Professional Documents

Culture Documents

Reforms LM

Reforms LM

Uploaded by

Surendra Sharma0 ratings0% found this document useful (0 votes)

18 views8 pagesOriginal Title

ReformsLM

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views8 pagesReforms LM

Reforms LM

Uploaded by

Surendra SharmaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 8

arate faerst

IEPARTMENT OF

-ONSUMER AFFAIRS

REFORMS IN THE AREA OF

LEGAL METROLOGY

(PACKAGED COMMODITIES)

RULES

INTRODUCTION

Consumer protection has always been one of the main thrust areas of policy formulation.

Use of proper, accurate and standard weight and measure is very important for effective

functioning of any economy, as it plays an important role in promoting welfare of

consumers. Through this, consumers are protected from malpractice of underweight or

under measure and they get right and exact amount of product for the money spent by

them. The Packaged Commodities Rules are primarily intended to ensure that the

consumers are able to make informed choices, being informed of essentially declarations.

The establishment of the Standards of Weights and Measures and their specification is the

responsibility of the Union Government and the enforcement of the Weights and Measures

isdone by the State Governments. The Department of Consumer Affairs safeguards the

interest of Consumers to get the correct quantity for the value paid by ensuring use of the

correct weights and measures.

Legal Metrology is the application of legal requirements to measurements and measuring

instruments. The objective of Legal Metrology is to ensure public guarantee from the point

of view of security and accuracy of the weighments and measurements.

Various reforms are made in packaged Commodities. Rules , since 2014 in the interest of

Consumers and industries.

Provides the framework for the regulation of pre-packa:

commodities

‘pre-packaged commodity’ means ‘a commodity which without the purchaser being present is.

placed in a package of whatever nature, whether sealed or not, so that the product contained

therein has a pre-determined quantity’.

Declarations on pre-packaged commodities:

Manufacturing, packing, importing, selling, distributing or delivery of pre-packaged commodities

without giving the declarations and particulars is not allowed.

An advertisement of retail sale price of a pre-packaged commodity should have the declaration of

the net quantity or number of the commodity contained in the package.

Penalty for selling, etc. of non-standard packages:

Manufacturing, packing, importing, selling, distributing or delivery of pre-packaged commodities

without giving the declarations is punishable with fine for the first and the second offence. Any

subsequent offence is punishable with fine or with imprisonment or with both.

Manufacturing, packing or importing any pre-packaged commodity, with error in net quantity is

punished with fine for the first offence and for the second and subsequent offence with fine or with

imprisonment or with both.

The packaged commodities meant for industrial consumers or institutional consumers are exempted

from the provisions of these Rules. Also, the packages of commodities containing quantity of more

than 25 kg or 25 litre, excluding cement and fertilizer sold in bags up to 50 kg, are exempted from the

provisions of these Rules.

Central Government has made it mandatory to pack 19 commodities in the prescribed sizes.

Baby food, Weaning food, Biscuits, Bread

including brown bread but excluding bun

Un-canned packages of butter and margarine,

Cereals and Pulses

Coffee, Tea, Materials which may be constituted

or reconstituted as beverages

Edible Oils Vanaspati, ghee, butter oil

Milk Powder,Non-soapy detergents (powder)

Rice (powdered), flour, atta, rawa, and suji

Salt

Soaps (Laundry Soap, Non-soapy detergent

cakes/ bars, Toilet,Soap including all kinds of

bath soap, cakes)

Aerated soft drinks, non-alcoholic beverages

Mineral water and drinking water

Cement in bags

Paint varnish etc. [Paint (other than paste paint

or solid paint) varnish, varnish stains, enamels,

Paste paint and solid paint,Base paint]

Declarations required on packages:

Name and address of the Manufacturer/ Packer /Importer

‘¢ Common or generic name of the commodity

e Net quantity

e Month and year of manufacturing! packing/ importing

Retail sale price (MRP)

Consumer care details

‘© Country of origin for imported products

Best before or use by the date, month and year

of a commodity which may become unfit for

human consumption after a period of time

It is provided that every declaration should be legible and prominent; numerals of the retail sale price

and net quantity declaration should be printed, painted or inscribed on the package in a colour that

contrasts conspicuously with the background of the label.

The declarations on a package should be either in Hindi in Devnagri script or in English. However,

use of any other language in addition to Hindi or English language is allowed.

In the declaration of the quantity the words which may create an exaggerated, misleading or inadequate

expression as to the quantity of the commodity contained in the package is not allowed.

No retail dealer or other person including manufacturer, packer, importer and wholesale dealer are

allowed to make any sale of any commodity in packed form at a price exceeding the retail sale price

thereof.

Where, after any commodity has been pre-packed for sale, any tax payable in relation to such

commodity is revised, the retail dealer or any other person shall not make any retail sale of such

commodity at a price exceeding the revised retail sale price.

The Central Government may permit a manufacturer or packer to pack for sale the packages for a

reasonable period by relaxing one or more provision of these Rules with corrective measures as may

be specified. Central Government may also permit a manufacturer or packer or importer to pack or

sell of the packages not allowed in the Second Schedule for a maximum period of one year.

Emergence of IT and d

*With the initiatives taken by the Government of India for Digital India the consumer markets for

goods and services had undergone a profound transformation.

+With the emergence of information technology and digital India the reach of global companies is to

the small and medium consumers.

+The emergence of global supply chains for procurement of goods meant for domestic consumers

and rapid development of e-commerce as a medium for purchase of goods by consumers,

rendered consumers vulnerable to new forms of unfair trade practices.

+The need was felt to amend the Rules to simplify the ease of doing business and ease of life of

people.

+To protect the interest of consumers, e-commerce sale has been regulated and industry has also

been facilitated to meet the requirements

APPROACH AND PRESENT IMPACT

Initiative taken In the interest of industries for ease of doing business

and to reduce the compliances:

Thread which is sold in coil to handloom weavers is exempted from the preview of the Rules to

safeguard the interest of small weavers Importers are allowed to put a label on imported packages

for making the declarations,

Bar Code/ QR Coding allowed on voluntarily basis

Provisions regarding declarations on Food Products have been harmonized with regulation under

the Food Safety & Standards Act.

The declarations to be made on e-commerce sites required under Rule

6(10) of the said Rules, with the products, are as follows:

© Name and address of the manufacturer/ packer! importer

¢ The name of the country of origin or manufacture or assembly for imported products

‘© The common or generic names of the commodity

he net quantity,

© The ‘best before or use by the date, month and year' if a package contains a commodity which may

become unfit for human consumption after a period of time;

¢ The retail sale price of the package;

In the Interest of consumers to redress their grievances and to provide complete

information about the product:

Email address of the person of the company for consumer complaint is made mandatory

It is made mandatory to declare all the declarations required under these rules on tobacco and

tobacco products of any quantity

Since 2016, packing of any essential commodity in the quantity fixed and notified by the Competent

Authority under the Essential Commodities Act has been allowed

Selling of any essential commodity at the price fixed and notified by the Competent Authority under

the Essential Commodities Act, has been allowed since 2016

Goods displayed by the seller on e-commerce platform shall contain declarations required under

the Rules.

Specific mention is made in the rules that no person shall declare different MRPs (dual MRP) on an

identical pre-packaged commodity.

Size of letters and numerals for making declaration is increased, so that consumer can easily read

the same.

Medical devices which are declared as drugs, are brought into the purview of declarations to be

made under the rules

Advisories issued for smooth implementation of the rules

1.70 ensure all declarations including MRP on masks, sanitizers etc. during COVID-19

2.70 ensure that no sale of packaged commodities is made over and above MRP

3.E- Commerce entities were requested to publish mandatory declarations on their website.

Controllers of Legal Metrology of State Governments were also requested for ensuring

implementation.

4.Jo ensure that all imported/ indigenously produced Margarine packages are making all mandatory

declarations including name of the product so that consumers can differentiate between butter and

margarine and make informed choices.

5.Permission was granted for utilisation of the packing material stock with pre-printed date of

manufacturing, which could not be utilised due to prevalent situation of COVID-19 up to 31.03.2021

6.0n account of implementation of GST permission was granted to display revised MRP due to

change of rates of GST

7.The validity of stamp was extended upto 31.12.2020 for weight & measure used in transaction in

the interest of industries/users due to COVID-19

Benet

ies speaks:

The permission given to utilize packing

material stock with pre-printed date of

manufacturing, which could not be

utilised due to prevalent situation of

COVID-19 up to 31.03.2021, was

appreciated by UK India Business

Council, London that:

DON'T FOOL ME.

MRP 15 MAXIMUM RETAIL,

“This step showcases yet another

forward- looking approach by the

Government of India that improves

further the Ease of Doing Business

We are certain that this development

will have a constructive impact on UK

businesses having manufacturing

facilities in India.”

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 07 - 2022 CTR EngDocument2 pages07 - 2022 CTR EngSurendra SharmaNo ratings yet

- Ranjit Das PDFDocument2 pagesRanjit Das PDFSurendra SharmaNo ratings yet

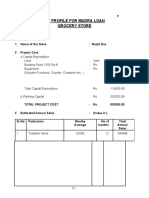

- Project Profile For Mudra Loan Grocery Store: 1 Name of The Store: 2 Project Cost Ranjit DasDocument3 pagesProject Profile For Mudra Loan Grocery Store: 1 Name of The Store: 2 Project Cost Ranjit DasSurendra SharmaNo ratings yet

- Two Wheeler Repair and Service UnitDocument8 pagesTwo Wheeler Repair and Service UnitSurendra SharmaNo ratings yet

- Wgrep CementDocument176 pagesWgrep CementSurendra SharmaNo ratings yet

- Financial Accounting 1213527362725423 9Document259 pagesFinancial Accounting 1213527362725423 9Surendra Sharma100% (1)