Professional Documents

Culture Documents

Sunnys

Sunnys

Uploaded by

Telle Sirch0 ratings0% found this document useful (0 votes)

5 views6 pagesOriginal Title

Sunnys (1)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views6 pagesSunnys

Sunnys

Uploaded by

Telle SirchCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 6

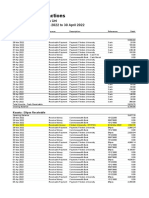

sara, 1:16 PM Print| Australian Taxation Ofce

‘Agent PANGEA ADVISORY PTY LTD

Client ARJ UNIT TRUST

ABN 75 925 669 776

TFN 969 808 832

Activity statement 002

Date generated 4082022

Overdue $0.00

Not yet due $0.00

Balance $61,930.53 CR

Transactions

123 results found - from 04 August 2020 to 04 August 2022 sorted by processed date ordered newest to

oldest

Processed date Effective date Description Debit (DR) Credit (CR) Balance

3 Aug 2022 2Aug 2022 Payment received $10,000.00 $61,930.53 CR

26 Jul 2022 25 Jul2022 Payment received $8,000.00 $51,930.53 CR

19 Jul 2022 18 Jul 2022 Payment received $6,000.00 $43,930.53 CR

13 Jul 2022 12 Jul 2022 Payment received $6,000.00 $37,930.53 CR

5 Jul 2022. 4 Jul2022 Payment received $8,000.00 $31,930.53 CR

22.Jun 2022 21. Jun2022 Payment received $5,000.00 $23,930.53 CR

15 Jun 2022 14,Jun 2022 Payment received $5,000.00 $18,930.53 CR

9 Jun 2022 21 Jun 2022 Original Activity Statement $16,529.00 $13,930.53 CR

for the period ending 31

May 22 - PAYG

Withholding

7 Jun 2022 6 Jun 2022 Payment received $5,000.00 $30,459.53 CR

31 May 2022 30 May 2022 Payment received $5,000.00 $25,459.53 CR

24 May 2022 23 May 2022 Payment received $10,000.00 $20,459.53 CR

23.May 2022 26 May 2022. Original Activity Statement $35,878.00 $10,459.53 CR

for the period ending 31

Mar 22

23May 2022-26 May 2022. - GST {$25,535.00

23May 2022.26 May 2022 - PAYG Withholding $10,343.00

18 May 2022 17 May 2022 Payment received $15,000.00 $46,337.53 CR

11 May 2022 23 May 2022 Original Activity Statement $10,606.00 $31,337.53 CR

for the period ending 30

Apr 22 - PAYG Withholding

‘1 May 2022 10 May 2022 Payment received $15,000.00 $41,943.53 CR

4 May 2022 3May 2022 Payment received $7,000.00 $26,943.53 CR

20 Apr 2022 19.Apr 2022 Payment received $7,000.00 $19,943.53 CR

1422, 116 8M

Processed date

13 Apr 2022

6 Apr 2022

6 Apr 2022

1 Apr 2022

31 Mar 2022

23 Mar 2022

16 Mar 2022

10 Mar 2022

8 Mar 2022

2 Mar 2022

1 Mar 2022

25 Feb 2022

25 Feb 2022

2 Feb 2022

24 Feb 2022

16 Fob 2022

9 Feb 2022

9 Feb 2022

2 Feb 2022

25 Jan 2022

19 Jan 2022

13 Jan 2022

13 Jan 2022

4 Jan 2022

15 Dec 2021

7 Dec 2021

7 Dec 2021

1 Dec 2021

1 Dec 2021

Effective date

12 Apr 2022

6 Apr 2022

5 Apr 2022

1 Mar 2022

30 Mar 2022

22 Mar 2022

15 Mar 2022

21 Mar 2022

7 Mar 2022

28 Feb 2022

4Mar 2022

28 Feb 2022

28 Feb 2022

28 Feb 2022

23 Feb 2022

18 Fob 2022

21 Feb 2022

8 Feb 2022

1 Feb 2022

24 Jan 2022

18 Jan 2022

13 Jan 2022

12 Jan 2022

1 Dec 2021

14 Dec 2021

21 Dec 2021

6 Dec 2021

1 Dec 2021

30 Nov 2021

Print| Australian Taxation Ofce

Description Debit (DR)

Payment received

General interest charge

Payment received

General interest charge

Payment received

Payment received

Payment received

Original Activity Statement

for the period ending 28

Feb 22 - PAYG Withholding

$9,712.00

Payment received

Payment received

General interest charge

Original Activity Statement

for the period ending 31

Dec 21

$42,247.00

-GST $31,708.00

- PAYG Withholding $10,538.00

Payment received

Payment received

Original Activity Statement

for the period ending 31

Jan 22 - PAYG Withholding

$11,145.00

Payment received

Payment received

Payment received

Payment received

General interest charge

Payment received

General interest charge

Payment received

Original Activity Statement

for the period ending 30

Nov 21 - PAYG Withholding

$10,976.00

Payment received

General interest charge

Payment received

Credit (CR)

$8,000.00

$5,000.00

$5,000.00

$8,000.00

$10,000.00

$7,000.00

$10,000.00

$5,000.00

$3,000.00

$3,000.00

$3,000.00

$3,000.00

$3,000.00

$5,000.00

$7,000.00

$5,000.00

$5,000.00

Balance

$12,943.53 CR

$4,943.53 CR

$4,943.53 CR

$56.47 DR

$56.47 DR

$5,056.47 DR

$13,056.47 DR

$23,056.47 DR

$13,344.47 DR

$20,344.47 DR

$30,344.47 DR

$30,344.47 DR

$11,902.53 CR

$6,902.53 CR

$3,902.53 CR

$15,047.53 CR

$12,047.53 CR

$9,047.53 CR

$6,047.53 CR

$3,047.53 CR

$3,047.53 CR

$1,952.47 DR

$1,952.47 DR

$8,952.47 DR

$2,023.53 CR

$2,976.47 DR

$2,976.47 DR

26

1422, 116 8M

Processed date

24 Nov 2021

19 Nov 2021

19 Nov 2021

19 Nov 2021

16 Nov 2021

10 Nov 2021

10 Nov 2021

3 Nov 2021

26 Oct 2021

20 Oct 2021

13 Oct 2021

28 Sep 2021

21 Sep 2021

21 Sep 2021

14 Sep 2021

9 Sep 2021

8 Sep 2021

1 Sep 2021

31 Aug 2021

25 Aug 2021

23 Aug 2021

23 Aug 2021

23 Aug 2021

18 Aug 2021

10 Aug 2021

8 Aug 2021

22 Jul 2021

7 Jul 2021

Effective date

23 Nov 2021

25 Nov 2021

25 Nov 2021

25 Nov 2021

15 Nov 2021

22 Nov 2021

9 Nov 2021

2Nov 2024

25 Oct 2021

19 Oct 2021

12 Oct 2021

27 Sep 2021

21 Sep 2021

20 Sep 2021

13 Sep 2021

21 Sep 2021

7 Sep 2021

1 Sep 2021

30 Aug 2021

24 Aug 2021

25 Aug 2021

25 Aug 2021

25 Aug 2021

17 Aug 2021

9 Aug 2021

23 Aug 2021

21 Jul 2021

6 Jul 2021

Print| Australian Taxation Ofce

Description Debit (DR)

Payment received

Original Activity Statement

for the period ending 30

Sep 21

$34,460.00

-GST $24,055.00

- PAYG Withholding $10,405.00

Payment received

Original Activity Statement

for the period ending 31

(Oct 21 - PAYG Withholding

$13,437.00

Payment received

Payment received

Payment received

Payment received

Payment received

Payment received

General interest charge

Payment received

Payment received

Original Activity Statement $11,471.00

for the period ending 31

‘Aug 21 - PAYG Withholding

Payment received

General interest charge

Payment received

Payment received

Original Activity Statement

for the period ending 30

Jun 24

$45,668.00

- GST $35,432.00

- PAYG Withholding $10,236.00

Payment received

Payment received

Original Activity Statement

for the period ending 31 Jul

24 « PAYG Withholding

$7,957.00

Payment received

Payment received

Credit (CR)

$5,000.00

$5,000.00

$2,000.00

$4,000.00

$5,000.00

$3,000.00

$7,000.00

$5,000.00

$12,000.00

$5,000.00

$4,000.00

$3,000.00

$5,000.00

$5,000.00

$5,000.00

$5,000.00

$3,500.00

Balance

$7,976.47 DR

$12,976.47 DR

$21,483.53 CR

$16,483.53 CR

$29,920.53 CR

$27,920.53 CR

$23,920.53 CR

$18,920.53 CR

$15,920.53 CR

$8,920.53 CR

$3,920.53 CR

$3,920.53 CR

$8,079.47 DR

$13,079.47 DR

$1,608.47 DR

$5,608.47 DR

$5,608.47 DR

$8,608.47 DR

$13,608.47 DR

$32,059.53 CR

$27,059.53 CR

$22,059.53 CR

$30,016.53 CR

$25,016.53 CR

36

1422, 116 8M

Processed date

4 Jul 2021

30 Jun 2021

24 Jun 2021

16 Jun 2021

11 Jun 2021

9 Jun 2021

9 Jun 2021

2 Jun 2024

26 May 2021

24 May 2021

21 May 2021

21 May 2021

21 May 2021

18 May 2021

14 May 2021

12 May 2021

7 May 2021

4 May 2024

28 Apr 2021

23 Apr 2021

31 Mar 2021

31 Mar 2021

30 Mar 2021

22 Mar 2021

19 Mar 2021

18 Mar 2021

15 Mar 2021

2Mar 2021

Effective date

30 Jun 2021

29 Jun 2021

23 Jun 2021

15 Jun 2021

10 Jun 2021

24 Jun 2021

8 Jun 2021

4 Jun 2024

25 May 2021

24 May 2021

26 May 2021

26 May 2021

26 May 2021

17 May 2021

21 May 2021

11 May 2021

6 May 2021

3 May 2021

27 Apr 2024

22.Apr 2024

31 Mar 2021

30 Mar 2021

29 Mar 2021

22 Mar 2021

22 Mar 2021

17 Mar 2021

12. Mar 2021

2Mar 2021

Print| Australian Taxation Ofce

Description

Payment received

Payment received

Payment received

Payment received

Payment received

Original Activity Statement

for the period ending 31

May 21 - PAYG.

Withholding

Payment received

Payment received

Payment received

Payment received

Original Activity Statement

for the period ending 31

Mar 21

GST

= PAYG Withholding

Payment received

Original Activity Statement

for the period ending 30

‘Apr 21 « PAYG Withholding

Payment received

Payment received

Payment received

Payment received

Payment received

General interest charge

Payment received

Payment received

General interest charge

Original Activity Statement

for the period ending 28

Feb 21 - PAYG Withholding

Payment received

Payment received

Original Activity Statement

for the period ending 31

Dec 20

Debit (DR)

$18,441.00

$35,162.00

$25,908.00

$9,254.00

$10,477.00

$8,237.00

$22,159.00

Credit (CR)

$2,000.00

$5,000.00

$5,000.00

$4,000.00

$5,000.00

$4,000.00

$4,000.00

$5,000.00

$5,000.00

$10,477.00

$5,000.00

$6,000.00

$10,000.00

$5,000.00

$10,000.00

$5,000.00

$5,000.00

$12,000.00

$10,000.00

Balance

$21,516.53 CR

$19,516.53 CR

$14,516.53 CR

$9,516.53 CR

$5,516.53 CR

$516.53 CR

$18,957.53 CR

$14,957.53 CR

$10,957.53 CR

$5,957.53 CR

$957.53 CR

$36,119.53 CR

$25,642.53 CR

$36,119.53 CR

$31,119.53 CR

$25,119.53 CR

$15,119.53 CR

$10,119.53 CR

$119.53 CR

$119.53 CR

$4,880.47 DR

$9,880.47 DR

$9,880.47 DR

$1,643.47 DR

$13,643.47 DR

$23,643.47 DR

406

1422, 116 8M

Processed date

2 Mar 2021

2 Mar 2021

4 Mar 2021

17 Feb 2021

10 Feb 2021

9 Feb 2021

5 Feb 2021

4 Feb 2021

1 Feb 2021

4 Jan 2021

15 Dec 2020

14 Dec 2020

1 Dec 2020

23 Nov 2020

23 Nov 2020

23 Now 2020

23 Nov 2020

13 Nov 2020

9 Nov 2020

9 Sep 2020

7 Sep 2020

7 Sep 2020

7 Sep 2020

Effective date

2Mar 2021

2 Mar 2024

4 Mar 2021

16 Feb 2021

9 Feb 2021

22 Feb 2021

4 Feb 2021

3 Feb 2021

1 Feb 2021

4 Jan 2021

21 Dec 2020

8 Dec 2020

1 Dec 2020

25 Nov 2020

25 Nov 2020

25 Nov 2020

23 Nov 2020

12 Nov 2020

23 Nov 2020

8 Sep 2020

21 Sep 2020

10 Sep 2020

7 Sep 2020

Print| Australian Taxation Ofce

Description

- GST

- PAYG Withholding

General interest charge

Payment received

Payment received

Original Activity Statement

for the period ending 31

Jan 21 - PAYG Withholding

Payment received

Payment received

General interest charge

calculated from 04 Jan 24

to. 31 Jan 21

General interest charge

calculated from 01 Dec 20

to 03 Jan 21

Original Activity Statement

for the period ending 30

Nov 20 - PAYG Withholding

Payment received

General interest charge

Original Activity Statement

for the period ending 30

Sep 20

- GST

- PAYG Withholding

Original Cash Flow Boost 2

Payment for the period

ending 30 Sep 20

Payment received

Original Activity Statement

for the period ending 31

(Oct 20 - PAYG Withholding

Payment received

Original Activity Statement

for the period ending 31

‘Aug 20 - PAYG Withholding

EFT refund for PAYG

Withholding for the period

from 01 Aug 20 to 31 Aug

20

General interest charge

Debit (DR)

$14,862.00

$7,297.00

$9,322.00

$119.01

$124.21

$8,114.00

$32,756.00

$23,510.00

$9,246.00

$6,904.00

$10,283.00

$667.75

Credit (CR)

$12,000.00

$8,000.00

$5,000.00

$5,000.00

$8,000.00

$10,950.75

$3,941.00

$8,000.00

Balance

$1,484.47 DR

$1,484.47 DR

$13,484.47 DR

$21,484.47 DR

$12,162.47 DR

$17,162.47 DR

$22,162.47 DR

$22,043.46 DR

$21,919.25 DR

$13,805.25 DR

$21,805.25 DR

$21,805.25 DR

$10,950.75 CR

$0.00

$3,941.00 DR

$2,963.00 CR

$5,037.00 DR

$5,246.00 CR

$5,913.75 CR

1422, 116 8M

Processed date

7 Sep 2020

21 Aug 2020

21 Aug 2020

21 Aug 2020

21 Aug 2020

21 Aug 2020

21 Aug 2020

21 Aug 2020

10 Aug 2020

10 Aug 2020

10 Aug 2020

10 Aug 2020

Effective date

7 Sep 2020

26 Aug 2020

25 Aug 2020

25 Aug 2020

25 Aug 2020

21 Aug 2020

21 Aug 2020

10 Aug 2020

21 Aug 2020

13 Aug 2020

10 Aug 2020

10 Aug 2020

Print| Australian Taxation Ofce

Description Debit (DR)

Original Cash Flow Boost 2

Payment for the period

ending 31 Aug 20

Refund $4,209.25

Original Activity Statement $15,554.00

for the period ending 30

Jun 20

-@sT $8,504.00

- PAYG Withholding $7,050.00

Original Cash Flow Boost 2

Payment for the period

‘ending 30 Jun 20

Original Cash Flow Boost 1

Payment for the period

ending 30 Jun 20

Revised Cash Flow Boost

2 Payment for the period

ending 31 Jul 20

Original Activity Statement $8,320.00

for the period ending 31 Jul

20 - PAYG Withholding

EFT refund for PAYG. $868.25

Withholding for the period

from 01 Jul 20 to 31 Jul 20

General interest charge

Original Cash Flow Boost 2

Payment for the period

ending 31 Jul 20

Credit (CR)

$10,950.75

$10,950.75

$7,050.00

$1,762.50

$9,188.25

Balance

$6,913.75 CR

$5,037.00 DR

$827.75 DR

$14,726.25 CR

$3,775.50 CR

$3,274.50 DR

$5,037.00 DR

$3,283.00 CR

$4,151.25 CR

$4,151.25 CR

ae

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chart of Accounts QBDocument8 pagesChart of Accounts QBTelle SirchNo ratings yet

- Petty Cash Fund Policy - EcaDocument4 pagesPetty Cash Fund Policy - EcaTelle SirchNo ratings yet

- Alfred S Bar - Account TransactionsDocument10 pagesAlfred S Bar - Account TransactionsTelle SirchNo ratings yet

- Remittance Advice From Sunny's Pizza 13jun2022Document16 pagesRemittance Advice From Sunny's Pizza 13jun2022Telle SirchNo ratings yet

- Prepayments Transactions: Radj Mahal Pty LTD For The Period 1 July 2021 To 26 June 2022Document2 pagesPrepayments Transactions: Radj Mahal Pty LTD For The Period 1 July 2021 To 26 June 2022Telle SirchNo ratings yet

- Comida Nominees Pty LTD - Account TransactionsDocument8 pagesComida Nominees Pty LTD - Account TransactionsTelle SirchNo ratings yet

- Alfreds Bar - Activity StatementDocument3 pagesAlfreds Bar - Activity StatementTelle SirchNo ratings yet

- Aged Payables Summary: Vagabond Byron Bay Pty LTD As at 9 August 2022 Ageing by Due DateDocument2 pagesAged Payables Summary: Vagabond Byron Bay Pty LTD As at 9 August 2022 Ageing by Due DateTelle SirchNo ratings yet

- Low Slow American BBQ Pty LTD - Aged Payables DetailDocument2 pagesLow Slow American BBQ Pty LTD - Aged Payables DetailTelle SirchNo ratings yet

- Batch Payment Summary - Radj Mahal Pty LTD - 09aug2022Document1 pageBatch Payment Summary - Radj Mahal Pty LTD - 09aug2022Telle SirchNo ratings yet

- Comida Nominees Pty LTD - Aged Payables DetailDocument18 pagesComida Nominees Pty LTD - Aged Payables DetailTelle SirchNo ratings yet

- Sunny S Pizza - Account TransactionsDocument8 pagesSunny S Pizza - Account TransactionsTelle SirchNo ratings yet

- Burger Theory - Flinders Uni - Account TransactionsDocument8 pagesBurger Theory - Flinders Uni - Account TransactionsTelle SirchNo ratings yet

- Divinagracia, Christelle G. JD 3BDocument3 pagesDivinagracia, Christelle G. JD 3BTelle SirchNo ratings yet

- Case StudyDocument4 pagesCase StudyTelle SirchNo ratings yet

- Clinical Legal Education ProgramDocument1 pageClinical Legal Education ProgramTelle SirchNo ratings yet

- Civil Code CasesDocument59 pagesCivil Code CasesTelle SirchNo ratings yet

- Civpro CaseDocument4 pagesCivpro CaseTelle SirchNo ratings yet

- Revolving Fund Policy - 3esDocument4 pagesRevolving Fund Policy - 3esTelle SirchNo ratings yet