Professional Documents

Culture Documents

Tax Alert - March 2020 - EN

Uploaded by

Hartono WidjayaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Alert - March 2020 - EN

Uploaded by

Hartono WidjayaCopyright:

Available Formats

18 March 2020

March 2020

Indonesia Tax Alert March 2020

Tax Court Service Hours for the Period of 17 March 2020 up to 3 April

2020 In this issue:

1. Tax Court Service

In the effort to contain the outbreak of Corona Virus Disease 2019 (COVID- Hours for the

19) in Indonesia, the Government is encouraging people to work from home

Period of 17 March

(“WFH”). This WFH program applies to some government institutions,

2020 up to 3 April

including the tax court and the Directorate General of Tax (“DGT”).

2020

Head of Tax Court issued a Circular Letter Number SE-01/PP/2020 on 16 2. DGT Service Hours

March 2020, as amended by Circular Letter Number SE-02/PP/2020 on 18 during WFH Period

March 2020, which informs that the following services from the Tax Court

will be postponed/temporarily ceased from 17 March 2020 until 3 April 2020:

1. Tax court hearings;

2. Receipt of appeal and/or lawsuit request letters;

3. Receipt of judicial review request letters;

4. Helpdesk services beside requests for appeals/lawsuit and judicial review; and

5. Delivery of tax court decision letters and judicial review decision letters.

Further, the period of 17 March 2020 until 3 April 2020 will not be accounted for in determining the

deadlines related to the filing of tax appeals/lawsuits/judicial reviews. This is also applicable for the

delivery of tax court decision letters and judicial review decision letters.

Indonesia Tax Alert | March 2020

Page 1

DGT Service Hours during WFH Period

On 15 March 2020, the DGT issued Circular Letter Number SE-13/PJ/2020 (“SE-13”) to govern the DGT’s

service hours during WFH period (i.e. starting from 16 March 2020 until 5 April 2020).

During the WFH period, the vertical units of the DGT still operate as usual, but services that require direct

contact between the DGT officials with taxpayers is temporarily halted. These include services provided in:

1. Integrated Service Desk (Tempat Pelayanan Terpadu or TPT) in all tax offices;

2. Service Desk Outside Tax Office (Layanan di Luar Kantor or LDK), e.g., Tax Corner (pojok pajak), Tax

Mobile Service (mobil pajak);

3. One Door Integrated Service (Pelayanan Terpadu Satu Pintu), such as Public Service in Malls (Mal

Pelayanan Publik or MPP);

4. Other places.

Value Added Tax (“VAT”) restitution counters in airports still operate with certain limitations.

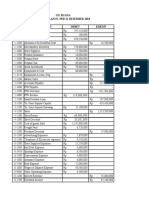

Furthermore, SE-13 provides the following details of guidance:

Type of tax or services Services during WFH period

Individual Annual Income Tax Return 1. Individual taxpayers are encouraged to submit their tax returns through

(SPT OP) submission for Fiscal Year online system.

2019 2. The deadline for payment and submission is extended to 30 April 2020

without penalty for late payment and late submission.

Corporate Annual Income Tax Return SE-13 is silent on this matter. As such, it appears that the deadline for

(SPT Badan) whose submission deadline submission of Corporate Annual Income Tax Returns whose deadline falls during

falls during the WFH period WFH period remains the same.

Reporting Taxpayers are encouraged to submit their tax returns through online system or

through post office.

Deadline for monthly tax return Deadline for submission of withholding tax returns for tax period February 2020

submission is extended to 30 April 2020; except for VAT return.

Deadline for monthly tax payment No change.

Tax administrative services (e.g. Tax Requests will be processed without direct contact with taxpayers.

Exemption Certificate (Surat

Keterangan Bebas or SKB), overbooking

request, etc.), which have been

submitted prior to SE-13 stipulation

Tax supervision, audit, collection, Points to be concerned:

enforcement, and objection 1. Communication is encouraged by call or email (without direct contact with

taxpayers).

2. No Tax Audit Notification Letter (Surat Perintah Pemeriksaan or “SP2”) will

be issued or delivered during the WFH period, except for delivery of SP2 for

tax overpayment.

3. Tax audit closing conference is encouraged to be held through video

teleconference. Closing conference acknowledgment letter can be signed

and corresponded by mail or each party may present their own approval or

rejection statement letter.

Active tax collection activities Activities are temporarily ceased, unless the tax arrears are close to statute of

limitation.

Other activities Activities requiring direct contact with taxpayers are to be temporarily ceased.

For more details, please refer to the relevant circular letters mentioned above.

***

Indonesia Tax Alert | March 2020

Page 2

Contact Persons

Questions concerning any of the subjects or issues contained in this newsletter should be

directed to your usual contact in our firm, or any of the following Tax Partners:

Melisa Himawan

Business Tax mehimawan@deloitte.com

Tax Managing Partner

Ali Mardi Djohardi Business Tax alimardi@deloitte.com

Balim Transfer Pricing bbalim@deloitte.com

Cindy Sukiman Business Tax csukiman@deloitte.com

Dionisius Damijanto Business Tax ddamijanto@deloitte.com

Heru Supriyanto Business Tax hsupriyanto@deloitte.com

Global Employer Services and

Irene Atmawijaya iatmawijaya@deloitte.com

Business Process Solutions

Business Tax and Merger &

John Lauwrenz jlauwrenz@deloitte.com

Acquisition

Business Tax and Business Process

Ratna Lie ratnalie@deloitte.com

Solutions

Roy David Kiantiong Transfer Pricing rkiantiong@deloitte.com

Business Tax, Indirect Tax and

Roy Sidharta Tedja roytedja@deloitte.com

Business Process Solutions

Shivaji Das Transfer Pricing shivdas@deloitte.com

Business Tax and

Turmanto tturmanto@deloitte.com

Global Trade Advisory (Customs)

Yan Hardyana Business Tax yhardyana@deloitte.com

Deloitte Touche Solutions

The Plaza Office Tower, 32nd Floor

Jl. M.H. Thamrin Kav 28-30

Jakarta 10350, Indonesia

Tel: +62 21 5081 8000

Fax: +62 21 2992 8303

Email: iddttl@deloitte.com

www.deloitte.com/id

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global

network of member firms, and their related entities (collectively, the “Deloitte

organisation”). DTTL (also referred to as “Deloitte Global”) and each of its member firms

and related entities are legally separate and independent entities, which cannot obligate or

bind each other in respect of third parties. DTTL and each DTTL member firm and related

entity is liable only for its own acts and omissions, and not those of each other. DTTL does

not provide services to clients. Please see www.deloitte.com/about to learn more.

Deloitte is a leading global provider of audit and assurance, consulting, financial advisory,

risk advisory, tax & legal and related services. Our global network of member firms and

related entities in more than 150 countries and territories (collectively, the “Deloitte

organisation”) serves four out of five Fortune Global 500® companies. Learn how

Deloitte’s approximately 312,000 people make an impact that matters at

www.deloitte.com.

Deloitte Asia Pacific Limited is a company limited by guarantee and a member firm of

DTTL. Members of Deloitte Asia Pacific Limited and their related entities, each of which are

separate and independent legal entities, provide services from more than 100 cities across

the region, including Auckland, Bangkok, Beijing, Hanoi, Ho Chi Minh City, Hong Kong,

Jakarta, Kuala Lumpur, Manila, Melbourne, Osaka, Shanghai, Singapore, Sydney, Taipei,

Tokyo and Yangon.

About Deloitte Indonesia

In Indonesia, services are provided by Deloitte Touche Solutions and its subsidiaries and

affiliates.

This communication contains general information only, and none of Deloitte Touche

Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities

(collectively, the “Deloitte organisation”) is, by means of this communication, rendering

professional advice or services. Before making any decision or taking any action that may

affect your finances or your business, you should consult a qualified professional adviser.

No representations, warranties or undertakings (express or implied) are given as to the

accuracy or completeness of the information in this communication, and none of DTTL, its

member firms, related entities, employees or agents shall be liable or responsible for any

loss or damage whatsoever arising directly or indirectly in connection with any person

relying on this communication. DTTL and each of its member firms, and their related

entities, are legally separate and independent entities.

© 2020 Deloitte Touche Solutions

You might also like

- Tax Info September 2019Document5 pagesTax Info September 2019HutapeaapynNo ratings yet

- Id Tax Indonesian Tax Guide 2019 2020 enDocument84 pagesId Tax Indonesian Tax Guide 2019 2020 enDesty Andini LarasatiNo ratings yet

- Taxjournal July 2020Document60 pagesTaxjournal July 2020Venkatesh PrabhuNo ratings yet

- Kenya Finance Bill 2020Document36 pagesKenya Finance Bill 2020Life NoanneNo ratings yet

- EY Tax - Vietnam Implements Taxation of Digital Transactions - 2020Document4 pagesEY Tax - Vietnam Implements Taxation of Digital Transactions - 2020Pham Ha AnNo ratings yet

- Income Tax Refund PDFDocument3 pagesIncome Tax Refund PDFArunDaniel100% (1)

- Tax EvasionDocument5 pagesTax EvasionAbhiramNo ratings yet

- Tax Update 2016 Invitation-LoDocument4 pagesTax Update 2016 Invitation-LoHutapea_apynNo ratings yet

- Flash NewsDocument3 pagesFlash Newslingesh1892No ratings yet

- Tax Assessment-Part ADocument20 pagesTax Assessment-Part Ajoseph lupashaNo ratings yet

- Vietnam Tax Legal HandbookDocument52 pagesVietnam Tax Legal HandbookaNo ratings yet

- VAT GUIDE - ITC Accounting and Tax ConsultancyDocument15 pagesVAT GUIDE - ITC Accounting and Tax ConsultancymarketingNo ratings yet

- Presenting: Direct Tax - Trends in IndiaDocument27 pagesPresenting: Direct Tax - Trends in IndiatusharNo ratings yet

- It 48Document40 pagesIt 48Robert Daysor BancifraNo ratings yet

- VAT in UAEDocument20 pagesVAT in UAELaxmidhara NayakNo ratings yet

- Lynco Client Alert 3.18.2020 - Tax Updates and The CornoavirusDocument2 pagesLynco Client Alert 3.18.2020 - Tax Updates and The CornoavirusPomelo PinkNo ratings yet

- Article VAT Refunds and Cashflows Alexander Mapunda 17JUNE2019Document2 pagesArticle VAT Refunds and Cashflows Alexander Mapunda 17JUNE2019James MsuyaNo ratings yet

- Ch03 - SL Tax Administration - 2024 - UoHDocument24 pagesCh03 - SL Tax Administration - 2024 - UoHMustafe MohamedNo ratings yet

- Jasa Perpajakan Dan Pembukuan 3Document4 pagesJasa Perpajakan Dan Pembukuan 3Revli Meyhendra HarbangkaraNo ratings yet

- Tds GuidelineDocument23 pagesTds GuidelineYash BhayaniNo ratings yet

- Effectiveness of Tax Deduction at Source (TDS) in IndiaDocument4 pagesEffectiveness of Tax Deduction at Source (TDS) in IndiaIJEMR JournalNo ratings yet

- Custom Duty in IndiaDocument29 pagesCustom Duty in IndiaKaranvir GuptaNo ratings yet

- Deloitte Africa Tax and LegalDocument2 pagesDeloitte Africa Tax and LegalCalvin kamothoNo ratings yet

- International Taxation 2022Document2 pagesInternational Taxation 2022SS17No ratings yet

- Zoho - Explanation Letter To Hanoi TD On Einvoice - en - Draft - 24.2Document2 pagesZoho - Explanation Letter To Hanoi TD On Einvoice - en - Draft - 24.2Trúc ThanhNo ratings yet

- Business WorldDocument2 pagesBusiness WorldJames Ryan AlzonaNo ratings yet

- Direct Tax Vs Indirect TaxDocument44 pagesDirect Tax Vs Indirect TaxShuchi BhatiaNo ratings yet

- Direct Tax Vs Indirect TaxDocument44 pagesDirect Tax Vs Indirect TaxShuchi BhatiaNo ratings yet

- Cascading Effect of TaxesDocument5 pagesCascading Effect of TaxesPraveen NairNo ratings yet

- Tax On Corporate Transactions in Portugal Overview - 1 - 1Document27 pagesTax On Corporate Transactions in Portugal Overview - 1 - 1doegoodNo ratings yet

- Obayemi Emmanuel Ayomide ID Number: 20222928 Taxation Theory and PracticeDocument6 pagesObayemi Emmanuel Ayomide ID Number: 20222928 Taxation Theory and PracticeObayemi AyomideNo ratings yet

- Subject: Taxation Laws I: Satya Prakash (Don)Document10 pagesSubject: Taxation Laws I: Satya Prakash (Don)ABHINAV DEWALIYANo ratings yet

- Elective Paper GST CPTDocument169 pagesElective Paper GST CPTVani BalajiNo ratings yet

- Report On Developing SMEs 2Document12 pagesReport On Developing SMEs 2wizardwatch88No ratings yet

- Deloitte Vietnam - Tax Alert On Decision 1250 On Transfer Pricing - July 2012Document5 pagesDeloitte Vietnam - Tax Alert On Decision 1250 On Transfer Pricing - July 2012Phong NguyenNo ratings yet

- TIES ThailandDocument32 pagesTIES ThailandNasih TrNo ratings yet

- Tax ReformDocument5 pagesTax Reformakky.vns2004No ratings yet

- Basic Features of Value Added Tax (VAT) For ItesDocument24 pagesBasic Features of Value Added Tax (VAT) For ItesDebashishDolonNo ratings yet

- The Icfai Law School, Dehradun: GST and GST RefundDocument17 pagesThe Icfai Law School, Dehradun: GST and GST RefundTwinkle RajpalNo ratings yet

- Income Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21Document11 pagesIncome Tax - Income Tax Department, IT Returns, E-Filing, Tax Slab FY 2020-21LAKSHMANARAO PNo ratings yet

- Paper 12 TAX Practice Admin Ethics Questions August 2020Document3 pagesPaper 12 TAX Practice Admin Ethics Questions August 2020Justice ArkohNo ratings yet

- TTP Auditing Company LimitedDocument6 pagesTTP Auditing Company LimitedNguyễn Quang SángNo ratings yet

- Chapter 1: Introduction To Corporate Tax PlanningDocument5 pagesChapter 1: Introduction To Corporate Tax PlanningMd Manajer RoshidNo ratings yet

- Solutions For GST Question BankDocument55 pagesSolutions For GST Question BankVarun VardhanNo ratings yet

- Business Update: PAYE PainDocument4 pagesBusiness Update: PAYE Painapi-125732404No ratings yet

- Unit 1Document5 pagesUnit 1piyush.birru25No ratings yet

- 1 Understanding VAT For BusinessesDocument6 pages1 Understanding VAT For BusinessesBensonNo ratings yet

- UAE VAT InfoCircularDocument3 pagesUAE VAT InfoCircularMohammadNo ratings yet

- 1365-Article Text-6870-3-10-20200422Document6 pages1365-Article Text-6870-3-10-20200422asistensi varaNo ratings yet

- The Indian Tax Scenario - Part 1Document5 pagesThe Indian Tax Scenario - Part 1rk_rkaushikNo ratings yet

- Income Tax - Income Tax Guide 2023, Latest NewsDocument34 pagesIncome Tax - Income Tax Guide 2023, Latest NewsnandiniNo ratings yet

- Taxation Dissertation SampleDocument36 pagesTaxation Dissertation SampleOnline Dissertation WritingNo ratings yet

- Botswana Tax Lecture Slides, SydneyDocument84 pagesBotswana Tax Lecture Slides, Sydneysmedupe100% (1)

- Tax Laws June2020 Old Syllabus - CS ExecutiveDocument824 pagesTax Laws June2020 Old Syllabus - CS ExecutivePravinNo ratings yet

- Tax Planning - Intro NotesDocument7 pagesTax Planning - Intro NotesBest How To StudioNo ratings yet

- Draw A Chart Showin Tax Structure in IndiaDocument55 pagesDraw A Chart Showin Tax Structure in IndiaShubh ShahNo ratings yet

- Ey Ireland Early Payment of 2020 Excess Randd Tax CreditsDocument5 pagesEy Ireland Early Payment of 2020 Excess Randd Tax CreditsharryNo ratings yet

- "Understanding Incoterms 2020" SeminarDocument1 page"Understanding Incoterms 2020" SeminarPortCallsNo ratings yet

- Ud. Buana Trial Balance, Per 31 Desember 2018 Kode Nama Akun Debet KreditDocument10 pagesUd. Buana Trial Balance, Per 31 Desember 2018 Kode Nama Akun Debet KreditIta ArumsariNo ratings yet

- Fashion Market Research OverviewDocument7 pagesFashion Market Research OverviewAgatha NastorNo ratings yet

- Universal Credit ReportDocument21 pagesUniversal Credit ReportGail Ward80% (5)

- 1.2.3 SpudsDocument2 pages1.2.3 SpudsTha Libra FraudsterNo ratings yet

- CITN Study Pack - Taxation of Specialized BusinessesDocument219 pagesCITN Study Pack - Taxation of Specialized BusinessesOguntimehin AdebisolaNo ratings yet

- Annex B-1 RR 11-2018 - 1Document1 pageAnnex B-1 RR 11-2018 - 1Brianna MendezNo ratings yet

- Supply Chain Management: Indian Institute of Management LucknowDocument29 pagesSupply Chain Management: Indian Institute of Management LucknowParidhi VarmaNo ratings yet

- BillCatchesPips Course - xPAKOZZxDocument8 pagesBillCatchesPips Course - xPAKOZZxTonderai ChihambakweNo ratings yet

- Market Changes in SupplyDocument5 pagesMarket Changes in SupplyOhYeahNo ratings yet

- Abc Advertising AgencyDocument27 pagesAbc Advertising AgencyPeer Anees AhmadNo ratings yet

- 5 Tools To Gain Competitive AdvantageDocument40 pages5 Tools To Gain Competitive Advantagegandalfa12100% (1)

- UntitledDocument4 pagesUntitledrodelyn waclinNo ratings yet

- Bloomberg Businessweek Asia June15 PDFDocument68 pagesBloomberg Businessweek Asia June15 PDFArthur LoboNo ratings yet

- Week 5 - Global Business Strategy Case - BMW at 100Document3 pagesWeek 5 - Global Business Strategy Case - BMW at 100Edgard Alberto Cuellar IriarteNo ratings yet

- Intraday Trading Tips and Tricks - Part 1Document5 pagesIntraday Trading Tips and Tricks - Part 1Chandramouli KonduruNo ratings yet

- Case Study On Financial Institution Role in DevelopingDocument9 pagesCase Study On Financial Institution Role in DevelopingKanchanNo ratings yet

- 1 - Kagiso Mmusi Uif - 20230711 - 0001Document8 pages1 - Kagiso Mmusi Uif - 20230711 - 0001Kagiso Kagi MmusiNo ratings yet

- Management Practices at Daraz - PKDocument25 pagesManagement Practices at Daraz - PKMumtaz Yaseen80% (15)

- أثر تطوير نظم المعلومات المحاسبية في الحد من مخاطر التمويل المصرفي - - دراسة تطبيقية على بنك أم درمان الوطني - -Document20 pagesأثر تطوير نظم المعلومات المحاسبية في الحد من مخاطر التمويل المصرفي - - دراسة تطبيقية على بنك أم درمان الوطني - -Aymen DifNo ratings yet

- Chapter 2 - Building Trust and Sales EthicsDocument24 pagesChapter 2 - Building Trust and Sales EthicsNhizza Dawn Aleria-Daligdig Tuburan100% (1)

- Mba Eco v6 e F ADocument108 pagesMba Eco v6 e F AantonamalarajNo ratings yet

- Taxation of InsuranceDocument351 pagesTaxation of InsuranceJerwin DaveNo ratings yet

- CU Free Style Ski Team Investigation ReportDocument7 pagesCU Free Style Ski Team Investigation ReportSarah KutaNo ratings yet

- The Statement of Financial Position of Sargent Corporation Follows For PDFDocument2 pagesThe Statement of Financial Position of Sargent Corporation Follows For PDFTaimur TechnologistNo ratings yet

- ENGRO TFC ProspectusDocument103 pagesENGRO TFC ProspectusAsad Khalil100% (1)

- Haier LogisticsDocument58 pagesHaier LogisticsVikram Fernandez100% (1)

- Simplifying Trade in UKDocument44 pagesSimplifying Trade in UKdmaproiectNo ratings yet

- Ecotourism Travel EssentialsDocument1 pageEcotourism Travel EssentialsfrancartaNo ratings yet

- Business Distruption Book PDFDocument112 pagesBusiness Distruption Book PDFRamaswamy SrinivasanNo ratings yet