Professional Documents

Culture Documents

MCQ Financial Accounting

Uploaded by

Abhishek Bhandare0 ratings0% found this document useful (0 votes)

27 views2 pagesOriginal Title

Mcq Financial Accounting

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views2 pagesMCQ Financial Accounting

Uploaded by

Abhishek BhandareCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

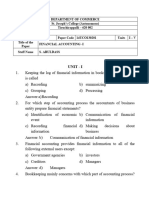

TribhuvanUniversity

Faculty of Humanities & Social Sciences

OFFICE OF THE DEAN

2018

Bachelor in Computer Applications Full Marks: 60

Course Title:Financial Accounting Pass Marks: 24

Code No:CAAC 152 Time: 3 hours

Semester: II

Centre: Symbol No:

Candidates are required to answer the questions in their own words as far as possible.

Group A

Attempt all the questions. [101 = 10]

Circle (O) the correct answer.

1. In accounting, the terms debit and credit indicates

a) Increase & Decrease b) Left & Right

c) Expenses & incomes d) Assets & Liabilities

2. Resources invested by the owner refers to;

a) Assets b) Liabilities c) Revenue d) Capital

3. Process of entering transaction into the journal is called;

a) Posting b) balancing c) Journalizing d) None of above

4. In accounting, the terms ‘Nominal accounts' indicates

a) Increase & Decrease b) Left & Right

c) Expenses & incomes d) Assets & Liabilities

5. The reason of depreciation is;

a) Loss on sale b) Discount c) Purchase d) Accident

6. Wages paid for installation of machinery refers to;

a) Capital expenditure b) Revenue expenditure

c) Revenue receipts d) Capital receipts

7. A fiim purchased machinery for Rs. 22000 having life 3 years. The estimated value at

end Rs. 1000. What is the amount of depreciation under SLM?

a) 6000 b) 7000 c) 9000 d) 5000

8. Who prepared the cash book?

a) Teacher b) Business man

c) Accountant of the business d) Employee of the bank

9. The maximum number of share of company as indicated;

a) Issued Capital b) Authorized Capital

c) Paid up Capital d) Called up Capital

10. Which transaction are not recorded in purchase book?

a) Purchased goods from City Shopping Centre.

b) Purchased goods from New Road Shopping Centre.

c) Purchased goods from Astha Departmental Stores on credit;

d) Purchased office computer for Rs. 35000 from Micro net Solution.

You might also like

- No.1 For CA/CWA & MEC/CEC: Master MindsDocument8 pagesNo.1 For CA/CWA & MEC/CEC: Master MindsBadri AthreyasNo ratings yet

- Class XI Accounting Model Paper 2021-22Document10 pagesClass XI Accounting Model Paper 2021-22Taha KHILARINo ratings yet

- 14UCO130201Document29 pages14UCO130201Fawaz FazilNo ratings yet

- Eco MCQDocument9 pagesEco MCQthis.is.goldensnowflakesNo ratings yet

- 11 Accountancy SP 01Document33 pages11 Accountancy SP 01Haridas OngallurNo ratings yet

- Financial Accounting Fundamentals QuizDocument12 pagesFinancial Accounting Fundamentals Quiztouria100% (1)

- Accounting PaperDocument4 pagesAccounting PaperMaryam TanveerNo ratings yet

- ACCT1A Sample Exam 3 TitleDocument15 pagesACCT1A Sample Exam 3 TitleBenson WencenslausNo ratings yet

- 22-23 X2 S4 BAFS P2A MC ExplanationsDocument6 pages22-23 X2 S4 BAFS P2A MC Explanationss191056No ratings yet

- HKUGA CollegeDocument8 pagesHKUGA Colleges191056No ratings yet

- Fundamentals of Accountancy, Business & Management 1 Third Grading ExaminationDocument6 pagesFundamentals of Accountancy, Business & Management 1 Third Grading ExaminationMc Clent CervantesNo ratings yet

- Sample Quiz Question 3Document7 pagesSample Quiz Question 3Sonam Dema DorjiNo ratings yet

- CPT June 2010Document15 pagesCPT June 2010poiooio101No ratings yet

- Final Exam - Introduction To Accounting Set 1 - QuestionsDocument7 pagesFinal Exam - Introduction To Accounting Set 1 - Questionsrizman AimanNo ratings yet

- 11th Accountancy DraftDocument8 pages11th Accountancy Draftmohit pandeyNo ratings yet

- 11th Accountancy EM Half Yearly Exam 2023 Question Paper Virudhunagar District English Medium PDF DownloadDocument4 pages11th Accountancy EM Half Yearly Exam 2023 Question Paper Virudhunagar District English Medium PDF DownloadDr.ManogaranNo ratings yet

- The Bhawanipur Education Society College Department of CommerceDocument3 pagesThe Bhawanipur Education Society College Department of CommerceAyush PathakNo ratings yet

- Financial Accounting - MCQ'S For PracticeDocument8 pagesFinancial Accounting - MCQ'S For Practiceprathampawar5912No ratings yet

- COMSATS Accounting Exam ReviewDocument14 pagesCOMSATS Accounting Exam ReviewFami FamzNo ratings yet

- TCA 1 Questions ACDocument9 pagesTCA 1 Questions ACCristian MazurNo ratings yet

- Accounting I Exam 1Document17 pagesAccounting I Exam 1Sapna SharmaNo ratings yet

- CPT PaperDocument4 pagesCPT Paperpsawant77No ratings yet

- Accounts: Common Proficiency Test - CPT Innova Sample PaperDocument19 pagesAccounts: Common Proficiency Test - CPT Innova Sample PapercptinnovaNo ratings yet

- Kerala +1 Accountancy Focus Area Question Bank - Introduction To AccountingDocument6 pagesKerala +1 Accountancy Focus Area Question Bank - Introduction To AccountinghadiyxxNo ratings yet

- S.S. Mota Singh Sr. Sec Model School, Janakpuri Class Xi Accountancy First Term Exam 2021-22 Maximum Marks: 40 Time Allowed: 90 Minutes General InstructionsDocument10 pagesS.S. Mota Singh Sr. Sec Model School, Janakpuri Class Xi Accountancy First Term Exam 2021-22 Maximum Marks: 40 Time Allowed: 90 Minutes General InstructionsSatish agggarwalNo ratings yet

- Babesa Higher Scondary School: Trial Examination, 2021 Accountancy Writing Time: 3 Hours Class: XII Full Marks: 100Document22 pagesBabesa Higher Scondary School: Trial Examination, 2021 Accountancy Writing Time: 3 Hours Class: XII Full Marks: 100Kuenga GeltshenNo ratings yet

- Accountancy Class 11 Most Important Sample Paper 2023-2024Document12 pagesAccountancy Class 11 Most Important Sample Paper 2023-2024Hardik ChhabraNo ratings yet

- Basic Accounting ExamDocument8 pagesBasic Accounting ExamJollibee JollibeeeNo ratings yet

- Accounting MCQs With AnswersDocument77 pagesAccounting MCQs With AnswersAbhijeet AnandNo ratings yet

- Samara UN Model Exam AcfnDocument49 pagesSamara UN Model Exam AcfnTesfu HettoNo ratings yet

- CA CPT Exam December 2012Document24 pagesCA CPT Exam December 2012Tushar BhattacharyyaNo ratings yet

- CIIT Accounting Terminal PaperDocument9 pagesCIIT Accounting Terminal PaperFami FamzNo ratings yet

- MCQ - BasicDocument22 pagesMCQ - BasicLalitNo ratings yet

- Accounting I Exam 3Document19 pagesAccounting I Exam 3Sapna SharmaNo ratings yet

- Bcom I Fa 103 MCQSDocument11 pagesBcom I Fa 103 MCQSTushar GuptaNo ratings yet

- Examination Paper: Instruction To CandidatesDocument11 pagesExamination Paper: Instruction To CandidatesNikesh MunankarmiNo ratings yet

- Accounting and Auditing MCQs Part-1 by Alisha Mahajan PDFDocument58 pagesAccounting and Auditing MCQs Part-1 by Alisha Mahajan PDFJamodvipulNo ratings yet

- ADBM – Full Time Financial Accounting Multiple Choice QuestionsDocument8 pagesADBM – Full Time Financial Accounting Multiple Choice QuestionsAshika JayaweeraNo ratings yet

- 11 Accountancy SP 01Document33 pages11 Accountancy SP 01Abhay ChoudharyNo ratings yet

- MCQ AfmDocument6 pagesMCQ AfmHaripriya VNo ratings yet

- Prudence Final ExamDocument5 pagesPrudence Final ExamBhumi NavtiaNo ratings yet

- ABM 2 Exam 2 v1 2023 StudentDocument10 pagesABM 2 Exam 2 v1 2023 StudentdwacindyfjNo ratings yet

- MCQ FA (UNIT 1 and UNIT 2)Document13 pagesMCQ FA (UNIT 1 and UNIT 2)Udit SinghalNo ratings yet

- Cma Inter MCQ Booklet Financial Accounting Paper 5Document175 pagesCma Inter MCQ Booklet Financial Accounting Paper 5DGGI BPL Group1No ratings yet

- ACC100.101 Preliminary Examination - For PostingDocument5 pagesACC100.101 Preliminary Examination - For PostingRAMOS, Aliyah Faith P.No ratings yet

- Commercial Underwriting Fresher Assessment-1Document8 pagesCommercial Underwriting Fresher Assessment-1MariaNo ratings yet

- Comprehensive 1Document44 pagesComprehensive 1Alan RajNo ratings yet

- Part - I Section - A Instructions:: From Question Number 1 To 18, Attempt Any 15 QuestionsDocument16 pagesPart - I Section - A Instructions:: From Question Number 1 To 18, Attempt Any 15 QuestionsVANSH KARELNo ratings yet

- AccountancyDocument9 pagesAccountancyPiyush JhamNo ratings yet

- ACCOUNTING FOR MANAGEMENT MCQDocument14 pagesACCOUNTING FOR MANAGEMENT MCQEr. THAMIZHMANI MNo ratings yet

- Exit Exam Tutorial ClassDocument58 pagesExit Exam Tutorial Classkedirmahammed8No ratings yet

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiArroNo ratings yet

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiAli HassanNo ratings yet

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiShahid NaikNo ratings yet

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiAli HassanNo ratings yet

- Ch03 TB Hoggetta8eDocument15 pagesCh03 TB Hoggetta8eAlex Schuldiner75% (8)

- Activity No. 1 CA 2022 Financial Accounting and Reepeorting Far PCVDocument8 pagesActivity No. 1 CA 2022 Financial Accounting and Reepeorting Far PCVPrecious mae BarrientosNo ratings yet

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersFrom EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersRating: 2 out of 5 stars2/5 (4)

- Let's Practise: Maths Workbook Coursebook 6From EverandLet's Practise: Maths Workbook Coursebook 6No ratings yet

- SG Chapter 5 Valuation Concepts and MethodologiesDocument11 pagesSG Chapter 5 Valuation Concepts and MethodologiesTACIPIT, Rowena Marie DizonNo ratings yet

- Wealth-Insight - Sep 2020Document68 pagesWealth-Insight - Sep 2020Anonymous rjsnUw9xpUNo ratings yet

- Assignment 3: Part 1: Mutual Funds (20 Marks)Document2 pagesAssignment 3: Part 1: Mutual Funds (20 Marks)Julia KristelNo ratings yet

- Indonesia Construction Equipment Market - April 2013Document83 pagesIndonesia Construction Equipment Market - April 2013girish_patkiNo ratings yet

- You Are Discussing Your 401 K With Dan Ervin When HeDocument2 pagesYou Are Discussing Your 401 K With Dan Ervin When HeAmit PandeyNo ratings yet

- @piratedstudy: Get Our Special Grand Bundle PDF Course For All Upcoming Bank ExamsDocument34 pages@piratedstudy: Get Our Special Grand Bundle PDF Course For All Upcoming Bank ExamsCrack ItNo ratings yet

- Company Law - Full Book PDFDocument347 pagesCompany Law - Full Book PDFRam Iyer0% (1)

- Trend Following Strategies in Commodity Markets and The Impact of FinancializationDocument71 pagesTrend Following Strategies in Commodity Markets and The Impact of FinancializationAlexandra100% (1)

- Credit SuisseDocument8 pagesCredit SuisseCharles MartineauNo ratings yet

- Key Question Answers MacroDocument18 pagesKey Question Answers Macrokrenarabazi100% (2)

- Business Finance Xii SP New SyllabusDocument21 pagesBusiness Finance Xii SP New SyllabusSanthosh Kumar100% (1)

- IDirect Motogaze Aug16Document16 pagesIDirect Motogaze Aug16umaganNo ratings yet

- Trading Lessons From Nicolas DarvasDocument2 pagesTrading Lessons From Nicolas DarvasAlejandro Gonzalez Hartmann100% (1)

- Citigroup Industrial Training ReportDocument27 pagesCitigroup Industrial Training ReporthisyamstarkNo ratings yet

- 9 - Segment ReportingDocument4 pages9 - Segment ReportingCathNo ratings yet

- Keown - Foundations of Finance 7eDocument28 pagesKeown - Foundations of Finance 7eBenny Khor100% (1)

- Balance Sheet of Mahanagar Telephone Nigam: - in Rs. Cr.Document5 pagesBalance Sheet of Mahanagar Telephone Nigam: - in Rs. Cr.Raj ChauhanNo ratings yet

- Treasury Analysis WorksheetDocument3 pagesTreasury Analysis WorksheetdebashisdasNo ratings yet

- Industry Profile: Automobile Industry at Global LevelDocument21 pagesIndustry Profile: Automobile Industry at Global LevelTanzim VankaniNo ratings yet

- Mesa Metrics That Matter and Roi of Mes MomDocument18 pagesMesa Metrics That Matter and Roi of Mes MomSonyAcerNo ratings yet

- ADD MATH ProjectDocument13 pagesADD MATH Projectmegazat27No ratings yet

- Wealth Management Strategies in The Era of E-CommerceDocument15 pagesWealth Management Strategies in The Era of E-CommerceDr. Mohammad ShamsuddohaNo ratings yet

- Introduction To The Investment EnvironmentDocument51 pagesIntroduction To The Investment EnvironmentSaish ChavanNo ratings yet

- Kaushik Kapoor: Bancassurance - Sales - Relationship Management - Team Management - BankingDocument2 pagesKaushik Kapoor: Bancassurance - Sales - Relationship Management - Team Management - BankingbujjiNo ratings yet

- CB2402 Week 1Document4 pagesCB2402 Week 1RoyChungNo ratings yet

- Financial Ratio Analysis - DashboardDocument15 pagesFinancial Ratio Analysis - DashboardAry BenzerNo ratings yet

- Profile Yogesh Maheshwari 24Document2 pagesProfile Yogesh Maheshwari 24mukul choudhary0% (1)

- BOOK Maher Stickney Weil 08-Managerial-Accounting PDFDocument624 pagesBOOK Maher Stickney Weil 08-Managerial-Accounting PDFNIvardo Celi Rivera Toralva80% (10)

- Hong Kong Graduate Recruitment Brochure 2023 2024Document24 pagesHong Kong Graduate Recruitment Brochure 2023 2024Alexandra HoNo ratings yet

- Jocelyn Tuanzon: Assets Current AssetsDocument4 pagesJocelyn Tuanzon: Assets Current AssetsJheza Mae PitogoNo ratings yet