Professional Documents

Culture Documents

Valuation Report CooperFinTech

Valuation Report CooperFinTech

Uploaded by

sia kamath0 ratings0% found this document useful (0 votes)

10 views17 pagesOriginal Title

Valuation-Report-CooperFinTech

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views17 pagesValuation Report CooperFinTech

Valuation Report CooperFinTech

Uploaded by

sia kamathCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 17

B.Chhawchharia & Co. Jor sz our rowers uso ossruct cent, uSOUA NEW DUH 10028, INO

Chartered Accountants TELEFAX (71-11) 41081004 ® E-MAIL: delhi@becocoin

The Board of Directors

S Chand and Company Limited

A-27, Mohan Co-operative Industrial Estate

‘New Delhi - 110 044

Dear Sir(s),

Sub: Report on valuation of shares and recommendation of share exchange

1. Our Engagement

We, B.Chhawchharia & Co, Chartered Accountants, have been mandated by the

management of $ Chand and Company Limited (hereinafter referred as “S Chand” or “the

Company”) to determine the fair value per equity share as per the Internationally Accepted

Valuation Principles as on the valuation date ie, 31% March, 2017 and to recommend the

share exchange ratio for the following companies

a) S Chand and Company Limited (*$ Chand”)

b) Blackie & Son (Calcutta) Private Limited (“BSPL”)

c) Nitja Publishers and Printers Private Limited (“NPPL”)

d) DS Digital Private Limited (“DDPL”) — Education Business and Full Business

) Safari Digital Education Services Private Limited (“SDPL”) — Education Business and

Full Business

2. Purpose of this report

2.1 We have been given to understand that S Chand is proposing to restructure the Group by

way of a Composite Scheme of Arrangement w.c.f. 1* April, 2017, wherein:

a) BSPL and NPPL shall be amalgamated with $ Chand

b) Education Businesses of DDPL and SDPL shall be demerged into S Chand on a going

concern basis

c) DDPL post demerger of its education business shall be amalgamated with SDPL

2.2 The valuations have been carried out for the purposes of determination of relative fair

value per share of the abovementioned companies as on 31" March, 2017 pursuant to the

proposed Composite Scheme of Arrangement under the Companies Act, 2013 and subject,

to SEBI regulations.

KOLKATA | NEWDELHI | NAGPUR

2.3 The report also recommends the share exchange ratio based upon the relative fair values

of the companies in respect of the shares to be issued as consideration under the proposed

‘Composite Scheme of Arrangement.

- About the companies

3.1 S Chand is a public limited company incorporated under the provisions of the Companies

Act, 1956 and having its registered office situated in the State of Delhi. S Chand is

engaged in the business of publishing of educational books with products ranging fiom

school books, higher academic books, competition and references books, technical and

professional books and children books. Equity shares of $ Chand are listed on Bombay

Stock Exchange and National Stock Exchange.

3.2 BSPL is a private limited company incorporated under the provisions of the Companies

Act, 1956 and having its registered office situated in the State of Delhi. BSPL is earning

its revenue from royalty income and is a wholly owned subsidiary of S Chand.

3.3 NPPL is a private limited company incorporated under the provisions of the Companies

Act, 1956 and having its registered office situated in the State of Delhi. NPPL is engaged

in the business of manufacturing paper and paper products, publishing, printing and

reproduction of recorded media and is a wholly owned subsidiary of S Chand,

3.4 DDPL is a private limited company incorporated under the provisions of the Companies

Act, 1956 and having its registered office situated in the State of Delhi. DDPL is engaged

in the business of providing digital educational services and is a subsidiary company of S

Chand.

3.5 SDPL is a private limited company incorporated under the provisions of the Companies

Act, 1956 and having its registered office situated in the State of Delhi. SDPL is engaged

in the business of rendering digital education. S Chand and NPPL are holding 60% and

40% of the share capital of SDPL and accordingly, SDPL is an indirect wholly owned

subsidiary of S Chand.

. Information and documents relied upon

4.1 For the purpose of this valuation report, we have relied upon the following information

and documents made available to us by S Chand

a) Presentation on the proposed restructuring

b) Draft Composite Scheme of Arrangement

©) Copies of Audited Financial Statements for the years ended 31" March, 2016 and 31*

March, 2017 of all the companies

4) Division wise financial statements of DDPL and SDPL as on 31% Mareh, 2017

e) Projected Financial statements for next 5 years (FY 2017-18 to FY 2021-22)

f) Such other information and explanations as was required and which have been

provided by the representatives of S Chand

4.2 For our analysis and independent checks, we have relied on published and secondary

sources of data available in the public domain and which can be generally relied upon.

Valuation Methodology

S.1.As per the Intemationally Accepted Valuation Pri

les, any of the following

methodologies for valuation of equity shares may be used depending upon the company

dynamics:

a) Income Approach

* Discounted Free Cash Flow Method

© Profit Eaming Capacity Value Method

b) Market Approach

© Market Price Method

* Comparable Multiple Method

c) Assets based Approach

© Net Assets Value Method. Under this method, the value of the assets can be taken

at book value or it may be taken at fair values.

5.2 The fair value of equity shares have to be determined using a particular method or a

weighted average of combination of methods after taking into consideration all the

factors and the valuation principles mentioned above.

5.3 In the given context, after considering all the factors and the fact that the majority of the

companies are unlisted and are subsidiaries of the Transferee Company and that the

projections of future cash flows of the companies are reasonably achievable, we are of

the view that it is appropriate to determine the fair value of the shares by considering a

weighted average of Discounted Cash Flow Method (“DCF Method”) and Net Assets

Value Method (“NAV Method”.

5.4 DCF Method

a) Under DCF approach, the future free cash flows of the companyidivision are

discounted to the valuation date to arrive at the present value of the cash flows of the

business or capitalized using a discount rate depending on the capital structure of the

company. This approach also takes into account the value of the business in

perpetuity by the calculation of the terminal value using the perpetuity growth

method.

b) The mechanism involved to calculate the fair value per equity share under this

method is enumerated below:

+ The profit after taxes for future years are adjusted for non-cash items, changes in

working capital, deployment of funds in fixed assets, changes in borrowings, ete.

to arrive at the free cash flows available with the business for its shareholders.

© The cash flows are then discounted using a discount rate determined using the

Capital Asset Pricing Mechanism.

© The present value of the terminal value of the business is calculated assuming a

perpetual growth rate and discounting the same using the discount rate used

above.

‘© The total value available for the shareholders reflect the value of the business

which is divided by the total number of equity shares to arrive at the value per

share

5.5 NAV Method

a) Under NAV method, the fair value per equity share is determined based on the net

assets of the company/division available to the equity shareholders. The same can be

calculated either using the book values or the market value of the assets and

liabilities. Keeping in mind the nature of the business and the purpose of valuation,

we have used the book value to determine the fair value per share under this method.

b) The mechanism involved to calculate the fair value per equity share under this

method is enumerated below:

‘© The net assets of the business are computed as on the valuation date by deducting

from the total assets the value of the total liabilities.

© The net asset value is then divided by the total number of equity shares to arrive at

the value per share.

5.6 The fair value per share derived under DCF method and under NAV method is given

suitable weights based on various factors and nature of the business and accordingly, fair

value per share on the valuation date has been arrived for.

6. Valuation Analysis

6.1 We have assigned a weight of 3 to the fair value determined using the DCF method and a

weight of 1 to the fair value determined using the NAV method to arrive at the value per

date.

equity share as on the valuati

6.2 For the purposes of determination of fair value per share under DCF method, following

assumptions and calculations have been used:

# Discount Factor i.e. Cost of equity has been determined by applying the Capital Asset

Pricing Model (CAPM) which is expressed as follows:

Ke=RF+B(Rm- RA), where

Ke =Cost of equity

R&™= Risk free rate of return, taken at 7%

B = Beta, a measure of risk associated with the company, taken at 1.2

Rm = Return on market, taken at 13%

‘Thus, Ke has been determined at 14% using the above formula.

© The terminal values have been determined using a terminal growth rate of 11% for S

Chand and 7% for other companies.

6.2 The fair value per share as on 31% March, 2017 for various companies are summarized in

the following table:

‘Name of the company ‘Annexure | Face Value per | Fair Value per

reference share (Rs.) share (Rs.)

$ Chand and Company T 5 650.00

Limited

Blackie & Son (Calcutta) 0 1000 384680.00

Private Limited

Nirja Publishers and Printers I 10 7048.00

Private Limited

DS Digital Private Limited — Vv 10 114

Education Business

DS Digital Private Limited — ¥ 10 11.98

Full Business F

Safari Digital Education VI 10 828

Services Private Limited —

Education Business

Safari Digital Education Vit 10 15.40

Services Private Limited —

Full Business.

7. Share exchange ratio

7.1 The share exchange ratios have been recommended based on the relative fair values of

the shares determined above.

7.2 Since BSPL and NPPL are wholly owned subsidiaries of S Chand, no shares shall be

issued by S Chand upon amalgamation of both the companies with the company.

7.3 Since the shares of SDPL are held by S Chand and NPPL (which is getting amalgamated

with § Chand under the Composite Scheme of Arrangement), no shares shall be issued by

'S Chand upon demerger of Education Business of SDPL into the company.

7.4 Upon the demerger of Education Business of DDPL into $ Chand, 1 (One) equity share

of Rs, 5 each fully paid up of $ Chand should be allotted to the shareholders of DDPL in

lieu of 117 (One Hundred Seventeen) equity shares of Rs.10 each fully paid up of DDPL,

computed as follows:

Rs. 5 each as on 31.03.2017

(Rs.)

'S Chand DDPL — Education

Business

Face value per share (Rs.)__| 5 10

Value per equity share of | 650 5.57 (11.142)

Exchange ratio

| 116.70

‘Exchange ratio (rounded off)

117

7.5 Upon the amalgamation of DDPL into SDPL post demerger of education businesses into

S Chand,

a) 2 (Two) equity shares of Rs. 10 each fully paid up of SDPL should be allotted to the

equity shareholders of DDPL in liew of 17 (Seventeen) equity shares of Rs.10 each

fully paid up of DDPL; and

b) 2 (Two) preference shares of Rs. 10 each fully paid up of SDPL should be allotted to

the preference shareholders of DDPL in lieu of 17 (Seventeen) preference shares of

Rs.10 each fully paid up of DDPL,

SDPL DDPL Ec

Value per share as on| 15.40 11.98

31.03.2017 (Rs.)

Less: Value per share of the | 8.28 1114

demenged undertakin;

Value per share _ post | 7.12 0.84

demerger (Rs.)

Exchange ratio 2 16.95

Exchange ratio (Founded off) [2 7

Since the preference shares are convertible into equity in the ratio of 1:1, the same has been

treated at par with equity shares for the above computation.

8 Scope Limitation

This valuation is subject to the scope of our engagement and assumptions, exclusions,

limitations and disclaimers as below:

a) The valuation report is based on the information and documents provided to us and

representations made by the representatives of the company. We have not audited or

reviewed any data or projections provided to us. Accordingly, we do not assume any

responsibility for any error(s) in the information furnished to us.

b) By its very nature, valuation work cannot be regarded as an exact science and the

conclusions arrived at in many cases will be subjective and dependent on the exercise of

individual judgement.

©) This valuation report has been prepared solely for the purposes stated herein and should

not be relied upon for any other purpose. This document is strictly confidential and, save

to the extent required by applicable law and/or regulations, must not be released to any

third party without our express written consent which is at our sole discretion,

For B.Chhawehharia & Co.

Chartered Accountants

Firm Registration No. 305123E

Ques

Abhishek Gupta

Partner

Membership No. 529082

Date: 14 November, 2017

Place : New Delhi

‘VALUATION OF EQUITY SHARES OF MS $ CHAND AND COMPANY LIMITED

‘Table 1: Valuation as per DCF Method

Annexure [

(Amount Rs in milons)

ate per equity share (in Rs)

7

“Table 3: Weighted Average Value of Share

eae Wale Pas Share

[Paice a

Nal as per DCF Mestod (Table 1) i

[Value as por NAV Method (Table2) aly

Tou

Value Per Share (Rs)

650.

[particulars 2017 2018, amy 2020 2m 2022

INetProfit After Taxation 582.06 92166 1,190.50 Lams L767 2,149.43

Depreciation & her no eas tems 330.06 36048 37599 952 ai203 432.98

|ctangss in Working Capital min 369.87 318.84 301.33 88028-1004.

Audition w Fixed Assets 1.70660 472396 40529 8528 33028 345.29)

ocrase in Share capital 3138.90 :

ncras(Deceae) in baronies Lon6st 2800.86 25960 198.88 19887 -tst.s|

|Net Cash Flow Available for disuibtion 4995107734 553.06 8717 psa7 4.09087

iscoun Factor (Retum on Eguiy) 10% 10% 1% 10% 0% sas

[presen Value (PV) 409 95 943.38 42407 59030 49757 561.46

|cumulaive Present Vai Primary Period 3,396.73

Present ele of Terminal vale 1948.76,

[Tat Present Vaive nanas

Jad: Long Term tvestmens as on 3st Marc, 2017 was

|Add Cash and cash equivalent son 3st March, 2017 31541

Emerpise vale 23,690.35

fo or stares 29.88

[Vatu per Eauity Share Rs) 4

‘Table 2: Valuation a per NAV Meth

Parcs ‘Amount cnn

[rat Vatuc of Assets Hues

Less: Libties e73298

ver Assets Value nasi

Wo. of Shares 2084

Annexure IL

VALUATION OF EQUITY SHARES OF M/S BLACKIE AND SONS (CALCUTTA) PRIVATE LIMITED.

‘Table 1: Valuation as per DCF Method sin Lac)

aa 2017 201k 2019 2020 2m 202)

eecissei than} Aine timation 134 1935 2508 22804] «3SOT

Depreciation & other non cash items 395 109 - 7 7 7

(esse wasting Cooma os 2565 2070 ass anss 1a

Net Cash Fow availble for istibation 465 52 230 an 339

biscoun Factor (Return on Equity) lass a lay Ma Mam 14

Npseent Va (PV) 1465 467 7 183 18s 186

|cumutaive Present Value nn29

Present valu of Terminal value 4078

[rua Presene Value e607

[Ac Cash and cash equivalents sen 31st March, 2017 1930

|Add: Long Ter vestments as.on 31st Mach, 2017, 453.4

Emerprise Value 538 92

catenin of vale per sare

lEmerprise Value Rs.) 538.91,685

No of Shares 1

Value ner Equity Share (Rs) 361.659

2 “Tinount (Rain Lae

rota Vatue of Assets os4o1

Less Liabilities 896

Net Assets Value 67398

calculation of value per share

Net Assets Value Rs.) 675,94245,

No.of Shares 199

Valve pe equity share in Rs.) 451655

ble 2: Valuation as per NAV Method

“Table 3: Weighted Average Value of Share

‘VahePa Shae Wasnt Amount

Pamicuar @

[Value as per DCF Method (Table 1) 361,689 3 1085067

Value as per NAV Method (Table 2) 453.653 453653,

Twat 1538.70

Vatu Pershare Rs) 388.680

a

eR

VALUATION OF EQUITY SHARES OF MIS NIRJA PUBLISHERS & PRINTERS PRIVATE LIMITED

Annexure I

“Table 1: Valuation as per DCF Method (isin Les)

a 2017 2018 2019 2020) 2021 202)

[Nec Profe/(Loss) Aer Taxation 3857058039, 69621 169.76 91677 108071

Depecaton & other nom cash ters 3468 cos e594 eras 9535 ost

\ceanges in Working Capital yaa 8 15600-24883 279.71 2265

|nadtdoerSao of Feed Ames 500.0 $0.00 -$0.00 70.00 so

beresetacrv Deroy 4m 0069 7000-10000 «130.00

celeritete 317392871 489.00 438 48240 mass

(oiscount Factor (Retr on Equity) 14% 1a 14% 14% 1% Pa

[esset ss CV) 3173937606 37627 29859 28562 40191

(cumulative Present Value 208584

Presont value of Teri value ss0072

[rxt Present Vale 797656

[Ade Cash and cash equivalents son SIst March, 2017 203

|Add: Lone Term tvestnents 25 on 31s March, 2017 2.06592

erpise Value 1.044 32

(calculation of vase per share

leterprise Vale (Rs) 1004451,719

INorshares

[Va per Equity Share (Rs)

‘Table 2: Valuation as per NAV Method

Paouaes

[rol Vale of Assess

Less: Lables

Net Asses Vale

[caution of valve per share

et assets Valve (Rs)

Io. of Shares

ae pe equity share (in Rs)

‘Amount Rn Lass)

751697

66735

4.02

osi9.02.04

12000

57.080

Valu as per DCF Method (Table 1)

[Valu as per NAW Method (Table2)

frou

Value Per Share (Rs.)

83,708

$7080

3

“Amat

251113

s70%0

4 308,198,

rue

‘Annexure IV

VALUATION OF EQUITY SHARES OF MIS DS DIGITAL PRIVATE LIMITED. EDUCATION BUSINESS,

“Tabie |: Valuation 2 per DCF Method Rs. In Mons)

rola iT aie me at a 72033

ae a 1 Ts 35 Ta

INetPrott (Loss) Aer Texation

740 1012 193.22 16090 9.04

Depreiton& oer non cash ites sss : a

anreatey Decrease in Working Cepia aedanetastan bs fe -

(addiion oy Salen of Fixed Assets Ele Beet ao sas

nio00 13000 25.00 7 is i

ncreaseKDecrease in Capital)

ncreaseKDecrease in Borrowings) 207 e006 1968 ne

et CanhFow avaiable or distin 02 199 881 10 4935 srs

biscount Fair (Reta on Ein 1 1% 14 1% as

Presa Value) 21925-6119, or au

[cumstie Preset Value Primary Period 10492.

Jresert sala ofTeminal ave e209

frost Preset Value m0

[ada Cash Cash Equivalents o ist Nach, 2017 520

frre vue rent

JNotShares $699

[aoe per Equity Share (Rs) 175

‘able 2: Valuation as pee NAV Method

ails ino (Ri Mion

Total Value of Asets ‘eit

less isis

Ine Ass Valve tas.s8

Iso of Shares 80

[value pr equi sare (in Rs) EEE aa

“Table 3: Weighed Average Value of Share

|Valve 2s per DCF Method (Table 1) — 3 4125

|Value as per NAV Method (Table 2) - 1 331

[vse Per Shares)

VALUATION OF EQUITY SHARES OF MS DS DIGEFAL PRIVATE LIMITED. FULL BUSINESS

“Tabet: Valuation as per DCF Method

Annexure V

fParueuaes mT ame m9 a0

Na Pi coat) AN ni “78 3350 “449 mas a5 7435]

erection & ether no eas items srs yo. 10320 95, 162.90 19104

nreaseyDecrese in Working Capit saz sue 99 : “gs an

| adsiton oySales of Fixed Assets : amas 203.99 180.00 73.50 sss.

ncreaselDereas in Capita) Mom 130002500

ncrease(Decresse in horrowins)-neuding ESC zs 201 008 4100 1998 m8

|sst Cash Flow avaible fr dsrbation 13831 map 120 00s sms

bisount Factor Metunon Equity) 196 196 1 1 Aas 1a

Preset Value) 13831 sss 90s oss asst 2507

[cumnisive Present alte Primary Pein’ 10.27

set val of Terminal vue 0990

[otal Preset Value ss07

| ad: Cash& Cash Equivalents as on st March, 2017 610

Emeriss value ssut7

No of Sars 5089

[vale per Equity Share (Rs) 1.08

‘Table 2: Valustion at pee NAV Method.

Paniclars “Aunt in Mons)

[rol Vatu of assets ae:

Les: Lables oo

Inet Ase Valve 15199

Ivo ot Shares 5089

vate pr equi sare (i Ra) 2st

“Table 3: Weighted Average Valo of Share

fsricuar Vale Pests Weight Amount

vale a per DCF Method (Tale 1) aa 3 452

[Valu as per NAV Method (Table 2) oa 26

[rot 4 97

[va Per Shares)

Annexure VI

‘VALUATION OF EQUITY SHARES OF MIS SAFARI DIGITAL EDUCATION SERVICES PVT. LTD. - EDUCATION BUSINESS

(moet Rs in millions)

a7 Sis a PE

he Pot/tn) AtrTatoe “am ana aaao 270 osm

Decanter ash items pr a0 nm a0

changes Working Capit aim am 30 re

(nsston wvSabs rite Ase : sos 220 2.10 i

en com 3500 : . :

nase Decrease in borowing som 1000 moa 20m somo

Net Cash lw nate dion moma a0 ssa ss29

[iccun Factor Rew on au 1 1s vs

sen Vaue a7 st u18 088

cununiePset Ye ry Paso 50

Pose ae of Tera ae 4520

Entei Vate 479

ors an

apr Ey Sane)

‘ahe 1: Vatation apo WAY Meta

7 aa iol

raat ve of se peat

es ihies ie

et ses Ya cea

ovo ws

apr eis Gn) 332

“ae hed Average Vale of Sure

arcu TR whem

| Value as per DCF Method (Table 1) ad 3 3345,

| Value as per NAV Method (Table 2) 032 0.32

rt 4

haere sae) 2s

Annexure VIL

‘VALUATION OF EQUITY SHARES OF MS SAFARI DIGITAL EDUCATION SERVICES PVT. LTD. - FULL BUSINESS.

“Table 1: Valuation a per DCF Method.

(Amon Rs. a millons)

icwars Bi wie a9 2 zo 013]

Ne Profi (Las) Air Taxation 32.48 sor 4951 480 1559 16691

Depreciation & other noa cash tems 429 870 170 nao 90 70

[changes in Working Capital 12139 43053877 6.46 7654 90.53]

(Addition tySates of Fixed Assets 7 3080 220 2.10 : -

Increase in share capil : 90.00 65.00 25.00 2500 1000]

Increase Decrease) in boowings 7 50.00 1000 2000, 20.00 000

[Net Cash Fw avaiable for dstrbuton 149.8 24 378 6x6 5675 Be

Discount Factor (Return on Equity 16% as ase ay ase a4

Present Value (PV) 149.78 1860 290 4m, 3337 2527

[curative Present Value Pinar Period on

Present value of Terminal vale 375.56

Foal Proton Vale 29585

[ad Cash and cash quivalents as on 31s March 2017 262

[Ad Long Term Investment 8 on 3st March, 2017 $85.06

leaerrise Value 7413

{No of Shares 437

[vaive per Equity Share (Rs) 1161

‘Tale 2: Valuation as per NAV Meshod

mii ‘nani sail)

Foal Valve of asses a

Less: Listes aan

Net Assets Vale saxion

No.of Shares 437

[vai per eat shar in Rs) 356

‘Table 3: Weighted Average Value of Share

"Val Per Share

foul Weight Amount

Psu in et

|Valueas yer DCF Method (Table 1) 7 3 sa

Value as por NAV Method (Table 2) bial 856

frat 4 uss

[Value Per Share (Rs) 1540

» B.Chhawchharia & Co. (51 22, tovers, uso osrect NRE, SOLA NEW OEL-110025, NDIA

Chartered Accountants TRLPAC 91-1) 4081004 # EMAL: di@bea con

‘The Board of Directors

S Chand and Company Limited

A-27, Mohan Co-operative Industrial Estate

New Delhi - 110 044

Dear Sir(s),

Sub: Computation of Fair Share Exchange Ratio in continuation of our earlier report dated 14"

November, 2017

1. Our Engagement

We, B.Chhawchbaria & Co., Chartered Accountants, have been mandated by the

management of $ Chand and Company Limited (hereinafter referred as “S Chand” or “the

Company”) to determine the fair value per equity share as per the Intemationally Accepted

Valuation Principles as on the valuation date ie. 31" March, 2017 and to recommend the

share exchange ratio for the following companies

a) $ Chand and Company Limited (“S Chand”)

b) Blackie & Son (Calcutta) Private Limited (“BSPL”)

©) Nirja Publishers and Printers Private Limited (“NPPL”)

@ DS Digital Private Limited (“DDPL”) — Education Business and Full Business

¢) Safari Digital Education Services Private Limited (“SDPL”) ~ Education Business and

Full Business

2. Computation of Fair Share Exchange Ratio

2.1 The share exchange ratios have been recommended based on the relative fair values of

the shares,

2.2 Since BSPL and NPPL are wholly owned subsidiaries of $ Chand, no shares shall be

issued by S Chand upon amalgamation of both the companies with the company,

2.3 Since the shares of SDPL are held.by § Chand and NPPL (which is getting amalgamated

with $ Chand under the Composite Scheme of Arrangement), no shares shall be issued by

S Chand upon demerger of Education Business of SDPL into the company.

KOLKATA | NEWDELHI | NAGPUR

2.4 Upon the demerger of Education Business of DDPL into $ Chand,

Valuation Approach |S Chand and Company | DS Digital Pvt. Ltd. — Education

Lid. _| Business

Value per) Weight | Value per | Weight

share having share having

face value face value

Rs.5 each (Rs.) |Rs.10 each

| Rs.) HaHa

‘Asset Approach 217 i 3.31 L

Income Approach __| 794 3 13.75 3

Market Approach | - = 2 :

Relative Value per | 650 11.14 |

Share Hee |

Exchange Ratio (rounded off) Lily [

RATIO:

1 (One) equity share of $ Chand and Company Ltd. of Rs.5 each fully paid up for every

117 (One Hundred Seventeen) equity shares of DS Digital Pvt, Ltd. of Rs.10 each fully

paid up

2.5 Upon the amalgamation of DDPL into SDPL post demerger of education businesses into

S Chand,

| Valuation Approach | Safari Digital Education |DS Digital Pvi. Ltd. (post |

Services Pvt. Ltd. (post | demerger)

demerger) Ha EEE

Value per | Weight | Value per | Weight

share having share having

face value face value

Rs.10 each |Rs.10 each

(Rs) Rs)

‘Asset Approach 8.88 a (0.64) 1

Income Approach__| 6.52 3 [1.33 3

Market Approach _| - > -

Relative Value per | 7.12 0.84

|Share _ 7

Exchange Ratio (rounded off) 217

RATIO:

a) 2 (Two) equity shares of Safari Digital Education Services Pvt. Ltd. of Rs.10 each

fully paid up for every 17 (Seventeen) equity shares of DS Digital Pvt. Ltd. of Rs.10

each fully paid up

b) 2 (Two) preference shares of Safari Digital Education Services Pvt. Ltd. of Rs.10

each fully paid up for every 17 (Seventeen) preference shares of DS Digital Pvt. Lid

of Rs.10 each fully paid up

3. Scope Limitation

This valuation is subject to the scope of our engagement and assumptions, exclusions,

limitations and disclaimers as below:

a) The valuation report is based on the information and documents provided to us and

representations made by the representatives of the company. We have not audited or

reviewed any data or projections provided to us. Accordingly, we do not assume any

responsibility for any error(s) in the information furnished to us.

b) By its very nature, valuation work cannot be regarded as an exact science and the

conclusions arrived at in many cases will be subjective and dependent on the exercise of

individual judgement.

¢) This valuation report has been prepared solely for the purposes stated herein and should

not be relied upon for any other purpose, This document is strictly confidential and, save

to the extent required by applicable law and/or regulations, must not be released to any

third party without our express written consent which is at our sole discretion.

For B.Chhawchharia & Co.

Chartered Accountants

Firm Registration No. 305123E.

Qu.pe.

Abhishek Gupta

Partner

Membership No. 529082

Date : 19" January, 2018

Place : New Delhi

You might also like

- Auditors Report FY 2020 21Q3Document15 pagesAuditors Report FY 2020 21Q3sia kamathNo ratings yet

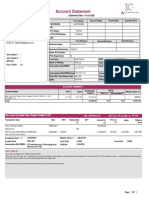

- Account StatementDocument2 pagesAccount Statementsia kamathNo ratings yet

- Account StatementDocument3 pagesAccount Statementsia kamathNo ratings yet

- Account StatementDocument2 pagesAccount Statementsia kamathNo ratings yet

- Account StatementDocument3 pagesAccount Statementsia kamathNo ratings yet

- Account Statement: Savita Shivagouda PatilDocument3 pagesAccount Statement: Savita Shivagouda Patilsia kamathNo ratings yet

- Account Statement: Shivagouda Shidagouda PatilDocument2 pagesAccount Statement: Shivagouda Shidagouda Patilsia kamathNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)