Professional Documents

Culture Documents

Turnover

Uploaded by

Vivek KumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Turnover

Uploaded by

Vivek KumarCopyright:

Available Formats

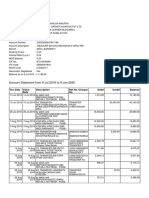

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Assessment Year

[Where the data of the Return of Income In Form ITR-1 (SAHAJ), ITR-2, ITR-3, 2017-18

ITR4 , ITR-5, ITR-6,ITR-7 transmitted electronically with digital signature]

Name PAN

NATCOMP COMPUTERS (P) LIMITED I AABCN4575F .

Ill

; _FI_a_tlD_o_o_rlB_lo_c_k_N_o +N_am_e_O~f_P_r_e_m_i_se_slB_u_i_Id_i_n.::..g!V_il_la--'g"'-e-------1Form

No. whlch

· Q bas been

~~ U-5, PARVANA VIHAR

;z; ;z; electronically

~ ~ ~i--R-o-ad/_S_t-re_e_t/_P_os_t_O_f_fi_ce------1-A-r-ea/L_o_c_a_li_ty---------------1.,:ansmltted

<u~~~~~~~~~~~~~--+~~~~~~~~~~~~~~--1-~~~~~L-~~~~~

~ ~ [fl SECTOR-9 ROHINI

0 - ;.,,; Status Pvt Company

~~~~,1~~~~~~~~~-1-~~~~~~~--~~-1-~~~~~~~--1

2So

, Town/City/District. State Pln/ZipCode Aadhaar Number/Enrollment.ID

~f:1-----------------4-------------+-----,l---------------

z -e NEW DELHI DELHI

£Q

a:

110085

'"'

0..

Designation of AO(Ward/Circle) 117(4) !Original or Revised ORIGINAL·

E-filing Acknowledgement Number l2sS299511251017 I Date(DD/MM/YYYY) 25-10-2017

Gross total income 1 417327

2 Deductions under Chapter-VI-A 2 0

3 Total Income 3 417330

0

'"'

~

0

3a Current Year loss, if any It 3a

o z. 4 Net. tax payable ~ 4 128955

. 2S 0

~ ~· 5 Interest payable 5 0

0

:z ~ 6 Total tax and interest payable 6 128955

0

~ ~ a Advance Tax 7a 0

I- 1--

< 7 Taxes Paid

;::) Q b TDS 7b 327764

0..

~ ~ c TCS 7c 0

0

u

d Self Assessment Tax 7d 0

e Total Taxes Paid (7a+7b+7c +7d) 7e 327764

8 Tax Payable (6-7e) 8 0

9 Refund (7e-6) 9 198810

A riculture 10

IO Exempt [ncome

Others

This return has been digitally signed by · RAJEEV MiSHRA in the capacity of -=D:..cl.:.cRE=CT"-'-0:;.;R;,c.... _

--------------,.---~

having PAN AJHPM6208L from IP Address 182.68.214.203 on 25-10-2017 at -=D;.;;E;;;;;L:;.:.HI=------

13017211CN=e-MudhraSub CA for Class 2 Individual2014,0U=CertifyingAuthority,C>-eMudhraConsumerServicesLimited,C=IN

Dsc SI No & issuer

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Assessment Year

[Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4 , ITR-5, ITR-6,ITR-7 transmitted electronically with digital signature]

2018-19

Name PAN

NATCOMP COMPUTERS (P) LIMITED AABCN4575F

PERSONAL INFORMATION AND THE

Flat/Door/Block No Name Of Premises/Building/Village Form No. which

U-5, PARVANA VIHAR has been

DATE OF ELECTRONIC

electronically ITR-6

transmitted

TRANSMISSION

Road/Street/Post Office Area/Locality

SECTOR-9 ROHINI

Pvt Company

Status

Town/City/District State Pin/ZipCode Aadhaar Number/Enrollment ID

NEW DELHI DELHI

110085

Designation of AO(Ward/Circle) 17(4) Original or Revised ORIGINAL

E-filing Acknowledgement Number 325427201061018 Date(DD/MM/YYYY) 06-10-2018

1 Gross total income 1 422544

2 Deductions under Chapter-VI-A 2 0

3 Total Income 3 422540

COMPUTATION OF INCOME

3a Current Year loss, if any 3a 0

4 108809

AND TAX THEREON

4 Net tax payable

5 Interest and Fee Payable 5 0

6 Total tax, interest and Fee payable 6 108809

a Advance Tax 7a 0

7 Taxes Paid

b TDS 7b 344511

c TCS 7c 0

d Self Assessment Tax 7d 0

e Total Taxes Paid (7a+7b+7c +7d) 7e 344511

8 Tax Payable (6-7e) 8 0

9 Refund (7e-6) 9 235700

Agriculture 10

10 Exempt Income

Others

This return has been digitally signed by RAJEEV MISHRA in the capacity of M.DIRECTOR

having PAN AJHPM6208L from IP Address 112.196.144.169 on 06-10-2018 at DELHI

834184CN=Capricorn CA 2014,2.5.4.51=#131647352c56494b41532044454550204255494c44494e47,STREET=18\,LAXMI NAGAR

Dsc Sl No & issuer DISTRICT CENTER,ST=DELHI,2.5.4.17=#1306313130303932,OU=Certifying Authority,O=Capricorn Identity Services Pvt Ltd.,C=IN

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT Assessment Year

[Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3, 2019-20

ITR-4 , ITR-5, ITR-6,ITR-7 filed and verified electronically]

Name PAN

NATCOMP COMPUTERS (P) LIMITED AABCN4575F

PERSONAL INFORMATION AND THE

Flat/Door/Block No Name Of Premises/Building/Village

U-5 PARVANA VIHAR

ACKNOWLEDGEMENT

Form Number. ITR-6

Road/Street/Post Office Area/Locality

NUMBER

PARVANA VIHAR SECTOR 9 ROHINI

ROHINI Status Pvt Company

Town/City/District State Pin/ZipCode Filed u/s

NORTH WEST DELHI DELHI

110085 139(1)-On or before due date

Assessing Officer Details (Ward/Circle) WARD 18(1), DELHI

e-filing Acknowledgement Number 187062551011019

1 Gross total income 1 437426

2 Total Deductions under Chapter-VI-A 2 0

3 Total Income 3 437430

COMPUTATION OF INCOME

3a Deemed Total Income under AMT/MAT 3a 150931

3b 0

AND TAX THEREON

3b Current Year loss, if any

4 Net tax payable 4 113734

5 Interest and Fee Payable 5 0

6 Total tax, interest and Fee payable 6 113734

a Advance Tax 7a 0

7 Taxes Paid

b TDS 7b 375021

c TCS 7c 13438

d Self Assessment Tax 7d 0

e Total Taxes Paid (7a+7b+7c +7d) 7e 388459

8 Tax Payable (6-7e) 8 0

9 Refund (7e-6) 9 274730

Agriculture

10 Exempt Income 10

Others

Income Tax Return submitted electronically on 01-10-2019 18:02:06 from IP address 182.68.247.90 and verified by

RAJEEV MISHRA having PAN AJHPM6208L on 01-10-2019 18:02:06 from IP address

182.68.247.90 using Digital Signature Certificate (DSC)

834184CN=Capricorn CA 2014,2.5.4.51=#131647352c56494b41532044454550204255494c44494e47,STREET=18\,LAXMI NAGAR

DSC details: DISTRICT CENTER,ST=DELHI,2.5.4.17=#1306313130303932,OU=Certifying Authority,O=Capricorn Identity Services Pvt Ltd.,C=IN

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

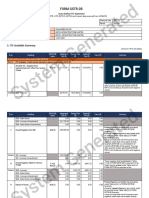

(

V/\.,111,HlH

:_., '2070-?1 7342 ::iz:r:i211110

CPC/2021/A4/116158831

Amount m ~

SI No Patt,culars Reporting Heads

As provided by Taxpayer As CoriputE'd tJ 1!: 143(1 l

BUSINESS OR

01 In orne from Bur.1n1?r.s or Prof,,s•1on 3,06,000 3,06,000

PROH.SSION

0 SALARY 0 0

0 0

(a) "'aloryar.p"r c\lon17(1)

(b) Value of peruursttes as per section 17(2) 0

0

( ) P1of1t~ in heu nf ">alary asp r r.ec 17(:l)

(11) Lesi; Allowance to the extent exempt u/s 1 O 0

(111) Net salary (1·11)

(1v) Deduction uh 16 [iva+r 1b-11vc.) 0

(a) Standard deduction u/s lb (ia) 0 0

(b) Ent rtainrnent allo venc= ulr.1!> (11) 0

(c) Prof essional tax l 6(111)

(v) Income charqeabt- under the head SALARIES (l!r-r, 0

0 HOUSE PROPERTY Type of House Property

(1) Gror;,; rcn recerved/rec-nvcble/lett blc V.Jlu? 0 0

111) Tax paid to local authonues 0 0

(1111 Annual value (1-11) 0 0

(1v) 30".<, of Annual value 0

(v) Interest payable or. borrowed capital 0 0

(v1J Arrears/ Unrealized rent received during the Year Less 30% 0

(v11) Income chargeable under the head House Property [(111-1v-v)+v1J 0

04 OTHER SOURCES Income from other sources (sum of the items below)

OS Gross Total Income (5=(1 +2+3+4)) 3,06,000 3,06,000

DEDUCTION

-, 06 UNDER CHAPTER

VIA

Deductions (u/s)

Total deductions under chapter VI-A (sum cf the items above) 0 0

07 Taxable Total irrcorne (7=(5-6r 3,06,000 3,06,000

oa TAX DETAILS Tax payable on total income 2,800 2,800

09 Rebate u/s 87A 2,800 2,800

fox payable after rebate 110=(8-<.l)] 0

10 0

11 Surcharge (on 10) 0 0

Health & education cess 1cM% on (1 O+ 11) • 0

12 0

Total Tax & Health & education cess {total ta>', and cess) [13={1 O+ 11 + 12)1 0

13 0

14 TAX RELIEF Relief u/s &9 0 0

TOT AL INCOME TAX B lance tax after relief [l 5=(13· 14)]

15 0 0

LIABILITY

INTE.REsT AND FEE (a) Interest u/s 234A

1(, 0 0

PAYABLE

·, (h) trrterest u/s 2348

le) lnterest v/s 234C

0

0

0

0

(d) Fee u/s 234F 0 0

(e) lotalllrt re t,11dfeel1C,c ll(,( .. jtl6(hJ-t·16ic)t1bld)}I 0

Aagrf'gate Income Tax l!Jbllrty [17=(1 + 1 be)J 0 0

17

P,lU ti o t H

Scanned with CamScanner

4 •

"' I I, ff t

fl Ii 11}111' IJ l/1 , , I ; t ' ,

J•11 f •t f•I I•• •r' ,1

lfDU 1111

R, U ·NO TAI

,. 111,111,,

f..,

'~ l l• ph f 11, I , •.•• ) IH,·' I

l ti• r I I, 1! 1 ,t, lil•t\ .. 11,1111, t

Ii,!,,, ,I .H ,I • I t ,: J, • 11 1, 1 Ai 1 I 'i :' I.. ;' • 'f ' ,_ .

j, I,, l , T,

.,4

t', f ,1 .. 1 .. !l•·I I,

NC .lRA

Scanned with CamScanner

': • .J . . .~

..... ~ ... ~

!:'(.IJ, .Jt'.~ ...,_•,3t, :·"~ .,.l _} ~· .''' ........ t s'

: ')

. ~

:: ,t Ref cable

Scanned with CamScanner

You might also like

- Tax Invoice: Chennai-600059 Gstin/Uin: 33BMOPM1236R1ZJ State Name: Tamil Nadu, Code: 33Document1 pageTax Invoice: Chennai-600059 Gstin/Uin: 33BMOPM1236R1ZJ State Name: Tamil Nadu, Code: 33Abhinaya JoNo ratings yet

- Hersey K Delynn PayStubDocument1 pageHersey K Delynn PayStubSharon JonesNo ratings yet

- Break-even Analysis for Eat and Be Well CafeDocument1 pageBreak-even Analysis for Eat and Be Well CafeRikki Mae TeofistoNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBiju DivakaranNo ratings yet

- OpMiniStatementUX315 06 2021 PDFDocument1 pageOpMiniStatementUX315 06 2021 PDFsaritaNo ratings yet

- Maa Santoshi Transport Financial ReportDocument12 pagesMaa Santoshi Transport Financial ReportPruthiv Raj100% (1)

- Operative Accounts Deposit Accounts Loan Accounts All AccountsDocument2 pagesOperative Accounts Deposit Accounts Loan Accounts All AccountsGamer JiNo ratings yet

- Unknown PDFDocument2 pagesUnknown PDFbijoytvknrNo ratings yet

- Operative Accounts Deposit Accounts Loan Accounts All AccountsDocument2 pagesOperative Accounts Deposit Accounts Loan Accounts All AccountsGamer JiNo ratings yet

- Hotel Shagun invoice detailsDocument1 pageHotel Shagun invoice detailsvamsi krishna yvamsikrshna81100% (1)

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearPrateeksha SharmaNo ratings yet

- Cir v. SekisuiDocument1 pageCir v. SekisuiFrancis Xavier SinonNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument6 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit Balanceabhishek125inNo ratings yet

- IDFCFIRSTBankstatement 10116871316Document25 pagesIDFCFIRSTBankstatement 10116871316abrarkhan47792No ratings yet

- GSTR1 08axvpp9576c1zl 062018 PDFDocument5 pagesGSTR1 08axvpp9576c1zl 062018 PDFkrishan chaturvediNo ratings yet

- Going To The Bank PDFDocument6 pagesGoing To The Bank PDFKemTràXanhNo ratings yet

- ITR-1 filing acknowledgement for AY 2022-23Document7 pagesITR-1 filing acknowledgement for AY 2022-23Yogesh SharmaNo ratings yet

- 6A. HDFC Sept2018 EStatementDocument9 pages6A. HDFC Sept2018 EStatementNanu PatelNo ratings yet

- GSTR3B 24agppp8172k1zp 032021Document2 pagesGSTR3B 24agppp8172k1zp 032021Nanu PatelNo ratings yet

- PDF 828490820141121Document1 pagePDF 828490820141121Aditya SinghNo ratings yet

- M/S BADE MIYAN WHEELS statementDocument19 pagesM/S BADE MIYAN WHEELS statementtawhide_islamicNo ratings yet

- Account Statement: Rai Singh MeenaDocument9 pagesAccount Statement: Rai Singh MeenaPraveen SainiNo ratings yet

- Computation of Total Income Income From Other Sources (Chapter IV F) 392007Document2 pagesComputation of Total Income Income From Other Sources (Chapter IV F) 392007vipin agarwal0% (1)

- GSTR3B 09ehmpm8928j1zf 062021Document2 pagesGSTR3B 09ehmpm8928j1zf 062021Ankur mittalNo ratings yet

- GSTR2B 20CHSPM6149M1ZS 032023 10062023Document7 pagesGSTR2B 20CHSPM6149M1ZS 032023 10062023laxmi handloommdpNo ratings yet

- Indian Income Tax Return Acknowledgement FormDocument1 pageIndian Income Tax Return Acknowledgement FormRahulMahajanNo ratings yet

- LNL Iklcqd /: Grand Total 25,716 7,868 0 0 17,753Document2 pagesLNL Iklcqd /: Grand Total 25,716 7,868 0 0 17,753Rani SaradeNo ratings yet

- TAX - TranscibedDocument14 pagesTAX - TranscibedPriscilla DawnNo ratings yet

- PDF 441907670270322Document1 pagePDF 441907670270322shryeasNo ratings yet

- Timir MannaDocument5 pagesTimir MannaAmalkumar BeraNo ratings yet

- 1552113071829Document34 pages1552113071829Bhautik MunjaniNo ratings yet

- GSTR1 08CMBPK3397K2ZL 022023Document4 pagesGSTR1 08CMBPK3397K2ZL 022023shiva khandelwalNo ratings yet

- F5 o VIGDj 8 Tpus IVDocument4 pagesF5 o VIGDj 8 Tpus IVThirupathi KotteNo ratings yet

- GSTR1 33cfhpd2441a1zb 122022Document4 pagesGSTR1 33cfhpd2441a1zb 122022Prabhu SNo ratings yet

- GSTR3B 07arbpb8459q1z8 122021Document2 pagesGSTR3B 07arbpb8459q1z8 122021Ajit GuptaNo ratings yet

- Date Description Cheque No Debit Credit BalanceDocument2 pagesDate Description Cheque No Debit Credit BalanceDhivya BhaskaranNo ratings yet

- ITR Form AY 21-22Document96 pagesITR Form AY 21-22Anurag Kumar ReloadedNo ratings yet

- Indian Income Tax Return Acknowledgement for AY 2022-23Document1 pageIndian Income Tax Return Acknowledgement for AY 2022-23santy309No ratings yet

- Master CardDocument22 pagesMaster CardAsef KhademiNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument24 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancetawhide_islamicNo ratings yet

- PDF 169223670270722Document1 pagePDF 169223670270722adhya100% (1)

- Statement 6590792236 20220613 152347 4Document1 pageStatement 6590792236 20220613 152347 4mohamed arabathNo ratings yet

- GSTR-2B ITC StatementDocument8 pagesGSTR-2B ITC StatementNaga DineshNo ratings yet

- Vijaya Oct To Nov 2018Document8 pagesVijaya Oct To Nov 2018SURANA1973No ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument42 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceAbhisek DasNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementNANDAN SALESNo ratings yet

- R 9 T RZJTMJ CHT 4 VW ZDocument5 pagesR 9 T RZJTMJ CHT 4 VW ZmukulprakashsrivastavaNo ratings yet

- 1567496511412VyAvOJ9gFZxAPRBX PDFDocument22 pages1567496511412VyAvOJ9gFZxAPRBX PDFManju Purushothama Manju PurushothamaNo ratings yet

- Itr 2018-19 PDFDocument1 pageItr 2018-19 PDFMalik MuzafferNo ratings yet

- PDF 816776770290723Document1 pagePDF 816776770290723Sunita SinghNo ratings yet

- Generally Used AbbreviationsDocument1 pageGenerally Used AbbreviationsShanmukhi MNo ratings yet

- Bank statement summary for Mr. Chandrakumar ADocument8 pagesBank statement summary for Mr. Chandrakumar AJayaselichandrakumarNo ratings yet

- PDF 974069050240722Document1 pagePDF 974069050240722tax advisorNo ratings yet

- Account activity and balance from 10 Apr to 22 AprDocument2 pagesAccount activity and balance from 10 Apr to 22 AprSRIDHAR allhari0% (1)

- Value Date Post Date Remitter Branch Description Chequ Eno DR CR BalanceDocument2 pagesValue Date Post Date Remitter Branch Description Chequ Eno DR CR BalanceS Arasa GumarNo ratings yet

- Itr 22-23Document1 pageItr 22-23MoghAKaranNo ratings yet

- Account Statement From 9 Jul 2019 To 9 Jan 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesAccount Statement From 9 Jul 2019 To 9 Jan 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancemauryapiaeNo ratings yet

- Meralco v. CBAADocument1 pageMeralco v. CBAAkdescallarNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearshyam krishnaNo ratings yet

- Itr Form 2019-20Document10 pagesItr Form 2019-20AartiNo ratings yet

- VAT RETAIL INVOICE FOR NATURAL GASDocument2 pagesVAT RETAIL INVOICE FOR NATURAL GASHarDik PatelNo ratings yet

- PDFDocument12 pagesPDFDyna JoseNo ratings yet

- 1st Page ITRV FY 20-21Document1 page1st Page ITRV FY 20-21naveen kumarNo ratings yet

- Shubam Roy PDFDocument11 pagesShubam Roy PDFparul jainNo ratings yet

- Naked Nude Arab Girls WomenDocument8 pagesNaked Nude Arab Girls WomensalmaNo ratings yet

- Pay Slip JunDocument1 pagePay Slip Junraj d100% (1)

- StatementDocument2 pagesStatementDivesh YadavNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancethiyaguNo ratings yet

- Tax Computation SheetDocument2 pagesTax Computation SheetPandu DoradlaNo ratings yet

- Tax Return Summary for Mr. Bidhan MukherjeeDocument6 pagesTax Return Summary for Mr. Bidhan MukherjeeBIDHANNo ratings yet

- Annual Audit Report SubmissionDocument15 pagesAnnual Audit Report SubmissionAkshat GoyalNo ratings yet

- Container Corporation of India LTDDocument12 pagesContainer Corporation of India LTDVivek KumarNo ratings yet

- Department of FertilizersDocument7 pagesDepartment of FertilizersVivek KumarNo ratings yet

- Ministry of PowerDocument4 pagesMinistry of PowerVivek KumarNo ratings yet

- Ministry of Power 2Document8 pagesMinistry of Power 2Vivek KumarNo ratings yet

- Ministry of Ports, Shipping and WaterwaysDocument14 pagesMinistry of Ports, Shipping and WaterwaysVivek KumarNo ratings yet

- Form GST REG-06: Government of IndiaDocument11 pagesForm GST REG-06: Government of IndiaVivek KumarNo ratings yet

- Department of Water ResourcesDocument4 pagesDepartment of Water ResourcesVivek KumarNo ratings yet

- MECLDocument3 pagesMECLVivek KumarNo ratings yet

- Dell Sales Affiliate: Is A CertifiedDocument3 pagesDell Sales Affiliate: Is A CertifiedVivek KumarNo ratings yet

- BIRO Infotech Seeks MSME ExemptionDocument4 pagesBIRO Infotech Seeks MSME ExemptionVivek KumarNo ratings yet

- Flat FileDocument1 pageFlat FileEr Sundeep RachakondaNo ratings yet

- InvoiceDocument1 pageInvoiceKameenNo ratings yet

- Ch06 Taxation of Fringe BenefitsDocument6 pagesCh06 Taxation of Fringe BenefitsKyla ArcillaNo ratings yet

- Corporate Tax Planning PDFDocument152 pagesCorporate Tax Planning PDFdimple0% (1)

- Binder1 PDFDocument6 pagesBinder1 PDFGmail sNo ratings yet

- IESCO ONLINE BILLL Atif SalehDocument1 pageIESCO ONLINE BILLL Atif SalehUmair SharifNo ratings yet

- Delivery Challan DetailsDocument4 pagesDelivery Challan Detailsmrcopy xeroxNo ratings yet

- Eo Bits Bill FormsDocument9 pagesEo Bits Bill FormsVivekNo ratings yet

- Direct Taxation Essay PDFDocument9 pagesDirect Taxation Essay PDFHina chaudhryNo ratings yet

- April - Kenneth de OcampoDocument1 pageApril - Kenneth de OcampoDennis Dela CruzNo ratings yet

- Sharon PLC (Long Question)Document4 pagesSharon PLC (Long Question)Jimmy LimNo ratings yet

- Tax Invoice SummaryDocument1 pageTax Invoice SummaryGadgets GuruNo ratings yet

- IT10B EnglishDocument10 pagesIT10B Englishapi-37090980% (1)

- Pascual vs. DragonDocument2 pagesPascual vs. DragonRussell John HipolitoNo ratings yet

- LAW 323-Tax Law-Akhtar AliDocument5 pagesLAW 323-Tax Law-Akhtar AliMuhammad Irfan RiazNo ratings yet

- ACC404 - Chapter 4,6,9Document9 pagesACC404 - Chapter 4,6,9delrisco8No ratings yet

- 19sep - 26nov 2022Document14 pages19sep - 26nov 2022Srishti SharmaNo ratings yet

- MEGA - Registration FormDocument1 pageMEGA - Registration Formrafik baoucheNo ratings yet

- Essential reading list and instructions for live UPSC classDocument12 pagesEssential reading list and instructions for live UPSC classJana KvNo ratings yet