Professional Documents

Culture Documents

Aiecta Side Letter Taxation India To Australia

Uploaded by

Alpa Shah Desai0 ratings0% found this document useful (0 votes)

6 views1 pageAustralia side letter

Original Title

aiecta-side-letter-taxation-india-to-australia

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAustralia side letter

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageAiecta Side Letter Taxation India To Australia

Uploaded by

Alpa Shah DesaiAustralia side letter

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

aoilaa ar, Sa oaeete

ys alae Par ae Te HA, Hee eae

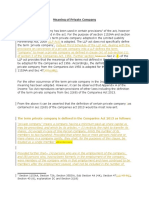

PIYUSH GOYAL MINISTER OF COMMERCE & INDUSTRY,

wautaq7a CONSUMER AFFAIRS, FOOD & PUBLIC DISTRIBUTION AND

TEXTILES, GOVERNMENT OF INDIA

02 April, 2022

H.E. Dan Tehan

Minister for Trade, Tourism and Investment of Australia

Government of Australia

Excellency,

In connection with the signing of the India-Australia Economic Cooperation and Trade

Agreement (“the Agreement”) between the Government of Australia and the

Government of the Republic of India (“the Parties”), and your letter dated

02 April 2022, which reads:

“In connection with the signing of the Australia-India Economic Cooperation and

Trade Agreement (‘the Agreement’), | have the honour to confirm the following

understandings reached between the Government of Australia and the

Government of the Republic of India (‘the Parties’)

1. The Government of Australia has agreed to amend Australian domestic

taxation law to stop the taxation of offshore income of Indian firms providing

technical services to Australia. This would resolve the issue that the Indian

Government has raised about the Double Taxation Avoidance Agreement

between the Government of the Republic of India and the Government of

Australia for the avoidance of double taxation and the prevention of fiscal

evasion with respect to taxes on income, done at Canberra on 25 July 1991.

2. Australia will implement the amendments to its taxation legislation referred

to in paragraph 1 in a similar time period as the Agreement.

| have the honour to propose that this letter and your letter in reply confirming

that your Government shares these understandings, which will come into effect

on the date on which the Agreement enters into force, shall constitute an

integral part of the Agreement.”

Ihave the honour to confirm that my Government shares these understandings, which

shall constitute an integral part of the Agreement

Minister of Commerce and Industry

Government of India

Ministry of Commerce & Industry : Udyog Bhavan, Rafi Marg, New Delhi-110011

Tel. No. : +91 11 23062223, 23061492, 23061008, Fax : +91 11 23062947, E-mail : cimoffice@nic.in

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Aiecta Side Letter Taxation Australia To IndiaDocument1 pageAiecta Side Letter Taxation Australia To IndiaAlpa Shah DesaiNo ratings yet

- 1610 Tax Insight - Tech Mahindra LTDDocument3 pages1610 Tax Insight - Tech Mahindra LTDAlpa Shah DesaiNo ratings yet

- Taxsutra All Rights ReservedDocument8 pagesTaxsutra All Rights ReservedAlpa Shah DesaiNo ratings yet

- Taxsutra All Rights ReservedDocument7 pagesTaxsutra All Rights ReservedAlpa Shah DesaiNo ratings yet

- Meaning of Private CompanyDocument4 pagesMeaning of Private CompanyAlpa Shah DesaiNo ratings yet