Professional Documents

Culture Documents

Interview Case Study

Uploaded by

nngọc_829676Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Interview Case Study

Uploaded by

nngọc_829676Copyright:

Available Formats

Brian Jordan is interviewing for a junior equity analyst position at Orion Investment Advisors.

As part

of the interview process, Mary Benn, Orion’s Director of Research, provides Jordan with information

about two hypothetical companies, Alpha and Beta, and asks him to comment on the information on

their financial statements and ratios. Both companies prepare their financial statements in

accordance with International Financial Reporting Standards (IFRS) and are identical in all respects

except for their accounting choices.

Jordan is told that at the beginning of the current fiscal year, both companies purchased a major new

computer system and began building new manufacturing plants for their own use. Alpha capitalized

and Beta expensed the cost of the computer system; Alpha capitalized and Beta expensed the

interest costs associated with the construction of the manufacturing plants.

Benn asks Jordan, “What was the impact of these decisions on each company’s current fiscal year

financial statements and ratios?”

Jordan responds, “Alpha’s decision to capitalize the cost of its new computer system instead of

expensing it results in higher net income, higher total assets, and higher cash flow from operating

activities in the current fiscal year. Alpha’s decision to capitalize its interest costs instead of

expensing them results in a lower fixed asset turnover ratio and an unchanged interest coverage

ratio.”

Jordan is told that Alpha uses the straight-line depreciation method and Beta uses an accelerated

depreciation method; both companies estimate the same useful lives for long-lived assets. Many

companies in their industry use the units-of-production method.

Benn asks Jordan, “What are the financial statement implications of each depreciation method, and

how do you determine a company’s need to reinvest in its productive capacity?”

Jordan replies, “All other things being equal, the straight-line depreciation method results in the least

variability of net profit margin over time, while an accelerated depreciation method results in an

improving trend in net profit margin over time. The units-of-production can result in a net profit

margin trend that is quite variable. I use a three-step approach to estimate a company’s need to

reinvest in its productive capacity. First, I estimate the average age of the assets by dividing

accumulated depreciation by depreciation expense. Second, I estimate the average remaining useful

life of the assets by dividing net property, plant, and equipment by annual depreciation expense.

Third, I add the estimates of the average remaining useful life and the average age of the assets in

order to determine the total useful life.”

Jordan is told that at the end of the current fiscal year, Alpha revalued a manufacturing plant; this

increased its reported carrying amount by 15 percent. There was no previous downward revaluation

of the plant. Beta recorded an impairment loss on a manufacturing plant; this reduced its carrying by

10 percent.

Benn asks Jordan “What was the impact of these decisions on each company’s current fiscal year

financial ratios?”

Jordan responds, “Beta’s impairment loss increases its debt to total assets and fixed asset turnover

ratios, the impairment loss is a non-cash charge and will not affect cash flow from operating

activities. Alpha’s revaluation decreases its debt to capital and return on assets ratios, and reduces

its return on equity.”

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- 2020 AU Draft NIPA Table FormatsDocument136 pages2020 AU Draft NIPA Table Formatsnngọc_829676No ratings yet

- AnsCFA Level I Mock Exam A - February 2022Document113 pagesAnsCFA Level I Mock Exam A - February 2022nngọc_829676100% (2)

- Topic Assessment: Fixed IncomeDocument3 pagesTopic Assessment: Fixed Incomenngọc_829676No ratings yet

- 2022 Cfa Level I ErrataDocument10 pages2022 Cfa Level I Erratanngọc_829676No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PWC Global Annual Review 2013Document60 pagesPWC Global Annual Review 2013hermesstrategyNo ratings yet

- Idc Cloud Erp and SustainabilityDocument6 pagesIdc Cloud Erp and SustainabilityPatrick CHRABIEHNo ratings yet

- Shein's Value Chain AnalysisDocument9 pagesShein's Value Chain AnalysisNheo LeonadoNo ratings yet

- Illustrative Examples Accounting For Health Care Providers-HospitalsDocument2 pagesIllustrative Examples Accounting For Health Care Providers-HospitalsLa MarieNo ratings yet

- MABA2 CalculusDocument111 pagesMABA2 CalculusHarper DooNo ratings yet

- TVET and Entrepreneurship SkillsDocument34 pagesTVET and Entrepreneurship SkillsAida MohammedNo ratings yet

- Practice BK Question BankDocument24 pagesPractice BK Question BankKrina JainNo ratings yet

- De Thi Business Econ K58 CTTT C A Vinh Thi 14h30 Ngày 15.7.2021Document2 pagesDe Thi Business Econ K58 CTTT C A Vinh Thi 14h30 Ngày 15.7.2021Trương Tuấn ĐạtNo ratings yet

- Seatwork - Day 20 - Leases AnswersDocument9 pagesSeatwork - Day 20 - Leases AnswersRj ArenasNo ratings yet

- Test 1 - 2021 - Mac 320Document17 pagesTest 1 - 2021 - Mac 320pretty jesayaNo ratings yet

- SecA Group8 CaseMichiganManufacturingCorpDocument7 pagesSecA Group8 CaseMichiganManufacturingCorpSuyash LoiwalNo ratings yet

- Important Definitions Igcse BusinessDocument19 pagesImportant Definitions Igcse BusinessBigBoiNo ratings yet

- Corps NotesDocument102 pagesCorps NotesamarafreemanNo ratings yet

- Registered Agent ListDocument1 pageRegistered Agent ListZparo YinkuzNo ratings yet

- F.7.f.2. Central Bank v. BancoDocument2 pagesF.7.f.2. Central Bank v. BancoPre Pacionela100% (2)

- Implementation Guideline ILO 2001Document120 pagesImplementation Guideline ILO 2001Butake ButakeNo ratings yet

- Module 3 Learner GuideDocument228 pagesModule 3 Learner Guidealex.cooney4No ratings yet

- Concrete Cutting & Drilling in Brisbane 1Document1 pageConcrete Cutting & Drilling in Brisbane 1amelia.smith1277No ratings yet

- Shifting of Demand and Supply CurveDocument3 pagesShifting of Demand and Supply Curveaditi anandNo ratings yet

- Xoy ResumeDocument2 pagesXoy ResumexoyaihNo ratings yet

- Smart TrolleyDocument41 pagesSmart Trolleyhelene ganawaNo ratings yet

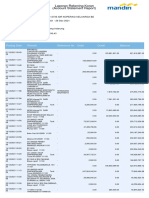

- RK Mandiri SPDocument2 pagesRK Mandiri SPakun hiburanNo ratings yet

- Visaka IndustriesDocument225 pagesVisaka IndustriesReTHINK INDIANo ratings yet

- GaisanoDocument9 pagesGaisanoAimelenne Jay AninionNo ratings yet

- Far110 Quiz 1 Inventory & Suspense Ac January 2022 QDocument2 pagesFar110 Quiz 1 Inventory & Suspense Ac January 2022 QINTAN NOOR AMIRA ROSDINo ratings yet

- Excel Sheet Ratio AnalysisDocument5 pagesExcel Sheet Ratio AnalysisTajalli FatimaNo ratings yet

- Construction Cost Insight Report: Research - September 2021Document5 pagesConstruction Cost Insight Report: Research - September 2021dev dasNo ratings yet

- WORK BOOK 8 - SegmentationDocument12 pagesWORK BOOK 8 - Segmentationakash bathamNo ratings yet

- Week 15 Strategic Challenges and Change For Supply ChainsDocument31 pagesWeek 15 Strategic Challenges and Change For Supply ChainsSaiparnNo ratings yet

- GFR IiiDocument128 pagesGFR Iiiavinash_vyas77813No ratings yet