Professional Documents

Culture Documents

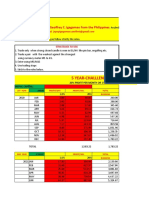

(Base 2010 100) Month Average Neer Reer Percentage Change Over Last Year

Uploaded by

HameedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(Base 2010 100) Month Average Neer Reer Percentage Change Over Last Year

Uploaded by

HameedCopyright:

Available Formats

STATISTICS AND DATA WAREHOUSE DEPARTMENT

Nominal / Real Effective Exchange Rate Indices of Pak Rupees

( Base 2010 = 100)*

Month

NEER REER Percentage Change over last Year

Average NEER REER

100 100

Jun-17 90.9981 121.0086 1.91 3.13

Jun-18 78.4221 107.4833 -13.82 -11.18

Jun-19 62.8885 90.9787 -19.81 -15.36

Jun-20 59.7676 93.0417 -4.96 2.27

Jun-21 60.0186 99.7778 0.42 7.24

Monthly Position

Percentage Change over last Month

Apr-20 61.1568 94.4187 -2.12 -2.81

May-20 62.5240 97.1981 2.24 2.94

Jun-20 59.7676 93.0417 -4.41 -4.28

Jul-20 58.6417 93.1023 -1.88 0.07

Aug-20 57.5413 91.7888 -1.88 -1.41

Sep-20 58.1729 94.1174 1.10 2.54

Oct-20 59.0687 97.1044 1.54 3.17

Nov-20 59.8030 99.3417 1.24 2.30

Dec-20 58.6234 96.3266 -1.97 -3.04

Jan-21 58.2541 95.1638 -0.63 -1.21

Feb-21 58.6869 97.2192 0.74 2.16

Mar-21 60.5813 100.8229 3.23 3.71

Apr-21 61.7514 102.9503 1.93 2.11

May-21 61.2430 102.2170 -0.82 -0.71

Jun-21 60.0186 99.7778 -2.00 -2.39

Jul-21 59.3409 99.5682 -1.13 -0.21

Aug-21 57.8110 97.4062 -2.58 -2.17

Sep-21 56.3249 96.7089 -2.57 -0.72

Oct-21 55.4874 96.3782 -1.49 -0.34

Nov-21 55.3541 98.6014 -0.24 2.31

Dec-21 54.5239 96.7978 -1.50 -1.83

Jan-22 54.7694 97.0363 0.45 0.25

Feb-22 54.9725 97.8186 0.37 0.81

Mar-22 R 54.3456 96.6611 -1.14 -1.18

Apr-22 P 53.4026 95.8538 -1.74 -0.84

* A REER index of 100 should not be misinterpreted as denoting the equilibrium value of the currency.

100 merely represents the value of the currency at a chosen point in time (in this case the average value

of the currency in 2010). Therefore, movement of the REER away from 100 simply reflects changes

relative to its average value in 2010 and is unrelated to its equilibrium value.

Sources: IMF for exchange rate, Central Banks and Bureau of Statistics websites for CPI

P= Provisional, R= Revised

Notes:

i. From July 2020, PBS has discontinued the dissemination of CPI on base 2007-08 using which the REER index was

calculated, and changed the base to 2015-16. For the compilation of the REER index, therefore, the CPI - Base 2015-16

has been spliced and rebased to 2010 using the IMF's methodology.

ii. RPI and REER indices may be revised due to revisions in base period or splicing factor of CPIs data by PBS.

iii. Weights and number of trading partners have been revised since Jan-2013. The REER and NEER have been recalculated

since Jan-2013 using these revised weights and number of trading partners. For detailed methodology and old series of

REER and NEER, please visit the Revision Study at

https://www.sbp.org.pk/departments/stats/Notice/Revision-Study(REER).pdf

iv. Appreciation (depreciation) of REER is sometimes confused with the concept of currency overvaluation (undervaluation)

while these are two separate concepts and not necessarily interpreted in the same direction. For an assessment of a

country’s exchange rate misalignment, a more sophisticated analysis is required taking into account factors such as

demographics, external and fiscal sustainability, and some other macroeconomic fundamentals over the medium-term.

The following explainer-video on REER [by SBP] goes into further detail.

https://youtu.be/RX0Oa7oevLg

Contact person: Muhammad Ali Shah, Senior Joint Director

E-mail: muhammadali@sbp.org.pk

Ph. No 021-32453988, 021-99221900

You might also like

- D'leon Financial Statements Analysis Exercise - SolvedDocument8 pagesD'leon Financial Statements Analysis Exercise - SolvedDIPESH KUNWARNo ratings yet

- THE COMPOUNDING POWER OF FOREX TRADING - XLSX ($1000)Document6 pagesTHE COMPOUNDING POWER OF FOREX TRADING - XLSX ($1000)georgeNo ratings yet

- Cause & EffectDocument5 pagesCause & EffectKit Champ50% (2)

- The Million Dollar Case Study 1Document78 pagesThe Million Dollar Case Study 1SergiuFuiorNo ratings yet

- Full FileDocument168 pagesFull Fileyp0No ratings yet

- Trading Plan Compounding PNLDocument256 pagesTrading Plan Compounding PNLAdhitiya PersadaNo ratings yet

- The General EnvironmentDocument5 pagesThe General EnvironmentLawal Idris AdesholaNo ratings yet

- Confirmation For Booking ID # 409849089 Check-In (Arrival)Document1 pageConfirmation For Booking ID # 409849089 Check-In (Arrival)CahyoNo ratings yet

- Neer ReerDocument1 pageNeer Reerjalees23No ratings yet

- Nominal / Real Effective Exchange Rate Indices of Pak RupeesDocument1 pageNominal / Real Effective Exchange Rate Indices of Pak RupeesFariha QurêshïNo ratings yet

- Kr. Meureubo-Meunasah RayekDocument99 pagesKr. Meureubo-Meunasah RayekDian Afifah RahmawatiNo ratings yet

- Keandalan-JarKit 2023Document117 pagesKeandalan-JarKit 2023Hendry LuaseNo ratings yet

- Nominal / Real Effective Exchange Rate Indices of Pak RupeesDocument1 pageNominal / Real Effective Exchange Rate Indices of Pak RupeesADEELNo ratings yet

- STT STT Bid BVH CTD CTG DPM Eib FPT Gas GMD HDB HPG MBB MSNMWGNVL PNJ ReeDocument23 pagesSTT STT Bid BVH CTD CTG DPM Eib FPT Gas GMD HDB HPG MBB MSNMWGNVL PNJ ReeTuan NguyenNo ratings yet

- Tabel 1.1 Data Curah Hujan Harian MaksimumDocument10 pagesTabel 1.1 Data Curah Hujan Harian MaksimumIrfan LuckerNo ratings yet

- Sample Rain Yudha1Document4 pagesSample Rain Yudha1Pagindhu YudhaNo ratings yet

- Weight Tracking Chartv2 365days WeeklyDocument20 pagesWeight Tracking Chartv2 365days WeeklyozgegizemNo ratings yet

- Details of Rbi IndexDocument1 pageDetails of Rbi IndexBhadresh KumbhaniNo ratings yet

- Data FixDocument3 pagesData FixIrfansyah FaridNo ratings yet

- PICSINASDocument2 pagesPICSINASfelipe rojasNo ratings yet

- SSS GuideDocument1 pageSSS GuideArianne Coyco100% (1)

- T Year Month Demand MA (4) CMA (4) S, I S: Regression StatisticsDocument8 pagesT Year Month Demand MA (4) CMA (4) S, I S: Regression StatisticsAilene QuintoNo ratings yet

- T Year Month Demand MA (4) CMA (4) S, I S: Regression StatisticsDocument8 pagesT Year Month Demand MA (4) CMA (4) S, I S: Regression StatisticsAilene QuintoNo ratings yet

- Data 1Document1 pageData 1Irfansyah FaridNo ratings yet

- Geometric Brownian MotionDocument25 pagesGeometric Brownian MotionPanagiotis BraimakisNo ratings yet

- Ailene Quinto-Midterm (Forecasting)Document8 pagesAilene Quinto-Midterm (Forecasting)Ailene QuintoNo ratings yet

- Data - PlaneamientoDocument19 pagesData - PlaneamientodanielNo ratings yet

- Sample Workbook To Linear Regression Analysis in Excel: Author Last Update 6-Jul-18 Tutorial URLDocument9 pagesSample Workbook To Linear Regression Analysis in Excel: Author Last Update 6-Jul-18 Tutorial URLatibNo ratings yet

- Mii514 S3 G8Document11 pagesMii514 S3 G8Yon Flores AvendañoNo ratings yet

- Liquidacion Diaria de Mortalidad PollosDocument8 pagesLiquidacion Diaria de Mortalidad PollosYasmin Alessandra Yucra LizarribarNo ratings yet

- Online Tenders ReportDocument2 pagesOnline Tenders ReportinfoNo ratings yet

- Preceso 2019Document5 pagesPreceso 2019Jesus Emmanuel Cerón CarballoNo ratings yet

- BrambleDocument29 pagesBrambleJoyNo ratings yet

- Coporate Finance1Document10 pagesCoporate Finance1T TakashiNo ratings yet

- Estacion Yungay 2022-2023Document2 pagesEstacion Yungay 2022-20232813natyNo ratings yet

- Forecasting ExerciseDocument8 pagesForecasting ExerciserizkiNo ratings yet

- 1.3 Método de Holzer Dirección X-XDocument2 pages1.3 Método de Holzer Dirección X-XLeonel Chepe UcancialNo ratings yet

- Student SolutionDocument20 pagesStudent SolutionSadeeq Ul HasnainNo ratings yet

- North American Midcontinent Oil ForecastDocument16 pagesNorth American Midcontinent Oil ForecastArtur SilvaNo ratings yet

- Sss PDFDocument1 pageSss PDFROVI ROSE MAILOMNo ratings yet

- Leyes Vs RecuperacionesDocument1 pageLeyes Vs RecuperacionesJose Miguel Benavente MendezNo ratings yet

- Control Mensual de Recuperacion de OroDocument1 pageControl Mensual de Recuperacion de OroJose Miguel Benavente MendezNo ratings yet

- Yes Yes Yes Yes Yes Yes YesDocument5 pagesYes Yes Yes Yes Yes Yes YeshamsNo ratings yet

- Sample IAS 29 COS ComputationDocument29 pagesSample IAS 29 COS ComputationShingirai CynthiaNo ratings yet

- CO 1 # 5 - Main Engine Separate Runing Hours ReportDocument1 pageCO 1 # 5 - Main Engine Separate Runing Hours Reportsukhaidir suripnoNo ratings yet

- Feeder Wise Loss 02-2021Document1 pageFeeder Wise Loss 02-2021MuhsenNo ratings yet

- Summary of Wayne Whaley TechniquesDocument17 pagesSummary of Wayne Whaley TechniquesJMSchultzNo ratings yet

- Space Cypto QuotaDocument3 pagesSpace Cypto QuotaMateo LucasNo ratings yet

- Source: Pakistan Bureau of Statistics (PBS) : 5 15 18 21 FY19 FY20Document1 pageSource: Pakistan Bureau of Statistics (PBS) : 5 15 18 21 FY19 FY20nida younasNo ratings yet

- Lecturas Pucusana-Consumo de MarzoDocument5 pagesLecturas Pucusana-Consumo de MarzoJean PaulNo ratings yet

- CM - 005 - Siniestralidad 2021Document6 pagesCM - 005 - Siniestralidad 2021luis ortega castilloNo ratings yet

- Month VAR (S) No. of Data No. of Non Dectects Minimum Value Maximum Value Mann Kendell Statistic S Normalis Ed Test Statistic (ZS)Document3 pagesMonth VAR (S) No. of Data No. of Non Dectects Minimum Value Maximum Value Mann Kendell Statistic S Normalis Ed Test Statistic (ZS)DeepaNo ratings yet

- Irias Samuel S2 Tarea GrupalDocument13 pagesIrias Samuel S2 Tarea GrupalAntonio ValerianoNo ratings yet

- NPM Ecr Daily, June - 2023Document5 pagesNPM Ecr Daily, June - 2023Nibha KumariNo ratings yet

- WMAI AssignmentDocument13 pagesWMAI AssignmentArbaz MalikNo ratings yet

- Preceso 2018Document5 pagesPreceso 2018Jesus Emmanuel Cerón CarballoNo ratings yet

- Flood Hydrology FrequencyDocument3 pagesFlood Hydrology FrequencydsanandaNo ratings yet

- Line Chart - Data SetDocument2 pagesLine Chart - Data SetalexfurnaseNo ratings yet

- Re Acci OnesDocument9 pagesRe Acci OnesCres P. BaldeonNo ratings yet

- Min Constraint: Max Constraint: Current Units: Product NameDocument48 pagesMin Constraint: Max Constraint: Current Units: Product NamePepitofanNo ratings yet

- Global Summary of The Year 1958 - 1980: Date Liquid Precipitation (Inches) Frozen Precipitation (Inches) Number of DaysDocument1 pageGlobal Summary of The Year 1958 - 1980: Date Liquid Precipitation (Inches) Frozen Precipitation (Inches) Number of DaysbrandonjjarvisNo ratings yet

- Recieved Limestone BhumichuliDocument1 pageRecieved Limestone Bhumichulisupendra phuyalNo ratings yet

- A TotalDocument5 pagesA Totalegi pebritamaNo ratings yet

- International Fund ListDocument8 pagesInternational Fund ListArmstrong CapitalNo ratings yet

- SouvenirSales MultiplicativeDocument57 pagesSouvenirSales MultiplicativeKunal JainNo ratings yet

- AuditDocument8 pagesAuditHameedNo ratings yet

- Public FinanceDocument21 pagesPublic FinanceHameedNo ratings yet

- Important : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadDocument1 pageImportant : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadHameedNo ratings yet

- CSS Syllabus: Subject: Accountancy & AuditingDocument6 pagesCSS Syllabus: Subject: Accountancy & AuditingHameedNo ratings yet

- Educational PsychologyDocument3 pagesEducational PsychologyHameedNo ratings yet

- Education ManagementDocument3 pagesEducation ManagementHameedNo ratings yet

- Production Process and CostsDocument22 pagesProduction Process and CostsMuhammad IrfanNo ratings yet

- Chap 006Document35 pagesChap 006rietzhel22No ratings yet

- Quiz 12 AnsDocument3 pagesQuiz 12 AnsParth VaswaniNo ratings yet

- What Is The RGSTDocument4 pagesWhat Is The RGSTMaira HassanNo ratings yet

- EGB Review Sheet First Exam On TradeDocument2 pagesEGB Review Sheet First Exam On TradeErinNo ratings yet

- Financial Analysis of Dell - Inc and HP CompaniesDocument29 pagesFinancial Analysis of Dell - Inc and HP CompaniesObaidullah R Siddiqui0% (2)

- Company ProfileDocument39 pagesCompany ProfilePradeep MeherNo ratings yet

- JioMart Invoice 16582472940212031ADocument1 pageJioMart Invoice 16582472940212031ADipankarNo ratings yet

- Guide To Retail Math Key FormulasDocument1 pageGuide To Retail Math Key FormulasJitender BhardwajNo ratings yet

- Chapter 9 NegotiationDocument34 pagesChapter 9 Negotiationsantiny sanNo ratings yet

- Bahan Kuliah IuEBDocument7 pagesBahan Kuliah IuEBAlvin AdrianNo ratings yet

- Revques t3 Sub 2011Document37 pagesRevques t3 Sub 2011Rod Lester de GuzmanNo ratings yet

- 2 Law of Contract - Definition Element of Offer PDFDocument64 pages2 Law of Contract - Definition Element of Offer PDFMurugan RSNo ratings yet

- 3 FX ProductsDocument0 pages3 FX Productsmy hoangNo ratings yet

- Chapter 2-Distribution Network DesignDocument47 pagesChapter 2-Distribution Network DesignDo Thi My LeNo ratings yet

- Supplement 7: Capacity and Constraint ManagementDocument8 pagesSupplement 7: Capacity and Constraint ManagementElie DibNo ratings yet

- Chapter 8Document74 pagesChapter 8jjmaducdocNo ratings yet

- Japan Medical Device Reimbursement PolicyDocument26 pagesJapan Medical Device Reimbursement Policyanimeshsarkar87No ratings yet

- Lemonsexperiment PDFDocument28 pagesLemonsexperiment PDFRyan Dave Agaton BironNo ratings yet

- LatinFocus Consensus Forecast - February 2020Document142 pagesLatinFocus Consensus Forecast - February 2020Felipe OrnellesNo ratings yet

- Daktronics Response 8 2019 PDFDocument208 pagesDaktronics Response 8 2019 PDFJigisha VasaNo ratings yet

- Tesco Business Model ExtractDocument4 pagesTesco Business Model ExtractSajon MohammedNo ratings yet

- TBCH06Document13 pagesTBCH06Shayne LimNo ratings yet

- Ex08 PDFDocument29 pagesEx08 PDFSalman FarooqNo ratings yet