Professional Documents

Culture Documents

FAR-I Statement of Changes Equity

Uploaded by

Umair AhmedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAR-I Statement of Changes Equity

Uploaded by

Umair AhmedCopyright:

Available Formats

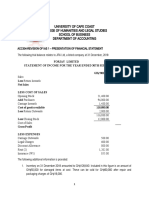

TABANI’S SCHOOL OF ACCOUNTANCY

FAR-I ADDITIONAL PRACTICE QUESTION

STATEMENT OF CHANGES EQUITY

Q.1. Following balances were extracted from the books Fatee Ltd as at 31st December 2019: (08)

Rs.000’s

Share Capital (@Rs.100 each) 300,000

Share Premium 20,000

Surplus on Revaluation (on plant) 35,000

Retained Earning 110,000

Relevant information for 2020:

Final dividend proposed for 2020 @20% (2019 @18% – approved by shareholders on 10th

February 2020 @15%).

Interim stock dividend declared @15% on 1st July 2020. (2019 @10% cash dividend).

On 1st September 2020 bought Plant & Machinery having fair value Rs.80,000,000 and

issued 700,000 shares, fully paid shares.

Net profit for 2020 was Rss.55,000,000.

Following Revaluation was certificated by qualified valuer

o Plant – upward Rs.6,000,000

o Vehicle upward Rs.7,000,000

(During 2018 downward was charged to retained earning Rs.2,000,000)

o Furniture downward Rs.600,000

Incremental deprecation for 2020 was Rs.4,500,000

Required:

Prepare Statement of Changes in Equity for the year ended 31st December 2020.

From the desk of Sir Sharif Tabani Page 1 of 2

TABANI’S SCHOOL OF ACCOUNTANCY

FAR-I ADDITIONAL PRACTICE QUESTION

STATEMENT OF CHANGES EQUITY

Q.2. Following balances were extracted from the books of PK Ltd (PKL) as a 31 December 2018: (08)

Rs.’000’

Ordinary share capital @100/- each 250,000

Share premium 40,000

Surplus on Revaluation (Land Rs.35,000; Building Rs.25,000) 60,000

Un-appropriate Profit 120,000

Transactions for 2019:

(1) The directors have proposed final dividend on 2nd February 2020; on ordinary

shares @15/- (2018 @12% - Stock Dividend).

(2) On 1st July 2019 interim dividend was made @10% on ordinary capital.

(3) Right issue was made @ one for every five shares held at premium of Rs.120

each.

(Rs.’000’s)

Land Building

Balance as at 31 December, 2019 before revaluable cost 85,000 260,000

Accumulated depreciation - 80,000

Re-valued amounts as at 31 December, 2019 72,000 156,000

(4) PKL has revalued its assets as 31 December, 2019 but effect is not incorporated

in above balance.

(5) Profit before above adjustment is 48 million and transfer of incremental

depreciation is Rs.6 million (credited to unappropriated profit).

Requirement:

Prepare statement of changes in equity for the year ended 31 December 2019.

From the desk of Sir Sharif Tabani Page 2 of 2

You might also like

- Zoleta, Hannah Joy M. Weeks 2 - 3 - AssignmentsDocument6 pagesZoleta, Hannah Joy M. Weeks 2 - 3 - AssignmentsHannah JoyNo ratings yet

- Woven Capital Associate ChallengeDocument2 pagesWoven Capital Associate ChallengeHaruka TakamoriNo ratings yet

- Prof. Francis O. Mateos, CPA: Bappaud - Applied AuditingDocument5 pagesProf. Francis O. Mateos, CPA: Bappaud - Applied AuditingElisha Batalla80% (5)

- General Information Sheet (Gis) : Stock Corporation General InstructionsDocument19 pagesGeneral Information Sheet (Gis) : Stock Corporation General InstructionsMichelle GonzalesNo ratings yet

- Makati Sports Club, Inc. vs. ChengDocument2 pagesMakati Sports Club, Inc. vs. Chengiwamawi100% (2)

- Far-I Autumn 2021 TsaDocument3 pagesFar-I Autumn 2021 TsaUsman AhmedNo ratings yet

- Past Paper FAR1Document116 pagesPast Paper FAR1Daniyal AhmedNo ratings yet

- Ias 8Document9 pagesIas 8Syed Huzaifa SamiNo ratings yet

- Past Paper FAR1Document105 pagesPast Paper FAR1Hamza VirkNo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) : Group - I Paper - 1: AccountingHarsh KumarNo ratings yet

- Financial Accounting and Reporting 1Document11 pagesFinancial Accounting and Reporting 1BablooNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Department The Institute of Chartered Accountants of NepalDocument192 pagesChartered Accountancy Professional Ii (CAP-II) : Education Department The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP June 2020 QNDocument14 pagesRTP June 2020 QNbinuNo ratings yet

- 301 AFA II PL III Question CMA June 2021 Exam.Document4 pages301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNo ratings yet

- Crescent All CAF Mocks QP With Solutions Compiled by Saboor AhmadDocument124 pagesCrescent All CAF Mocks QP With Solutions Compiled by Saboor AhmadAr Sal AnNo ratings yet

- (Aa35) Corporate and Personal Taxation: Association of Accounting Technicians of Sri LankaDocument8 pages(Aa35) Corporate and Personal Taxation: Association of Accounting Technicians of Sri LankaSujan SanjayNo ratings yet

- CAF1 ModelPaperDocument7 pagesCAF1 ModelPaperahmedNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- ARM - FAR 1 Mock For March 2024 With Solution - FinalDocument26 pagesARM - FAR 1 Mock For March 2024 With Solution - FinalTooba MaqboolNo ratings yet

- Mock Exam 2Document7 pagesMock Exam 2ZahidNo ratings yet

- MPACC512 Advanced Fin Reporting Answer Bank 2022Document44 pagesMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertNo ratings yet

- Financial Accounting and Reporting-IIDocument5 pagesFinancial Accounting and Reporting-IIHooriaNo ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaJayaprakash VenkatesanNo ratings yet

- Icag Nov 2020-Group Discuss...Document6 pagesIcag Nov 2020-Group Discuss...Papa Ekow ArmahNo ratings yet

- Term Test-1 FAR-1Document6 pagesTerm Test-1 FAR-1Dua FarmoodNo ratings yet

- Mock Test QuestionsDocument36 pagesMock Test QuestionsKish VNo ratings yet

- Advanced Accounting and Financial ReportingDocument5 pagesAdvanced Accounting and Financial ReportingMuhammed NaqiNo ratings yet

- M - Limited Companies (After Edit)Document41 pagesM - Limited Companies (After Edit)PublicEnemy007No ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2021 Mock Test Paper 2 Intermediate (New) : Group - I Paper - 1: AccountingHarsh KumarNo ratings yet

- AAC10403 - Individual Assignment 1 Sept'19Document2 pagesAAC10403 - Individual Assignment 1 Sept'19Vindhaya vasiniNo ratings yet

- Caf-01 Far-01 Skans Mock QPDocument8 pagesCaf-01 Far-01 Skans Mock QPTaha MalikNo ratings yet

- CFS - ProblemsDocument5 pagesCFS - Problemskatasani likhithNo ratings yet

- Dea Aul - QuizDocument5 pagesDea Aul - QuizDea Aulia AmanahNo ratings yet

- (In Lakhs) : © The Institute of Chartered Accountants of IndiaDocument12 pages(In Lakhs) : © The Institute of Chartered Accountants of IndiaIndhuNo ratings yet

- Goodwill QuestionsDocument7 pagesGoodwill QuestionsTanisha JainNo ratings yet

- ACCO 420 Final F2020 Version 2Document4 pagesACCO 420 Final F2020 Version 2Wasif SethNo ratings yet

- Financial Accounting and Reporting-IIDocument5 pagesFinancial Accounting and Reporting-IIZahidNo ratings yet

- Final FAR-2 Mock Q. PaperDocument6 pagesFinal FAR-2 Mock Q. PaperAli OptimisticNo ratings yet

- Financial Accounting and Reporting-IIDocument6 pagesFinancial Accounting and Reporting-IIZahidNo ratings yet

- CASH FLOW Revision-1 PDFDocument12 pagesCASH FLOW Revision-1 PDFBHUMIKA JAINNo ratings yet

- MTP - Nov - 20 AccountsDocument19 pagesMTP - Nov - 20 AccountsPartibha GehlotNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- Financial Accounting and Reporting: Page 1 of 4Document4 pagesFinancial Accounting and Reporting: Page 1 of 4ebshuvoNo ratings yet

- ExercisesDocument20 pagesExercisesRolivhuwaNo ratings yet

- Paper - 1: Accounting: © The Institute of Chartered Accountants of IndiaDocument31 pagesPaper - 1: Accounting: © The Institute of Chartered Accountants of Indiakunal akhadeNo ratings yet

- Assignment 2Document7 pagesAssignment 2Dharminee GanesanNo ratings yet

- Tutorial 3 QDocument3 pagesTutorial 3 Q謝中豪No ratings yet

- Rapid Test Series 2021 (Accounting For Not For Profit Organizations, Partnership Firms)Document5 pagesRapid Test Series 2021 (Accounting For Not For Profit Organizations, Partnership Firms)Swami NarangNo ratings yet

- CAF 1 IA ModelPaperDocument7 pagesCAF 1 IA ModelPaperAli RehanNo ratings yet

- Blue Book - Set 8-7Document1 pageBlue Book - Set 8-7Anna TungNo ratings yet

- CAF 1 FAR1 Spring 2023Document6 pagesCAF 1 FAR1 Spring 2023haris khanNo ratings yet

- 2017 MJDocument4 pages2017 MJRasel AshrafulNo ratings yet

- CFS-1 Shot - (C)Document4 pagesCFS-1 Shot - (C)xjnk6fwfvhNo ratings yet

- Accountancy QP-Term II-Pre Board 1 - Class XIIDocument6 pagesAccountancy QP-Term II-Pre Board 1 - Class XIIRaunofficialNo ratings yet

- Kendriya Vidyalaya Sangathan, Delhi Region Pre-Board Examination 2020-21 Class XII - AccountancyDocument9 pagesKendriya Vidyalaya Sangathan, Delhi Region Pre-Board Examination 2020-21 Class XII - Accountancyraghu monnappaNo ratings yet

- ACCT2014 Final Exam 2021-2022 - K.Ashman v2Document9 pagesACCT2014 Final Exam 2021-2022 - K.Ashman v2Christina StephensonNo ratings yet

- Mid AFA-II 2020Document2 pagesMid AFA-II 2020CRAZY SportsNo ratings yet

- Investment Type Date of Investment Investee Shareholding Goodwill/ (Bargain Purchase) On Acquisition (Rs. in Million)Document2 pagesInvestment Type Date of Investment Investee Shareholding Goodwill/ (Bargain Purchase) On Acquisition (Rs. in Million)James MartinNo ratings yet

- 9706 w19 QP 31Document13 pages9706 w19 QP 31PontuChowdhuryNo ratings yet

- 2020 FA L4 To L10 StudentsDocument40 pages2020 FA L4 To L10 Students徐恺民No ratings yet

- ACC304-IAS 1 Final AccountsDocument4 pagesACC304-IAS 1 Final AccountsGeorge AdjeiNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Gland Pharma LimitedDocument316 pagesGland Pharma LimitedPranav WarneNo ratings yet

- Arts of IncorpDocument6 pagesArts of IncorpLezama and Umadhay Law OfficeNo ratings yet

- Corporation - Quiz Question and AnswerDocument4 pagesCorporation - Quiz Question and AnswerGeraldine VitanzosNo ratings yet

- Company Law B A. LL.BDocument64 pagesCompany Law B A. LL.BKshamaa Kshamaa100% (1)

- Governance AssignmentDocument11 pagesGovernance AssignmentAnonymous xtuM4xNo ratings yet

- Annual Report 2020 2020 12 12 5fd47734ddab0Document203 pagesAnnual Report 2020 2020 12 12 5fd47734ddab0HridoyNo ratings yet

- C14 CHP 12 2 Homework Sol S CorpsDocument6 pagesC14 CHP 12 2 Homework Sol S CorpsRimpy SondhNo ratings yet

- English For Accounting: Brief Course For BeginnersDocument29 pagesEnglish For Accounting: Brief Course For BeginnersLam NguyễnNo ratings yet

- Review On Corporation CodeDocument51 pagesReview On Corporation CodeLhowellaAquinoNo ratings yet

- Icici BankDocument8 pagesIcici BankHarsh VardhanNo ratings yet

- Instruction: 1. Email AddressDocument26 pagesInstruction: 1. Email AddressYeji BabeNo ratings yet

- Total Liabilities Total AssetsDocument4 pagesTotal Liabilities Total AssetsAngelica CondenoNo ratings yet

- SEC 6 - Classification of StocksDocument7 pagesSEC 6 - Classification of StocksFrylle Kanz Harani PocsonNo ratings yet

- Reliance Infrastructure Limited: Company ProfileDocument45 pagesReliance Infrastructure Limited: Company Profilenitin_maurya_3No ratings yet

- Assignment On Powers of Corporation Pt. 3 Name: Section: Date: ScoreDocument2 pagesAssignment On Powers of Corporation Pt. 3 Name: Section: Date: ScoreKris Tine100% (1)

- Andrade, Mitchell, Stafford - 2001 - New Evidence and Perspectives On MergersDocument18 pagesAndrade, Mitchell, Stafford - 2001 - New Evidence and Perspectives On MergersGokulNo ratings yet

- Multiple Choice Questions For Chapter 01Document14 pagesMultiple Choice Questions For Chapter 01Phương Anh HàNo ratings yet

- PD 4726Document5 pagesPD 4726Jaymark EchanoNo ratings yet

- Chapter 1 - Introduction To Corporate FinanceDocument9 pagesChapter 1 - Introduction To Corporate FinanceNguyễn Hồ Yến NhiNo ratings yet

- MSEZ Annual Report 2019 20 - FinalDocument180 pagesMSEZ Annual Report 2019 20 - FinalDebasis MohantyNo ratings yet

- Fabml1 2Document3 pagesFabml1 2Althea AguadillaNo ratings yet

- Listings of Securities in Stock Exchange: Mayank Tripathi UG17-58Document8 pagesListings of Securities in Stock Exchange: Mayank Tripathi UG17-58Mayank TripathiNo ratings yet

- Issue of Shares and DebenturesDocument3 pagesIssue of Shares and DebenturesAarya KhedekarNo ratings yet

- DEMERGERDocument8 pagesDEMERGERsuvansh majmudarNo ratings yet

- APC 403 PFRS For SEs (Section 4)Document3 pagesAPC 403 PFRS For SEs (Section 4)AnnSareineMamadesNo ratings yet

- Bluebell Letter To Glencore (17 January 2024)Document5 pagesBluebell Letter To Glencore (17 January 2024)janove9536No ratings yet