Professional Documents

Culture Documents

Audit of Cash and Cash Equivalents for Accounting Students

Uploaded by

General ScopiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit of Cash and Cash Equivalents for Accounting Students

Uploaded by

General ScopiCopyright:

Available Formats

lOMoARcPSD|9618707

Audit of Cash

Accounting (University of Manila)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

CHAPTER 3 - Audit of Cash &

Cash Equivalents

Problem 1

The “CASH” account of Don Corporation’s ledger on December 31, 2006 showed the

following:

a. Petty cash fund (including P7,500 unreplenished

voucher of which P2,400 is dated January 3, 2007) P 15,000

b. Redemption Fund Account – PNB 500,000

c. Traveler’s check 100,000

d. Money order 10,000

e. Treasury bill, purchased December 1, 2006 (due on Feb. 1, 2007) 50,000

f. Time deposit due on March 31, 2007 50,000

g. 180-day Treasury bill, due March 15, 2007 120,000

h. Note receivable in the possession of a collecting agency 20,000

i. PNB – Checking Account #211-009-091 325,900

j. Cash on hand, including customer postdated check of P15,000 23,000

k. Savings deposit, earmarked for acquisition of equipment 210,000

l. A check payable to San Ignacio Incorporated, dated January 5, 2007,

that was included in the December 31 PNB Checking Account

#211-009-091 50,000

m. Bond Sinking Fund (used to finance the maturing long-term obligation

on March 31, 2007) 150,000

n. Overdraft in PNB Checking Account #211-099-085 ( 50,000)

o. Check #801 in payment to Accounts Payable, dated Dec. 31, 2006

not mailed until January 5, 2007 20,000

p. Advances to Officers/Employees for Seminars (no liquidation is

required) 80,000

q. Money market placement (due June 30, 2007) 600,000

r. Listed stock held as temporary investment 100,000

s. Check #789 in payment to Suppliers, dated January 5, 2007 and

recorded December 31, 2006. 35,000

t. Customers’ certified checks 10,000

u. Pension Fund 150,000

TOTAL 2,568,900

Questions

1. The entry to correct/adjust item F is:

a. Investment 50,000

Cash 50,000

b. Other assets 50,000

Cash 50,000

c. Short-term investment 50,000

Cash 50,000

d. No adjustment

2. The entry to correct/adjust item L is:

a. Accounts payable 50,000

Cash 50,000

b. Cash 50,000

Other liabilities 50,000

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

c. Cash 50,000

Accounts payable 50,000

d. No adjustment

3. The entry to correct/adjust item M is:

a. Investment 150,000

Cash 150,000

b. Other assets 150,000

Cash 150,000

c. Short-tem investment 150,000

Cash 150,000

d. No adjustment

4. DON CORPORATION’S cash and cash equivalents balance at December 31, 2006 is:

a. Overstated by P1,950,100 c. Overstated by P 1,845,100

b. Overstated by P 1,895,100 d. Overstated by P 1,795,100

5. DON CORPORATION’S adjusted cash and cash equivalents balance at December 31,

2006 is:

a. P 618,800 b. P 623,800 c. P 673,800 d. P 723,800

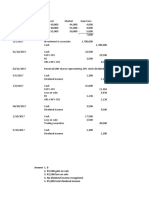

Solution

a. Operating expenses 5,100

Cash 5,100

b. Investment 500,000

Cash 500,000

c. No adjustment

d. No adjustment

e. No adjustment

f. No adjustment

g. Short-term investment 120,000

Cash 120,000

h. Notes receivable 20,000

Cash 20,000

i. No adjustment

j. Accounts receivable 15,000

Cash 15,000

k. Cash – restricted 210,000

Cash 210,000

l. No adjustment

m. Investment – current 150,000

Cash 150,000

n. No adjustment

o. No adjustment

p. Operating expenses 80,000

Cash 80,000

q. Short-term investment 600,000

Cash 600,000

r. Short-term investment 100,000

Cash 100,000

s. No adjustment

t. No adjustment

u. Investment 150,000

Cash 150,000

Answer:

1. D 2. D 3. C 4. A 5. A

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Problem 2

The following items are found in the cash account of Ivie Company at December 31, 2006.

The company’s controller asks your opinion whether the items listed below should be

considered as part of cash account and come up with adjusting entry to adjust the cash

account.

1. Customers’ check dated December 25, 2006, P25,000.

2. Company’s check (P30,000) dated December 26, 2006 which was drawn in payment for

merchandise purchased on that date but not delivered until January 3, 2007. This check

was deducted in the cash balance.

3. A check worth P196,000 from customer who paid the account net of the 2% discount.

The company records the transaction as credit to Accounts Receivable for the proceeds.

4. Cash in closed bank (Urban Bank), P95,000.

5. Redemption fund, P100,000

6. Sinking fund, P100,000. This will be used on March 1, 2007 to redeem the bonds

payable.

7. Metro Bank Checking Account No. 0004568, P210,000.

8. RCBC Checking Account No. 0002347, P115,000.

9. Overdraft in PNB Checking Account No. 00011256, P50,000.

10. Company’s check dated January 3, 2007 in payment of account, P50,000. This was

recorded in the company’s disbursement ledger at December 31, 2006.

11. Overdraft in RCBC Checking Account No. 0056791, P15,000.

12. Postage stamps, P2,000.

13. 90-day Treasury Bills (purchase on November 1, 2006), P100,000

14. Treasury Bills that matures on February 1, 2007, P50,000.

15. Change fund, P10,000.

16. Customers’ certified check, P20,000.

17. Company’s certified check, P50,000. (This was included in the cash disbursement for

December).

Questions

1. The entry to correct/adjust item number 3 is:

a. Accounts receivable 4,000

Sales discounts 4,000

b. Sales discounts 4,000

Accounts receivable 4,000

c. Accounts receivable 4,000

Sales 4,000

d. No adjustments

2. The entry to correct/adjust item number 10 is:

a. Accounts payable 50,000

Cash 50,000

b. Other liabilities 50,000

Cash 50,000

c. Cash 50,000

Accounts payable 50,000

d. No adjustment

3. The entry to correct/adjust item number 17 is:

a. Accounts payable 50,000

Cash 50,000

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

b. Cash 50,000

Accounts receivable 50,000

c. Cash 50,000

Accounts payable 50,000

d. No adjustments

4. The entry to correct/adjust item number 16 is:

a. Accounts receivable 20,000

Cash 20,000

b. Cash 20,000

Accounts payable 20,000

c. Cash 20,000

Accounts receivable 20,000

d. No adjustments

5. IVIE COMPANY’S adjusted cash and cash equivalents balance at December 31, 2006 is:

a. P 771,000 b. P 741,000 c. P 721,000s d. P 691,000

Solution

Item 1 - Cash

Item 2 - Cash

Item 3 - Cash

Item 4 - Other Assets

Item 5 - Investment

Item 6 - Investment – current

Item 7 - Cash

Item 8 - Cash

Item 9 - Current liability

Item 10 – Offset to cash

Item 11 – Offset to Cash

Item 12 – Unused supplies

Item 13 – Cash as cash equivalents

Item 14 – Short-term investment

Item 15 – Cash

Item 16 – Cash

Item 17 – property recorded as disbursement

Answer:

1. B 2. A 3. D 4. D 5. D

Problem 3

Your audit of the December 31, 2006, financial statements of Mato Corporation reveals the

following:

1. Current account at PBCom P (35,000)

2. Current account at PNB 65,000

3. Treasury bills (acquired 3 months before maturity) 200,000

4. Treasury bills (maturity date is 12/31/07) 500,000

5. Payroll account 175,000

6. Foreign bank account - restricted (translated using the

12/31/06 exchange rate) 900,000

7. Postage stamps 600

8. Employees’ checks marked “DAIF” 10,000

9. IOU from the vice-president 50,000

10. Credit memo from a supplier for a purchase returns 25,000

11. Traveler’s check 60,000

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

12. Money order 10,000

13. Company’s check dated 12/30/06 but not mailed at year-end 30,000

14. Petty cash fund (P4,000 in currency and expense receipts for

(P6,000) 10,000

Questions

1. The entry to adjust the employees’ checks marked “DAIF” is:

a. Accounts receivable 10,000

Cash 10,000

b. Cash 10,000

Accounts receivable 10,000

c. Employees’ advances 10,000

Cash 10,000

d. Cash 10,000

Employees’ advances 10,000

2. MATO CORPORATION’S adjusted cash and cash equivalents balance at December 31,

2006 is:

a. P 560,000 b. P 544,000 c. P 514,000 d. P 509,000

Solution

Current account at PNB 65,000

Treasury bills acquired 3 mos. Before maturity 200,000

Payroll account 175,000

Traveler’s check 60,000

Money order 10,000

Company’s undelivered check 30,000

Petty cash fund 4,000

TOTAL 544,000

Answer:

1. C B. B

Problem 4

The controller of Pacatang Company is attempting to determine the amount of cash to be

reported on its December 31, 2006 balance sheet. The following information is provided:

a. Commercial savings account of P1,000,000 and a commercial checking account balance

of P900,000 are held at Phil. Banking Corporation.

b. Money market fund account held at Allied Bank, P600,000

c. Travel advance of P180,000 for executive travel for the first quarter of next year

(employee to reimburse through salary reduction)

d. A separate fund in the amount of P1,500,000 is restricted for the retirement of long-

term debt.

e. Petty cash fund, P5,000

f. An IOU from David Santos, a company officer, in the amount of P10,000.

g. A bank overdraft of P110,000 has occurred at one of the banks the company uses to

deposit its cash receipts. At the present time, the company has no other deposits at this

bank.

h. The company has two certificates of deposit, each totaling P500,000. These certificates

of deposit have a maturity of 120 days.

i. Pacatang Company has received a check that is dated January 12, 2007 in the amount

of P125,000.

j. Currency and coins on hand amounted to P5,300.

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Questions

1. PACATANG COMPANY’S adjusted cash and cash equivalents balance at December 31,

2006 is:

a. P 1,910,300 b. P 2,400,300 c. P 2,510,300 d. P 3,510,300

2. The travel advance of P180,000 for executive travel should be classified as:

a. Accounts receivable c. Prepaid expenses

b. Travel expenses d. Advances to employees

Solution

Commercial savings account P1,000,000

Commercial checking account 900,000

Petty cash fund 5,000

Currency and coin on hand 5,300

Amount of cash to be reported on balance sheet at 12.31.03 P1,910,300

(2) Money market fund acct. M/S or Temp. Investments

(3) Travel advance for executive travel (employee to

reimburse through salary deduction) Advances to Employees

(4) Bond Retirement Fund Long-term Investment

(6) IOU from company officer Advance to officers

(7) Bank overdraft (the co. has no other deposits at this bank)

Current Liabilities

(8) Certificates of deposit (maturity of 120 days Marketable securities

(9) Postdated check January 12, 2004 Receivable

Answer:

1. A 2. D

Problem 5

Present journal entries to record the following transactions in the books of Marites

Corporation, which uses a calendar year as accounting period. Assume that the company is

using the imprest method in accounting for petty cash fund:

a. A petty cash fund was set up on November 1, 2006 in the amount of P2,400.

b. On November 29, 2006, a check was issued to replenish the fund, the composition of

which was as follows:

Currency – bills and coins 166

Vouchers showing expenditures for:

Office supplies 270

Charges from purchased of supplies 124

Repairs and maintenance 350

Wages paid to casual employees 950

Charges from purchased of goods to be sold 400

c. On December 18, 2006, the fund was replenished and correspondingly increased to

P3,000; its composition included the following:

Currency – bills and coins 158

Vouchers showing expenditures for:

Store supplies 304

Accounts payable 914

Charges from purchased of goods to be sold 242

Miscellaneous expenses 782

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

d. An examination on December 31, 2006, disclosed the following composition of the fund,

although it was not replenished on this date:

Currency – bills and coins 958

Check of office manager, dated January 5, 2007 1,000

Vouchers showing expenditures for:

Office supplies 126

Miscellaneous expenses 90

Accounts payable 800

e. On January 5, 2007, the check of office manager was cashed and the proceeds were

added to the petty cash fund.

f. On January 6, 2007, replenished disbursement from December 18, 2006 to January 5,

2007.

Questions

1. The entry to record the November 29 replenishment of petty cash fund is:

a. Operating expenses 1,694

Freight-in 400

Cash short/over 140

Cash 2,234

b. Operating expenses 2,234

Petty cash fun d 2,234

c. Operating expenses 1,694

Freight-in 400

Cash short/(over) 140

Petty cash fund 2,234

d. No entry since the company is using an impress fund system.

2. The adjusted Petty Cash Fund balance of MARITES CORPORATION at December 31,

2006 is:

a. P 3,000 b. P 1,958 c. P 984 d. P 958

3. The entry to record the December 31, 2006 adjustment of petty cash fund is:

a. Operating expenses 216

Accounts payable 800

Cash short/over 26

Petty cash fund 1,042

b. Operating expenses 216

Accounts payable 800

Cash short/over 26

Cash 1,042

c. Operating expenses 216

Accounts payable 800

Advances – employees 1,000

Cash short/(over) 26

Petty cash fund 2,042

d. No entry since there is no replenishment yet.

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

4. The entry to record the January 6, 2004 replenishment of petty cash fund is:

a. Operating expenses 216

Accounts payable 800

Cash short/over 26

Petty cash fund 1,042

b. Operating expenses 216

Accounts payable 800

Cash short/over 26

Cash 1,042

c. Operating expenses 216

Accounts payable 800

Advances – employees 1,000

Cash short/(over) 26

Cash 2,042

d. No entry since the account has been adjusted on December 31.

Solution

a. Petty cash fund 2,400

Cash 2,400

b. Operating expenses 1,694 TCAF 2,260

Freight-in 400 Accountability 2,400

Cash short/over 140 Shortage 140

Cash 2,234

c. Operating expenses 1,086 TCAF 2,400

Accounts payable 914 Accountability 2,400

Freight-in 242 Shortage 0

Cash 2,242

Petty cash fund 600

Cash 600

d. Operating expenses 216 TCAF 2,994

Advances to employees 1,000 Accountability 3,000

Accounts payable 800 Shortage 26

Cash short/over 26

Petty cash fund 2,042

Reversing entry – January 1

Petty cash fund 2,042

Operating expenses 216

Advances to employees 1,000

Accounts payable 800

Cash short/over 26

e. No entry

f. Operating expenses 216

Accounts payable 800

Cash short/over 26

Cash 1,042

Answer:

1. A 2. D 3. C 4. B

Problem 6

Your audit of the petty cash (P10,000) of Juliet Company as of December 31, 2006 revealed

the following: (cash count date is January 3, 2007 at 5:00 pm)

Bills: 10 - P500 bill 15 - P100 bill 18 - P50 15 - P20 5 - P10

Coins: P180 in P5 pieces; P42 in P1.00 pieces; P23 in P0.25 pieces.

IOU’s submitted were:

Dec. 18 Nap R. - P 750

Dec. 28 Ruel R. 125

Dec. 30 Sonny S. 500

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Cashed checks:

Dec. 28, 2006 check drawn by the manager P 1,125

Dec. 28, 2006 check drawn by an employee 500

Dec. 30, 2006 check drawn by a customer 350

Jan 1, 2007 check drawn by an employee 1,250

The cashier informed you that owing to the lack of cash it was necessary for him to open

certain payroll envelopes unclaimed by employees and use the cash found herein. They

were as follows:

Dec. 15, 2006 - Ed A. P 1,250

Dec. 30, 2006 - Andoy 1,750

Dec. 30, 2006 - Macky 650

Dec. 30, 2006 - Paz 1,000

The cashier also informed you that all cash sales receipts were passed through his fund

and that cash sales tickets Nos. 2059 to 2061 under dates of Dec. 30, Jan. 3 and Jan. 4

for P350, 500 and P545, respectively, had not yet been turned over to the general

cashier.

The petty cash vouchers found in the petty cash box were as follows:

Dec. 30, 2006 Transportation P515

Dec. 30, 2006 Token gifts to visitors 650

Dec. 30, 2006 Freight for office supplies purchase 215

Jan. 1, 2007 Freight for mdse. purchased 125

Jan. 2, 2007 Freight for mdse. sold 575

Questions

1. JULIET COMPANY’S cash shortage at December 31, 2006 is:

a. P 2,072.75 b. P 1,370.00 c. P 1,027.75 d. P 327.75

2. The adjusted petty cash balance of JULIET COMPANY at December 31, 2006 is:

a. P 10,000 b. P 9,625 c. P 5,975 d. P 4,625

3. The entry to adjust the unclaimed payroll at December 31, 2006 is:

a. Petty Cash Fund c. Cash

Salaries expense Accrued salaries

b. Salaries expense d. Accrued salaries

Petty cash fund Cash

4. The cashed check dated January 1, 2007

a. Should be adjusted since it was dated January 1, 2007, hence a postdated check.

b. Should be adjusted since it was received December 31, 2006 but the check is dated

January 1, 2007, hence a postdated check.

c. Should not be adjusted since the check is dated January 1, 2007.

d. Should not be adjusted since the check was received December 31, 2007.

5. The Cash account (excluding PCF) of JULIET COMPANY is understated at December 31,

2006 by:

a. P 4,650 b. P 4,900 c. P 6,045 d. P 6,370

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Solution

Cash Count Due to custodian 1,370

Bills 7,750 Petty cash fund 1,370

Coins 245

IOUs 1,375 Advances to employees 1,375

Checks 3,225 Petty cash fund 1,375

Vouchers 2,080

TCAF 14,675 Cash 350

Accountability Sales 350

PCF per ledger (10,000)

Unclaimed payroll ( 4,650) Advances to employees 1,250

Undeposited sales ( 1,395) Petty cash fund 1,250

Cash shortage 1,370

Cash 4,650

Accrued salaries 4,650

Operating expenses 1,380

Petty cash fund 1,380

ANSWER:

1. B 2. D 3. C 4. B 5. B

Problem 7

You are making an audit of the Darwin Corporation for the past calendar year. The balance

of the Petty Cash account at December 31, 2006 was P1,300. Your count of the imprest

cash count made at 8:30 am on January 3, 2007, in the presence of the petty cash

custodian, revealed:

Currency and coins 571.38

Checks:

Date Maker Bank

12/28/06 Macky, vice-president PNB 360.00

12/29/06 Andy, employee DBP 60.00

12/31/06 Bobot, customer RCBC 153.80

01/02/07 Neil, customer PNB 121.36

01/10/07 Jeff, employee PNB 60.00

(check received Dec. 29)

(These checks were all considered good when deposited after dates shown on the

checks. The first four checks were actually deposited Jan. 3; the last check was

deposited Jan. 11; all five checks proved to be good.)

Vouchers:

Dec. 11 #261 Richard, shipping clerk – temporary advance for the use of the

receiving department. Your count of Mr. Richard’s fund revealed:

currency – P28.80; merchandise freight bills, P31.20. P 60.00

Dec. 28 # 301 Postage 12.00

Dec. 29 # 302 Freight bill on merchandise purchases 47.30

Dec. 31 # 305 Freight bill on office supplies 88.93

Jan. 2 # 500 Freight bill on merchandise purchases 29.36

IOU Dec. 21 Mabel, employee 36.00

10

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Sales Invoices (for cash sales, collections handled by the petty cashier):

Invoice # 315 Dec. 30 P 120.00

328 Dec. 31 153.80

334 Jan. 2 121.36

(As a general rule, the petty cashier endeavored to turn over the proceeds of

cash sales to the general cashier on the 10 th, 20th and last days of each month.

Proceeds on these sales were recorded and deposited by the general cashier.)

Postage Stamps:

Three one-peso stamps. The petty cashier handled postage stamps. These

stamps represent the unused stamps purchased on Voucher # 301.

Questions

1. The petty cash fund shortage at December 31, 2006 is:

a. P 216.39 b. P 123.83 c. P 98.03 d. P 95.03

2. The adjusted petty cash fund balance of DARWIN CORPORATION at December 31, 2006

is:

a. P 900.74 b. P 960.74 c. P 1,174.54 d. P 1,234.54

3. DARWIN CORPORATION’S operating expenses found in the petty cash fund at December

31, 2006 is:

a. P 208.23 b. P 205.75 c. P 174.03 d. P 97.93

4. The Cash account (excluding PCF) of DARWIN CORPORATION is understated at

December 31, 2006 by:

a. P 395.16 b. P 273.80 c. P 153.80 d. P 120.00

Solution

Cash count

Currency and coins 571.38 Due to custodian 95.03

Checks 755.16 PCF 95.03

Vouchers 237.59

IOU 36.00 Cash 273.80

TCAF 1,600.13 Sales (SI#328 & 315) 273.80

Accountability

PCF per ledger (1,300.00) Adv. to employee 60.00

Undeposited sales ( 395.16) PCF 60.00

Cash shortage 95.03

Adv. to employee 60.00

Operating expenses 100.93

Freight-in 47.30

PCF 208.23

Freight-in 31.20

Adv. to employee 31.20

Adv. to employee 36.00

PCF 36.00

Unused postage 3.00

Operating expenses 3.00

Answer:

1. D 2. A 3. D 4. B

11

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Problem 8

In connection with your audit of the financial statements of Reyes Corporation for the year

ended December 31, 2006, you conducted a surprise count of the company’s petty cash and

undeposited collections at 9:10 am on January 3, 2007. You count disclosed the following:

Bills and counts

Bills Coins

P100.00 5 pieces P1.00 205 pieces

50.00 40 pieces 0.50 162 pieces

20.00 35 pieces 0.25 32 pieces

10.00 27 pieces

Postage stamps (unused) - P365

Checks

Date Payee Maker Amount

Dec. 30 Cash Custodian P 1,200

Dec. 30 Reyes Corp. Karren, Inc. 14,000

Dec. 31 Reyes Corp. Sheryl, sales manager 1,680

Dec. 31 Reyes Corp. Victor Corp. 17,800

Dec. 31 Reyes Corp. Ma. Karen, Inc. 8,300

Dec. 31 Merry Corp. Reyes Corp. 27,000

(not endorsed)

Unreimbursed vouchers

Date Payee Description Amount

Dec. 23 Sheryl, sales mgr. Advance for trip P 7,000

Dec. 28 Post Office Postage stamps 1,620

Dec. 29 Messengers Transportation 150

Dec. 29 Ace, Inc. Computer repair 800

Other items found inside the cash box:

1. Unclaimed pay envelope of Jeanette. Indicated on the pay slip is his net salary of

P7,500. Your inquiry revealed that Jeanette’s salary is mingled with the petty cash

fund.

2. The sales manager’s liquidation report for this Baguio Trip.

Cash Advance received on Dec. 23 P 7,000

Less: Hotel accomodation, meals, etc. P 4,500

Bus fare for two 400

Cash given to Carlo, salesman 300 5,200

Balance P 1,800

Accounted for as follows:

Cash returned by Carlo to the sales manager P 120

Personal check of the sales manager 1,680

Total P 1,800

Additional information:

1. The custodian is not authorized to cash checks.

12

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

2. The last official receipt included in the deposit on December 30 is No. 4351 and the last

official receipt issued for the current year is No. 4355. The following official receipts are

all dated December 31, 2006.

OR No. Amount Form of Payment

4352 P 13,600 Cash

4353 17,800 Check

4354 3,600 Cash

4355 8,300 Check

3. The petty cash balance per general ledger is P10,000. The last replenishment of the

fund was made on December 22, 2006.

Questions

1. REYES CORPORATION’S cash shortage/overage at December 31, 2006 is:

a. P 61,166 short c. P 34,166 over

b. P 20,166 short d. P 22,514 over

2. The adjusted petty cash balance of REYES CORPORATION at December 31, 2006 is:

a. P 4,964 b. P 2,110 c. P 1,200 d. P 430

3. The undeposited sales/collection of REYES CORPORATION at December 31, 2006 is:

a. P 66,480 b. P 64,800 c. P 57,300 d. P 43,300

Solution

Bills and coins 3,764

Checks 69,980

Vouchers 9,570

TCAF 83,314

Accountability

PCF per ledger (10,000)

Undeposited sales – with receipts (43,300)

Unclaimed payroll ( 7,500)

Unendorsed check (27,000)

Undeposited sales – without receipts (14,000)

Check endorsed by sales manager ( 1,680)

Cash shortage (20,166)

Due to custodian 20,166

Cash 20,166

Cash 57,300

Sales (with and without receipts) 57,300

Cash 7,500

Accrued salary 7,500

Petty cash fund 1,680

Advances to employees 1,680

Advances to employees 7,000

Operating expenses 2,570

Petty cash fund 9,570

Operating expenses 5,080

Advances to employees 5,080

Answer: 1. B 2. B 3. C

13

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Problem 9

Mary Jane is the cashier of Adlawan Corporation. AS representative of the Zarate and

Associates, CPAs, you were assigned to verify her cash on hand in the morning of January

3, 2007. You began to count at 9:00 AM in the presence of Mary Jane. In the course of

your counting, you found currencies in paper bills and coins together with checks, vouchers,

and other items, which are mentioned below:

Bills: (2) P500; (8) P100; (12) P50; (5) P20

Coins: P 5.00 11 loose

1.00 24 loose

0.25 5 rolls and 32 loose (50 pieces to a roll)

0.10 10 rolls and 15 loose (50 pieces to a roll)

0.05 14 rolls and 20 loose (40 pieces to a roll)

Checks:

Date Maker Payee Amount

12/22/06 Vivian, Asst. Mgr Adlawan Corp. P 6,000

12/26/06 Mary Jane, cashier Adlawan Corp. 4,000

IOUs:

Date Maker Amount

12/20/06 Yap, Janitor P 500

12/22/06 Felix, clerk 750

12/24/06 Ablay, bookkeeper 500

PETTY CASH VOUCHERS FOR REPLENISHMENT

Date Payee Accounts Charged Amount

12/16/06 Wagan, messenger Advances to employees P1,000.00

12/17/06 Maren and Co. Supplies 545.00

12/18/06 Eeman Liner Freight in 982.50

12/18/06 Posts Office Supplies 300.00

12/20/06 Alejandre, carpenter Repairs 2,950.00

12/21/06 Violan Miscellaneous expense 554.00

Your investigation also disclosed the following:

1. The balance of petty cash fund per books is P20,000.00.

2. Cash sale of January 2, 2007 amounted to P8,650 per sales records, while cash

receipts book and bank deposit slip showed that only P7,650 was deposited in the

bank on January 3, 2007

3. The following employees’ pay envelopes had been opened and the money removed.

Each envelope was marked “Unclaimed” - Ernesto, P332.50; Secinando, P447.50.

Questions

1. The petty cash shortage of ADLAWAN CORPORATION at December 31, 2006 is:

a. P 2,748.50 b. P 1,748.50 c. P 968.50 d. P 188.50

2. The adjusted petty cash balance of ADLAWAN CORPORATION at December 31, 2006 is:

a. P 10,950 b. P 11,950 c. P 11,730 d. P 12,730

14

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

3. The undeposited sales/collection of ADLAWAN CORPORATION at December 31, 2006 is:

a. P 8,650 b. P 7,650 c. P 1,000 d. P 0

Solution

Cash count

Bills and coins 2,730.00 Due to custodian 968.50

Checks 10,000.00 Petty cash fund 968.50

IOUs 1,750.00

PCF Vouchers 6,331.50 Adv. to employees 1,750.00

TCAF 20,811.50 Petty cash fund 1,750.00

Accountability

PCF per ledger (20,000.00) Adv. to employees 1,000.00

Uneposited sales ( 1,000.00) Operating expenses 4,349.00

Unclaimed payroll ( 780.00) Freight-in 982.50

Cash shortage 968.50 Petty cash fund 6,331.50

Cash 780.00

Accrued salary 780.00

Answer:

1. C 2. A 3. D

Problem 10

In your year-end audit of Angela Corp., the cashier showed a cash accountability of

P1,100,000 as at December 31, 2006. The following transactions were extracted in the

books of the company, in summary form:

Accounts receivable, beginning P 275,000

Accounts receivable, end 385,000

Sales (80% on credit) 1,850,000

Accounts written-off 25,000

Recovery of accounts written-off, included in the collection

of account receivable 15,000

Depreciation of fixed assets 150,000

Inventory, end 185,000

Inventory, beg 203,000

Cost of sales 960,000

Income tax accrued 18,500

Payment of bank loan 200,000

Subscription receivable 250,000

Subscribed capital stock 950,000

Purchases of fixed assets 320,000

Proceeds from short-term bank loan 300,000

Accounts payable, end 425,000

Accounts payable, beg. 200,000

Questions

1. The correct cashier’s accountability at December 31, 2006 is:

a. P 1,493,000 b. P 1,123,000 c. P 793,000 d. P 423,000

2. ANGELA CORPORATION’S cash account at December31, 2006 is:

a. Understated by P 307,000 c. Overstated by P 693,000

b. Understated by P 393,000 d. Overstated by P 677,000

15

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Solution

Proceeds from collection of accounts receivable 1,360,000 *

Proceeds from cash sales 370,000

Proceeds from bank loan 300,000

Proceeds from issuance of capital stock (P950,000 – P250,000) 700,000

Payment of accounts payable ( 717,000) **

Payment of short-term bank loan ( 200,000)

Purchase of fixed assets ( 320,000)

Total Accountability 1,493,000

Total Cash 1,100,000

Cash shortage 393,000

* Accounts Receivable

Beg. bal 275,000 Collection 1,360,000 squeeze figure

Cr. Sales 1,480,000 Write-off 25,000

Recovery 15,000 ________

1,770,000 1,385,000

End bal 385,000

** Accounts payable *** Beg. Inv. 203,000

Payment 717,000 Beg. bal. 200,000 Purchases 942,000

_______ Purchases 942,000 *** TGAS 1,145,000

717,000 1,142,000 End inv. 185,000

End bal. 425,000 COS 960,000

Answer:

1. A 2. B

Problem 11

The following data are gathered from the cash books and bank statement received from

Davao Bank by Grace Company:

The cash in bank ledger account shows a debit balance of P290,438.50 as of May 31.

The bank statement shows a credit balance of P318,560 as of May 31.

An examination of the checks encashed by the bank shows that the following checks are not

presented for payment:

No. 187, P3,608; No. 189, P15,499; No. 191, P4,400;

No. 192, P1,545.50, No. 193, P23,001

A certified check for P24,750 payable to creditor, was encashed by the bank during May.

The bank statement shows a deduction of P10,802 for check No. 184. The check was

actually made out at P10,208.

A check deposited on May 27 for P34,100 was returned by the bank on May 28 marked

Refer to Maker.

A non-interest bearing note for P44,000 was collected by the bank for the account Grace

Company. Collection fee deducted by the bank is P330.

A deposit for P20,900 was recorded in the books twice.

Check No. 179 for P26,400 was erroneously recorded in the books as P46,200.

Interest on an outstanding loan payable, deducted by the bank on May 31, P1,320.

Collections on May 31 to be deposited on June 1, P26,488.

16

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Questions

1. GRACE COMPANY’S adjusted cash balance at May 31, 2006 is:

a. P 341,939.50 b. P 283,288.50 c. P 297,588.50 d. P 273,168.50

2. The recorded cash of GRACE COMPANY at May 31 is:

a. Understated by P 17,270 c. Overstated by P 7,150

b. Understated by P 7,150 d. Overstated by P 17,270

Solution

Unadjusted Book balance 290,438.50 Unadjusted Bank balance 318,560.00

Returned check (34,100.00) Outstanding checks (48,053.50)

Collection of Notes 43,670.00 Error 594.00

Error (20,900.00) Deposit in transit 26,488.00

Error 19,800.00

Error ( 1,320.00) _________

Adjusted book balance 297,588.50 Adjusted bank balance 297,588.50

Adjusting entry:

Accounts receivable 34,100

Cash 34,100

Cash 43,670

Collection fee 330

Notes receivable 44,000

Accounts receivable 20,900

Cash 20,900

Cash 19,800

Accounts payable 19,800

Interest expense 1,320

Cash 1,320

Answer:

1. C 2. B

Problem 12

The following data pertaining to the cash transactions and bank account of Abiso Company

for May 2006 are available to you:

Cash balance, per accounting records, May 31, 2006 P 51,582

Cash balance, per bank statement, May 31, 2006 95,874

Bank service charge for May 327

Debit memo for the cost of printed checks delivered by the bank;

the charge has not been recorded in the accounting records 375

Outstanding checks, May 31, 2006 20,184

Deposit of May 30 not recorded by bank until June 1 14,610

Proceeds of bank loan on May 30, not recorded in the accounting

records, net of interest of P900 17,100

Proceeds from a customer’s promissory note; principal amount P24,000,

collected by the bank, taken up in the books with interest 24,300

Check No. 1086 issued to a supplier entered in the accounting records

as P6,300 but deducted in the bank statement at an erroneous amount

of 3,600

Stolen check lacking an authorized signature, deducted from Abiso’s

account by the bank in error 2,400

17

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Customer’s checks returned by the bank marked NSF, indicating that the

customer’s balance was not adequate to cover the checks; no entry has

been made in the accounting records to record the returned check 2,280

Questions

1. The adjusted cash in bank balance of ABISO COMPANY at May 31, 2006 is:

a. P 87,570 b. P 90,000 c. P 90,570 d. P 90,900

2. The cash in bank balance of ABISO COMPANY at May 31, 2006 is:

a. Understated by P39,318 c. Understated by P38,418

b. Understated by P38,988 d. Understated by P35,988

Solution

Book Bank

Unadjusted balance 51,582 95,874

Service charge ( 327)

DM – printed checks ( 375)

Outstanding checks (20,184)

Deposit in transit 14,610

Loan proceed 17,100

Proceed from note collection 24,300

Bank error ( 2,700)

Bank error 2,400

NSF ( 2,280) __________

Adjusted balance 90,000 90,000

Adjusting entry:

Service charge 327

Cash 327

Service charge 375

Cash 375

Cash 17,100

Prepaid interest 900

Bank loan 18,000

Cash 24,300

Note receivable 24,000

Interest income 300

Accounts receivable 2,280

Cash 2,280

Answer:

1. B 2. C

Problem 13

In connection with an audit, you are given the following bank reconciliation.

BANK RECONCILIATION

December 31, 2006

Balance per ledger, 12/31/03 P 34,349.72

Add: Collections received on the last day of

December and charged to “Cash in Bank”

on books but not deposited 5,324.50

Debit memo for customer’s checks returned

unpaid (check is on hand but no entry has been

made on the books) 4,000.00

18

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Debit memo for bank service charge for December 1,000.00

P 46,674.22

Deduct:

Outstanding checks P 18,625

(see details below)

Credit memo for proceeds of a note receivable

which had been left at the bank for collection

but which has not been recorded as collected 8,000

Check for an account payable entered on books

as P12,625 but drawn and paid by bank as

16,225 3,600 32,225.00

Computed balance P 14,449.22

Unlocated difference 36,601.00

Balance per bank (check to confirmation) P 51,050.22

LIST OF OUTSTANDING CHECKS

December 31, 2006

Check No. Amount

14344 P 5,820

14358 1,295

14367 3,543

14399 2,001

14401 4,892

14407 5,074

P 18,625

Questions:

1. The adjusted cash balance at December 31, 2006 is:

a. P 33,749.72 b. P 34,949.72 c. P 37,749.72 d.P40,949.72

2. A check for an account payable entered on books as P12,625 but drawn and paid by

bank as 16,225

a. Should not be included in the reconciliation since the bank already gave the money

to the payee.

b. Should not be included in the reconciliation since bank’s record is always followed.

c. Should be included as deduction in the book reconciliation since this is considered as

book error, thus a reconciling item.

d. Should be included as addition in the book reconciliation since this is considered as

book error, thus a reconciling item.

3. The outstanding checks at December 31, 2006 is:

a. P 15,025 b. P 18,625 c. P 19,025 d. P 22,625

4. The cash balance of the company per record at December 31, 2006 is:

a. Overstated by P600 c. Understated by P 3,400

b. Overstated by P1,200 d. Overstated by P 6,600

Solution

Bank Book

Unadjusted balance 51,050.22 34,349.72

Returned checks ( 4,000.00)

Service charge ( 1,000.00)

Collection of note receivable 8,000.00

19

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Deposit in transit 5,324.50

Outstanding checks (22,625.00)

Book error ____________ ( 3,600.00)

Adjusted balance 33,749.72 33,749.72

Adjusting entry

Accounts receivable 4,000

Cash 4,000

Service charge 1,000

Cash 1,000

Cash 8,000

Note receivable 8,000

Accounts receivable 3,600

Cash 3,600

Answer:

1. A 2. C 3. D 4. A

Problem 14

The cash books of Grace Corporation show the following entries during the month of June

2006.

Cash Receipts Journal Check Register

Date Amount Date Check No. Amount

June 1Balance 762,000 June2 801 15,625

4Deposit 113,000 3 802 7,526

4Deposit 811,000 5 803 229,205

7Deposit 152,200 7 804 169,555

10 Deposit 11,300 8 805 74,936

10 Deposit 12,700 10 806 274,600

11 Deposit 73,000 11 807 34,842

17 Deposit 110,075 13 808 250,000

18 Deposit 3,725 14 809 1,070,000

18 Deposit 65,000 17 810 167,300

19 Deposit 26,463 19 811 3,130

20 Deposit 133,037 21 812 82,730

27 Deposit 273,628 23 813 127,200

30 Deposit 92,400 25 814 93,080

30 815 720

The bank statement for the month of June 2006 shows:

Checks No. Deposits Date Amount

Balance May 31 798,000

924,000 June 5 1,722,000

800 36,000 6 1,686,000

804 169,555 7 1,516,445

805 74,936 217,200 8 1,658,709

801 16,525

803 229,205 9 1,412,979

807 34,842 97,000 12 1,475,137

924 75,000

200 40,400 CM 13 1,440,337

(collection charge)

809 1,070,000 14 370,337

20

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

808 250,000 15 120,337

198,000 CM 16 318,337

810 167,300 113,800 19 264,837

812 82,730 159,500 21 341,607

806 274,600 24 67,007

273,628 28 340,635

811 3,130

DM 300 30 337,205

Upon investigation, the following are discovered:

CM - Represents a 60-day, 6% note for P40,000 collected by the bank for the account of

Grace Company.

CM - Represents a 60-day, 6% own note for P200,000 discounted by Grace Corporation with

the bank and not yet recorded in the books.

DM - Represents bank service charge for the month.

Check No. 924 represents a check signed by Graciele Company.

Collection charge – represents collection fee charged by the bank.

Questions

1. The unadjusted cash ledger balance of GRACE CORPORATION at June 30, 2006 is:

a. P 114,079 b. P 113,179 c. P 39,079 d. P 38,179

2. The unadjusted cash bank balance of GRACE CORPORATION at June 30, 2006 is:

a. P 261,305 b. P 336,305 c. P 337,205s d. P 412,205

3. The deposit in transit of GRACE CORPORATION at June 30, 2006 is:

a. P 92,400 b. P 104,500 c. P 182,000 d. P 0

4. The outstanding checks of GRACE CORPORATION at June 30, 2006 is:

a. P 302,806 b. P 228,526 c. P 227,806 d. P 153,526

5. The adjusted cash balance of GRACE CORPORATION at June 30, 2006 is:

a. P 277,879 b. P 276,079 c. P 261,305 d. P 201,079

6. The error made in check number 801 is known as:

a. Fundamental error c. Transplacement error

b. Balance sheet error d. Transposition error

7. In the discounting of P200,000 note, the company should credit

a. Notes receivable discounting c. Notes payable

b. Notes Receivable d. Notes discounting

Solution

Unadjusted book bal. 39,079 Unadjusted bank bal. 337,205

Error – Deposit in transit 92,400

Check # 801 – P 15,625 Outstanding checks:

Correct 16,525 ( 900) # 802 7,526

Collection fee ( 200) # 813 127,200

DM ( 300) # 814 93,080

CM 40,400 # 815 720 (228,526)

CM 198,000 Error 75,000

Adjusted balance 276,079 Adjusted balance 276,079

21

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Adjusting entry:

Accounts payable 900

Cash 900

Cash 40,200

Collection fee 200

Notes receivable 40,000

Interest income 400

Service charge 300

Cash 300

Cash 198,000

Interest expense 2,000

Notes payable 200,000

Answer:

1. C 2. C 3. A 4. B 5. B

6. D 7. B

Problem 15

The bank portion of the bank reconciliation for Angelo Company at October 31, 2006 was as

follows:

Angelo Company

Bank Reconciliation

October 31, 2006

Cash Balance per Bank P 12,367.90

Add: Deposit in transit 1,530.20

P 13,898.10

Less: Outstanding checks

Check Number Check Amount

2451 P 1,260.40

2470 720.10

2471 844.50

2472 426.80

2474 1,050.00 4,301.80

Adjusted cash balance per bank P 9,596.30

The adjusted cash balance per bank agreed with the cash balance per books at October 31.

The November bank statement showed the following checks and deposits.

Bank Statement

Checks Deposits

Date Number Amount Date Amount

11-1 2470 720.10 11-1 1,530.20

11-2 2471 844.50 11-4 1,211.60

11-5 2474 1,050.00 11-8 990.10

11-4 2475 1,640.70 11-13 2,575.00

11-8 2476 2,830.00 11-18 1,472.70

11-10 2477 600.00 11-21 2,945.00

11-15 2479 1,750.00 11-25 2,567.30

11-18 2480 1,330.00 11-28 1,650.00

11-27 2481 695.40 11-30 1,186.00

11-30 2483 575.50 Total 16,127.90

11-29 2486 900.00

Total 12,936.20

22

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

The cash records per books for November showed the following:

Cash Receipts

Cash Payments Journal Journal____

Date Number Amount Date Number Amount Date Amount

11-1 2475 1,640.70 11-20 2483 575.50 11-3 1,211.60

11-2 2476 2,830.00 11-22 2484 829.50 11-7 990.10

11-2 2477 600.00 11-23 2485 974.80 11-12 2,575.00

11-4 2478 538.20 11-24 2486 900.00 11-17 1,472.70

11-8 2479 1,570.00 11-29 2487 398.00 11-20 2,954.00

11-10 2480 1,330.00 11-30 2488 800.00 11-24 2,567.30

11-15 2481 695.40 Total 14,294.10 11-27 1,650.00

11-18 2482 612.00 11-29 1,186.00

11-30 1,225.00

Total 15,831.70

The bank statement contained two bank memoranda:

1. A credit of P2,105.00 for the collection of a P2,000 note for Angelo Company plus

interest of P120 and less a collection fee of P15. Angelo company has not accrued any

interest on the note.

2. A debit for the printing of additional company checks, P50.

At November 30, the cash balance per books was P11,123.90, and the cash balance per the

bank statement was P17,604.60. The bank did not make any errors, but Angelo Company

made two errors.

Note: The correction of any errors pertaining to recording checks should be made to

Accounts Payable. The correction of any errors relating to recording cash receipts should be

made to Accounts Receivable

Questions

1. The unadjusted cash ledger balance of ANGELO COMPANY at November 30, 2006 is:

a. P 11,133.90 b. P 12,990.90 c. P 13,188.90 d. P 13,377.90

2. The unadjusted bank balance of ANGELO COMPANY at November 30, 2006 is:

a. P 12,828.90 b. P 13,008.90 c. P 13,188.90 d. P 17,614.60

3. The outstanding checks of ANGELO COMPANY at November 30, 2006 is:

a. P 5,659.70 b. P 5,830.70 c. P 5,839.70 d. P 6,028.70

4. The deposit in transit of ANGELO COMPANY at November 30, 2006 is:

a. P 1,225 b. P 1,216 c. P 1,234 d. P 1,396

5. The adjusted book balance of ANGELO COMPANY at November 30, 2006 is:

a. P 11,133.90 b. P 12,990.90 c. P 13,188.90 d. P 13,377.90

23

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Solution

Unadjusted bank bal. 17,614.60 Unadjusted book bal. 11,133.90

Deposit in transit 1,225.00 CM – notes collected 2,105.00

Outstanding checks: DM – service charge ( 50.00)

#2451 1,260.40 Error – overstatement of

#2473 426.80 recorded receipts ( 9.00)

#2478 538.20 Error- understatement of

#2482 612.00 disbursement ( 180.00)

#2483 829.50

#2484 974.80

#2488 800.00 ( 5,839.70) _________

Adjusted balance 12,990.90 Adjusted balance 12,990.90

Adjusting entry:

Cash 2,105

Service charge 15

Notes receivable 2,000

Interest income 120

Service charge 50

Cash 50

Accounts receivable 9

Cash 9

Accounts payable 180

Cash 180

Answer:

1. A 2. D 3. C 4. A 5. B

Problem 16

The following information pertains to the cash of Jenny Company:

Nov 31 Dec. 31

Balance shown on bank statement P 27,380 P 26,960

Balance shown in general ledger before

reconciling the bank account 25,780 25,000

Outstanding checks 8,630 10,150

Deposits in transit 6,850 12,450

For Dec.

Deposits shown in bank statement P 55,880

Charges shown on bank statement 56,300

Cash receipts shown in company’s books 53,980

Cash payments shown in company’s books 54,760

The bank service charge was P180 in November (recorded by the company during

December) and P240 in December (not yet recorded by the company).

Included with the December bank statement was a check for P5,000 that had been received

on December 25 from a customer on account. The returned check marked “NSF” by the

bank, has not yet been recorded on the company’s books.

During December the bank collected P7,500 of bond interest for the company and credited

the proceeds to the company’s account. The company earned the interest during the

current accounting period but has not yet recorded it.

During December the company issued a check for P6,960 for equipment. The check, which

cleared the bank during December, was incorrectly recorded by the company for P8,960.

24

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Questions

1. The adjusted cash receipts of JENNY COMPANY at December 31 is:

a. P 61,480 b. P 53,980 c. P 50,280 d. P 46,480

2. The adjusted cash disbursements of JENNY COMPANY at December 31 is:

a. P 63,980 b. P 61,980 c. P 57,820 d. P 54,780

3. In a proof of cash, the NSF check:

a. Should be added in the December 31 column since this was returned back by the

bank.

b. Should be deducted in the December 31 column since this was returned back by the

bank.

c. Should be deducted in the December 31 column since this was returned back and

not paid by the bank, thus not considered as receipts.

d. Should be added in the December 31 column since this was returned back and not

paid by the bank, thus not considered as receipts.

4. The adjusted December 31 cash balance of JENNY COMPANY is:

a. P 29,760 b. P 29,260 c. P 27,260 d. P 25,600

5. The adjusted November 31 cash balance of JENNY COMPANY is:

a. P 29,160 b. P 27,260 c. P 26,160 d. P 25,600

6. The check issued but was incorrectly recorded as P8,960 should be adjusted by:

a. Accounts payable 2,000 c. Cash 2,000

Cash 2,000 Accounts payable 2,000

b. Equipment 2,000 d. Cash 2,000

Cash 2,000 Equipment 2,000

Solution

Nov. 30 Receipts Disburs. Dec. 31

Balance per book 25,780 53,980 54,760 25,000

Service charge – Nov. 30 (180) (180)

- Dec. 31 240 (240)

NSF check 5,000 (5,000)

Interest earned 7,500 7,500

Book error __________ _________ (2,000) 2,000

Adjusted Balance 25,600 61,480 57,820 29,260

Nov. 30 Receipts Disburs. Dec. 31

Balance per bank 27,380 55,880 56,300 26,960

Outstanding check – Nov. (8,630) (8,630)

- Dec. 10,150 (10,150)

Deposit in transit - Nov 6,850 (6,850)

- Dec __________ 12,450 _________ 12,450

Adjusted balance 25,600 61,480 57,820 29,260

Adjusting entry

Service charge 240

Cash 240

Accounts receivable 5,000

Cash 5,000

Cash 7,500

Interest income 7,500

25

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Cash 2,000

Equipment 2,000

Answer:

1. A 2. C 3. C 4. B 5. D 6. D

Problem 17

ELEFANTE’s check register shows the following entries for the month of December

Date Checks Deposits Balance

2006

Dec 1 Beginning Balance P 83,900

5 Deposit P 65,000

7 Check # 14344 32,500 120,800

11 Check # 14345 14,000 106,800

26 Deposit 49,000

29 Check #14346 8,600 147,200

ELEFANTE’s bank reconciliation for November revealed one outstanding check (No.14343)

for P12,000 (written on November 28), and one deposit in transit for P5,550 (made

November 29).

The following is from Elefante’s bank statement for December 2006:

Date Checks Deposits Balance

2006

Dec. 1 Beginning balance P 95,970

1 Deposit P 5,550 101,300

4 Check No. 14344 P 32,500 68,800

5 Deposit 56,000 124,800

14 Check No. 14345 14,000 110,800

15 Loan Proceeds 500,000 610,800

20 NSF check 7,600 603,200

29 Service charge 1,000 602,200

31 Interest 3,600 605,800

Note: All errors noted in this problem were committed by the Elefante, not the bank. It is

also noted that the company failed to record one deposit in the book.

Questions

1. The unadjusted cash receipts per ledger of ELEFANTE COMPANY for the month of

December is:

a. P 119,620 b. P 114,000 c. P 110,620 d. P 105,000

2. The unadjusted cash receipts per bank of ELEFANTE COMPANY for the month of

December is:

a. P 574,150 b. P 568,600 c. P 565,150 d. P 559,600

3. The adjusted December 1 cash ledger balance of ELEFANTE COMPANY is:

a. P 95,970 b. P 89,520 c. P 83,900 d. P 78,280

4. The adjusted December31 cash bank balance of ELEFANTE COMPANY is:

a. P 634,420 b. P 628,800 c. P 623,180 d. P 577,620

26

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

5. The overstatement of deposit should be:

a. Deducted in the bank December 31 column.

b. Added in the bank December 31 column.

c. Deducted in the book December 31 column.

d. Added in the book December 31 column.

Solution

Dec. 1 Receipts Disburs. Dec. 31

Bank balance 95,970 565,150 55,100 606,020

Deposit in transit – Dec. 1 5,550 (5,550)

- Dec. 31 49,000 49,000

Outstanding checks

Dec. 1 - #14343 (12,000) (12,000)

Dec. 31 - #14343 – P12,000

#14346 - 8,600 __________ ________ 20,600 (20,600)

Adjusted balance 89,520 608,900 63,700 634,420

Dec. 1 Receipts Disburs. Dec. 31

Book balance 83,900 114,000 55,100 142,800

Overstatement of deposit (9,000) (9,000)

Loan proceeds 500,000 500,000

Interest income 3,600 3,600

NSF 7,600 (7,600)

Service charge __________ ________ 1,000 (1,000)

Total 83,900 608,600 63,700 628,800

Unrecorded collection 5,620 ________ _________ 5,620

Adjusted balance 89,520 608,900 63,700 634,420

Adjusting entry

Accounts receivable 9,000

Cash 9,000

Cash 500,000

Notes payable 500,000

Cash 3,600

Interest income 3,600

Accounts receivable 7,600

Cash 7,600

Service charge 1,000

Cash 1,000

Answer:

1. B 2. C 3. B 4. A 5. C

Problem 18

Juliet Company maintains a checking account at the Davao Bank. At July 31, selected data

from the ledger balance and the bank statement are as follows:

Cash in Bank

Per Books Per Bank

Balance, July 1 P 17,600 P 19,200

July Receipts 82,000

July Credits 80,070

July Disbursement 76,900

July Debits . 74,740

P 22,700 P 24,530

27

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Analysis of the bank data reveals that the credits consist of P78,000 of July deposits and a

credit memorandum of P2,070 for collection of a P2,000 note plus interest revenue of P70.

The July debits per bank consist of checks cleared, P74,700 and a debit memorandum of

P40 for printing additional company checks.

You also discover the following errors involving July checks: (1) a check for P230 to a

creditor on account that cleared the bank in July was journalized and posted as P320, and

(2) a salary check to an employee for P255 was recorded by the bank for P155.

The June 30 bank reconciliation contained only two reconciling items: deposits in transit,

P1,000 and outstanding checks, P2,600.

Assume that the interest on the note has been accrued.

Questions

1. The deposit in transit of JULIET COMPANY at July 31 is

a. P 5,000 c. P 1,000

b. P 2,930 d. Cannot be determined

2. The outstanding check of JULIET COMPANY at July 31 is:

a. P 4,700 b. P 4,660 c. P 4,610 d. P 4,520

3. The adjusted cash ledger balance of JULIET COMPANY at July 31 is:

a. P 25,020 b. P 24,820 c. P 24,730 d. P 24,640

4. The adjusted cash bank balance of JULIET COMPANY at July 31 is:

a. P 25,020 b. P 24,820 c. P 24,730 d. P 24,640

Solution

Book balance 22,700 Bank balance 24,530

CM – collection 2,070 Error – understatement of

DM – service charge ( 40) withdrawal ( 100)

Error – overstatement of Deposit in transit 5,000

disbursement 90 Outstanding checks (4,610)

Adjusted book balance 24,820 Adjusted bank balance 24,820

DIT – beg. 1,000 OC – beg 2,600

+ Book receipts 82,000 + Book disbursement 78,810

- Bank credits - Bank debits

(excluding all CMs) 78,000 (excluding all DMs) 74,800

DIT – end 5,000 OC – end 4,610

Adjusting entry:

Cash 2,070

Notes receivable 2,000

Interest income 70

Service charge 40

Cash 40

Cash 90

Accounts payable 90

Answer:

1. A 2. C 3. B 4. B

28

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Problem 19

You are asked to audit the cash of Letty Corporation. Letty Corporation carries its checking

account with Mindanao Bank. The following data are available:

a. Letty Company Cash account for December:

Balance, November 30 P 20,900

Deposits during December 93,400

Checks written during December ( 83,000)

Balance, December 31 P 32,300

b. Bank statement for December:

Balance, November 30 P 20,000

Deposits during December 92,300

Checks cleared during December ( 82,150)

Funds transferred from foreign operations revenue

(in peso amount not yet recorded by Letty Corp.) 25,000

NSF check, Customer Nelly ( 180)

Bank Service charge ( 70)

Balance, December 31 P 54,900

c. Additional data:

1. Balance in Petty Cash account, P200 (not included in Letty Cash account).

2. The deposits of P93,400 by Letty Company are overstated by P100; the bank

recorded the correct amount.

3. The checks cleared by the bank of P82,150 erroneously included a P300 check

drawn by Laity Corporation; the bank has not yet corrected this error.

4. November 30: deposits outstanding, P2,000; and checks outstanding, P1,500.

Questions

1. The deposit in transit of LETTY COMPANY at December 31 is:

a. P 3,100 b. P 3,000 c. P 2,900 d. P 2,000

2. The outstanding checks of LETTY COMPANY at December 31 is:

a. P 1,650 b. P 1,500 c. P 2,050 d. P 2,350

3. The adjusted cash balance of LETTY COMPANY at December 31 is:

a. P 56,050 b. P 55,950 c. P 55,650 d. P 55,550

4. The cash shortage of LETTY COMPANY at December 31 is:

a. P 0 b. P 400 c. P 500 d. P 600

Solution

Book balance 31,300 Bank balance 54,900

CM 25,000 Error 300

DM ( 70) Deposit in transit 3,000

NSF ( 180) Outstanding checks (2,650)

Error ( 100) ______

Total 55,950 Total 55,550

Shortage ( 400) ______

Adjusted balance 55,550 55,550

29

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

DIT – beg 2,000 OC – beg 1,500

+ Book receipts 93,300 + Book disbursement 83,000

- Bank deposits 92,300 - Bank disbursement 81,850

DIT – end 3,000 OC – end 2,650

Adjusting entry:

Cash 25,000

Cash – foreign bank 25,000

Service charge 70

Cash 70

Accounts receivable 180

Cash 180

Accounts receivable 100

Cash 100

Due to custodian 400

Cash 400

Answer:

1. B 2. A 3. D 4. B

Problem 20

In Your audit of the accounts of Cleenenth Company, you find the following facts on

December 31, 2006.

Balance of cash in bank account P1,350,000

Balance of bank statement 1,200,000

Outstanding checks, December 31:

No. 000567 10,000

581 55,000

582 40,000

602 25,000

615 65,000

616 70,000 265,000

Receipts of December 31, deposited the following month 275,000

The bank statement shows the following charges:

Service charge for December 5,000

NSF check received from a customer 85,000

Additional information:

The stub for check number 000581 and the invoice relating thereto show that it was for

P35,000 but was incorrectly recorded as P55,000. This was in payment of the accounts

payable.

Payment has been stopped on check number 000567 which was drawn in payment of

accounts payable. The payee cannot be located.

Included in the bank statement was a canceled check the company had failed to record.

The check was in payment of accounts payable.

Questions

1. The unrecorded disbursement of CLEENETH COMPANY at December 31, 2006 is:

a. P 80,000 b. P 50,000 c. P 40,000 d. P 10,000

30

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

2. Cancellation of check number 567 should be recorded as:

a. Debit to Accounts Payable c. Credit to Accounts Payable

b. Credit to Cash d. No adjustment/entry

3. Cash shortage of CLEENETH COMPANY at December 31, 2006 is:

a. P 0 b. P 50,000 c. P 40,000 d. P 10,000

4. The adjusted cash balance of CLEENETH COMPANY at December 31, 2006 is:

a. P 1,290,000 b. P 1,240,000 c. P 1,210,000 d. P 1,180,000

Solution

Balance per book 1,350,000 Accounts payable 50,000

Service charge ( 5,000) Cash 50,000

NSF check ( 85,000)

Overstatement of disburs Service charge 5,000

check # 581 20,000 Cash 5,000

Cancellation of check

# 567 10,000 Accounts receivable 85,000

Total 1,290,000 Cash 85,000

Unrecorded disburs. * ( 50,000)

Adjusted balance 1,240,000 Cash 20,000

Accounts payable 20,000

Balance per bank 1,200,000

Outstanding checks ( 265,000) Cash 10,000

Deposit in transit 275,000 Accounts payable 10,000

Overstatement of disburs

check # 581 20,000

Cancellation of check

# 567 10,000

Adjusted balance 1,240,000

* squeeze figure

Answer:

1. B 2. C 3. A 4. B

Problem 21

Dema-ala Company is very profitable small business. It has not, however, given much

consideration to internal control. For example, in an attempt to keep clerical and office

expenses to a minimum, the company has combined the jobs of cashier and bookkeeper.

As a result, Maria handles all cash receipts, keeps the accounting records, and prepares the

monthly bank reconciliation.

The balance per bank statement on October 31, 2006, was P73,520. Outstanding checks

were: No. 62 for P507, No. 183 for P600, No. 284 for P1,103, No. 862 for P762.84, No. 863

for P907.20, No. 864 for P661.12. Included with the statement was a credit memorandum

of P800 indicating the collection of a note receivable for Dema-ala Company by the bank on

October 25. Dema-ala Company has not recorded this memorandum.

The company’s ledger showed one cash account with a balance of P87,570.88. The balance

included undeposited cash on hand. Because of the lack of internal control, Maria took for

personal use all the undeposited receipts in excess of P15,182.04. She then prepared the

following bank reconciliation in an effort to conceal her theft of cash.

Cash balance per books, October 31 P 87,570.88

Add: Outstanding checks

No. 862 P 762.84

No. 863 907.20

No. 864 661.12 1,931.16

31

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

P 89,502.04

Less: Undeposited receipts 15,182.04

Unadjusted balance per bank, October 31 P 74,320.00

Less: Bank credit memorandum 800.00

Cash balance per bank statement, October 31 P 73,520.00

Questions

1. DEMA-ALA COMPANY’S cash shortage at October 31 is:

a. P 4,210 b. P 3,410 c. P 1,600 d. P 800

2. DEMA-ALA COMPANY’S adjusted cash balance at October 31 is:

a. P 88,370.88 b. P 87,570.88 c. P 86,770.88 d. P 84,160.88

Solution

Book Bank

Unadjusted balance 87,570.88 73,520.00

Collection of note 800.00

Outstanding checks

# 62 P 507.00

#183 600.00

#284 1,103.00

#862 762.84

#863 907.20

#864 661.12 ( 4,541.16)

Deposit in transit _________ 15,182.04

Total 88,370.88 84,160.88

Cash shortage (4,210.00) ________

Adjusted cash balance 84,160.88 84,160.88

Adjusting entry:

Cash 800

Notes receivable 800

Due to custodian 4,210

Cash 4,210

Answer:

1. A 2. D

Problem 22

On December 15 of the current year, Darwin, who owns Herald Corporation, asks you to

investigate the cash-handling activities in his firm. He thinks that an employee might be

stealing funds. “I have no proof” he say, “but I’m fairly certain that the November 30

undeposited receipts amounted to more than P6,000 although the November 30 bank

reconciliation prepared by the cashier shows only P3,619.20. Also, the November bank

reconciliation doesn’t show several checks that have been outstanding for a long time. The

cashier told me that these checks needn’t appear on the reconciliation because he has

notified the bank to stop payment on them and he had made the necessary payment on the

books.

32

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

At your request, Darwin showed you the following November 30 bank reconciliation

prepared by the cashier.

Bal. Per bank statement P 2,360.12 Bal. Per Books P 5,385.22

Deposit in transit 3,619.20 Bank Service charge ( 30.00)

Outstanding checks Unrecorded bank CM ( 600.00)

# 2351 550.10

2353 289.16

2354 484.84 ( 1,224.10) ________

Adjusted Balance P 4,755.22 Adjusted Balance P 4,755.22

You discover that the P600 unrecorded bank credit represents a note collected by the bank

on Darwin’s behalf. It appears in the deposits column of the November bank statement.

Your investigation also reveals that the October 31 bank reconciliation showed three checks

that had been outstanding longer than 10 months: No. 1432 for P300, No. 1458 for

P233.45, and No. 1512 for P126.55.

You also discover that these items were never added back into the cash account in the

books. In confirming that the checks shown on the cashier’s November 30 bank

reconciliation were outstanding on that date, you discover that check No. 2353 was actually

a payment of P829.16 and had been recorded on the books for the amount.

To confirm the amount of undeposited receipts at November 30, you request a bank

statement for December 1-12 (called a cut-off bank statement). This indeed shows a

December 1 deposit of P3,619.20.

Questions

1. The amount of fund stolen by the cashier is:

a. P 3,160 b. P 2,500 c. P 1,840 d. P 580

2. The total outstanding checks of HERALD CORPORATION at November 30 is:

a. P 2,524.10 b. P 1,884.10 c. P 1,864.10 d. P1,224.10

3. The adjusted cash balance of HERALD CORPORATION at November 30 is:

a. P 5,955.22 b. P 5,355.22 c. P 4,115.22 d. P 3,455.22

Solution

Book balance 5,385.22 Bank balance 2,360.12

CM 600.00 Deposit in transit 3,619.20

Service charge ( 30.00) Outstanding checks

Stalled checks #2351 550.10

#1432 300.00 #2353 829.16

#1458 233.45 #2354 484.84 (1,864.10)

#1512 126.55 660.00 ________

Total 6,615.22 Total 4,115.22

Cash shortage (2,500.00) ________

Adjusted balance 4,115.22 Adjusted balance 4,115.22

Adjusting entry:

Cash 600

Notes receivable 600

Service charge 30

Cash 30

33

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Cash 660

Accounts payable 660

Due to custodian 2,500

Cash 2,500

Answer:

1. B 2. C 3. C

Problem 23

The bank statement for the account of ARNOLD COMPANY at December 31, 2006 showed a

credit balance of P20,000, while the company’s ledger balance of the cash account as of

November 30, 2006 was a debit of P40,000. During December, 2006, the ledger showed

two postings, a debit of P60,000 and a credit of P39,000 from the Cash Receipts and Check

Disbursements Journal, respectively.

Your examination revealed that the cash column of the receipts book was underfooted by

P6,400. The receipts book recorded only the collections from customers and did not include

a bank credit in December for P8,000, representing loan proceeds of a P10,000 promissory

note.

An examination of the customers’ subsidiary ledgers showed total credits to individual

accounts amounting to P70,400. The December Check Disbursements Journal which was

overfooted by P500, records only the checks issued by the company. In the month of

December, 2006, the bank charged ARNOLD COMPANY for P5,000 representing a loan

guaranteed by the client but was dishonored by the maker, the company vice-president.

The December bank service charges of P1,200 were erroneously charged by the bank to the

account of Ronald Company. The bank made the correction in January, 2007. The

outstanding checks as of December 31, 2006 amounted to P5,600.

On the morning of January 2, 2007, a cash count conducted produced the following:

Bills and coins P 5,200

Three (3) duplicate copies of ARNOLD CO.

official receipts, all dated Jan. 2, 2007 1,800

Checks 2,900

NSF check charged by the bank on Jan. 2, 2007 1,400

Questions

1. The deposit in transit of ARNOLD COMPANY at December 31, 2006 is:

a. P 6,300 b. P 7,700 c. P 8,100 d. P 11,300

2. The cash shortage of ARNOLD COMPANY at December 31, 2006 is:

a. P 54,200 b. P 50,200 c. P 46,200 d. P 36,400

3. The maximum probable cash shortage of ARNOLD COMPANY at December 31, 2006

based on the records is:

a. P 54,200 b. P 50,200 c. P 46,200 d. P 36,400

4. The adjusted cash balance of ARNODL COMPANY at December 31, 2006 is:

a. P 19,500 b. P 21,300 c. P 20,900 d. P 24,500

34

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Solution

Book Bank Cash shortage 50,200

Unadjusted balance 61,000 20,000 - Bank Recon

Understatement of receipts 6,400 Cash shortage – AR ledger

CM 8,000 -AR subsidiary

Overstatement of disbursements 500 ledger credit

DM – service charge (5,000) posting 70,400

DM – service charge not recorded - Cash debit

in the book and erroneously postings * 66,400 4,000

recorded by the bank (1,200) (1,200) Maximum Shortage 54,200

Outstanding checks (5,600)

Deposit in transit * Cash debit posting 60,000

(5,200 + 2,900 – 1,800) ______ 6,300 unrecorded collection 6,400

Total 69,700 19,500 66,400

Cash shortage (50,200) ______

Adjusted cash balance 19,500 19,500

Answer::

1. A 2. B 3. A 4. A

Problem 24

The PAMA CORPORATION engaged your services to audit its account. In your examination of

cash, you find that the Cash account represents both cash on hand and cash in bank. You

further noted that there is very poor internal control of cash.

Your audit covers period ended June 30, 2006. You started the audit on June 15. Upon cash

count on this date, cash on hand amounted to P4,800. Examination of the cash book and

other evidence of transaction disclosed the following:

1. July collections per duplicate receipts, P18,800

2. Total of duplicate deposit slips, all dated, July, P11,000, includes a deposit

representing collections of June 30.

3. Cash book balance at June 30, 2006 is P46,500, representing both cash on hand and

cash in bank.

4. Bank statement for June shows a balance of P42, 400.

5. Outstanding checks at June 30: May checks, No. 183 for P450, and No. 198 for

P1,650; June checks, No. 205 for P600, No. 254 for P400, No. 280 for P5,000, No.

302 for P900, and No.317 for P2,500.

6. Undeposited collections at June 30, P5,000.

7. An amount of P900 representing proceeds of clean draft on a customer was credited

by bank, but is not yet taken up in the company’s books.

8. Bank service charges for June, P100.

The company cashier presented to you the following reconciliation statement for June, 2006

which he has prepared:

Balance per books, June 30, 2006 P46,500

Add: outstanding checks:

No. 205 P 600

254 400

280 500

302 700

317 1,500 3,600

Total P49,200

Bank charges (100)

Undeposited collections ( 5,100)

Balance per bank, June 30, 2006 P44,000

35

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Questions

1. The outstanding checks of PAMA CORPORATION at June 30, 2006 is:

a. P 3,600 b. P 3,700 c. P 5,700 d. P 11,500

2. The cash shortage of PAMA CORPORATION at June 30, 2006 is:

a. P 7,800 b. P 11,400 c. P 12,800 d. P 19,400

3. The cash shortage of PAMA CORPORATION from July 1 to July 15, 2006 is:

a. P 8,000 b. P 7,800 c. P 3,000 d. P 2,800

4. The total cash shortage of PAMA CORPORATION up to July 15, 2006 is:

a. P 14,400 b. P 15,600 c. P 15,800 d. P 19,400

5. The adjusted cash balance of PAMA CORPORATION at June 30, 2006 is:

a. P 35,900 b. P 39,600 c. P 43,800 d. P 44,900

Solution

Book Bank

Unadjusted balance 46,500 42,400

Outstanding checks ( 11,500)

Deposit in transit 5,000

CM 900

Service charge ( 100) ______

Total 47,300 35,900

Cash shortage (11,400) ______

Adjusted cash balance 35,900 36,900

Cash shortage from July 1 to July 15

Collection per records 18,800

Deposit in transit – June 30 5,000

Cash that should be deposited 23,800

Deposited collection 11,000

Undeposited collection 12,800

Cash on hand – July 15 4,800

Cash shortage – July 1 to July 15 8,000

ANSWER:

1. D 2. B 3. A 4. D 5. A

Problem 25

In connection with the general examination of the accounts of Nelson Trading Company at

December 31, 2006, you obtained the information and data as shown below relative to your

verification of Cash.

The record kept by the accountant showed the following:

(a) Balances at the end of the month:

December 1, 2006 December 31, 2006

Per Bank Statement P 54,000 P101,100

Per Books 50,400 70,215

Undeposited collections 3,300 7,200

Outstanding checks 6,900 * 12,000 *

36

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

* Composed of the following #6515 510 #6552 P 1,800

6517 2,250 6553 5,700

6518 2,400 6554 2,550

6519 1,740 6555 1,950

(b) Totals for the month of December, 2006:

Cash Book:

Receipts P 425,550

Disbursement 405,735

Bank Statement

Receipts P 444,225

Disbursement 397,125

After application of the necessary auditing procedures, the following were noted:

a. Footing of disbursement should be P 404,235, instead of P 405,735.

b. Bank service charge of P15 for December has not been booked.

c. Cancelled checks (returned together with the December bank statement) include the

following which were charged in the statement:

1. Check #6530 dated December 15, 2006 for P2,400 - this was issued as

replacement of check # 6518 which was returned by the payee because of

certain erasures. No entry has been made to record the cancellation of check

#6518.

2. Check #6517 for P225 - this was erroneously recorded on the books as

P2,250.

3. Check of Neil Trading for P900 - this was charged by bank in error.

d. Proceeds from sale of stocks amounting to P23,250 (cost is P18,000) transmitted

directly by the broker to the bank and credited on December 31, 2006. No entry has

been made on the books to record this sale of stock investment.

e. The company failed to record disbursement for payment of accounts payable at

December 31, 2006 for P1,500.

Questions

1. The adjusted cash receipts per ledger of NELSON TRADING COMPANY at December 31,

2006 is:

a. P 448,800 b. P 448,125 c. P 444,225 d. P 425,550

2. The adjusted cash disbursement per bank of NELSON TRADING COMPANY at December

31, 2006 is:

a. P 401,325 b. P 402,000 c. P 405,735 d. P 406,125

3. The adjusted cash ledger balance of NELSON TRADING COMPANY at December 31, 2006

is:

a. P 91,350 b. P 95,400 c. P 97,200 d. P 97,500

4. The adjusted cash in bank balance of NELSON TRADING COMPANY at December 31,

2006 is:

a. P 91,350 b. P 95,400 c. P 97,200 d. P 97,500

5. The cash shortage of NELSON TRADING COMPANY at December 31, 2006 is:

a. P 765 b. P 675 c. P 575 d. P 390

37

Downloaded by cod doc (cod@getairmail.com)

lOMoARcPSD|9618707

Solution

Dec. 1 Receipts Disburse. Dec. 31

Balance per book 50,400 425,550 405,735 70,215

Overfooting of disburse. ( 1,500) 1,500

Service charge 15 ( 15)

Cancellation of check

# 6518 ( 2,400) 2,400

Overstatement of

disbursement ( 2,025) 2,025

Proceeds from sale of

stock 23,250 23,250

Unrecorded disbursement _________ _________ 1,500 ( 1,500)

Balance 50,400 448,800 401,325 97,875

Cash shortage _________ ( 675) _________ ( 675)