan Form (Cash Voucher) - 01 Challan Form (Cash Voucher) - 01Document2 pagesChallan Form (Cash Voucher) - 01 Challan Form (Cash Voucher) - 01abhi046btecheeeNo ratings yet

- PFMS Generated Print Payment Advice: Helpdesk-Pfms@gov - inDocument2 pagesPFMS Generated Print Payment Advice: Helpdesk-Pfms@gov - inTanuj ChakrabortyNo ratings yet

- Scripbox Nach Mandate FormDocument1 pageScripbox Nach Mandate FormravidevaNo ratings yet

- Gofne NachDocument2 pagesGofne NachSHAM CHAUDHARINo ratings yet

- Individual-Product DetailsDocument2 pagesIndividual-Product DetailsMohd Musa HashimNo ratings yet

- Re Activation Dormant Ac Form Combine 2september 2021 v2Document1 pageRe Activation Dormant Ac Form Combine 2september 2021 v2syedumarahmed52No ratings yet

- Digital Channel Enrollment FormDocument2 pagesDigital Channel Enrollment Formmhkhanbd23No ratings yet

- Epayment Form - NewDocument3 pagesEpayment Form - NewVirender SainiNo ratings yet

- Bank Copy: Position Code For Assistant Is 301 Position Code For Stenotypist Is 302Document1 pageBank Copy: Position Code For Assistant Is 301 Position Code For Stenotypist Is 302i am lateNo ratings yet

- Electronic Payment Mandate FormDocument1 pageElectronic Payment Mandate FormkokaanilkumarNo ratings yet

- 7S Electronic Payout Mandate PDFDocument1 page7S Electronic Payout Mandate PDFSunil SulakheNo ratings yet

- Net Banking and Mobile Banking Form For Retail UsersDocument4 pagesNet Banking and Mobile Banking Form For Retail UsersChowkidar Dhirendra Pratap SinghNo ratings yet

- Bank Copy CandidateDocument1 pageBank Copy CandidateVamshi Kumar Reddy MNo ratings yet

- Bank of Baroda: Annexure - Ii Paying-In-Slip-For Neft / RtgsDocument3 pagesBank of Baroda: Annexure - Ii Paying-In-Slip-For Neft / RtgsGirish NimbhorkarNo ratings yet

- Cams One Time MandateDocument2 pagesCams One Time Mandatepiyush agarwalNo ratings yet

- Cams One Time MandateDocument2 pagesCams One Time Mandatepiyush agarwalNo ratings yet

- HDFC RtgsDocument1 pageHDFC Rtgshanif4800No ratings yet

- 31 05 2016 AddBank - 296974Document3 pages31 05 2016 AddBank - 296974Suprotim DuttaNo ratings yet

- Account Closure FormDocument1 pageAccount Closure FormDineshya GNo ratings yet

- Neha Enterprises: Flooring, Dry-Cleaningat (Estb. 2001)Document2 pagesNeha Enterprises: Flooring, Dry-Cleaningat (Estb. 2001)mohitNo ratings yet

- Standing Instructions Request FormDocument1 pageStanding Instructions Request FormMogli SinghNo ratings yet

- NACH Direct Debit New Mandate Form Blank-1Document1 pageNACH Direct Debit New Mandate Form Blank-1prayas03No ratings yet

- Nseit Bank FormDocument1 pageNseit Bank Formनित्यानन्द कुमार सिन्हा यादवNo ratings yet

- Rtgs and Neft FormDocument1 pageRtgs and Neft FormAmruta patilNo ratings yet

- RTGS and NEFT Application FormDocument1 pageRTGS and NEFT Application FormRajesh KumarNo ratings yet

- SBI Change-Of-Bank-Mandate-Form PDFDocument1 pageSBI Change-Of-Bank-Mandate-Form PDFsstewariNo ratings yet

- Nach Deposit SlipDocument1 pageNach Deposit SlipRitesh Kumar DubeyNo ratings yet

- Sbi Internet Banking Resistration FormDocument2 pagesSbi Internet Banking Resistration FormakhilNo ratings yet

- Common Transaction FormDocument2 pagesCommon Transaction FormKamleshNo ratings yet

- 5 Things To Know About NACH Mandate: Iifl Securities Limited 50100038522704Document1 page5 Things To Know About NACH Mandate: Iifl Securities Limited 50100038522704Mahesh Kumar VermaNo ratings yet

- Change in Bank DetailDocument2 pagesChange in Bank Detailjha.sofcon5941No ratings yet

- PFMS Generated Print Payment Advice: To, The Branch HeadDocument3 pagesPFMS Generated Print Payment Advice: To, The Branch HeadsreeNo ratings yet

- Internet and SMS Banking Enrollment Form: United Commercial Bank Limited BranchDocument1 pageInternet and SMS Banking Enrollment Form: United Commercial Bank Limited BranchShahidul Islam RaselNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Budget Exercises - Part II (Model Answers)Document7 pagesBudget Exercises - Part II (Model Answers)Menna AssemNo ratings yet

- True of False Accounting CycleDocument7 pagesTrue of False Accounting Cycleandrea arapocNo ratings yet

- Quotation - Householders - LAPSONDocument1 pageQuotation - Householders - LAPSONCredsureNo ratings yet

- Authorization To Use and ChargeDocument1 pageAuthorization To Use and ChargeRonald Garcia PreNo ratings yet

- Khurana TiketDocument2 pagesKhurana TiketRAJU GHORPADE100% (1)

- Syllabus On Banking and Financial InstitutionsDocument2 pagesSyllabus On Banking and Financial InstitutionsFatima Bagay94% (18)

- Jci Application FormDocument3 pagesJci Application FormharikrishnanNo ratings yet

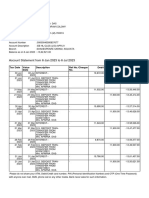

- Account Statement From 6 Jan 2023 To 6 Jul 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 6 Jan 2023 To 6 Jul 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceCosmic HealerNo ratings yet

- Review of Related LiteratureDocument22 pagesReview of Related Literatureelizabeth monasterio100% (1)

- A Perspective On German PaymentsDocument12 pagesA Perspective On German PaymentsRohan Batra100% (1)

- Gati 1Document16 pagesGati 1Mukesh YadavNo ratings yet

- PROCEDURES TANK To TANKDocument1 pagePROCEDURES TANK To TANKTam Fae da IslandsNo ratings yet

- Philippine School of Business Administration R. Papa ST., Sampaloc, ManilaDocument12 pagesPhilippine School of Business Administration R. Papa ST., Sampaloc, ManilaNaiomi NicasioNo ratings yet

- Supply Chain Management Logistics Multimodal Transportation OverviewDocument25 pagesSupply Chain Management Logistics Multimodal Transportation OverviewgizzillaNo ratings yet

- Zakiyyah Logan Joins PrivatePlus MortgageDocument2 pagesZakiyyah Logan Joins PrivatePlus MortgagePR.comNo ratings yet

- Bacs Form For Payment of BenefitsDocument2 pagesBacs Form For Payment of BenefitsKishore KumarNo ratings yet

- Guided Transmission MediaDocument3 pagesGuided Transmission Mediamohammad javedNo ratings yet

- Ryan Deiss - 80 Point Business Marketing ChecklistDocument4 pagesRyan Deiss - 80 Point Business Marketing Checklistchiguybg100% (7)

- Case Study 10Document2 pagesCase Study 10Mythes JicaNo ratings yet

- Case Problem Hanievon MerchandisingDocument20 pagesCase Problem Hanievon MerchandisingPrincessjane Largo100% (1)

- !7 Cisco - Testkings.700 150.PDF - Download.2020 Sep 26.by - Eli.82q.vceDocument6 pages!7 Cisco - Testkings.700 150.PDF - Download.2020 Sep 26.by - Eli.82q.vceDmitrii DaniliukNo ratings yet

- Auto Invoicing Setup StepsDocument3 pagesAuto Invoicing Setup StepschandanNo ratings yet

- Ngoaingu24H.Vn 1: Topic 8: TransportationDocument10 pagesNgoaingu24H.Vn 1: Topic 8: Transportation31-11A1.2 Duy TháiNo ratings yet

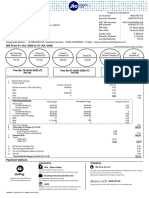

- Bill From 01-Jul-2020 To 31-Jul-2020: JiopayDocument1 pageBill From 01-Jul-2020 To 31-Jul-2020: JiopayAmitkumar SinghNo ratings yet

- Fitbase Cancellation FormDocument1 pageFitbase Cancellation FormMarley HarrisNo ratings yet

- E-Ticket AYPRC1877337Document2 pagesE-Ticket AYPRC1877337vijisaravNo ratings yet

- Tour PackageDocument25 pagesTour PackageLEONARDO FLORESNo ratings yet

- Books of Original Entry Part 3 (Petty Cash Book)Document10 pagesBooks of Original Entry Part 3 (Petty Cash Book)Paula-Kay Thompson100% (1)

- Nov 2012 MLCDocument25 pagesNov 2012 MLCalan_franco19No ratings yet