Professional Documents

Culture Documents

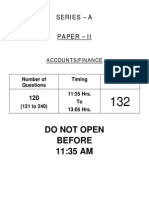

Soal Preliminary Accounting

Uploaded by

Zara Winter0 ratings0% found this document useful (0 votes)

32 views10 pagesThis document contains multiple choice questions covering various accounting and tax topics in Indonesia, including:

1) Identifying and assessing risks of material misstatement is important at the entity operational level.

2) Calculating cost of goods sold given opening stock, purchases, and closing stock amounts.

3) Recording investments in shares using the equity method requires the investor to have significant influence over the investee.

The document tests understanding of accounting concepts like inventory valuation, investments, audit risk assessment, and tax regulations.

Original Description:

Accounting problem

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains multiple choice questions covering various accounting and tax topics in Indonesia, including:

1) Identifying and assessing risks of material misstatement is important at the entity operational level.

2) Calculating cost of goods sold given opening stock, purchases, and closing stock amounts.

3) Recording investments in shares using the equity method requires the investor to have significant influence over the investee.

The document tests understanding of accounting concepts like inventory valuation, investments, audit risk assessment, and tax regulations.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views10 pagesSoal Preliminary Accounting

Uploaded by

Zara WinterThis document contains multiple choice questions covering various accounting and tax topics in Indonesia, including:

1) Identifying and assessing risks of material misstatement is important at the entity operational level.

2) Calculating cost of goods sold given opening stock, purchases, and closing stock amounts.

3) Recording investments in shares using the equity method requires the investor to have significant influence over the investee.

The document tests understanding of accounting concepts like inventory valuation, investments, audit risk assessment, and tax regulations.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 10

1. Dalam hal apakah, auditor harus mengidentifikasi dan menilai risiko kesalahan material?

A. Tingkat laporan keuangan

B. Tingkat operasional entitas

C. Kepatuhan pada peraturan perundang-undangan

D. Entitas

2. If opening stock is Rs. 50,000, purchase is Rs. 420,000 and closing stock is Rs. 30,000, then

what is the cost of goods sold?

A. Rs. 440,000

B. Rs. 470,000

C. Rs. 400,000

D. Rs. 500,000

3. PT. Beruntung membeli 20% saham PT. Sejahtera, setelah perolehan saham tersebut

pencatatan investasi saham dilakukan sebagai berikut :

A. PT Beruntung menggunakan metode Cost, jika ada bukti bahwa PT Beruntung mempunyai

pengaruh signifikan terhadap PT Sejahtera

B. PT Beruntung harus menggunakan metode fair value, meskipun ada bukti bahwa Beruntung

mempunyai pengaruh signifikan terhadap Sejahtera

C. PT Beruntung harus menggunakan metode Ekuitas jika ada bukti bahwa PT Beruntung

mempunyai pengaruh signifikan terhadap PT Sejahtera

D. Semua salah

4. In the first month of operations, the total of the debit entries to the cash account amounted to

$700 and the total of the credit entries to the cash account amounted to $500. The cash

account has a

A. $500 credit balance

B. $700 debit balance

C. $200 debit balance

D. $200 credit balance

5. A large part of individual income tax is collected through withholding by employers. In case

the employee is a resident taxpayer (living in Indonesia), the above-mentioned tax rates

apply, except:

A. 15% for interest, dividend and royalties

B. 2% for service

C. 10% for land and building rental

D. 20% normal rate (can be reduced by using tax treaty provisions, or exempt services that

quality as business profits)

6. Which of the following is the most important qualitative factor that auditors should consider

when making materiality judgments?

A. A misstatement exceeded five percent of net income

B. The auditor also provides consulting services to the audit client

C. The misstatement will cause the client to fail to meet an earnings forecast

D. The audit committee is not well-educated about the accounting principle in question

7. The following are not included in the fiscal financial statements, namely:

A. Tax Liability Overview

B. Calculating of Profit and Loss and changes in retained earnings

C. Fiscal Balance

D. Statement of Financial Position

8. Rumus untuk menghitung ending inventory adalah…

A. Beginning Inventory + Purchase – Purchase Discount – Purchase Return + Freight-in – Cost

of Goods Sold

B. Beginning Inventory + Net Purchase – Goods Available for Sale

C. Beginning Inventory + Purchase – Purchase Discount + Purchase Return + Freight-in – Cost of

Goods Sold

D. Beginning Inventory + Net Purchase + Cost of Goods Sold

9. Which of the following relatively small misstatements most likely would have a material effect

on an entity's financial statements?

A. An illegal payment to a foreign official that was not recorded

B. A piece of obsolete office equipment that was not retired

C. A petty cash fund disbursement that was not properly authorized

D. An uncollectible account receivable that was not written-off

10. Investasi pada saham dicatat pada harhga perolehan dan disesuaikan dengan keuntungan,

kerugian dan deviden disebut metode …

A. Ekuitas

B. Biaya

C. Cost

D. Semua salah

11. Jurnal yang perlu dibuat untuk mengeliminasikan pengakuan yang dilakukan oleh suatu

entitas induk atas dividen sebesar Rp1000 juta yang dibagikan entitas anak. Diketahui

entitas induk memegang 80% kepemilikan pada entitas anak serta menggunakan metode

ekuitas dalam mencatat..

A. Debit Kas Rp800 juta / Kredit Penghasilan Dividen Rp800 juta

B. Debit Penghasilan Dividen Rp800 juta / Kredit Kas Rp800 juta

C. Debit Penghasilan Dividen Rp800 juta / Kredit Dividen Diumumkan Rp800 juta

D. Debit Investasi pada entitas anak Rp800 juta / Kredit Dividen Diumumkan Rp800 juta

12. The company bears the risk for violating the basic principles of hedging principles. These

risks arise in the form of:

A. Currency mismatch

B. Liquidity risk

C. Outsourcing

D. Credit risk

13. Prime Cost + Conversion Cost equal to?

A. Manufacturing Cost

B. Conversion Cost

C. Prime Cost

D. None of the answer

14. Merchandise Inventory tidak ada dalam...

A. Statement of Financial Position

B. Income Statement

C. Trial Balance

D. Retained Earnings Statement

15. Salah satu keunggulan Activity Based Costing dibandingkan dengan Volume Based Costing

adalah…

A. Memberikan pengukuran yang lebih akurat dari kos yang ditimbulkan oleh aktivitas

B. Kos yang diidentifikasi oleh system ABC mencakup seluruh kos yang berkaitan dengan

produk

C. Beberapa kos yang membutuhkan alokasi dari departemen dan produk pengukurannya

sudah tetap

D. Membutuhkan waktu yang relative singkat untuk mengimplementasikannya

16. Value Added Tax (VAT) involves the transfer of taxable goods or the provision of taxable

services in Indonesia. Events/services that are taxable, except:

A. Deliveries of taxable goods in by an enterprise

B. Import of taxable goods

C. Export of taxable goods (tangible and intangible) or services by a non-taxable enterprise

D. Use or consumption of taxable intangible goods/service originating from abroad

17. Manakah dibawah ini formula yang tepat untuk harga pokok penjualan pada entitas

manufaktur?

A. Saldo awal persediaan dalam proses + harga pokok produksi – saldo akhir persediaan dalam

proses

B. Saldo awal persediaan dalam proses + harga pokok produksi + saldo akhir persediaan dalam

proses

C. Harga pokok produksi – saldo awal barang jadi – saldo akhir barang jadi

D. Harga pokok produksi + saldo awal barang jadi – saldo akhir barang jadi

18. PT. BERSAUDARA menerima deviden senilai Rp 250. 000.000., atas Laba ditahan (R/E)

tahun 2017 dari kepemilikan saham sebesar 20% pada PT. KELUARGA, Pajak atas deviden

adalah ….

A. Rp37.500.000, PPh pasal 23 bersifat Final

B. Rp37.500.000, PPh pasal 23 bersifat Tidak Final

C. Rp25.000.000, PPh pasal 23 bersifat Final

D. Rp25.000.000, PPh pasal 23 bersifat Tidak Final

19. Planning, recording, analyzing, and interpreting financial information are called:

A. accounting

B. ethics

C. transaction

D. revenue

20. Assume the following data concerning the operation of the Mambo Company for the month

of September:

Number of units sold 100 units

Selling price per unit $20

Variable manufacturing cost/unit $5

Fixed manufacturing costs $300

Variable selling and administrative costs/unit $4

Fixed selling and administrative costs $110

Please compute the amount of contribution margin?

A. $690

B. $1,200

C. $1,100

D. 1,500

21. Yang dimaksud prinsip obyektif adalah sebagai berikut :

A. Menyelesaikan pekerjaan dengan baik dan tuntas

B. Bebas konflik kepentingan dalam mengaudit

C. Menjaga informasi penting agar tidak dimanipulasi

D. Selalu focus mencapai tujuan audit

22. Assets taken out of a business for the owner's personal use is called:

A. capital

B. withdrawals

C. equities

D. revenue

23. Financial accounting provides the primary source of information for:

A. Decision making in finishing department

B. Improving customer service

C. Preparing the income statement for shareholders

D. Planning next year’s operating budget

24. What is not an impact of the application of PSAK 72 is...

A. Update on IT system

B. Revised Estimates and Judgment

C. Bad internal control

D. Communication with stakeholders

25. The purpose of the formation of PSAK 72 is to...

A. Adoption of IFRS 15 standard on customer contract revenue. Aims to harmonize and adjust

domestic SAK with world or international accounting

B. Allocating transaction prices to performance obligations separately based on relative stand-

alone selling prices

C. Establishes the principles that an entity applies to reporting information that is useful to

users of financial statements about the nature and cash flows arising from contracts with

customers

D. Combining two or more contracts entered into at the same time or adjacent the same

customer

26. If an individual fulfills any of the following conditions, then he/she is regarded a tax resident

in Indonesia, except:

A. The individual lives in Indonesia

B. The individual whose income come from Indonesia

C. The individual is in Indonesia for more than 183 days within a 12 month period

D. The individuals is in Indonesia during a fiscal year and intends to reside in Indonesia

27. Pernyataan yang benar terkait penggunaan metode ekuitas adalah...

A. Kepemilikan saham oleh investor <20%

B. Perlakuan akuntansi mengacu pada PSAK 71

C. Entitas penerbit ekuitas disebut sebagai anak perusahaan

D. Investor memiliki pengaruh signifikan atas investasinya

28. Randy just bought 800 shares of stock in Facebook at $19.50 per share. A stock company

that you have been working with charges $10 per transaction and you want to sell because

the current rate for your shares skyrocketed and is at $34.50 per share. How much did

Randy buy from Facebook?

A. 800 × $34.50 = $27,600

B. 800 × $19.50 = $15,600

C. $27,600 - $15,600 = $12,000

D. $12,000 - $20 = $11,980

29. The law that regulates the depreciation method in tax calculations is?

A. Law No. 36 of 2008 Article 11 concerning Income Tax

B. Law No. 36 of 2008 Article 16 concerning Income Tax

C. Law No. 36 of 2008 Article 11 concerning Income Value Added Tax

D. Law No. 36 of 2008 Article 16 concerning Income Value Added Tax

30. One of the reasons for the increase in end-user computing is the ability to offer the following

benefits:

A. Develop and maintain a company-wide transaction processing system and database that is a

resource for end-users to meet their information need

B. Accountants and end-users can decide what information need are important and whether

C. System should be developed or not, and the sense of ownership generated by implementing

end-user development helps users develop better system

D. Users realize computers can be used to meet more of their information needs

E. Users of information can develop their own applications using computer specialist as

advisors

31. Berdasarkan PSAK 1, pihak yang bertanggung jawab atas penyusunan dan penyajian

laporan keuangan entitas adalah...

A. investor

B. kreditor

C. manajemen

D. auditor

32. Princess Company has production data for January 20X1:

Direct materials used $ 400.000

Direct Labor 300.000

Factory Overhead 175.000

The Princess Company's Prime Cost for January are:

A. $400,000

B. $300,000

C. $700,000

D. $475,000

33. Audit ketaatan seringkali berkembang melebihi lingkup audit lainnya, yaitu selain

mengungkapkan pendapat atas kewajaran penyajian laporan keuangan, mencakup juga

audit atas efisiensi, ekonomi, efektivitas, serta

A. akurasi

B. evaluasi

C. kepatuhan atas prosedur dan peraturan tertentu

D. pengendalian internal

34. On January 3, 2011, Han Company purchases a 15 percent interest in Ben Corporation’s

common stock for $50,000 cash. Han accounts for the investment using the cost method.

Ben’s net income for 2011 is $20,000, but it declares no dividends. In 2012, Ben’s net

income is $80,000, and it declares dividends of $120,000. What is the correct balance of

Han’s Investment in Ben account at December 31, 2012?

A. $47,000

B. $50,000

C. $62,000

D. $65,000

35. Identify which of the following is not part of the control process

A. Monitoring of actual activity

B. Comparison of actual with planned activity

C. investigating

D. developing a strategic plan

36. PT Martani memiliki 15% saham PT Mitra Karya Optima. Selama tahun 2019, PT Martani

menerima deviden kas sebanyak Rp 10.000.000,- dari PT Mitra Karya Optima.

Bagaimanakah pengaruh dividen kas tersebut terhadap investasi PT Martani jika pencatatan

investasi menggunakan metode ekuitas?

A. Menambah income

B. Mengurangu income

C. Mengurangi investasi

D. Menambah investasi

37. Pada hari terakhir periode, bengkel mobil Ferara membeli mesin turbo jet senilai Rp2M

secara kredit. Berdasarkan narasi tersebut, transaksi ini akan mempengaruhi...

A. Semua laporan keuangan

B. Laporan laba rugi dan laporan perubahan modal

C. Laporan posisi keuangan saja

D. Laporan laba rugi saja

38. Manakah dari pernyataan ini yang tidak tepat?

A. Ada hubungan sebab-akibat antara cost driver dengan jumlah biaya

B. Fixed cost memiliki cost driver dalam jangka pendek

C. Dalam jangka panjang semua biaya memiliki cost driver

D. Volume produksi merupakan cost driver bagi biaya produksi-langsung

39. Key activities of the internal audit function include:

A. Assessing whether the company is demonstrating best practice in corporate governance

B. Assessing the economy, efficiency, and effectiveness of operating activities (value for

money)

C. Providing recommendations on the prevention and detection of fraud

D. All options are correct

40. Are costs that vary in total directly and proportionately with changes in the activity level?

A. Fixed cost

B. Variable cost

C. Mixed cost

D. Irrelevant cost

41. Berikut ini adalah dampak e-commerce terhadap bukti audit, kecuali:

You might also like

- Accounting ReviewerDocument9 pagesAccounting ReviewerG Rosal, Denice Angela A.No ratings yet

- Quiz No. 1 Accounting PrinciplesDocument4 pagesQuiz No. 1 Accounting PrinciplesElla Feliciano100% (1)

- Orca Share Media1605010109407 6731900321930361605Document37 pagesOrca Share Media1605010109407 6731900321930361605MARY JUSTINE PAQUIBOTNo ratings yet

- Jpiacup FARFINALDocument2 pagesJpiacup FARFINALErica FranciscoNo ratings yet

- Chapter 1 Seatwork 2 PDFDocument6 pagesChapter 1 Seatwork 2 PDFmiles ebajanNo ratings yet

- Bkal1013 Tutorial Q&A All ChapterDocument78 pagesBkal1013 Tutorial Q&A All ChapterJoeyvanessa46% (13)

- MCQ in Bca-Accounting & CobolDocument20 pagesMCQ in Bca-Accounting & CobolSagar KansalNo ratings yet

- Fsa Questions FBNDocument34 pagesFsa Questions FBNsprykizyNo ratings yet

- Fundamentals of Accountancy Exam ReviewDocument6 pagesFundamentals of Accountancy Exam ReviewMc Clent CervantesNo ratings yet

- Tutorial - Introduction To Financial AccountingDocument10 pagesTutorial - Introduction To Financial Accountingnurfa061No ratings yet

- Mid Term Break HomeworkDocument10 pagesMid Term Break Homeworknurfa061No ratings yet

- PRINCIPLES OF FINANCIAL ACCOUNTING EXAMDocument5 pagesPRINCIPLES OF FINANCIAL ACCOUNTING EXAMJia SNo ratings yet

- San Beda College Alabang Midterm Examination 1st Semester AY2019-2020Document7 pagesSan Beda College Alabang Midterm Examination 1st Semester AY2019-2020Marriel Fate CullanoNo ratings yet

- ACCOUNTING REVIEW PrelimDocument32 pagesACCOUNTING REVIEW PrelimMaria Isabel FermocilNo ratings yet

- (ACCT2010) (2012) (F) Quiz Hzhongaa 49127Document13 pages(ACCT2010) (2012) (F) Quiz Hzhongaa 49127Brenda WijayaNo ratings yet

- Test Bank For CH1 - CH2Document15 pagesTest Bank For CH1 - CH2passemmoresNo ratings yet

- Quiz On RizalDocument14 pagesQuiz On RizalYorinNo ratings yet

- AC 501 (Pre-Mid)Document3 pagesAC 501 (Pre-Mid)RodNo ratings yet

- Before Course Exam SBSDocument17 pagesBefore Course Exam SBSGia LâmNo ratings yet

- PA - T NG H P TestbankDocument86 pagesPA - T NG H P TestbankBích Phan Ngô NgọcNo ratings yet

- 26u9ofk7l - FAR - FINAL EXAMDocument18 pages26u9ofk7l - FAR - FINAL EXAMLyra Mae De BotonNo ratings yet

- Business Math and Financial Statements ExplainedDocument8 pagesBusiness Math and Financial Statements ExplainedFerrer BenedickNo ratings yet

- PRELIM-EXAMS 2223 with-ANSWERDocument5 pagesPRELIM-EXAMS 2223 with-ANSWERbrmo.amatorio.uiNo ratings yet

- True or False Accounting Concepts ExplainedDocument7 pagesTrue or False Accounting Concepts ExplainedJan Allyson BiagNo ratings yet

- FDNACCT - Quiz #1 - Set B - Answer KeyDocument4 pagesFDNACCT - Quiz #1 - Set B - Answer KeyIchi HasukiNo ratings yet

- 35 Basic Accounting Test QuestionsDocument9 pages35 Basic Accounting Test QuestionsDenny OctavianoNo ratings yet

- Examen Contabilidad IntermediaDocument8 pagesExamen Contabilidad IntermediaMariaNo ratings yet

- Financial Acctg 1 ReviewerDocument9 pagesFinancial Acctg 1 ReviewerAllyza May GasparNo ratings yet

- Basic Accounting ExamDocument8 pagesBasic Accounting ExamMikaela SalvadorNo ratings yet

- Financial Accounting and Reporting-Preliminary ExamDocument7 pagesFinancial Accounting and Reporting-Preliminary Examromark lopezNo ratings yet

- Activity No. 1 CA 2022 Financial Accounting and Reepeorting Far PCVDocument8 pagesActivity No. 1 CA 2022 Financial Accounting and Reepeorting Far PCVPrecious mae BarrientosNo ratings yet

- Financial AccountingDocument5 pagesFinancial Accountingimsana minatozakiNo ratings yet

- ACC100.101 Preliminary Examination - For PostingDocument5 pagesACC100.101 Preliminary Examination - For PostingRAMOS, Aliyah Faith P.No ratings yet

- 1Document42 pages1Magdy KamelNo ratings yet

- ACC 290 Final Exam AnswersDocument12 pagesACC 290 Final Exam AnswerszeshansidraNo ratings yet

- Inbound 291317058018293855Document5 pagesInbound 291317058018293855Adrienne AvanceñaNo ratings yet

- MCQ of FinanceDocument17 pagesMCQ of FinanceRajveer RathodNo ratings yet

- C3 Accounting & Information SystemDocument22 pagesC3 Accounting & Information SystemSteeeeeeeephNo ratings yet

- Financial Accounting Purpose External UsersDocument37 pagesFinancial Accounting Purpose External UsersChelsy Santos100% (1)

- Accounting exam practice questions on corporations, financial statements, inventoryDocument11 pagesAccounting exam practice questions on corporations, financial statements, inventoryvonns80No ratings yet

- Post-Test - FABM-2Document7 pagesPost-Test - FABM-2eva hernandez528No ratings yet

- FABM2Document6 pagesFABM2Maedelle Anne TiradoNo ratings yet

- KTTC Quiz 1 & 2Document15 pagesKTTC Quiz 1 & 2nhuphan31221021135No ratings yet

- Kuis 1 Dira Septiani 4132101007Document3 pagesKuis 1 Dira Septiani 4132101007Teresia AgustinaNo ratings yet

- Fabm 1 Test QDocument7 pagesFabm 1 Test QJemimah CorporalNo ratings yet

- Fabm1 Pre TestDocument6 pagesFabm1 Pre Testlynlynie0613No ratings yet

- Far Reviewer CompleteDocument87 pagesFar Reviewer CompleteAngelica NimerNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument20 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionFebby Grace Villaceran Sabino0% (2)

- Basic Financial Accounting and Reporting 2nd Sem AY 2020 2021 Institutional Mock Board ExamDocument10 pagesBasic Financial Accounting and Reporting 2nd Sem AY 2020 2021 Institutional Mock Board ExamBai Dianne BagundangNo ratings yet

- Accounting ProcessDocument5 pagesAccounting ProcessCzarina PanganibanNo ratings yet

- Accounting 3 Done !Document24 pagesAccounting 3 Done !Kiminosunoo LelNo ratings yet

- Prelim TopicsDocument9 pagesPrelim TopicsCherryvic Alaska - KotlerNo ratings yet

- Exit Model (Fundamental of Accounting)Document6 pagesExit Model (Fundamental of Accounting)aronNo ratings yet

- Financial and Management Accounting QuizDocument5 pagesFinancial and Management Accounting Quizvignesh100% (1)

- Module 7 QuestionDocument21 pagesModule 7 QuestionWarren MakNo ratings yet

- Salale UniversityDocument10 pagesSalale UniversityRegasa GutemaNo ratings yet

- 5 Question - FinanceDocument19 pages5 Question - FinanceMuhammad IrfanNo ratings yet

- Level 4 Thoery-1Document25 pagesLevel 4 Thoery-1EdomNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Cambodia: (Cambodia) Power Transmission Lines Co., LTD., Power Transmission ProjectDocument45 pagesCambodia: (Cambodia) Power Transmission Lines Co., LTD., Power Transmission ProjectIndependent Evaluation at Asian Development BankNo ratings yet

- Reject Allowance Problem - 2 ProblemsDocument17 pagesReject Allowance Problem - 2 Problemschristinahaddadin02No ratings yet

- Ocbc Ar2016 Full Report English PDFDocument236 pagesOcbc Ar2016 Full Report English PDFMr TanNo ratings yet

- Primavera PERT Master Risk Analysis ToolDocument22 pagesPrimavera PERT Master Risk Analysis ToolPallav Paban BaruahNo ratings yet

- Darlington Business Venture Balance Sheet BasicsDocument10 pagesDarlington Business Venture Balance Sheet BasicsVipul DesaiNo ratings yet

- There Are Different Types of SharesDocument2 pagesThere Are Different Types of SharesMadhu Sudan PandeyNo ratings yet

- New Hair Streamer Marketing PlanDocument24 pagesNew Hair Streamer Marketing PlanTANGI85No ratings yet

- Solution Manual For Financial Acct2 2nd Edition by GodwinDocument11 pagesSolution Manual For Financial Acct2 2nd Edition by GodwinToni Johnston100% (36)

- Arrangement of Section in Income Tax Act 1961Document8 pagesArrangement of Section in Income Tax Act 1961Jitendra VernekarNo ratings yet

- Bcom V Semester SyllabusDocument23 pagesBcom V Semester SyllabusPriyadharshini RNo ratings yet

- Buying and SellingDocument19 pagesBuying and SellingNeri SangalangNo ratings yet

- Phil Gold Processing & Refining Corp: RF Monthly-Lgm 3Document1 pagePhil Gold Processing & Refining Corp: RF Monthly-Lgm 3bonemarkcosNo ratings yet

- The Behavior of Interest RatesDocument39 pagesThe Behavior of Interest RatesAhmad RahhalNo ratings yet

- Stakeholders HSBCDocument7 pagesStakeholders HSBCOwen HudsonNo ratings yet

- Fci 132 Accounts - Finance PaperDocument15 pagesFci 132 Accounts - Finance PapersukanyaNo ratings yet

- Circular Flow of EconomyDocument19 pagesCircular Flow of EconomyAbhijeet GuptaNo ratings yet

- M&A Intro by Prof. Rahul KavishwarDocument51 pagesM&A Intro by Prof. Rahul Kavishwarsalman parvezNo ratings yet

- Quamto Taxation Law 2017Document34 pagesQuamto Taxation Law 2017Anonymous MCsSDJ100% (6)

- AEC 34 - ACB Assignment: Module 3: Problem 3-1.TRUE OR FALSEDocument2 pagesAEC 34 - ACB Assignment: Module 3: Problem 3-1.TRUE OR FALSEDrew BanlutaNo ratings yet

- DXN Marketing Plan: Definition of TermsDocument28 pagesDXN Marketing Plan: Definition of TermsJayKumarNo ratings yet

- Cost Accounting (Chapter 1-3)Document5 pagesCost Accounting (Chapter 1-3)eunice0% (1)

- Shinepukur Ceramics Limited: Balance Sheet StatementDocument9 pagesShinepukur Ceramics Limited: Balance Sheet StatementTahmid Shovon100% (1)

- Early Greek Coinage and The Influence of The Athenian State / Keith RutterDocument5 pagesEarly Greek Coinage and The Influence of The Athenian State / Keith RutterDigital Library Numis (DLN)No ratings yet

- Tanla Share Price - Google SearchDocument1 pageTanla Share Price - Google Searchaditya goswamiNo ratings yet

- Taxation of Individuals Answers1Document22 pagesTaxation of Individuals Answers1Ben ZhaoNo ratings yet

- Rezoning Proposal For Subdivision PlansDocument186 pagesRezoning Proposal For Subdivision PlansKarly BlatsNo ratings yet

- Ang & Bekaert - 2007 - RFS - Stock Return Predictability Is It ThereDocument58 pagesAng & Bekaert - 2007 - RFS - Stock Return Predictability Is It ThereẢo Tung ChảoNo ratings yet

- Corporate Liquidation DisDocument4 pagesCorporate Liquidation DisRenelyn DavidNo ratings yet