Professional Documents

Culture Documents

Wa0008.

Wa0008.

Uploaded by

Antony JoeCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cam Wesense 2022Document44 pagesCam Wesense 2022Antony JoeNo ratings yet

- Account Statement 010421 140122Document57 pagesAccount Statement 010421 140122Antony JoeNo ratings yet

- Fault Codes: Diesel (D5204T6 - Diagnosis - MT/AT)Document8 pagesFault Codes: Diesel (D5204T6 - Diagnosis - MT/AT)Antony JoeNo ratings yet

- Relay Type / Make: GE T60 General Data:: SYS FmaxDocument6 pagesRelay Type / Make: GE T60 General Data:: SYS FmaxAntony JoeNo ratings yet

- Weekly Time Sheet: Star Powergen (India) PVT LTD, ChennaiDocument4 pagesWeekly Time Sheet: Star Powergen (India) PVT LTD, ChennaiAntony JoeNo ratings yet

- Drawing NoDocument2 pagesDrawing NoAntony JoeNo ratings yet

- 172 Supreme Court Reports Annotated: Maloles II vs. PhillipsDocument17 pages172 Supreme Court Reports Annotated: Maloles II vs. PhillipsIRRANo ratings yet

- ARTS 1231-1255 ReviewDocument16 pagesARTS 1231-1255 ReviewKareen BaucanNo ratings yet

- Sub Contractor W.O. Shrinked FormatDocument2 pagesSub Contractor W.O. Shrinked FormatSourabh SharmaNo ratings yet

- DE LY, Filip. Les Clauses Mettant Fin Aux Contrats Internationaux - Termination Clauses in International ContractsDocument37 pagesDE LY, Filip. Les Clauses Mettant Fin Aux Contrats Internationaux - Termination Clauses in International Contractsakemi09No ratings yet

- Revised Due Diligence Report NewDocument2 pagesRevised Due Diligence Report NewSmith lawfirmNo ratings yet

- Con4541 CCM Chapter 4 9Document2 pagesCon4541 CCM Chapter 4 9LTWNo ratings yet

- Sudiksha Ravi - Silence As AcceptanceDocument8 pagesSudiksha Ravi - Silence As AcceptanceUdbhav BhargavaNo ratings yet

- UP Commercial Law Reviewer 2008Document691 pagesUP Commercial Law Reviewer 2008seanNo ratings yet

- Script Oficial by Hausky Tutoriales 2019Document2 pagesScript Oficial by Hausky Tutoriales 2019SPARKLETNo ratings yet

- Corporation Law Reviewer Title 3Document5 pagesCorporation Law Reviewer Title 3Wendell Leigh OasanNo ratings yet

- 4 DigestDocument2 pages4 DigestRey Almon Tolentino AlibuyogNo ratings yet

- Meetings of CoMpanyDocument18 pagesMeetings of CoMpanyHeer ChaudharyNo ratings yet

- Far 2 QuicknotesDocument9 pagesFar 2 QuicknotesAlyssa Camille CabelloNo ratings yet

- Open University Malaysia: Business LawDocument16 pagesOpen University Malaysia: Business LawCity HunterNo ratings yet

- Due DiligenceDocument9 pagesDue Diligenceishaankc1510No ratings yet

- Deed of Trust - 1Document9 pagesDeed of Trust - 1Sandeep DuttaNo ratings yet

- DEED OF ABSOLUTE SALE OF A AbelDocument2 pagesDEED OF ABSOLUTE SALE OF A AbelEdward Rey EbaoNo ratings yet

- Oblicon Codal OutlineDocument6 pagesOblicon Codal OutlineGab NaparatoNo ratings yet

- TM 4 - GMS, BoC and BoD, Functions and Responsibilities of Commissioners and DirectorsDocument19 pagesTM 4 - GMS, BoC and BoD, Functions and Responsibilities of Commissioners and DirectorsMuh Rizky HendrawanNo ratings yet

- Unjust EnrichmentDocument8 pagesUnjust EnrichmentDm Witney JesonNo ratings yet

- Dimitiman, Irish Dale Louise MDocument5 pagesDimitiman, Irish Dale Louise MIrish Dale Louise M. DimitimanNo ratings yet

- 17 Leynes Great Asian Sales Center Corp. v. CADocument4 pages17 Leynes Great Asian Sales Center Corp. v. CAEugenio Sixwillfix LeynesNo ratings yet

- ISO27k The Business Value of ISO27k Case StudyDocument45 pagesISO27k The Business Value of ISO27k Case StudyvishnukesarwaniNo ratings yet

- Reyes v. SierraDocument2 pagesReyes v. SierraGabe RuaroNo ratings yet

- Independent Contractor Agreement: (CCM Corporation)Document8 pagesIndependent Contractor Agreement: (CCM Corporation)aya_montero_1No ratings yet

- Course OutlineDocument4 pagesCourse OutlinePrenita RamcharitarNo ratings yet

- Lessee Builder in Bad FaithDocument1 pageLessee Builder in Bad FaithBnl NinaNo ratings yet

- Bustax Chapter 7Document10 pagesBustax Chapter 7Pineda, Paula MarieNo ratings yet

- Juridical Necessity Means That The Court May BeDocument9 pagesJuridical Necessity Means That The Court May BeAngel CastroNo ratings yet

- Case Law About Gift IntervivosDocument2 pagesCase Law About Gift IntervivosCynthia Amweno0% (1)

Wa0008.

Wa0008.

Uploaded by

Antony JoeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wa0008.

Wa0008.

Uploaded by

Antony JoeCopyright:

Available Formats

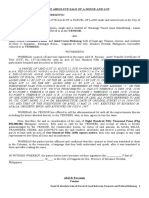

SU PLEM IN T A R Y PA RTN ER SH IP D EED

THIS AGREEMENT made at Chennai this 08 Day of August - 2022

1. A ANTHONY RAJ, S/o ALEXANDER aged about 62 years, residing at,

PLOT NO.29 MGR STREET SANTOSHPURAM CHENNAI 600073 FIRST

PART (hereinafter referred to as "FIRST PART” )

2. Mrs N NIRMALA W/o ANTHONY RAJ aged about 60 years, was residing

at PLOT NO.29 MGR STREET SANTOSHPURAM CHENNAI 600073

The above parties ENTERED the partnership through the partnership deed

dated 26-Feb-2016 to conduct the business in the name and style of M/s HB

MULTI BRAND CAR SERVICE GST No 33AAJFH2896N2ZR and office at NO 96,

CHELLAPPA NAGAR, SANTHOSAPURAM, Kanchipuram, Tamil Nadu, 600073.

Mrs N NIRMALA W/o ANTHONY RAJ, PASSED AWAY on 05-09-2021, Death

Certificate No.D-2021:33-16871-000448 dated 25-11-2021.

Mrs N NIRMALA W/o ANTHONY RAJ, PASSED AWAY on 05-09-2021, Death Certificate

No.D-2021:33-16871-000448. Death Certificate copy attached with this deed.

Due to the above, Mr ANTONY JOE NAVEEN aged about 33 years having PAN

ANJPN6056D AADHAAR NUMBER 9091 6316 8905 residing at Old No 3/75 New

No.3/86 MGR Street Visalakshi Nagar Santhosapuram Chennai 600073 (herein after

called second Part) has expressed his willingness to Join the partnership as a Partner

and the same was accepted by the FIRST PART.

The SECOND PART Mr ANTONY JOE NAVEEN JOINED IN THIS

PARTNERSHIP with effect from 08-AUGUST-2022 through this

deed, and WHEREAS the parties agreed to reduce the terms

and conditions of the partnership in writing AND NOW THIS

DEED IS WITNESSETH AS FOLLOWS:

1) The partners hereto shall carry on the business of partnership under the name and style

of HB MULTI BRAND CAR SERVICE GST No 33AAJFH2896N2ZR

2) The business of the partnership shall be carried on in the name and style of HB

MULTI BRAND CAR SERVICE GST No 33AAJFH2896N2ZR or such other

name or names as the partners hereto may decide from time to time.

3) The principal place of business of the Partnership shall be carried on ADDRESS

MENTIONED ABOVE and / or such other place or places as the partners hereto may

decide from time to time.

4) The capital of the partnership firm shall be contributed by both the partners equally. From

time to time, based on business and working capital requirements additional capital will be

contributed by the partners.

5) That the duration of the partnership shall be one AT WILL.

6) Both the partners shall have the right of management of the said business of the firm and

both the partners shall be the WORKING PARTNERS of the firms and also in charge of

the day to day administration of the business of the firms and manage and supervise

diligently the said businesses and carry it to the common Advantage of all partners and the

firm. In the event of the need for business development and management both partners

can jointly decide through a written resolution to appoint one of them as the MANAGING

PARTNER for a certain period in order to transact the business more efficiently and in a

focused manner. Any such a reappointment and continuing of office will be based on the

joint resolution of both the partners. However the Managing Partner has to take all the

business, commercial and financial decisions jointly and collectively with the other partner.

It is hereby agreed that in Consideration of the parties of all, actively devoting their time

and attention to the business of partnership, they shall be entitled to draw yearly

remuneration as under:

7) The yearly remuneration payable to each of the following partners shall be calculated as

percentage of the book profits for each accounting year in the following manner:

In respect of First Rs.3,00,000/- of book profit =

Rs.1,50,000 or @ 90% of Book Profit, whichever is more,

In respect of balance of book profit @ 60 %

For the purpose of the above calculation the book profit shall be calculated on the basis of

book profits as shown by the books and computed as provided in Sec.28 to Sec.44D (Chapter

IV-D) of the Income-Tax without deducting the remuneration paid or payable to the partners

for the relevant accounting year.

It is hereby agreed that on any event the remuneration payable to the above partners shall not

exceed the following amounts:

A ANTHONY RAJ Rs. 1,00,000/- P.M

ANTONY JOE NAVEEN Rs. 1,00,000/- P.M

The above partners shall be entitled to draw minimum remuneration in the accounting year in

which the partnership firm has made inadequate profits or suffered losses on the basis of the

calculation referred to in (ii) above as under:

A ANTHONY RAJ Rs. 15,000/- P.M

ANTONY JOE NAVEEN Rs. 15,000/- P.M

8 The partners shall be entitled to increase or reduce the above remuneration. The

parties here to may also agree to revise the mode of calculation the above

remuneration and decide to pay salary and other benefits either on monthly or

yearly basis as they may mutually agreed upon in writing and on passing of a joint

resolution.

9 The partners shall be entitled to withdraw any amount during the year from the

partnership towards their yearly remuneration, share of profit or out of their current,

loan or capital account from time to time as may be decided by the partners by

mutual consent in writing and passing of a joint resolution.

10 The partners shall be entitled to modify the above terms relating to remuneration payable

to partners by executing a supplementary deed, and any such deed when executed shall

be effective unless otherwise provided from the first day of the accounting period in which

such supplementary deed is executed and the same shall form part of this deed of

partnership.

11 The partners shall be entitled to an interest at the rate of 12% P.A on their capital balances

standing to their credit.

12 If the firm borrows loans from its partners then the interest rate paid shall be determined

jointly by the partners through a resolution in writing, based on the terms of conditions as

set through a loan agreement.

13 The partners shall maintain or cause to maintain proper books of accounts of daily

transaction such as Day Book, Ledgers etc., which are usually required and maintained in

businesses of similar nature.

14 All the records and accounts of partnership whether current or otherwise shall be opened

to inspection to any of the partners. Each of the partners has right to take copies of the

same.

15 The accounts of the firm shall be closed on 31 st March of each year provided that the

parties may by mutual consent close the accounts for any other period or periods as may

be considered expedient. The parties shall cause the Statement of Assets and Liabilities

and Profit and Loss accounts to be prepared at the end of each accounting year / period.

16 The Net Profit or Loss of the Partnership business as per the accounts maintained by the

Partnership after deduction of all expenses relating to business of Partnership including

Rent, Salaries, Interest, Traveling and other establishment expenses as well as

remuneration payable to the partners in accordance with this deed of partnership or any

supplementary deed as may be executed by the partners shall be divided and distributed

among the partners as detailed below..

A ANTHONY RAJ 50%

ANTONY JOE NAVEEN 50%

17 Any one of the partners of the firm shall have no power to borrow money singly from bank

or Financial Institutions or outsiders, in the name of the Firm. Both the partners of the firm

shall have to sign in the case of borrowings on behalf of the Firm. For discharge of the

loan, separate loan agreement can create on behalf of the Firm and interest etc should be

mentioned in the loan agreement.

18 Both the partners of the firm shall have the power to appoint staffs for the partnership firm,

fix salary and other perks, monitor their works, etc.

19 The firm shall open accounts with any Scheduled Bank or Banks all such bank account

and existing bank accounts and any one partners of the Firm shall operate Current,

Savings, Cash Credit or Overdraft in the name of the firm.

20 That the license, permits, brands, trademarks, copyright and other rights obtained in any

of the partner’s name for the purpose of Partnership business shall belong to the

partnership firm.

21 If a partner wants to retire from the Partnership he shall give Three months prior notice to

the other partner of his intention to retire.

22 That the death, insolvency, or retirement of a partner of the firm shall not stand dissolved

the partnership but shall be carried on by way of appointing new partners. In the event of

the demise of the both partners their respective heirs and successors of the partners will

become the new partners in proportion to the capital holdings of the original partners.

23 Any dispute or differences which may arise between the parties or their representatives,

which cannot be resolved among themselves with regard to the construction, meaning

and effect of this deed or any part thereof or with respect to the accounts, profits and

losses of the business, rights and liabilities of the Partners under this deed, dissolution or

winding up of the business or any other matter relating to the firm and its business, shall

be referred to an arbitrator or arbitrators mutually selected for the purpose. The decision

of the arbitrator or arbitrator’s matters of such disputes or differences shall be final and

binding on all the parties.

24 At the time of dissolution, all the assets of the firm have to be realized and all the

borrowings have to be repaid. The Profit / Loss arising out of such realisation after

discharging all liabilities as well, shall be divided among the parties in the same ratio as

they divide the profits / losses as mentioned in Para 14 supra.

25 It is mutually agreed that none of the Parties are entitled to claim a share in the goodwill

during the continuance of the Partnership. After dissolution, none of the parties shall have

a right to use the firm’s name individually. It is mutually agreed that if any party wish to

use the firm’s name, he may do so with the consent of other partners.

26 The parties shall punctually pay and discharge their separate debts and liabilities and shall

keep the firm indemnified against the same.

27 No new partner shall be admitted into the partnership without the mutual consent of the

parties hereto. No partner shall hereafter assign, transfer or encumber or in any way

dispose off his share of interest in the firm to any other person without the written consent

of the other partners.

28 Any of the above-mentioned terms and conditions may be varied, altered or amended by

means of a codicil signed by all the partners and such codicil shall be considered as part

of this agreement.

29 All other matters for which no provisions have been made in this deed shall be governed

by the Provisions of the Partnership Act, 1932, as amended up to date

IN WITNESS WHEREOF, THE PARTIES HERETO HAVE SET THEIR HANDS TO THIS DEED OF

PARTNERSHIP ON THIS DAY OF 08 TH DAY OF AUGUST 2022.

WITNESSES SIGNATURES

(…………………………….) A ANTHONY RAJ

PARTY OF THE FIRST PART

(……………………………..) ANTONY JOE NAVEEN

PARTY OF THE SECOND PART

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cam Wesense 2022Document44 pagesCam Wesense 2022Antony JoeNo ratings yet

- Account Statement 010421 140122Document57 pagesAccount Statement 010421 140122Antony JoeNo ratings yet

- Fault Codes: Diesel (D5204T6 - Diagnosis - MT/AT)Document8 pagesFault Codes: Diesel (D5204T6 - Diagnosis - MT/AT)Antony JoeNo ratings yet

- Relay Type / Make: GE T60 General Data:: SYS FmaxDocument6 pagesRelay Type / Make: GE T60 General Data:: SYS FmaxAntony JoeNo ratings yet

- Weekly Time Sheet: Star Powergen (India) PVT LTD, ChennaiDocument4 pagesWeekly Time Sheet: Star Powergen (India) PVT LTD, ChennaiAntony JoeNo ratings yet

- Drawing NoDocument2 pagesDrawing NoAntony JoeNo ratings yet

- 172 Supreme Court Reports Annotated: Maloles II vs. PhillipsDocument17 pages172 Supreme Court Reports Annotated: Maloles II vs. PhillipsIRRANo ratings yet

- ARTS 1231-1255 ReviewDocument16 pagesARTS 1231-1255 ReviewKareen BaucanNo ratings yet

- Sub Contractor W.O. Shrinked FormatDocument2 pagesSub Contractor W.O. Shrinked FormatSourabh SharmaNo ratings yet

- DE LY, Filip. Les Clauses Mettant Fin Aux Contrats Internationaux - Termination Clauses in International ContractsDocument37 pagesDE LY, Filip. Les Clauses Mettant Fin Aux Contrats Internationaux - Termination Clauses in International Contractsakemi09No ratings yet

- Revised Due Diligence Report NewDocument2 pagesRevised Due Diligence Report NewSmith lawfirmNo ratings yet

- Con4541 CCM Chapter 4 9Document2 pagesCon4541 CCM Chapter 4 9LTWNo ratings yet

- Sudiksha Ravi - Silence As AcceptanceDocument8 pagesSudiksha Ravi - Silence As AcceptanceUdbhav BhargavaNo ratings yet

- UP Commercial Law Reviewer 2008Document691 pagesUP Commercial Law Reviewer 2008seanNo ratings yet

- Script Oficial by Hausky Tutoriales 2019Document2 pagesScript Oficial by Hausky Tutoriales 2019SPARKLETNo ratings yet

- Corporation Law Reviewer Title 3Document5 pagesCorporation Law Reviewer Title 3Wendell Leigh OasanNo ratings yet

- 4 DigestDocument2 pages4 DigestRey Almon Tolentino AlibuyogNo ratings yet

- Meetings of CoMpanyDocument18 pagesMeetings of CoMpanyHeer ChaudharyNo ratings yet

- Far 2 QuicknotesDocument9 pagesFar 2 QuicknotesAlyssa Camille CabelloNo ratings yet

- Open University Malaysia: Business LawDocument16 pagesOpen University Malaysia: Business LawCity HunterNo ratings yet

- Due DiligenceDocument9 pagesDue Diligenceishaankc1510No ratings yet

- Deed of Trust - 1Document9 pagesDeed of Trust - 1Sandeep DuttaNo ratings yet

- DEED OF ABSOLUTE SALE OF A AbelDocument2 pagesDEED OF ABSOLUTE SALE OF A AbelEdward Rey EbaoNo ratings yet

- Oblicon Codal OutlineDocument6 pagesOblicon Codal OutlineGab NaparatoNo ratings yet

- TM 4 - GMS, BoC and BoD, Functions and Responsibilities of Commissioners and DirectorsDocument19 pagesTM 4 - GMS, BoC and BoD, Functions and Responsibilities of Commissioners and DirectorsMuh Rizky HendrawanNo ratings yet

- Unjust EnrichmentDocument8 pagesUnjust EnrichmentDm Witney JesonNo ratings yet

- Dimitiman, Irish Dale Louise MDocument5 pagesDimitiman, Irish Dale Louise MIrish Dale Louise M. DimitimanNo ratings yet

- 17 Leynes Great Asian Sales Center Corp. v. CADocument4 pages17 Leynes Great Asian Sales Center Corp. v. CAEugenio Sixwillfix LeynesNo ratings yet

- ISO27k The Business Value of ISO27k Case StudyDocument45 pagesISO27k The Business Value of ISO27k Case StudyvishnukesarwaniNo ratings yet

- Reyes v. SierraDocument2 pagesReyes v. SierraGabe RuaroNo ratings yet

- Independent Contractor Agreement: (CCM Corporation)Document8 pagesIndependent Contractor Agreement: (CCM Corporation)aya_montero_1No ratings yet

- Course OutlineDocument4 pagesCourse OutlinePrenita RamcharitarNo ratings yet

- Lessee Builder in Bad FaithDocument1 pageLessee Builder in Bad FaithBnl NinaNo ratings yet

- Bustax Chapter 7Document10 pagesBustax Chapter 7Pineda, Paula MarieNo ratings yet

- Juridical Necessity Means That The Court May BeDocument9 pagesJuridical Necessity Means That The Court May BeAngel CastroNo ratings yet

- Case Law About Gift IntervivosDocument2 pagesCase Law About Gift IntervivosCynthia Amweno0% (1)