Professional Documents

Culture Documents

Jada Taglione: Yesterdayjan 18 at 7:58Pm

Jada Taglione: Yesterdayjan 18 at 7:58Pm

Uploaded by

Beniah Tussah0 ratings0% found this document useful (0 votes)

17 views4 pagesAirBnB had a very successful IPO in December 2020. The initial offering price was $68 per share, and the stock price rose sharply and closed at $144.71 on the first day of trading. Within 10 days, the price rose further to $154.84, and after 30 days it was $169.27. The total amount raised in the offering was $86.5 billion, more than double the $47 billion valuation initially sought. This high debut performance made AirBnB the 10th best IPO of 2020 and demonstrated strong investor demand despite the pandemic.

Original Description:

Original Title

Jada Taglione

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAirBnB had a very successful IPO in December 2020. The initial offering price was $68 per share, and the stock price rose sharply and closed at $144.71 on the first day of trading. Within 10 days, the price rose further to $154.84, and after 30 days it was $169.27. The total amount raised in the offering was $86.5 billion, more than double the $47 billion valuation initially sought. This high debut performance made AirBnB the 10th best IPO of 2020 and demonstrated strong investor demand despite the pandemic.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views4 pagesJada Taglione: Yesterdayjan 18 at 7:58Pm

Jada Taglione: Yesterdayjan 18 at 7:58Pm

Uploaded by

Beniah TussahAirBnB had a very successful IPO in December 2020. The initial offering price was $68 per share, and the stock price rose sharply and closed at $144.71 on the first day of trading. Within 10 days, the price rose further to $154.84, and after 30 days it was $169.27. The total amount raised in the offering was $86.5 billion, more than double the $47 billion valuation initially sought. This high debut performance made AirBnB the 10th best IPO of 2020 and demonstrated strong investor demand despite the pandemic.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

Jada Taglione

YesterdayJan 18 at 7:58pm

Manage Discussion Entry

UAGC - Student Login

IPO offering in 2020:

AirBnB (ABNB)

IPO date: Dec 10th, 2020

The initial price: $68 per share

The stock price at the end of the first day of trading: $144.71 per share

The stock price at the end of 10 days of trading: $154.84

The stock price at the end of 30 days of trading: $169.27

The total amount of the offering: $86.5 billion (double its valuation it sought in the IPO 1

day prior)

The number of shares offered: 51,323,531 shares of Class A common stock (50 mil from

Airbnb, 1.3 mil from current shareholders)

The underwriter: Co-leads Morgan Stanley and Goldman Sachs

The fees for the IPO: $370,188 registration fee and $1.4416 per share

This was a very successful IPO launch for AirBnb. There was much hype around it the

weeks and days before the launch but launching at the end of a pandemic year after

travel and tourism had declined considerably was questionable to investors. Their first

valuation during their IPO underwriting was promising Morgan Stanley 17,600,478

shares, Goldman Sachs 12,397,276 shares, and other investment companies the

remaining at only $47 per share (SEC, 2020). This was eventually raised to $68 per share

and announced the day before the launch. This would have yielded a valuation of $47

billion. However, it opened at $146 a share and closing the day at $144, ultimately

earning the company a valuation of $86.5 bil (Feiner, 2020). This market cap surpasses

that of hotel chains like Marriot and Hilton which hold caps of $42 bil and $29 bil,

respectively (Feiner, 2020). The first day surge also made Airbnb the 10 th best debut in

2020 (Feiner, 2020). Investors also profited with a 30 day jump to $169 per share.

Though the underwriters did not end up acquiring the 50 mil shares, they did earn

$1.4416 per share totaling $74 million (SEC, 2020).

References:

Feiner, L. (2020, December 10). Airbnb skyrockets 112% in public market debut, giving it a

market cap of $86.5 billion. CNBC. Retrieved

from https://www.cnbc.com/2020/12/10/airbnb-ipo-abnb-starts-trading-on-the-

nasdaq.html

SEC. (2020, December 11). Form 424(b)4: AirBnb. Retrieved

from https://sec.report/Document/0001193125-20-315318/#toc81668_20

Yahoo! Finance. (2022, January 18). AirBnb Inc. (ABNB). Retrieved

from https://finance.yahoo.com/quote/ABNB/

Brandon Stevens

4:47amJan 19 at 4:47am

Manage Discussion Entry

Brandon Stevens

BUS 629: Financial Forecasting and Budgeting

Week 4 Discussion 2

Compare the advantages and disadvantages of using a Dutch Auction to a traditional

underwriting method for an IPO.

The Dutch Auction method differs greatly from the traditional methods of

underwriting an IPO. “A Dutch auction is a market structure in which the price of

something offered is determined after taking in all bids to arrive at the highest price at

which the total offering can be sold. In this type of auction, investors place a bid for the

amount they are willing to buy in terms of quantity and price” (Chen, 2021, para 2).

Essentially, the price in which has the highest number of bidders is then selected as the

offering price, not necessarily the highest or lowest price. One of the key advantages to

this type of system is that it opens up the bidding to smaller firms and investors instead

of only to larger investors. Traditional IPO offerings are primarily handled by investment

banks who then become responsible for as underwriters which allow them to purchase

securities at a major discount. Another benefit is that it is much more transparent and

often results in fairer prices versus the traditional method. The major drawback to this

method however is that of experience. In the traditional method, investment banks often

do plenty of research and can be counted on for their purchase. Since the Dutch Auction

method allows smaller firms to participate, they may be inexperienced and as a result,

may miscalculate their bids and therefore may sell the stock to remove themselves from

the purchase which crashes the stock’s value.

Identify one real-life IPO that occurred in 2020.

Initial Price: $68

Price at end of first day: $144.25

Price at end of 10 days: $154.84

Price at end of 30 days: $151.39

Total Amount Offered: $3.5 billion

Number of Shares: 51.5 million

Underwriter: Morgan Stanley, Goldman Sachs

Fees for the IPO: $105 million

Evaluate the success of this IPO from the perspective of the issuer; the underwriter,

and investors.

When Airbnb went public, they underestimated just how high the demand would

be and therefore made a very smart move shifting from the private sector where they

debuted their stock at $68. “It was a far higher price than the company had originally set,

indicating investor demand for the stock. Airbnb had initially put its price range at $44 to

$50 a share, and on Monday it had raised that to $56 to $60 each” (Griffith, 2020, para

2). This was a huge win for the company as the COVID pandemic has reduced their

valuation to from $31 billion to $18 billion due to travel restrictions. The Underwriter

also saw major success as they took on a company who was trending downwards and

instead saw their value sky rocket through public investor interest. In most cases, the

Underwriter inherits a large amount of risk depending on the type of market/firm and

this was no different however Airbnb’s performance proved them right. Investors also

won in this move as they saw the value of their shares increase quickly. While in the

beginning, they may have been upset that the initial price increased from $44 to $68,

Airbnb is currently at $154.18 as of January 19 th 2022 so they have also seen a major

increase. Overall, everyone involved in this IPO has benefited.

References

Chen, J. (2021, December 30). Dutch auction definition. Investopedia. Retrieved January

19, 2022, from https://www.investopedia.com/terms/d/dutchauction.asp

Griffith, E. (2020, December 10). Airbnb prices i.p.o. at $68 a share, for a $47 billion

valuation. The New York Times. Retrieved January 19, 2022,

from https://www.nytimes.com/2020/12/09/business/airbnb-ipo-price.html

You might also like

- Mander Moves - Trading 101Document13 pagesMander Moves - Trading 101SebastianNo ratings yet

- 2023 - FRM - PI - PE2 - 020223 - CleanDocument171 pages2023 - FRM - PI - PE2 - 020223 - CleanRaymond Kwong100% (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Full Download Corporate Finance 3rd Edition Berk Solutions ManualDocument35 pagesFull Download Corporate Finance 3rd Edition Berk Solutions Manualetalibelmi2100% (26)

- Trust Indenture Act of 1939 PDFDocument36 pagesTrust Indenture Act of 1939 PDFAnonymous OiCUnTNGXX100% (6)

- Iridium LLC - Group 2Document7 pagesIridium LLC - Group 2NishantDeyPurkayasthaNo ratings yet

- Bear Bull Traders ManualDocument37 pagesBear Bull Traders ManualVince Field100% (2)

- fn3092 Hillier Textbook SolutionsDocument169 pagesfn3092 Hillier Textbook SolutionsAmine IzamNo ratings yet

- How We Trade OptionsDocument21 pagesHow We Trade Optionslecee01100% (1)

- Evergrande - in A Hurry - 30mar21Document2 pagesEvergrande - in A Hurry - 30mar21neil5mNo ratings yet

- Mock Exam II Midterm WITH SOLUTIONSDocument6 pagesMock Exam II Midterm WITH SOLUTIONSAlessandro FestanteNo ratings yet

- Objection Letter - 5Document3 pagesObjection Letter - 5stockboardguyNo ratings yet

- FINC 302 2020 (Ready)Document7 pagesFINC 302 2020 (Ready)Nana Yaw100% (1)

- TB19 Earnings Per ShareDocument20 pagesTB19 Earnings Per Sharescrapped prince100% (3)

- Derivatives ProjectDocument109 pagesDerivatives Project47198666100% (4)

- Bruce Packard Weekly Commentary 04 140920Document8 pagesBruce Packard Weekly Commentary 04 140920bruce packardNo ratings yet

- Lecture 5 Initial Public Offerings 02112022 010816pmDocument14 pagesLecture 5 Initial Public Offerings 02112022 010816pmdua nadeemNo ratings yet

- Initial Public Offerings Chinese StyleDocument38 pagesInitial Public Offerings Chinese StyleCarolinaNo ratings yet

- A Guide To Real Estate Crowdfunding TodayDocument16 pagesA Guide To Real Estate Crowdfunding TodayCrowdFunding BeatNo ratings yet

- Dwnload Full Corporate Finance 3rd Edition Berk Solutions Manual PDFDocument26 pagesDwnload Full Corporate Finance 3rd Edition Berk Solutions Manual PDFlief.tanrec.culjd100% (12)

- Real Estate Crowdfunding - Gimmick or Game Changer (November 2016) ReportDocument36 pagesReal Estate Crowdfunding - Gimmick or Game Changer (November 2016) Reportmystratex100% (2)

- Money Banking and The Financial System 3rd Edition Hubbard Test BankDocument41 pagesMoney Banking and The Financial System 3rd Edition Hubbard Test Bankhebexuyenod8q100% (31)

- Tutorial Program Tute 1 (Week 2)Document2 pagesTutorial Program Tute 1 (Week 2)mavisNo ratings yet

- Mock - Exam - II Midterm - WITH SOLUTIONS PDFDocument6 pagesMock - Exam - II Midterm - WITH SOLUTIONS PDFAlessandro FestanteNo ratings yet

- Topic 2 - Homework2 SolutionDocument7 pagesTopic 2 - Homework2 SolutionTsz Wei CHANNo ratings yet

- Dwnload Full Corporate Finance The Core 3rd Edition Berk Solutions Manual PDFDocument22 pagesDwnload Full Corporate Finance The Core 3rd Edition Berk Solutions Manual PDFdesidapawangl100% (16)

- Full Download Corporate Finance The Core 3rd Edition Berk Solutions ManualDocument35 pagesFull Download Corporate Finance The Core 3rd Edition Berk Solutions Manualslodgeghidinc100% (35)

- Business AssignmentDocument7 pagesBusiness AssignmentNahyaNo ratings yet

- FIS WorldpayDocument1 pageFIS WorldpayharikaNo ratings yet

- Fina4050 - Jai Paul VasudevaDocument9 pagesFina4050 - Jai Paul VasudevaJai PaulNo ratings yet

- Crowdfunding Takes OffDocument4 pagesCrowdfunding Takes Offdjzack07No ratings yet

- Financial: Fin 6212 PolicyDocument83 pagesFinancial: Fin 6212 PolicyYuhan KENo ratings yet

- Week 3 WritingDocument37 pagesWeek 3 WritingnameeoNo ratings yet

- (Edit) Reasons For ListingDocument6 pages(Edit) Reasons For Listingnaman89No ratings yet

- History: Expansion Dutch East India CompanyDocument7 pagesHistory: Expansion Dutch East India CompanyvaosyaNo ratings yet

- Value Analysis: by Nishant SahDocument43 pagesValue Analysis: by Nishant SahNishant SahNo ratings yet

- Business Case - First Draft - Uday Kal Kal - 6th September 2021Document14 pagesBusiness Case - First Draft - Uday Kal Kal - 6th September 2021Asena doğanNo ratings yet

- H1 2023 Funding PDFDocument15 pagesH1 2023 Funding PDFVinay SudershanNo ratings yet

- Name: Rahul Nambiar Roll No: 109 Project Topic: Initial Public Offer Faculty: Prof. Akhil ShettyDocument38 pagesName: Rahul Nambiar Roll No: 109 Project Topic: Initial Public Offer Faculty: Prof. Akhil ShettyRAHUL NAMBIARNo ratings yet

- CGAP Compartamos Case StudyDocument24 pagesCGAP Compartamos Case Studypoket 3337No ratings yet

- BV Newsletter 2020 02Document3 pagesBV Newsletter 2020 02api-510417436No ratings yet

- Final Airbnb Case mktg182Document9 pagesFinal Airbnb Case mktg182api-543944007No ratings yet

- IPO Chinese StyleDocument72 pagesIPO Chinese StyleAriSBNo ratings yet

- Hong Kong MArketDocument4 pagesHong Kong MArketOyin AyoNo ratings yet

- Primary Markets and The Underwriting of SecuritiesDocument8 pagesPrimary Markets and The Underwriting of SecuritiesJion DiazNo ratings yet

- C30CY Week 4 Lecture - CanvasDocument54 pagesC30CY Week 4 Lecture - Canvasjohnshabin123No ratings yet

- FE - Final ProjectDocument4 pagesFE - Final ProjectBrenda TobinsonNo ratings yet

- Google Ipo ProjectDocument21 pagesGoogle Ipo ProjectRobert Taylor0% (1)

- Shane McMahon Lawsuit IdeanomicsDocument86 pagesShane McMahon Lawsuit IdeanomicsHeel By NatureNo ratings yet

- Prinicples of Financial Markets AssignmentDocument12 pagesPrinicples of Financial Markets AssignmentRahul KumarNo ratings yet

- An Initial Public OfferingDocument10 pagesAn Initial Public OfferingBhavaraju Chandra Sekhar SharmaNo ratings yet

- Name: Rahul Nambiar Roll No: 109 Project Topic: Initial Public Offer Faculty: Prof Akhil ShettyDocument47 pagesName: Rahul Nambiar Roll No: 109 Project Topic: Initial Public Offer Faculty: Prof Akhil ShettyRAHUL NAMBIARNo ratings yet

- The Top 100 Networked VentureDocument4 pagesThe Top 100 Networked VentureJobin GeorgeNo ratings yet

- Abc Ipo Top Investors:: Commission and ExpensesDocument4 pagesAbc Ipo Top Investors:: Commission and ExpensesPrithvi BarodiaNo ratings yet

- Dwnload Full Corporate Finance The Core 4th Edition Berk Solutions Manual PDFDocument36 pagesDwnload Full Corporate Finance The Core 4th Edition Berk Solutions Manual PDFdesidapawangl100% (18)

- Ipr Valuation Study Material 1. Introduction and SignificanceDocument9 pagesIpr Valuation Study Material 1. Introduction and SignificanceNeha SumanNo ratings yet

- FINANCE 481 Group 2 10-19Document5 pagesFINANCE 481 Group 2 10-19JerodNo ratings yet

- Dottie's Grocery Corporate Bonds and Common StockDocument6 pagesDottie's Grocery Corporate Bonds and Common Stockmodar KhNo ratings yet

- 'Initial Public Offering - IPO': Dutch East India CompanyDocument2 pages'Initial Public Offering - IPO': Dutch East India CompanysairamaryanNo ratings yet

- Facebook IPO Case Study: Group Project - Investment BankingDocument18 pagesFacebook IPO Case Study: Group Project - Investment BankingLakshmi SrinivasanNo ratings yet

- ReportDocument3 pagesReportnancysinglaNo ratings yet

- The Beauty of The GP Co-Investment Structure - CrowdStreetDocument6 pagesThe Beauty of The GP Co-Investment Structure - CrowdStreetJerry WilliamsonNo ratings yet

- W7 Capital Market TradingDocument12 pagesW7 Capital Market TradingPesidas, Shiela Mae J.No ratings yet

- FRMO Corp. 2019 Shareholder Letter: Part I: New VenturesDocument8 pagesFRMO Corp. 2019 Shareholder Letter: Part I: New VenturesPland SpringNo ratings yet

- Prosper: An Insider's Guide To Investing In Off Plan PropertyFrom EverandProsper: An Insider's Guide To Investing In Off Plan PropertyNo ratings yet

- Collapse Subdiscussion Jodi JohnsonDocument2 pagesCollapse Subdiscussion Jodi JohnsonBeniah TussahNo ratings yet

- UAGC - Student LoginDocument4 pagesUAGC - Student LoginBeniah TussahNo ratings yet

- EXERCIS1Document6 pagesEXERCIS1Beniah TussahNo ratings yet

- The Outsiders: Eight Unconventional Ceos Student'S Name Course Instructor'S Name Date SubmittedDocument11 pagesThe Outsiders: Eight Unconventional Ceos Student'S Name Course Instructor'S Name Date SubmittedBeniah TussahNo ratings yet

- Brandon Stevens: 3:48amjan 19 at 3:48amDocument4 pagesBrandon Stevens: 3:48amjan 19 at 3:48amBeniah TussahNo ratings yet

- Efeects of Stakeholder Analysis On Project Initiation A Case of Low Income Urban Housing in Nairobi, KenyaDocument22 pagesEfeects of Stakeholder Analysis On Project Initiation A Case of Low Income Urban Housing in Nairobi, KenyaBeniah TussahNo ratings yet

- ThesisDocument22 pagesThesisBeniah TussahNo ratings yet

- Wa0022.Document164 pagesWa0022.vartica100% (1)

- Bank Mandiri, 2% 19apr2026, USDDocument9 pagesBank Mandiri, 2% 19apr2026, USDMonika Adhi PermataNo ratings yet

- Topic 7-ValuationDocument36 pagesTopic 7-ValuationK60 Nguyễn Ngọc Quế AnhNo ratings yet

- Short Strangle Option Strategy - The Options PlaybookDocument3 pagesShort Strangle Option Strategy - The Options PlaybookdanNo ratings yet

- Capital Markets & Securities Analyst (CMSA) ® Certification ProgramDocument2 pagesCapital Markets & Securities Analyst (CMSA) ® Certification ProgramMantu KumarNo ratings yet

- Net Asset AcquisitionDocument3 pagesNet Asset AcquisitionAlexsandra GarciaNo ratings yet

- Compound Option ValuationDocument19 pagesCompound Option ValuationKapil ShuklaNo ratings yet

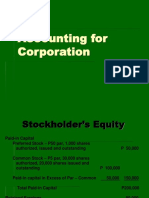

- Accounting For CorporationDocument11 pagesAccounting For CorporationMaricar D. VillarazaNo ratings yet

- Financial Market & InstrumentDocument73 pagesFinancial Market & InstrumentSoumya ShettyNo ratings yet

- Put Call Parity Formula Excel-TemplateDocument7 pagesPut Call Parity Formula Excel-TemplateJaspreet GillNo ratings yet

- A Comparative Interrelationship Study of Indian Stock Market With Global Stock MarketsDocument23 pagesA Comparative Interrelationship Study of Indian Stock Market With Global Stock MarketsNandita IyerNo ratings yet

- Lecture 16 PSDocument2 pagesLecture 16 PSSimon GalvizNo ratings yet

- Bodie 11e PPT Ch03Document39 pagesBodie 11e PPT Ch03Fatimah AlashourNo ratings yet

- Arbitrage Models of Commodity Prices - SlidesDocument36 pagesArbitrage Models of Commodity Prices - SlidesTraderCat SolarisNo ratings yet

- Premier Cement Mills Limited-RbDocument1 pagePremier Cement Mills Limited-Rbmr9_apeceNo ratings yet

- Secondary Market Regulatory Framework and Sebi Fuctions and RolesDocument20 pagesSecondary Market Regulatory Framework and Sebi Fuctions and RolesBADAM NAVINA Finance2019No ratings yet

- Derivatives - AshifHvcDocument51 pagesDerivatives - AshifHvcadctgNo ratings yet

- Derivatives Principle and PracticeDocument9 pagesDerivatives Principle and PracticeDiana HerreraNo ratings yet

- Chapter 14 - Financial Asset at Fair ValueDocument3 pagesChapter 14 - Financial Asset at Fair Valuelooter198No ratings yet

- PDFDocument4 pagesPDFKaran PatilNo ratings yet

- Notes Cfa Fixed Income R42Document30 pagesNotes Cfa Fixed Income R42Ayah AkNo ratings yet

- Next Generation Credit CurvesDocument2 pagesNext Generation Credit CurvesbobmezzNo ratings yet