Professional Documents

Culture Documents

CFAS Chapter 19 Problem 2

Uploaded by

jelou ubag0 ratings0% found this document useful (0 votes)

130 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

130 views1 pageCFAS Chapter 19 Problem 2

Uploaded by

jelou ubagCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

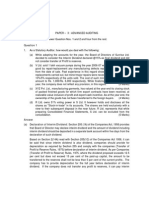

CFAS Chapter 19 Problem 2

1. Financial statements prepared in accordance with PFRSs are said to be the entity first PFRS

financial statements if the previous financial statements any of these (choices presented:

were prepared in accordance with other reporting standards not consistent with the

PFRSs, did not contain an explicit and unreserved statement of compliance with PFRSs,

and contained an explicit and unreserved statement of compliance with some, but not all,

PFRSs)

NURTURE REAR Co. uses a calendar year accounting period. In 20x9, NURTURE Co. decides

to adopt the PFRSs for the first time. NURTURE Co. reports one year comparative

information.

2. What is the date of transition to PFRSs? January 1,20x8

3. What is the date of the opening PFRS statement of financial position? January 1,20x8

4. How many balance sheets will be prepared on December 31,20x9? 3

5. What if NURTURE Co. reports two years of comparative information, what is the date of

transition to PFRSs? January 1,20x7

6. If NURTURE Co. reports two years of comparative information, how many balance sheets will

be prepared on December 31,20x9? 4

7. PFRS 1 requires first-time adopters to apply their selected accounting policies

retrospectively, but with some exceptions

8. A retrospective application under PFRS 1 requires restating assets and liabilities in the

opening statement of financial position to conform with PFRSs. The resulting adjustments

are recognized directly in retained earnings, or recognized directly in other category of

equity.

9. Entity a is adopting the PFRSs for the first time in this 20x3 financial reporting. Entity a has

recognized 300,000 advertising costs for billboards and tarpaulins as deferred charges and

are being amortized over 3 years. The billboards and tarpaulins have already been displayed

to the public. The contracts for those advertisements require the counter-party to publicly

display the billboards and tarpaulins over the next 3 years. How should entity a account for

the deferred charges in its first PFRS financial statements? Derecognize the deferred

advertising costs and charge them directly to retained earnings.

10. ABC’s statement of financial position as of January 1,20x2 (prepared under previous GAAP)

shows an allowance for bad debts of 456,000. A review of the aging schedule revealed a

mathematical mistake. The correct amount should have been 546,000. Does ABC Co. need

to revise its previous estimate of bad debts as of January 1,20x2 (date of transition) on

December 31,20x3 (end of first PFRS reporting period) yes. ABC needs to correct the error.

The correction shall be recognized in January 1,20x2 retained earnings.

You might also like

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Intermediate Accounting III ReviewerDocument3 pagesIntermediate Accounting III ReviewerRenalyn PascuaNo ratings yet

- 11 - Article Ship Registratin Letter1fr Compiler 2.0 - Ca Final New - by Ca Ravi AgarwalDocument27 pages11 - Article Ship Registratin Letter1fr Compiler 2.0 - Ca Final New - by Ca Ravi Agarwalhrudaya boysNo ratings yet

- "Full" Pfrss Refer To The Standards That We Had DiscussedDocument7 pages"Full" Pfrss Refer To The Standards That We Had DiscussedJustine VeralloNo ratings yet

- IFRS 1 Presentation of Financial StatementsDocument14 pagesIFRS 1 Presentation of Financial StatementsCatherine RiveraNo ratings yet

- Petron PDFDocument71 pagesPetron PDFEliza MapaNo ratings yet

- Presentation of FSDocument9 pagesPresentation of FSrose anneNo ratings yet

- Ind As 8Document4 pagesInd As 8qwertyNo ratings yet

- Updates to Philippine Financial Reporting Standards for PFRS 1 and 2Document50 pagesUpdates to Philippine Financial Reporting Standards for PFRS 1 and 2Princess ElaineNo ratings yet

- PAS 1: Financial Statement Presentation BasicsDocument52 pagesPAS 1: Financial Statement Presentation BasicsJustine VeralloNo ratings yet

- Accounting Policies SummaryDocument6 pagesAccounting Policies SummaryCaptain ObviousNo ratings yet

- Ind AS 101Document114 pagesInd AS 101Manisha DeyNo ratings yet

- Adv Aud Final May08Document16 pagesAdv Aud Final May08Fazi HaiderNo ratings yet

- Related Party Disclosures Events PeriodTITLE Disclosures Events Period FinancialsTITLE Related Disclosures Events Financial ReportingDocument15 pagesRelated Party Disclosures Events PeriodTITLE Disclosures Events Period FinancialsTITLE Related Disclosures Events Financial ReportingChin FiguraNo ratings yet

- PFRS 1 9Document22 pagesPFRS 1 9Apol AsusNo ratings yet

- IAS 29 IllustrationDocument28 pagesIAS 29 Illustrationapi-3828505No ratings yet

- REVIEW QUESTIONS FOR ACCOUNTING STANDARDSDocument24 pagesREVIEW QUESTIONS FOR ACCOUNTING STANDARDSMa. Flora Mae B LeponNo ratings yet

- SMEs SummaryDocument10 pagesSMEs SummaryGloria BeltranNo ratings yet

- C12 - Interim Financial ReportingDocument65 pagesC12 - Interim Financial ReportingKlare JimenoNo ratings yet

- Answer Key Week 3Document14 pagesAnswer Key Week 3Luigi Enderez Balucan100% (2)

- 2022-2023 INTACC3 PAS 1 HandoutsDocument9 pages2022-2023 INTACC3 PAS 1 HandoutsJefferson AlingasaNo ratings yet

- NAS 8 Accounting PoliciesDocument10 pagesNAS 8 Accounting PoliciesbinuNo ratings yet

- CFAS Long QuizDocument4 pagesCFAS Long QuizKatrina PaquizNo ratings yet

- 1.6.events After Reporting DateDocument19 pages1.6.events After Reporting DateGray ChilekwaNo ratings yet

- 3 RdyrDocument6 pages3 RdyrErikaNo ratings yet

- Application of Concepts SFP (1)Document10 pagesApplication of Concepts SFP (1)blancocarizagioNo ratings yet

- Ch.13 Current Liabilities: Exercise 13.01 True or FalseDocument6 pagesCh.13 Current Liabilities: Exercise 13.01 True or FalseFaishal Alghi FariNo ratings yet

- SQB - Chapter 10 QuestionsDocument8 pagesSQB - Chapter 10 QuestionsracsoNo ratings yet

- PFRS 12 MergedDocument45 pagesPFRS 12 MergedRojie Ann AmorNo ratings yet

- IFRS AND IAS of AuditDocument11 pagesIFRS AND IAS of AuditAvinash KumarNo ratings yet

- Nfjpia Nmbe Far 2017 AnsDocument9 pagesNfjpia Nmbe Far 2017 AnsSamieeNo ratings yet

- File belated income tax return and consequences of not filing by 31 MarchDocument2 pagesFile belated income tax return and consequences of not filing by 31 MarchAnanya D RNo ratings yet

- 1_Quiz-6-PAS-8-PAS-10-PAS-24-PAS-12-PAS-34-PFRS-1Document4 pages1_Quiz-6-PAS-8-PAS-10-PAS-24-PAS-12-PAS-34-PFRS-1quintanamarfrancisNo ratings yet

- PAS 34 Interim Financial Reporting: Learning ObjectivesDocument5 pagesPAS 34 Interim Financial Reporting: Learning ObjectivesFhrince Carl CalaquianNo ratings yet

- Mid-Term Revision Exercises (ch4-5)Document3 pagesMid-Term Revision Exercises (ch4-5)Cheuk Ying NicoleNo ratings yet

- Ashik Iqbal Aca Cpa (Usa) : Certificate Course On IfrsDocument19 pagesAshik Iqbal Aca Cpa (Usa) : Certificate Course On Ifrsঅরূপ মিস্ত্রী বলেছেনNo ratings yet

- SEC Memorandum Circular No. 34, S. 2020Document4 pagesSEC Memorandum Circular No. 34, S. 2020Riziel Ann CabrerosNo ratings yet

- Ias 8 Accounting Policies, Change in Accounting Estimates and ErrorsDocument13 pagesIas 8 Accounting Policies, Change in Accounting Estimates and ErrorsSyed Munib AbdullahNo ratings yet

- CFAS Graded Recitation CompleteDocument14 pagesCFAS Graded Recitation CompleteJONATHAN LANCE JOBLENo ratings yet

- 105 DepaDocument12 pages105 DepaLA M AENo ratings yet

- 53225indasitfg42666Document21 pages53225indasitfg42666sneh bansalNo ratings yet

- Nfjpia Nmbe Far 2017 Ans-1Document10 pagesNfjpia Nmbe Far 2017 Ans-1Stephen ChuaNo ratings yet

- AccountingDocument8 pagesAccountingGuiamae GuaroNo ratings yet

- P1 Exams Set ADocument10 pagesP1 Exams Set Aerica lamsenNo ratings yet

- Theories Discontinued, Acctg Changes, Interim, Opseg, ErrorsDocument43 pagesTheories Discontinued, Acctg Changes, Interim, Opseg, ErrorsMmNo ratings yet

- Pfrs Update 2022Document21 pagesPfrs Update 2022Robert CastilloNo ratings yet

- IND As Vs As ComparisonDocument42 pagesIND As Vs As ComparisonGeetikaNo ratings yet

- MCQ Accounting StandardDocument13 pagesMCQ Accounting StandardNgân GiangNo ratings yet

- Accounting LalaDocument2 pagesAccounting LalaPaw PaladanNo ratings yet

- Transportation & Logistics Transportation & Logistics: Impacts of The Annual Improvements ProjectDocument6 pagesTransportation & Logistics Transportation & Logistics: Impacts of The Annual Improvements ProjectSo LokNo ratings yet

- Comprehension Questions - Danica Garcia 137824 Week 7Document3 pagesComprehension Questions - Danica Garcia 137824 Week 7ddga2003No ratings yet

- Module 5 Amendments to Financial Reporting StandardsDocument5 pagesModule 5 Amendments to Financial Reporting StandardsMon RamNo ratings yet

- Quiz 2Document24 pagesQuiz 2Lee TeukNo ratings yet

- 10-MWSS2020 Part2-Observations and RecommDocument91 pages10-MWSS2020 Part2-Observations and RecommGabriel OrolfoNo ratings yet

- 3 Engine FundamentalsDocument40 pages3 Engine FundamentalsSankit SinghNo ratings yet

- Compiler Amendments and New Sums Added in May 2022 ICAI SM BhavikDocument90 pagesCompiler Amendments and New Sums Added in May 2022 ICAI SM BhavikJanani SankaranNo ratings yet

- Ifrs Updates August 2019Document9 pagesIfrs Updates August 2019obedNo ratings yet

- 1st Tym AdoptionDocument15 pages1st Tym Adoptionmishra2210No ratings yet

- Text Doc - NFJPIA Exam MOCKDocument15 pagesText Doc - NFJPIA Exam MOCKEugeneDumalagNo ratings yet

- Ind As 10Document2 pagesInd As 10qwertyNo ratings yet

- CFAS Chapter 26 Problem 1Document1 pageCFAS Chapter 26 Problem 1jelou ubagNo ratings yet

- CFAS Chapter 33 Problem 1Document1 pageCFAS Chapter 33 Problem 1jelou ubagNo ratings yet

- FAR Chapter 1 Problem 1Document1 pageFAR Chapter 1 Problem 1jelou ubagNo ratings yet

- FAR Chapter 3 Problem 3Document1 pageFAR Chapter 3 Problem 3jelou ubagNo ratings yet

- CFAS Chapter 25 Problem 2Document1 pageCFAS Chapter 25 Problem 2jelou ubagNo ratings yet

- CFAS Chapter 24 Problem 2Document1 pageCFAS Chapter 24 Problem 2jelou ubagNo ratings yet

- CFAS Chapter 32 Problem 2Document1 pageCFAS Chapter 32 Problem 2jelou ubagNo ratings yet

- CFAS Chapter 27 Problem 2Document1 pageCFAS Chapter 27 Problem 2jelou ubagNo ratings yet

- FAR Chapter 1 Problem 2Document1 pageFAR Chapter 1 Problem 2jelou ubagNo ratings yet

- Chapter 15 22Document1 pageChapter 15 22jelou ubagNo ratings yet

- Chapter 15 20Document1 pageChapter 15 20jelou ubagNo ratings yet

- FAR Chapter 3 Problem 4Document1 pageFAR Chapter 3 Problem 4jelou ubagNo ratings yet

- FAR Chapter 2 Problem 1Document1 pageFAR Chapter 2 Problem 1jelou ubagNo ratings yet

- FAR Chapter 3 Problem 2Document1 pageFAR Chapter 3 Problem 2jelou ubagNo ratings yet

- CFAS Chapter 32 Problem 1Document1 pageCFAS Chapter 32 Problem 1jelou ubagNo ratings yet

- FAR Chapter 3 Problem 1Document1 pageFAR Chapter 3 Problem 1jelou ubagNo ratings yet

- CFAS Chapter 22 Problem 2Document1 pageCFAS Chapter 22 Problem 2jelou ubagNo ratings yet

- CFAS Chapter 24 Problem 1Document1 pageCFAS Chapter 24 Problem 1jelou ubagNo ratings yet

- Chapter 15 18Document1 pageChapter 15 18jelou ubagNo ratings yet

- FAR Chapter 1 Problem 4Document1 pageFAR Chapter 1 Problem 4jelou ubagNo ratings yet

- CFAS Chapter 31 Problem 2Document1 pageCFAS Chapter 31 Problem 2jelou ubagNo ratings yet

- CFAS Chapter 27 Problem 1Document1 pageCFAS Chapter 27 Problem 1jelou ubagNo ratings yet

- CFAS Chapter 31 Problem 1Document1 pageCFAS Chapter 31 Problem 1jelou ubagNo ratings yet

- CFAS Chapter 30 Problem 2Document1 pageCFAS Chapter 30 Problem 2jelou ubagNo ratings yet

- CFAS Chapter 21 Problem 2Document1 pageCFAS Chapter 21 Problem 2jelou ubagNo ratings yet

- CFAS Chapter 25 Problem 1Document1 pageCFAS Chapter 25 Problem 1jelou ubagNo ratings yet

- FAR Chapter 2 Problem 2Document1 pageFAR Chapter 2 Problem 2jelou ubagNo ratings yet

- CFAS Chapter 29 Problem 2Document1 pageCFAS Chapter 29 Problem 2jelou ubagNo ratings yet

- CFAS Chapter 23 Problem 2Document1 pageCFAS Chapter 23 Problem 2jelou ubagNo ratings yet

- CFAS Chapter 29 Problem 1Document1 pageCFAS Chapter 29 Problem 1jelou ubagNo ratings yet

- The Importance of AccountingDocument3 pagesThe Importance of AccountingMathias MikeNo ratings yet

- BIWS Atlassian 3 Statement Model - VFDocument8 pagesBIWS Atlassian 3 Statement Model - VFJohnny BravoNo ratings yet

- Unit 5 PomDocument32 pagesUnit 5 PomDebasis BanerjeeNo ratings yet

- Business Startup Costs and FundingDocument9 pagesBusiness Startup Costs and Fundingنور روسلنNo ratings yet

- Final Accounts ProblemsDocument7 pagesFinal Accounts ProblemsTushar SahuNo ratings yet

- Dax PDFDocument64 pagesDax PDFpiyushNo ratings yet

- 12 - Iepf Div 2015 16 2 IntDocument136 pages12 - Iepf Div 2015 16 2 IntRimoNo ratings yet

- 2076 - Varias, Aizel Ann B - Module 1Document18 pages2076 - Varias, Aizel Ann B - Module 1Aizel Ann VariasNo ratings yet

- Fas 123r PDFDocument2 pagesFas 123r PDFLindsayNo ratings yet

- Suspense FA1 Practise Exercise To Students PDFDocument2 pagesSuspense FA1 Practise Exercise To Students PDFJannatul Ferdous Pontha100% (1)

- Amalda Aulia 1810533004 Int - AccountingDocument11 pagesAmalda Aulia 1810533004 Int - AccountingAmalda AuliaNo ratings yet

- ANSWER KEY ON PARTNERSHIP MOCK TESTxDocument6 pagesANSWER KEY ON PARTNERSHIP MOCK TESTxzhyrus macasilNo ratings yet

- NB Annual Report 2023Document72 pagesNB Annual Report 2023mad eye moodyNo ratings yet

- 42 Investors Awareness Towards Mutual FundsDocument8 pages42 Investors Awareness Towards Mutual FundsFathimaNo ratings yet

- Division of Danao City Ramon M. Duran Sr. Found. - Stec: (School)Document6 pagesDivision of Danao City Ramon M. Duran Sr. Found. - Stec: (School)John Michael GianNo ratings yet

- Assessing Organizational Performance and Setting Strategic PrioritiesDocument20 pagesAssessing Organizational Performance and Setting Strategic PrioritiesMilan MisraNo ratings yet

- PERCENTAGEDocument7 pagesPERCENTAGEPrakash KumarNo ratings yet

- POB Revision Questions 2Document6 pagesPOB Revision Questions 2Khalil Weir100% (1)

- Conceptual Framework Accounting Standards: Summary ofDocument5 pagesConceptual Framework Accounting Standards: Summary of버니 모지코No ratings yet

- Priority Payment: The Status For Payment 78735WQ007TU Is: Pending AuthorisationDocument3 pagesPriority Payment: The Status For Payment 78735WQ007TU Is: Pending AuthorisationShohag RaihanNo ratings yet

- Tax Invoice: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument2 pagesTax Invoice: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountManish YadavNo ratings yet

- Sucheta Dalal on Corruption & Friction Hindering Crypto & Ease of Doing Business in IndiaDocument68 pagesSucheta Dalal on Corruption & Friction Hindering Crypto & Ease of Doing Business in IndiapramodkrishnaNo ratings yet

- BB 3 Futures & Options Hull Chap 3Document31 pagesBB 3 Futures & Options Hull Chap 3winfldNo ratings yet

- F9 RM QuestionsDocument14 pagesF9 RM QuestionsImranRazaBozdar0% (1)

- Solid Q 50 KW InvoiceDocument1 pageSolid Q 50 KW InvoiceTrisha RawatNo ratings yet

- Withholding Tax Remittance Return: Kawanihan NG Rentas InternasDocument4 pagesWithholding Tax Remittance Return: Kawanihan NG Rentas InternasMHILET BasanNo ratings yet

- Application Form Account Opening UBIDocument4 pagesApplication Form Account Opening UBIDba ApsuNo ratings yet

- Electronic Banking: Bahaa Abas Noor Abo HanDocument23 pagesElectronic Banking: Bahaa Abas Noor Abo HanBishyer AmitNo ratings yet

- Top 6 Asset Management Companies in India - Dr.R.Ayyamperumal - PPSXDocument23 pagesTop 6 Asset Management Companies in India - Dr.R.Ayyamperumal - PPSXayyamperumalrNo ratings yet

- Next Ias EconomyDocument41 pagesNext Ias EconomyChinmay JenaNo ratings yet