Professional Documents

Culture Documents

What Is Keynesian Economics?

What Is Keynesian Economics?

Uploaded by

Ruxandra CucuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Is Keynesian Economics?

What Is Keynesian Economics?

Uploaded by

Ruxandra CucuCopyright:

Available Formats

BACK TO BASICS

What Is Keynesian

Economics?

The central tenet of this school of thought is that

government intervention can stabilize the economy

Sarwat Jahan, Ahmed Saber Mahmud, and Chris Papageorgiou

D

URING the Great Depression of the 1930s, exist- • Aggregate demand is influenced by many economic deci-

ing economic theory was unable either to explain sions—public and private. Private sector decisions can some-

the causes of the severe worldwide economic col- times lead to adverse macroeconomic outcomes, such as

lapse or to provide an adequate public policy so- reduction in consumer spending during a recession. These

lution to jump-start production and employment. market failures sometimes call for active policies by the gov-

British economist John Maynard Keynes spearheaded a ernment, such as a fiscal stimulus package (explained below).

revolution in economic thinking that overturned the then- Therefore, Keynesian economics supports a mixed economy

prevailing idea that free markets would automatically provide guided mainly by the private sector but partly operated by

full employment—that is, that everyone who wanted a job the government.

would have one as long as workers were flexible in their wage • Prices, and especially wages, respond slowly to changes

demands (see box). The main plank of Keynes’s theory, which in supply and demand, resulting in periodic shortages and

has come to bear his name, is the assertion that aggregate surpluses, especially of labor.

demand—measured as the sum of spending by households,

businesses, and the government—is the most important Keynes the master

driving force in an economy. Keynes further asserted that

Keynesian economics gets its name, theories, and prin-

free markets have no self-balancing mechanisms that lead to

ciples from British economist John Maynard Keynes

full employment. Keynesian economists justify government

(1883–1946), who is regarded as the founder of modern

intervention through public policies that aim to achieve full

macroeconomics. His most famous work, The General

employment and price stability.

Theory of Employment, Interest and Money, was pub-

The revolutionary idea lished in 1936. But its 1930 precursor, A Treatise on

Money, is often regarded as more important to econom-

Keynes argued that inadequate overall demand could lead

ic thought. Until then economics analyzed only static

to prolonged periods of high unemployment. An economy’s

conditions—essentially doing detailed examination of a

output of goods and services is the sum of four components:

snapshot of a rapidly moving process. Keynes, in Trea-

consumption, investment, government purchases, and net

tise, created a dynamic approach that converted eco-

exports (the difference between what a country sells to and

nomics into a study of the flow of incomes and expen-

buys from foreign countries). Any increase in demand has to

ditures. He opened up new vistas for economic analysis.

come from one of these four components. But during a reces-

In The Economic Consequences of the Peace in 1919,

sion, strong forces often dampen demand as spending goes

Keynes predicted that the crushing conditions the

down. For example, during economic downturns uncertainty

Versailles peace treaty placed on Germany to end World

often erodes consumer confidence, causing them to reduce

War I would lead to another European war.

their spending, especially on discretionary purchases like He remembered the lessons from Versailles and from

a house or a car. This reduction in spending by consumers the Great Depression, when he led the British delegation

can result in less investment spending by businesses, as firms at the 1944 Bretton Woods conference—which set down

respond to weakened demand for their products. This puts rules to ensure the stability of the international financial

the task of increasing output on the shoulders of the govern- system and facilitated the rebuilding of nations devastated

ment. According to Keynesian economics, state intervention by World War II. Along with U.S. Treasury official Harry

is necessary to moderate the booms and busts in economic Dexter White, Keynes is considered the intellectual found-

activity, otherwise known as the business cycle. ing father of the International Monetary Fund and the

There are three principal tenets in the Keynesian descrip- World Bank, which were created at Bretton Woods.

tion of how the economy works:

Finance & Development September 2014 53

©International Monetary Fund. Not for Redistribution

• Changes in aggregate demand, whether anticipated or ness cycle with fiscal policy and argued that judicious use

unanticipated, have their greatest short-run effect on real of monetary policy (essentially controlling the supply of

output and employment, not on prices. Keynesians believe money to affect interest rates) could alleviate the crisis (see

that, because prices are somewhat rigid, fluctuations in any “What Is Monetarism?” in the March 2014 F&D). Members

component of spending—consumption, investment, or gov- of the monetarist school also maintained that money can

ernment expenditures—cause output to change. If govern-

ment spending increases, for example, and all other spending

components remain constant, then output will increase. Keynesian economics dominated

Keynesian models of economic activity also include a mul-

tiplier effect; that is, output changes by some multiple of the economic theory and policy after

increase or decrease in spending that caused the change. If

the fiscal multiplier is greater than one, then a one dollar

World War II until the 1970s.

increase in government spending would result in an increase

in output greater than one dollar. have an effect on output in the short run but believed that

in the long run, expansionary monetary policy leads to

Stabilizing the economy inflation only. Keynesian economists largely adopted these

No policy prescriptions follow from these three tenets alone. critiques, adding to the original theory a better integration

What distinguishes Keynesians from other economists is of the short and the long run and an understanding of the

their belief in activist policies to reduce the amplitude of the long-run neutrality of money—the idea that a change in the

business cycle, which they rank among the most important of stock of money affects only nominal variables in the econ-

all economic problems. omy, such as prices and wages, and has no effect on real

Rather than seeing unbalanced government budgets as variables, like employment and output.

wrong, Keynes advocated so-called countercyclical fiscal Both Keynesians and monetarists came under scrutiny

policies that act against the direction of the business cycle. with the rise of the new classical school during the mid-

For example, Keynesian economists would advocate defi- 1970s. The new classical school asserted that policymakers

cit spending on labor-intensive infrastructure projects to are ineffective because individual market participants can

stimulate employment and stabilize wages during economic anticipate the changes from a policy and act in advance to

downturns. They would raise taxes to cool the economy counteract them. A new generation of Keynesians that arose

and prevent inflation when there is abundant demand-side in the 1970s and 1980s argued that even though individu-

growth. Monetary policy could also be used to stimulate the als can anticipate correctly, aggregate markets may not clear

economy—for example, by reducing interest rates to encour- instantaneously; therefore, fiscal policy can still be effective

age investment. The exception occurs during a liquidity trap, in the short run.

when increases in the money stock fail to lower interest rates The global financial crisis of 2007–08 caused a resurgence

and, therefore, do not boost output and employment. in Keynesian thought. It was the theoretical underpinnings

Keynes argued that governments should solve problems in of economic policies in response to the crisis by many gov-

the short run rather than wait for market forces to fix things ernments, including in the United States and the United

over the long run, because, as he wrote, “In the long run, we Kingdom. As the global recession was unfurling in late 2008,

are all dead.” This does not mean that Keynesians advocate Harvard professor N. Gregory Mankiw wrote in the New

adjusting policies every few months to keep the economy at York Times, “If you were going to turn to only one econo-

full employment. In fact, they believe that governments can- mist to understand the problems facing the economy, there

not know enough to fine-tune successfully. is little doubt that the economist would be John Maynard

Keynes. Although Keynes died more than a half-century ago,

Keynesianism evolves his diagnosis of recessions and depressions remains the foun-

Even though his ideas were widely accepted while Keynes dation of modern macroeconomics. Keynes wrote, ‘Practical

was alive, they were also scrutinized and contested by sev- men, who believe themselves to be quite exempt from any

eral contemporary thinkers. Particularly noteworthy were his intellectual influence, are usually the slave of some defunct

arguments with the Austrian School of Economics, whose economist.’ In 2008, no defunct economist is more promi-

adherents believed that recessions and booms are a part of nent than Keynes himself.”

the natural order and that government intervention only But the 2007–08 crisis also showed that Keynesian the-

worsens the recovery process. ory had to better include the role of the financial system.

Keynesian economics dominated economic theory and Keynesian economists are rectifying that omission by inte-

policy after World War II until the 1970s, when many

advanced economies suffered both inflation and slow

grating the real and financial sectors of the economy. ■

growth, a condition dubbed “stagflation.” Keynesian the- Sarwat Jahan is an Economist and Chris Papageorgiou is a

ory’s popularity waned then because it had no appropri- Deputy Division Chief in the IMF’s Strategy and Policy Review

ate policy response for stagflation. Monetarist economists Department. Ahmed Saber Mahmud is the Associate Director

doubted the ability of governments to regulate the busi- of Applied Economics at Johns Hopkins University.

54 Finance & Development September 2014

©International Monetary Fund. Not for Redistribution

You might also like

- 16 - Earth Leakage Circuit Breaker (ELCB) Testing Procedure - R1!05!11-2015Document11 pages16 - Earth Leakage Circuit Breaker (ELCB) Testing Procedure - R1!05!11-2015Praveen Kumar100% (2)

- Keynesian RevolutionDocument4 pagesKeynesian RevolutionRakesh KumarNo ratings yet

- Money Banking Finance MBF Notes B.com Part 1 Punjab University PDFDocument85 pagesMoney Banking Finance MBF Notes B.com Part 1 Punjab University PDFEraj Ahmed100% (2)

- Person Status: 1. Measuring Employment, Unemployment, and Labor Force ParticipationDocument12 pagesPerson Status: 1. Measuring Employment, Unemployment, and Labor Force Participationklm klmNo ratings yet

- Jahan KeynesDocument2 pagesJahan Keynesgenevaroncesvalles88No ratings yet

- Chapter 7 The Keynesian SchoolDocument28 pagesChapter 7 The Keynesian Schoolismail adanNo ratings yet

- Economic TheoriesDocument28 pagesEconomic TheoriesANNTRESA MATHEWNo ratings yet

- Thought II ch-4 Lecture NoteDocument16 pagesThought II ch-4 Lecture NoteAddaa WondimeNo ratings yet

- Can Keynesian Economics Reduce BoomDocument4 pagesCan Keynesian Economics Reduce BoomCalvince OumaNo ratings yet

- Unit-1 - Keynesian Concept DescriptionDocument5 pagesUnit-1 - Keynesian Concept DescriptionMinakshi SinghNo ratings yet

- John Maynard KeynesDocument3 pagesJohn Maynard KeynesVonderNo ratings yet

- The Keynesian TheoryDocument5 pagesThe Keynesian TheoryDwight Jenna de MesaNo ratings yet

- Published in 1936 The Interpretations of Keynes Are Contentious, andDocument14 pagesPublished in 1936 The Interpretations of Keynes Are Contentious, andPratik PatelNo ratings yet

- Keynesian EconomicsDocument12 pagesKeynesian EconomicsMaria Shams100% (1)

- Keynesian Liquidity TrapDocument16 pagesKeynesian Liquidity Trapjhw007No ratings yet

- Keynesian EconomicsDocument12 pagesKeynesian EconomicsSheilaNo ratings yet

- Keynes and National Income MultiplierDocument30 pagesKeynes and National Income MultiplierfarahNo ratings yet

- Keynesian Economics: Inflation Economist John Maynard Keynes Great DepressionDocument4 pagesKeynesian Economics: Inflation Economist John Maynard Keynes Great DepressionShairah Ericka AmoraNo ratings yet

- Keynesianism and MonetarismDocument22 pagesKeynesianism and MonetarismMeztli LunaNo ratings yet

- Essay On Keynesian EconomicsDocument3 pagesEssay On Keynesian Economicsayeshanoor1354No ratings yet

- Question:The Similarities Between Keynesian Economics and Classical EconomicsDocument5 pagesQuestion:The Similarities Between Keynesian Economics and Classical EconomicsWinnerton GeochiNo ratings yet

- 2008-2009 Keynesian Resurgence: Navigation SearchDocument19 pages2008-2009 Keynesian Resurgence: Navigation SearchAppan Kandala VasudevacharyNo ratings yet

- Essay - Final ProjectDocument2 pagesEssay - Final ProjectAndres SagarnagaNo ratings yet

- ReviewerDocument5 pagesReviewerIrana CañezaNo ratings yet

- INSTITUTIONAL ECONOMICS MODULE-editedDocument21 pagesINSTITUTIONAL ECONOMICS MODULE-editedDennis NemesisBellarin RichardNo ratings yet

- What Is Demand-Side Economics?: Keynesian EconomistsDocument2 pagesWhat Is Demand-Side Economics?: Keynesian EconomistsTommyYapNo ratings yet

- MA I Short Note For Extit TutorDocument43 pagesMA I Short Note For Extit TutorTesfaye GutaNo ratings yet

- Introduction To The Keynesian Model of The MacroeconomyDocument3 pagesIntroduction To The Keynesian Model of The MacroeconomyNozeelia BlairNo ratings yet

- Keynesian Economics - Questionnaire - BinayakJhaDocument3 pagesKeynesian Economics - Questionnaire - BinayakJhajha36binayakNo ratings yet

- Keynesian AnalysisDocument7 pagesKeynesian AnalysisParmeet SinghNo ratings yet

- The "Keynesian Moment" in Policymaking, The Perils Ahead, and A Flow-Of-Funds Interpretation of Fiscal PolicyDocument30 pagesThe "Keynesian Moment" in Policymaking, The Perils Ahead, and A Flow-Of-Funds Interpretation of Fiscal PolicyAryan SalihNo ratings yet

- Comparison and Contrast Between Classical and Keynesian ContributionDocument6 pagesComparison and Contrast Between Classical and Keynesian ContributionVansh ChadhaNo ratings yet

- The "Keynesian Moment" in Policymaking, The Perils Ahead, and A Flow-Of-Funds Interpretation of Fiscal PolicyDocument30 pagesThe "Keynesian Moment" in Policymaking, The Perils Ahead, and A Flow-Of-Funds Interpretation of Fiscal PolicyAryan SalihNo ratings yet

- Economic Schools of ThoughtDocument6 pagesEconomic Schools of ThoughtSimon LonghurstNo ratings yet

- E-Portfolio ProjectDocument7 pagesE-Portfolio Projectapi-437555637No ratings yet

- Classical&KeynesianDocument7 pagesClassical&KeynesianShayan siddiquiNo ratings yet

- ECONOMIC ENVIRONMENT OF BUSINESS (CP 203) - Assignements - ABDUL KHALIQ (19MBE002)Document26 pagesECONOMIC ENVIRONMENT OF BUSINESS (CP 203) - Assignements - ABDUL KHALIQ (19MBE002)Abdul Khaliq ChoudharyNo ratings yet

- The Keynesians - Classicals Macro Economic School of Thought Debate 1Document9 pagesThe Keynesians - Classicals Macro Economic School of Thought Debate 1sirconceptNo ratings yet

- Cape Econ Macro Vs MicroDocument4 pagesCape Econ Macro Vs MicrohotfujNo ratings yet

- Keynesian ModelDocument28 pagesKeynesian ModelMsKhan0078100% (3)

- Nature and ScopeDocument5 pagesNature and ScopeGanesh AroteNo ratings yet

- Keynesian ThesisDocument4 pagesKeynesian Thesismichellespragueplano100% (2)

- New Keynesian AgeDocument13 pagesNew Keynesian AgeSami Ur RehmanNo ratings yet

- Group 6 - KeynesDocument2 pagesGroup 6 - KeynesRikki Mae TeofistoNo ratings yet

- Chap 2Document24 pagesChap 2mikialeabrha23No ratings yet

- CORONAVIRUS PANDEMIC SHOCK Contrasting Classical and Keynes TheoriesDocument9 pagesCORONAVIRUS PANDEMIC SHOCK Contrasting Classical and Keynes TheoriesaijbmNo ratings yet

- Impact of Keynesian Economy Policy in The Growth of The EconomyDocument8 pagesImpact of Keynesian Economy Policy in The Growth of The EconomyA Prem '1010'No ratings yet

- Resume 4Document2 pagesResume 4Akira KontakuNo ratings yet

- Aea 206 Macroeconomics PDFDocument187 pagesAea 206 Macroeconomics PDFmarikiannawNo ratings yet

- The Consequences of Keynes: Volume 20, Number 1 (Spring 2017) : 155-164Document11 pagesThe Consequences of Keynes: Volume 20, Number 1 (Spring 2017) : 155-164Karen DayanaNo ratings yet

- Keynesian EconomicsDocument7 pagesKeynesian EconomicsDeepikaa PoobalarajaNo ratings yet

- Unit-5 Macro EconomicsDocument16 pagesUnit-5 Macro EconomicsYash JainNo ratings yet

- Write and Explain Neo Classical and Keynesian Economics Policy. Neo Classical EconomicsDocument3 pagesWrite and Explain Neo Classical and Keynesian Economics Policy. Neo Classical EconomicsaureliaNo ratings yet

- Chapter OneDocument33 pagesChapter OneTesfahun GetachewNo ratings yet

- Keneysian-Thinking JanetDabuetDocument41 pagesKeneysian-Thinking JanetDabuetJanet DabuetNo ratings yet

- A Classical Overview2Document6 pagesA Classical Overview2Alex SemusuNo ratings yet

- Chapter 2 PDFDocument16 pagesChapter 2 PDFHayamnotNo ratings yet

- Review of Literature: Section 1Document40 pagesReview of Literature: Section 1777priyankaNo ratings yet

- Colin Rogers: The Principle of Effective Demand and The State of Post Keynesian Monetary EconomicsDocument30 pagesColin Rogers: The Principle of Effective Demand and The State of Post Keynesian Monetary EconomicsMiracle MathandaNo ratings yet

- MACROECONOMICS - I Reading MaterialDocument80 pagesMACROECONOMICS - I Reading MaterialMeron TemisNo ratings yet

- Keynes Stagnation ThesisDocument6 pagesKeynes Stagnation Thesispatriciamedinadowney100% (2)

- Macroec IDocument109 pagesMacroec IProveedor Iptv España100% (1)

- Indian Oil Corporation (IOCL IN) : Q4FY19 Result UpdateDocument7 pagesIndian Oil Corporation (IOCL IN) : Q4FY19 Result UpdatePraveen KumarNo ratings yet

- Engineers India (ENGR IN) : Q4FY19 Result UpdateDocument7 pagesEngineers India (ENGR IN) : Q4FY19 Result UpdatePraveen KumarNo ratings yet

- Sr. No. Annexure 1 Post Graduate Program in Management (PGPM) Class of 2017Document2 pagesSr. No. Annexure 1 Post Graduate Program in Management (PGPM) Class of 2017Praveen KumarNo ratings yet

- JSW Steel (JSTL In) : Q4FY19 Result UpdateDocument6 pagesJSW Steel (JSTL In) : Q4FY19 Result UpdatePraveen KumarNo ratings yet

- NIE Advt Web June 2019 134Document6 pagesNIE Advt Web June 2019 134Praveen KumarNo ratings yet

- Advance Esimate GDP 2017Document10 pagesAdvance Esimate GDP 2017Praveen KumarNo ratings yet

- Leakages and InjectionsDocument1 pageLeakages and InjectionsPraveen KumarNo ratings yet

- Hindustan Petroleum Corporation (HPCL In) : Q4FY19 Result UpdateDocument6 pagesHindustan Petroleum Corporation (HPCL In) : Q4FY19 Result UpdatePraveen KumarNo ratings yet

- Notes-Negotiable InstrumentsDocument4 pagesNotes-Negotiable InstrumentsPraveen KumarNo ratings yet

- Hemotask2018 PDFDocument3 pagesHemotask2018 PDFPraveen KumarNo ratings yet

- Indian Oil Corporation (IOCL IN) : Q4FY19 Result UpdateDocument7 pagesIndian Oil Corporation (IOCL IN) : Q4FY19 Result UpdatePraveen KumarNo ratings yet

- Sai Vrat Katha in HindiDocument9 pagesSai Vrat Katha in Hindiankit jNo ratings yet

- Monetarism IMFDocument2 pagesMonetarism IMFPraveen KumarNo ratings yet

- Hemotask2018 PDFDocument3 pagesHemotask2018 PDFPraveen KumarNo ratings yet

- Fuel Economy: How Much Fuel Are Your Trucks Really Burning?Document5 pagesFuel Economy: How Much Fuel Are Your Trucks Really Burning?Praveen KumarNo ratings yet

- Tata Power-Ddl DSM Case Study Ceo&MdDocument4 pagesTata Power-Ddl DSM Case Study Ceo&MdPraveen KumarNo ratings yet

- EAC OpinionDocument4 pagesEAC OpinionPraveen KumarNo ratings yet

- Who Does What in Grant ManagementDocument1 pageWho Does What in Grant ManagementPraveen KumarNo ratings yet

- Big Data AnalyticsDocument5 pagesBig Data AnalyticsPraveen KumarNo ratings yet

- Future of Fintech in Capital Markets enDocument20 pagesFuture of Fintech in Capital Markets enPraveen KumarNo ratings yet

- StarbucksDocument19 pagesStarbucksPraveen KumarNo ratings yet

- Internal Audit Review Checklist: A. GeneralDocument8 pagesInternal Audit Review Checklist: A. GeneralPraveen KumarNo ratings yet

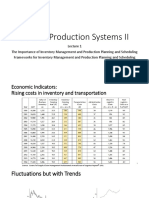

- Chapter 1 Importance of Inventory Management and Production SystemsDocument39 pagesChapter 1 Importance of Inventory Management and Production Systemsjane chahineNo ratings yet

- Parkin Econ SM CH30 GeDocument22 pagesParkin Econ SM CH30 GeMuri SetiawanNo ratings yet

- Lin80357 ch16Document35 pagesLin80357 ch16awaisjinnahNo ratings yet

- A Comparative Study of Two Global CrisesDocument18 pagesA Comparative Study of Two Global CrisessdfNo ratings yet

- Introduction To Economics and FinanceDocument4 pagesIntroduction To Economics and FinanceShaheer MalikNo ratings yet

- Applied Economics NotesDocument63 pagesApplied Economics NotesMs. CcNo ratings yet

- The Crisis of CapitalismDocument9 pagesThe Crisis of CapitalismAmeer Taimur AliNo ratings yet

- Ekonomski Pregled OECD-aDocument26 pagesEkonomski Pregled OECD-aTportal.hrNo ratings yet

- Block 1Document93 pagesBlock 1chiscribdNo ratings yet

- Topic 0 - BasicsOfEconomicsDocument49 pagesTopic 0 - BasicsOfEconomicsKanwar Preet SinghNo ratings yet

- Between Empire and GlobalizationDocument5 pagesBetween Empire and Globalizationazert yuiopNo ratings yet

- Economic Cycles and Maritime ShippingDocument29 pagesEconomic Cycles and Maritime Shippinganna annaNo ratings yet

- Impact of Covid 19 On Employment in India.Document20 pagesImpact of Covid 19 On Employment in India.Arushi BhasinNo ratings yet

- 總體經濟學 12Document63 pages總體經濟學 12王佑丞No ratings yet

- Bba Ii SylDocument8 pagesBba Ii SylDavid SdavidNo ratings yet

- Econ 1500Document4 pagesEcon 1500Freddie YuanNo ratings yet

- Role of Government in Economic GrowthDocument26 pagesRole of Government in Economic GrowthAbhay BajwaNo ratings yet

- CHAP19 Advance in Business Cycle TheoryDocument23 pagesCHAP19 Advance in Business Cycle TheoryFitriyani SalamuddinNo ratings yet

- Mankiw (1990) Refresher Course in Macroeconomics PDFDocument17 pagesMankiw (1990) Refresher Course in Macroeconomics PDFAngie PérezNo ratings yet

- Business in Action 8th Edition Chapter 2:building The Framework: Business Ownership and EntrepreneurshipDocument5 pagesBusiness in Action 8th Edition Chapter 2:building The Framework: Business Ownership and EntrepreneurshipFatima MajidliNo ratings yet

- Bba - Unit-5Document3 pagesBba - Unit-5Priya NandhakumarNo ratings yet

- Slept ModelDocument4 pagesSlept Modelvsb2121987No ratings yet

- Graduate Program: EconomicsDocument20 pagesGraduate Program: EconomicsJhonatan Hinestroza100% (1)

- Personal Finance Jan2021 OERDocument444 pagesPersonal Finance Jan2021 OERguiradodiana8No ratings yet

- Current Challenges With Inflation in NigeriaDocument23 pagesCurrent Challenges With Inflation in Nigeriajamessabraham2No ratings yet

- Ultra Militarism GroyperDocument46 pagesUltra Militarism GroyperThe Author of TCNo ratings yet

- Effect of Interest Rates On Performance of Commercial Banks in Uganda. Case Study Centenary BankDocument19 pagesEffect of Interest Rates On Performance of Commercial Banks in Uganda. Case Study Centenary BankMakanga BenardNo ratings yet

- 200504.construction Economics - NotesDocument2 pages200504.construction Economics - NotesdanNo ratings yet