Professional Documents

Culture Documents

Description: S&P/TOPIX 150

Uploaded by

Michael JoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Description: S&P/TOPIX 150

Uploaded by

Michael JoCopyright:

Available Formats

Equity

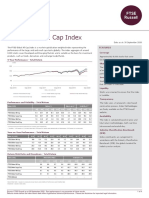

S&P/TOPIX 150

Description

S&P/TOPIX 150 represents the large cap universe for Japan. It includes 150 highly liquid securities as leading, blue chip companies

from each of the Global Industry Classification Standard (GICS®) sectors of the Japanese market.

Quick Facts

WEIGHTING METHOD Float-adjusted market cap weighted

REBALANCING FREQUENCY Quarterly in March, June, September, and December

CALCULATION FREQUENCY Real time

CALCULATION CURRENCIES JPY, USD

LAUNCH DATE June 21, 1999

FIRST VALUE DATE December 31, 1987

REGULATORY AUTHORIZATION European Union

For more information, including the complete methodology document, please visit:

https://www.spglobal.com/spdji/en//indices/equity/sp-topix-150

All information for an index prior to its Launch Date is back-tested, based on the methodology that was in effect on the Launch Date. Back-tested performance, which is

hypothetical and not actual performance, is subject to inherent limitations because it reflects application of an Index methodology and selection of index constituents in

hindsight. No theoretical approach can take into account all of the factors in the markets in general and the impact of decisions that might have been made during the actual

operation of an index. Actual returns may differ from, and be lower than, back-tested returns.

Historical Performance

* Data has been re-based at 100

Static text

S&P/TOPIX 150 (TR) S&P Japan 500 (TR)

AS OF SEPTEMBER 30, 2020 spdji.com index_services@spglobal.com

Equity

S&P/TOPIX 150

Performance

INDEX LEVEL RETURNS ANNUALIZED RETURNS

1 MO 3 MOS YTD 1 YR 3 YRS 5 YRS 10 YRS

Total Return

1,935.9 0.25% 4.85% -3.13% 4.74% 2.33% 5.33% 8.96%

Price Return

1,344.81 -0.63% 3.91% -5.32% 2.23% -0.14% 2.87% 6.59%

BENCHMARK* Total Return

2,135.56 0.9% 4.9% -3.25% 4.79% 1.79% 5.31% 9.27%

BENCHMARK* Price Return

1,488.7 0.07% 4.03% -5.34% 2.38% -0.55% 2.97% 7%

* The index benchmark is the S&P Japan 500

Calendar Year Performance

2019 2018 2017 2016 2015 2014 2013 2012 2011 2010

Total Return

19.26% -14.52% 20.13% -0.39% 10.49% 8.78% 54.27% 23.23% -20.02% 0.65%

Price Return

16.25% -16.5% 17.51% -2.65% 8.35% 6.65% 51.48% 20.34% -21.71% -1.07%

BENCHMARK* Total Return

18.13% -15.27% 21.49% 0% 11.39% 10.26% 55.48% 21.31% -18.19% 0.51%

BENCHMARK* Price Return

15.27% -17.12% 18.99% -2.15% 9.36% 8.21% 52.76% 18.57% -19.88% -1.18%

* The index benchmark is the S&P Japan 500

Risk

ANNUALIZED RISK ANNUALIZED RISK-ADJUSTED RETURNS

3 YRS 5 YRS 10 YRS 3 YRS 5 YRS 10 YRS

Total Return

15.89% 16.21% 17.12% 0.15 0.33 0.52

Price Return

15.97% 16.23% 17.16% -0.01 0.18 0.38

BENCHMARK* Total Return

16.17% 16.19% 16.85% 0.11 0.33 0.55

BENCHMARK* Price Return

16.22% 16.19% 16.87% -0.03 0.18 0.41

Risk is defined as standard deviation calculated based on total returns using monthly values.

* The index benchmark is the S&P Japan 500

AS OF SEPTEMBER 30, 2020 spdji.com index_services@spglobal.com

Equity

S&P/TOPIX 150

Fundamentals

P/E (TRAILING) P/E (PROJECTED) P/B INDICATED DIV YIELD P/SALES P/CASH FLOW

28.11 23.08 1.34 2.22% 0.94 9.38

As of September 30, 2020. Fundamentals are updated on approximately the fifth business day of each month.

Index Characteristics

NUMBER OF CONSTITUENTS 150

CONSTITUENT MARKET [JPY MILLION]

MEAN TOTAL MARKET CAP 2,625,824.43

LARGEST TOTAL MARKET CAP 22,619,095.2

SMALLEST TOTAL MARKET CAP 449,768.62

MEDIAN TOTAL MARKET CAP 1,710,834.64

WEIGHT LARGEST CONSTITUENT [%] 5.3

WEIGHT TOP 10 CONSTITUENTS [%] 25.4

ESG Carbon Characteristics

CARBON TO VALUE INVESTED (METRIC TONS CO2e/$1M INVESTED)* 110.73

CARBON TO REVENUE (METRIC TONS CO2e/$1M REVENUES)* 144.93

WEIGHTED AVERAGE CARBON INTENSITY (METRIC TONS CO2e/$1M REVENUES)* 142.05

FOSSIL FUEL RESERVE EMISSIONS (METRIC TONS CO2/$1M INVESTED) 313.34

*Operational and first-tier supply chain greenhouse gas emissions.

For more information, please visit: www.spdji.com/esg-carbon-metrics.

Top 10 Constituents By Index Weight

CONSTITUENT SYMBOL SECTOR*

Toyota Motor Corp 7203 Consumer Discretionary

SoftBank Group Corp 9984 Communication Services

Sony Corp 6758 Consumer Discretionary

Keyence Corp 6861 Information Technology

Nintendo Co Ltd 7974 Communication Services

Recruit Holdings Co Ltd 6098 Industrials

Daiichi Sankyo Co Ltd 4568 Health Care

Takeda Pharmaceutical Co Ltd 4502 Health Care

Daikin Industries 6367 Industrials

Shin-Etsu Chemical Co 4063 Materials

*Based on GICS® sectors

AS OF SEPTEMBER 30, 2020 spdji.com index_services@spglobal.com

Equity

S&P/TOPIX 150

Sector* Breakdown

*Based on GICS® sectors

The weightings for each sector of the index are rounded to the nearest tenth of a percent; therefore, the aggregate weights for the index may not equal 100%.

Country Breakdown

COUNTRY NUMBER OF CONSTITUENTS TOTAL MARKET CAP [JPY MILLION] INDEX WEIGHT [%]

Japan 150 393,873,664.53 100

Based on index constituents’ country of domicile.

Tickers

TICKER REUTERS

Price Return SPTPX .SPTPX

Total Return SPTPXT .SPTPXT

Static text

AS OF SEPTEMBER 30, 2020 spdji.com index_services@spglobal.com

Equity

S&P/TOPIX 150

CONTACT US

spdji.com New York Dubai Hong Kong

index_services@spglobal.com 1 212 438 7354 971 (0)4 371 7131 852 2532 8000

1 877 325 5415

S&P Dow Jones Custom Indices

Mexico City Mumbai Tokyo

customindices@spglobal.com

52 (55) 1037 5290 91-22-2272-5312 81 3 4550 8564

London Beijing Sydney

44 207 176 8888 86.10.6569.2770 61 2 9255 9802

DISCLAIMER

Source: S&P Dow Jones Indices LLC.

The launch date of the S&P/TOPIX 150 was June 21, 1999.The launch date of the S&P Japan 500 was December 19, 2006.

All information presented prior to the index launch date is back-tested. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations

are based on the same methodology that was in effect when the index was officially launched. Past performance is not an indication or guarantee of future results. Please

see the Performance Disclosure at http://www.spindices.com/regulatory-affairs-disclaimers/ for more information regarding the inherent limitations associated with back-

tested performance.

Copyright © 2020 S&P Dow Jones Indices LLC. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission. STANDARD &

POOR’S and S&P are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); DOW JONES is a registered trademark of Dow Jones Trademark Holdings

LLC (“Dow Jones”); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC. S&P Dow Jones Indices LLC, Dow Jones, S&P and their respective

affiliates (“S&P Dow Jones Indices”) and third party licensors makes no representation or warranty, express or implied, as to the ability of any index to accurately represent

the asset class or market sector that it purports to represent and S&P Dow Jones Indices and its third party licensors shall have no liability for any errors, omissions, or

interruptions of any index or the data included therein. Past performance of an index is not an indication or guarantee of future results. This document does not constitute an

offer of any services. Except for certain custom index calculation services, all information provided by S&P Dow Jones Indices is general in nature and not tailored to the

needs of any person, entity or group of persons. S&P Dow Jones Indices receives compensation in connection with licensing its indices to third parties and providing custom

calculation services. It is not possible to invest directly in an index. Exposure to an asset class represented by an index may be available through investable instruments

offered by third parties that are based on that index. S&P Dow Jones Indices does not sponsor, endorse, sell, promote or manage any investment fund or other investment

product or vehicle that seeks to provide an investment return based on the performance of any Index. S&P Dow Jones Indices LLC is not an investment or tax advisor. S&P

Dow Jones Indices makes no representation regarding the advisability of investing in any such investment fund or other investment product or vehicle. A tax advisor should

be consulted to evaluate the impact of any tax-exempt securities on portfolios and the tax consequences of making any particular investment decision. Credit-related

information and other analyses, including ratings, are generally provided by licensors and/or affiliates of S&P Dow Jones Indices. Any credit-related information and other

related analyses and statements are opinions as of the date they are expressed and are not statements of fact. S&P Dow Jones Indices LLC is analytically separate and

independent from any other analytical department. For more information on any of our indices please visit www.spdji.com.

AS OF SEPTEMBER 30, 2020 spdji.com index_services@spglobal.com

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Index Trading Course - FontanillsDocument432 pagesThe Index Trading Course - Fontanillskaddour7108100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Planetary TradingDocument22 pagesPlanetary TradingArunKumarNo ratings yet

- Carolan, C. (1998) - Spiral Calendar - TheoryDocument21 pagesCarolan, C. (1998) - Spiral Calendar - Theorystummel6636100% (8)

- Yale Hirsch - Stock Traders Almanac 2005 PDFDocument195 pagesYale Hirsch - Stock Traders Almanac 2005 PDFediNo ratings yet

- Manajemen Investasi - Modul (IBN)Document130 pagesManajemen Investasi - Modul (IBN)Fajar Ariesman100% (1)

- Stocks Sstrategies and Common Sense - DR D-EbookDocument76 pagesStocks Sstrategies and Common Sense - DR D-EbookCarlos Treseme100% (1)

- Learn Before You LoseDocument25 pagesLearn Before You Losematt100% (1)

- Chart Patterns, Trading, and Dan ZangerDocument5 pagesChart Patterns, Trading, and Dan ZangerLNo ratings yet

- Credit Card NumbersDocument3 pagesCredit Card NumbersAnonymous 4LxqXiX67% (3)

- Trading FX Like Jesse Livermore Traded StocksDocument5 pagesTrading FX Like Jesse Livermore Traded StocksMishu Aqua0% (1)

- About London Stock ExchangeDocument24 pagesAbout London Stock ExchangeNabadeep UrangNo ratings yet

- Murphy K.W. - Long-Term Fibonacci Support and ResistanceDocument5 pagesMurphy K.W. - Long-Term Fibonacci Support and ResistanceCarlos TresemeNo ratings yet

- Labview Basic 1 ManualDocument476 pagesLabview Basic 1 ManualPallavi SinglaNo ratings yet

- FTSE Global All Cap IndexDocument4 pagesFTSE Global All Cap IndexMichael JoNo ratings yet

- Global Industry Classification Standard (GICS) : MethodologyDocument11 pagesGlobal Industry Classification Standard (GICS) : MethodologyMichael JoNo ratings yet

- A Second Conversation With Werner VogelsDocument26 pagesA Second Conversation With Werner VogelsMichael JoNo ratings yet

- Sunrom 283300Document8 pagesSunrom 283300adriali666No ratings yet

- Ep 2811752 A1 20141210 (En)Document2 pagesEp 2811752 A1 20141210 (En)Michael JoNo ratings yet

- LIDAR Pulsed Time of Flight Reference Design: TI DesignsDocument25 pagesLIDAR Pulsed Time of Flight Reference Design: TI DesignsMichael JoNo ratings yet

- Labview Templates and Sample ProjectsDocument2 pagesLabview Templates and Sample ProjectsMichael JoNo ratings yet

- Guidelines For Functional SpecificationsDocument9 pagesGuidelines For Functional SpecificationsPritom100% (1)

- Public Shariah MFR February 2018Document42 pagesPublic Shariah MFR February 2018ieda1718No ratings yet

- JPM Guide To The Markets - Q1 2014Document71 pagesJPM Guide To The Markets - Q1 2014adamsro9No ratings yet

- The Economic Monitor U.S.: Free EditionDocument5 pagesThe Economic Monitor U.S.: Free EditionInternational Business TimesNo ratings yet

- Chap7 AnsDocument9 pagesChap7 AnsJane MingNo ratings yet

- Dow Jones Global Indices: MethodologyDocument31 pagesDow Jones Global Indices: MethodologymaryNo ratings yet

- Summary The Intelligent InvestorDocument6 pagesSummary The Intelligent InvestorDion GerriNo ratings yet

- Ip ProjectDocument11 pagesIp ProjectDhruvNo ratings yet

- List of Stock Market Crashes and Bear Markets - Wikipedia PDFDocument22 pagesList of Stock Market Crashes and Bear Markets - Wikipedia PDFBhanwar Singh ParmarNo ratings yet

- Pi Cossmil SoporteDocument90 pagesPi Cossmil SoporteLeo QuisNo ratings yet

- Index - 5 - Volatility-Control AlgorithmDocument27 pagesIndex - 5 - Volatility-Control AlgorithmSergeGardienNo ratings yet

- Investments Canadian Canadian 8th Edition Bodie Test BankDocument39 pagesInvestments Canadian Canadian 8th Edition Bodie Test Banka609526046No ratings yet

- CNNMoney - Business, Financial and Personal Finance NewsDocument5 pagesCNNMoney - Business, Financial and Personal Finance NewsleroyNo ratings yet

- Wallstreetjournal 20191217 TheWallStreetJournal PDFDocument33 pagesWallstreetjournal 20191217 TheWallStreetJournal PDFmotoluc10 MotolNo ratings yet

- What Is A Financial System?: Key TakeawaysDocument28 pagesWhat Is A Financial System?: Key TakeawaystamiratNo ratings yet

- Thomson One Symbols: Quick Reference CardDocument5 pagesThomson One Symbols: Quick Reference CardazaiahNo ratings yet

- PDCFDocument51 pagesPDCFreutersdotcomNo ratings yet

- September Is The Cruelest Month - Mark Hulbert - Market WatchDocument5 pagesSeptember Is The Cruelest Month - Mark Hulbert - Market WatchMike NgNo ratings yet

- Refinitiv Catalog SymbolDocument10 pagesRefinitiv Catalog SymbolFritz Safety ServiceNo ratings yet